Pepperstone Kenya Review 2023

Pepperstone is regulated by CMA and several other top regulatory authorities globally. It offers trading with tight spread on various instruments with local bank deposit and withdrawals in Kenya.

Pepperstone is CMA regulated CFD broker in Kenya that is also regulated by top-tier regulatory authorities globally. It offers spread as well as commission-based trading on forex, indices, commodities, shares, etc.

Pepperstone is a well-known online platform where you can trade forex and CFDs in different financial markets. It’s liked for being user-friendly, making it easy for people to navigate and trade. You get access to various assets like forex pairs, commodities, indices, and cryptocurrencies.

What’s cool about Pepperstone is that they offer competitive spreads, which traders really appreciate. It’s known for being reliable and transparent, making it a popular choice for people who want a trustworthy and smooth trading experience.

Read our comprehensive and fact-based review of Pepperstone in Kenya. We have considered several factors to provide honest reviews for every aspect of the broker. All the pros and cons of Pepperstone in Kenya have been discussed in this review.

Pepperstone Kenya Pros

- Pepperstone is regulated by the Capital Markets Authority (CMA) of Kenya.

- Pepperstone is regulated by top-tier ASIC and FCA.

- Tight spreads on major currency pairs.

- Maximum Leverage on forex pairs is 1:400.

- Local phone support is available in Kenya.

- Local bank transfer and m-Pesa accepted for deposits and withdrawals.

- MT4, MT5, as well as cTrader trading platforms are available.

- No lower limit on the minimum deposit amount.

Pepperstone Kenya Cons

- Only USD and GBP can be chosen as a base account currency.

- No bonus is available for Kenyan clients.

Table of Content

- Pepperstone Summery

- Regulation & Safety of Funds

- Pepperstone Trading Fees

- Pepperstone Account Types

- Pepperstone Account Opening

- Pepperstone Deposits and Withdrawals

- Pepperstone Trading Platform

- Pepperstone Available Instruments

- Pepperstone Customer Support & Contact

- Pepperstone Bonus

- Pepperstone FAQs

Pepperstone Kenya Summary

| Broker Name | Pepperstone Markets Kenya Limited |

| Website | www.pepperstone.com |

| Regulation | CMA, FCA, ASIC, CySEC |

| Year of Establishment | 2010 |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:400 |

| Trading Platforms | MT4, MT5, cTrader |

| Trading Instruments | CFDs on forex pairs, commodities, indices, shares, ETFs |

Safety and Regulation

Pepperstone Safety Pros

- Pepperstone is regulated by CMA of Kenya

- Pepperstone is regulated by FCA, ASIC, and CySEC

- Pepperstone is transparent with their financials

Pepperstone Safety Cons

- Pepperstone is not listed on any stock exchange

In online trading, the safety of traders’ money is the most important factor. Pepperstone follows the regulatory compliance of the Capital Markets Authority (CMA) for Kenyan clients. Following are the regulation details of Pepperstone.

- CMA of Kenya

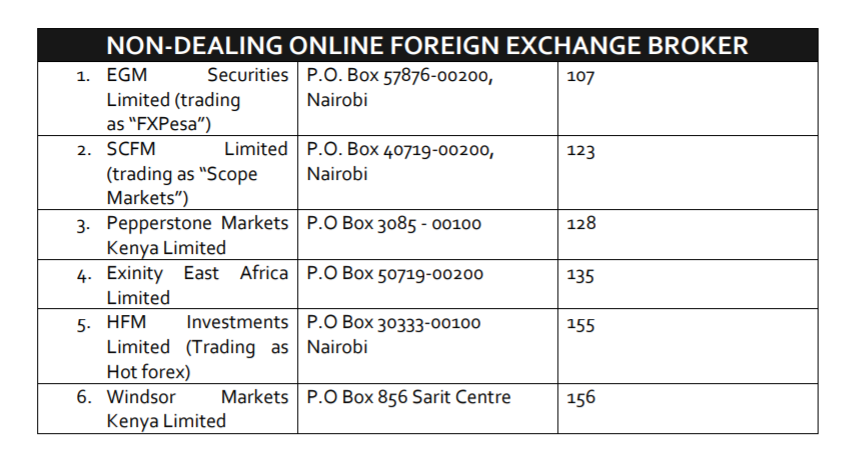

Pepperstone holds the CMA regulatory license with the registered name Pepperstone Markets Kenya Limited. The license is registered as a non-dealing broker with company number PVT-PJU7Q8K and CMA license number 128.

Kenyan clients are registered under CMA regulation. This gives them access to maximum leverage of 1:400 and negative balance protection on all account types. - FCA of UK

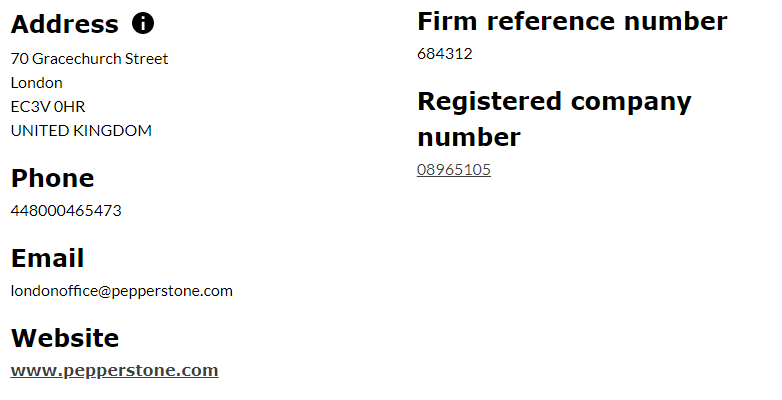

Financial Conduct Authority (FCA) is a top-tier financial regulatory authority based in the jurisdiction of the United Kingdom. Pepperstone is regulated by FCA in the UK under the name of Pepperstone Limited and FRM number 684312. Kenyan clients are not registered under FCA regulation but it increases the trust factor of Pepperstone. - ASIC of Australia

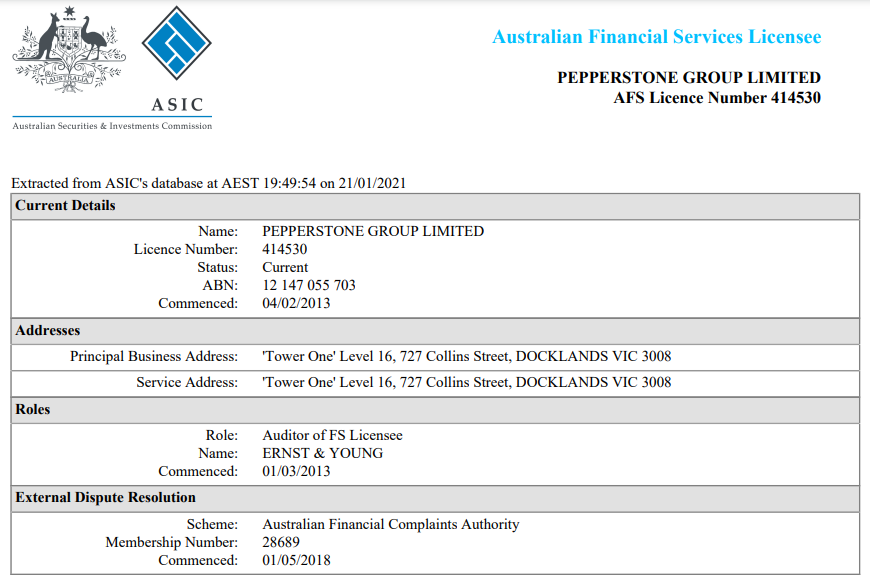

The Australian Securities and Exchange Commission (ASIC) is a top-tier financial regulatory authority based in the Australian jurisdiction. Pepperstone holds the ASIC regulatory license by the name Pepperstone Group Limited with ACN number 147 055 703 and AFSL number 414530. - CySEC of EU

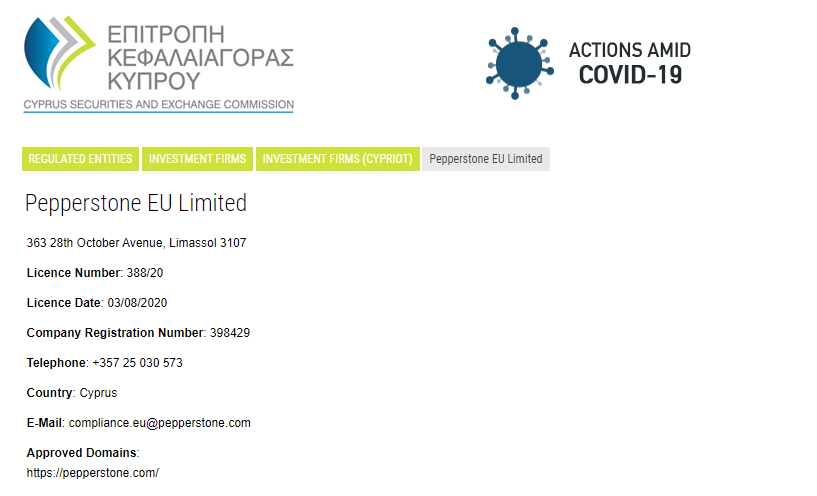

CySEC is not a top-tier regulatory authority but is an important regulator as its license allows brokers to operate in the European Union. Pepperstone holds the CySEC license by the name Pepperstone EU Limited under license number 388/20.

Apart from these major regulatory authorities, Pepperstone also holds a regulatory license from SCB (Bahamas), DFSA (Dubai), and BaFIN (Germany).

The CMA regulation makes Pepperstone safe for trading online. Regulatory licenses from reputed regulatory authorities in multiple jurisdictions further reduce the third-party risk factor.

The clients’ money is kept in a segregated bank account of a top-tier bank. Pepperstone was launched in 2010 and acquired the CMA license in 2020. Pepperstone Markets Kenya Limited is a subsidiary of Pepperstone Group.

Compared to other brokers in Kenya, Peppestone is among the safest online non-dealing forex brokers.

Peppestone Fees

Pepperstone Fees Pros

- Multiple fee structure available

- Spreads are lower than most CFD brokers

- No non-trading fees exist

- No inactivity charges

Pepperstone Fees Cons

- Trading commission with Razor account is different for each trading platform

The Fees can greatly affect the trading experience in leveraged forex and CFD trading. It includes all the charges paid to the broker and liquidity providers. Higher fees mean lower profits for the traders and higher revenue for the broker.

We have separately reviewed every component of the fees that are commonly incurred by online forex brokers.

- Spread: Spread is the difference between the bid and ask price of any underlying CFD instrument.

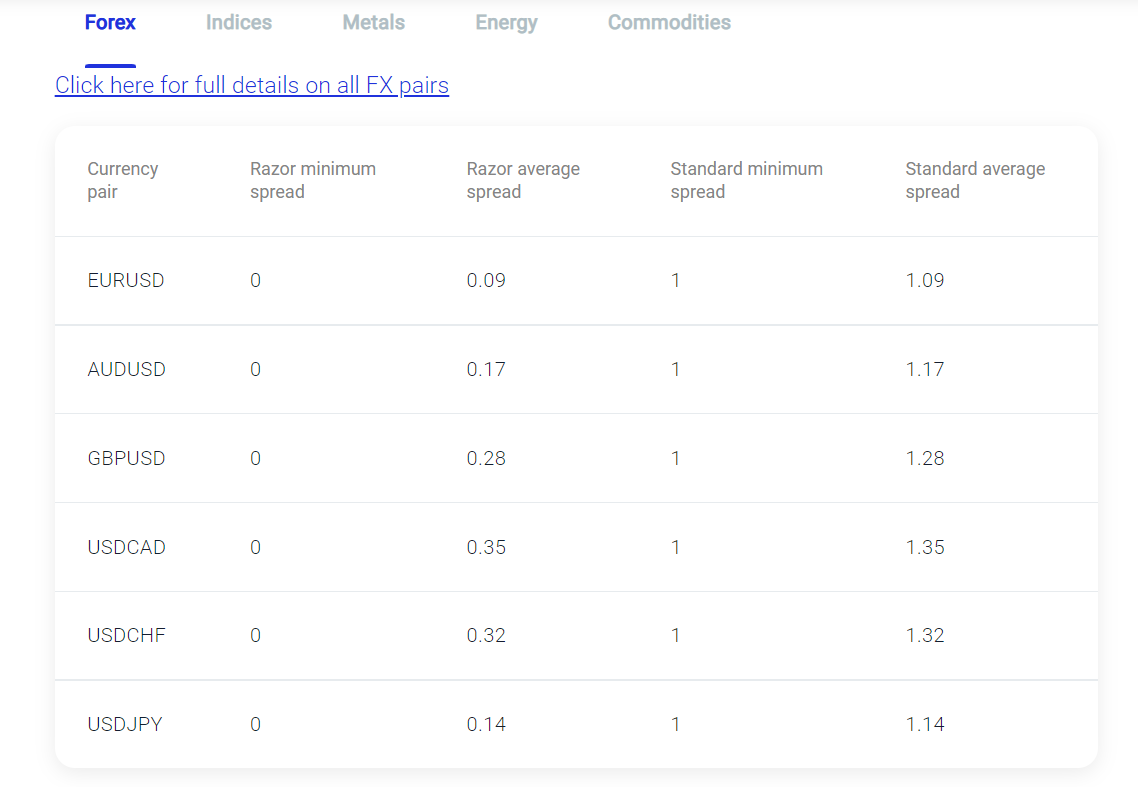

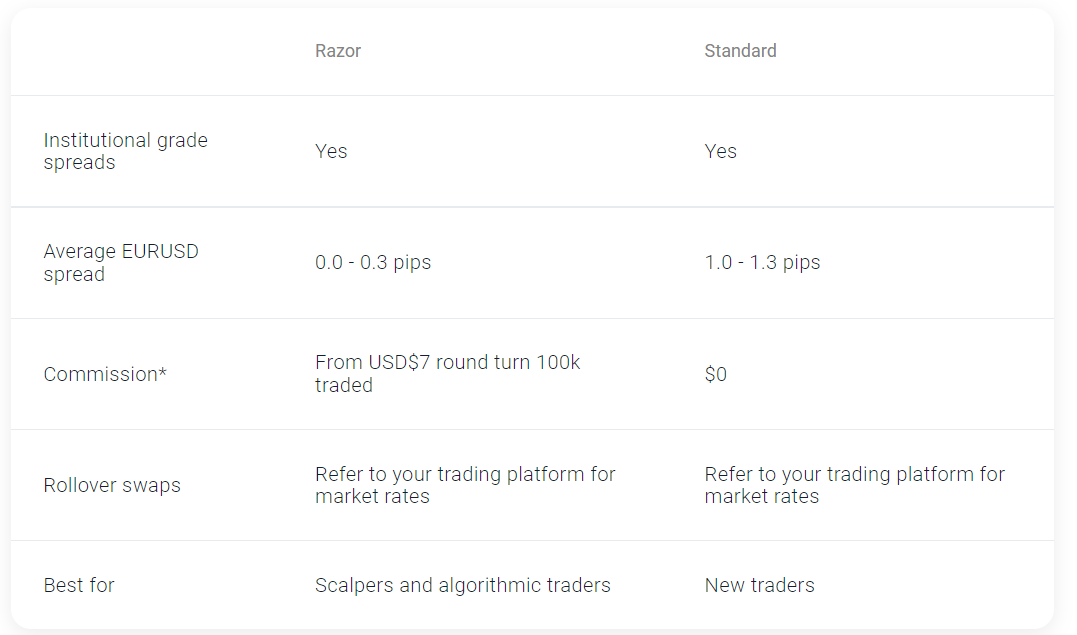

Pepperstone offers traders the to choose between two account types. One account is commission-based (Razor) while the other is commission-free (Standard). The spreads with the commission-based razor account are low starting from 0 pips while the same with the Standard account starts from 1 pip.

For EUR/USD as a benchmark, the average typical spread with the Razor account is 0.02 pips and 1.2 pips with the Standard account type. The following table compares the average typical spread in pips for the most traded financial instruments during peak trading hours.

Trading Instrument Standard Account Razor Account Account EUR/USD 0.77 0.17 GBP/USD 1.19 0.59 EUR/GBP 1.4 0.4 Gold/USD 13.81 13.81 Crude Oil 2.3 2.3 US Tech 100 Index 1 1 UK 100 1 1 The average spread at Pepperstone is lower when compared with the majority of regulated brokers in Kenya. We compared the average spreads on most traded forex pairs charged by various brokers in Kenya. The following table compares the spread on some of the most chosen forex pairs in Kenya. It must be noted that these are the spreads with no commission account at the following brokers.

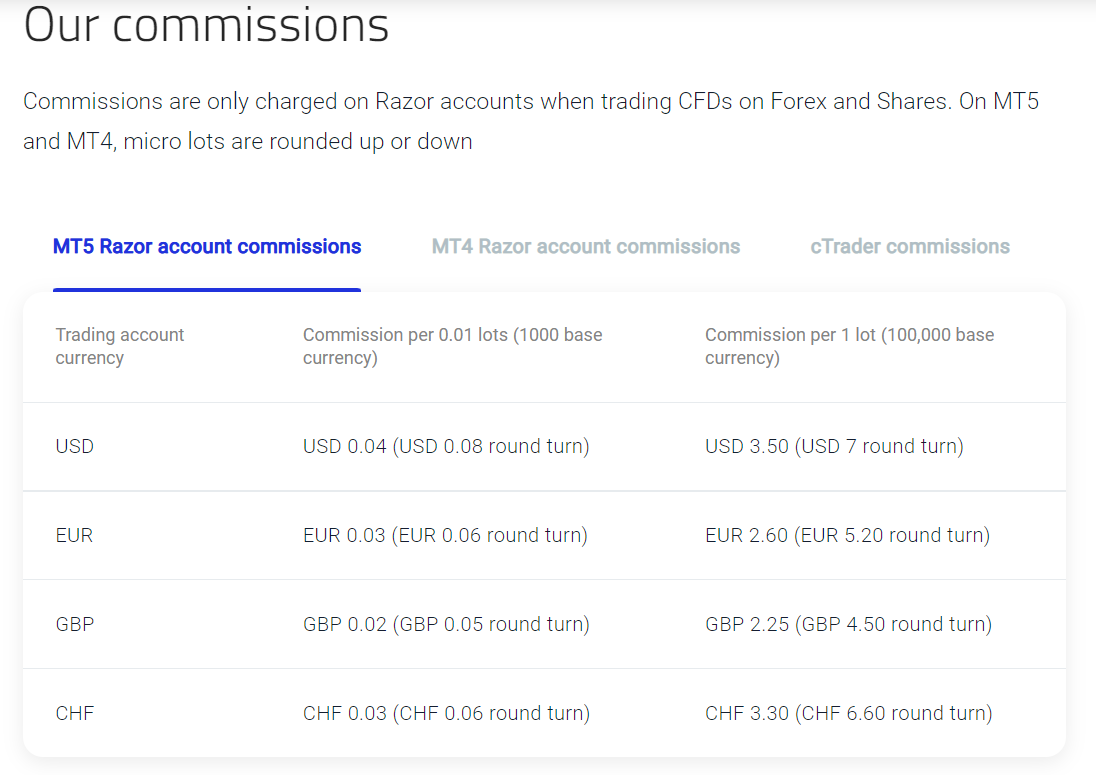

Trading Instrument IC Markets FXTM eToro CMC Markets Pepperstone EUR/USD 0.62 1.9 1.1 0.70 0.77 GBP/USD 0.83 2 2.3 0.9 1.19 EUR/GBP 1.27 2.4 2.8 1.10 1.40 USD/JPY 0.74 2.2 1.2 0.7 0.86 USD/CAD 0.85 2.5 1.7 1.3 1.07 - Trading Commission: The trading commission at Pepperstone is only incurred on the Razor account while trading Forex and shares. For the Standard account, the trading fee is built only in the spread. Apart from the low spreads, the trader will need to pay a fixed commission for each trade order with the Razor account.

If MT4 or MT5 trading platform is chosen with the Razor account, the single-side trading commission will be USD 3.5 or GBP 2.25 depending on the base currency of the account. For a round-turn trade of a standard lot, the commission will be USD 7 and GBP 4.5 with MT4 and MT5 Razor accounts.If the cTrader trading platform is chosen with the Razor account type, the trading commission will be $6 for a round-turn trade of a standard lot.

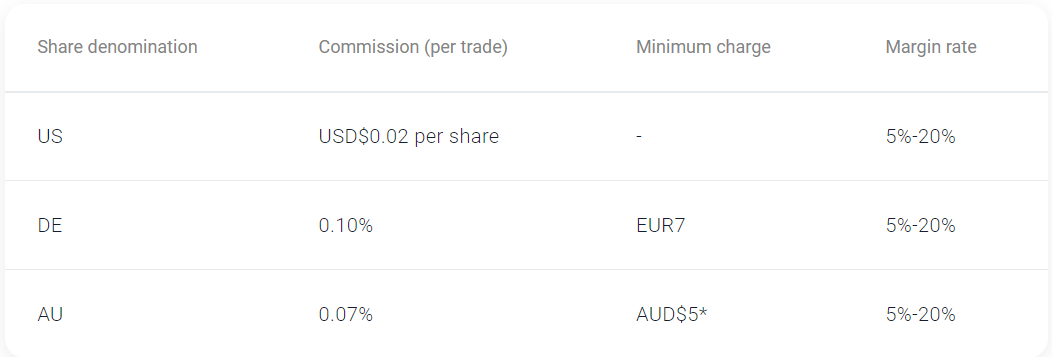

The trading commission of shares is different for stock exchanges and also has a minimum limit.

The trading commission is only applicable on CFDs of forex pairs and shares. For all the other instruments, only spreads will be incurred as a trading fee regardless of the account type. - Swap Fee: This is also known as rollover interest rate or overnight charges. The swap fee is the fee incurred on each position if it is kept open overnight. For every night the position is kept open, this will keep on adding. Hence, clients must check the swap fee before keeping any position overnight. This is very important for those traders who trade for a tenure of more than a day.

The swap rates at Pepperstone are slightly higher than average when compared with other regulated brokers in Kenya. For EUR/USD as a benchmark, the swap rates are -11.49 and 7.42 for long and short positions respectively.

- Non-Trading Commission: Most CFD brokers charge inactivity fees if no trade orders are placed for a prolonged period. No such inactivity is charged at Pepperstone. There is no account opening or maintenance fee at Pepperstone in Kenya. The deposits and withdrawals are also free of additional commission.

Overall, there are no non-trading fees at Pepperstone while the trading fees are lower than the majority of the regulated CFD brokers. We found Pepperstone to be among the most cost-effective CFD brokers in Kenya.

Pepperstone Account Types

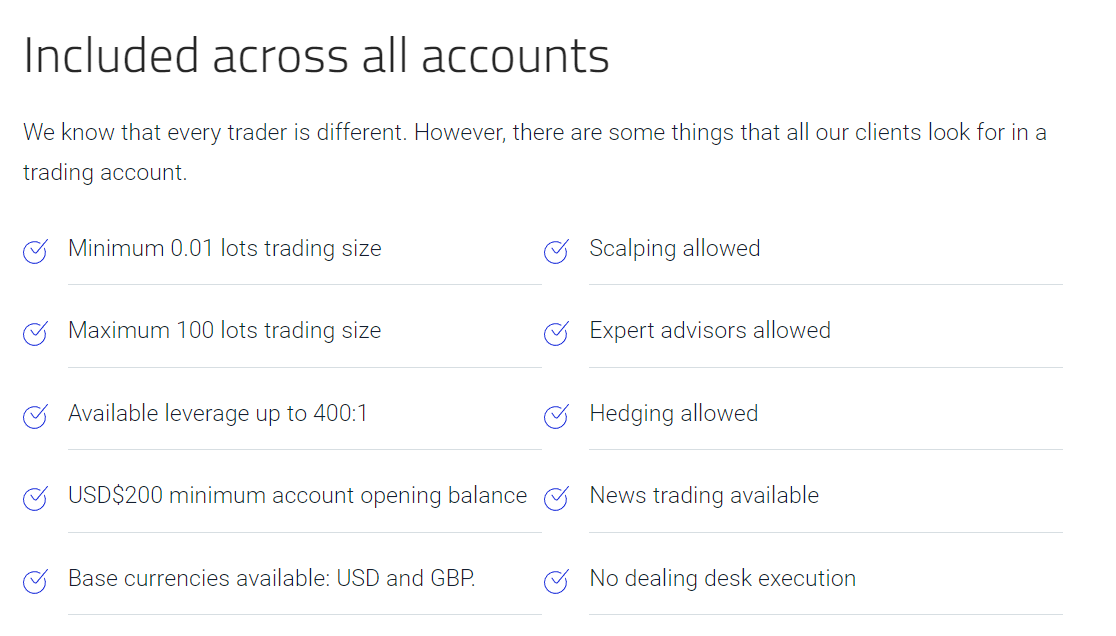

Pepperstone offers 2 types of accounts to suit different types of traders in Kenya. Both the accounts can only be opened with USD or EUR as a base currency. Kenyan Shillings cannot be chosen as the base currency of any account type.

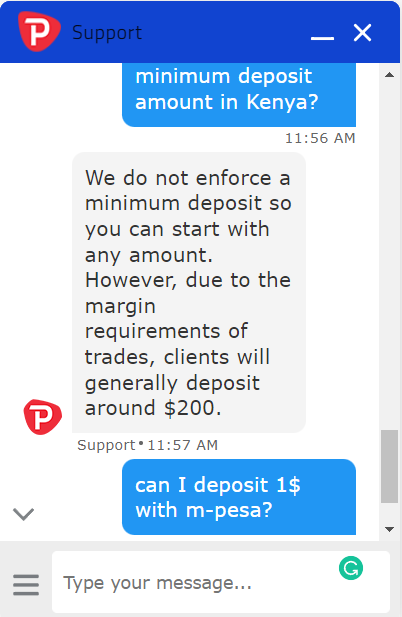

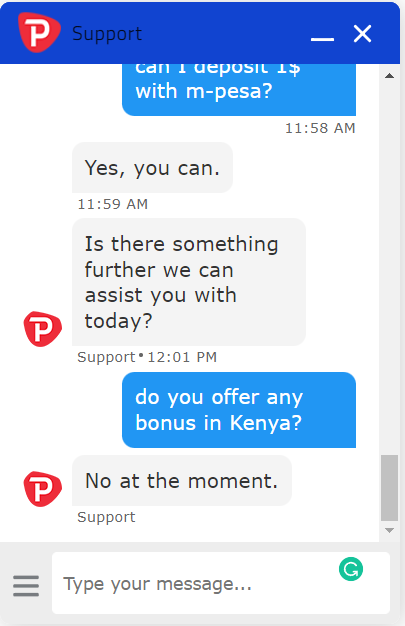

The minimum recommended deposit amount for both account types is $200 for margin requirements. However, Kenyan clients can deposit as low as 1$ to start trading at Pepperstone.

The major difference between the two types of live trading accounts is based on trading fees. The Razor account is a commission-based account while the trading fees with the Standard account are built into spreads only.

All the other features offered by Pepperstone are the same for both account types. The number of available instruments, maximum leverage, and trading conditions is the same for both account types.

- The Razor account is ideal for scalpers and algorithmic traders. Due to lower spreads, the advantage of a small movement in pips can be taken with the Razor account. High-volume traders may also find the Razor account type more useful.

- The Standard account is ideal for beginners and small-volume traders as there is no commission involved with this account.

The choice of account types is good to suit different types of traders in Kenya.

How to Open an Account at Pepperstone?

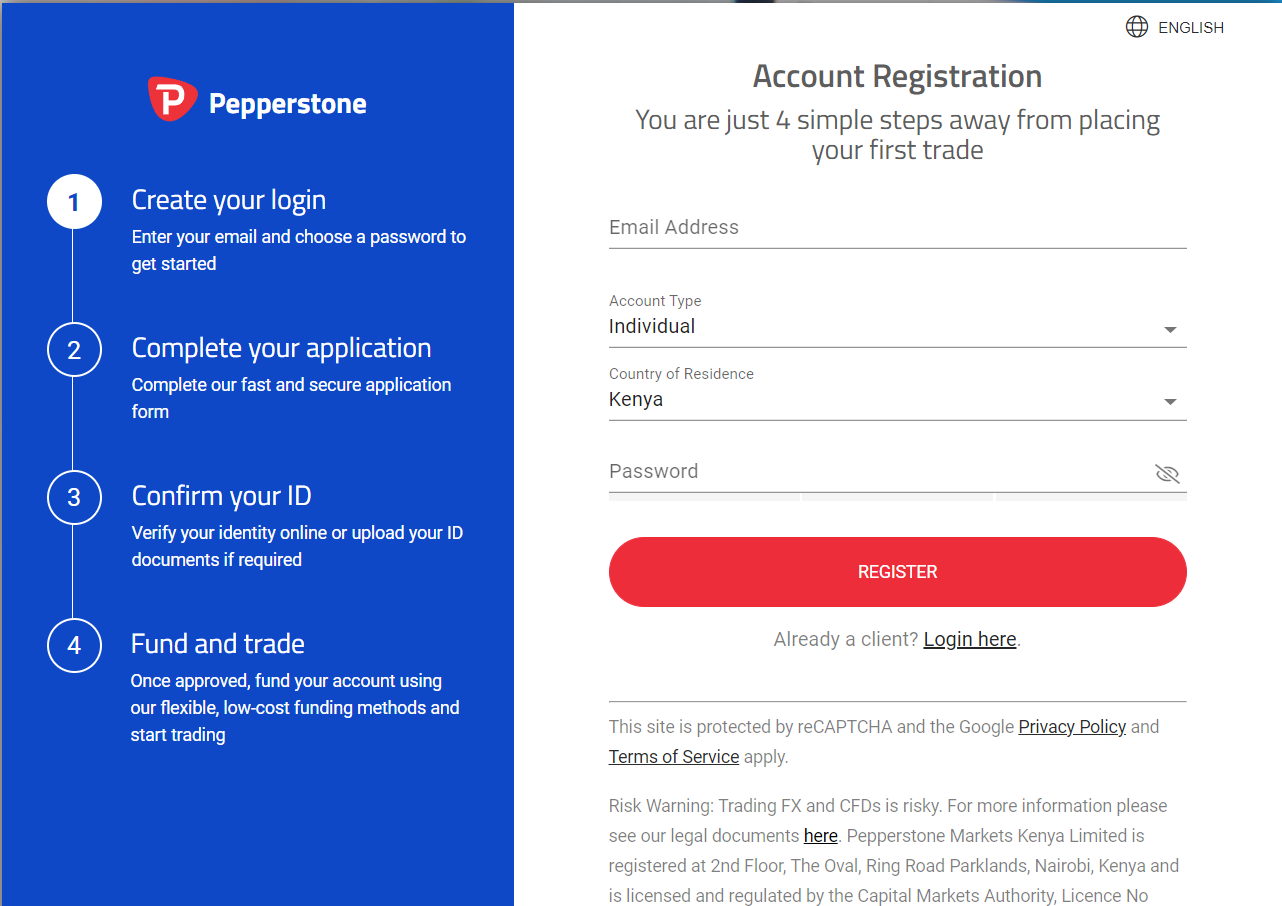

The account opening process at Pepperstone is simple and can be completed within 24 hours. There are 4 steps involved in setting up a live trading account in Kenya.

Step 1: Create Login

Once you click on ‘Join now’ at the Pepperstone website and app, you will be redirected to the account opening form. The first step is to enter the email and choose a password. A confirmation link to the entered e-mail address will be sent to confirm the email.

Clients can also choose to log in with Google or Facebook accounts.

Step 2: Complete Account Opening Form

The next step requires clients to enter their personal details. This includes the address, phone number, date of birth, income, and employment details. Clients also need to select the account type and base account currency in this step.

After filling in the personal details, Pepperstone will take a quick survey of your trading experience and expertise.

Step 3: Verification of Identity

The details that you entered in step 2 need to be verified by Pepperstone before you start trading. For this, you need to submit the address and identity proof with supporting documents. The Kenyan National ID or passport can be used to verify the address and identity.

This process will be completed by the Pepperstone staff. Hence, it can take up to 3 business days to complete but is generally completed within 24 hours.

Once the details are verified, a confirmation mail will be sent to you with login details of the trading platform. These credentials can be used to login into selected trading platforms.

Step 4: Fund your Account

The last step is to deposit funds in order to start trading. Pepperstone requires clients to make an initial deposit of $200 to start trading. Any of the available methods including local bank transfer or m-Pesa can be used to deposit funds at Pepperstone.

Once the funds are deposited, you can place orders trade with any of the available trading instruments.

It is always advisable for beginners in forex trading to start with demo accounts. Trading with virtual currencies will provide experience and will make the newcomers get comfortable with the features and terminologies. CFD trading involves high risk and is not suitable for all types of traders.

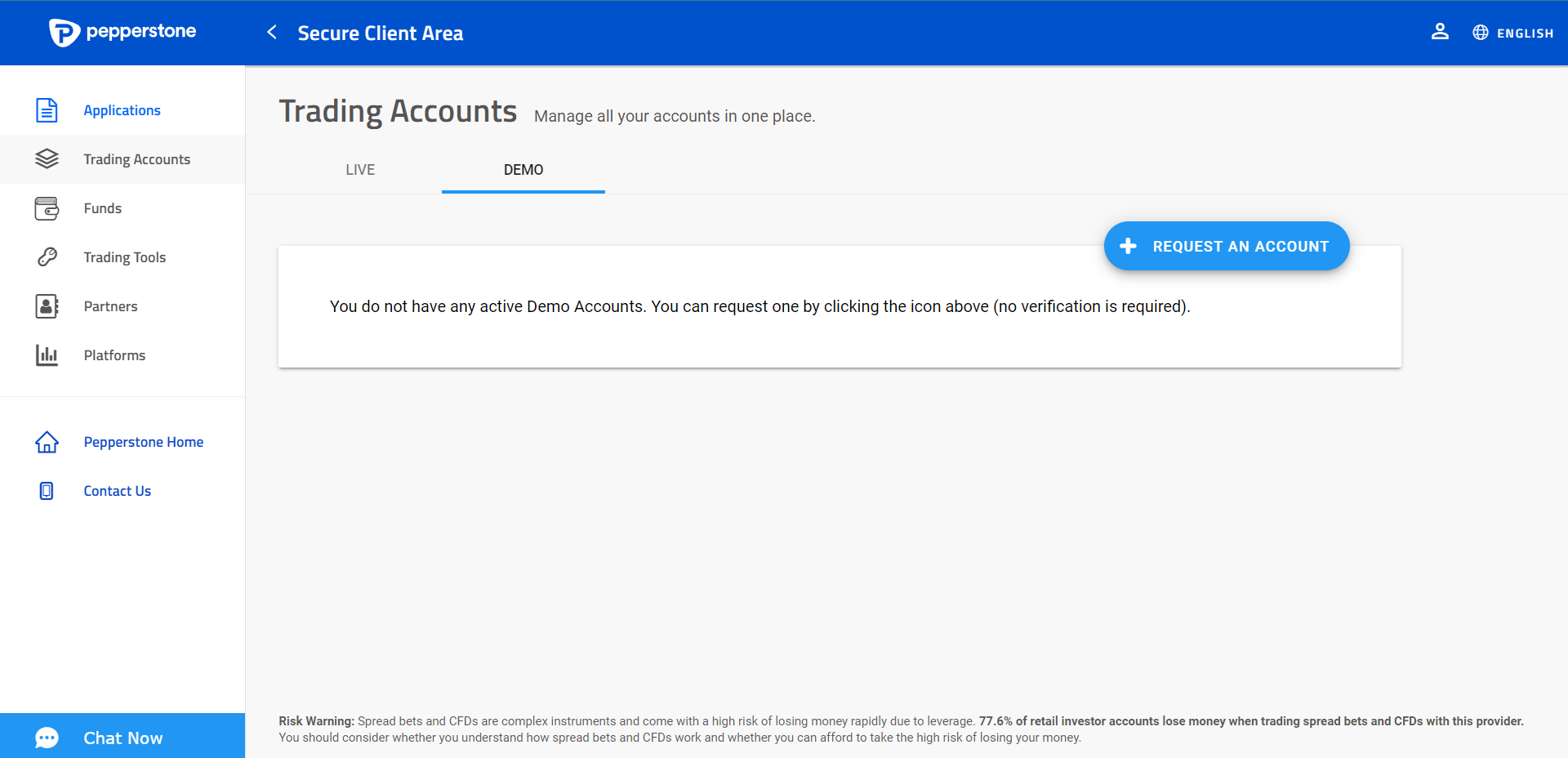

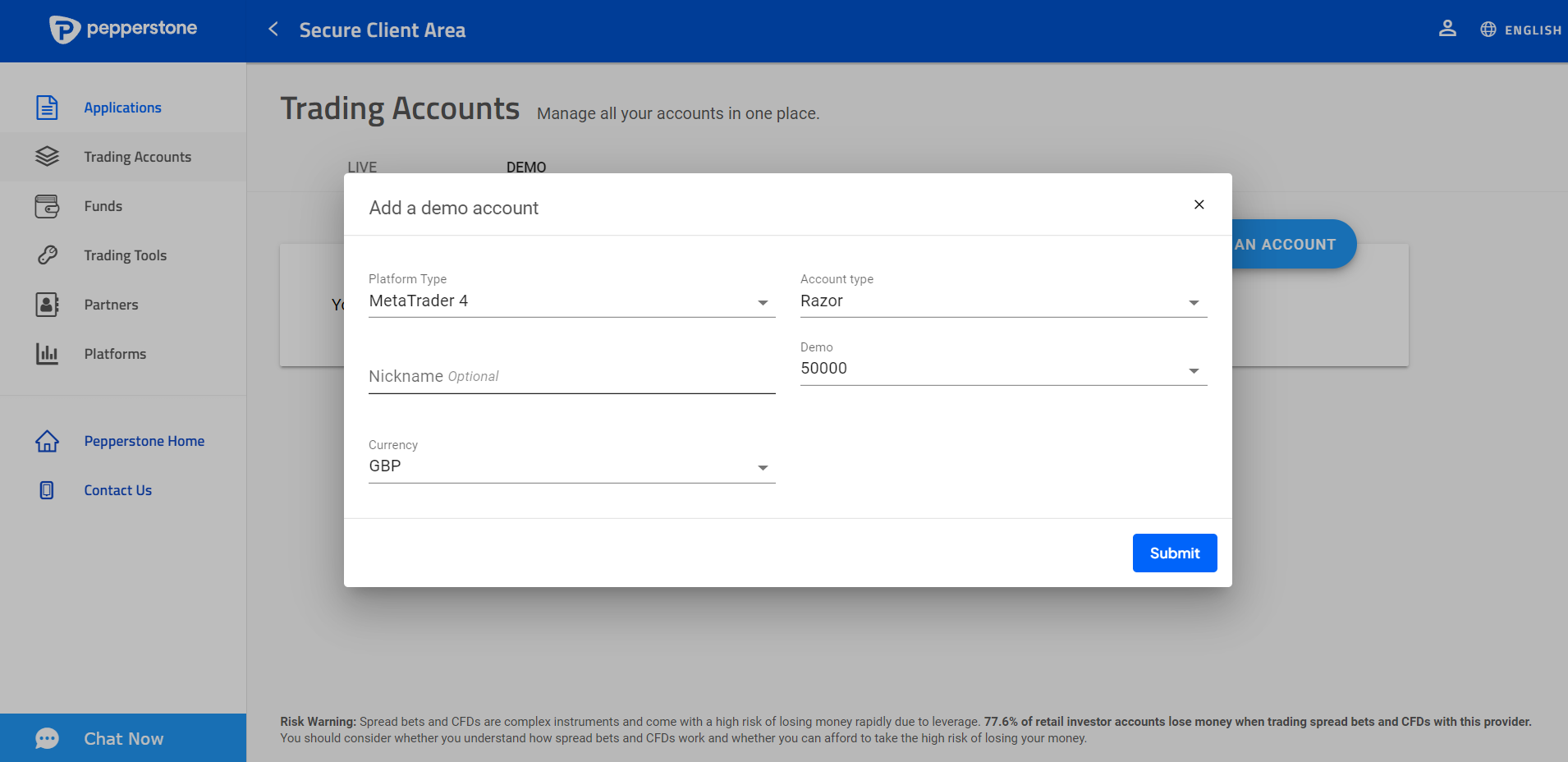

Pepperstone Demo Account Review

Pepperstone offers a very useful demo account where traders can learn about trading and gain experience without depositing any money to the broker.

The demo account at Pepperstone is available for everyone free of cost. Compared to other brokers, we found Pepperstone to be better than most other brokers as it allows traders to customize the demo account on multiple trading platforms.

To open a demo account at Pepperstone, traders need to complete the first step of account opening by providing basic details like name, phone number, and email address.

After completing this, traders will be redirected to the dashboard where another detail and account verification is to be completed. However, traders can directly go to the ‘Trading Accounts’ section without filling in any detail on the dashboard.

Under the demo account section, traders can open multiple demo accounts with different configurations with different trading platforms. The trading platform for the demo account can be chosen between MT4, MT5, cTrader, and TradingView. Those who are new to trading can try 4 different types of trading platforms to find the most suitable platform.

Traders can also open a demo account for spread betting. Razor, Standard, and Spread betting accounts can be chosen for suitable pricing structures. The Standard account will incur only a spread as a trading fee while the Razor account includes a commission with a narrower spread. The demo account can also help to choose the best-suited account type for the traders.

The base currency of the demo account can be chosen between USD, EUR, GBP, and CHF. The initial deposit amount can be chosen from 200 to 50,000 units of the base account currency.

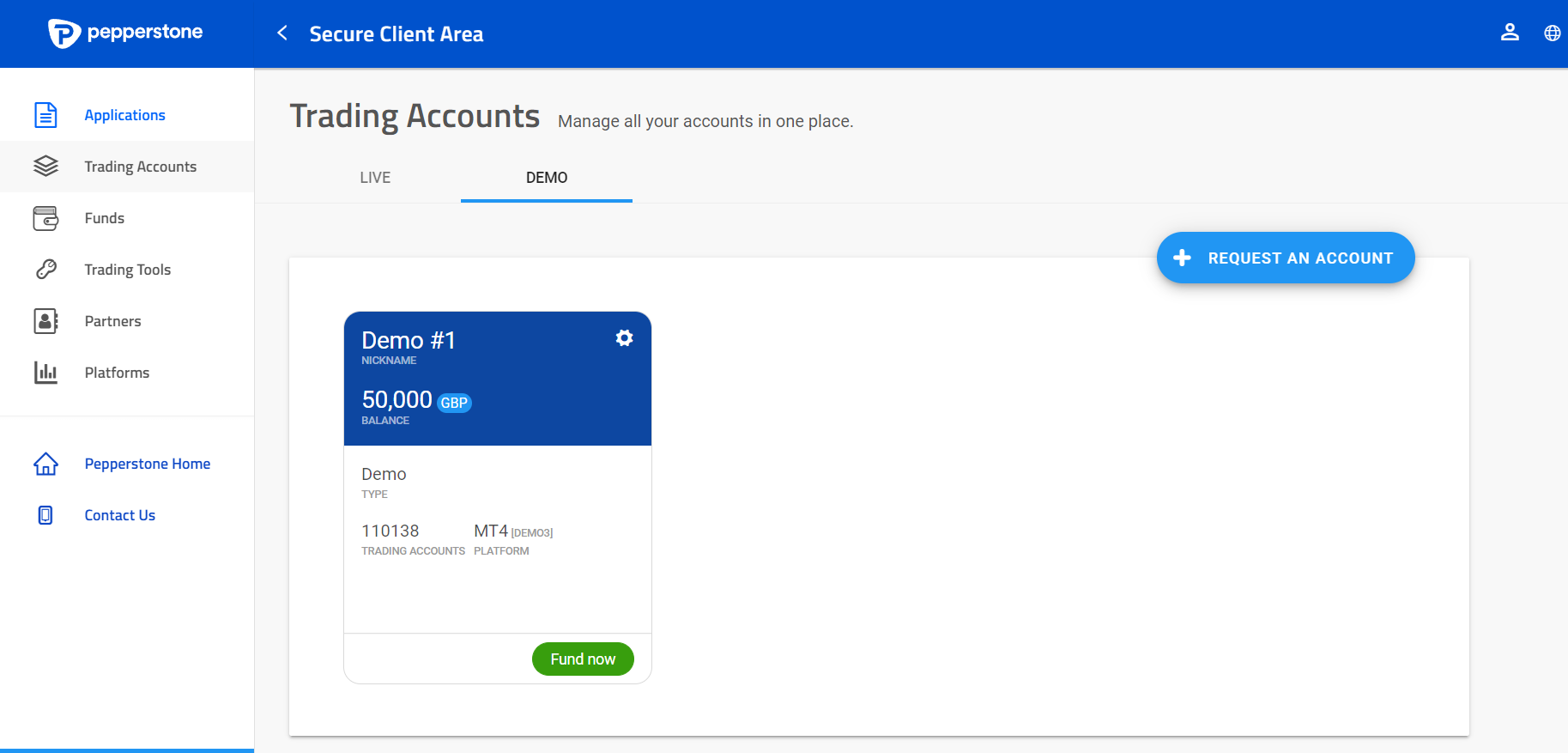

Once configured, the details of the demo accounts will be visible on the dashboard. These details can be used login into the trading platform chosen. The demo account can be funded anytime with any amount of virtual currency.

According to our review and analysis, Pepperstone offers a very useful demo account for all types of traders. New, as well as experienced traders, can use the demo account at Pepperstone to enhance their trading strategies. The availability of the TradingView trading platform with the demo account is a major advantage for traders.

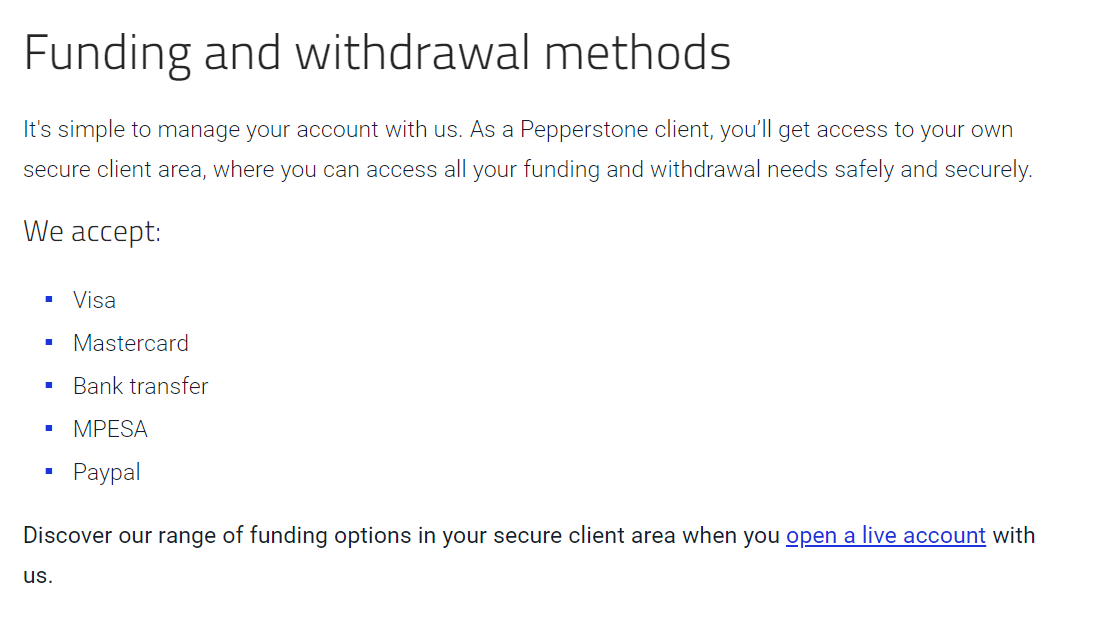

Pepperstone Deposits and Withdrawals

There are multiple methods to deposit and withdraw at Pepperstone in Kenya. Withdrawals can only be done through the methods used for the deposit.

There is no lower limit on the minimum deposit amount at Pepperstone. Kenyan clients can also deposit as low as $1 through m-Pesa.

Following are the methods that can be used to transact at Pepperstone in Kenya:

- Bank Transfer: Pepperstone accepts deposits and withdrawals through local bank transfers in Kenya. The deposits are reflected into trading accounts within a day while the withdrawals through this method can take up to 3 business days to process.

Clients can also deposit through international wire transfer but a commission of $20 is charged for each transaction through wire transfer. Local bank transfer is completely free in Kenya. - M-Pesa: This is the most preferred method to deposit and withdraw at Pepperstone in Kenya. The recommended deposit while account opening is $200 but minimum deposits can be lower. Deposits made in KES will be automatically converted to USD or GBP according to prevailing conversion rates.

- VISA/MasterCard: The debit and credit cards can also be used to deposit at Pepperstone. The card must be registered with the same name as the trading account.

- Paypal: Paypal is the only accepted e-wallet accepted for deposits and withdrawals at Pepperstone in Kenya. No other e-wallets can be used to deposit and withdraw.

Withdrawal requests made before 07:00 (AEST) will be processed the same day. All other withdrawal requests executed before 21:00 (GMT) will be processed the next day.

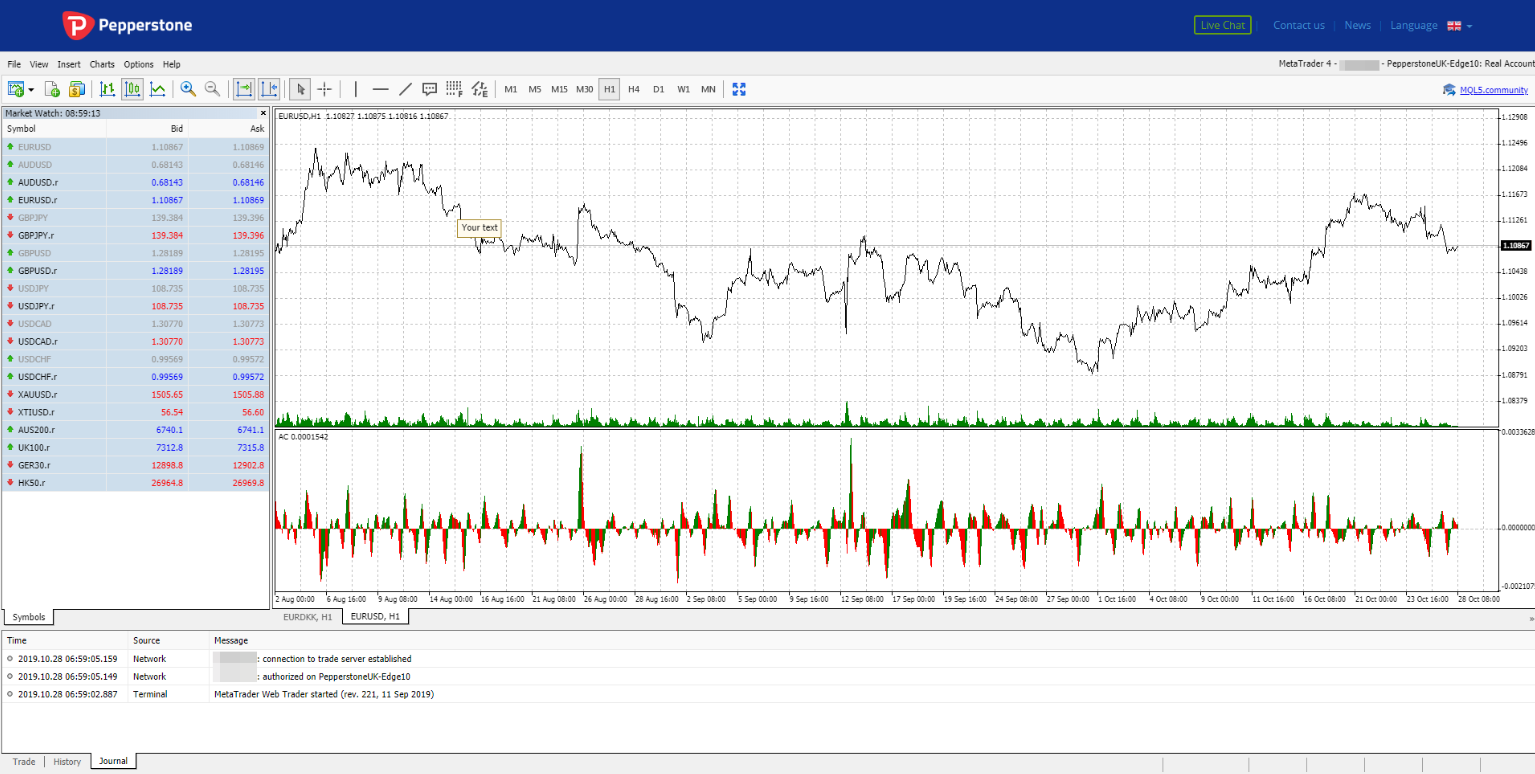

Pepperstone Trading Platforms

Pepperstone offers multiple trading platforms to suit different types of traders in Kenya. Pepperstone does not have its own trading platform. All the available trading platforms at Pepperstone are developed by third-party software companies.

To assist the traders in making a better decision, we have separately reviewed the web, mobile, and desktop trading platforms available at Pepperstone in Kenya.

Web Trading Platform

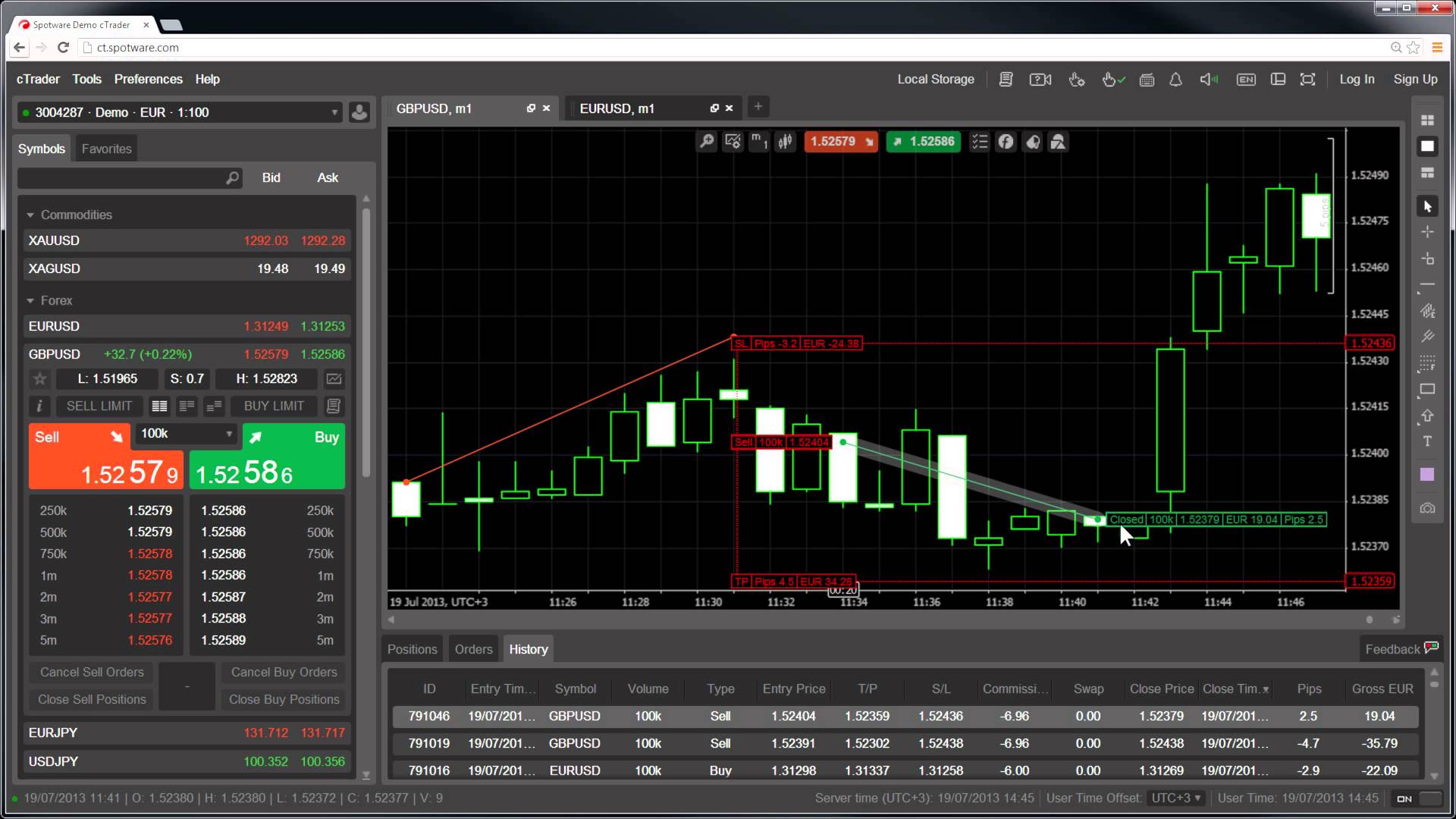

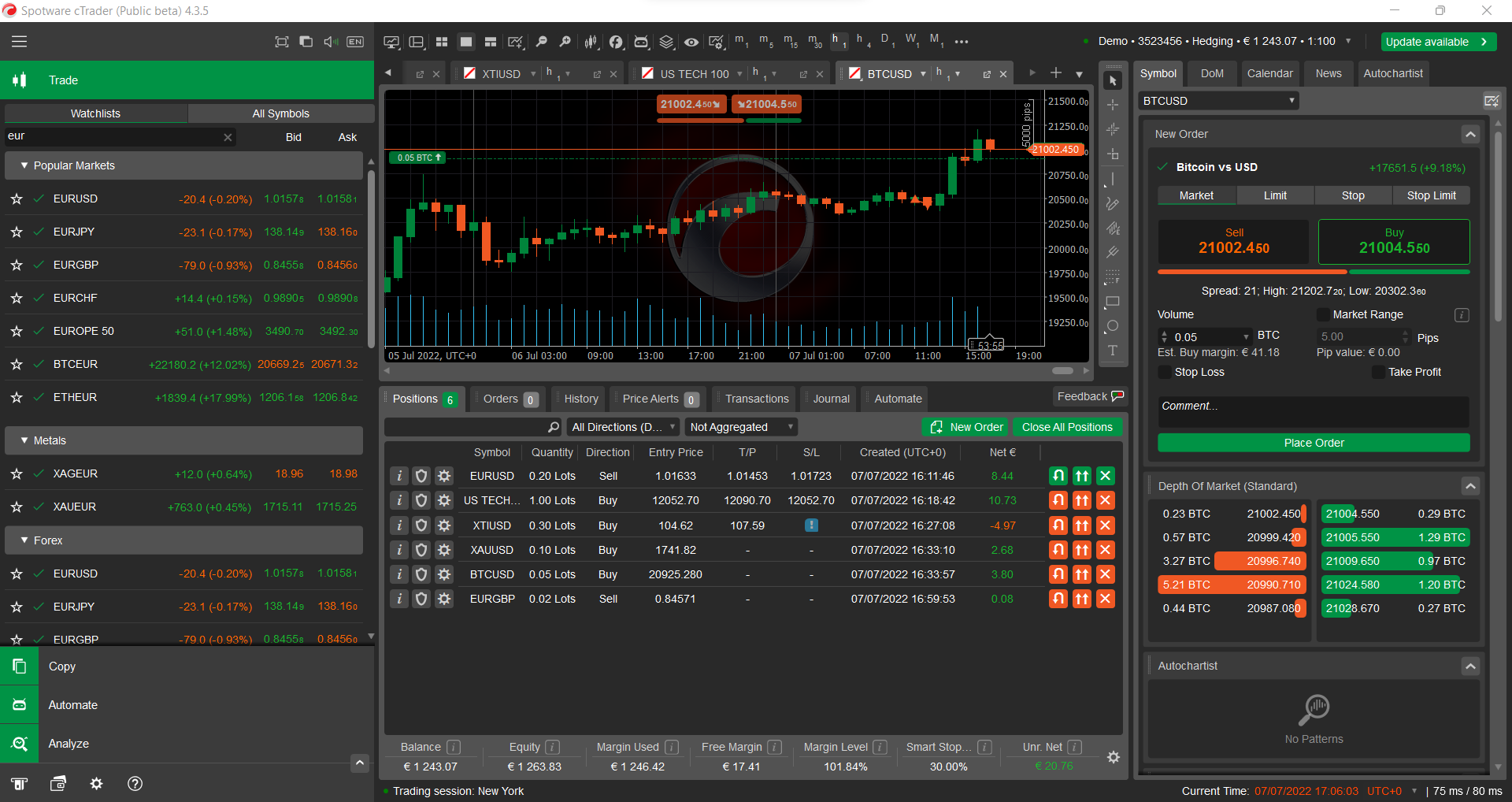

The web trading platform at Pepperstone is provided by MetaTrader and cTrader trading platforms. The MT4 and MT5 web trading platforms are available in 40+ languages and can be customised easily. MT4 has a basic interface with 28 indicators. It can be connected to other online tools and plug-ins on the web browser.

MT5 is an upgraded version of MT4 with 38 in-built indicators and 21 time frames. MT5 supports the MQL5 language for algorithmic trading which can be easily learned. MT4 supports MQL4 language and cTrader supports #C language.

cTrader web trading platform has a better interface that makes it ideal for beginners. It cannot be customised and offers lesser indicators and time frames compared to MetaTrader web platforms.

All three web trading platforms at Pepperstone have a one-step login and offer market, limit, and stop orders. Trailing stop loss orders are not available on web trading platforms at Pepperstone.

Mobile Trading Platform

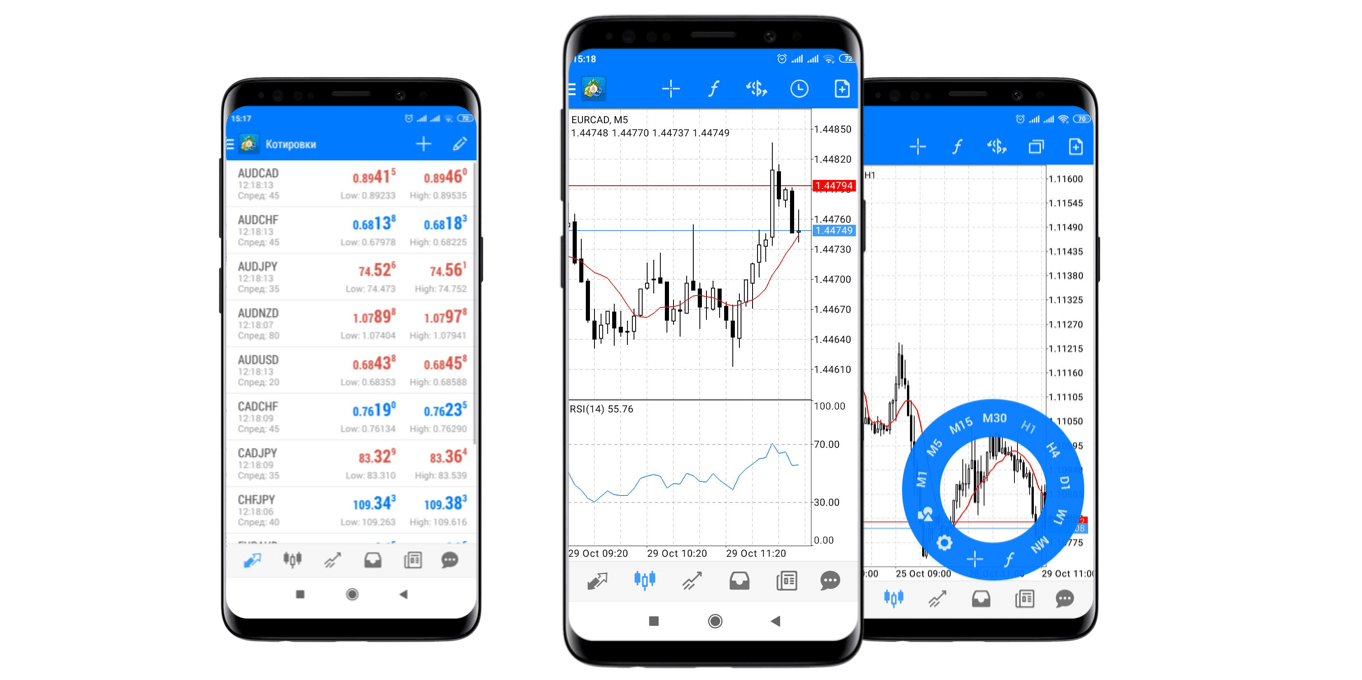

MT4, MT5, and cTrader are also available as android and iOS applications. These can be downloaded separately and linked to the Pepperstone account to trade on the go from anywhere.

The mobile trading platforms at Pepperstone offer limited features and accessibility for research and analysis purposes when compared to web and desktop platforms. The MT4 and MT5 mobile trading platforms are available in 21 languages and have 2 step login. All mobile platforms can be accessed through fingerprint and facial recognition.

cTrader offers similar features as web and desktop platforms for mobile devices. Mobile trading devices cannot be customised and are slightly slower than desktop platforms for trading forex and CFDs.

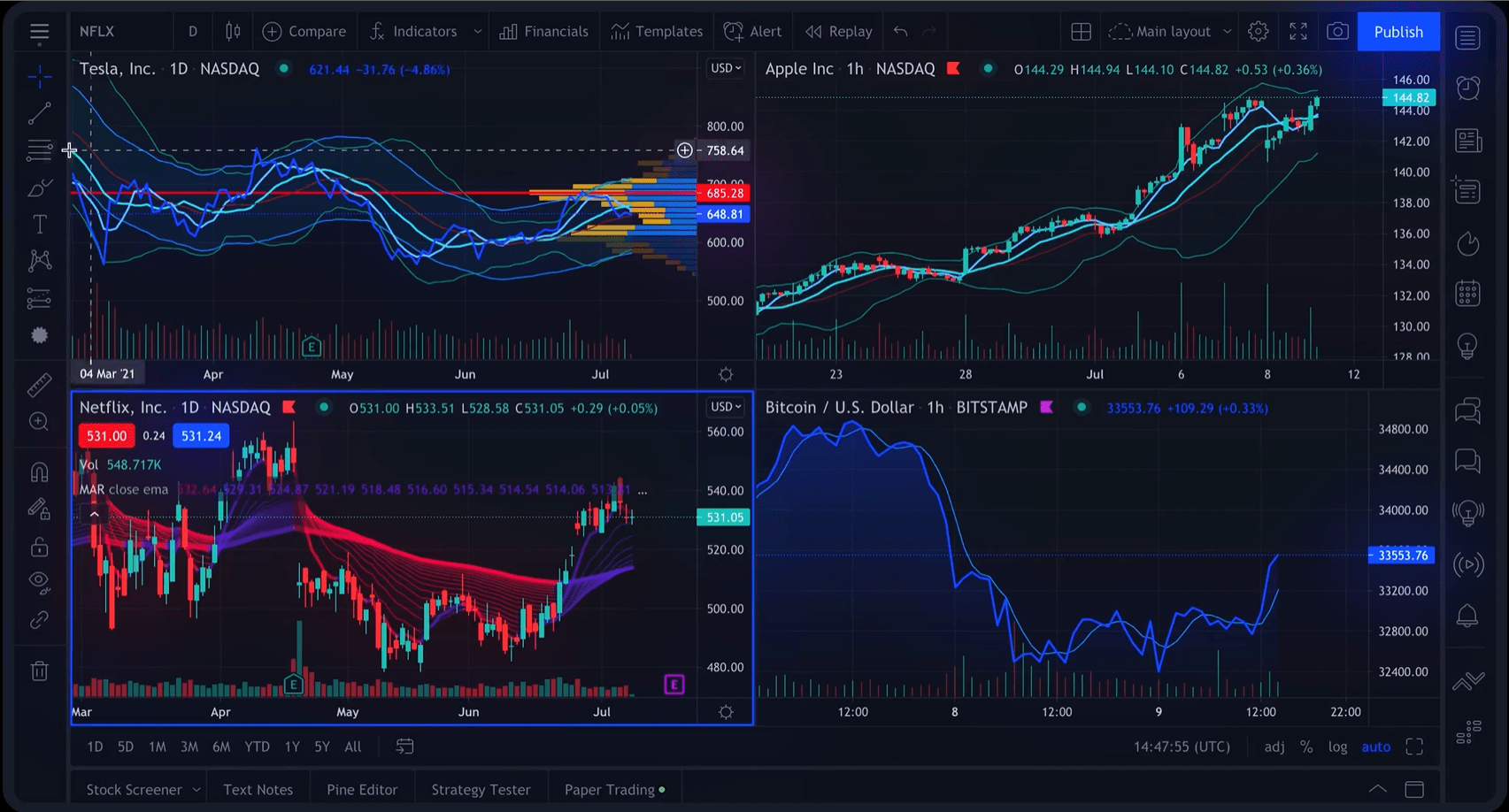

Mobile trading can also be done through Trading View at Pepperstone. Trading View is among the best software for the analysis of capital markets.

Desktop Trading Platform

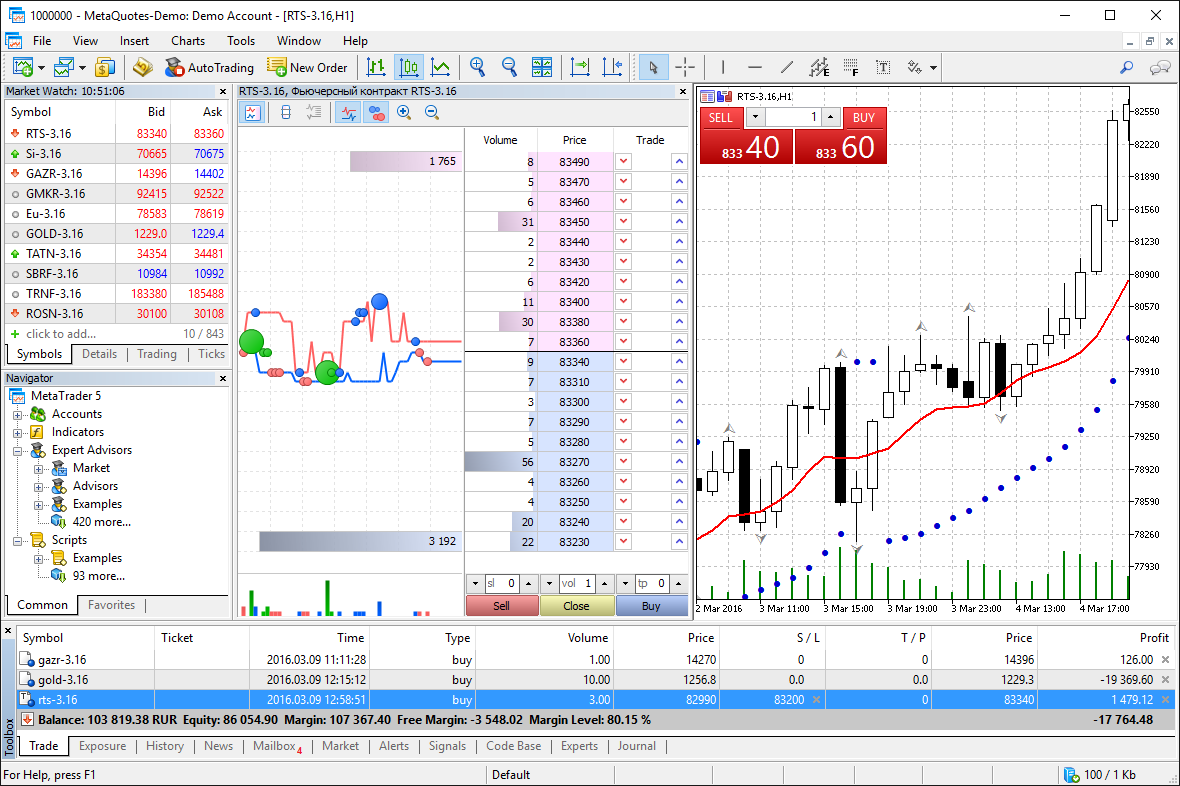

Pepperstone offers 4 options for trading on desktop devices. MetaTrader 4, MetaTrader 5, cTrader, and Trading View. All these platforms can be downloaded on Windows and macOS devices and can be connected with external software and plugins. You can also set price alerts and notifications on the desktop trading platforms at Pepperstone.

MT4 has the most simple interface that looks like Windows 98. It is highly customisable and works well on all types of desktop devices. MT4 is the most chosen trading platform globally for trading forex and CFDs.

MT5 is also chosen largely over the globe for trading forex and CFDs but it is banned in some countries like the USA, UAE, etc. MT5 is legal and available at Pepperstone in Kenya. It has a better interface compared to MT4 and more indicators, time frames, and features. Mt5 has easier backtesting of algorithms and is ideal for experienced and algorithmic traders.

cTrader has a much better interface compared to MT4 and MT5 desktop trading platforms. It is less customisable and has lesser tools compared to MT5 but the modern-looking interface makes it a good choice for beginners.

Trading View is also available as a desktop trading platform at Pepperstone. Trading View is a very useful software for all types of traders for the analysis of financial instruments. No other CMA-regulated brokers in Kenya allow trading through Trading View.

Trading View offers the widest range of indicators and patterns and has one of the largest social trading networks. Automation on Trading View is done through Pine Script language which is much simpler for beginners.

According to our analysis, Pepperstone offers a great variety of trading platforms for all devices. Each platform is ideal for different types of traders. The availability of Trading View is a major advantage of choosing Pepperstone in Kenya.

IC Markets Research and Education

IC Markets offer multiple tools to educate every type of trader in Australia. The research tools are however limited when compared with other forex and CFD brokers in Australia.

The research tools include a market analysis blog and an economic calendar. They publish blogs on price prediction, market sentiments, and trends to assist traders. No specific research tools are available for specific capital markets and instruments.

We found a rich variety of education tools at IC Markets. They offer a beginner’s course to understand the basics of forex and CFD markets that includes 10 lessons. Other offerings like podcasts, webinars, video tutorials, WebTV, etc can assist all types of traders to enhance their trading skills.

Following are the list of research and education tools offered by IC Markets

- Market Analysis: They provide daily, weekly, and monthly market reports, including technical and fundamental analyses.

- Economic Calendars: IC Markets features economic calendars to track key events impacting financial markets.

- Webinars and Seminars: Expert-led webinars and seminars cover trading strategies and market insights.

- Video Tutorials: Traders access video tutorials on various topics, including platform usage and trading strategies.

- Written Guides and E-Books: Educational materials on risk management, technical analysis, and trading psychology.

- Demo Accounts: Practice trading with virtual money using their demo accounts.

- Customer Support: Responsive customer support for addressing queries and concerns.

Multiple articles are available at IC Markets describing the advantages and analysis techniques that can be helpful for traders in Kenya.

Compared with other ASIC-regulated forex and CFD brokers in Australia, IC Markets offer sufficient tools for educating the traders. However, the number of tools to support the traders in the research is much lesser.

Available Instruments

Pepperstone offers CFD trading on various financial instruments. Contract for Deposits (CFDs) is derivative instruments of financial markets in which there is no actual buying or selling of underlying assets. Only the price difference is speculated by the traders to book profits and losses.

High leverage can allow traders to open bigger positions with a small deposit but it will also increase the risk factor. Following are the trading instruments that can be traded at Pepperstone in Kenya.

- 63 Currency Pairs: A total of 63 currency pairs including major, minor, exotics, and other crosses can be traded at Pepperstone with any of the account types. The maximum leverage for Kenyan clients is 1:400 for CFDs on forex pairs.

- 26 Indices: Indices of North American, African, UK, and European stock markets can be traded as CFDs. The maximum leverage is 1:200 for indices with professional accounts. For retail clients, the maximum leverage is 1:20. 3 currency indices can also be traded with max leverage of 1:10 for retail clients.

- 32 Commodities: Precious metals, energy, and soft commodities can also be traded as CFD. The maximum leverage for retail clients is 1:20 for this asset class.

- 1000+ Shares: More than 1000 stocks of the US, UK, Germany, and Australian stock exchanges can be traded as a CFD. The commission is different for the US, European, and Australian stocks. The leverage ratio ranges from 1:20 to 1:5 for CFDs on stocks.

- 100+ ETFs: Kenyan clients can go long and short on various exchange-traded funds from 35 countries worldwide. These ETFs are traded as CFDs with a maximum leverage of 1:20. The CFDs on ETFs are subject to spreads, overnight charges, and a fixed trading commission on each order.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 63 | 1:400 |

| Indices | 16 | 1:200 |

| Commodities | 32 | 1:20 |

| Shares | 1000+ | 1:20 |

| ETFs | 100+ | 1:20 |

Overall, the number of the available trading instrument is higher than most of the regulated online CFD brokers in Kenya. Trading on cryptocurrencies as CFD is not available at Pepperstone.

Pepperstone Trade Execution Method

Pepperstone operates as an STP (Straight Through Processing) broker. This means that client orders are directly forwarded to liquidity providers without any interference or dealing desk intervention from the broker. As a trader, when you place an order with Pepperstone, it is transmitted straight through to the interbank market or liquidity providers with whom Pepperstone has partnerships.

The STP model ensures that there is no conflict of interest between the broker and the trader. Pepperstone generates revenue through spreads or commissions on trades rather than taking the opposite side of the trade.

The STP execution model can provide advantages such as fast trade execution, transparency, and potentially tighter spreads.

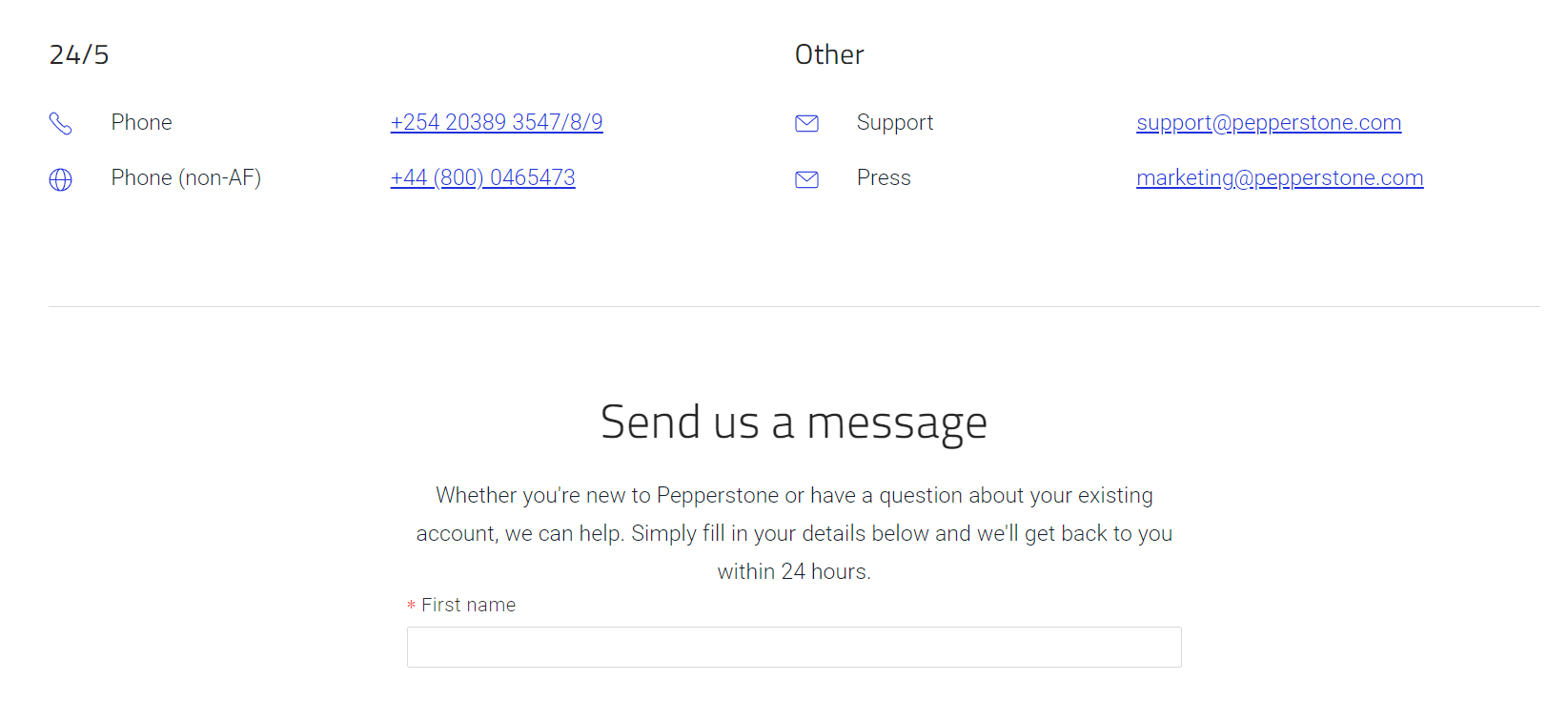

Pepperstone Customer Support

The customer support services can be utilized to solve any query faced at any stage. The support executives at Pepperstone can be reached out through multiple methods.

- Live Chat: The live chat window on the website and app is a great option to clear most of the queries faced. The live chat gets connected to a chatbot at first but can be connected to an agent upon request. The live chat support is also available through WhatsApp.

We tried to connect with them multiple times. The connectivity with the live agent can take up to 5-10 minutes. The support staff is helpful and can clear most of your queries. - E-mail: The support staff at Pepperstone can also be reached out through [email protected]. This is a slower method as the executives can take up to 24 hours to revert back to the email.

- Local Phone Support: Pepperstone offers local phone support for Kenyan clients. Clients can connect with the support staff at Pepperstone through 3 different local helpline numbers +254 20389 3547/8/9. This is a major advantage for Kenyan clients.

According to our review, the customer support service is excellent with the live chat. The support service is also available on WhatsApp which is quite user-friendly. The availability of local phone support is a major advantage for Kenyan clients.

Pepperstone Bonus

At the time of this review in 2022, there is no bonus offering of any type for Kenyan clients at Pepperstone. We also confirmed this by asking the support executives.

Other CMA or top-tier regulated brokers in Kenya offer better bonuses compared to Pepperstone.

Do We Recommend Pepperstone?

Yes, Pepperstone is a CMA-regulated non-dealing CFD broker that is also regulated by top-tier ASIC and FCA. The trading fees are low and there is no minimum deposit requirement. Transactions can be done via local bank transfer and m-Pesa without any additional commission.

Multiple trading platforms are supported with different account types. The customer support service is excellent. Kenyan Shillings cannot be chosen as a base currency and there is no bonus offering for Kenyan clients.

According to our review, Pepperstone is one of the most cost-effective CFD brokers in Kenya with the lowest third-party risk.

Pepperstone FAQs

Is Pepperstone Regulated in Kenya?

Yes, Pepperstone is regulated by the Capital Markets Authority (CMA) in Kenya as a non-dealing online forex broker. The Pepperstone CMA license is held by the name Pepperstone Markets Kenya Limited with company number PVT-PJU7Q8K and CMA license number 128.

What is the Minimum Deposit at Pepperstone?

There is no lower limit on the minimum deposit at Pepperstone. Clients can deposit as low as $1 but the suggested minimum deposit amount is $200 for margin requirement.

Is Pepperstone a Scammer?

No, Pepperstone is a legit Financial Service Provider and is regulated by CMA in Kenya, FCA in the UK, ASIC in Australia, and several other regulations. It is an online CFD broker that allows the trading of various financial instruments with leverage.