9 CMA Regulated Forex Brokers in Kenya

We have checked and listed the CMA regulated forex brokers in Kenya. The comparison of these locally regulated Forex Brokers is based on their safety, deposit & withdrawals, trading platforms, support & more factors.

Forex trading is legal in Kenya as long as you trade with a CMA Licensed Forex broker. Forex trading is regulated in Kenya by the Capital Markets Authority (CMA). It is risky to trade with unlicensed brokers.

Seven non-dealing forex brokers are currently regulated by CMA in Kenya as of December 2023.

Many offshore and foreign brokers accept traders from Kenya, but if you want to trade Forex in Kenya, it is really important to use a local Forex broker who is regulated in Kenya.

When you trade via a CMA-regulated broker in Kenya, you are in compliance and protection of the regulation and law with low third-party risk. Traders have to ensure the safety of their deposited funds, and in case of a dispute with a broker, you can get protection by filing a complaint with the CMA.

List of 9 CMA Regulated Forex Brokers in Kenya for 2024

- FXPesa – Best Regulated Forex Broker in Kenya

- HotForex Kenya – Regulated Forex Broker with Low Fees

- Scope Markets – Regulated Forex Broker with MT5

- Pepperstone Kenya – Regulated Forex Broker with ECN Type Account

- Exinity Limited – CMA Regulated Forex Broker with Raw Spread

- Windsor Markets – CMA Regulated Forex Broker

- Exness (Tradenex) – Low cost CMA Regulated Forex Broker

- Ingot Africa Limited – CMA Regulated Forex Broker

- Admirals KE Limited – CMA Regulated Forex Broker with Low Spread

This guide provides the list of regulated Forex brokers operating in Kenya, their license details, and trading conditions.

CMA Regulated Forex Brokers in Kenya

The 9 forex brokers that are licensed in Kenya by CMA and details about their registration and trading are described below:

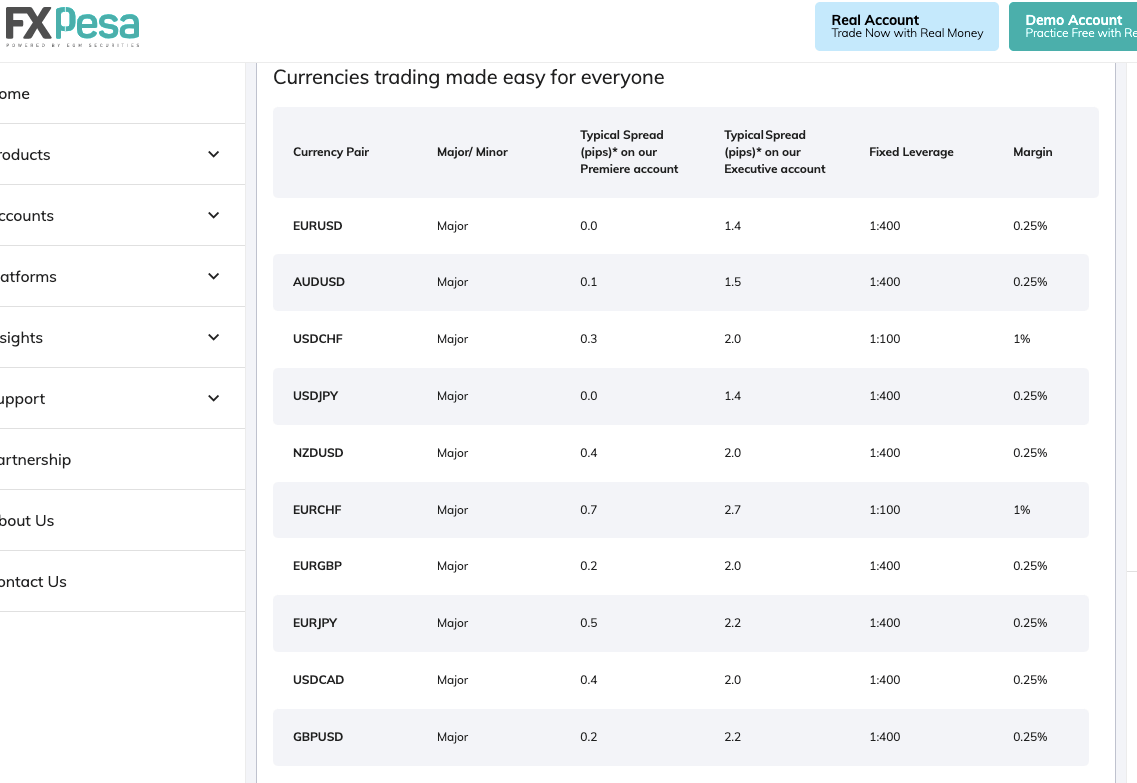

#1 FXPesa – Best Regulated Forex Broker in Kenya

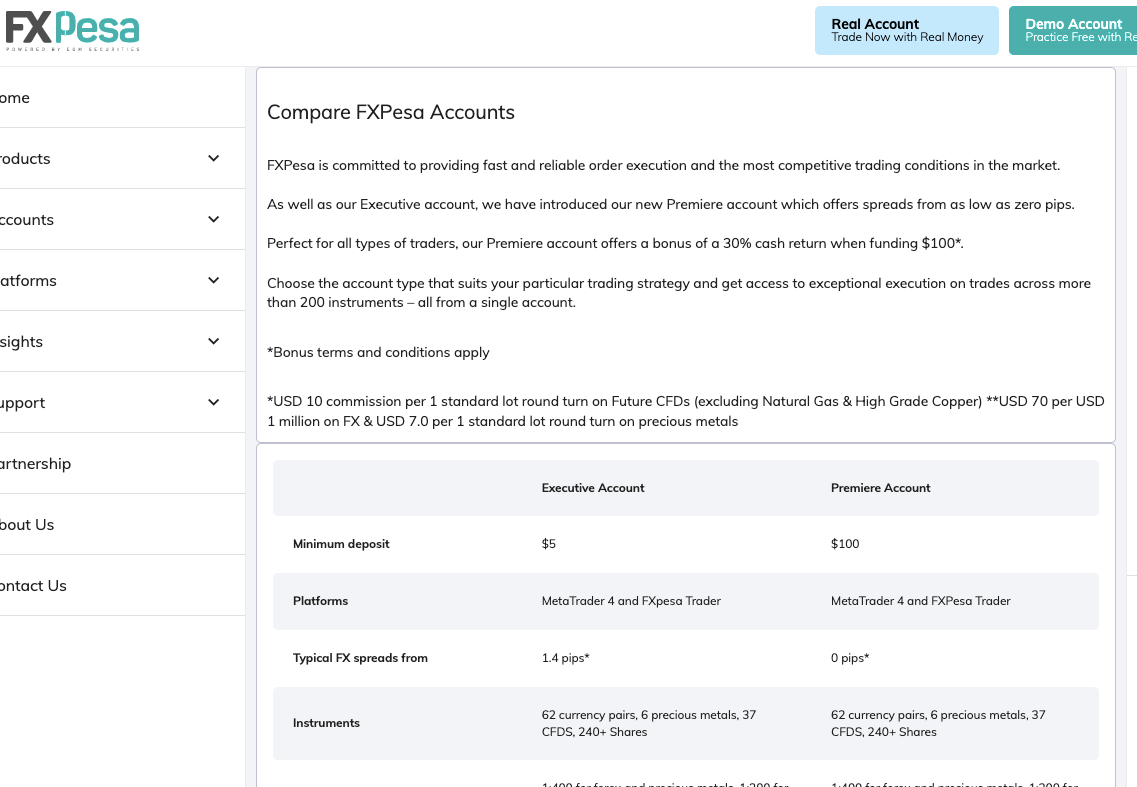

The FXPesa Executive Account is commission-free, while The Premiere Account attracts commission charges of $3.5 per position lot opened, which makes $7 for a standard round turn. The charges can be up to $10 for a standard round turn when trading some future CFDs.

CMA Regulatory license No. & Company Name: FXPesa is registered as EGM Securities Limited which is authorized by the CMA as a non-dealing online foreign exchange broker in 2018. FXPesa is registered in Kenya with license number 107.

Trading Fees: FXPesa trading fees depend on the account type, while the typical spreads for majors on Executive Accounts start from 1.4 pips, Premiere Accounts start from 0.0 pips. See a benchmark of spreads for EUR/USD, GBP/USD & Gold CFD rolling on the table below:

| Pairs | Executive Account | Premiere Account |

|---|---|---|

| EUR/USD | 1.2 pips | 0.0 pips |

| GBP/USD | 2.2 pips | 0.2 pips |

| XAUUSD (Gold vs US Dollar) | 0.32 pips | 0.18 pips |

Non-Trading Fees: FXPesa charges zero deposit fees and zero withdrawal fees on bank/wire transfers and mobile money. FXPesa charges a 1% fee on e-wallet withdrawals, which is capped at a maximum of $30.

Deposit Methods & Time: FXPesa accepts multiple deposit methods. Deposits made via mobile payments like MPesa, debit/credit cards, and e-wallets are credited to the trading account instantly.

Deposit via local bank transfer takes 1-3 working days to the credited. The supported bank used by FXPesa for deposits is I&M Bank Limited. Traders can make deposits to the account from all commercial banks licensed by the Central Bank of Kenya (CBK).

Withdrawal Methods & Time: Supported withdrawal methods on FXPesa are e-wallets (Skrill and Netteler) and mobile payments (MPesa, MTN Money, and others) which are processed in 3 hours, and wire/bank transfers to I&M Bank Limited which takes 3-5 working days to be processed.

Minimum Deposit: The minimum deposit on FXPesa depends on the account type. The FXPesa Premiere Account accepts a minimum deposit of $100 while the Executive Account accepts a $5 minimum deposit.

Platforms: Trading platforms supported by FXPesa are:

- MetaTrader 4: Accessible on all devices

- FXPesa Mobile: For trading on the go, available on Android and iOS devices.

- MyFXPesa: This is an account management portal for funding, checking statements, and managing account settings.

- Available for Android and iOS.

- FXPesa Webtrader: For web trading.

Tradable Instruments: The tradable instruments and CFDs on FXPesa are:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 62 currency pairs (12 majors, 16 minors, and 34 exotics) |

| Commodities CFDs | Yes | 8 pairs (Gold, Silver, Platinum, Brent Crude Oil and WTI Crude Oil) |

| CFDs on Indices | Yes | 16 Indices (US SPX 500, US Wall Street 30, France 40, Australia 200, US Tech 100, UK 100, Hong Kong 50, etc.) |

| Shares CFDs | Yes | US Shares, EU Shares and UK shares (including, Alphabet, Apple, Barclays, Adidas, BMW, Amazon, etc) |

FXPesa Pros

- FXPesa is regulated in Kenya

- They have responsive 24/6 (Sunday to Friday) live chat support

- Access to a lot of trading instruments

- No deposit fees

- No account inactivity charges

- Supports all banks in Kenya for Deposit/Withdrawal

- Has a commission-free account type

- Supports multiple trading platforms

- Toll-free local phone number support for Kenyans

- Accepts MPesa

FXPesa Cons

- The commission fees are relatively high for Premiere Accounts

- Demo accounts expire after 90 days

#2 HotForex Kenya – Regulated Forex Broker with Low Fees

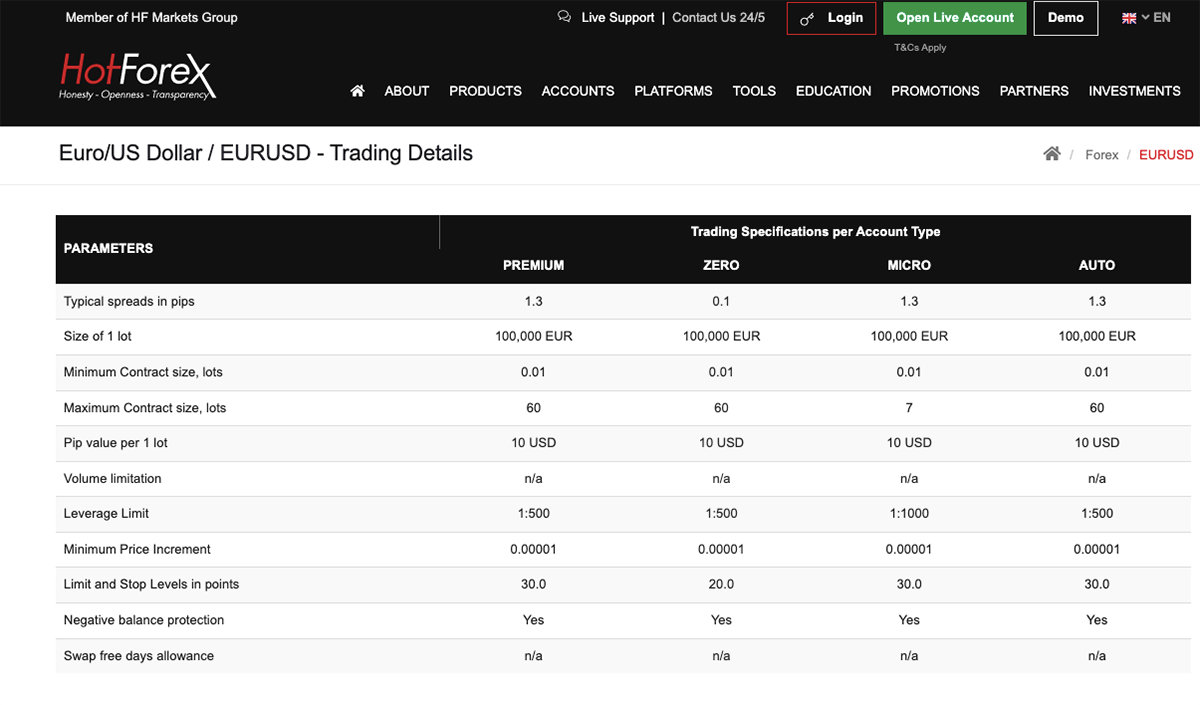

HotForex is licensed as HFM Investments Limited with the CMA as a non-dealing online forex broker and was approved in 2021. Their license number is 155. They are authorized to offer Forex and CFDs trading to residents of Kenya.

Trading Fees: Trading fees on HotForex depends on the account type held by the trader. HotForex offers 6 account types to traders with different spreads and commissions. They operate a variable spreads type, and all accounts are commission-free except Zero-Spread Account. The typical spreads for all account types start from 1 pip, spreads for major currency pairs on HotForex are:

| Pairs | Micro Account | Premium Account | Zero Account | Auto Account |

|---|---|---|---|---|

| EUR/USD | 1.3 pips | 1.3 pips | 0.1 pips | 1.3 pips |

| GBP/USD | 1.7 pips | 1.7 pips | 0.3 pips | 1.7 pips |

| XAUUSD (Gold vs US Dollar) | 0.25 pips | 0.13 pips | 0.25 pips | 0.25 pips |

Non-Trading Fees: HotForex charges no deposit and withdrawals fees whenever traders deposit to their account or withdraw from it. Although payment processors may charge independent fees, deposits less than $100 through wire transfers attract a deposit fee and a 1% fee on cryptocurrency withdrawals via Bitpay.

HotForex charges dormant account fees after 6 months of inactivity.

Deposit Methods & Time: The deposit methods used on HotForex determine the time it takes for the funds to reflect in the trading account. Bank transfers/wire transfers take about 2-7 days, deposit by cards (MasterCard or Visa) and e-wallets (Skrill, Neteller, Perfect Money, and Bitpay for cryptocurrencies) take up to 10 minutes.

Deposits via MPesa are credited instantly.

Withdrawal Methods & Time: HotForex supports withdrawals via wire transfers and cards which are processed within 2-10 business days. Deposits via e-wallets and mobile payments are processed instantly or take 10 minutes, and cryptocurrency withdrawals take 2 days.

Minimum Deposit: The minimum deposit amount on HotForex is determined by account type and method used for the deposit. The minimum amount is $5 for micro-accounts.

| Micro Account | Premium Account | Zero Account | Auto Account | PAMM Account | HFCopy Account |

|---|---|---|---|---|---|

| $5 | $100 | $200 | $200 | $250 | $500 |

The minimum withdrawal amount is $5 for Visa cards and $10 for other withdrawal methods.

Platforms: HotForex supports MT4 & MT5 trader, available on the web, desktop, iOS, iPad, and Android devices.

Tradable Instruments: HotForex supports a lot of trading instruments, find details on the table below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 53 currency pairs (15 majors & 38 minors) |

| Commodities CFDs | Yes | 5 Commodities Futures |

| Energies CFDs | Yes | 4 Energies Spot and Futures Energies |

| Metals CFDs | Yes | 6 CFDs on Metals spot |

| CFDs on Indices | Yes | 23 Indices Spot and Futures |

| ETFs CFDs | Yes | 34 ETFs Spots |

| Shares CFDs | Yes | 54 Shares Contracts |

| DMA Stocks | Yes | 945 DMA Stocks Spot |

| Bonds CFDs | Yes | 3 Bonds Contracts |

HotForex Kenya Pros

- Regulated in Kenya by CMA

- Has live chat 24/5

- Has an office in Nairobi, Kenya

- HotForex has low trading fees compared to others

- Offers deposit bonus

- Offers a lot of trading instruments

HotForex Kenya Cons

- Customer service is not available 24/7

- Charges account inactivity fees

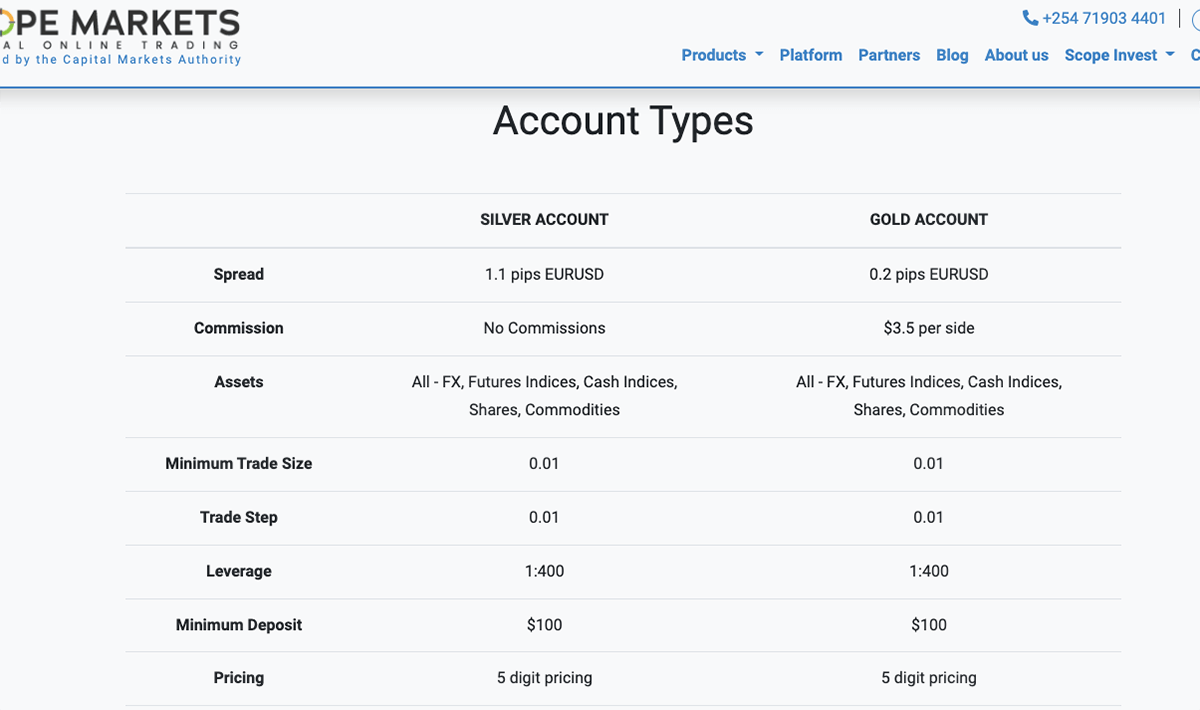

#3 Scope Markets – Regulated Forex Broker with MT5

They are registered as SCFM Limited while their trading name is Scope Markets. Their CMA license number is 123.

CMA Regulatory license No. & Company Name: Scope Markets Kenya is a broker regulated by the CMA, offering forex and CFDs trading.

Trading Fees: Scope Markets trading fees depends on the account type. For Silver Accounts, there is no commission fee and spreads start from 1.1 pips while Gold Account charges a commission of $3.5 per side lot (making it $7 for a round turn), and spreads for this account start from 0.2 pips. No swap fees are charged on Scope Markets.

Non-Trading Fees: Scope Markets charges zero deposit and withdrawal fees.

Deposit Methods & Time: Deposits can be made in KES from any bank account in Kenya to Scope Markets bank account and the funds will be credited immediately. Other payment methods accepted are mobile money (MPesa, Airtel Money, etc.), e-wallets, and cards.

Scope Markets have bank accounts with I&M Bank Limited, KCB, GTBank, COOP, and NCBA.

Withdrawal Methods & Time: The withdrawal methods used determines the time in which it is processed. Mobile money (MPesa, Airtel money, etc,) is processed instantly or within 1 business day, with a minimum withdrawal amount of 50 KES or $5. Withdrawals to bank accounts in Kenya require a minimum amount of $1,500 and is processed in 1-2 business days.

While withdrawals can be requested at any time of the day, requests after 6 PM Kenyan time are processed on the next business day.

Minimum Deposit: The minimum deposit on Scope Markets is $100 for both Silver Account and Gold Account.

Platforms: Scope Markets uses MT5 trading application which is available on Windows, macOS, Google Play Store, and App Store.

Tradable Instruments: There are about 500 trading instruments on Scope Markets, find the details below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 46 currency pairs (majors and minors) |

| Commodities CFDs | Yes | 6 pairs (Gold, Silver, Natural Gas, Crude Oil) |

| CFDs on Indices | Yes | 14 Indices (DAX30, ESP35, CAC40, AUS200, etc.) |

| Shares CFDs | Yes | 434 shares (including US Shares, France Shares, German Shares and UK shares, etc) |

| ETFs CFDs | Yes | 7 ETFs (Vanguard Energy ETF, S&P 500 ETF, etc) |

Scope Markets Pros

- Regulated in Kenya by CMA

- Has 2 offices in Kenya, Westlands and Nairobi

- Has local phone support in Kenya

- Charges no swap fees

- Zero deposit/withdrawal fees

- Has a commission-free account type

- Has responsive live chat that is available 24 hours Mondays to Fridays

- Has deposit bonus offers for new traders

Scope Markets Cons

- Their website is difficult to navigate

- Does not support the MT4 trading application

- Support is not available 24/7

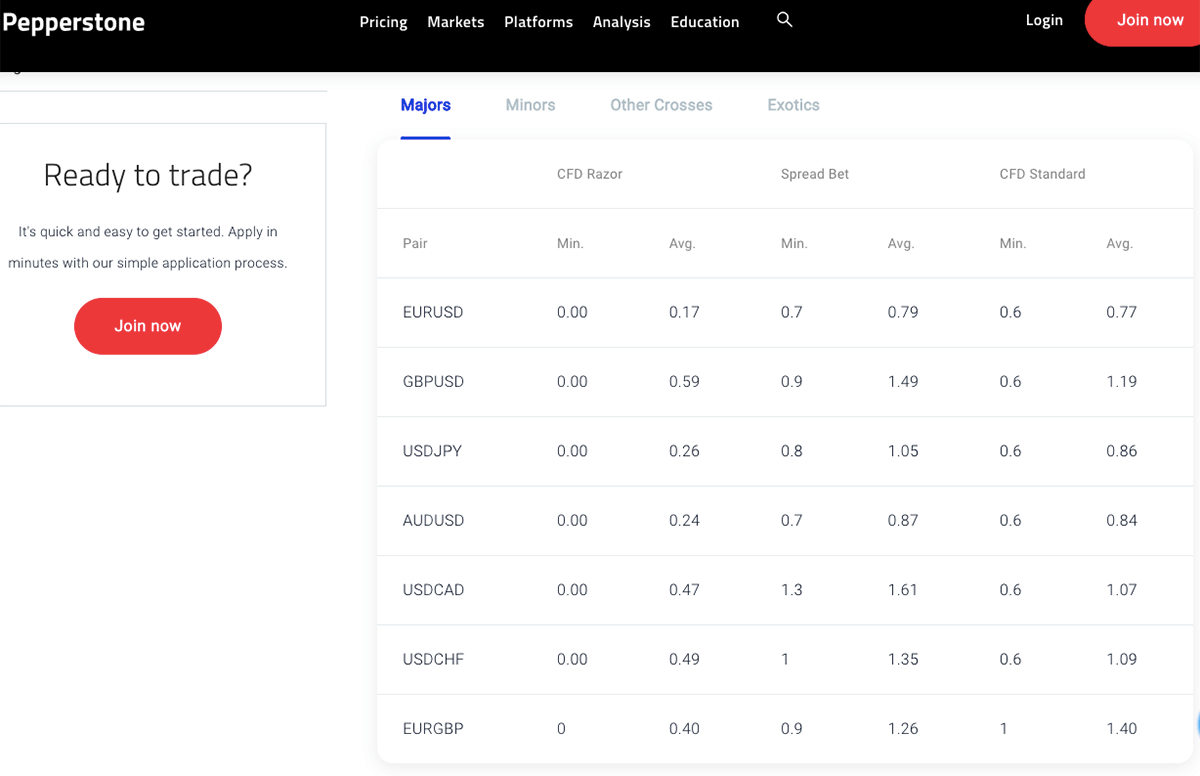

#4 Pepperstone Kenya – Regulated Forex Broker with ECN Type Account

Pepperstone trading accounts charge swap fees and the same spread rate when trading Commodities, Energy, Metals, Indices, and ETFs.

CMA Regulatory license No. & Company Name: PepperStone Kenya has the company name Pepperstone Markets Kenya Limited, which is regulated by the Capital Markets Authority as a non-dealing online foreign exchange broker, with license number 128.

Trading Fees: PepperStone charges trading fees based on the account type, while the Razor Account has lower spread charges and a commission of $7 round turn on each FX trade, the Standard Account charges no commission but instead, there is a 1 pip mark-up i.e. spread on FX pricing. This means that the Bid price will be 5 points lower, and the Ask price 5 points higher.

Average FX spread fees on both account types are:

| Pairs | Razor Account | Standard Account |

|---|---|---|

| EUR/USD | 0.17 pips | 0.77 pips |

| GBP/USD | 0.59 pips | 1.19 pips |

Non-Trading Fees: PepperStone charges no deposit fees, and the withdrawal fees depend on the method used. If you withdraw via bank transfer there is a $20 fee, PayPal and Mpesa withdrawals carry no fee. Withdrawals via Skrill or Neteller are $1.

Deposit Methods & Time: PepperStone accepts deposits via cards credited in 1-4 business days, bank transfers take 2-5 business days, PayPal takes 1-2 days and MPesa is credited instantly.

Withdrawal Methods & Time: PepperStone withdrawals via MPesa are credited instantly, while cards and PayPal take 1-4 business days, withdrawals made to bank accounts take about 3-5 working days for you to receive them. Traders can initiate a withdrawal at any time, withdrawal requests submitted after 9 PM (GMT) are processed in the next business day.

Minimum Deposit: PepperStone does not enforce a minimum deposit, traders can start with any amount. However, due to the margin requirements of trades, clients will generally deposit around $200.

Minimum Withdrawal: Bank transfer withdrawals require a minimum of $80 and $10 for MPesa, PayPal, Skrill, or Neteller.

Platforms: PepperStone uses MT 4, MT 5, and cTrader applications, available to traders on multiple devices (macOS, iOS, Android, Windows, and tablets).

Tradable Instruments: You can trade the following instruments on PepperStone

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 62 currency pairs (7 majors, 9 minors, 17 exotics, and 29 other crosses) |

| Commodities CFDs | Yes | 16 Commodities (Cocoa, Coffee, Orange Juice, Sugar, etc.) |

| Metals CFDs | Yes | 5 Metals (Silver, Gold, Platinum, Copper, and Palladium) |

| Energies CFDs | Yes | 3 Energies (Spot Crude oil, Spot Brent oil, Gasoline, and Natural Gas) |

| Index CFDs | Yes | 23 Indices (US30, GER30, UK100, AUS200, etc.) |

| Shares CFDs | Yes | 600+ shares (including US Shares, Australian Shares, German Shares and UK shares, etc) |

| ETFs CFDs | Yes | 100+ ETFs (Vanguard Energy ETF, S&P 500 ETF, etc) |

| Currency index CFDs | Yes | 3 currencies (US Dollar, Euro, Japanese Yen) |

Pepperstone Kenya Pros

- 24/7 WhatsApp and live chat support

- Local phone support in Kenya, available during working hours on business days

- Offers a lot of trading instruments

- Has no mandatory minimum deposit

- licensed in Kenya

Pepperstone Kenya Cons

- Takes long to process deposits and transfers other than MPesa

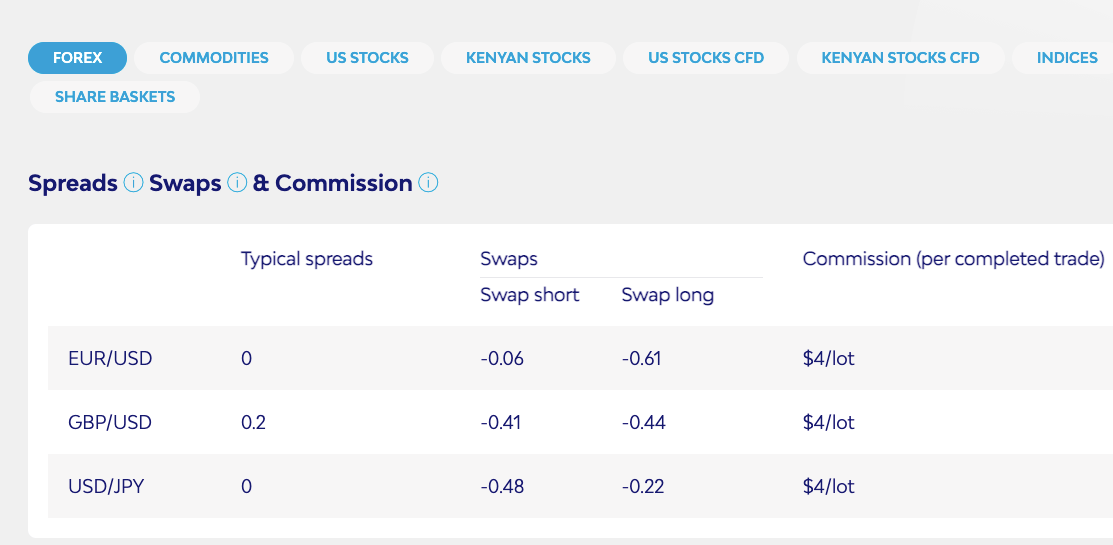

#5 Exinity Limited – CMA Regulated Forex Broker with Raw Spread

Exinity does not charge any commission on US stocks and US Stocks CFDs while Kenyan Stocks have a 3.08% commission charge.

CMA Regulatory license No. & Company Name: Exinity Limited is licensed by the Capital Markets Authority in Kenya as Exinity East Africa Limited, a non-dealing online forex broker. Their license number is 135.

Trading Fees: Exinity has only one account type, and charges spread, swaps and a $4 commission per Forex trade lot opened and closed.

Typical spreads for FX majors are:

| Pairs | Spread |

|---|---|

| EUR/USD | 0.0 pips |

| GBP/USD | 0.2 pips |

| XAUUSD (Gold vs US Dollar) | 9 pips |

Non-Trading Fees: Exinity does not charge any non-trading fees. Deposits and withdrawals are free of charge.

Deposit Methods & Time: You can deposit to the Exinity Trader account via M-Pesa and Bank Wire which are credited immediately after it reaches the Exinity account. Transfers can be made from any bank to the Exinity bank accounts in Equity Bank and NCBA bank, as long as your bank supports Pesalink.

Withdrawal Methods & Time: Withdrawals can be made via MPesa which are processed instantly or to a local bank in Kenya and funds are received within 24 hours.

Minimum Deposit: The required minimum deposit on Exinity Limited is $50 before you start trading.

Minimum Withdrawal: There is no minimum amount on Exinity Limited, as long as there are funds in your account.

Platforms: Exinity Limited supports the MetaTrader 4 and MetaTrader 5 which is available on all devices for trading, although traders have to register their accounts on the web.

Tradable Instruments: You can trade the following financial instruments on Exinity Limited

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 19 currency pairs |

| Commodities CFDs | Yes | 3 Commodities (UK Brent, UK Crude, and Natural Gas) |

| Metals CFDs | Yes | 3 Metals pairs of (Silver, Gold, USD, and EUR) |

| Energies CFDs | Yes | 3 Energies (Spot Crude oil, Spot Brent oil, Gasoline, and Natural Gas) |

| CFDs on Stock Market Indices | Yes | 11 Indices (US30, Japan225, UK100, Europe50, etc.) |

| Currency Indices CFDs | Yes | 6 currencies (AUD, EUR, JPY, USD, GBP, and NZD) |

| Stocks | Yes | 30 US Stocks and 16 Kenyan Stocks |

| Stocks CFDs | Yes | For 30 US Stock CFDs and 16 Kenyan Stocks CFDs |

| Share Basket | Yes | 5 Shares basket (GreenID, VeganID, etc.) |

Exinity Limited Pros

- No minimum withdrawal

- No hidden fees

- No dormant account fees

- Fast processing of deposits and withdrawals

- Has responsive live chat support

- Regulated in Kenya

- Local phone support in Kenya is available 24/5 Monday to Friday

- Up to 7 days swap free trading

Exinity Limited Cons

- Card payments are not supported yet

- No bonus promotions

- Has fewer trading instruments compared to others

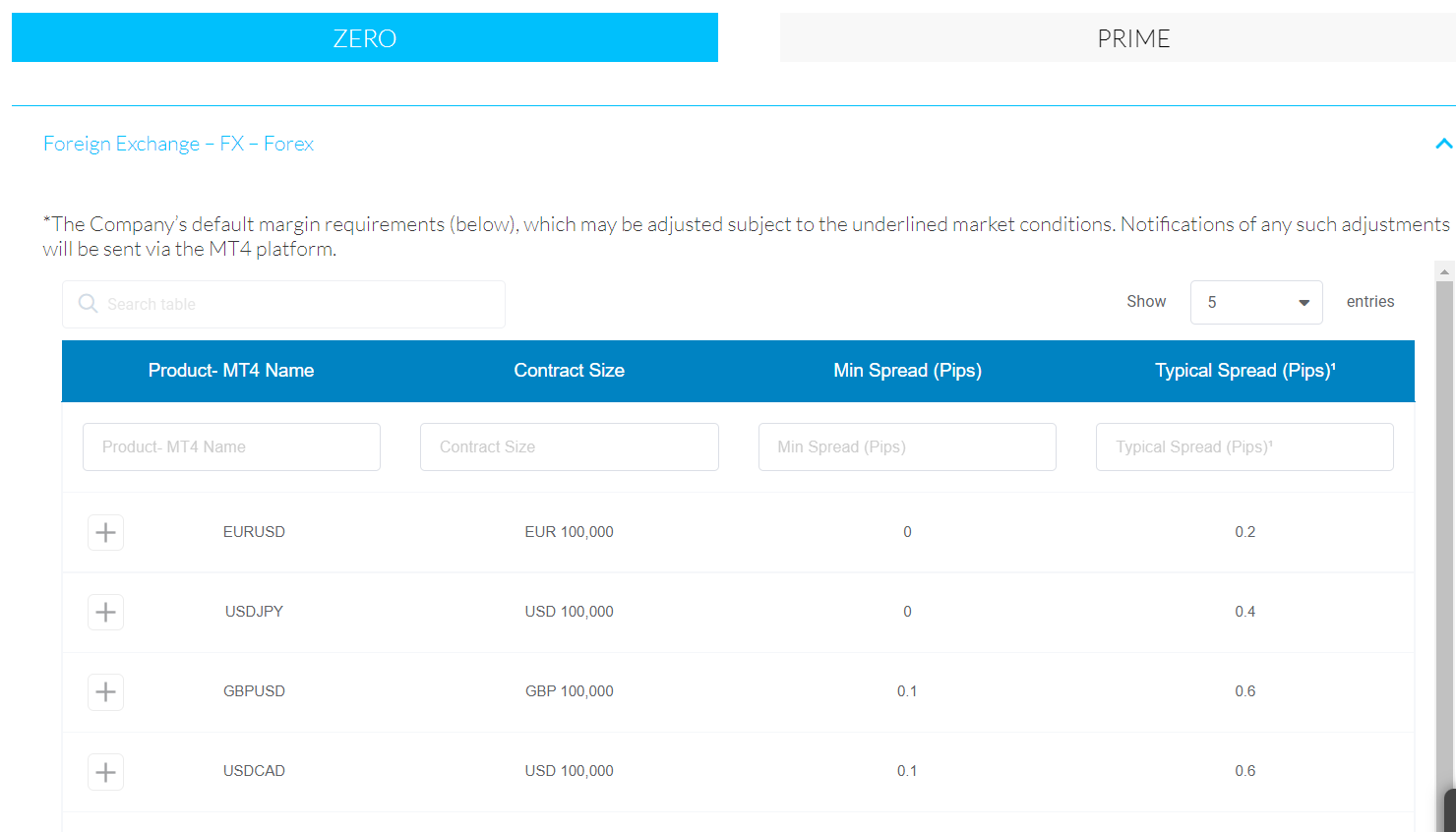

#6 Windsor Kenya – CMA Regulated Broker in Kenya

Windsor Brokers allows trading with spread -based as well as commission-based pricing structure with different account types.

CMA Regulatory license No. & Company Name: Windsor Brokers Kenya has the company name Windsor Brokers Kenya Limited, which is regulated by the Capital Markets Authority as a non-dealing online foreign exchange broker, with license number 156.

Trading Fees: The standard account type named Prime at Windsor Brokers has a spread-only pricing structure. The spreads start from 1 pip while the average spread for EUR/USD is 1.5 pips. The Prime account has no trading commission.

The Zero account has spread as low as 0 pips with a fixed commission of $8 per round trade of a standard lot. This account may not be ideal for retail clients as it requires a minimum deposit of $2500.

Average FX spread fees on both account types at Windsor Brokers are:

| Pairs | Zero Account | Prime Account |

|---|---|---|

| EUR/USD | 0.4 pips | 1.4 pips |

| GBP/USD | 0.6 pips | 1.9 pips |

Non-Trading Fees: Windsor Brokers charges no deposit fees and withdrawal fees for most of the accepted methods. deposits and withdrawals through WebMoney incur a commission of 0.8%. For all other methods, deposits are free and withdrawal has a fixed commission of $3 for each withdrawal.

Minimum Deposit: The minimum deposit amount for the Prime account type is $100 and for the Zero account is $2500.

Platforms: Windsor Brokers uses MT4 trading platform that is available to traders on multiple devices (macOS, iOS, Android, Windows, and tablets).

Tradable Instruments: You can trade the following instruments on Windsor Brokers

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 44 currency pairs |

| Commodities CFDs | Yes | 13 Commodities |

| Metals CFDs | Yes | 2 Metals (Silver, Gold) |

| Energies CFDs | Yes | 2 Energies |

| Index CFDs | Yes | 14 Indices |

| Shares CFDs | Yes | 92 shares (including US Shares, Australian Shares, German Shares and UK shares, etc) |

| ETFs CFDs | no | N.A. |

| Cryptocurrencies | Yes | 5 Cryptocurrencies |

Windsor Brokers Kenya Pros

- 24/7 WhatsApp and live chat support

- Local phone support in Kenya, available (+254 205029240)

- licensed by CMA in Kenya

- Multiple account types

Windsor Brokers Kenya Cons

- High minimum deposit ($100)

- Lesser number of trading instruments

- Withdrawals are not free

#7 Exness – CMA Regulated Broker in Kenya with KES Account

Exness allows trading at low cost with KES as base currency of the account. Multiple pricing structure available.

CMA Regulatory license No. & Company Name: Exness is the trading name of the broker that is regulated by several regulatory authorities across the globe. In Kenya, Tradenex Limited is the legal entity of Exness that is regulated by the Capital Market Authority of Kenya under license number 162. Other Entities of Exness are also regulated by FCA of the UK, FSCA of South Africa, CySEC of the European Union, etc.

Trading Fees: Exness offers 5 trading accounts with different pricing structures. The Standard and Standard Cent account do not involve commission and spreads start from 0.3 pips. The professional accounts namely Raw Spread and Zero Account have much lower spread starting from 0 pips but involves a fix commission per lot.

The commission with the Raw Spread account is $3.5 per each side or $7 for a round trade of a standard lot. The commission with the Zero account is variable starting from $0.4 per round trade of a standard lot. The Pro Account does not involve any commission and the spread starts from 0.1 pips.

The Standard and Standard Cent account can be opened with a minimum deposit of $10 while the 3 professional accounts require a minimum deposit of $500.

Average FX spread fees on all account types at Exness are:

| Pairs | Standard | Standard Cent | Raw Spread | Zero | Pro |

|---|---|---|---|---|---|

| EUR/USD | 1 pips | 1 pips | 0 pips | 0 pips | 0.6 pips |

| GBP/USD | 1.2 pips | 1.2 pips | 0.1 pips | 0 pips | 0.7 pips |

Non-Trading Fees: Exness does not charge any non-trading fees from the traders. The deposits and withdrawals are free from the broker’s end while no inactivity fees exist. The account opening/maintenance is free.

Minimum Deposit: The minimum deposit amount with the Standard account depends on the deposit method as there is no lower limit on the minimum deposit amount. The 3 professional accounts namely Raw Spread, Zero, and Pro account require a minimum deposit of $500.

Platforms: Exness offers the complete suite of MetaTrader 4 and MetaTrader 5 trading platforms for all types of devices. Additionally, it also offers a user-friendly mobile trading platform that is proprietary.

Tradable Instruments: You can trade the following instruments on Exness Brokers

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 107 currency pairs |

| Commodities CFDs | Yes | 12 Commodities |

| Metals CFDs | Yes | 10 Metals |

| Energies CFDs | Yes | 2 Energies |

| Index CFDs | Yes | 10 Indices |

| Shares CFDs | Yes | 88 shares |

| ETFs CFDs | no | N.A. |

| Cryptocurrencies | Yes | 34 Cryptocurrencies |

Exness Kenya Pros

- Exness offers KES as base currency of the account

- Local phone support in Kenya is available

- licensed by CMA in Kenya by the name Tradenex

- Low minimum deposit requirement

- Free deposit and withdrawal in KES currency

- Multiple account types with different pricing structure

Exness Kenya Cons

- Lesser number of trading instruments

- Support services are not available on weekends

#8 Ingot Africa Ltd – CMA Regulated Broker Based in Kenya

Ingot Africa Limited is a Kenya-based forex and CFD broker that allows trading through ECN execution with multiple account types.

CMA Regulatory license No. & Company Name: Ingot Africa Limited has recently acquired a regulatory license issued by the Capital Markets Authority of Kenya. It holds license number 173 according to the official CMA website. Apart from CMA, the broker is also regulated by the Australian Securities and Exchange Commission (ASIC) and FSCA of South Africa. The international clients at Ingot Africa Limited are registered under SVG regulations of St Vincent and Grenadines.

Trading Fees: Ingot Africa offers 3 account types for retail traders namely Pro, ECN, and Cent. The fee structure of Pro and Cent Account types are the same as they only differ on the basis of lot size and minimum deposit. The Pro and Cent account incurs spread as the only trading fees.

The spreads start from 1 pip for EUR/USD currency pair. The spreads with the ECN account are as low as 0 pips but it also involves a commission of $7 for a round trade of a standard lot.

Trading Conditions: The minimum deposit is lowest with the Cent Account i.e. $30, $50 for Pro, and $100 for the ECN account at Ingot Africa Ltd. They offer negative balance protection across all account types. MT4 and MT5 are the available trading platforms with all the account types. Credit/debit cards, wire transfers, and selective e-wallets are available for deposits and withdrawals.

#9 Admiral Markets – CMA Regulated Broker with Low Spread and Low Minimum Deposit

Admirals KE Limited is a CMA-regulated broker that offers low-cost trading and has a very low minimum deposit requirement.

Regulation: Admiral markets recently acquired the regulatory license from the CMA of Kenya as an online forex broker with no dealing desk. Admiral KE Limited is the legal entity of Admiral Markets that is regulated by the CMA of Kenya under license number 178. Admiral Markets is a well-regulated broker with regulatory licenses from top-tier regulatory authorities like FCA of the UK, ASIC of Australia, FSCA of South Africa and CySEC of the European Union.

Fees: The trading fee at Admiral Markets depend on the account type chosen by the trader. Admiral KE Limited offers 2 trading and 1 investing account. The minimum deposit for the trading account is $25 with Standard and Zero accounts. The Standard account does not involve trading commission where the spreads start from 0.5 pips.

The average spread on EUR/USD pair with the Standard trading account at Admiral Markets is 0.6 pips. With zero accounts, traders can enjoy trading with 0 spreads on many instruments at the expense of $6 commission for a round trade of per standard lot.

Trading Conditions: KES is not available as the base currency of the account. Traders can choose between USD, EUR, AED, and JOD as the base currency of the account. Debit/credit cards, bank transfers, and e-wallets are supported for deposit and withdrawal with no commission. MT4 and MT5 are the available trading platforms but clients can also trade with the Admirals Mobile Application.

What is CMA

The Capital Markets Authority (CMA) in Kenya is the regulatory agency responsible for overseeing and governing the country’s capital markets. It was established through the Capital Markets Authority Act of 1989 and is tasked with the regulation and supervision of various aspects within the capital markets sector. The core objective of the CMA is to ensure transparency, fairness, and the protection of investors participating in the capital markets.

Key roles and responsibilities of the CMA include:

Regulatory Oversight: The CMA holds the authority to regulate and oversee entities and activities within the capital markets domain. This encompasses entities such as stock exchanges, brokerage firms, investment banks, fund management companies, and other intermediaries.

Licensing and Approvals: The CMA is responsible for granting licenses and approvals to entities operating within the capital markets, ensuring they adhere to specified standards and comply with regulatory requirements.

Safeguarding Investor Interests: A significant focus of the CMA is to safeguard the interests of investors by promoting equitable practices, disseminating relevant information, and ensuring market participants uphold ethical and professional standards.

How to verify that a Forex Broker is Regulated in Kenya?

You can verify regulated brokers in 3 steps, let us use HotForex Kenya for example, follow these steps to verify their license with CMA:

Step 1) You can use their registered name, or get their license number, the brokers usually display it on the footer section of their website. HotForex’s CMA license number is 155.

Step 2) Visit the CMA website and download the list of licensees.

Step 3) Look for the broker’s name or license number in the ‘Non-Dealing Online Foreign Exchange Broker’ section.

There you are! You have verified the broker’s license.

Why should you Trade with Regulated Forex Brokers?

The first and most important reason is that the regulation makes it legal for brokers to offer forex trading in Kenya, and it helps to avoid fraud and malpractice.

The Capital Markets Authority (CMA) was incorporated in 1989 to regulate and organize the financial markets in Kenya. However, the first forex broker acquired a license from CMA to offer forex and CFD trading services in 2017.

As of now, 6 forex brokers hold the CMA license to offer leveraged trading services on forex and other capital markets as CFDs.

Regulated Forex Brokers in Kenya are required to follow the guidelines set by CMA, and in case of unfair dealing by a broker, a trader can report to the Regulators for grievance redressal.

If a broker is not licensed then they can cheat you, run away with your hard-earned money, without any legal action possible against that broker to get your money back.

The only way to ensure that your funds are safe is to trade with one of the 6 CMA licensed Non-dealing forex brokers. We have highlighted the important details for the six brokers in this post.

With this information, you can compare the brokers’ fees, platforms, deposit, and withdrawal methods and choose the one that’s right for you.

How to Choose a CMA-Regulated Forex Broker in Kenya

As of now, there are a total of 9 forex brokers in Kenya that are regulated by the Capital Markets Authority (CMA). All these brokers use no dealing desk market execution technique which means they cannot take part in the trade orders placed by the clients.

Apart from CMA regulations, there are several more aspects that must be considered before opening an account with CMA-regulated forex brokers in Kenya.

Fees: Lower fees are highly advantageous for forex traders. CMA-regulated forex brokers incur trading as well as non-trading fees. Trading fees include spread, overnight charges, and trading commission while the non-trading fees can be inactivity fees, deposit/withdrawal fees, currency conversion fees, etc.

Also, don’t forget to consider the minimum deposit. There are many brokers which don’t require a minimum deposit while there are others which require a minimum deposit. Aim to join a broker which either does not have a minimum deposit requirement or their requirement is very low (such as $5). There are some brokers which require a high amount as well (such as $100 to $500).

Each CMA-Regulated forex broker in Kenya incurs different fees. Traders must check and compare the fees before opening their accounts.

Trading Platform: Choosing an appropriate trading platform is important as all trading activities will be done on the platform. Traders should be comfortable with the interface, tabs, and features on the trading platform.

Most brokers use third-party trading platforms like MT4, MT5, and cTrader. Some brokers can also have their proprietary trading platform built by themselves. It is better to test the trading platforms through demo accounts before opening live accounts.

Customer Support: Traders may face queries at any instance while trading online at any CMA-regulated broker. The trading experience will be much better if the queries faced by the traders are answered instantly. Hence, it is important to choose a broker that offers good quality customer support services.

Most brokers offer customer support services through live chat, email, and phone support. However, the availability of support executives and the quality of assistance can be different. Traders can raise a random query through available methods just to check the quality of services before opening their accounts.

Available Instruments: The number of available instruments will be different for each broker. Commonly traded forex pairs and CFD instruments with high liquidity will be available at most brokers. However, it is possible that the instruments that you wish to trade are not available at a broker.

More instruments give more opportunities to traders but traders must have adequate knowledge of the instruments they are dealing with. It is also important to check and compare the contract specification before opening the account.

Deposit and Withdrawals: A forex broker with great features and low fees will be of no good if you cannot deposit or withdraw through your preferred method. Most CMA-regulated brokers in Kenya, allow deposits and withdrawals through local bank transfers, debit/credit cards, and e-wallets.

Traders must check the deposit and withdrawal conditions on their preferred method before opening the account. This includes the minimum amount, transaction commission, supported currency, and time taken to process the transaction.

Transparency and Disclosures: Ensure the broker provides clear information regarding fees, commissions, trading conditions, and any potential conflicts of interest. Transparency is essential in building trust and ensuring a fair trading environment.

Demo Account and Educational Resources: Look for brokers that offer demo accounts or virtual trading platforms. These tools allow you to practice trading strategies and get familiar with the broker’s platform before risking real money. Additionally, consider if the broker provides educational resources, such as tutorials, webinars, or articles, to help you enhance your trading knowledge.

Comparison of CMA Regulated Forex Brokers in Kenya

| Forex Broker | Regulation | EUR/USD Spread | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|---|

| FxPesa |

CMA

|

1.4 pips

|

1:400

|

$5

|

Visit Broker |

| HotForex kenya |

FSCA, CySEC, FCA

|

0.6 pips

|

1:400

|

$5

|

Visit Broker |

| Scope Markets |

CMA, IFSC

|

1.1 pips

|

1:400

|

$100

|

Visit Broker |

| Pepperstone Kenya |

ASIC, FCA, CMA, CySEC

|

0.7 pips

|

1:400

|

$0

|

Visit Broker |

| Exinity Limited |

CMA, FSC, FSRA

|

0.0 pip + $4 per lot

|

1:400

|

$20

|

Visit Broker |

| Windsor Markets |

CMA, FSC, FSRA

|

1.5 pip

|

1:400

|

$100

|

Visit Broker |

| Exness |

FCA, CMA, FSCA, CySEC

|

1 pip

|

1:400

|

$10

|

Visit Broker |

| Ingot Africa |

CMA, ASIC, FSCA

|

1 pip

|

1:400

|

$30

|

Visit Broker |

| Admiral Markets |

CMA, FCA, ASIC, FSCA, CySEC.

|

0.6 pips

|

1:400

|

$1

|

Visit Broker |

FAQs on CMA Regulated Forex Brokers in Kenya

Which Forex Brokers accept MPesa?

All the forex brokers listed in our guide accept MPesa as a payment method for deposit and withdrawal. These include HotForex, FXPesa, Scope Markets, Pepperstone & Exinity.

Which is the Best Forex broker in Kenya?

FXPesa is the best online forex broker in Kenya because it is regulated by CMA, has low fees, is available on all devices, offers multiple trading instruments and payment methods, with responsive customer service support and has an easy-to-use interface.

Which forex brokers are licenced in Kenya?

currently there are only 6 CFD brokers that are regulated under CMA to offer forex and CFD instruments with a max leverage of 1:400. The 6 CMA regulated CFD brokers in Kenya are FXPesa, Scope Markets, Pepperstone, Exinity, HotForex, and Windsor Brokers.

Can I trade forex with non-CMA regulated broker in Kenya?

Yes, clients residing in Kenya can trade with a broker that is not regulated by the CMA. However, the third party risk of choosing such a broker will be higher than that of CMA regulated broker in Kenya. Non-CMA-regulated brokers can be fake and it is always advisable to trade with CMA-regulated brokers in Kenya.

What is CMA in forex?

CMA stands for Capital Markets Authority. It is the financial regulatory authority in Kenya that authorises and regulated brokers and financial services providers in Kenya. CMA has authorised 7 forex brokers in Kenya to offer forex trading services as non-dealing desk brokers.

Is FXPesa regulated by CMA?

Yes, FxPesa is regulated by the Capital Markets Authority of Kenya. It is registered with the legal entity name EGM Securities Limited under license number 107. The broker acquired the CMA regulatory license in 2018.

Who is the best regulated forex broker?

Each broker can be ideal for different traders. As a beginner, traders should look out for brokers with low minimum deposit requirements, low spreads, user-friendly platforms, and helpful research tools. Clients residing in Kenya must only trade with brokers that are regulated by the CMA of Kenya.

Which broker is non dealing in Kenya?

Capital Markets Authority (CMA) of Kenya has approved 9 forex brokers for offering forex and CFD trading services in Kenya. FxPesa, HotForex, Scope Markets, Pepperstone, Exinity, Windsor Markets, Exness, Ingot Africa, and Admiral markets are CMA-regulated non-dealing desk brokers in Kenya. All of these 9 brokers are non-dealing desk brokers in Kenya.

What is the most trusted regulated forex broker?

All brokers that are regulated by the CMA of Kenya can be considered safe and trustworthy for trading forex and CFDs in Kenya. If the broker is also regulated by top-tier regulatory authorities or listed on an stock exchange, it is more trustworthy.

Is Forex Trading Legal in Kenya?

Forex Trading is legal in Kenya if you are trading with a CMA-authorized Forex Broker. There are 9 authorized Non-dealing Forex Brokers in Kenya as of January 2024.