Best Forex Brokers that Accept MPesa in Kenya 2024

We have ranked the best forex brokers in Kenya that accepts M-Pesa from traders. The ranking of Forex Brokers in our list are based on their regulation, deposit & withdrawal fees, platforms, support & many other factors.

The use of Mpesa for deposits and withdrawals on Forex trading platforms has gained wide acceptance in recent times, especially in Kenya.

M-Pesa, a mobile money service, is owned by Safaricom, a leading telecommunications company in Kenya. Safaricom is a subsidiary of Vodafone Group Plc, a British multinational telecommunications conglomerate.

To assist the Kenyan clients, we tracked and compared six forex brokers in Kenya that accept Mpesa for payments. Our review adopts a variety of parameters as a guide.

6 Best Forex Brokers in Kenya that Accepts MPesa in 2024

- FxPesa – Local Regulated Forex broker that accepts MPesa

- Exness – Trade Forex with Tight Spread using MPesa

- XM Broker – Zero Commission Forex broker that accepts MPesa

- FXTM – Forex Trading using MPesa with high Leverage

- HF Markets – Regulated Forex Broker in Kenya that accepts M-Pesa

- Scope Markets Kenya – Local Forex Broker in Kenya that accept MPesa

These parameters are safety (regulation), instruments offered, trading conditions, fees, the platform used for trading, deposit, and withdrawal time with Mpesa.

Best Forex Brokers in Kenya that Accepts MPesa

Now let’s elaborate forex brokers for a better understanding and comparison to select the best-suited forex broker for oneself.

#1 FxPesa – Local regulated broker that accepts MPesa

FXPesa is a trading name for EGM Securities limited. This broker was established in 2019 and is headquartered in Kenya.

FxPesa is registered with the Capital Markets Authority of Kenya (C.M.A). FXPesa’s regulation with the CMA has makes the a safe broker for traders in Kenya. Its affiliate company Equity Capital Limited is registered by the FCA in the U.K.

FXPesa offers trading on two account types; Executive and Premiere accounts. While the executive account has a minimum deposit of $5, the premiere account’s minimum deposit is $100.

FXPesa base account currency is the USD only. No commission is charged to the FxPesa executive account. However, the premiere account has a $7 charge per 1 standard lot on FX and precious metals. A $10 commission is also charged on round turn on future CFDs except for natural gas and high-grade copper.

This broker offers maximum leverage of 1:400 on forex and precious metals, 1:200 on CFDs and 1:20 on equities. FXPesa offers over 200 instruments including 65 currency pairs, 6 precious metals, 37 CFDs and over 240 shares.

FxPesa Premiere account has a spread beginning from 0pip while its executive account spread starts from 1.4pips.

Trading on FxPesa is carried out on MT4 and the web. The FXPesa app is available on Android and iOS and can be downloaded from their various stores.

Deposits and withdrawals are made on FXPesa across several methods such as bank transfer, credit and debit cards, Skrill, Neteller, and mobile payment methods such as MTNMoney, EazzyPay, Mpesa, Airtel Money, Vodacom, etc.

Wire/bank transfer deposits usually take three days to reflect while those of credit cards, E-wallet, and mobile payments are instant.

FXPesa Pros

- FXPesa is regulated by CMA in Kenya

- They have responsive 24/6 (Sunday to Friday) live chat support

- Access to a lot of trading instruments

- No deposit fees

- No account inactivity charges

- Supports all banks in Kenya for Deposit/Withdrawal

- Has a commission-free account type

- Supports multiple trading platforms

- Toll-free local phone number support for Kenyans

FXPesa Cons

- The commission fees are relatively high for Premiere Accounts

- Demo accounts expire after 90 days

- USD is the only available account currency

#2 Exness – Trade Forex with tight Spread using MPesa

Exness is regulated by Kenya’s CMA, additionally, it is also registered with the U.K’s FCA and CySEC. Exness offers a low spread and allows trading with KES as the base currency.

Exness holds a CMA license as a non-dealing desk foreign exchange broker. The CMA license is held by the name Tradenex under license number 162. Additionally, the two top-tier regulators namely FCA and CySEC further increase the trust and confidence of Kenyan traders in the broker.

Exness offers trading on two category account types. They are; the Standard and Professional accounts. Under the Standard account type, we have the Standard account and the standard cent account. For the Professional account, they offer the Pro, Zero, and Raw Spread accounts. On the standard account type, Exness offers leverage of 1:400 in Kenya. The minimum deposit depends on the payment method and there is no trading commission.

Exness accepts as low as a $1 deposit for the Standard and Standard Cent account types. All three professional account types require a minimum deposit of $500. Through m-Pesa, the minimum deposit and withdrawal amount is $10 while the maximum deposit and withdrawal amount are $820 and $550 respectively. Transactions are free with mPesa at Exness and are processed instantly. In some cases, it can take up to 3 days to process the transactions through m-Pesa at Exness.

The spreads are very low with professional accounts. However, around $0.1 per lot and $3.5 per lot are charged for the zero and raw spread professional accounts

The instruments offered by Exness for trading are; forex, cryptos, energies, indices, and stock. A total of 108 forex pairs can be traded at Exness in Kenya which is more than any other CMA-regulated broker in Kenya that accepts m-Pesa.

Exness Pros

- Exness is regulated by CMA in Kenya

- Trading fees at Exness is very low

- They have responsive 24/6 (Sunday to Friday) live chat support

- Low minimum deposit

- No deposit fees

- Supports local banks in Kenya for Deposit/Withdrawal

- Exness offers multiple account types

- Supports multiple trading platforms

- Number of available forex pairs is highest at Exness in Kenya

Exness Cons

- No local phone support in Kenya

#3 XM Forex – Zero Commission Forex broker that accepts MPesa

This broker is regulated by the Australian Securities and Investment Commission (ASIC)- a tier-1 regulator, and CySEC- a tier-2 regulator.

XM is not regulated by the CMA in Kenya. Kenyan clients at XM are registered under the regulation of IFSC Belize. Their parent company Trading Point of Financial Instruments is regulated by several top-tier regulatory authorities.

XM offers 3 live account types with different fee structures. The spreads for EUR/USD at XM start from 0.9 pips. The maximum leverage on forex pairs at XM is 1:888.

Deposits and withdrawals are carried out on XM via credit/debit cards, Mpesa, Skrill, Neteller and WebMoney. There are no charges/fees for deposits and withdrawals.

XM Forex offers trading on four account types; standard, micro, shares and ultra-low account. There is no commission on all accounts except the shares account. 5 USD is the minimum deposit on all accounts apart from the shares account who’s minimum deposit is 10,000 USD.

XM Pros

- Trading fees at XM with the Ultra low account is very low

- Low minimum deposit

- No deposit fees

- Supports local banks in Kenya for Deposit/Withdrawal

- XM offers multiple account types

- Supports multiple trading platforms

XM Cons

- XM is not regulated by CMA in Kenya

- No local phone support in Kenya

#4 FXTM – Forex Trading using MPesa with ECN Account

FXTM broker firm was established in 2011 and is one of only seven Forex brokerage firms registered and regulated by the Capital Markets Authority (CMA) in Kenya.

Apart from CMA in Kenya, FXTM is also regulated by the FCA in the U.K and the CySEC in Cyprus. Both are tier-1 and tier-2 regulators respectively. This denotes high trust from the Kenyan public.

FXTM offers its clients four account types. The Standard, Micro, Advantage, and Advantage Plus accounts. The Standard and Micro accounts have a minimum deposit of $10 but are available with the MT4 platform only. No commission is incurred on the Standard account. They offer instant market execution but the spreads are higher compared to other brokers in Kenya. Instruments such as indices, stock CFDs, and stocks are not traded on this account type.

On the advantage account, the minimum deposit is $100, it is available on MT4 and MT5, with zero spread on forex majors, and commission from $0.4 to $2. Instruments traded include; stock CFDs, stocks, stock baskets, indices, commodities, metals, forex, and FX indices.

The Advantage Plus account offers a minimum deposit of $500, no commission, and tight spreads. It is available on the MT4 and MT5 platforms and offers the same instruments as the Advantage account.

Traders can deposit and withdraw funds on FXTM via the following media bank wire transfer, credit/debit cards, and E-payment systems. Kenyan traders can instantly deposit and withdraw funds in KSH using an African local solution (Mpesa).

FXTM Pros

- FXTM is regulated by CMA in Kenya

- FXTM have responsive 24/7 live chat support

- Low minimum deposit

- No deposit fees

- Supports local banks in Kenya for Deposit/Withdrawal

- FXTM offers multiple account types

- Supports multiple trading platforms

FXTM Cons

- The spreads at FXTM are higher than average

- FXTM incurs inactivity and withdrawal fees.

#5 HF Markets – Regulated Forex Broker in Kenya that accepts MPesa

HF Markets, previously known as HotForex is regulated by the CMA in Kenya with reference number 155. It is also registered by other lower-tier regulators in Dubai, Belize etc. It is a highly trustworthy broker.

HotForex is a popular forex broker that recently changed its name to HF Markets. It holds the CMA license as a non-dealing desk foreign exchange broker under license number 155. Apart from this, HF Markets holds several regulatory licenses from top-tier regulators like FCA in the UK, CySEC in the European Union, etc.

HF Markets offers six different account types for traders to choose from. They are named Premium, Zero, Micro, PAMM, HF Copy and Auto. All accounts have a typical spread of 1.3 except the zero accounts which have a spread of 0.1. The leverage limit is 1:500 for the premium, zero and auto accounts. The micro account has a leverage of 1:1000. All accounts have negative balance protection. The minimum contract size is 0.1 on all accounts while the maximum contract size is 60 except for the micro account which has 7 as its maximum contract size.

The minimum deposit varies across the different accounts. The micro account has a minimum deposit of $5, the zero and the auto account is $200 as the minimum opening deposit, for the premium it is $100, and the HF Copy has a minimum deposit of $500 for the strategy provider and $100 for followers.

Only the zero spread account has a commission on trades. The account currencies are USD, EUR, NGN and JPY. Deposits and withdrawals are carried out across different platforms. These platforms are; banks transfer, debit/credit cards, Skrill, Neteller, VLoad, WebMoney, bitpay, Mpesa, Fasapay etc. The deposit is free of any charges/commission. HotForex offers a large variety of instruments such as forex, metals, energies, indices, shares, commodities, stock DMA, ETF and bonds.

Trading on HF Markets is carried out on the MT4, web and MT5 platforms which are available on different devices.

HF Markets Pros

- HF Markets is regulated by CMA in Kenya

- They have responsive 24/5 live chat support

- Low minimum deposit

- No deposit fees

- Supports local banks in Kenya for Deposit/Withdrawal

- HF Markets offers multiple account types

- Supports multiple trading platforms

HF Markets Cons

- Trading fees is slightly higher than average

- KES not available as base account currency

#6 Scope Markets – CMA Regulated Broker That Accepts Mpesa

Scope Markets is a Kenya-based forex and CFD broker that is regulated by CMA and accepts deposits and withdrawals through mPesa.

Scope Markets is regulated by the Capital Markets Authority (CMA) of Kenya with license number 123. The legal entity of Scope Markets is registered as SCFM Limited for clients residing in Kenya.

Scope Markets is an international forex broker that accepts clients from multiple nations and is also regulated by CySEC of EU and FSCA of South Africa.

There is only a single choice of account type which is a spread-only account which can be opened with a minimum deposit of $100. The subsequent minimum deposit or top-up is $50.

The spreads start from 0.9 pips but the average typical spread for EUR/USD at Scope Markets is 1.5 pips.

Clients can trade with more than 250 CFD instruments including 44 currency pairs at Scope Markets. They support the most widely used MT4 and MT5 trading platforms with the same account type and pricing structure.

The customer support services at Scope Markets are excellent for Kenyan clients. Support staff can be reached out through phone, live chat, and email.

Scope Markets Pros

- Scope Markets is regulated by CMA in Kenya

- No deposit fees

- Supports local banks in Kenya for Deposit/Withdrawal

- Supports multiple trading platforms

Scope Markets Cons

- Less number of available instruments to trade

- High minimum deposit

- No choices for account types

What is mPesa?

M-Pesa (Mobile Money Transfer) is a mobile-centric financial service that Safaricom, a telecommunications company in Kenya, introduced in 2007. It empowers users to send and receive money, perform payments, and engage in diverse financial activities via their mobile devices. Particularly in areas with restricted traditional banking infrastructure, M-Pesa has been a pivotal force in reshaping financial services.

Key attributes of M-Pesa encompass:

- Mobile Wallet: Users can establish a virtual mobile wallet tied to their mobile number. This digital wallet allows them to hold funds and carry out transactions.

- Cash Handling: Users can deposit and withdraw cash at authorized M-Pesa agents, often found in small retail establishments. These agents facilitate the conversion between electronic money and physical currency.

- Money Transfers: M-Pesa enables users to transfer money to others, extending this capability even to individuals without bank accounts. Beneficiaries receive notifications and can extract the funds in cash from an M-Pesa agent.

- Settling Bills: Users can conveniently pay bills, such as utilities and school fees, directly from their M-Pesa wallet.

- Merchant Transactions: M-Pesa is widely accepted for payments at various merchants, spanning retail, dining, and services.

- Global Remittances: In select regions, M-Pesa facilitates international remittances, allowing users to receive funds from overseas.

M-Pesa’s triumphant impact in Kenya spurred its expansion to other nations, including Tanzania, India, and multiple African countries. Its significance is especially pronounced in locations where conventional banking services are scarce, ushering financial inclusion to previously underserved populations.

By delivering a secure and accessible avenue for financial management, transactions, and service access via mobile phones, M-Pesa has profoundly shaped financial accessibility and economic empowerment in numerous regions.

How to Deposit at Forex Broker with mPesa

mPesa is a phone-based payment service provider. Through mPesa, money can be transferred through a SIM card or mobile phone number. mPesa is a widely used payment method in Kenya. Several CMA-regulated forex and CFD broker accept deposits and withdrawals through mPesa in Kenya.

To deposit through m-Pesa, traders need to open an account with any of the above-listed brokers that accept mPesa. The account opening process at forex brokers can be completed online by providing basic details and document verification. Once the account opening is complete, clients can deposit through mPesa following these steps.

Step 1: Go to Deposit Section

The deposit page is generally easily visible on the dashboard of the mobile app or website of the broker.

Step 2: Select mPesa to Deposit

On the deposit screen, there will be multiple options to deposit funds into the account. clients need to select m-Pesa out of bank transfer, credit/debit cards, and e-wallets.

Step 3: Select Account and Amount

Traders must carefully choose the account in which the deposits are to be made and the amount that needs to be deposited. Make sure the phone number linked with the forex trading account is the same as the one used for the mPesa account. For brokers that do not have KES as the base currency, traders can also choose the currency in which the deposits will be made.

Step 4: Confirm Through mPesa PIN

Once you made the request to deposit at a forex broker through mPesa, the mPesa request to confirm will pop up on your mobile phone linked with mPesa and forex broker. This requires a mPesa PIN for confirmation of the payment. Once, the PIN is entered through the mobile phone, the deposit will be processed. Generally, mPesa deposits are reflected in the account within a few minutes but processing time depends on the broker is chosen.

How to Choose a Forex Broker with mPesa in Kenya?

For Kenyans looking forward to trading in the global forex market, one of the requirements you need is a broker. In this guide, we have curated factors to be considered when choosing a forex broker.

Our guide adopts factors such as regulation, trading fees/charges, deposits and withdrawal fees, suitability of trading platform, and trading conditions.

1. Regulation: For a forex broker to prove her trustworthiness, it should be regulated by tier-1 regulators or by the regulatory authority in the trader’s country.

In Kenya, the regulatory authority is the Capital Market Authority (CMA). Only six brokers are registered and regulated by the CMA. They are FXPesa, Pepperstone, Scope Market Kenya, and FXTM. However, forex brokers who are regulated by tier-1 regulators such as Australia’s ASIC and Britain’s FCA and those tier-2 regulators such as CySEC and South Africa’s FSCA are considered trustworthy.

The most important regulator a Kenyan trader should look out for is the C.M.A.

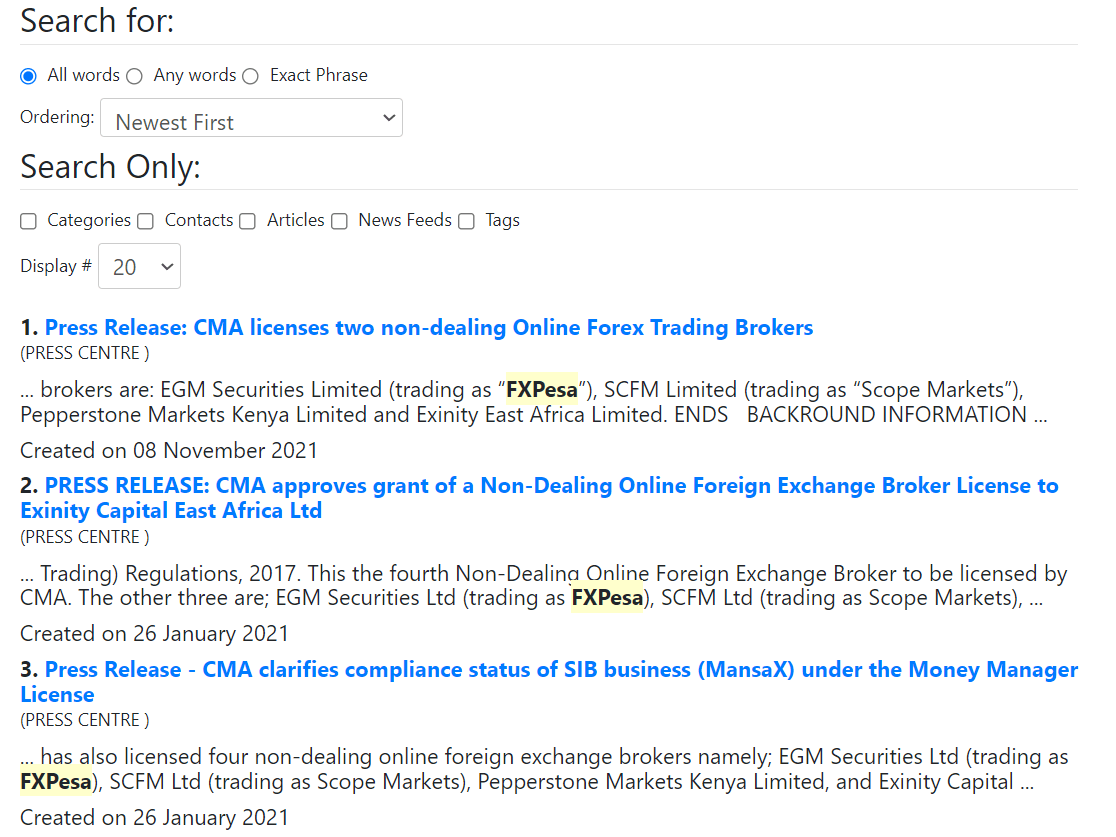

We’ll use FXPesa to illustrate how to verify the registration of a Forex Broker with Kenya’s CMA.

-

- First, visit the official CMA website.

- Click on the search icon and search the name of the broker you wish to verify its registration. In this case, we are using “FXPesa”.

- The search result will determine if the broker is registered by the CMA or not. If it is registered as is the case with FXPesa, the pictorial evidence below will tell.

- Lastly, to confirm the registration of the broker just click on any of the press releases by the CMA. In this review, we used the second press release.

Note: In the event, that a broker is not registered by the CMA, a search result of its name on the CMA website will be zero results found. Exness was used as an example here.

Or you can check the list of licenses under CMA, and there you can check the list of all the approved Online Forex Brokers. Refer to the following screenshot.

You can download the document, and there you will find the list of all the updated CMA Licensed Forex Brokers in Kenya. There are 9 Licensed Forex brokers currently and 4 of these forex brokers accept MPesa currently as per our check including FXPesa, Scope Markets, PepperStone, and HotForex.

2. Trading Fees/Commission: A trader should be aware of the potential charges/fees levied before trading with a broker. These fees range from deposit/withdrawal fees, account dormancy fees, trading commission and swap fees.

Some brokers have found a way to levy charges using spreads. High spreads are used as a cover for zero fees. A trader should check properly for the spread on different instruments.

For example, on the FXPesa website, the spread on each Forex pair differs.

Not only on currency pairs do these charges differ, but some brokers do also charge special commissions on CFDs, stocks, indices, and even dormant accounts.

Hence, it is important a trader conducts thorough research on the broker and fees of the instruments he wishes to trade.

3. Suitability of Trading Platform: For trading to go on with ease, the trading platform should be suitable for the device of the trader.

A trader should check whether the broker’s trading platform is available on his device be it Android, iOS, PC, or web. Most brokers use the MT4 and MT5 trading platforms.

The trading platform should also have instant execution and multiple order types to facilitate quick execution.

Quick withdrawals and fast KYC verification are attributes of a very good trading platform. On FXPesa for example, withdrawals via mobile payment options like MPesa are free and take three hours.

It’s important to note that the MetaTrader 4 is the most popular trading platform used by traders around the world including Kenya. Almost every broker will offer MetaTrader 4 as a trading platform. Hence, learning the platform can be quite useful as well since you can easily switch brokers without needing to learn a new platform if you’re familiar with the MetaTrader 4.

4. Customer Support Services: The customer support services can come in handy at any step while trading through any forex and CFD broker in Kenya. If queries are resolved quickly, traders can have a better trading experience.

Most brokers offer live chat support while some brokers with local offices in Kenya also offer support services through local phone support.

5. Available Instruments: Traders must check the instruments that are available for trading at any broker that accepts m-Pesa for deposits and withdrawals. Each broker offers different number of instruments for trading.

It is important to check whether the instrument that the you wish to trade with is available with the chosen broker or not.

A trader should also look for negative balance protection. Brokers who offer negative balance protection should be considered. This ensures a trader doesn’t owe the broker in a situation where markets go south while trading with high leverage.

Finally, the number and classes of instruments on offer together with their fees should be properly researched before deciding on the broker to trade with.

Comparison of Forex Brokers in Kenya that Accept MPesa

| Forex Broker | Regulation | EUR/USD Spread | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|---|

| FxPesa |

CMA |

0 pips

|

1:400

|

$5

|

Visit Broker |

| Exness |

FCA, CySEC |

0.3 pips

|

1:2000

|

$1

|

Visit Broker |

| XM Forex |

CySEC, ASIC |

0.8 pips

|

1.888

|

$5

|

Visit Broker |

| FXTM |

CMA, FCA, FSCA, CySEC |

1.5 pips

|

1:400

|

$10

|

Visit Broker |

| HF Markets |

CMA, FCA, CySEC |

0.6 pips

|

1:400

|

$5

|

Visit Broker |

| Scope Markets |

CMA, FSCA, CySEC |

1.5 pips

|

1:400

|

$100

|

Visit Broker |

FAQs on Best Forex Brokers in Kenya that Accepts M-Pesa

Which is the Best Forex Broker in Kenya with MPesa?

Based on our research, FxPesa is the best local forex broker in Kenya that accepts MPesa for deposits & withdrawals from traders at Zero Fees. FxPesa is regulated with local regulatory CMA & offers a very low spread of 0 pips on EUR/USD currency pair with other best trading conditions.

Which is MPesa accepting Forex Brokers are regulated in Kenya?

FxPesa, Exness, HF Markets, Scope Markets, and FXTM are the forex brokers that accept MPesa in Kenya and are also regulated by the Capital Markets Authority of Kenya.

Who is the best forex broker in Kenya?

According to our analysis and comparison, FxPesa, Exness, and HF Markets are among the best forex brokers in Kenya. These brokers have low fees, and low minimum deposits, and offer good quality support services in Kenya. A total of 7 forex brokers are regulated by the CMA in Kenya.

Does Exness allow M-Pesa?

Yes, Exness is a CMA-regulated broker that allows deposits and withdrawals through m-Pesa in Kenya. Traders can deposit as low as $1 through m-Pesa in Kenya at Exness. The deposits and withdrawals are generally processed instantly but in some cases, it can take up to 3 days to process the transaction.

Does Interactive brokers accept mpesa?

No, Interactive Brokers accept clients residing in Kenya to trade forex and CFDs but they do not support MPesa for deposit and withdrawal in Kenya. Interactive Brokers is not regulated by the CMA of Kenya and carries higher third-party risk than any other CMA-regulated forex and CFD broker in Kenya.

Does FXPesa use mpesa?

Yes, FXPesa supports MPesa for deposits and withdrawals in Kenya. FXPesa is a Kenya-based forex and CFD broker that is regulated by the CMA of Kenya and allows trading with KES as the base currency. Traders in Kenya do not need to change their currency or pay a currency conversion fee if they choose to trade with KES currency and deposit with the same.

Does Pepperstone accept mpesa?

Yes, Pepperstone allows deposits and withdrawals through MPesa in Kenya. Pepperstone is a CMA-regulated forex and CFD broker but they do not offer KES-based trading accounts. Hence, the KES deposits will be converted to base currency of the account at prevailing conversion rates.

Which Forex Brokers with MPesa have the lowest fees?

Based on our research, FxPesa, Exness, HF Markets, FXTM, and Scope Markets do not incur any additional commission for deposits and withdrawals through mPesa in Kenya. FxPesa and Exness have the lowest trading cost among others accepting mPesa in Kenya.