HF Markets Kenya Review 2024

HotForex or HFM Investment Limited is regulated by CMA in Kenya as a Non Dealing Desk Forex Broker. HotForex is considered safe for Kenyan clients but check our honest review to find out if it is the right choice for you or not.

HF Markets, previously known as HotForex, is a CMA-regulated financial services provider that offers forex and CFD trading services in Kenya. It allows deposits and withdrawals in Kenyan Shillings via e-wallets like DusuPay and M-Pesa. Kenyan clients can open an account with USD, EUR, NGN, and JPY as the base currency at HotForex.

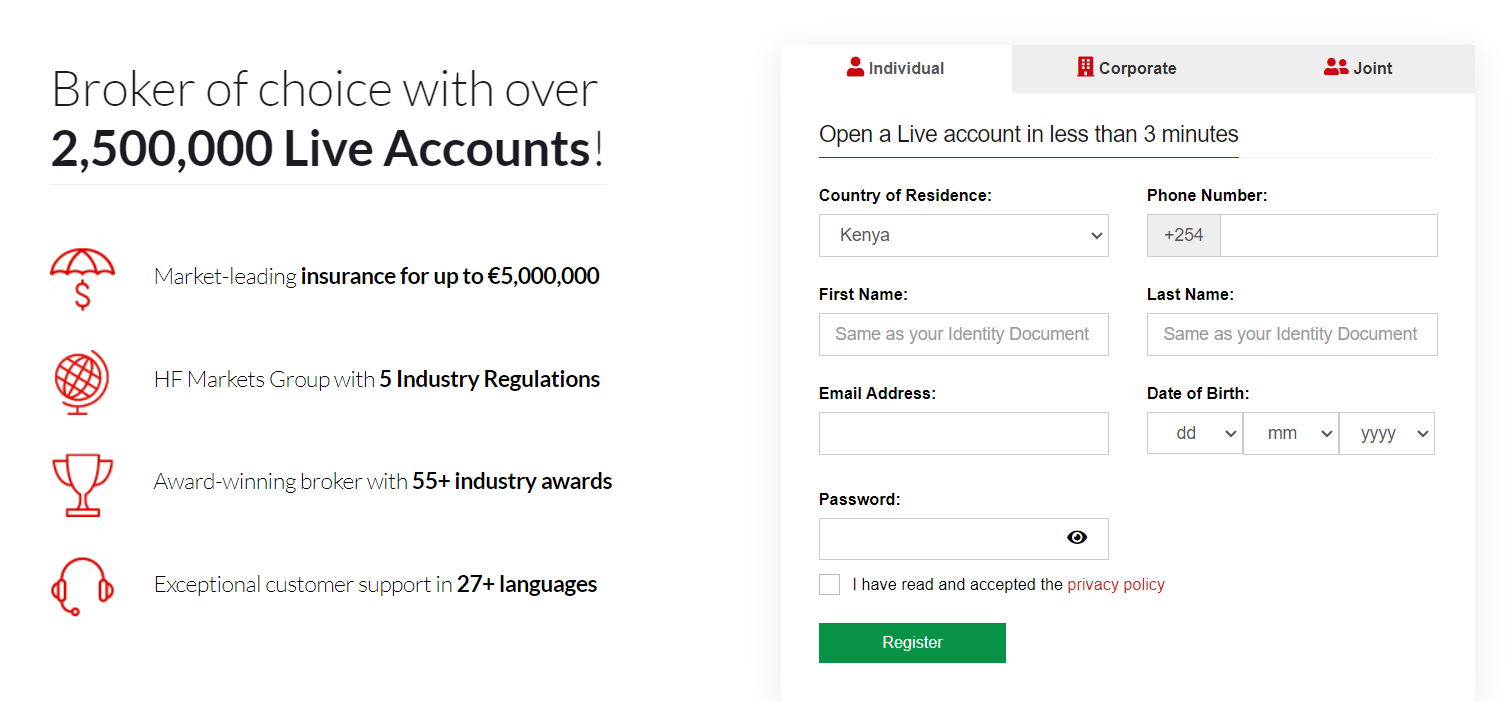

HF Markets claims to have opened more than 2.5 million live trading accounts across the globe. It has been in the forex and CFD trading business for more than 10 years. It is one of the most reputed forex brokers in the world due to multiple top-tier regulatory licenses.

HF Markets is regulated by multiple top-tier offshore regulatory authorities and is also regulated by CMA in Kenya. There are multiple account types to facilitate different types of traders.

HF Markets UK Pros

- HF Markets is regulated by Capital Markets Authority in Kenya

- HF Markets is regulated by top-tier regulatory authorities like FCA and FSCA

- No non-trading charges exist in the Standard account type

- Free deposits and withdrawals through multiple methods

- Minimum deposit as low as $5

- customer support available with live chat and email and local phone support

- Multiple account types available

- Multiple Trading Platforms Supported

- HF Markets is an STP/ECN broker

- 1200+ trading instruments available from multiple asset classes

- The bonus offerings at HF Markets are excellent

- Wide range of research and education tools available

HF Markets UK Cons

- KES is not available as the base currency of the account

- High Inactivity charges

- The support services are not available on the weekends

- The spreads with the Classic account is slightly higher than many forex and CFD brokers

Table of Content

- HF Markets’s Summery

- Regulation & Safety of Funds

- HF Markets Trading Fees

- HF Markets Account Types

- How to Open an Account at HF Markets?

- HF Markets Deposits and Withdrawals

- HF Markets Trading Platforms

- HF Markets Available Instruments

- HF Markets Research and Education

- HF Markets Customer Support & Contact

- HF Markets Bonus

- HF Markets FAQs

Read our detailed review of HF Markets exclusively for Kenyan clients before opening an account. We have honestly reviewed all the advantages and shortcomings of choosing HotForex to trade forex and CFD in Kenya.

The review can also assist you in choosing the right account type for yourself.

HF Markets Kenya Summary

| Broker Name | HFM Investments Ltd |

| Website | www.hfm.co.ke |

| Regulation | CMA, FSCA, FCA, CySEC, FSA & DFSA |

| Year of Establishment | 2010 |

| Minimum Deposit | 5$ |

| Maximum Leverage | 1:400 |

| Trading Platforms | MT4 & MT5 |

| Trading Instruments | Forex, CFDs on Metals, Energy, Indices, Shares, Commodities. |

Is HF Markets Legit?

The safety of traders greatly relies on the regulatory licenses held by the broker. Forex and CFD trading in Kenya is legal but traders must ensure that the chosen broker is regulated by CMA or some other top-tier regulatory authority.

There are several forex trading service providers that are not regulated by CMA or any other regulatory authority. Forex and CFD brokers with no regulatory license are very likely to be fake and must be avoided.

HotForex Group is well regulated with following Regulations:

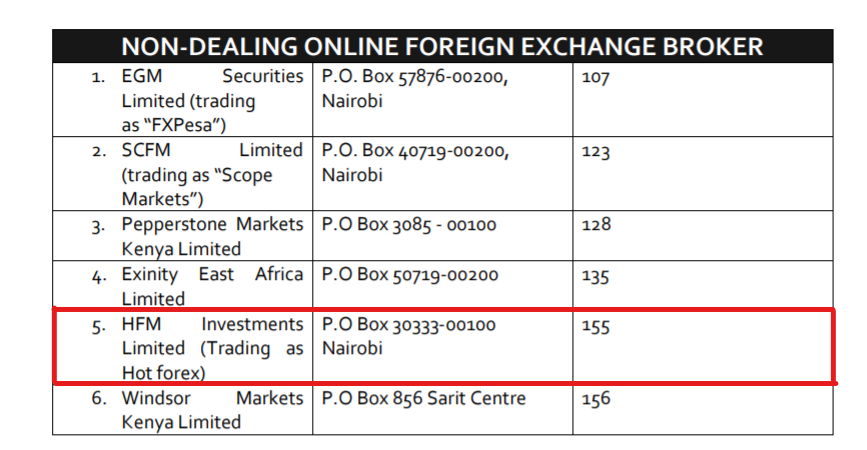

- Capital Markets Authority (CMA): HotForex has recently acquired the regulatory license from the Capital Markets Authority of Kenya. The license is registered by the name of ‘HFM Investments Limited’ under license number 155.

CMA was established in Nairobi in 1989 by the Ministry of Finance, Kenya. It authorizes and overlooks the activities of the registered Financial Services Providers and protects the clients. Kenyan clients at HotForex are registered under the CMA regulatory compliance. HotForex is one of the 6 Non-Dealing Desk brokers registered in Kenya.

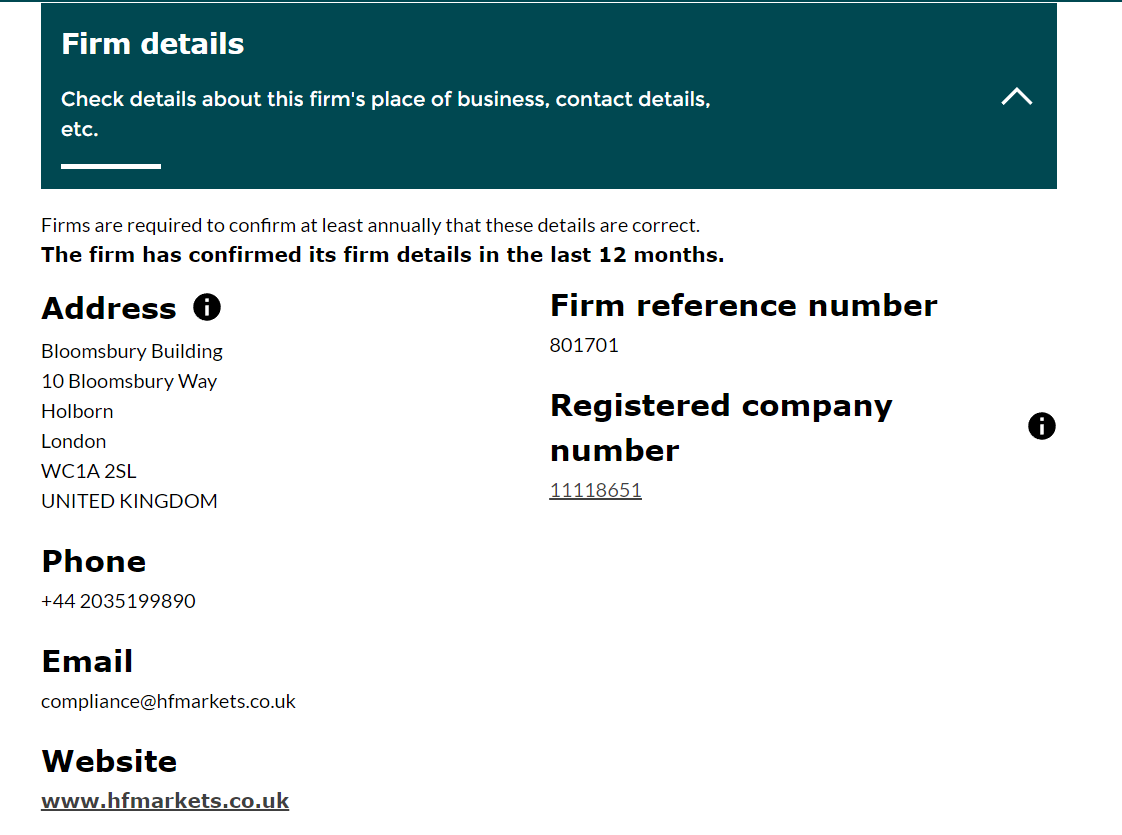

- Financial Conduct Authority (FCA): HotForex is regulated by the Financial Conduct Authority (FCA) of the United Kingdom by the name HF Markets (UK) Ltd under reference number 801701. FCA is also a top-tier regulatory authority that is governed by the Financial Services and Markets Act 2000 of the UK.

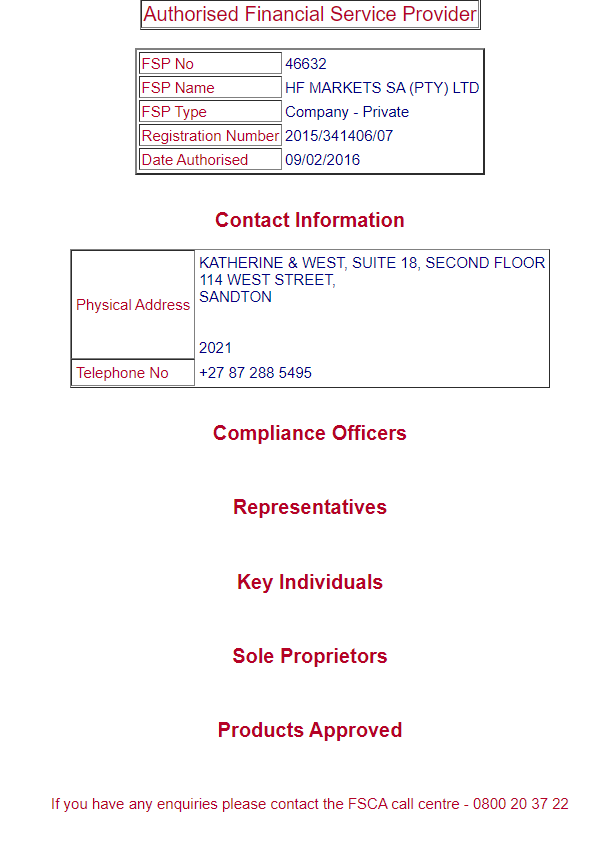

- Financial Sector Conduct Authority of South Africa (FSCA): HotForex is regulated by the Financial Sector Conduct Authority of South Africa under FSP number 46632 with the name HF Markets SA (PTY) Ltd. FSCA, previously known as Financial Services Board (FSB) is an independent financial regulator that overlooks the activities of financial service providers in South Africa. It is a top-tier regulatory authority that makes the regulated entity safe for traders and investors.

- FSA & DFSA: Apart from these top-tier regulators, HotForex is also regulated by the FSA of Seychelles (8419176-1) and DFSA of Dubai (F004885) as a financial service provider. It is registered as an international business company in St Vincent and Grenadines with registration number 22747 IBC 2015.

The multiple top-tier regulatory licenses and CMA regulatory license of Kenya makes HF Markets safe for Kenyan traders.

HotForex was founded in 2010, so it is a relatively old broker. Due to CMA and multiple top-tier regulations, the third-party risk of choosing HF for trading is very low in Kenya.

HF Markets Trading Fees

The overall cost incurred to traders at HF Markets is decent when compared with other regulated brokers in Kenya.

We have separately reviewed and compared every component of fees at HotForex that are incurred to traders.

- Competitive Spread: Spreads are the basic component of fees that are incurred to traders while trading forex and CFDs through any of the platforms. It is basically the difference between the buy (bid) price and the sell (ask) price.

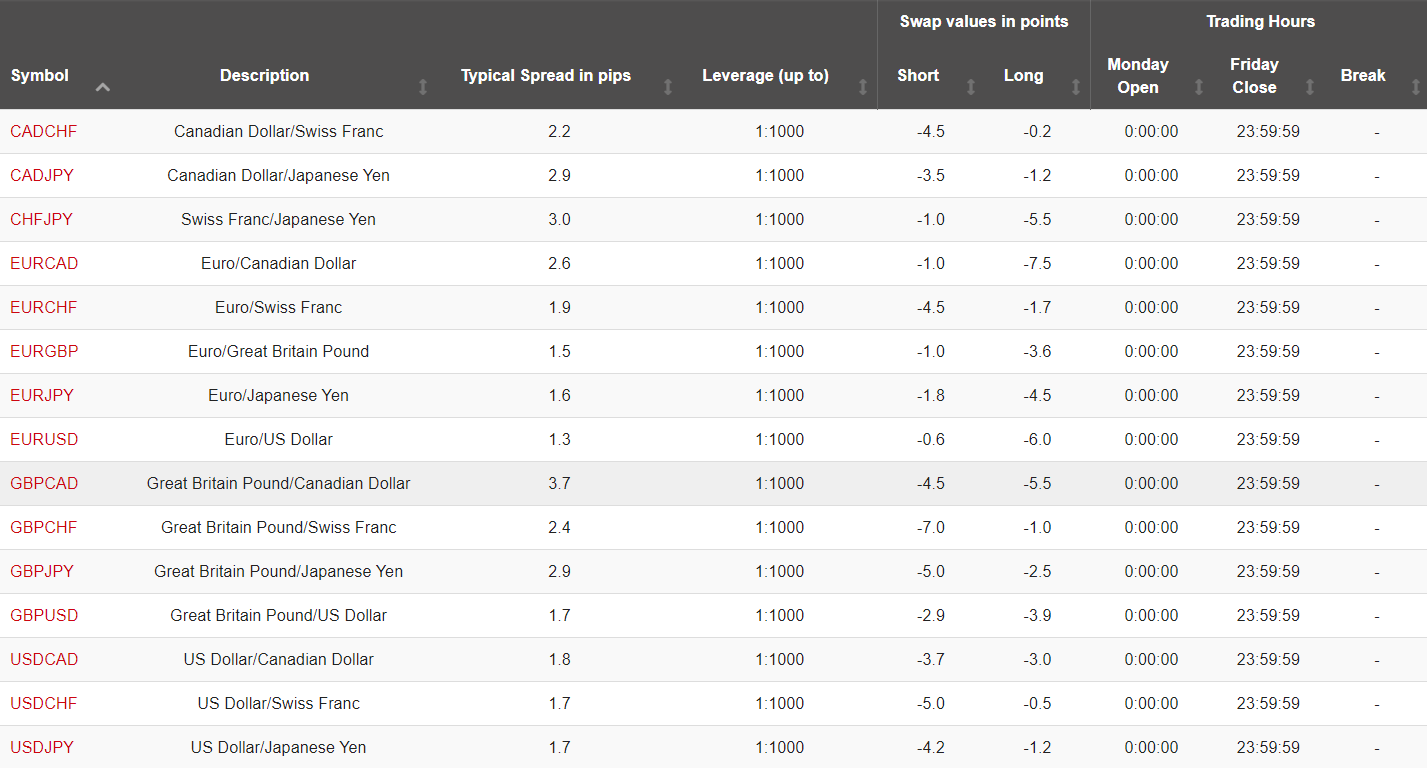

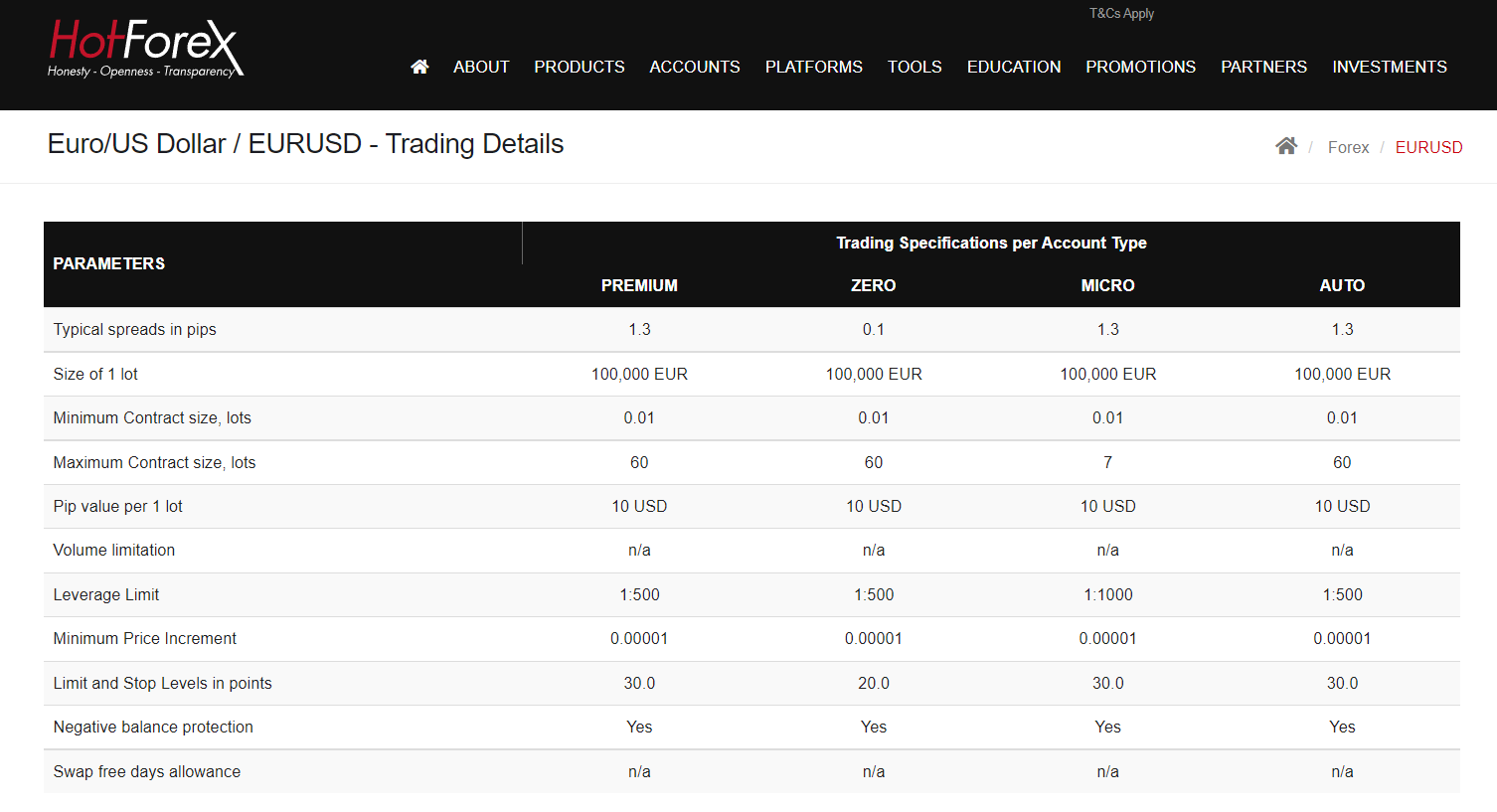

The spreads at HF Markets start from 1 pip but depend on the account type chosen by the trader. HotForex charge variable spread on all the instruments that can change according to the liquidity in the market and trade timings. The table below mentions the average typical spread at HF Markets with the Premium account type for major trading instruments.

Trading Instrument Average Spread with Premium Account Average Spread with Zero Account EUR/USD 1.5 0.4 GBP/USD 1.9 0.7 Gold/USD 0.28 0.13 US Crude Oil 0.1 0.1 US Tech 100 2.1 2.1 BTC/USD 56.0 56.0 GER40 0.6 0.6 UK100 3.3 3.3 USA30 3.1 3.1 USA500 0.31 0.31 The spreads with commission-free account types at HF Markets start from 1 pip while the same with commission-based account types start from 0 pip. The average typical spread with the Micro, Premium and HFCopy account for EUR/USD is 1.3 pips. The average spread for EUR/USD with the Zero spread account is 0.1 pips.

- Moderate Commissions with Zero Spread Account: The Zero Spread account type at HotForex is a commission-based account where the spreads are very low. Trading major currency pairs with this account incurs a commission of $3 for each side and $6 for a round-turn trade of a standard lot. For all the other currency pairs, the commission is 8$ for a round-turn trade of a standard lot.

Broker Name Commission for Single Side Trade Commission for a Round Trade HFM $3 $6 AvaTrade NA NA OctaFX NA NA FXTM $2 $4 XM NA NA IC Market $3.5 $7 Pepperstone $3.5 $7 Apart from this, no other additional commission is charged by HF Markets. The account opening is free and no commission is charged for deposits and withdrawals from the broker’s end.

- Moderate Overnight (Swap) Fees: This is the fee that is incurred to traders when a position is kept open overnight. The swap fees or overnight opening fees are different for each instrument. Swap fees for long positions and short positions are also different. The details of the swap fees can be checked on the HF Markets website and app and can also be calculated with the swap calculator feature at HF Markets. The overnight charges at HotForex are lower than XM but are higher than Exness.

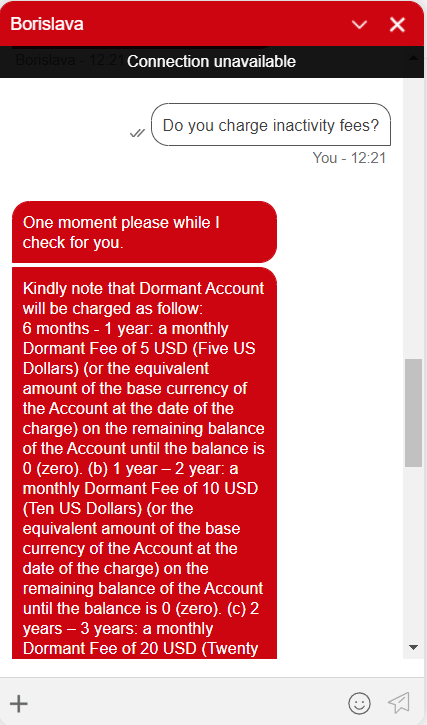

- Inactivity Charges: This is the fee that is incurred when no trades are executed for a prolonged period. It is applicable only when the account balance is more than 0 and no trades are executed for more than 6 months.

The following table compares the inactivity fees for popular forex and CFD brokers in Kenya. The inactivity fees are incurred each month after the inactivity period.

Broker Name Inactivity Period Monthly Inactivity Fees HFM 6 Months $5 FXTM 6 Months $5 OctaFX NA NA Pepperstone NA NA XM 12 Months $15 IC Market NA NA

For inactivity of 6 months to 1 year, HF Markets will charge a monthly dormant fee of 5$ or equivalent for each consecutive month of inactivity. For 1 year to 2 years of inactivity, this monthly fee will be 10$ equivalent of the base account currency. For 2 to 3 years, inactivity fees will be 20$. For more than 3 years of inactivity, the monthly dormant fees will keep increasing by 10$ until the account balance reaches 0.

| Trading Instrument | HF Markets | FXTM | eToro | IC Markets | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 1.5 | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 1.9 | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 1.9 | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 2.2 | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 2.3 | 2.5 | 1.7 | 1.3 | 1.07 |

Deposit Withdrawal Fees

HF Markets does not incur any kind of fees for deposit and withdrawals. However, if the clients are using the bank wire transfer, and the deposit amount is less than $100, only then a deposit fee will be incurred. The following table compares the deposit and withdrawal fees for popular forex and CFD brokers in Kenya.

| Broker Name | Deposit Fees | Withdrwal Fees |

|---|---|---|

| HFM | NA | NA |

| FXTM | NA | $1 For Local Bank Withdrawal |

| OctaFX | NA | NA |

| Pepperstone | NA | NA |

| XM | NA | NA |

| IC Market | NA | NA |

Overall, the fees incurred at HF Markets are lower than some of the regulated brokers but also higher than several others. The spreads are competitive while the commission and swap fees are decent when compared with other brokers.

However, the trading fees at HFM will depend largely on the account type chosen by the trader. Following is the comparison of fees that will be incurred if at HFM with different accounts if you place and close a trade order of 1 standard lot on EUR/USD.

| Account Type | Trade Amount | Fees on a Round Trade |

|---|---|---|

| Micro | $100,000 | $15 |

| Premium | $100,000 | $15 |

| Zero | $100,000 | $7 |

Many regulated forex brokers do not charge inactivity fees that are much higher at HotForex. Although this will only be charged if no trades are executed for 6 consecutive months.

HF Markets Account Types

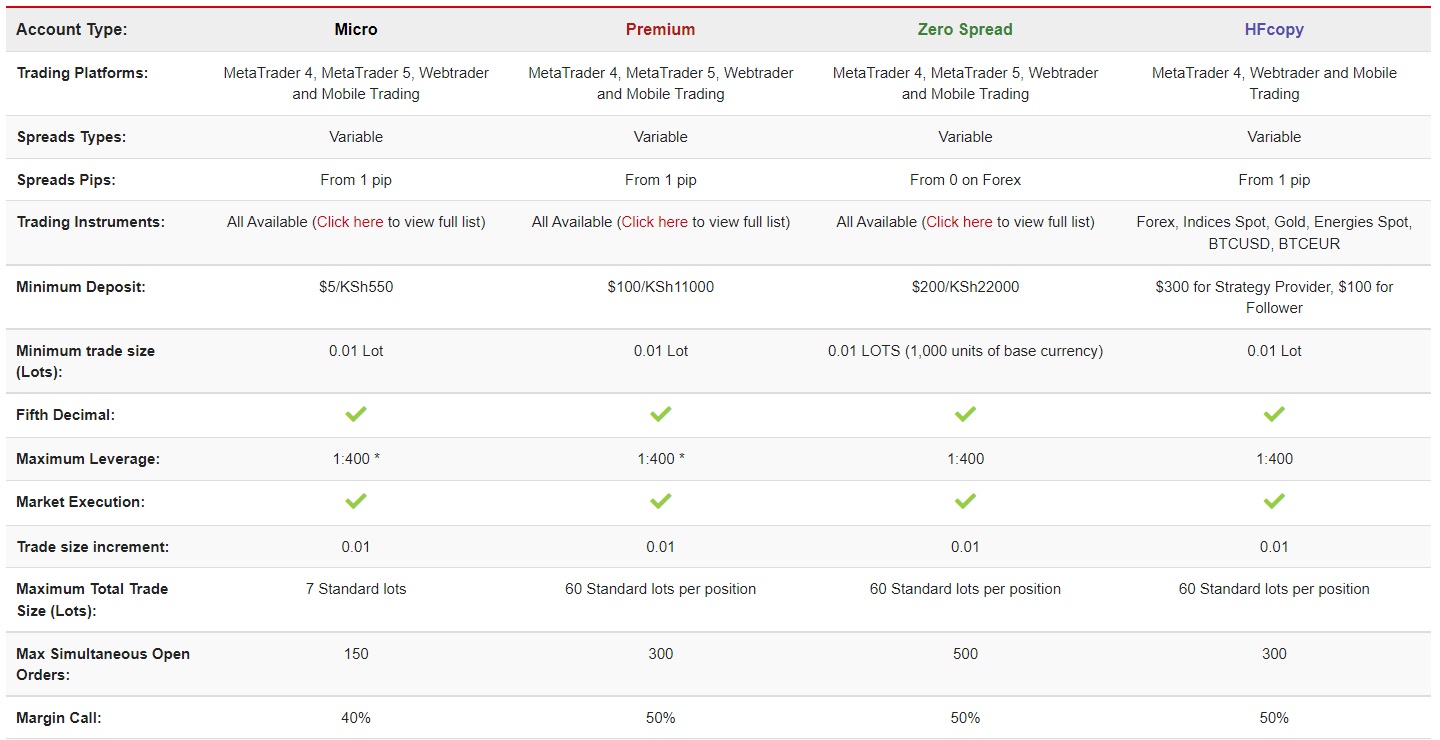

HF Markets offers multiple account types to suffice multiple types of traders in Kenya. Traders can choose from 4 different account types at HotForex. The account types are named Micro, Premium, Zero Spread, and HF Copy. Our experience with all the available account types has been reviewed below.

All 4 account types can be opened either with USD or KES as the base currency. Deposits made in KES to KES-based accounts will not be subject to currency conversion.

- Micro Account: This is the basic account type at HF Markets that can be opened with the lowest minimum deposit of 5$ or 600 Kenyan Shillings. It is a commission-free account type that allows trading on all the available instruments at HF Markets. The max leverage with this account is 1:400 and 150 orders can be opened simultaneously with this account type. Up to 7 standards, lots can be traded in a single position.

The Micro account gives access to MT4, MT5, web trader, and mobile trading. According to our review, this is the ideal account type for beginners and small-volume traders due to the low minimum deposit, no commission, and decent spreads.

- Premium: This is also a commission-free account type that can be opened with USD,EUR,NGN, and JPY as the base currency. The minimum deposit requirement with this account type is 100$ equivalent. The maximum leverage is 1:400 with this account and 60 standard lots can be traded in a single position.

The availability of instruments and trading platforms is similar to the Micro account type. This account is ideal for those who wish to trade high volume without any commission.

- Zero Spread: As the name suggests, the spreads with this account type start from 0 pip. This comes at the cost of 6$ commission for a round trade of a standard lot. The minimum deposit requirement with this account is 200$. All the other features are the same as the Premium account type.

Trading with a very low spread at the expense of a fixed commission is beneficial when the trade volume is high. This account is ideal for experienced and high-volume traders.

- HFCOPY: This is a copy trading account type at HotForex in which any trader can become the strategy provider and can follow any of the strategy providers.

The minimum deposit for a follower is 100$ and for strategy, provider is 300$. There is no added commission from the broker’s end but strategy providers can set their performance fee independently from 0 to 50% of the profits.

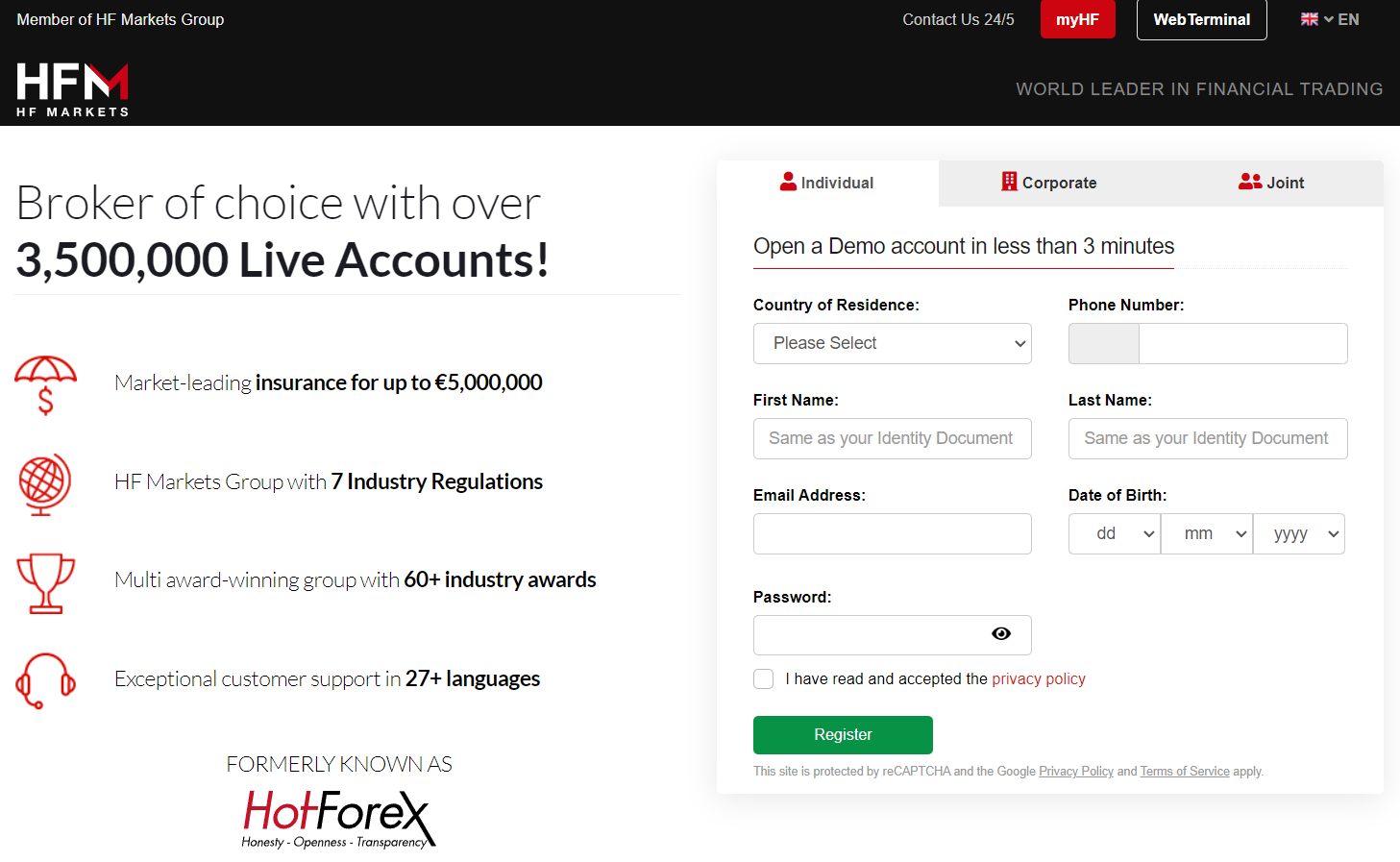

How to Open an Account at HF Markets?

Step 1) Enter the basic details: To open an account at HF Markets, traders can visit the official website of HF Markets or can also download the mobile application.

The first step is to enter the basic details like phone number, name, date of birth, country of residence, and email address. After entering these basic details, an activation link will be sent to your provided email. This link can be followed to open any of the account types at HotForex. This link will redirect you to the MyHF area where a demo account can be opened without providing bank details and submitting documents.

Step 2) Enter Bank details & Complete KYC: To open a live account, the next step is to enter bank details and complete the KYC process by submitting the proof of address and identity. The account type and base currency of the account needs to be chosen by the client. After making a deposit, the trading platforms can be downloaded from the MyHF area and trade orders can be executed.

Step 3) Select Account & Make a deposit: Availability of different account types allows clients to choose the most suitable one. Multiple account types can be opened with different base currencies which is an added advantage for the Kenyan traders. According to our review, the flexibility of choosing a suitable account type makes HF Markets better than many other regulated forex brokers in the section of account types.

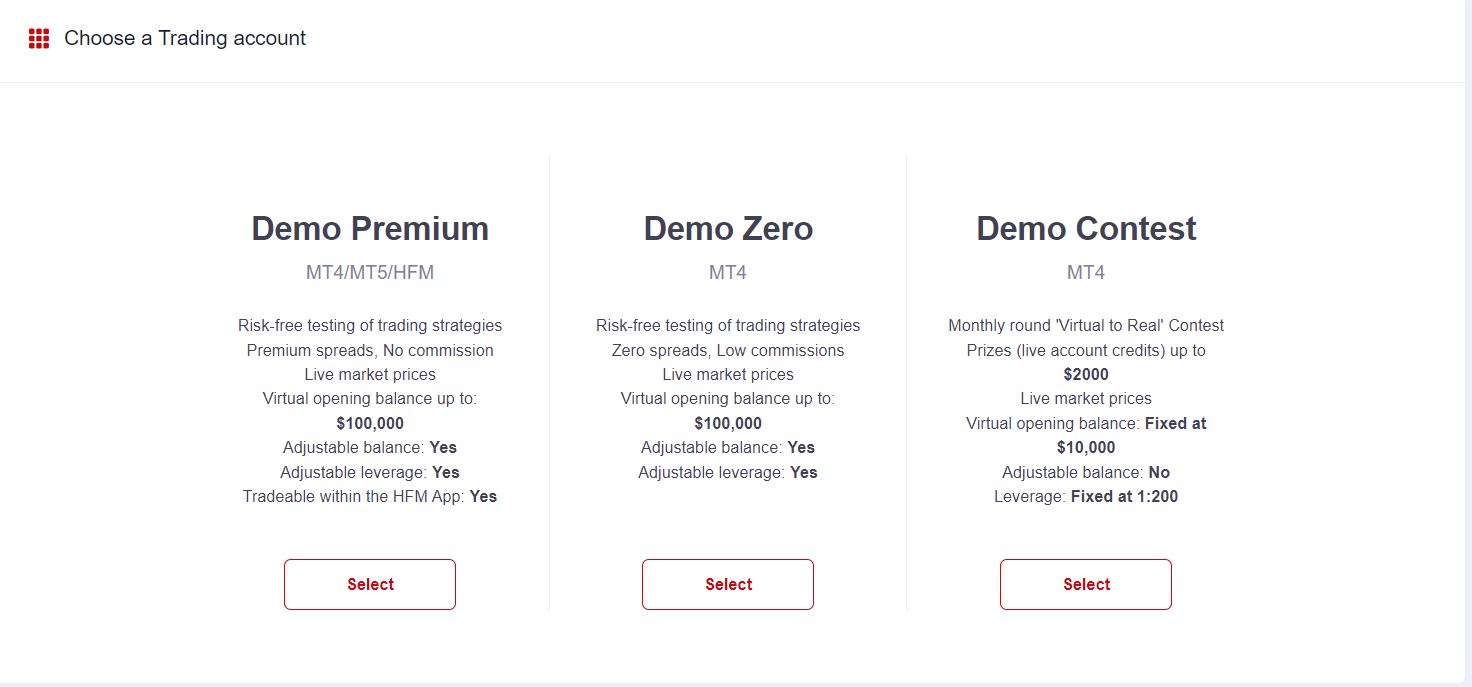

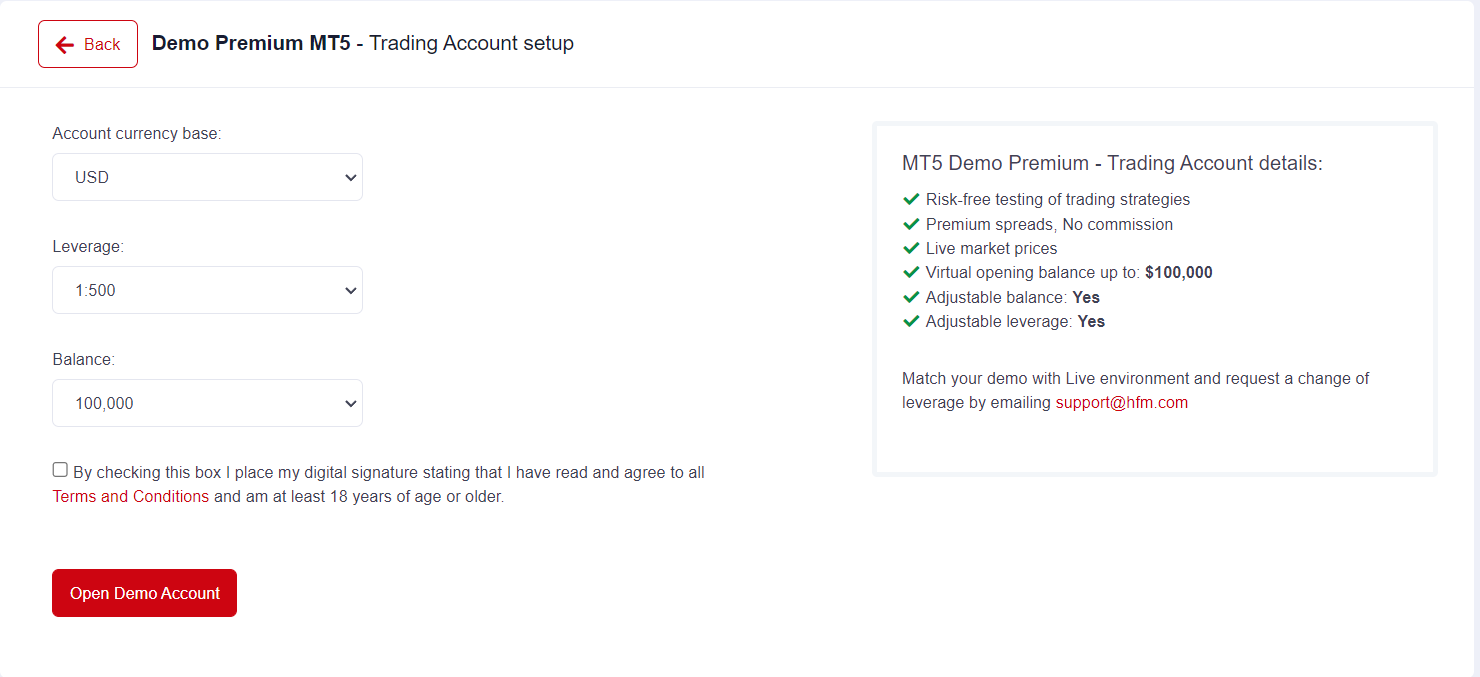

HF Markets Demo Account Review

The demo account can be very useful for beginners as well as existing traders. Beginners can learn about the forex and CFD market, get familiar with trading tools and terminologies, and can gain experience in the market before depositing real money. Existing traders can test their strategies or build a new strategy with the help of a demo account.

The demo account at HF Markets can be opened within a minute by providing basic details like name, phone number, and email address. An activation link will be sent to the mail which will redirect to the personal area of HF Markets. Clients can choose the type of demo account they wish to open. Clients can also enter a contest where top performers are rewarded without depositing any amount.

The demo account can be opened with MT4, MT5, and MyHF trading platforms. for each platform chosen, the account can be configured with a selection of base currency between USD, EUR, and GBP. Clients can choose the maximum leverage on the demo account and start with any amount they wish.

According to our analysis, the demo accounts at HF Markets are very useful. Demo accounts can be configured differently and traders can gain experience with each account type and trading platform before opening live accounts with real currency.

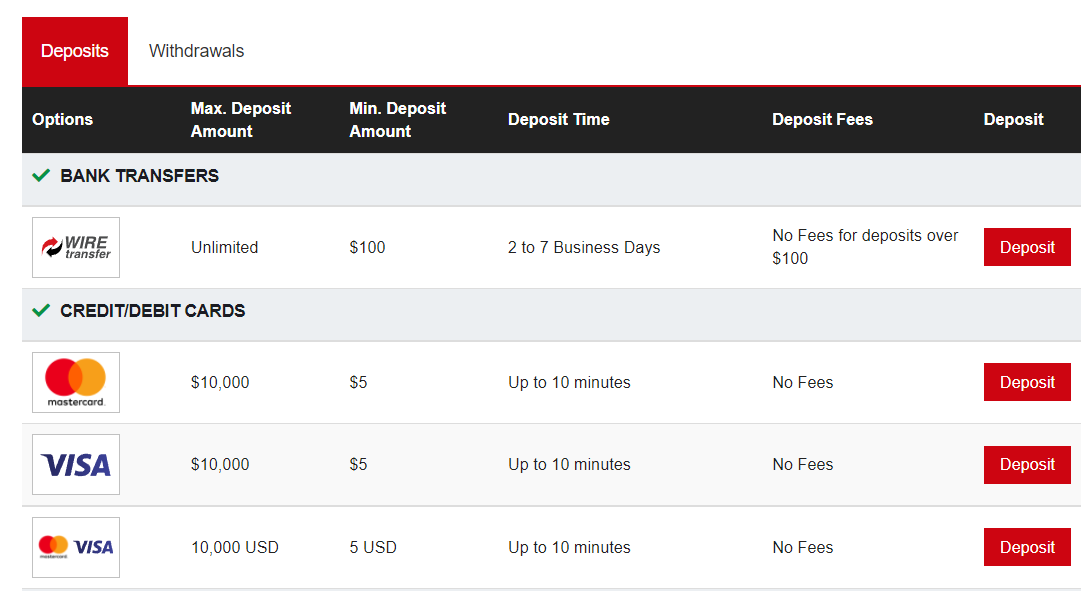

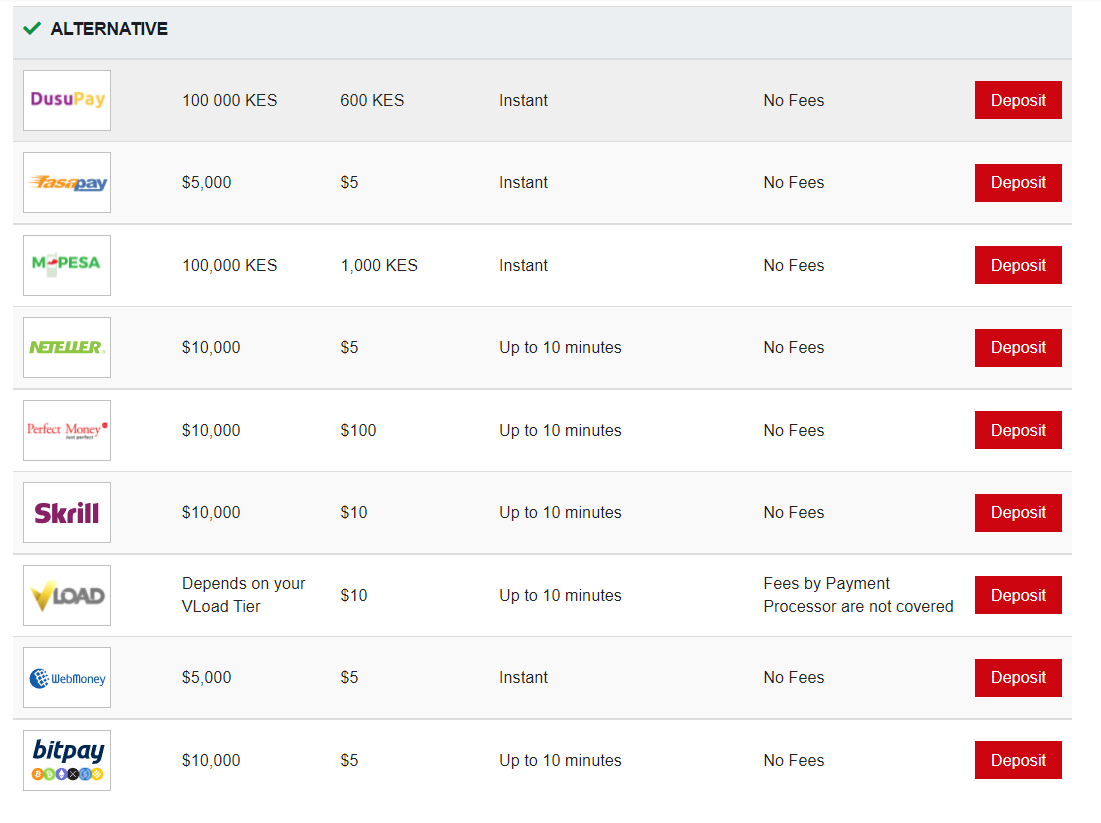

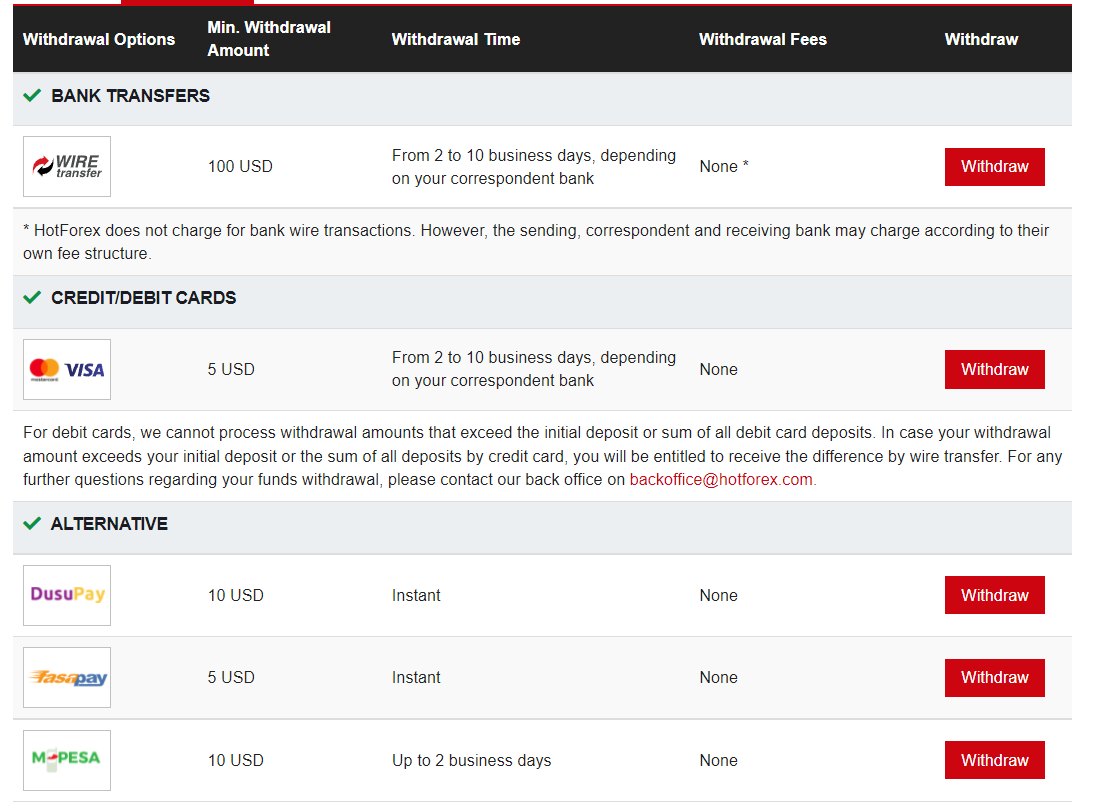

HF Markets Deposits and Withdrawals

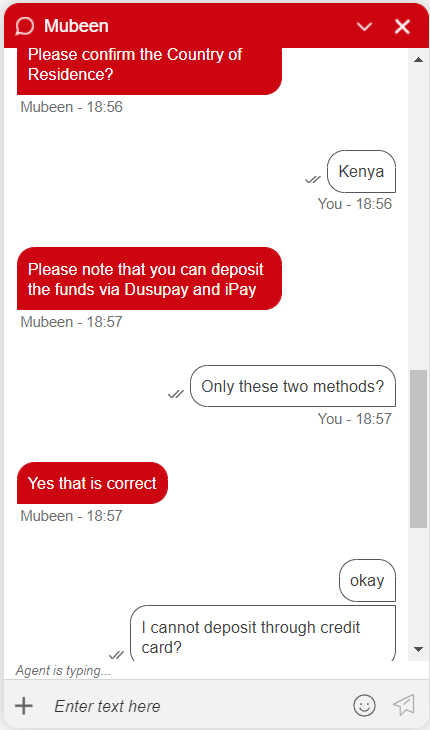

Kenyan clients can deposit and withdraw from HF Markets through wire transfers, credit/debit cards, and multiple e-wallets. The most convenient and feasible methods to transact are DusuPay and M-Pesa. The deposits and withdrawals can be done anytime during the business days (24/5). The currency conversion fee will be applicable if the deposit currency is different from the base account currency.

- Wire Transfer: Deposits and withdrawals in Kenya can be done through bank wire transfers with no added commission over 100$. For the wire transfers, all the commissions are covered by HF Markets if the deposit amount is more than 100$ or equivalent.

The minimum deposit amount with the bank wire transfer is 100$ and the maximum limit is 10,000$ equivalent. The minimum withdrawal limit through bank transfer is 10$ with no commission.

The deposits made through wire transfer will reflect in the account balance in 2 to 7 days while withdrawals can take up to 2 working days to get processed.

- Credit/Debit Cards: Deposits and withdrawals can also be done through Mastercard and VISA cards at HF Markets in Kenya. The minimum amount is 5$ equivalent. Time taken for deposit is 10 minutes while the same for withdrawal is 2 to 10 business days depending on the correspondent bank.

- E-Wallet: Kenyan clients can also transact through several e-wallets where deposits, as well as withdrawals, are reflected within 10 minutes. The minimum amount for deposit and withdrawal is 5$ or 600 KES through these methods. The accepted e-wallet transactions in Kenya include DusuPay, FasaPay, M-Pesa, Neteller, Perfect Money, Skrill, VLoad, WebMoney, and BitPay.

The free-of-cost deposits and withdrawals are advantageous for Kenyan clients. There is no commission involved and HotForex covers all the costs incurred during the transaction of funds.

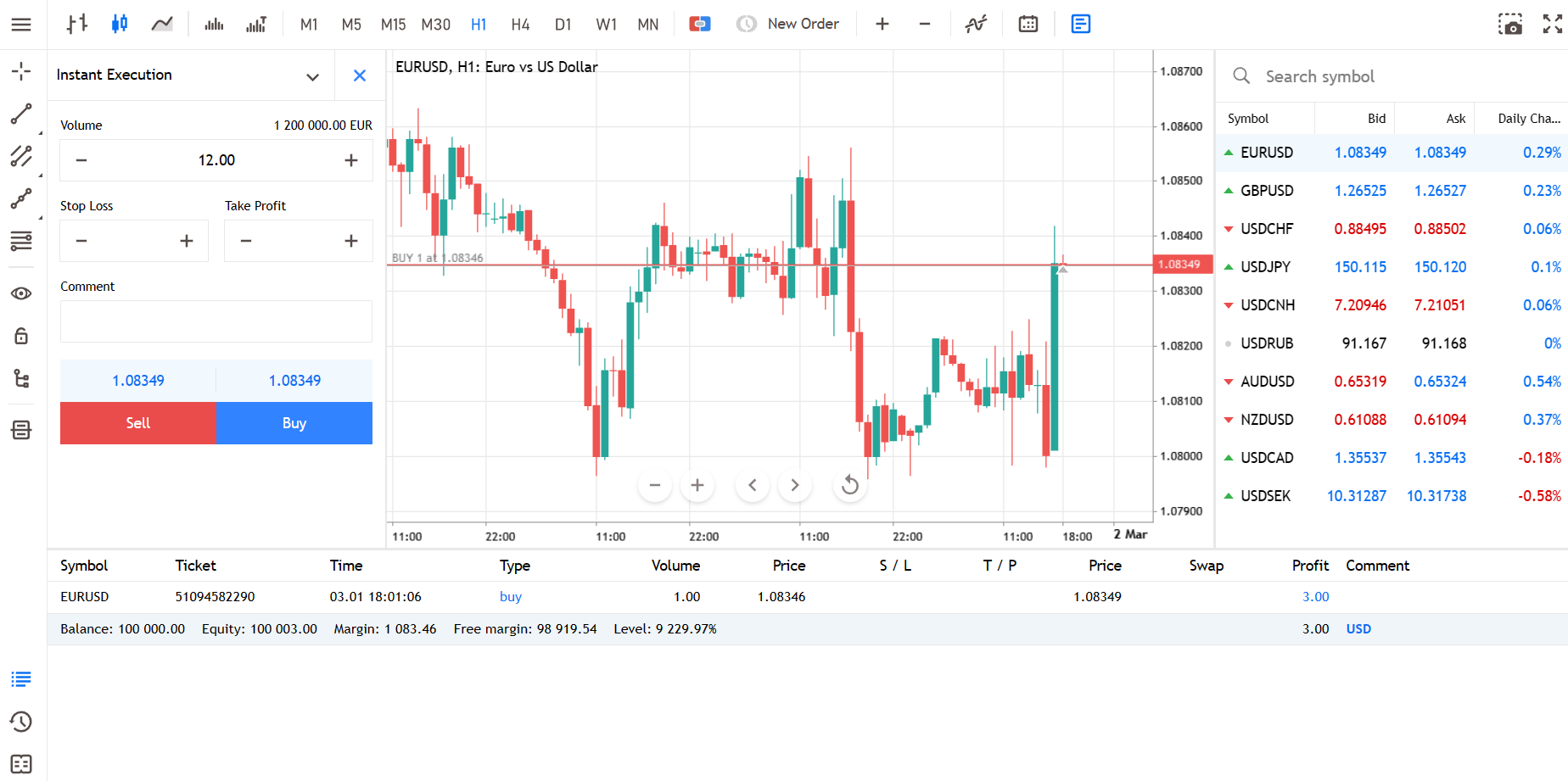

HF Markets Trading Platforms

HF Markets allows trading on all the available instruments through MetaTrader trading platforms and the HFM app. We have separately reviewed the available trading platforms at HotForex in Kenya.

Web Trading Platforms

MetaTrader 4 and MetaTrader 5 are the available web trading platform at HotForex in Kenya. Both these platforms can be customised on any web browser. These are available in multiple languages and support market, limit, and stop loss orders. Trailing stop loss orders are not available on the web trading platform.

MT4 and MT5 web trading platforms have limited features compared to the desktop version. However, traders who wish to link their accounts with online tools through web browsers prefer trading with MT4 and MT5 web trading platforms. MT4 is ideal for beginners while MT5 is more suitable for advanced traders.

Mobile Trading Platforms

MT4 and MT5 are also available for mobile devices at HF Markets. Additionally, HotForex also offers its proprietary trading application for Android and iOS devices called as HFM app.

MT4 and MT5 mobile trading platforms are quite popular among forex traders globally. However, the mobile version of these platforms only offers limited features and accessibility to charts and indicators.

The HFM app has a much better interface compared to MT4 and MT5 applications. Traders can get real-time news and market updates through the HFM app. It has various charting tools and indicators. HF Markets also offers customer support services on weekdays 24/5 through the HFM app.

Desktop Trading Platform

MT4 and MT5 are the available choices for desktop trading platforms. These platforms can be downloaded on Windows and macOS devices and accessed through one-step login. These are available in 21 languages.

MT4 offers 9 timeframes and 30 indicators and has a single-threaded strategy tester. MT5 is an upgraded version of MT4 and offers 21 timeframes and 37 indicators with a multi-threaded strategy tester. MT4 was introduced in 2005 by MetaQoutes Software while MT5 was launched in 2010 by the same firm.

At the time of this review, no other trading platforms are available at HF Markets in Kenya.

HF Markets Available Instruments

All the financial instruments offered by HF Markets are derivative CFD instruments. This means there is no physical buying and selling of the assets but only the price differences are speculated to book profits and loss.

Following the financial instruments that can be traded at HotForex in Kenya.

| Asset Class | Number of Instruments (CFDs) | Max Leverage |

|---|---|---|

| Forex Pairs | 53 | 1:400 |

| Metals | 6 | 1:200 |

| Energy | 4 | 1:66 |

| Indices | 11 Spot, 12 Futures | 1:200 |

| Shares | 71 | 1:14 |

| Commodities | 5 | 1:66 |

| Cryptocurrency | 19 | 1:10 |

| Bonds | 3 | 1:50 |

| Stocks (DMA) | 944 | 1:5 |

| ETFs | 34 | 1:5 |

Compared to other regulated CFD brokers in Kenya, HF Markets offers a large number of trading instruments. Variety in the availability of instruments provides more opportunities to traders in various capital markets.

HF Markets Research and Education

HF Markets, also known as HotForex, is a reputable online Forex and CFD broker that offers a variety of research and educational resources to its clients. Here are some of the research and education services provided by HF Markets:

Market Analysis: HF Markets regularly provides in-depth market analysis and insights to keep traders informed about the latest happenings in the financial markets. They offer daily market updates, technical analysis reports, fundamental analysis research, and expert commentary on various asset classes, including Forex, indices, commodities, and cryptocurrencies.

Economic Calendar: HF Markets offers an economic calendar that outlines upcoming economic events such as key economic indicators, central bank meetings, and geopolitical developments. This tool helps traders stay updated on events that can impact the markets and make informed trading decisions.

Educational Webinars and Seminars: HF Markets conducts educational webinars and seminars on a regular basis. These sessions cover a wide range of trading topics, including technical analysis techniques, trading strategies, risk management, and trading psychology. Participants have the opportunity to interact with experienced traders and market experts, ask questions, and gain valuable insights.

Video Tutorials: HF Markets provides a comprehensive library of video tutorials that cater to traders of all levels, from beginners to advanced. These tutorials offer step-by-step guidance on various aspects of trading, including platform navigation, chart analysis, trade execution, and risk management. Traders can access these videos to enhance their knowledge and skills at their own pace.

Educational Articles and Guides: HF Markets offers a wealth of educational articles and guides covering a wide range of trading topics. These resources provide valuable information on technical analysis methods, risk management strategies, trading psychology, and understanding market trends. Traders can refer to these articles to deepen their understanding of the markets and improve their trading strategies.

HF Markets Trade Execution Method

Execution Approaches: HotForex commonly utilizes both Market Execution and Instant Execution techniques across its range of accounts.

Market Execution: This method involves executing trades at the prevailing market price, suitable for traders seeking rapid order fulfillment at the current market rate.

Instant Execution: Traders using Instant Execution specify a specific entry price. If the market reaches that price, the trade is executed; otherwise, it’s not processed.

No Dealing Desk (NDD): HotForex emphasizes its no dealing desk approach, indicating that trades are executed electronically without broker intervention.

Variable Spreads: HotForex provides variable spreads that adjust based on market conditions. Spreads may tighten during periods of high liquidity and widen when market conditions are less favorable.

ECN Accounts: Certain account types, such as Zero Spread and ECN accounts, often involve Electronic Communication Network (ECN) execution. This system links traders directly with liquidity providers, aiming to offer competitive bid and ask prices.

Order Variety: HotForex typically supports diverse order types, encompassing market orders, pending orders (like buy limit, sell limit, buy stop, sell stop), and others.

Execution Speed: HotForex highlights its commitment to swift execution, particularly noticeable in its ECN accounts. This swiftness can benefit high-frequency and scalping trading strategies.

HF Markets Customer Support & Contact

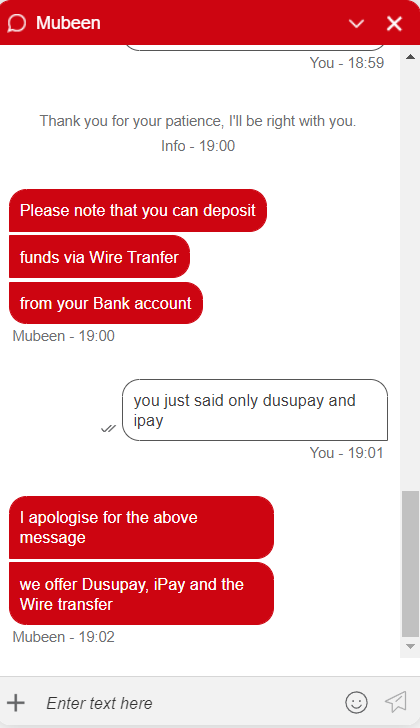

The customer support service is excellent as clients can reach out to support executives through multiple methods. To test the diligence of executives and the quality of support for Kenyan clients, we raised multiple queries through different methods.

- Live Chat: The live chat support is decent when compared with other regulated brokers as the waiting time ranges from 1 min to 10 min on working days. The response was resourceful and the support executives are user-friendly but the response time is slightly higher on average.

- E-mail Support: Clients can raise their queries through email support at [email protected]. We raised multiple queries at different times of the day and received a useful reply in 2-6 hours.

- No Local Phone Support: HF Markets does not offer local phone support for Kenyan clients. The support executives can be reached out through the international helpline number +44-2030978574 but local phone support is not available in Kenya.

Overall, the customer support service through the live chat window and e-mail are decent. It can be helpful to resolve queries most of the time.

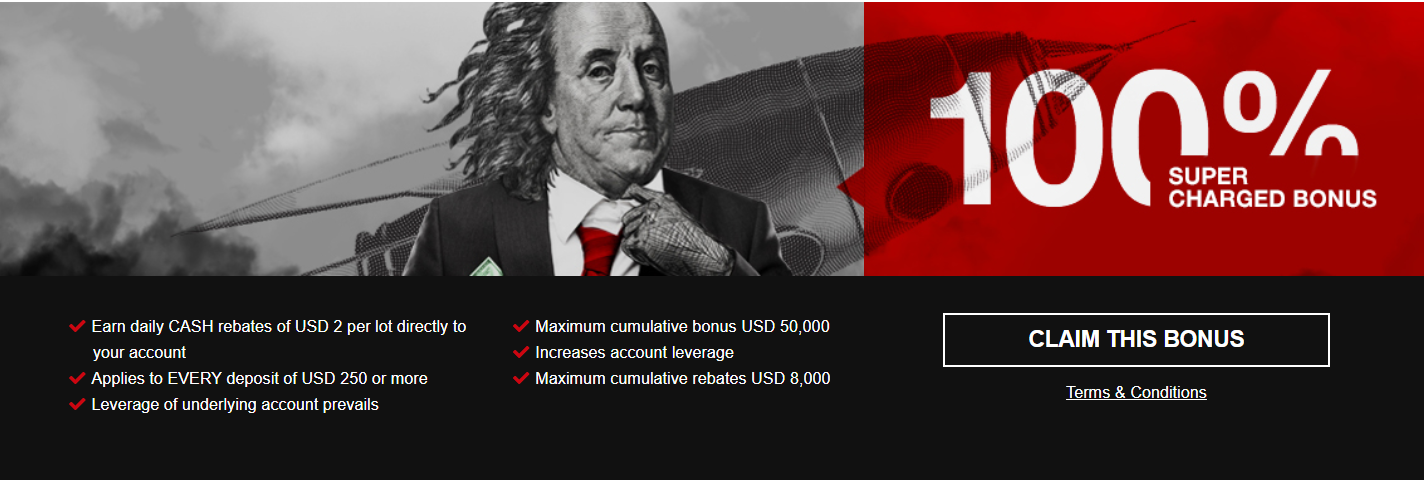

HF Markets Bonus

At the time of this review, HF Markets has attractive bonus offerings for Kenyan clients. We found 3 bonus offerings that can be grabbed by any Kenyan client. Following are the details and conditions of each bonus offer.

- 50% Welcome Bonus: This bonus is available to the clients making first deposits. This is only available to deposits of more than 50 USD. The maximum welcome bonus amount that can be claimed is 1000 USD. The amount added through the bonus cannot be withdrawn and will be deducted proportionately if a withdrawal is done.

- 100% SuperCharged Bonus: This bonus is exclusively available with the Premium account only in which each deposit gets doubled or increases by 100%. The minimum deposit amount to claim this bonus is 250 USD equivalent. The maximum bonus that can be claimed is 50,000 USD. The added bonus amount will be removed from the account balance when withdrawals are made.

- 100% Credit Bonus: This bonus is applicable to Kenyan clients with a minimum deposit of 100 USD with the Micro and Premium accounts. An e-mail needs to be sent to [email protected] requesting a bonus of 100%. The maximum bonus amount is 30,000 USD.

Compared with other regulated CFD brokers in Kenya, the bonus offerings are much more lucrative and beneficial for Kenyan clients.

Do we Recommend HF Markets?

Yes, HotForex is a regulated forex and CFD broker in Kenya that uses a 100% STP method for trade execution. They offer KES as the base currency of the account with free deposits and withdrawals through local banks in Kenya. The spreads are slightly higher than average but HotForex is a safe and reliable broker to trade forex and CFDs in Kenya.

HotForex FAQs

Is HotForex Regulated in Kenya?

Yes, HotForex is regulated by the Capital Markets Authority of Kenya by the name HFM Investments Ltd under license number 155. It is one of the 6 non-dealing desk brokers regulated by CMA in Kenya.

Does HotForex has MT4?

Yes, HotForex offers a complete suite of MetaTrader 4 and MetaTrader 5 for all the devices in Kenya.

What is the Minimum Deposit at HotForex in KES?

The minimum deposit at HotForex is 5$ or 550 KES (Kenyan Shillings). The deposits can be made through wire transfer or e-wallets in live trading account at HotForex.

How Long Does it Take to Withdraw Funds From HotForex?

The withdrawals from HotForex through e-wallet transfers in Kenya can be reflected in accounts within an hour. The bank wire transfer can take up to 7 days to reflect in the bank account.

Can I withdraw all my Money from HotForex?

Yes, the whole account balance can be withdrawn through wire transfer, m-pesa, and other e-wallets. If the deposits are made through debit cards, withdrawal amount has be to equal to or less than the deposit amount. The rest of the amount can be withdrawn through wire transfer.