HF Markets UK Review 2024

HotForex is a 100% STP broker and is regulated by FCA of the UK. Find out everything you must know about HotForex in the UK in this honest and unbiased review.

HF Markets, which was previously known as HotForex, is an FCA-regulated financial services provider that offers forex and CFD trading services in the UK. It allows GBP deposits and withdrawals in several methods. The account types can be opened with GBP as the base currency.

HF Markets claims to have opened more than 2.5 million live trading accounts across the globe. It has been in the forex and CFD trading business for more than 10 years. It is among the most reputed forex brokers in the world due to multiple top-tier regulatory licenses.

HF Markets has a local office in the UK and also provides local phone support to UK clients. There are multiple account types to facilitate different types of traders.

HF Markets UK Pros

- HF Markets is regulated and authorized by FCA in the UK

- No non-trading charges exist in the Standard account type

- Free deposits and withdrawals through multiple methods

- Minimum deposit as low as $5

- Local phone number available for customer support apart from live chat and email support

- Multiple account types available

- Multiple Trading Platforms Supported

- HF Markets is an STP/ECN broker

- 1200+ trading instruments available from multiple asset classes

- Wide range of research and education tools available

HF Markets UK Cons

- High Inactivity charges

- The support services are not available on the weekends

- The spreads with the Classic account is slightly higher than many forex and CFD brokers

Table of Content

- HF Markets’s Summery

- Regulation & Safety of Funds

- HF Markets Trading Fees

- HF Markets Account Types

- How to Open an Account at HF Markets?

- HF Markets Trading Platform

- HF Markets Deposits and Withdrawals

- HF Markets Available Instruments

- HF Markets Research and Education

- HF Markets Customer Support & Contact

- HF Markets FAQs

Read our detailed review of HF Markets exclusively for UK clients before opening an account. We have honestly reviewed all the advantages and shortcomings of choosing HF Markets to trade forex and CFD in the UK.

The review can also assist you in choosing the right account type for yourself.

HF Markets UK Summary

| Broker Name | HF Markets (UK) Ltd |

| Website | www.hfmarkets.co.uk |

| Regulation | FCA, FSCA, CySEC, DFSA |

| Year of Establishment | 2010 |

| Minimum Deposit | £100 |

| Maximum Leverage | 1:1000 |

| Trading Platforms | MT4 & MT5 |

| Trading Instruments | Forex, CFDs on Metals, Energy, Indices, Shares, Commodities. |

Is HF Markets Legit?

The safety of traders greatly relies on the regulatory licenses held by the broker. Forex and CFD trading in the UK is legal but traders must ensure that the chosen broker is regulated by FCA.

There are several forex trading service providers that are not regulated by FCA or any other regulatory authority. Such brokers are more likely to be fake and must be avoided.

HotForex Group is well regulated with the following Regulations:

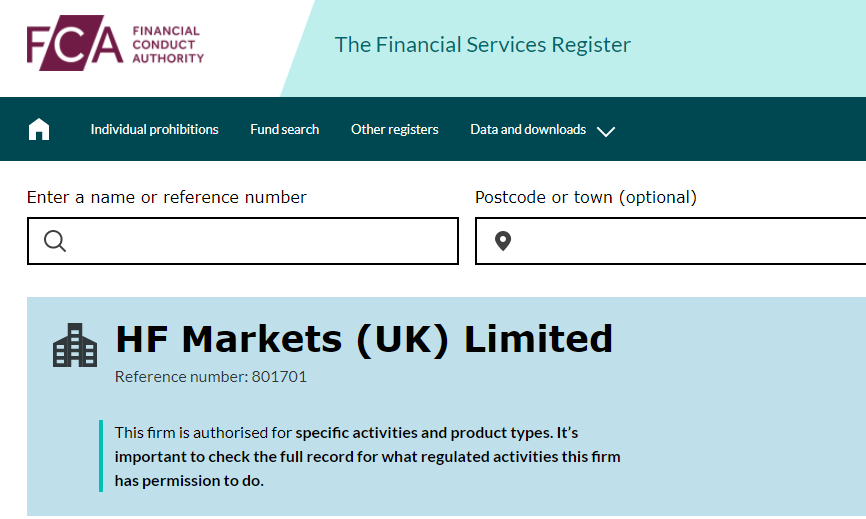

- Financial Conduct Authority (FCA): HF Markets is regulated by the Financial Conduct Authority (FCA) of the United Kingdom by the name HF Markets (UK) Ltd under reference number 801701. FCA is also a top-tier regulatory authority that is governed by the Financial Services and Markets Act 2000 of the UK.

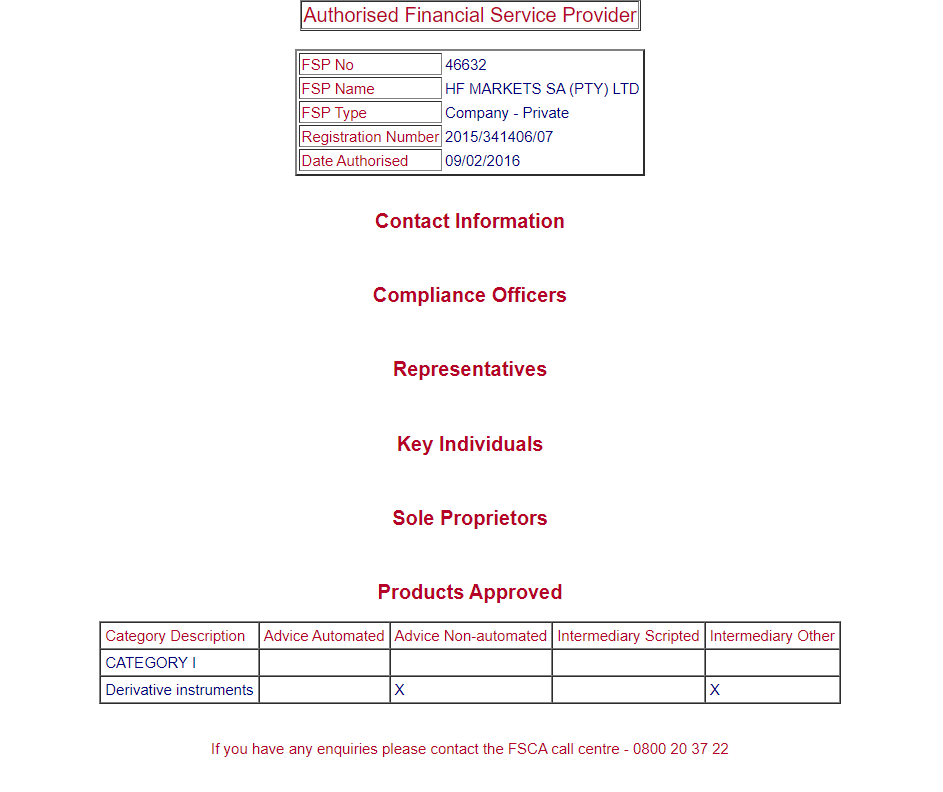

- Financial Sector Conduct Authority of South Africa (FSCA): HF Markets is regulated by the Financial Sector Conduct Authority of South Africa under FSP number 46632 with the name HF Markets SA (PTY) Ltd. FSCA is a top-tier regulatory authority that makes the regulated entity safe for traders and investors.

- FSA & DFSA: Apart from these top-tier regulators, HF Markets is also regulated by the FSA of Seychelles (8419176-1) and DFSA of Dubai (F004885) as a financial service provider. It is registered as an international business company in St Vincent and Grenadines with registration number 22747 IBC 2015.

The multiple top-tier regulatory licenses including FCA of the UK makes HF Markets safe for UK traders.

HotForex was founded in 2010, so it is a relatively old broker. HotForex changed its name to HF Markets in 2022. Due to multiple top-tier regulations, the third-party risk of choosing HF for trading is very low.

HF Markets Trading Fees

The overall cost incurred by traders at HF Markets is decent when compared with other regulated brokers in the UK.

We have separately reviewed and compared every component of fees at HF Markets that are incurred from traders.

- Competitive Spread: Spreads are the basic component of fees that are incurred from traders while trading forex and CFDs through any of the platforms. It is basically the difference between the buy (bid) price and the sell (ask) price.

The spreads at HF Markets start from 1.5 pip but depend on the account type chosen by the trader. HF Markets charge variable spread on all the instruments that can change according to the liquidity in the market and trade timings.

Trading Instrument Average Spread with Premium Account Average Spread with Zero Account EUR/USD 1.5 0.4 GBP/USD 1.9 0.7 Gold/USD 0.28 0.13 US Crude Oil 0.1 0.1 US Tech 100 2.1 2.1 BTC/USD 56.0 56.0 GER40 0.6 0.6 UK100 3.3 3.3 USA30 3.1 3.1 USA500 0.31 0.31 The spreads with commission-free account types at HF Markets start from 1 pip while the same with commission-based account types start from 0 pip. The average typical spread with the Premium account for EUR/USD is 1.5 pips. The average spread for EUR/USD with the Zero spread account is 0.4 pips.

We have compared the average typical spreads charged by various regulated brokers in the UK. The following table compares spreads on popular currency pairs with standard accounts of various brokers. It must be noted that these spreads are charged with the Standard account type without any trading commission.

Trading Instrument HF Markets FXTM eToro CMC Markets Pepperstone EUR/USD 1.5 1.9 1.1 0.70 0.77 GBP/USD 1.9 2 2.3 0.9 1.19 EUR/GBP 1.9 2.4 2.8 1.10 1.40 USD/JPY 2.2 2.2 1.2 0.7 0.86 USD/CAD 2.3 2.5 1.7 1.3 1.07 - Moderate Commissions with Zero Account: The Zero Spread account type at HF Markets is a commission-based account where the spreads are very low. It incurs a commission of £2.25 for each side and £4.50 for a round trade of a standard lot for major pairs.

For all other instruments, the trading commission for a round trade of a standard lot is $8 or £6.50. Apart from this, no other additional commission is charged by HF Markets. The account opening is free and no commission is charged for deposits and withdrawals from the broker’s end.

We checked and compared all types of trading commission with different brokers in the UK. Most forex and CFD brokers incur trading commission only with the account type with low spread or negligible spread. The following table comapares the trading commission incurred by various brokers for trading CFDs with low spread.

- Moderate Overnight (Swap) Fees: This is the fee that is incurred by traders when a position is kept open overnight. The swap fees or overnight opening fees are different for each instrument. Swap fees for long positions and short positions are also different.

The details of the swap fees can be checked on the HF Markets website and app and can also be calculated with the swap calculator feature at HF Markets. The overnight charges at HF Markets are lower than XM but are higher than Exness.

- Inactivity Charges: This is the fee that is incurred when no trades are executed for a prolonged period. It is applicable only when the account balance is more than 0 and no trades are executed for more than 6 months.

The following table compares the inactivity fees for popular forex and CFD brokers in the UK. The inactivity fees are incurred each month after the inactivity period.

Broker Name Inactivity Period Monthly Inactivity Fees HFM 6 Months $5 FXTM 6 Months $5 Tickmill NA NA Pepperstone NA NA Plus 500 3 Months $10 IG Market 2 Years $10 For inactivity of 6 months to 1 year, HF Markets will charge a monthly dormant fee of $5 for each consecutive month of inactivity. For 1 year to 2 years of inactivity, this monthly fee will be $10 equivalent to the base account currency. For 2 to 3 years, inactivity fees will be $20. For more than 3 years of inactivity, the monthly dormant fees will keep increasing by $10 until the account balance reaches 0.

| Broker Name | Commission for Single Side Trade | Commission for a Round Trade |

|---|---|---|

| HFM | $3 | $6 |

| IG Markets | $3.5 | $7 |

| Tickmill | $2 | $4 |

| FXTM | $2 | $4 |

| FBS | $10 | $20 |

| IC Market | $3.5 | $7 |

| Pepperstone | $3.5 | $7 |

Note: The commission mentioned in the table is with the Zero spread account for trading on major forex pairs. The commission mentioned in the table may differ for other instruments.

Deposit Withdrawal Fees

HF Markets does not incur any kind of fees for deposit and withdrawals. However, if the clients are using the bank wire transfer, and the deposit amount is less than $100, only then a deposit fee will be incurred. The following table compares the deposit and withdrawal fees for popular forex and CFD brokers in the UK.

| Broker Name | Deposit Fees | Withdrwal Fees |

|---|---|---|

| HFM | NA | NA |

| FXTM | NA | $1 For Local Bank Withdrawal |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | NA | NA |

| IG Market | NA | NA |

Overall, the fees incurred at HF Markets are lower than some of the regulated brokers but also higher than several others. The spreads are competitive while the commission and swap fees are decent when compared with other brokers.

However, the trading fees at HFM will depend largely on the account type chosen by the trader. Following is the comparison of fees that will be incurred if at HFM with different accounts if you place and close a trade order of 1 standard lot on EUR/USD.

| Account Type | Trade Amount | Fees on a Round Trade |

|---|---|---|

| Micro | $100,000 | $15 |

| Premium | $100,000 | $15 |

| Zero | $100,000 | $7 |

Many regulated forex brokers do not charge inactivity fees that are much higher at HF Markets. Although this will only be charged if no trades are executed for 6 consecutive months.

HF Markets Account Types

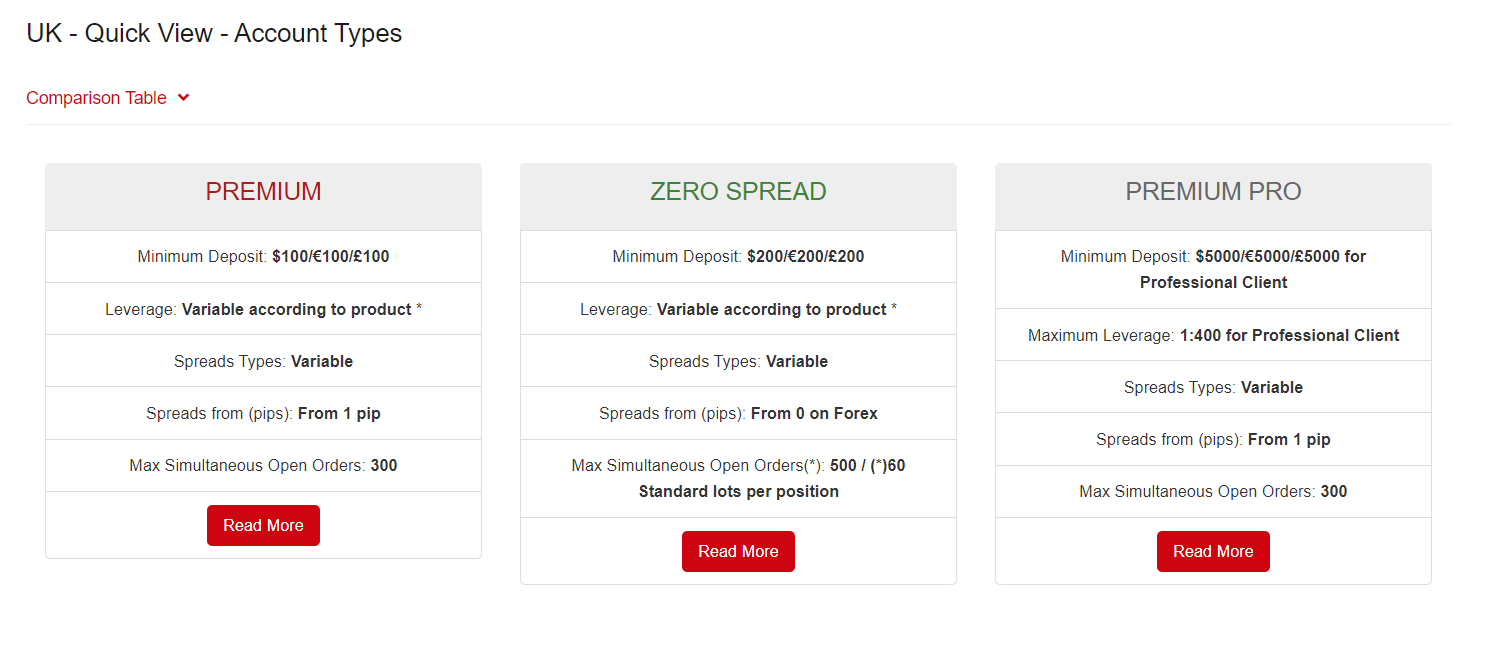

HF Markets offers two retail account types and one professional account to suffice multiple types of traders in the UK. The retail account types are named Premium and Zero Spread. Both account types can be opened with GBP as the base currency. Our experience with all the available account types has been reviewed below.

- Premium: This is a commission-free account type that can be opened with GBP as the base currency. The minimum deposit requirement with this account type is $100 or £100. The maximum leverage is 1:30 with this account and 60 standard lots can be traded in a single position.

- Zero Spread: As the name suggests, the spreads with this account type start from 0 pip. This comes at the cost of $6 or £4.50 commission for a round trade of a standard lot. The minimum deposit requirement with this account is $200. All the other features are the same as the Premium account type. Trading with a very low spread at the expense of a fixed commission is beneficial when the trade volume is high. This account is ideal for experienced and high-volume traders.

- Premium Pro: HF Markets offers a professional trading account in the UK that allows traders to use the leverage of up to 1:400. Traders need to meet the criteria of the professional trader and make a deposit of £5000 to open this account.

How to Open an Account at HF Markets?

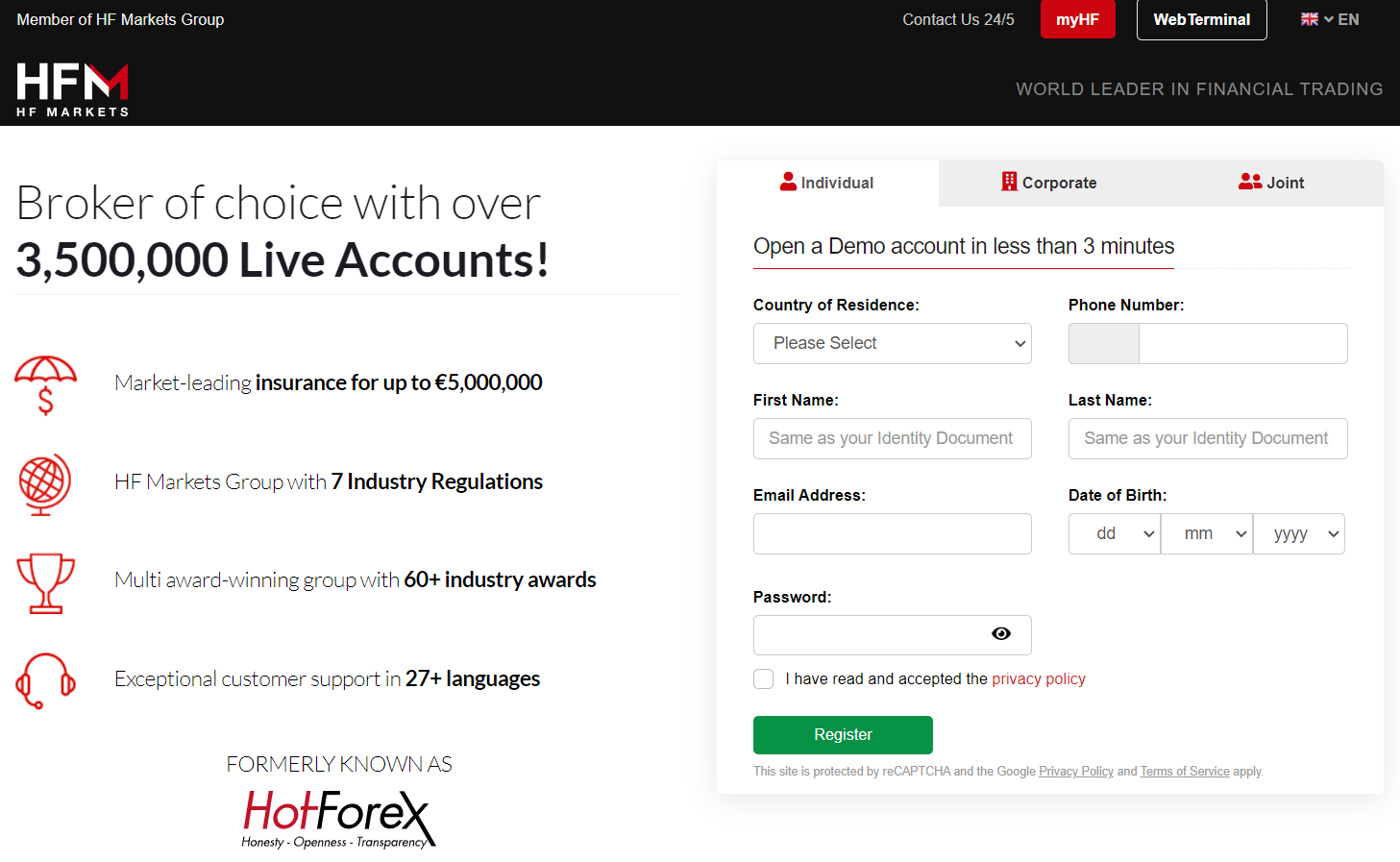

Step 1) Enter the basic details: To open an account at HF Markets, traders can visit the official website of HF Markets or can also download the mobile application.

The first step is to enter the basic details like phone number, name, date of birth, country of residence, and email address. After entering these basic details, an activation link will be sent to your provided email. This link can be followed to open any of the account types at HF Markets. This link will redirect you to the MyHF area where a demo account can be opened without providing bank details and submitting documents.

Step 2) Enter Bank details & Complete KYC: To open a live account, the next step is to enter bank details and complete the KYC process by submitting proof of address and identity. The account type and base currency of the account need to be chosen by the client. After making a deposit, the trading platforms can be downloaded from the MyHF area and trade orders can be executed.

Step 3) Select Account & Make a deposit: Availability of different account types allows clients to choose the most suitable one. Multiple account types can be opened with GBP as base currency which is an added advantage for UK traders. According to our review, the flexibility of choosing a suitable account type makes HF Markets better than many other regulated forex brokers in the section of account types.

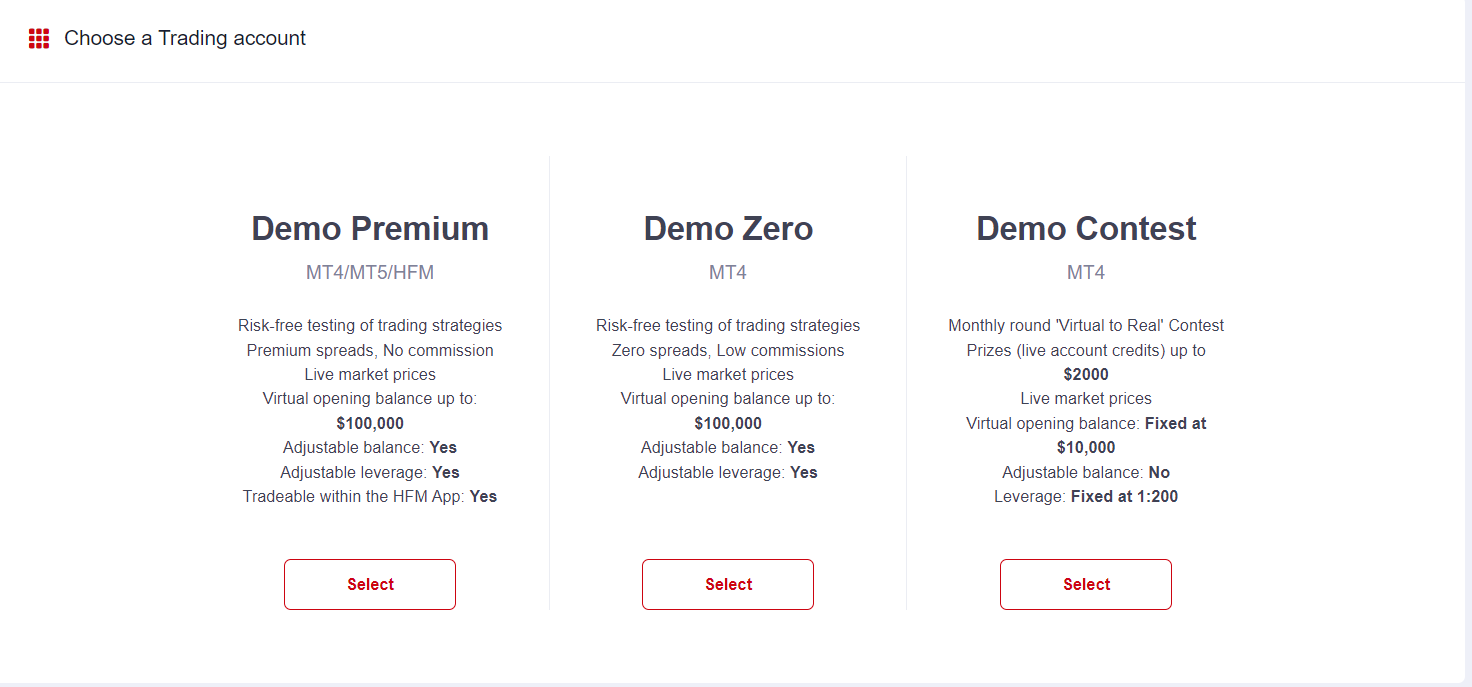

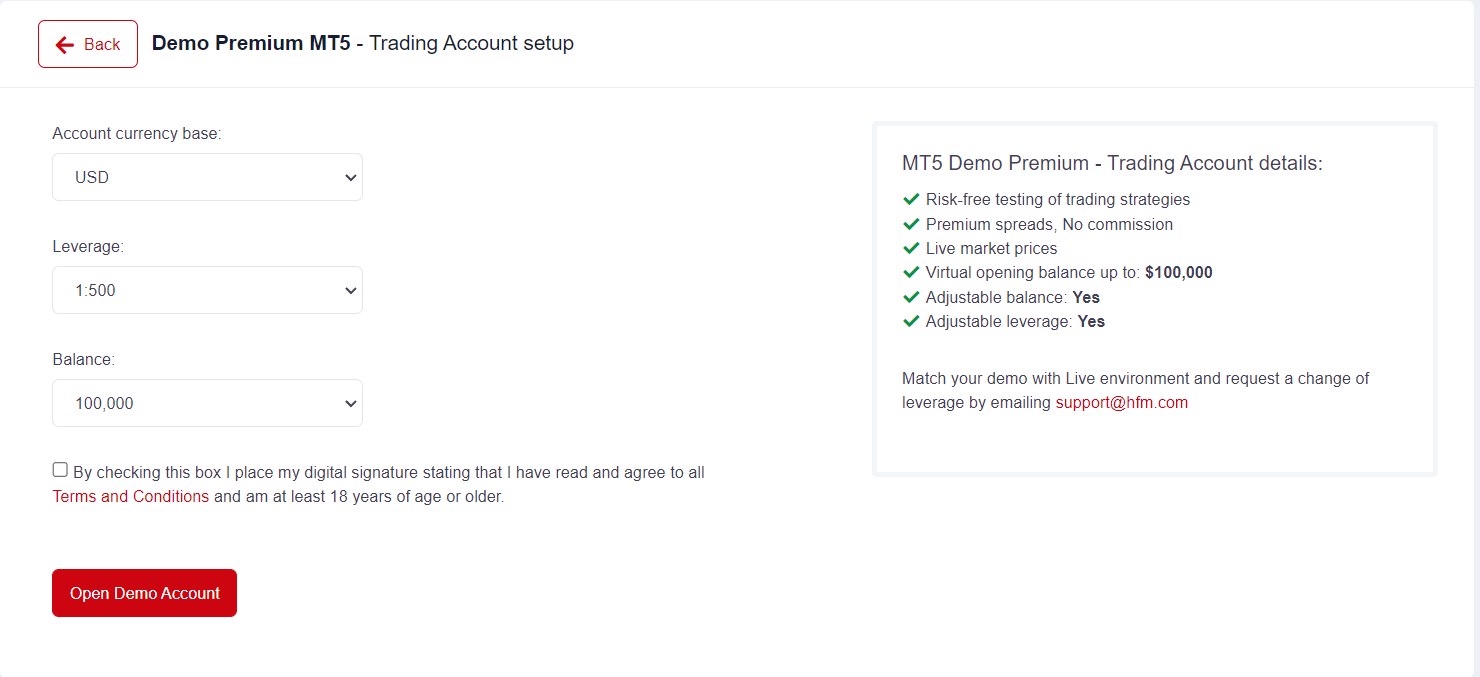

HF Markets Demo Account Review

The demo account can be very useful for beginners as well as existing traders. Beginners can learn about the forex and CFD market, get familiar with trading tools and terminologies, and can gain experience in the market before depositing real money. Existing traders can test their strategies or build a new strategy with the help of a demo account.

The demo account at HF Markets can be opened within a minute by providing basic details like name, phone number, and email address. An activation link will be sent to the mail which will redirect to the personal area of HF Markets. Clients can choose the type of demo account they wish to open. Clients can also enter a contest where top performers are rewarded without depositing any amount.

The demo account can be opened with MT4, MT5, and MyHF trading platforms. for each platform chosen, the account can be configured with a selection of base currency between USD, EUR, and GBP. Clients can choose the maximum leverage on the demo account and start with any amount they wish.

According to our analysis, the demo accounts at HF Markets are very useful. Demo accounts can be configured differently and traders can gain experience with each account type and trading platform before opening live accounts with real currency.

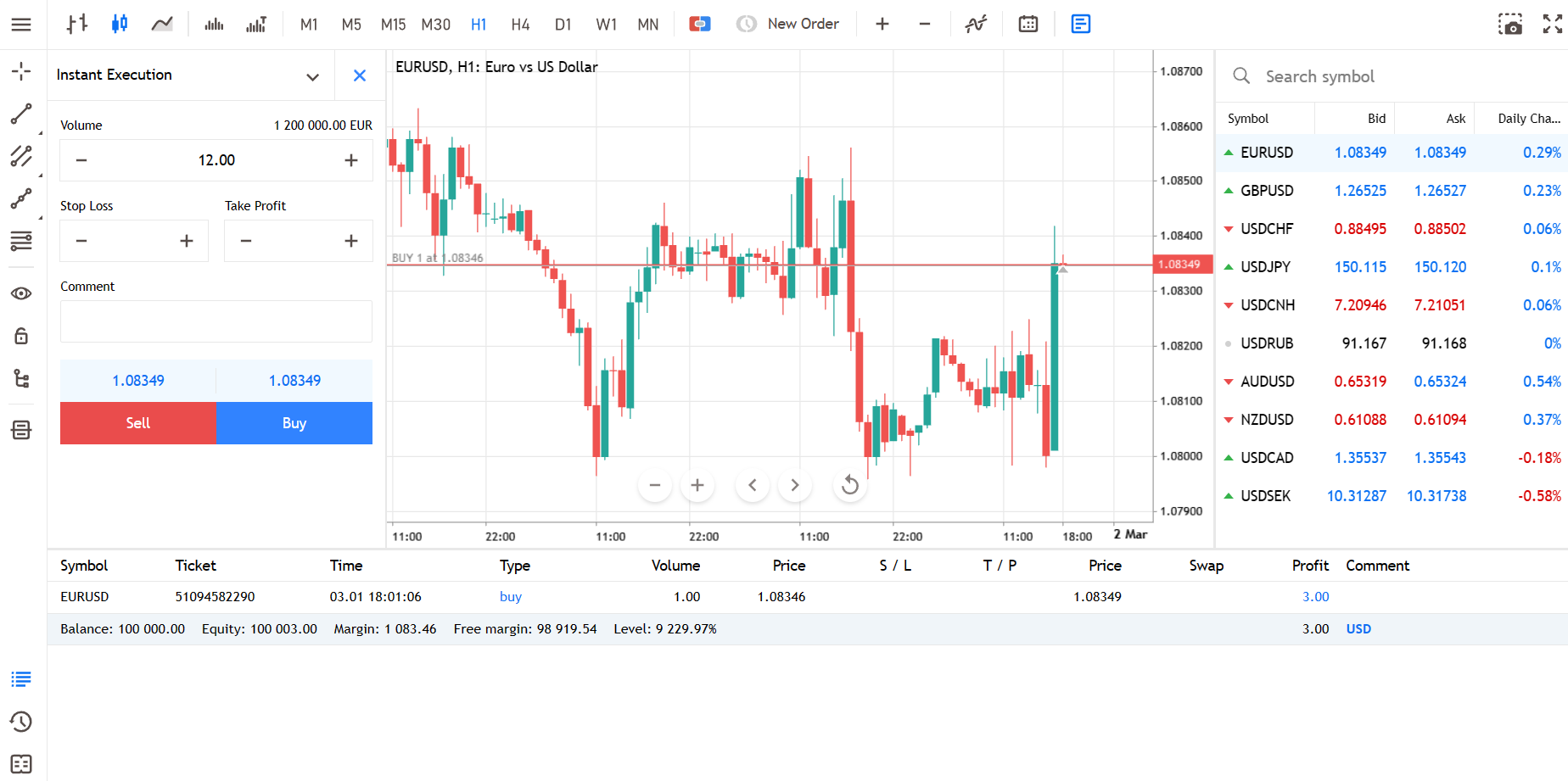

HF Markets Trading Platforms

HF Markets allows trading on all the available instruments through MetaTrader trading platforms and the HFM app. We have separately reviewed the available trading platforms at HF Markets in the UK.

Web Trading Platforms

MetaTrader 4 and MetaTrader 5 are the available web trading platform at HF Markets in the UK. Both these platforms can be customised on any web browser. These are available in multiple languages and support market, limit, and stop loss orders. Trailing stop loss orders are not available on the web trading platform.

MT4 and MT5 web trading platforms have limited features compared to the desktop version. However, traders who wish to link their accounts with online tools through web browsers prefer trading with MT4 and MT5 web trading platforms. MT4 is ideal for beginners while MT5 is more suitable for advanced traders.

Mobile Trading Platforms

MT4 and MT5 are also available for mobile devices at HF Markets. Additionally, HF Markets also offers its proprietary trading application for Android and iOS devices called as HFM app.

MT4 and MT5 mobile trading platforms are quite popular among forex traders globally. However, the mobile version of these platforms only offers limited features and accessibility to charts and indicators.

The HFM app has a much better interface compared to MT4 and MT5 applications. Traders can get real-time news and market updates through the HFM app. It has various charting tools and indicators. HF Markets also offers customer support services on weekdays 24/5 through the HFM app.

Desktop Trading Platform

MT4 and MT5 are the available choices for desktop trading platforms. These platforms can be downloaded on Windows and macOS devices and accessed through one-step login. These are available in 21 languages.

MT4 offers 9 timeframes and 30 indicators and has a single-threaded strategy tester. MT5 is an upgraded version of MT4 and offers 21 timeframes and 37 indicators with a multi-threaded strategy tester. MT4 was introduced in 2005 by MetaQoutes Software while MT5 was launched in 2010 by the same firm.

At the time of this review, no other trading platforms are available at HF Markets in the UK.

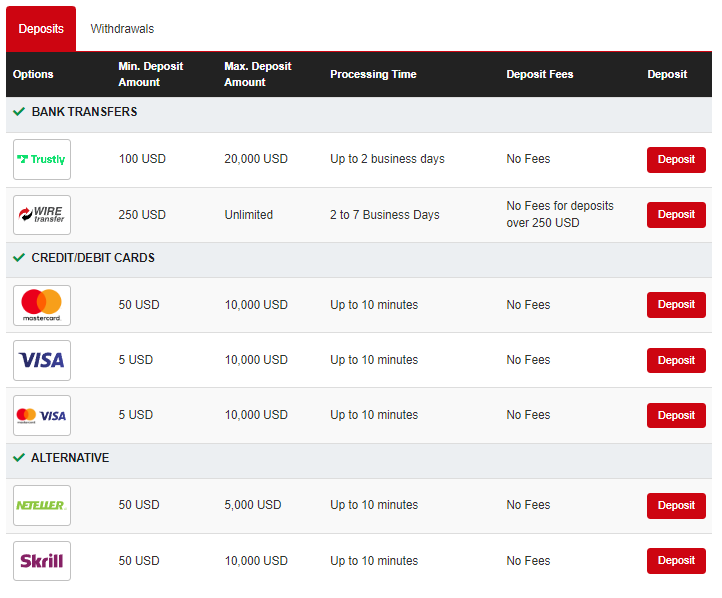

HF Markets Deposits and Withdrawals

HF Markets Deposit/Withdrwal Pros

- No Deposit and Withdrawal Fees: HF Markets charges no fees for making deposits and withdrawals, which can save you money on transactions.

- Wide Range of Payment Methods: HF Markets offers a variety of payment methods for deposits and withdrawals, including credit/debit cards, electronic wallets, and bank wire transfers, providing flexibility for clients worldwide.

- Fast Deposit Processing: Deposits via credit/debit cards are processed almost instantly, allowing you to start trading in no time.

HF Markets Deposit/Withdrawal Cons

- Account Verification Required for Withdrawals: Clients must complete the verification process to withdraw funds, which can be a hurdle for those who have not yet submitted the necessary KYC documents.

- Possible Third-party Fees: While HF Markets does not charge fees for deposits or withdrawals, clients might still incur fees from their banks, third-party companies, or payment service providers.

- Withdrawal Method Restrictions: Withdrawals must be made using the same method as the deposit, which might limit your options for receiving funds.

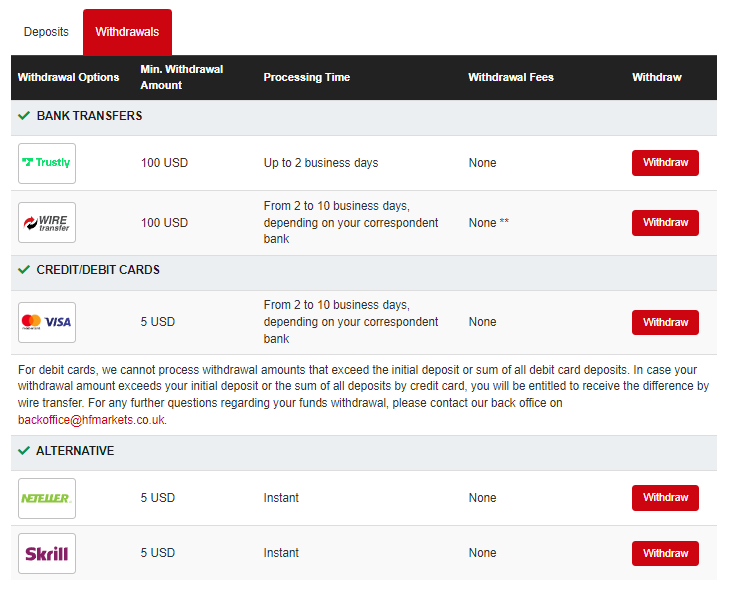

UK clients can deposit and withdraw from HF Markets through bank transfer, credit/debit cards, and Skrill e-wallet. The most convenient and feasible method to transact is the local bank transfer. The deposits and withdrawals can be done anytime during the business days (24/5).

- Bank Transfer: Deposits and withdrawals in the UK can be done through Trustly local bank transfers with no added commission. For the wire transfers, all the commissions are covered by HF Markets if the deposit amount is more than $250 or equivalent. The local bank transfer is entirely free and HF Markets will cover any expense incurred while transacting. The minimum deposit amount with the local bank transfer is $100 and the maximum limit is $20,000 equivalent. The minimum withdrawal limit through bank transfer is $100 with no commission.

The deposits made through local bank transfer will reflect in the account balance within 10 minutes while withdrawals can take up to 2 working days to get processed. The wire transfer funding, as well as withdrawal, will take 2 to 10 business days to reflect in the account balance.

- Credit/Debit Cards: Deposits and withdrawals can also be done through Mastercard and VISA cards at HF Markets in the UK. The minimum amount is $5 equivalent. Time taken for deposit is 10 minutes while the same for withdrawal is 2 to 10 business days depending on the correspondent bank.

- E-Wallets: UK clients can also transact through Skrill and Neteller where deposits, as well as withdrawals, are reflected within 10 minutes. The minimum amount for deposit and withdrawal is $50 equivalent through this method.

The free-of-cost local bank transfer in GBP is highly advantageous for UK clients. There is no commission involved and HF Markets covers all the costs incurred during the transaction of funds via local bank transfer. According to our review, this is the most convenient method to deposit and withdraw at HF Markets in the UK.

HF Markets Available Instruments

All the financial instruments offered by HF Markets are derivative CFD instruments. This means there is no physical buying and selling of the assets but only the price differences are speculated to book profits and losses.

Following the financial instruments that can be traded at HF Markets in the UK.

| Asset Class | Number of Instruments (CFDs) | Max Leverage |

|---|---|---|

| Forex Pairs | 53 | 1:30 for Majors, 1:20 for Minors |

| Metals | 6 | 1:20 |

| Energy | 4 | 1:10 |

| Indices | 11 Spot, 12 Futures | 1:10 |

| Shares | 71 | 1:5 |

| Commodities | 5 | 1:10 |

| Cryptocurrency | 19 | 1:2 |

| Bonds | 3 | 1:5 |

| Stocks (DMA) | 944 | 1:5 |

| ETFs | 34 | 1:5 |

Compared to other regulated CFD brokers in the UK, HF Markets offers a large number of trading instruments. Variety in the availability of instruments provides more opportunities to traders in various capital markets.

HF Markets Research and Education

HF Markets, also known as HotForex, is a reputable online Forex and CFD broker that offers a variety of research and educational resources to its clients. Here are some of the research and education services provided by HF Markets:

Market Analysis: HF Markets regularly provides in-depth market analysis and insights to keep traders informed about the latest happenings in the financial markets. They offer daily market updates, technical analysis reports, fundamental analysis research, and expert commentary on various asset classes, including Forex, indices, commodities, and cryptocurrencies.

Economic Calendar: HF Markets offers an economic calendar that outlines upcoming economic events such as key economic indicators, central bank meetings, and geopolitical developments. This tool helps traders stay updated on events that can impact the markets and make informed trading decisions.

Educational Webinars and Seminars: HF Markets conducts educational webinars and seminars on a regular basis. These sessions cover a wide range of trading topics, including technical analysis techniques, trading strategies, risk management, and trading psychology. Participants have the opportunity to interact with experienced traders and market experts, ask questions, and gain valuable insights.

Video Tutorials: HF Markets provides a comprehensive library of video tutorials that cater to traders of all levels, from beginners to advanced. These tutorials offer step-by-step guidance on various aspects of trading, including platform navigation, chart analysis, trade execution, and risk management. Traders can access these videos to enhance their knowledge and skills at their own pace.

Educational Articles and Guides: HF Markets offers a wealth of educational articles and guides covering a wide range of trading topics. These resources provide valuable information on technical analysis methods, risk management strategies, trading psychology, and understanding market trends. Traders can refer to these articles to deepen their understanding of the markets and improve their trading strategies.

HF Markets Trade Execution Method

Execution Approaches: HotForex commonly utilizes both Market Execution and Instant Execution techniques across its range of accounts.

Market Execution: This method involves executing trades at the prevailing market price, suitable for traders seeking rapid order fulfillment at the current market rate.

Instant Execution: Traders using Instant Execution specify a specific entry price. If the market reaches that price, the trade is executed; otherwise, it’s not processed.

No Dealing Desk (NDD): HotForex emphasizes its no dealing desk approach, indicating that trades are executed electronically without broker intervention.

Variable Spreads: HotForex provides variable spreads that adjust based on market conditions. Spreads may tighten during periods of high liquidity and widen when market conditions are less favorable.

ECN Accounts: Certain account types, such as Zero Spread and ECN accounts, often involve Electronic Communication Network (ECN) execution. This system links traders directly with liquidity providers, aiming to offer competitive bid and ask prices.

Order Variety: HotForex typically supports diverse order types, encompassing market orders, pending orders (like buy limit, sell limit, buy stop, sell stop), and others.

Execution Speed: HotForex highlights its commitment to swift execution, particularly noticeable in its ECN accounts. This swiftness can benefit high-frequency and scalping trading strategies.

HF Markets Customer Support & Contact

The customer support service is excellent as clients can reach out to support executives through multiple methods. To test the diligence of executives and quality of support for UK clients, we raised multiple queries through different methods.

- No Live Chat: HF Markets does not offer live chat support services in the UK.

- E-mail Support: Clients can raise their queries through email support at [email protected]. We raised multiple queries at different times of the day and received a useful reply in 2-6 hours.

- Phone Support: HF Markets offers local phone support for UK clients. The support executives can be reached out through local numbers +44-2035199898 and 0800 920 2432.

Overall, the customer support services of HF Markets are not as good as most of the other FCA-regulated brokers. The availability of local phone numbers for customer support is advantageous for local clients in the UK.

Do we Recommend HF Markets?

Yes, HF Markets is an FCA-regulated broker in the UK that uses the STP model for trade execution. They offer GBP-based accounts with multiple pricing structures and free deposits and withdrawals. The customer support service is decent. MT4 and MT5 trading platforms can be chosen.

HF Markets FAQs

Is HotForex a Market Maker?

No, HotForex is a 100% Straight Through Processing (STP) Broker that follows the market execution policy with No Dealing Desk (NDD). It is not a market maker as it does not take the other side of the trade and does not participate in the client’s trades.

What is the Minimum Deposit at HotForex in GBP?

The minimum deposit at HotForex is GBP 100. The deposits can be made through a local bank transfer in the UK to GBP based trading account at HotForex.

Is HF a good broker?

Yes HFM or HF Markets, previously known as HotForex is a forex and CFD broker that is regulated by FCA in the UK. It offers good customer support services and supports GBP as base currency of the account.

Is HF Markets regulated?

Yes, HF Markets is regulated by FCA in the UK. Apart from this, the other entities of HFM group is also regulated by the FSCA of South Africa, FSA of Seychelles, DFSA of Dubai, etc.

How Long Does it Take to Withdraw Funds From HotForex?

The withdrawals from HotForex through local bank transfers in the UK can take up to 2 business days to reflect in the bank account.

Is HotForex good for beginners?

Yes, HotForex can be considered safe for beginners as they are regulated by the FCA. MT4 and MT5 trading platforms are supported. However, it is better to start forex and CFD trading through demo accounts.