Best Forex Brokers UK

We've compared Regulated Forex Brokers for traders based in the UK. For this research we checked 14 forex brokers, and we looked at factors including fees, safety, platforms, trading conditions, account types, withdrawals, minimum deposit & more. We also list the Pros & Cons of each broker in our list.

Before you start trading forex, it is important to choose the right broker. As a UK resident, you should only register with a forex broker that is licensed by the Financial Conduct Authority (or the FCA) of the UK.

The FCA is the financial regulator of the UK, and it ensures that the interests of traders and investors in the UK are protected. When you register with a regulated broker, you can rest easy knowing that your funds are safe in their hands.

We’ve made a comprehensive guide through independent research to bring you this list of the best forex brokers in the UK.

Here is a List of Best Forex Brokers UK for 2024 based on our Research

- Pepperstone UK – Good Forex Broker for UK with Raw Spread Account

- City Index – Overall Best Forex Broker in the UK for Beginners

- AvaTrade – Best Forex Broker with Multiple Trading Platforms

- Plus500 – Best Low Spread Forex Broker

- Tickmill – Forex Broker with High Number of Instruments

- Capital.Com – Best FCA Regulated Forex Broker

- Forex.com – Best MT5 Broker in the UK

We’ve made comparisons and contacted numerous brokers to find out which ones offer the best services.

Best Forex Brokers UK

In this guide, we’ll talk about forex brokers in a systematic way to allow you to make your own comparisons. We’ll also cover the factors you need to consider before choosing a forex broker.

#1 Pepperstone UK – Good Forex Broker for UK with Raw Spread Account

Pepperstone was founded in 2010 and is a relatively new forex and CFD broker operating in the UK. The broker is regulated by Two Tier-1 financial authorities, making it low-risk.

Regulation: Pepperstone UK is registered under the FCA of the UK and holds a license number 684312. The company is licensed under the name Pepperstone Limited and has its headquarters in London.

Additionally, Pepperstone is regulated in Germany, Cyprus, Australia, the United Arab Emirates, the Bahamas, and Kenya.

The company also segregates funds according to legal requirements.

Overall, we consider Pepperstone UK to be a safe broker to trade through.

Overall Fees: The fees charged by Pepperstone depend on the type of account held by the trader and the instrument being traded.

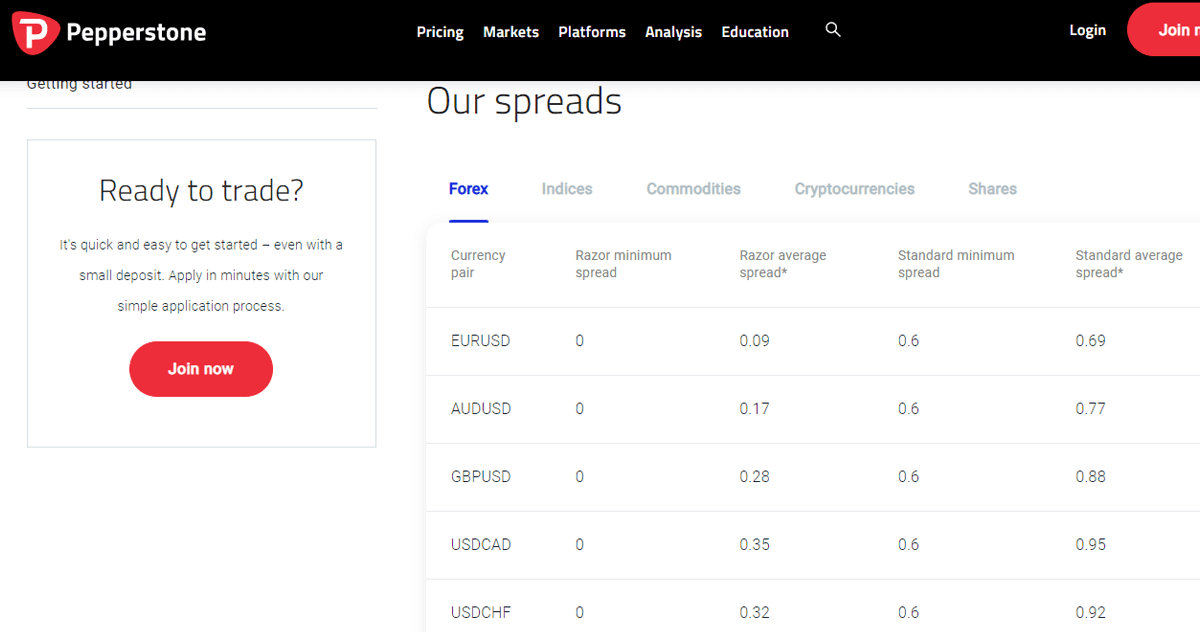

Pepperstone charges a variable spread that can be as low as 0.12 pips when trading the benchmark EURUSD currency pair through a Razor account. However, they will additionally charge a commission of $3.76 per lot per trade.

While Pepperstone charges a commission, it provides incredibly tight spreads. Hence, Pepperstone is suitable for high-volume traders.

Pepperstone will charge an overnight fee if trades are left open overnight.

Pepperstone does not charge any non-trading fee. They do not charge a deposit fee, withdrawal fee, or inactivity fee.

Trading Conditions: Pepperstone offers the choice between two types of accounts: Standard and Razer. The Standard account does not charge any commission but involves a widespread. In contrast, the Razer account offers tight spreads but with a decent commission.

The maximum leverage offered by Pepperstone for trading major currency pairs is 1:30. Further, you can change the amount of leverage you use subject to the maximum limit.

Pepperstone does not require a minimum deposit to be made at the time of account opening. This is especially suitable for new traders.

Pepperstone offers GBP as a base currency to traders from the UK. The company accepts deposits through local bank transfers, credit cards, debit cards, or certain payment wallets. As mentioned earlier, they do not charge a fee.

You can withdraw funds using the same methods.

When trading with Pepperstone, you have the option of choosing between three third-party trading platforms. These are MetaTrader 4, MetaTrader 5, and cTrader. They do not have a proprietary trading platform.

Customer Support: Pepperstone offers customer support through email, phone call, or live chat. The live chat window is available on their website for times when you need to quickly solve a doubt.

Overall, we found that they answered queries through the live chat window within a few minutes and their responses were helpful.

They also have an extensive FAQs library that answers a lot of questions.

Pepperstone Pros

- Regulated by FCA in the UK

- GBP available as base currency

- Good customer support

- Multiple account types and trading platforms available

Pepperstone Cons

- The maximum leverage offered is low

- The commission is high on the razor account

#2 City Index – Overall Best Forex Broker in the UK

City Index has been operating since 1983 and is one of the oldest online brokers in the country.

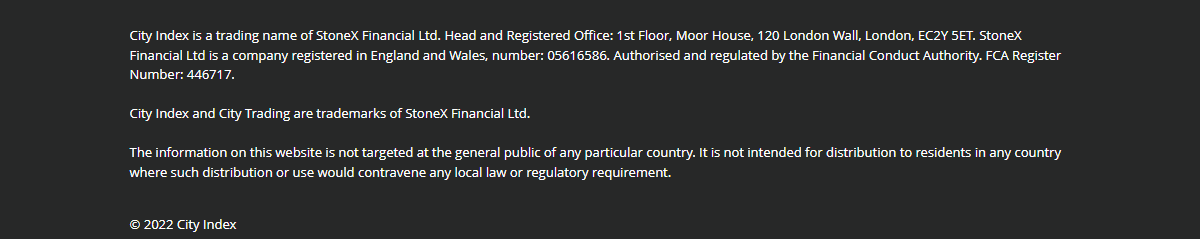

Regulation: City Index is licensed by the FCA and holds the reference number 446717. The company is registered under the name StoneX Financial Limited. The company has been authorized to operate in the UK since 2006.

Additionally, City Index is regulated by the ASIC of Australia and the MAS of Singapore.

Overall, we consider City Index to be a highly safe broker for UK traders. The company is also obligated to segregate its funds, leading to additional safety.

Overall Fees: For CFD trading, City Index charges a typical spread of 0.8 pips for trading the benchmark EURUSD currency pair. The overall fees charged by the broker is average when compared to other similar brokers.

They do not charge any commission for trading forex instruments. They only charge a commission when trading stock CFDs and the commission is around GBP 10 per trade.

City Index does not charge any deposit or withdrawal fees. However, you may be charged by your payment service provider.

If you’re trading CFDs, then you should be aware that they charge an overnight fee if you keep an open position for the next trading day. This overnight fee is variable and depends on your trade specifications.

Trading Conditions: City Index offers three types of accounts for you to choose from. Each account type differs in terms of services offered, charges, leverage, and minimum deposit required.

The three account types are Trader, Premium Trader, and Professional. The available leverage is 1:30, 1:30, and 1:400, respectively.

If you’re a new trader, then the trader account is the best option since it does not require any minimum deposit.

City Index offers a wide range of instruments including up to 84 currency pairs, 20 index CFDs, 4000+ stock CFDs, 600+ ETF CFDs, commodities, bonds, and 6 cryptocurrencies.

They do offer risk management tools such as guaranteed stop-loss orders so that you can effectively trade while minimizing risk.

City Index offers several ways for you to make a deposit. This includes debit cards, credit cards, PayPal, and local bank transfers. You can also withdraw funds through the same methods.

You can set GBP to be the base currency of your account to avoid conversion fees.

Customer Support: City Index has a comprehensive help section that answers a lot of questions. If you still need support, then you can contact them through a live chat option available on their website. This option is available at all times during weekdays (GMT).

They do not have a phone number or email ID that you can contact for support. Overall, their customer support is decent and should suffice for most requirements.

City Index Pros

- No commission to trade forex instruments

- Spreads are very low

- GBP is available as base currency with free local bank transfers

- Highly regulated and has a strong reputation with a long history

- No hidden fees such as deposit or withdrawal fees

City Index Cons

- Customer support only available through live chat

- Complex structure and variation in account types

- Low leverage offered through Trader and Premium Trader accounts

#3 AvaTrade – Best Forex Broker with Multiple Trading Platforms

AvaTrade is an FCA-regulated forex and CFD broker. It was incorporated in 2006 and is headquartered in Dublin, Ireland.

Regulation: AvaTrade is regulated by the FCA of the UK under license number 504072 under the legal entity Ava Trade EU Limited.

It is also regulated by the Bank of Ireland, ASIC of Australia, FSCA of South Africa, FSA of Japan, CySEC of EU, and several other jurisdictions. Due to multiple regulatory licenses, AvaTrade can be considered safe for trading forex and CFDs in the UK.

Overall Fees: AvaTrade has a fee structure that suits a variety of traders. When you trade the popular EUR/USD pair, they offer a competitive spread of 0.9 pips without charging any extra commissions. However, it’s important to know that if you keep your trades open overnight, AvaTrade will charge you a fee.

The good news is that AvaTrade doesn’t impose fees for making deposits, withdrawals, or maintaining your account. But if your account stays inactive for more than three months, they’ll charge you a fee every quarter.

Trading Conditions: AvaTrade offers two types of accounts for retail forex and CFD trading: Standard and Professional. The main difference is the amount of leverage you can use.

Professional accounts offer higher leverage, but there are certain requirements to meet for these accounts. Standard accounts can access up to 1:400 leverage, even in the UK where AvaTrade isn’t regulated by the FCA.

AvaTrade gives you a wide range of trading platforms to choose from. They have options like WebTrader, AvaTradeGo, AvaOptions, MetaTrader 4, MetaTrader 5, DupliTrade for automated trading, ZuluTrade for automated trading, and mobile and Mac platforms.

AvaTrade offers various trading instruments, including forex pairs, indices, commodities, and stocks.

Customer Support: If you’re trading from the UK, you can deposit funds using credit cards and wire transfers. They offer customer support through phone calls, live chat, and email, but keep in mind they don’t provide support on weekends.

We’ve tested AvaTrade’s live chat option on their UK website, and the responses were quick and helpful. They also have a FAQs section on their website, although it could be organized better to make information easier to find.

#4 Plus 500 – Best Low Spread Forex Broker

Plus500, headquartered in Israel and listed on the London Stock Exchange, boasts transparency in its financial operations and revenue generation.

Regulation: When it comes to trading in the UK, Plus500 is a safe choice, primarily due to its regulation by the FCA (Financial Conduct Authority) in the UK. Beyond the UK, Plus500 maintains regulatory oversight from reputable authorities such as the FSCA (Financial Sector Conduct Authority) in South Africa and ASIC (Australian Securities and Investments Commission) in Australia.

Plus500, headquartered in Israel and listed on the London Stock Exchange, boasts transparency in its financial operations and revenue generation. This transparency adds to the overall safety and reliability of trading forex and CFDs in the UK through Plus500.

Overall Fees: Plus500 keeps its fee structure straightforward by offering a single account type for all traders. They include the trading fee within the spreads, which start as low as 0.6 pips. For the EUR/USD currency pair, the typical spread averages at 0.8 pips on Plus500.

Trading Conditions: Plus500 provides traders with a user-friendly trading platform that boasts a modern and uncomplicated interface. This platform is designed to be easily understandable for both beginners and experienced traders. You can access it on a variety of devices, including the web, mobile, tablet, and desktop platforms.

The platform offers access to a broad spectrum of over 2,000 financial instruments, encompassing 67 currency pairs among them. However, it’s worth noting that in comparison to some other brokers, the research and educational resources provided may be somewhat limited.

#5 Tickmill – Forex Broker with High Number of Instruments

Tickmill, an FCA-regulated broker, offers diverse account types and a no dealing desk model. They support popular trading platforms like MT4 and MT5, and GBP can be selected as the account’s base currency.

Regulation: Tickmill is Regulated by the FCA since 2016, Tickmill UK Ltd, under license number 717270, provides protection for UK clients up to GBP 85,000 in case of disputes. Retail clients have a maximum leverage of 1:30, while professional traders can access up to 1:500 leverage.

Tickmill offers three account types for UK traders: Pro, Classic, and VIP. Pro and VIP are commission-based with very low spreads, while Classic relies on wider spreads.

Fees: Pro charges $4 or £4 per standard lot trade, and VIP charges $2 or £2 per standard lot trade. The Classic account has an average spread of 1.8 pips for EUR/USD.

Tickmill does not have non-trading fees, making it cost-effective for traders. The VIP account has attractive pricing but requires a high minimum deposit of $50,000.

Tickmill offers three account types: Classic, Pro, and VIP, each with varying fee structures. The Classic account features spreads as the sole trading fee and a minimum deposit of $100 or £100.

The Pro account also starts at $100 or £100, but it incurs a commission on each trade, offering negligible spreads. The VIP account, which provides the most competitive pricing, has a high minimum deposit requirement of $50,000 or £50,000, making it less accessible to retail traders.

Trading Conditions: Tickmill supports popular trading platforms, including MT4 and MT5, offering a wide range of trading tools and indicators. Additionally, they facilitate trading through modern platforms like CGQ, Trading View, and Agena Trader for futures and options.

With 62 currency pairs, 27 indices, 5 metals, 4 bonds, 8 cryptocurrencies, and 98 stock CFDs, Tickmill provides a diverse array of financial instruments for trading. Leverage varies depending on the asset, with some options available for retail clients at 1:30 for major currency pairs and up to 1:5 for stock CFDs, allowing traders to go short on stocks.

#5 Capital.com – Best FCA Regulated Forex Broker

Capital.com stands out for its competitive fee structure, especially when compared to many other FCA-regulated forex brokers in the UK.

Regulation: Capital Com (UK) Ltd operates under the regulatory oversight of the Financial Conduct Authority (FCA) and holds license number 793714. For clients residing in the UK, this FCA regulation provides a strong layer of protection. Furthermore, clients in the UK also benefit from the Financial Services Compensation Scheme (FSCS).

Beyond the UK, Capital.com is subject to additional regulatory scrutiny. They are regulated by the Australian Securities and Investments Commission (ASIC) in Australia and the Cyprus Securities and Exchange Commission (CySEC) within the European Union. While Capital.com is not publicly listed on any stock exchange, the company maintains a commendable level of transparency in its financial statements and operations.

Fees: The broker streamlines its pricing with a single account type, removing complexity for traders. Notably, Capital.com incorporates its trading fees within the spreads, thus eliminating any commission charges for traders.

Spreads at Capital.com start from a low of 0.7 pips, with the average typical spread for the EUR/USD currency pair standing at 0.8 pips. Additionally, their overnight rollover charges are notably lower than those of many other UK-based brokers.

Capital.com does not impose trading or non-trading commissions on its users. Moreover, they do not charge deposit/withdrawal fees, account opening or maintenance fees, or inactivity fees. This fee simplicity can be particularly advantageous for beginners looking to enter the trading world without the burden of additional costs.

Trading Conditions: Capital.com offers a range of trading platforms, including the popular MetaTrader 4 and TradingView platforms. These platforms are well-suited for trading the full spectrum of available instruments. In addition to desktop options, Capital.com provides mobile apps and webtrader capabilities for the convenience of traders.

Traders can access a wide selection of trading opportunities, including 140 forex pairs and numerous other CFD instruments.

Capital.com doesn’t merely offer trading opportunities; they also provide valuable tools for research and education, which can be especially beneficial for beginners. With a wealth of guides and courses, even those new to forex trading can access the knowledge and experience needed to succeed in the market.

#5 Tickmill – Best MT5 Broker in the UK

Forex.com is a well-established and reputable online forex broker that has been serving traders for many years.

Regulation: Forex.com is regulated in several jurisdictions, including the United States (by the CFTC and NFA), the United Kingdom (by the FCA), Australia (by ASIC), and Canada (by IIROC). These regulations provide a high level of security for traders, as brokers operating under these authorities must adhere to strict rules and standards.

Fees: The fee structure at Forex.com can vary depending on the account type and the instruments you trade. They typically offer both fixed and variable spreads, and there may be commissions on certain account types. Be sure to check their fee schedule for the most up-to-date information

Trading Condition: Forex.com offers a range of trading platforms, including its proprietary Advanced Trading Platform and the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms cater to traders of all experience levels, from beginners to advanced.

Forex.com provides a wide range of tradable instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and shares. This variety allows traders to diversify their portfolios.

They provide customer support through various channels, including phone, email, and live chat. Customer service is generally responsive and helpful.

How Did We Select the Best Forex Brokers For UK-based Traders?

There are a lot of factors that you need to consider before signing on with a broker. Every broker has its own pros and cons, and you need to decide which factors are more important to you. For example, if you plan on trading cryptocurrencies, then you should sign on with a broker that offers a good range of cryptocurrencies for you to trade.

Here are a few of the most important factors.

1) Verify that the Broker is Licensed by the FCA

The FCA, or the Financial Conduct Authority, is the regulatory body that oversees forex and CFD trading in the UK. The FCA is highly reputed around the world and is considered to be a Tier-1 financial regulator.

Before you sign up with a broker, you should check whether the broker holds a license from the FCA.

The broker will mention which licenses they hold on their website. This will also include a license number and the name of the entity which holds the license.

Let’s take the example of City Index broker. As you can see, at the footer of their website, they’ve noted that they’re licensed by the FCA and hold license number 446717.

You should take the license number and cross-check it on the FCA’s own website. The FCA publishes a register of the entities that are licensed by them. This web page will also carry the kind of authorization they have and since when the authorization has been bestowed.

City Index has been licensed by the FCA, as you can see on the FCA’s website.

The reason why being regulated by the FCA is important is because the FCA holds such licensees accountable and ensures that they protect the interests of traders and investors. In case there is a problem with their service, you can approach the FCA with your complaint.

Also, it is important to note that some brokers like IC Markets Ltd. do not have a full license from the FCA. However, they do hold a partial license and can offer certain services and products to UK residents. Further, they are regulated by other foreign reputable regulators. Hence, you can consider them to be safe as well.

You should not trade through any brokers that are Offshore companies & that offer high leverage. These brokers are unsafe and they can offer high leverage due to lax regulation in the region where they are regulated.

Certain brokers also pretend to be regulated by the FCA but are not. You should do your due diligence in ascertaining which brokers are genuine by following the method given above.

2) Is The Overall Fees Low?

You should check both the trading fees (spreads, commission, and overnight fee) as well as the non-trading fee (deposit and withdrawal fee, inactivity fee, account opening fee) charged by a broker. It is always good to choose a low-spread forex broker.

It is not necessary that a good broker charges high fees. The best brokers charge a low fee and offer competitive rates to their traders. They also do not charge any non-trading fees.

You should compare the fees charged by a broker with other similar brokers to ascertain which one is the most cost-effective.

The typical spread and commission charged by a broker are provided by the broker on its website.

For example, this screenshot has been taken from the Pepperstone website:

The fees can vary depending on the type of account held, the type of instrument being traded, etc. So, you should compare only the same instrument and the same type of account.

3) What are the Trading Conditions?

The trading conditions include factors in which trading platform is offered, how many trading instruments are offered, what is the leverage, how much is the minimum deposit, and so on.

Usually, all the information is available on their website, however, some information may be hard to find. If that is the case, do not hesitate to contact their customer support team and ask your questions.

You should ask questions like whether they offer negative balance protection, whether they offer guaranteed stop loss, can you trade indices, what is execution policy, and so on.

4) How is Customer Support?

This is an important but often overlooked factor. You should only trade through a broker that offers good and quick customer support. While trading, there will be many instances when you need the help of the customer support team.

A good broker offers customer support in your language and through live chat. This live chat window should be available on their website. They should also be open to receiving phone calls and emails.

Usually, you should check whether they respond to you within 5 minutes if you’re using the live chat option. Emails can take up to two hours while phone calls should be connected quickly.

5) What Instruments are Available to Trade?

The best forex brokers in terms of regulation and fees are of no good to you if your preferred financial instruments are not available at the chosen broker. Each broker offers a limited number of financial instruments and forex pairs. Clients must check and compare the availability of financial instruments before choosing a forex broker.

6) Which Trading Platforms are Supported?

A trading platform is where clients will spend most of their time after opening an account with any of the forex brokers in the UK. Most brokers offer an MT4 trading platform but some also offer their proprietary trading platform to execute trade orders.

MetaTrader 4 is the most chosen forex trading platform in the world. It is quite popular among forex traders worldwide. It is also ideal for beginners. MT5 is an upgraded version of MT4 but may not be ideal for all types of traders. eToro trading platform is most suitable for beginners due to its simple and user-friendly interface.

Clients can open a demo trading account with any of the trading platforms to get familiar with the platform before opening a live account. The trading experience can be different with each trading platform.

7) Available Account Types

Some brokers may offer multiple account types to serve the needs of different types of traders. Small-volume traders and beginners like to trade with the spread only while high-volume traders and scalpers would be more comfortable with commission-based spread-free pricing.

Brokers may or may not offer AUD or other preferred currency as the base currency of the account. The minimum deposit, leverage, available instruments, support trading platforms, maximum/minimum lot sizes, etc can be different for each account type. Clients should choose the best-suited account type according to their requirements and objective.

IC Markets and Pepperstone have multiple account types and allow traders to choose the most useful account type for themselves.

8) You Must Clear All Your Queries

If you are unable to gather any information about the broker, it is better to ask them directly through the live chat window, email, or phone support.

You must not rely on the words of a friend or relative and should make an effort to find the best-suited forex and CFD broker for yourself.

The reviews by professionals and existing clients can be used to select and compare brokers but the final decision must be made on your research. You must also note to not fall for every review (good or bad), and try to verify if that review is actually accurate.

When in doubt, ask questions to the broker through customer support services.

How to Open Live Forex Trading Account in the UK

After checking and comparing each FCA-regulated broker in the UK, clients can open their account online through their official websites. The account opening process is simple and can be completed within 24 hours but depends on the broker.

Step 1: Choose the Broker

The broker must be chosen after extensive analysis and comparison. FCA license is a must to trade safely in the UK.

Step 2: Provide Basic Details

Visit the official website of the chosen broker and enter basic details like name and email to begin the account opening process. If the broker offers multiple account types and trading platforms, clients will also need to configure their accounts.

Step 3: Choose Password

Choose a unique password that will be used in the future to access the trading account.

Step 4: Document Verification

Traders need to submit a soft copy of their documents that will be cross-checked by the authorities at the broker. This is the most time-consuming step. Some brokers complete this process within 2 hours while some may also take up to 24 hours to verify documents.

Step 5: Make a Deposit

Once the account is verified, clients can make a deposit through any of the accepted methods and start trading through the trading platforms.

Before starting forex trading in the UK, it is important to understand the working of the forex market and the terminologies used while trading online. Traders must acknowledge each component of the risk involved in the forex market. It is always advisable to start with a demo account to learn the basics of trading and gain experience. More than 70% of forex traders lose money.

Risk Involved in Forex Trading

Forex trading carries inherent risks that traders need to be aware of. Here are the key risks associated with forex trading:

- Market Volatility: Forex markets can be highly volatile, with exchange rates fluctuating rapidly in response to economic, political, or geopolitical events. The unpredictability of market shifts makes it challenging to accurately predict currency movements and increases the risk of adverse price swings.

- Leverage and Margin Risk: Forex trading often involves using leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses. If a trade goes against you, losses can exceed your initial investment. Proper management of leverage and margin requirements is crucial to avoid excessive risk exposure.

- Counterparty Risk: Forex trades are executed through brokers or financial institutions, introducing the risk of counterparty default or insolvency. It is important to choose reputable and regulated brokers that have robust risk management practices to mitigate counterparty risk.

- Liquidity Risk: Although forex markets are generally highly liquid, there may be instances of reduced liquidity during times of market turmoil or economic events. Low liquidity can make it difficult to execute trades at desired prices, leading to slippage or wider spreads.

- Economic and Political Risks: Currency exchange rates are influenced by economic factors, political decisions, and geopolitical tensions. Unforeseen events or policy changes can cause significant volatility in currency markets, impacting trade positions. Staying informed about economic and political developments is crucial to manage these risks effectively.

- Technical Risks: Technical issues related to trading platforms, internet connectivity, or broker systems can disrupt trading operations. System failures, outages, or delays can prevent timely order execution or lead to incorrect trade placements. It is important to use reliable platforms, maintain stable internet connections, and have contingency plans to minimize technical risks.

- Psychological Factors: Forex trading can be psychologically demanding, and emotional decision-making can lead to impulsive or irrational trading choices. Fear, greed, or overconfidence can cloud judgment and result in poor decision-making. Developing disciplined trading strategies, managing risk effectively, and maintaining emotional control are essential to mitigate psychological risks.

Traders should understand these risks and implement risk management strategies. This includes setting appropriate stop-loss orders, diversifying trades, using proper position sizing, and continuously educating themselves about forex market dynamics. Seeking advice from financial professionals and using demo accounts for practice can also help mitigate risks.

Methods to Reduce Risk in Forex Trading

Risk Management Plan:

Develop a comprehensive risk management plan outlining how you will approach trading, including maximum risk per trade, daily loss limits, and criteria for entering and exiting trades.

Use of Stop-Loss Orders:

Implement stop-loss orders to automatically close out a position at a predetermined price level, limiting potential losses if the market moves against your position.

Leverage Management:

Use leverage cautiously. While it can amplify profits, it can also magnify losses. Determine a sensible leverage ratio that aligns with your risk tolerance and trading style.

Position Sizing:

Adjust the size of your trades according to the level of risk involved. Smaller positions reduce potential losses, especially in volatile or uncertain market conditions.

Diversification:

Spread your risk by trading multiple currency pairs or other financial instruments. Avoid concentrating all your capital in a single trade or market.

Risk-Reward Ratios:

Before entering a trade, consider the potential reward relative to the risk. Aim for trades where the potential reward justifies the risk, commonly using ratios like 2:1 or 3:1.

Continuous Education:

Stay informed about market trends, economic indicators, and geopolitical events that can affect currency markets. Understanding these factors can help you make more informed trading decisions.

Emotional Discipline:

Maintain discipline to stick to your trading plan and avoid emotional decision-making. Use logical and analytical thinking to guide your trading actions.

Use of Protective Strategies:

Employ protective strategies such as hedging, where appropriate, to offset potential losses by taking an opposing position in a related asset.

Regular Review and Adjustment:

Periodically review your trading strategies and risk management practices, adjusting them as needed based on performance and changing market conditions.

Demo Accounts:

Practice trading in a risk-free environment using demo accounts to test strategies and refine your approach without risking real money.

Professional Advice:

Consider seeking advice from financial experts or using professional risk management services, especially if you’re new to Forex trading or dealing with complex strategies.

Comparison of Best Forex Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| Pepperstone UK |

1.12 pips

|

£0

|

1:30

|

Visit Broker |

| IC Markets |

1 pip

|

$200

|

1:30

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:30

|

Visit Broker |

| eToro |

1 pips

|

$200

|

1:30

|

Visit Broker |

| IG Markets |

1 pips

|

$300

|

1:30

|

Visit Broker |

| ETX Capital |

0.6 pips

|

$100

|

1:30

|

Visit Broker |

FAQs on Best Forex Brokers UK

Is forex trading legal in the UK?

Yes, forex trading is legal in the UK and is regulated by the Financial Conduct Authority (FCA) of the UK. You should trade via a regulated forex broker to ensure that your funds are safe.

What is the best FX broker in the UK?

There are many brokers that offer similar services with slight differences. The best broker depends on your unique requirements. The most important factor is to trade with an FCA-regulated forex broker. By our comparison, there are some good regulated forex brokers like Pepperstone, City Index etc. that are regulated & have competitive fees, and trading conditions.

Do forex traders pay tax in the UK?

Yes. There are two methods to speculate on the price movements of forex pairs in the UK. Profits made on forex trading as CFD trading is subject to capital gain tax at the end of the year. Profits made on forex trading as spread betting is tax-free in the UK.

Which forex broker is best for the beginners?

According to our analysis, eToro is an ideal choice for beginners as the trading platform is user-friendly and copy trading is free of cost. However, City Index, CMC Markets, Pepperstone, etc can also be ideal for beginners as they are safe and charge low spreads.

Which forex broker is safest?

City Index, CMC Markets, Pepperstone and all the brokers that are regulated by the Financial Conduct Authority (FCA) of the UK can be considered safe. Brokers that use STP/ECN method for trade execution are considered more safer as such brokers do not take part in trade orders placed by clients. A market maker can take another side of the trade.

Which broker is best for MT4?

CMC Markets, City Index, Pepperstone, and IG Markets can be considered best for MT4 trading platform. Traders must check the contract specifications and trading conditions for each broker before opening their account.

What is the best forex broker with lowest spread?

According to our analysis and comparison, Pepperstone, City Index, CMC Markets, and ETX Capital are the best forex brokers with the lowest spread in the UK. Apart from low spreads, traders should also check the authenticity and FCA license of the brokers.

Can you trust forex broker?

Yes but only if it the broker is regulated by the Financial Conduct Authority (FCA) of the UK. A broker that is not regulated by FCA involves high third-party risk and is risky for the traders.

Can you make a living trading forex UK?

Yes, you can make a living by trading forex but it is not recommended for a beginner. Forex trading involves significant financial risk and the majority of traders lose money in forex trading. Experienced traders who spend adequate time and effort in research and analysis tend to make regular income in forex.

How much does an FX trader make UK?

On average a forex trader makes nearly GBP 70,000 per year. However, the income through forex trading depends on the trading volume and capital used in trading. For example on a trade of a standard lot, a profit of 1 pip will be equal to $10 while the same movement with 0.1 lot will deliver $1 gain.