6 Best Spread Betting Platforms UK 2024

We've compared the Spread Betting Platforms for traders based in UK.

Spread betting is a way to speculate on the price movements of various financial instruments. It allows you to trade on margin but you don’t own the underlying security or asset.

Spread betting is a form of financial speculation where you bet on the price movements of various assets, such as stocks, forex, or commodities. Instead of buying or selling the actual assets, you bet on whether the asset’s price will rise or fall.

The “spread” is the difference between the buying and selling prices, and your profit or loss depends on how right or wrong your prediction is. Spread betting can offer tax advantages in some regions, but it’s highly speculative and carries significant risk, including the potential for substantial losses.

Spread betting is offered by several global CFD brokers along with attractive leverages. This is why spread betting has been gaining in popularity in the UK and around the world.

Before you can start spread betting, you will need to choose a spread betting broker.

List of Best Spread Betting Platforms UK for 2024

- City Index – Overall Best Spread Betting Platform in UK

- CMC Markets – Good Spread Betting Broker for New Traders

- ETX Capital – Best Spread Betting Platform for Low Fees

- Pepperstone UK – Best Spread Betting Platform For High-Volume Traders

- IG Markets – Oldest Spread Betting Broker in the UK

- FXCM – Spread Betting Broker with Multiple Trading Platform

We’ll also talk about what spread betting is and how to do it.

Best Spread Betting Platforms UK

In this article, we’ll cover the regulated spread brokers that offer their services to UK residents. We compared their Fees, Trading conditions, FCA Regulations, Leverage & more factors.

#1 City Index – Best Spread Betting Platform in the UK

City Index has been in operation since 1983 making it one of the oldest spread betting platforms. The company specializes in spread betting, but also offers forex and CFD trading services.

Regulation: City Index is regulated by the global tier-1 financial regulator Financial Conduct Authority of the UK. City Index is listed on the FCA website under the name StoneX Financial Limited and holds license number 446717.

City Index is also regulated in Australia and Singapore.

Since City Index is regulated by the FCA, we consider City Index to be completely safe for traders residing in the UK.

Leverage: The leverage offered by City Index depends on the type of security being traded. The maximum leverage that City Index offers for spread betting is 1:30. If you’re trading indices, then the maximum leverage is 1:20. Similarly, for shares, the leverage is 1:5 while for forex it is 1:30.

Minimum Deposit: City Index recommends that traders make a minimum deposit of 100 pounds. Traders need to have enough money in their trading accounts to meet the margin requirements from their trading activity.

Fees: It is worth noting that City Index does not charge any commission for spread betting. They only charge a commission when you trade share CFDs.

However, they do charge a spread for spread betting. This spread can be fixed or variable, depending on the type of instrument you’re trading.

The minimum spread for trading the benchmark EUR/USD currency pair is 0.5 pips while the typical spread for trading is 0.8.

Additionally, City Index also charges overnight fees if you keep an open trade for the next trading day. This fee is not applicable to futures contracts.

City Index does not charge any fee for making a deposit or withdrawal through bank transfers, debit cards, or credit cards.

Demo Account: Yes, City Index does offer a demo account to traders. This demo account provides unlimited access to all of City Index’s instruments and markets without any fee. However, the demo account can only be used for a maximum period of 12 weeks.

The demo account is an excellent way for new traders to learn the basics of spread betting in real-world conditions. The opening balance for your demo account is 10,000 pounds.

Instruments: City Index offers spread betting access to over 12,000 global markets. These markets include 21 global indices, 84 forex pairs, 4400+ global stocks, more than 25 commodities, bonds, options, futures, and more.

City Index Pros

- High number of available instruments

- Reasonable fees

- Intuitive trading platforms

City Index Cons

- Does not allow scalping

- Charges an inactivity fee after 12 months

#2 CMC Markets – Good Spread Betting Broker for New Traders

CMC Markets is a reputed spread betting platform that has been in operation since 1989. The company is based in London, UK with offices in Australia and Singapore.

Regulation: CMC markets are regulated in the UK by the FCA which is one of the strictest financial regulators in the world. CMC markets hold license numbers 173730 (under the name CMC Markets UK PLC) and 170627 (under the name CMC Spreadbet PLC).

According to FCA regulations, CMC also implements segregation of funds which means that client funds are kept separate from the company’s own funds.

Overall, we consider CMC Markets to be highly safe for UK traders and spread betters.

Leverage: The leverage (or margin) offered by CMC Markets depends on the instrument being traded. For example, the company offers maximum leverage of 1:30 for trading the GBP/USD currency pair. For trading Gold, the company offers maximum leverage of 1:20. For various indices, the maximum leverage is 1:20.

Minimum Deposit: CMC Markets recommends making a minimum deposit of 100 pounds at the time of account opening. However, there is no compulsion to deposit any amount. You can open a trading account with zero funds.

Fees: CMC markets do not charge any commission per trade for spread betting. However, they do charge a spread. The spread varies depending on the type of instrument that you’re trading.

For example, the minimum spread for trading the UK 100 is 1 pip. The minimum spread for trading the benchmark EUR/USD currency pair is 0.7 pips. And the minimum spread for trading the ARK Innovation ETF is 1 pip.

Additionally, CMC markets also charges an overnight fees if you hold an open position to the next trading day.

If you’re trading shares, then you will need to pay a commission as well as an additional spread.

There is an inactivity fee if your account is dormant for a period of more than one year. They do not charge any deposit or withdrawal fee.

Demo Account: Yes, CMC Markets offers a demo account with a paper balance of 10,000 pounds. You have the option of choosing between a spread betting demo account or a CFD trading demo account. You can practice trading for as long as you like under real-world trading conditions, without spending anything.

Instruments: CMC Markets offers a range of more than 11,000 markets in which you can trade. These markets include forex, commodities, shares, indices, bonds, and ETFs. However, CMC Markets does not offer cryptocurrencies yet.

CMC Markets Pros

- Low fees for trading forex instruments

- Good trading platform

- Advanced research tools offered

CMC Markets Cons

- Customer support only available on weekdays.

- No cryptocurrencies are available.

#3 ETX Capital – Best Spread Betting Platform for Low Fees

ETX Capital has been running since 2002 and offers spread betting, CFD trading, and forex trading services in the UK and select global markets. The company has a solid reputation that is backed by regulation and licensing.

Regulation: ETX Capital is regulated by the FCA of the UK and the FSCA of South Africa. The company holds license number 124721 under the FCA and the FSP No. 50246 from the FSCA. ETX Capital has a long history of operating in the UK and is considered to be safe for UK residents. The company also caters to traders from around the world.

Leverage: The leverage offered by ETX Capital depends on the type of instrument being traded. It offers maximum leverage of 1:30 for trading currency pairs. For trading commodities, the maximum leverage is 1:10. For shares and indices, the leverage can be up to 1:5 or 1:10.

Minimum Deposit: ETX Capital requires a minimum deposit of 100 GBP in order to open a Standard account.

Fees: ETX Capital charges a variable spread from its spread betters. The minimum spread for trading the benchmark EUR/USD currency pair is 0.8 pips. The minimum spread for trading gold is 0.4 pips. For trading EUR/GBP, the minimum spread is 1 pip.

ETX Capital does not charge any commission per trade.

They charge an overnight fee if you hold an open position overnight.

Demo Account: Yes, ETX Capital offers a demo account to its traders. The trading platform that you will be using will be MetaTrader 4 which is one of the most widely used platforms. You can hold a demo account for an unlimited amount of time and practice trading under real conditions. You do not have to pay any fee to open a demo account.

Instruments: ETX Capital offers a choice between more than 5000 trading markets. This includes around 60 forex pairs, commodities, indices, cryptocurrencies, shares, bonds, and more.

It is worth specially noting that ETX Capital is one of the few UK-based spread betting platforms that offer cryptocurrencies.

ETX Capital Pros

- Good educational tools available.

- Easy account-opening process

- Offers cryptocurrencies for spread betting

- Does not charge any commission

ETX Capital Cons

- High minimum deposit

- Market making broker

#4 Pepperstone UK – Best Spread Betting Platform For High-Volume Traders

Pepperstone UK was founded in 2010 and is the newest broker on the list. However, they’ve made a space for themselves in the market in a relatively short period of time. They cater to global clients along with UK residents.

Regulation: Pepperstone is regulated by the FCA of the UK and holds a license number 684312. The company is also licensed by the ASIC of Australia and the DFSA of the United Arab Emirates.

We consider Pepperstone to be safe for UK residents due to its UK license, its reputation, and its policy to segregate funds.

Leverage: Pepperstone offers a leverage of up to 1:30 to its retail clients. If you’re a professional trader, then you can access leverage of up to 1:500. The exact amount of leverage also depends on the type of instrument being traded.

Fees: The fees charged by Pepperstone UK depend on the type of account held by the trader and the instrument being traded. For example, the average spread for trading the benchmark EURUSD currency pair is 0.09 pips.

In addition, Pepperstone also charges a commission of GBP 2.25 per lot. This commission allows Pepperstone to offer much lower spreads. Hence, Pepperstone is a good option for those who trade in high volumes.

Additionally, Pepperstone will also charge a swap rate if you carry an open position overnight.

Demo Account: Pepperstone offers two types of demo accounts. The MT4/MT5 demo account expires automatically within 30 days. A cTrader demo account does not expire as long as you access it at least once a month.

The demo account offered by Pepperstone is a great way for new traders to check out Pepperstone’s services and gain experience before diving in with real money.

Instruments: Pepperstone offers a wide variety of instruments, however, it is less than the range offered by other brokers on this list.

With Pepperstone you can trade more than 60 different currency pairs, indices, commodities, shares, ETFs, and currency indices. They do not offer cryptocurrencies to traders as of now.

Pepperstone Pros

- Low commissions meant for high-volume traders.

- Good customer support.

- Great educational material for new traders.

Pepperstone Cons

- Does not offer cryptocurrencies

- No spread-only accounts.

#5 IG Markets – Oldest Spread Betting Broker in the UK

IG is an FCA regulated Financial Services Provider that has been offering spread betting services since 1974.

IG Markets is among the oldest spread betting financial services providers in the UK as its incorporation dates back to 1974. IG Markets Limited is the legal entity in the UK that is regulated by the FCA. Apart from this, IG Markets is also regulated by FSCA of South Africa, ASIC of Australia, and NFA, CFTC of the USA. Multiple top-tier regulations including FCA make it safe for spread betting in the UK.

IG Markets offer a separate spread betting account where the spread is the only trading fee that is incurred from the traders. Only CFDs on shares incur commission. The average typical spread for EUR/USD at IG Markets is 1 pip.

GBP can be chosen as the base currency of the account with the MT4 trading platform. They allow spread betting on more than 12000 financial instruments. This includes 90 currency pairs, 70 indices, 25 commodities, and 10 cryptocurrencies.

IG Markets Pros

- Oldest FCA regulated spread betting broker

- Regulated by FCA, FSCA, ASIC, NFA, etc.

- 90 currency pairs available for spread betting

- GBP available as base currency of the account

IG Markets Cons

- No major cons

#6 FXCM – Spread Betting Broker with Multiple Trading Platform

FXCM is an FCA regulated spread betting service provider that supports multiple trading platforms.

FXCM Limited is regulated by the Financial Conduct Authority (FCA) under license number 217689. They are also regulated in multiple jurisdictions including CySEC of the European Union, ASIC of Australia, and FSCA of South Africa. Hence, the third-party risk of choosing FXCM for spread betting is very low.

The spreads are slightly higher at FXCM compared to other spread betting service providers. The average typical spread for EUR/USD currency pair is 1.3 pips. They do not charge any other trading commission on the standard account type.

FXCM allows traders to choose from multiple trading platforms including MT4. Clients require a minimum deposit of $50 to start spread betting at FXCM. Deposits and withdrawals can be made through local bank transfers in the UK without any additional commission.

FXCM Pros

- Regulated by FCA, FSCA, ASIC, NFA, etc

- Multiple trading platforms available

- Local bank transfer supported

FXCM Cons

- GBP not available as base currency of account

- Customer support services not available on weekends

What is Spread Betting?

Spread betting involves speculating on the price movements of assets without the need to hold the actual asset. Spread betting can be both long or short, which means if you short an asset, you can profit if the value of the asset goes down.

Spread betting happens through derivative contracts. This means that you enter into a contract with the broker to pay the price difference of your trades without the need to purchase and sell actual assets.

Spread betting is legal in the UK and is regulated by the Financial Conduct Authority (FCA).

Difference Between Spread Betting and CFD Trading

Spread betting is different from CFD trading.

Spread betting does not attract capital gains tax in the UK, however, CFD trading does. This is why UK residents prefer to be spread betters rather than CFD traders.

There is a technical difference between spread betting and CFD trading. Spread betting involves betting on the movement of each pip in the underlying. In CFD trading, you are only concerned with the entry and exit prices.

Let’s understand spread betting with a short example.

Suppose you are betting on Gold prices. You believe that Gold prices will increase over the next few days.

The current gold price is £100.00 (for example). The leverage that you can use is 1:2. You place a bet (long) worth £500 per point of price movement. Since the leverage is 1:2, you will need to use £250 to be able to make the trade.

Over the next few days, the price of gold rises to £100.50. Hence, gold has risen by 5 points. You decide to close the trade and book your profit of £2500.

Overall, by using just £250, you were able to make £2500 thanks to leverage and the favourable price movement.

However, this can easily happen the other way around as well. You can lose £2500 by betting just £250 as well.

| Spread Betting | CFD Trading |

|---|---|

| An Amount of money is staked on the prices of the underlying instrument which is multiplied by each pip movement | The difference between the entry and exit price of the underlying instrument is settled with cash |

| Spread betting is exempted from capital gain or income tax | Profits from CFD trading are liable for capital gain tax at prevailing rates |

| Betting amount does not affect volume. Bet of any amount can be placed on pip movement | Trading amount defines the trading volume. The higher trading amount increases the volume of the underlying instrument |

| The pip difference between the opening and closing position is multiplied by the staked amount to calculate profit or loss | The pip difference between the opening and closing position is multiplied by the trading volume or lot to calculate profit or loss |

| Spread betting involves an expiry date after which the contract is automatically closed | CFD trading has no expiry. A swap fee is incurred if the position is kept open overnight. |

| Spread betting is only available in the UK and Ireland | CFD trading is available globally |

| Aspect | Spread Betting | CFD Trading |

|---|---|---|

| Taxation | No capital gains tax (subject to individual circumstances) | Subject to capital gains tax |

| Market Access | Primarily UK and Ireland markets | Global markets including stocks, indices, forex |

| Trading Costs | No commission, costs are within the spread | Commission may apply, especially for shares |

| Regulation | Regulated by the Financial Conduct Authority (FCA) | Also regulated by the FCA |

| Use | Suitable for speculative trading without taking ownership of the underlying asset | Used for hedging, speculation, and taking direct market positions |

| Profit/Loss Calculation | Based on the point movement | Based on the difference in the contract entry and exit prices |

How to Start Spread Betting?

Starting spread betting in the UK is quite easy and quick.

Step 1) Choose a Regulated Spread Betting Broker: The first thing that you need to do is to choose a broker. You must ensure that the broker is regulated by the FCA. This is because regulated brokers are safe to trade through and the likelihood of investor fraud is low. FCA-regulated brokers need to put lots of safety practices in place which is favourable for the trader.

You can check whether a broker is regulated by the FCA by going on their website. An FCA-regulated broker will display their license number on their website itself.

For example, here is the website of CMC Markets:

As you can see, they have displayed their FCA license number at the bottom of their home page.

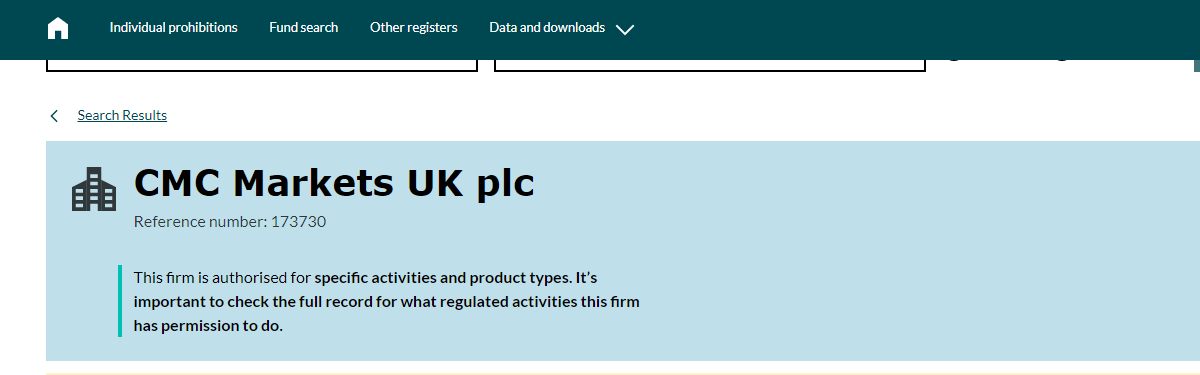

Once you have the license number, you should enter the license number on the FCA website to cross-check whether the number really belongs to CMC Markets.

This is a screenshot from the FCA website:

As you can see, CMC Market’s license is genuine.

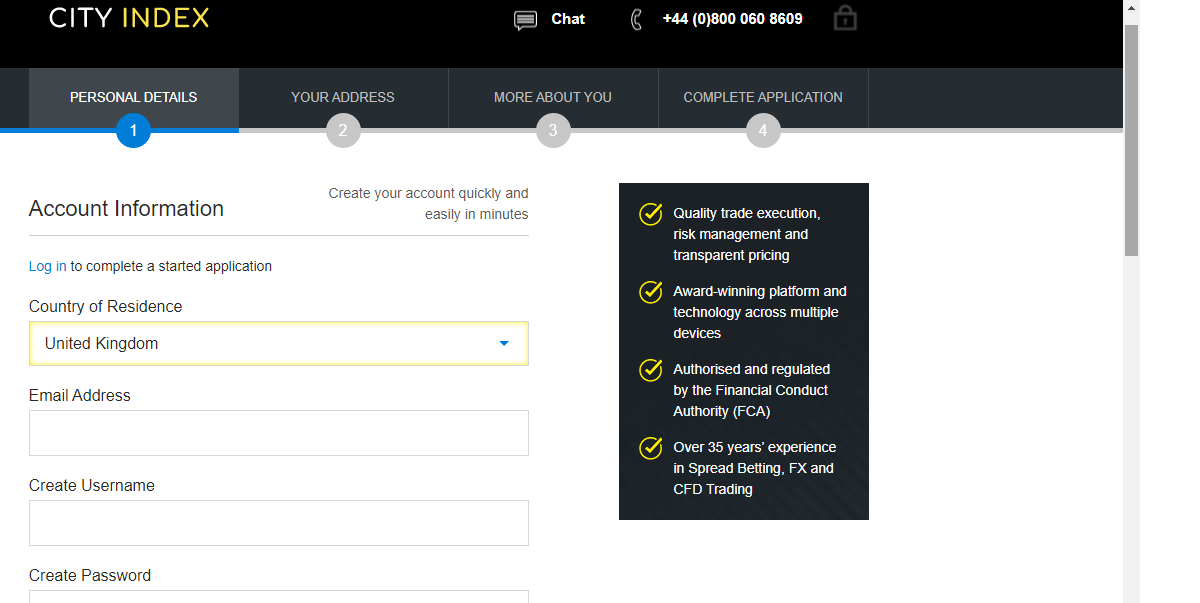

Step 2) Open Your Trading Account: The next step is quite simple. You need to go on the broker’s website and open your account. This process usually takes a few days since the broker will have to verify your identity according to FCA regulations to prevent money laundering.

You will need to provide your account details and choose whether you want a spread betting or a CFD trading account.

Step 3) Downloading the Platform: Once you have registered with the broker, you will be able to download the trading platform from the broker’s website within your account. Every broker offers different trading platforms, however, the most common are MetaTrader 4 and MetaTrader 5.

In case you do not want to download a trading platform, you can also check whether your broker offers a web-based trading platform that you can access directly through your browser.

If you have a Windows computer, then you should ensure that the broker offers Windows support for their trading platform. Similarly, if you own a Mac, then you should check whether the trading platform is compatible with MacOS.

Usually, you can download the trading platform on your Android or iOS smartphone as well.

Step 4) Place Your Trade: Once you have downloaded the trading platform, you can start trading. We recommend using a demo account first so that you can practice without risking real money.

Spread Betting Example

Let us understand how spread betting works with the help of an example.

In this example, we will place a bet of $10 on the EUR/USD currency pair. Let us assume the current price of EUR/USD to be 1.2000. With a long position of $10 on this instrument, each pip movement will increase the profit by $10.

If the price moves up to 1.2030, the profit will be $300 on the long position. If the better placed this bet on the short position he will incur a loss of $300.

How to Choose a Spread Betting Broker in the UK?

There are several brokers in the UK that allow spread betting and are regulated by the FCA. The FCA regulation and authorization is the most important factor to consider when choosing a spread betting platform in the UK.

Apart from the regulation, spread betters in the UK must also consider the following aspects while choosing a broker:

- Fees: In spread betting, spreads and commission are the major sources of revenue for brokers. Traders can only book profits when the price moves more than the spreads in the anticipated direction. Each broker offers different spreads and other charges that must be checked and compared before opening your account.

- Margin and Leverage: Leverage plays an important role in spread betting. Smaller leverage like 1:2 is also beneficial for the spread betters. However, excessive leverage will increase the risk associated. Traders should always check the amount of leverage and margin requirement on the preferred instruments.

- Available Instruments: Spread betting can be done on a variety of instruments. Most beginners prefer to start with major forex pairs and commodities like gold and crude oil. Traders must always check instruments at the broker that are available for spread betting.

- Deposits and Withdrawals: Each trader prefers to deposit and withdraw through different methods. However, local bank transfers are the most preferred transaction method. The commission for deposit and withdrawal can be different for each accepted method.

Traders must inquire about all the available deposit and withdrawal methods at a broker before opening the account. They must also check the processing time, commission, and minimum limits for the transactions.

Risk Involved in Spread Betting

Volatility Risk

In Spread betting, the underlying asset is a financial instrument whose value can change due to multiple reasons in the market. The trends and sentiments can change for each spread betting instrument at any time of the day. Research and analysis are very helpful in prediction but sometimes it is difficult to predict the market. Traders and spread betters can are always at a risk of losing their investments due to volatility risk in the market.

Account Close Out

When the account balance is low and a large spread betting position is opened, the broker will automatically close the position if you face significant losses even if you don’t want to close the position. If the account balance is high, the losses can be much higher. The best method to avoid the risk of automatic closure of position is by putting stop loss on each opened spread betting position.

Leverage Risk

Spread betting involves leverage. Leverage allows traders to open a bigger position with a smaller deposit. It is a short-term debt that is settled when a position is closed. Traders can book high profits with a small deposit but can also face significant losses if the prices move against the anticipated direction. Traders must always use safe leverage for trading and spread betting.

Third-Party Risk

Spread betting services in the UK are offered by CFD brokers and spread betting firms. Spread betting is regulated by FCA in the UK but there are many firms that accept clients from the UK and are not regulated by the FCA. If the chosen broker is not regulated in the UK, traders will not be registered under FCA regulatory compliance.

The risk of choosing a fake broker or scammer is called third-party risk. This can be mitigated to a good extent just by choosing FCA regulated firm for spread betting in the UK.

Market Liquidity Risk

In less liquid markets or during volatile periods, the availability of counterparties to match your trades may be limited. This can impact your ability to execute trades at desired prices or may result in wider bid-ask spreads, leading to increased trading costs or difficulty in closing positions.

Limited Asset Ownership

In spread betting, you don’t own the underlying assets you are speculating on. Instead, you are betting on the price movement. This means you won’t benefit from dividends, voting rights, or any other advantages associated with owning the underlying assets.

Psychological and Emotional Risks

Spread betting can be psychologically challenging, as trading decisions are often driven by emotions such as fear and greed. Emotional decision-making can lead to impulsive or irrational trades, which may result in substantial losses. It’s important to develop a disciplined trading strategy and exercise emotional control.

Tips for Success in Spread Betting

- Master the Basics: Understand spread betting principles.

- Educate Yourself: Learn about your chosen markets.

- Choose a Reliable Broker: Pick a regulated broker.

- Manage Risk: Develop a solid risk management strategy.

- Demo Practice: Use demo accounts to practice.

- Stay Informed: Follow market news and events.

- Use Analysis: Combine technical and fundamental analysis.

- Start Small: Begin with small positions.

- Diversify: Spread bets across different assets.

- Mind Leverage: Use leverage cautiously.

- Short-Term Trades: Opt for short-term trading.

- Control Emotions: Stick to your plan and manage emotions.

- Continuous Learning: Stay updated on strategies and trends.

- Understand Costs: Be aware of fees.

- Monitor Trades: Keep an eye on open positions.

Comparison of Best Spread Betting Platforms UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| ETX Capital |

0.8 pips

|

$100

|

1:30

|

Visit Broker |

| Pepperstone UK |

0.69 pips

|

£0

|

1:30

|

Visit Broker |

| IG Markets |

0.6 pips

|

£0

|

1:30

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:30

|

Visit Broker |

FAQs on Best Spread Betting Platforms UK

Is Spread Betting Taxable in the UK for individuals?

No, the profits that you make from spread betting are not taxable in the UK. Spread betting is free from both stamp duty and capital gains tax.

Which trading platform has the best spread?

As per our check, Pepperstone UK offers one of the lowest spreads for most instruments. IC Markets also has low spreads. However, both these brokers charge a commission per trade. Pepperstone is highly suitable for high-volume spread betters.

Is spread betting profitable?

Spread betting can be profitable if correct bets are placed after due analysis and research. Spread betting can also lead to substantial losses if prices move against prediction. It involves high risk and spread betters must only deposit the amount they are willing to lose.

Is spread betting better than CFD?

Spread betting as well as CFD trading involves substantial financial risk. In terms of taxes, spread betting is better as profits on spread betting are not subject to taxation in the UK. The fees in spread betting is built into spread while CFD trading may also include additional commission.

Why is spread so high at night?

During the night time, most businesses and capital markets are inactive. Due to this, there is lesser exchange of currencies, assets, and services. This leads to a decrease in liquidity and wider spreads on financial instruments.

Can you spread bet in UK?

Yes, spread betting is legal and regulated by the Financial Conduct Authority of the UK. The FCA has issued license to spread betting service providers but some may accept clients without FCA licenses. Spread betters must ensure that the chosen spread betting platform is regulated by the FCA in the UK or not.

Do I need to declare income from spread betting?

No, income earned through spread betting in the UK is non-taxable. No stamp duty or capital gain tax is applicable on the profits booked through spread betting in the UK. Hence, betters do not need to declare any income from spread betting.

Do people become millionaires from spread betting?

No, spread betting is not a scheme to get rich quickly or become a millionaire. It involves significant financial risk and spread betters can also lose all the amount held in the betting account. The profit depends on the research, analysis, strategies, discipline, and experience of the better.

Can I make a profit from spread betting?

Your ability to make a profit depends on your spread betting strategy. Spread betting is a risky activity and there is no guarantee that you will make a profit. Further, if you use leverage, then your losses may be quite high.