Best ECN Brokers UK 2024

We've compared the 10+ ECN forex brokers for UK traders. You can check compare them based on leverage, spread, funding, regulation and pros & cons.

ECN-type Forex Brokers are more popular amongst experienced traders for a good reason. An ECN broker works with several different liquidity providers, which means that they can offer their services at a lower cost.

ECN (Electronic Communication Network) trade execution is a direct, technology-driven method for executing financial trades. It connects traders directly to a network of participants and offers advantages like real-time transparency, tight spreads, and high liquidity.

ECNs do not have a dealing desk, provide market-depth data, and offer fast, automated order processing. This method is commonly used in forex trading for its transparency and competitive pricing.

There is also no conflict of interest between the trader and the broker since the broker earns a commission and spreads regardless of whether the trader makes a profit or a loss.

Here is a List of Best ECN Forex Brokers UK for 2024 based on our Research

- Pepperstone – Overall Best ECN Broker UK

- IC Markets – Best ECN Type Broker with cTrader

- FXCM – Safest ECN Broker Regulated in Three Tier-1 Jurisdictions

- FxPro – Best MetaTrader and cTrader Broker

- FP Markets – Best ECN Broker for Scalping

- FXTM – Best ECN/STP broker with Copy Trading platform

There are a few ECN brokers that offer their services in the UK. Before choosing an ECN broker, you should make sure that they are regulated by the Financial Conduct Authority (or the FCA) of the UK.

This ensures that your money is safe and you can hold the broker accountable for any misdeeds. Also, this ensures the protection of your funds in case the broker goes out of business.

Best ECN Brokers UK

In this guide, we’ll cover the best ECN brokers operating in the UK today, how to verify a true ECN broker, and how to open an account with an ECN broker.

#1 Pepperstone – Overall Best ECN Broker UK

Pepperstone is an ECN broker that works with different liquidity providers and provides its pricing from external sources. Pepperstone has been operating since 2010 and is a highly reputed broker.

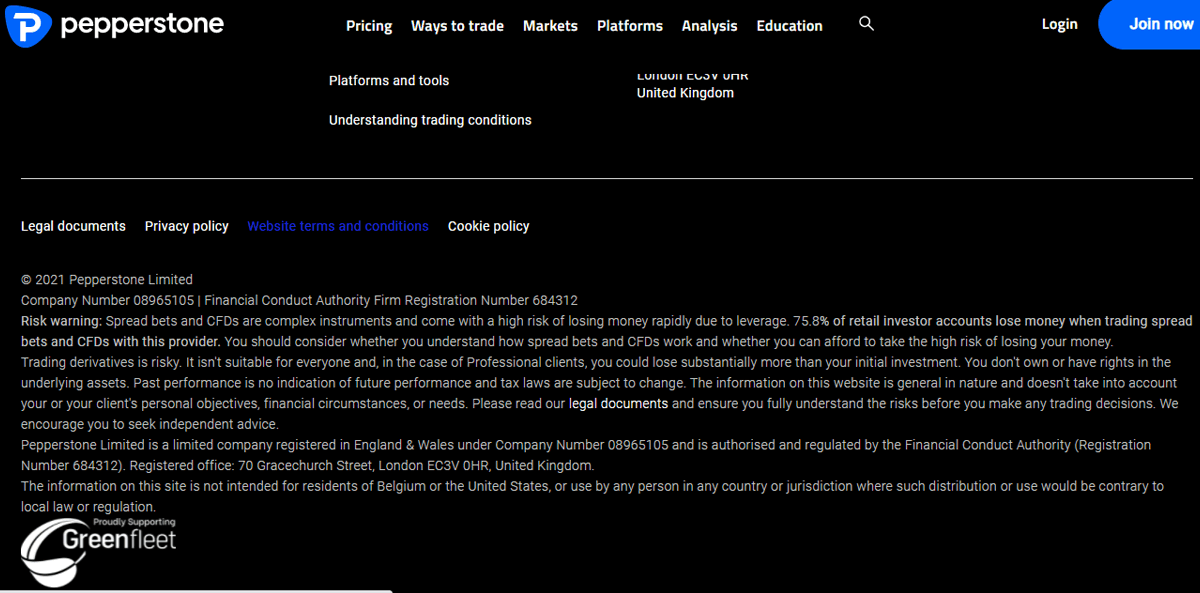

Regulation: Pepperstone is regulated by the FCA under the name ‘Pepperstone Limited’. The broker holds license number 684312. The company has held the license since 2015.

Additionally, Pepperstone is also regulated in Australia, Germany, Austria, Cyprus, United Arab Emirates, Kenya, and The Bahamas.

Pepperstone also provides negative balance protection and segregates traders’ funds from its own funds.

Hence, we consider Pepperstone to be a safe broker for UK residents.

Note: 75.8% of Retail Traders lose money when trading CFDs at Pepperstone.

Overall Fees: Pepperstone charges low overall fees, compared to other similar brokers.

For trading the benchmark EURUSD currency pair, the broker charges a commission of $7 (GBP4.59) Roundturn per trade per lot with a spread of 0.17 pips on average, while trading through their ECN Razer account.

If you are trading micro lots, then the Roundturn commission is higher at $0.08 per lot. This makes their overall fees for 1 Standard lot for EURUSD at $8.7 on average.

An added advantage is that Pepperstone does not charge any hidden or non-trading fees. They do not charge a deposit fee, withdrawal fee, inactivity fee, or account maintenance fee.

Trading Conditions: While trading with Pepperstone, users have the option of choosing between their Standard and Razer accounts. Both these types of accounts have different pricing structures and are suitable for different kinds of traders. The Razor Account is the ECN type account.

Pepperstone does not require a minimum deposit at the time of opening an account. This is another factor that goes in its favor.

The maximum leverage offered by Pepperstone to its traders from the UK is 1:30 for forex. This is the maximum amount of leverage allowed by the FCA for forex trading to retail traders. The max. leverage is lower for other CFDs. If you are looking to trade with higher leverage then you can open account as a Professional Trader.

Pepperstone offers a wide variety of trading instruments which includes 62 currency pairs, CFDs on 23 stock indices, 950 stock CFDs, and 25 commodity CFDs. The FCA does not allow Pepperstone to offer cryptocurrency trading to its UK-based traders.

Pepperstone offers the GBP as a base currency. Hence, UK traders do not have to convert their money into a different currency in order to make trades. This saves a significant amount of money in conversion fees. The other supported base currency options are USD, EUR & CHF.

Traders can deposit funds in their trading account through debit cards, credit cards, wire transfer, and PayPal.

Customer Support: Pepperstone offers customer support through live chat, phone call, and email. We found their responses to be fast and helpful.

Their customer support team is available at all times during weekdays. They are not available on weekends.

Pepperstone Pros

- The overall fees are low

- The customer support is excellent

- It does not charge any hidden fees

Pepperstone Cons

- It does not offer its own proprietary trading platform

- There are no options for social trading

#2 IC Markets – Best ECN Broker with Automated Trading Features

IC Markets is an ECN broker that has been operating since 2007. The company is best known for its social trading and automated trading services.

Regulation: A major drawback of IC Markets for UK traders is that they are not regulated by the FCA.

They are an Australian company and are regulated by the ASIC of Australia (which is a tier-1 financial authority), the CySEC of Cyprus, and the FSA of Seychelles. But IC Markets (EU) Ltd. has ‘temporary permission’ to accept UK clients as they are registered in EEA. The firm has reference No. 827935 on FCA’s register.

The company is a private company and is not listed on any stock exchange. Hence, their financial information is also not publicly available.

We would still recommend IC Markets because of its long track record and its license from the ASIC of Australia which is a highly reputed financial regulator.

They also segregate their funds and provide negative balance protection.

Note: 74.32% of retail traders lose money when trading CFDs at IC Markets.

Overall Fees: IC Markets’ rate is quite reasonable when compared to other similar brokers.

When using their Raw MT4 trading account, IC Markets charges a commission of $3.5 per lot per trade per side and a spread of as low as 0 pips for trading the benchmark EURUSD currency pair. This makes their typical cost about the same as Pepperstone (another Australian CFD broker)

If you choose the cTrader account, then the commission per lot is lower at $3.0 per side. This makes a total of $6 per 100,000 units Roundturn. The spread is about the same, so the total cost is a bit lower.

Further, similar to Pepperstone, IC Markets also does not charge any non-trading fees. Namely, they do not charge a deposit fee, withdrawal fee, inactivity fee, or account maintenance fee.

However, their overnight fee is higher than average.

Trading Conditions: IC Markets requires a minimum deposit of $200 at the time of account opening, which is very high.

They offer three different types of accounts that differ in terms of fee structure and available trading platform. Their account types are called True ECN for cTrader, True ECN for MetaTrader, and Standard account.

They do not charge a commission through their Standard account, however, the spread is much wider.

IC Markets offers a leverage of up to 1:30 to retail traders based in UK. You can register under their Pro Account if you want to trade with higher leverage, but you must understand the risks & it is not recommended.

While trading, you can choose from 61 forex pairs, CFDs on 25 indices, 1600 stock CFDs, 30 ETFs, 20 commodities, 9 bonds, and 10 cryptocurrencies. Since IC Markets is not regulated by the FCA, UK traders can gain exposure to the cryptocurrency market as well.

IC Markets offers the GBP as a base currency, which is an advantage for traders from the UK.

IC Markets has cTrader & MT4, and MT5 platforms available for traders in the UK.

UK traders who want to deposit money into their trading account can do so through bank transfers, debit cards, credit cards, and payment wallets such as Neteller and Skrill.

Customer Support: IC Markets provides 24/7 customer support. You can reach their customer support team through live chat, phone calls, and email.

While they provide excellent service through phone and email, their live chat can use some more work. We experienced a significant time lag between our questions and their answers while using live chat.

IC Markets Pros

- IC Markets is regulated with ASIC, CySEC, and has temporary permission to accept traders based in UK because of their regulation in EEA.

- They charge low typical fees compared to other similar brokers

- The support at IC Markets is good.

IC Markets Cons

- They are not regulated by the FCA of the UK

- Their customer support through live chat does not work well

- The commission of $7/lot Roundturn is a bit higher than some other ECN-type forex brokers.

#3 FXCM – Good ECN Broker Regulated with FCA

FXCM was founded in 1999 and is one of the older brokers on this list. The broker has offices in New York City, London, and Melbourne, amongst others.

Regulation: FXCM is regulated by the FCA under the name Forex Capital Markets Limited. The company holds license number 217689.

In addition, FXCM is also regulated by the ASIC of Australia, the CySEC of Cyprus, and the FSCA of South Africa.

Further, FXCM provides negative balance protection and does segregate its funds from traders’ funds.

Overall, we consider FXCM to be highly safe for traders from the UK thanks to its long reputation and solid regulation.

Overall Fees: FXCM charges average trading and non-trading fees when compared with other brokers.

When trading the benchmark EURUSD currency pair, the broker charges a typical spread of 1.2 pips when trading through its Standard account (non-ECN type account).

FXCM also charges a commission when trading through its Active Trader account, however, it charges a much tighter spread.

FXCM does not charge a deposit fee, withdrawal fee, or account maintenance fee. However, it does charge an inactivity fee of $50 if you’re inactive for a period of more than one year.

Trading Conditions: FXCM requires that traders deposit a minimum of 50 pounds at the time of opening an account with them. This is a fairly average minimum deposit requirement.

FXCM offers two types of accounts that differ in terms of fee structure. These account types are named Standard and Active Trader. The Standard account does not charge a commission but charges a wider spread. In contrast, the Active Trader account charges a commission with a tight spread.

For UK traders, FXCM offers maximum leverage of 1:30 in accordance with FCA rules.

FXCM offers a decent range of trading instruments that includes 45 currency pairs, CFDs on 15 stock indices, 219 stock CFDs, 12 commodity CFDs, and 1 bond CFD. Cryptocurrency CFDs are not available to traders from the UK.

FXCM offers GBP as a base currency, hence, UK residents do not have to convert their money when trading with FXCM.

Further, traders from the UK can deposit money into their trading accounts through debit cards, credit cards, bank transfers, wire transfers, or through payment wallets such as Skrill and Neteller.

Customer Support: FXCM can be contacted at any time during weekdays. They offer customer support through phone calls, email, and live chat. As a UK resident, you do not have to pay for the phone calls you make to them (toll-free).

FXCM Pros

- It is highly regulated and has a license from the FCA

- It was founded in 1999 and has been in the business for a long time

- It has offices in London

FXCM Cons

- It’s customer support is only available on weekdays

- The range of trading instruments it offers could be wider

#4 FxPro – Best MetaTrader and cTrader Broker

FxPro is a forex and CFD ECN broker that was founded in 2006.

Regulation: FxPro is regulated by the FCA of the UK under the name FxPro UK Limited. The broker holds license number 509956.

Additionally, group companies of FxPro are regulated by the CySEC of Cyprus (License No. 078/07), the FSCA of South Africa (License No. 45052), and the SCB of The Bahamas (License No. SIA – F184).

FxPro also provides negative balance protection and segregates its funds.

FxPro is a reputable broker and we consider it to be safe for traders residing in the UK.

Overall Fees: The fees charged by FxPro are built into the spread.

The average spread for trading the benchmark EURUSD currency pair is 1.7 pips. The spread is slightly above average when compared to other brokers. It does not charge a commission.

FxPro does not charge any non-trading fees, except an inactivity fee. The inactivity fee is $15 after twelve months of inactivity.

Trading Conditions: FxPro requires a minimum deposit of $100 at the time of opening a trading account with it. $100 is an average minimum deposit requirement since there are some brokers that charge as high as $2000.

FxPro offers 6 different types of accounts. Each type of account differs in terms of fee structure, mode of execution, and trading platform available. The six different account types are FxPro Platform, MT4, MT4 Instant, MT4 Fixed, MT5, and cTrader.

The cTrader is the only account type that charges a commission, however, the spreads are significantly tighter.

FxPro offers a leverage of up to 1:30 to traders residing in the UK.

Through FxPro, you can trade a variety of instruments such as 70 currency pairs, 29 indices, 1700 stock CFDs, and 25 commodity CFDs. The range of instruments is quite low when compared to other brokers. They do not offer any bonds or ETFs.

Traders can use the GBP as the base currency of their trading account. Hence, traders from the UK do not have to convert their currency in order to start trading. You get to save on currency conversion fees.

Traders from the UK can deposit funds into their accounts using debit cards, credit cards, and local bank transfer. However, FxPro does not accept payment through payment wallets from UK residents.

Customer Support: You can contact FxPro at any time during weekdays, but not on weekends.

They can be reached through live chat, email, and by requesting a call back through their website.

We found their responses through live chat to be quick and helpful. It took around 3 minutes for us to connect with a customer support executive.

FxPro Pros

- The account opening process is very quick

- The trading fees are decent

- You can make deposits and withdrawals for free

FxPro Cons

- It does not provide 24/7 customer support

- Traders from the UK cannot use payment wallets to deposit money into their trading account

#5 FP Markets – Best ECN Broker for Scalping

FP Markets is an Australia-based broker that has been operating since 2005.

Regulation: FP Markets is not licensed or regulated by the FCA of the UK. This is a major drawback for traders residing in the UK.

However, FP Markets is licensed in Australia by the ASIC, in Cyprus by the CySEC, and in St. Vincent and Grenadines by the FSA.

FP Markets also follows safety practices such as negative balance protection and segregation of funds.

We consider FP Markets to be moderately safe for UK traders.

Overall Fees: FP Markets charges low trading and non-trading fees when compared to other brokers.

To trade the EURUSD currency pair, they charge a very tight typical spread of 0.1 pips and a commission of $3 per lot per side per trade. This is $6/lot for Roundturn. This pricing is applicable when trading through their ECN type Raw account.

FP Markets does not charge any deposit fee, withdrawal fee, inactivity fee, or account maintenance fee.

Trading Conditions: FP Markets requires a minimum deposit of AUD 100 if you are opening a Raw account. The fee/deposit for UK traders is the GBP equivalent of that amount.

FP Markets offers two different account types: Standard and Raw. The account types differ in terms of the available trading platforms & the fee structure. The Raw account is their ECN account.

The maximum leverage that can be used is 1:500. You can change the amount of leverage that you want to use. Since FP Markets is not regulated by the FCA, traders from the UK can use FP Markets to access high leverage which is disallowed by the FCA.

FP Markets offers a very high number of stock CFDs but their selection of other types of instruments is quite low. They offer more than 9,000 stock CFDs which is one of the highest among all other brokers. However, they only offer 61 currency pairs, 14 indices, 8 commodities, and 4 cryptocurrencies.

Since FP Markets is not regulated by the FCA, UK traders can use FP Markets to trade cryptocurrency CFDs.

FP Markets offers the GBP as a base currency, which is an advantage for traders based in the UK.

Traders from the UK can deposit funds using bank transfers, debit cards, credit cards, or certain wallets.

Customer Support: FP Markets can be contacted through live chat, phone call, or email.

Recently, customer support has been made available 24/7, which means you contact them on weekends as well.

The customer support that FP Markets offers is quite excellent, and we were pleasantly surprised when we contacted them through the live chat option on their website. We didn’t experience any hold time and our questions were answered almost instantly.

FP Markets Pros

- They charge low fees for trading forex instruments

- They do not charge any non-trading fees

- Their customer support is excellent

FP Markets Cons

- They are not regulated by the FCA

- Their product portfolio is very limited, with the exception of stock CFDs

#6 FXTM – Best ECN broker with Copy Trading platform

FXTM is an FCA regulated ECN broker which can be chosen to trade various CFDs with a low minimum deposit of GBP 10.

Regulation: Exinity Limited is the legal entity of the trading name FXTM that is regulated by the Financial Conduct Authority of the UK under license number 777911. FXTM is also regulated by the top-tier FSCA of South Africa under license number 46614 with the legal entity ForexTime Limited.

Fees: FXTM charges higher spreads compared to the average of spreads at other forex ECN brokers in the UK. The spreads with the Standard non-commission account start from 1.5 pips. However, the average typical spread for EUR/USD at FXTM is 2 pips.

The commission-based Advantage account type allows trading with spreads as low as 0.1 pips but at the expense of variable commission. The trading commission at FXTM with the Advantage account ranges from $0.4 to $2 for a single side based on the trading volume.

Trading Conditions: Deposits are free with all the accepted methods but withdrawals through credit/debit card will incur a commission of GBP 2 for each withdrawal.

FXTM allows trading with GBP as a base currency with MT4 as well as MT5 trading platforms. Clients can trade up to 1200 CFD instruments including 57 currency pairs at FXTM.

FXTM Pros

- Multiple trading accounts available with different pricing structure

- Regulated by FCA and FSCA

- GBP available as base currency

- Multiple trading platforms supported

FXTM Cons

- The spreads with the Standard account is slightly higher

- Their product portfolio is comparatively lower

How to Verify a True ECN Broker?

An ECN (electronic communication network) broker is different from a market-making broker. ECN brokers directly connect buyers and sellers in the market through third-party liquidity providers. However, in contrast, market-making brokers usually take the opposite side in trading themselves.

An ECN broker will not have a dealing desk, while a market-making broker will operate through a dealing desk. A dealing desk is a system through which the broker takes the opposite side of a trade themself or passes on the trade to a market maker.

The problem with market-making brokers is that they create a conflict of interest between themselves and their traders. They also charge wider spreads, when compared to ECN brokers.

There are several ways in which you can identify if a broker is an ECN broker or a market-maker.

You can contact their customer support team and ask them if they have a dealing desk. If they have a dealing desk, then they are a market-maker. If they do not have a dealing desk, then they are an ECN broker.

There are some brokers that provide both ECN and market-making services. In such cases, the broker’s website will usually provide the required information and guide you towards the account type which is ECN.

Other ways in which you identify whether a broker is ECN is by reading their client agreement or checking if they have placed restrictions on order placement.

Difference Between ECN, STP, and Market Maker

CFD brokers in the UK allow traders to speculate on the price movements of various financial instruments. However, the order execution techniques can be different. There are three types of trade execution methods used by trading service providers in the UK.

STP or Straight Through Processing method is a trade execution method in which the orders placed by the clients are directly passed on to the liquidity providers. The brokers that use the STP method cannot take the opposite side of the trade and cannot intervene in a trading position opened by the client.

ECN or Electronic Communication Network is an automatic trade execution method in which an electronic trading system is used to automatically process trade orders. In the ECN execution method, there can be multiple liquidity providers and the trade orders are processed through the one that offers the best pricing.

ECN, which stands for Electronic Communication Network, is a trade execution method used in financial markets. It provides direct access to market participants, including individual traders, institutions, and liquidity providers, allowing them to trade with each other without the need for intermediaries like brokers.

Due to the involvement of multiple liquidity providers, the spreads can be lowered. However, the broker can increase the spread to cover the cost of the ECN execution method. Buying and selling can be done through different liquidity providers in the ECN method.

ECN enables traders to access the order books of various participants, such as banks, market makers, and other traders connected to the ECN network. This direct market access provides transparency as traders can see the current bid and ask prices, the depth of the market, and the available liquidity.

Market Makers are the trading service providers in which the entity processes the trade orders themselves. A market maker matches the trade orders placed by the clients and can also take the opposite position of the trade order.

Suppose a trader places a buy order on 1 standard lot of EUR/USD, a market maker can either match this order with another trader that places the sell order on 1 standard lot of EUR/USD. Or, the market maker can take the opposite side of the trade themselves. In this manner, if a trader makes losses, the market maker will earn revenue.

Market makers generally earn their revenue through spreads and commissions but can also make money by taking the opposite positions to the traders. Hence, a market maker earns more revenue than ECN/STP broker in general.

Benefits of Trading with an ECN Broker

- Direct Access: Interact with interbank markets for fair pricing.

- Tighter Spreads: Enjoy reduced trading costs with narrower spreads.

- Price Aggregation: Access best bid and ask prices from various sources.

- No Conflict: No trading against clients, aligning interests.

- Anonymity: Trades routed directly, preserving anonymity.

- Depth of Market: See order book levels for informed decisions.

- High Liquidity: Swift execution, reduced slippage risk.

- Scalping & HFT: Ideal for fast strategies and high-frequency trading.

- Variable Spreads: Benefit from fluctuating spreads.

- Institutional Quality: Transparent platform favored by institutions.

- Advanced Tools: Access advanced tools and technical analysis.

- Custom Orders: Utilize diverse order types for tailored trades.

- Diverse Assets: Trade various instruments beyond forex.

How to Open an Account with an ECN Broker?

Opening an account with an ECN broker is an easy and quick process, usually.

There are certain universal steps that you need to follow in order to get it done as soon as possible. The selection of a broker is the most important step in starting CFD trading.

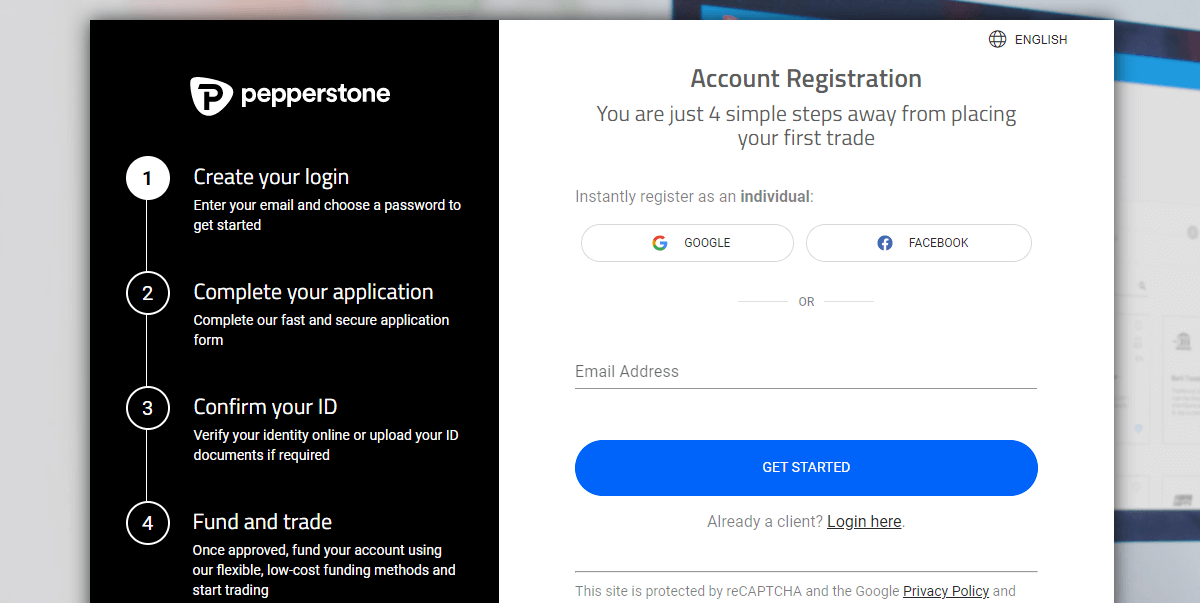

In this section, we’ll take the example of Pepperstone.

Step 1) Check whether the broker is regulated by the FCA: When you access Pepperstone’s UK website, you should read the footer of their homepage. The footer provides details of Pepperstone’s licenses and its authority to operate in the UK.

As you can see, they have provided their license number from the FCA of the UK.

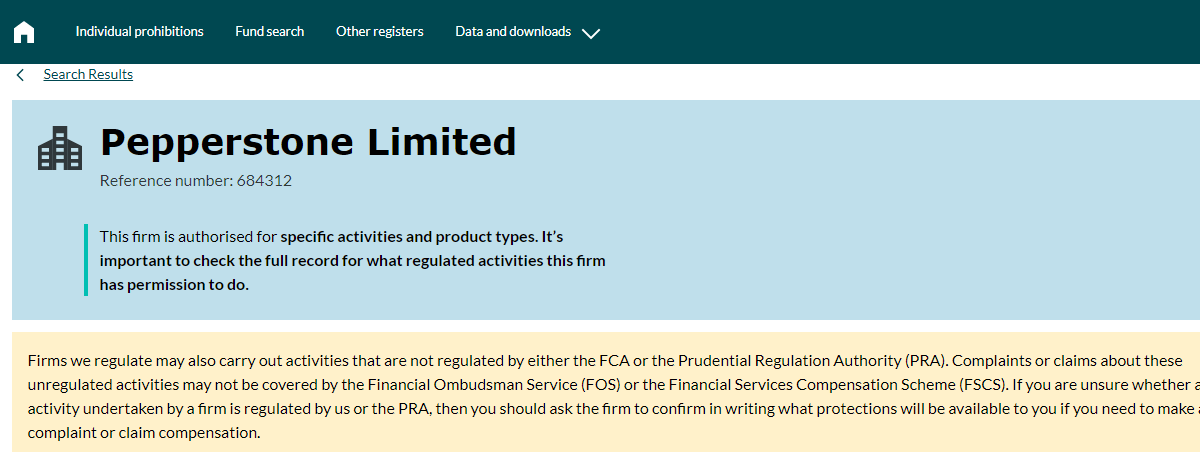

You need to cross-check this license number on the FCA’s website. The FCA’s website will have a register that contains the names and numbers of all entities that are registered with them. All you need to do is enter the license number on their register, and it will show which entity that license number belongs to.

For example, this is what the FCA’s website has to say about Pepperstone.

Hence, you can be sure that Pepperstone is truly registered and licensed by the FCA.

After cross-checking the FCA regulation, traders must also check and compare other attributes of the broker.

ECN brokers used electronic software for trade execution but each ECN broker can charge different fees for trading forex and CFDs. A lower fee is highly advantageous for the traders as each broker incurs different fees for trading forex and CFDs in the UK. Traders must compare the fees of all the available FCA-regulated ECN brokers before opening their accounts.

Apart from this, they must also check the available instruments, supported trading platforms, the quality and availability of customer support services, deposit/withdrawals conditions and available methods. To have the best trading experience, it is important to choose the most suitable broker out of all available brokers.

Step 2) Once you’ve verified whether the broker is licensed by the FCA, the next step is to start the account opening process: There are four steps to doing this, which have been detailed in the screenshot below, as available on Pepperstone’s website.

Step 3) The most time-consuming step is to verify your identity: You should be able to complete this process online. You may need to upload certain government-issued IDs before you can start trading.

Step 4) The final step is to deposit money into your account: Once you’re done, you can download their trading platform and start trading!

Before opening an account with a broker, traders must also ensure several other factors apart from regulation.

The fees incurred by traders is a revenue for the brokers. Most traders select a broker only on the basis of spread as a lower spread means higher profits and lesser losses for the traders. However, brokers can earn revenues from traders in multiple ways.

The spreads do not depict whether the broker is a market maker or STP or ECN broker. It is quite possible that an ECN broker has a lower spread than a market maker or vice versa. In general, market makers charge narrower spreads as they can also earn revenue by taking the other side of the position opened by traders. Thus making revenues on losses booked by the traders.

Brokers and market makers also incur fees from traders through multiple methods like commission, overnight (swap) fee, account opening/maintenance, deposit/withdrawal, inactivity, currency conversion and other fees. Traders must completely enquire about fees and compare them with other brokers before opening their accounts.

Comparison Between STP Broker and Market Maker

The following table compares STP brokers with market makers on various aspects:

| Feature | ECN Brokers | Market Makers |

|---|---|---|

| Execution | Direct market access, trades are executed directly in the market without dealer intervention. | Trades are often executed internally; market makers may take the opposite side of your trade. |

| Pricing | Prices come directly from liquidity providers, can be more variable. | Prices are set by the market maker, can include a markup. |

| Spreads | Variable spreads based on market conditions. Can be very tight, but may widen significantly during volatility. | Fixed or variable spreads, usually wider than raw spreads but more stable, even during market volatility. |

| Commissions | Typically charge a fixed commission per trade on top of spreads. | Usually do not charge a direct commission; profit from the spread and by taking the other side of the trade. |

| Liquidity Providers | Access to a pool of multiple liquidity providers which can include banks, funds, and other traders. | Acts as the sole liquidity provider for their clients’ trades. |

| Anonymity | Offers trader anonymity, which can be beneficial for traders using certain strategies. | No trader anonymity; the market maker knows your positions and trading intentions. |

| Conflict of Interest | Lower potential for conflict of interest as ECN brokers do not trade against their clients. | Higher potential for conflict of interest as market makers may take the opposite side of client trades. |

| Trading Style and Size | Suitable for all trading styles, including scalping and high-frequency trading. No restrictions on trade size. | May have restrictions on trading styles, such as scalping, and may impose minimum/maximum trade size limits. |

| Market Access | Direct access to interbank market rates. | Access is through the market maker’s own system, which may not reflect the broader market exactly. |

| Transparency | High transparency as the order book is visible, showing available liquidity and market depth. | Lower transparency since pricing and execution is controlled by the market maker. |

Fees Charged by ECN Brokers

Each broker can charge different fees for trading on the same CFD instrument or forex pair. It cannot be generalised whether an ECN broker charges more or lesser fee than STP and market maker. An ECN broker may incur fees in the form of trading commission or spread.

In the ECN trade execution method, multiple liquidity providers are involved and the trade gets executed through the liquidity provider that offers the best pricing. Buying and selling can be done with different liquidity providers to get the least spread on the trade. Hence, the spreads can be very low with ECN execution methods. However, the broker can increase the spreads on the ECN model to earn revenues or can charge a commission to low spreads in the ECN execution method.

It cannot be said that ECN brokers charge low fees compared to market makers or STP brokers. However, spreads as low as 0 pips can be offered by ECN brokers at the expense of the trading commissions charged by brokers. Such a fee structure can be highly beneficial for large-volume traders and scalpers.

Comparison of Best CFD Brokers UK

| Broker Name | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| Pepperstone |

0.69

|

$200

|

1:30

|

Visit Broker |

| IC Markets |

1 pip

|

$200

|

1:30

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:30

|

Visit Broker |

| FxPro |

1.2 pips

|

$100

|

1:30

|

Visit Broker |

| FP Markets |

0.7 pips

|

$100

|

1:30

|

Visit Broker |

| FXTM |

1.8 pips

|

$10

|

1:30

|

Visit Broker |

FAQs on Best ECN Brokers UK

What are the Advantages of an ECN Broker?

Yes, ECN brokers are the preferred choice for many traders. This is because they charge lower fees and the broker does not have a conflict of interest with the trader.

How do I Know if a Broker is an ECN Broker?

You should ask their customer support team or seek reviews from experts. Usually, if a broker doesn’t have a dealing desk, then it is an ECN broker. A market maker might try not to disclose their execution method if they have a dealing desk.

Are there true ECN brokers?

Yes, there are many forex and CFD brokers in the UK that are 100% ECN or STP. However, only a few ECN brokers are regulated by FCA in the UK. Pepperstone, FXTM, etc are among the few ECN brokers with FCA regulation.

How do ECN brokers make money?

ECN brokers do not have a dealing desk and they cannot make money on the losses of traders. ECN brokers make money solely through spreads and commissions incurred on each trade order. Since multiple liquidity providers are involved, the spreads are low but the broker can increase the spread to cover their revenues.

Which is the Best ECN broker?

According to our analysis and comparison, Pepperstone is the best ECN broker in the UK as it does not have a dealing desk and incurs a low spread with the availability of multiple trading platforms and excellent customer support.

Which broker offers ECN?

Several FCA-regulated brokers in the UK use Electronic Communication Network (ECN) method for trade execution. Pepperstone, IC Markets, FXCM, FxPro, FP Markets, etc are among the best brokers in the UK that use the ECN method for trade execution.

Is ECN broker good?

Yes, ECN brokers do not make money on the losses made by traders on their trading platform. There is less probability that an ECN broker acts in self-interest to scam the traders. A market maker is very likely to indulge in activities of self-interest.

Is ECN better than market maker?

For traders, ECN is a better option as ECN brokers do not have a dealing desk while the market makers have a dealing desk. In other words, a market maker can take another side of the trade and make profits on the losses incurred by traders. An ECN broker will earn money through spread regardless of the profits or losses booked by traders.

Is ECN good for scalping?

Yes, ECN method of trade execution is ideal for scalping as no dealing desk is involved in ECN method. Ideally, ECN is the best method for scalper as the trade execution time is low and less chance of slippage in Scalping.

Which is better ECN or STP?

In ECN trade orders are matched through an electronic network while in STP, the orders are passed on to the liquidity providers. The ECN and STP methods are almost similar methods of trade execution but have minor differences. The ECN method allows faster execution of trades compared to the STP method. However, the ECN method would generally be more expensive compared to the STP method but depends on the broker.

How to check if the ECN Broker is Regulated?

You should ask the broker for their Reference number, and then verify it on FCA’s public Register. Also, make sure to check the authorized website of the broker from FCA’s register, as it is possible that you are signing up under a fake/closed website if you are not careful.