Best Forex Brokers in Nigeria 2024

Forex trading is very popular in Nigeria & there is currently an estimated over 300,000 retail forex traders in Nigeria.

If you are looking to trade forex, the first thing to know is that you need a broker. Forex brokers allow you to buy and sell foreign currencies via online trading platforms.

Forex trading is currently not regulated in Nigeria. Trading with unregulated brokers is risky. You might lose your funds or fall victim to fraud.

Comparison of Best Forex Brokers Nigeria

| Broker Name | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| HF Markets |

1.3 pips

|

$5

|

1:1000

|

Visit Broker |

| FXTM |

1.9 pip

|

₦10,000

|

1:2000

|

Visit Broker |

| XM |

0.8 pips

|

$5

|

1:888

|

Visit Broker |

| OctaFX |

0.7 pips

|

$25

|

1:500

|

Visit Broker |

| FBS |

1 pips

|

$1

|

1:3000

|

Visit Broker |

| Exness |

1 pips

|

$10

|

1:2000

|

Visit Broker |

| AvaTrade |

0.9 pips

|

$100

|

1:500

|

Visit Broker |

| IC Markets |

0.62 pips

|

$200

|

1:500

|

Visit Broker |

These are the 8 Best Forex Brokers in Nigeria as per our Reviews for 2023

- HF Markets – Best Forex Broker in Nigeria with Local Deposit & Withdrawals

- FXTM – Well Regulated Forex Broker

- XM Trading – Low spread Forex Broker with Ultra Low Account

- OctaFX – STP Broker with very low spread

- FBS – Top-tier Regulated Forex Broker

- Exness – Good Forex Broker with low fees

- AvaTrade – Forex Broker with Proprietary Trading Platform

- IC Markets – ECN Account Forex Broker with Low Fees

Since there are no locally regulated forex brokers in Nigeria, you must only trade through brokers that are licensed by Top-tier regulators Your broker should be licensed with top-tier regulatory bodies such as FCA, FSCA, CySEC, and ASIC.

Few things to consider before choosing your broker include low spread, availability of naira-based payment/withdrawal method, range of instruments from currency pairs to CFDs on commodities like gold, stock market indices, good customer support service, at least a decade of experience in the market & licensed with top tier regulatory bodies.

We considered all these factors & more for this review.

Best Forex Brokers in Nigeria

Here are the Best Forex Brokers for traders in Nigeria.

#1 HF Markets – Best Overall Forex Broker in Nigeria with Local Deposit & Withdrawals

HF Markets Group is regulated under the FCA (UK), FSCA (South Africa), and CySEC (Cyprus).

Safety: HF Markets, previously known as HotForex is a multi regulated forex broker, and since these are Tier-1 & Tier-2 regulators, so it is considered safe to trade with them for Nigerian clients.

Fees: HF Markets has seven different accounts with different features. The typical spread for GBPUSD for HotForex is 1.7. Spread begins from 1 pip on the Premium account with no commission fee.

On a zero account, however, the spreads are tighter and there is a commission fee of $6 for every standard lot traded for Majors, but the commission is higher at $8/lot for other currency pairs. This fees is for Roundturn trade.

Trading conditions: You can trade 53 currency pairs (major, minor, and exotic) on popular trading platforms (MT4 and MT5). You can also trade CFDs on metals like Gold, and commodities on their platforms.

The deposit & withdrawals are convenient for traders in Nigeria. With your MasterCard, you can open a Naira, dollar, or euro account.

The minimum deposit is $5 to open a micro account. There are No extra charges for deposit or withdrawal. Negative balance protection is available for traders in Nigeria.

Support: HotForex’s customer support is readily available. They have an email you can send your complaints and a local Nigerian number you can call. You also get a personal account manager from HF Markets to help you. According to our test, live chat seems to be the quickest way to get a response from HotForex. We experienced a holding time of 10mins before our mails were responded to.

Pros of Trading with HF Markets

- They have local customer support & Phone No. in Nigeria.

- Low Minimum deposit of $5.

- HF Markets Group are multi regulated forex broker

- You can open an Islamic trading account.

- Range of CFD instruments are available on their platform

- MT4 and MT5 trading platforms are available.

Cons of Trading with HF Markets

- Your demo account may be closed if there not enough trading activities on it.

#2 FXTM – Good ECN Broker and well Regulated

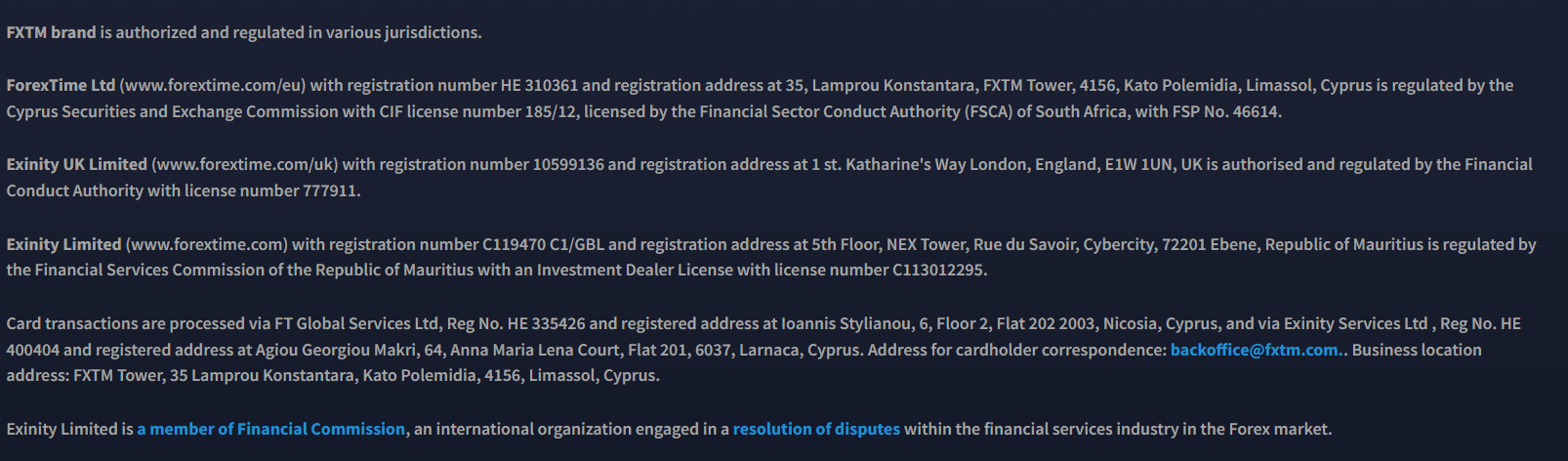

FXTM is regulated with CySEC, FSCA & offer a naira trading account for Nigerian Traders.

Safety: FXTM Broker is regulated with multiple Tier-1 & Tier-2 Regulations- CySEC, FCA, and FSCA. So, they are considered a low risk forex broker for Nigeria.

Fees: Typical and minimum spread for trading EURUSD is 1.9 on the standard (micro) account and no commission is charged. The Advantage (ECN) account offers a 0.0 spread and the commission is more competitive. The Advantage (ECN) MT5 account has a fixed commission of $4 per lot. On the Advantage (ECN) MT4, you get a floating commission that reduces with more equity and trading volume.

Trading Conditions: FXTM offers 60+ currency pairs, CFDs, and stocks. You will also be able to trade metals, FX indices, spot metals, and commodities. Your access to these commodities depends on the type of account you open.

Execution is instant on standard accounts while they offer market execution on all ECN accounts. You can leverage up to 1:2000 and deposit your funds locally without any commission. Withdrawals are without commissions too. Your minimum deposit is ₦10,000 for standard accounts. A minimum of ₦80,000 is required of you for an ECN account. Finally, there is room for flexible trading styles. You can scalp, hedge, or use an expert advisor.

Support: You can find their Nigerian office address on their website. In addition, there are three local Nigerian phone numbers for you to call.

They have separate emails for various inquiries and complaints. You can also chat with them on WhatsApp.

We used their live chat feature and discovered that it is automated to answer FAQs. If these pre-programmed answers do not satisfy you, you are connected to a live agent. Responses from the live agent were quick. It took us up to 30 mins to get a response via email.

Pros of Trading with FXTM

- Your account is verified quickly, typically done within 48 hours.

- FXTM is regulated.

- You can trade a range of instruments based on your account type

- You can improve your trading skills with their educational tools.

- MT4 and MT5 trading platforms are available

Cons of Trading with FXTM

- The spread is high for some currency pairs

- You are charged for inactivity on your trading account

#3 XM Trading – Low Spread Broker

Nigerian Traders can open trading account at XM with $5.

Regulations: XM Trading has a license under IFSC, Belize. XM Group is also licensed with CySEC (Licence Number: 120/10) and ASIC, but we could not confirm this information on their website.

According to an email we received from them, XM Trading is licensed under the IFSC alone. Traders from Nigeria are registered under IFSC.

XM is considered a medium-risk forex broker.

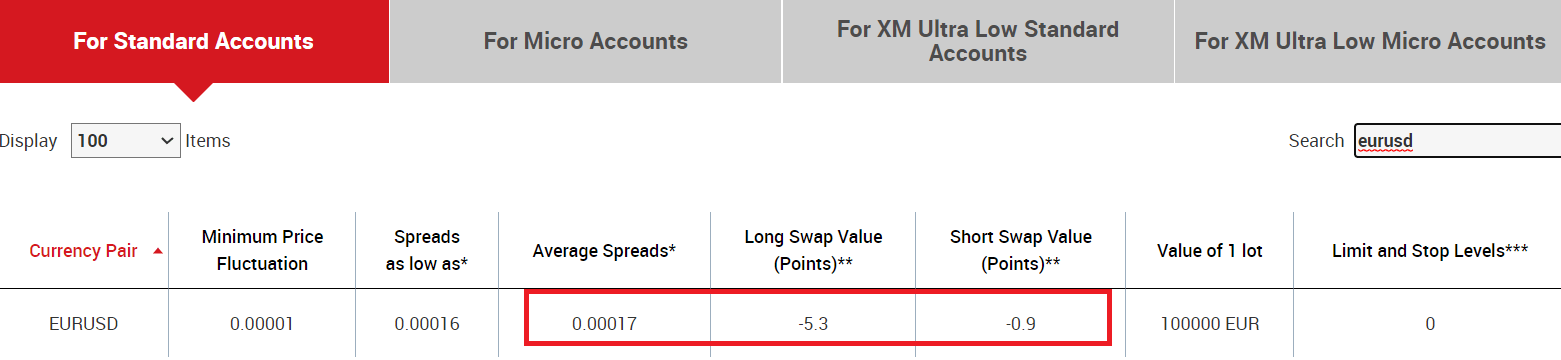

Fees: XM Trading charges you solely the spread, you do not incur extra costs per lot that you trade. XM Trading offers you four different account types __ standard, micro, XM Ultra-low standard, and XM Ultra low micro accounts. Average spreads for this account for EUR/USD instrument are 1.7 pips (standard and micro), and 0.8 (XM Ultra low standard and XM Ultra low micro).

Trading Conditions: XM Trading charges you solely the spread, you do not incur extra costs per lot that you trade. XM Trading offers you four different account types __ standard, micro, XM Ultra-low standard, and XM Ultra low micro accounts. Average spreads for this account for EUR/USD instrument are 1.7 pips (standard and micro), and 0.8 (XM Ultra low standard and XM Ultra low micro).

Support: They have an FAQ section with ready-made answers. If this is not enough, you can contact them via the email address on their website.

There is no local phone number or address. It took over an hour to get a response from them via email. The chat support is available 24/5 & we received quick answers to our questions.

Pros of Trading with XM Trading

- Low spreads with Ultra Low account

- They cover for your transaction fees during funding & withdrawals.

- Hedging is allowed

- They offer negative balance protection

- 24/5 customer support in multiple languages.

- MT4 and MT5 trading platforms are available.

Cons of Trading with XM Trading

- Crypto CFDs are not available

- There might be conversion charges from naira to USD (or your account’s base curreny)

- Demo account cannot be inactive for 30 days.

- Email response might be slow.

- There is no tier-1 regulation.

#4 OctaFX – STP Broker with very low spread

OctaFX offer very low spread with no commission.

Regulations: According to their website, the SvGFSA regulates them. There is no tier-1 regulation listed on their website.

But OctaFX Group is also licensed with CySEC in Europe under Licence Number: 372/18.

Fees: OctaFX have two account offers – OctaFX MT4 and OctaFX MT5 accounts. The MT4 account has a typical spread of 0.7 for EURUSD. You pay a swap/commission fee of $0.65 if you are selling and $1.03 when buying. On the MT5 account, you also get a low 0.7 typical spread without paying a commission.

Trading conditions: You get to trade 35 currency pairs if you choose OctaFX as your broker. This is very low in comparison to other CFD brokers. For CFDs on indices, you have access to 9 and 15 of them on the MT4 and MT5 accounts respectively. 5 commodities and 5 cryptocurrencies are also available. These assets have different leverages, spreads, and commissions attached to them.

There is an Islamic account if you want to open one. You incur no charges when you deposit or withdraw your funds. They also provided you with a flexible deposit and withdrawal system. You can pay via your local banks, cryptocurrencies, and alternative platforms like Skrill and Neteller. You can use expert advisors, scalp, and hedge your positions,

Support: There is no local address or phone number here. You can contact OctaFX via the live chat feature on their website. The good thing is they are available 24/7 so you can contact them anytime.

There is also a customized email section. You can reach out to specific departments in this section. We tried out this email section by filling out the form but we did not get any response quickly.

You will get a quicker response if you use their customer support email directly instead of filling the contact form on their website. They typically respond within a few hours. We also found that OctaFX gives a quick response when you chat with their live agent.

Pros of Trading with OctaFx

- You can trade CFDs on cryptocurrencies

- There is Islamic account

- Flexible deposit/withdrawal channels

- There is customer support on weekends

- Negative balance protection

- No commission for deposit/withdrawals

Cons of Trading with OctaFx

- Floating spreads, and there are no Fixed Spread trading accounts.

- There is no tier-1 regulation except for CySEC.

- You need a minimum of $20 to open an account.

- Their assets are limited compared to other brokers.

- There is no local address or mobile contact

#5 FBS – Top-tier Regulated Forex Broker

FBS is regulated with CySEC and offer personal trading assistance with their trading application.

Regulations: According to their website, FBS are licensed with IFSC in Belize. We also confirmed this via our chat with them.

FBS Group has recently been regulated with tier-1 & Tier-2 regulated bodies ASIC & FSCA.

Fees: There are 6 account offers you can choose from with FBS. They’ve got the standard, cent, micro, ECN, Zero Spread, and Crypto accounts. For some reason, FBS charges high commissions on their trade. Their typical EURUSD spread for their standard account i`s 8 pips.

On the Zero spread account, you pay a $6.37 swap for every standard lot of EURUSD purchased, $0.69 swap for every standard lot sold. You also pay an extra commission of $20. On the ECN account, you only pay the swap fees with a minimal spread of -0.1 pips.

Trading conditions: There is a range of instruments for you on FBS. 35 currency pairs, 4 metals, 11 indices, 4 energies, and 66 stocks are all yours to trade. An MT4 account gives you access to some of these assets. However, you can access all of them on an MT5 account. Their crypto account is top-notch. You get to trade over 100 Coin instruments with diverse pairings. There is a cent account that you can open with a minimum of $1 and you can leverage up to 1:3000. You are also allowed to use an expert advisor and any trading strategy.

Support: FBS offers 24/7 customer support. Their live chat only answers FAQs. The answers there are pre-programmed with no connection to a live agent. If you desire to speak with their live agent, you can do that via WhatsApp. Responses are quicker there. The email section on their website did not respond when we tried it.

Pros of Trading with FBS

- You can trade up to 100 crypto instruments

- There is customer service on weekends

- You can open an account with $1

- There are educational tools on their website

- FBS has 66 stocks.

Cons OF Trading with FBS

- Limited number of currency pairs

- High commission of $20

- Some assets are not accessible on MT4

- There is no tier-1 regulation.

#6 Exness – Good Forex Broker with low fees

Exness offer multiple account types with different pricing structure and trading conditions

Regulations: Exness is top regulated brokers in Nigeria. Exness is regulated by FSCA in South Africa (51024), FCA in the UK (730729), and CySEC in the EU (178/12). Nigerian clients at Exness are registered under the regulation of the Financial Services Authority (FSA) of Seychelles (SD025).

Multiple top-tier regulations make Exness safe for Nigerian traders.

Fees: Exness allows traders to choose from 5 different account types. The Standard and cent version of the Standard account does not require a minimum deposit. The 3 professional accounts namely Raw Spread, Zero, and Pro account require a minimum deposit of $500.

The Standard account is the spread-only account where the average spread for EUR/USD is 1 pip. The same with the Raw Spread and Zero account type is as low as 0. The Raw Spread account has a fixed commission of $3.5 for a single side trade of a standard lot. The trading commission is variable with the Zero account type.

The best pricing at Exness is with the Pro account where the average EUR/USD spread is 0.6 pips with no trading commission.

Trading conditions: Apart from the Standard cent account, all other account types can be opened with NGN as the base currency. Exness also accepts local bank deposits from Nigeria. No currency conversion fee will be applicable if base account currency and deposit currency are the same.

With each account type, clients get to trade with 107 currency pairs, and 150+ CFDs on indices, commodities, cryptocurrencies, energies, and stocks. The maximum leverage for Nigerian clients is 1:2000.

Support: Exness offers an excellent customer support service that is active 24*7. Clients can reach out to support executives through live chat, email, and phone support. Their FAQ section briefly covers most of the common queries raised by the clients.

Exness is a well-regulated CFD broker with low fees, local bank deposit/withdrawal, multiple account types, and 107 currency pairs to trade.

Pros of Trading with Exness

- You can trade 107 currency pairs at Exness

- Local bank transfer available in Nigeria

- NGN is available as base account currency

- There is customer support on weekends

- Low minimum deposit of $10

- No commission for deposit/withdrawals

Cons of Trading with Exness

- Floating spreads, and there are no Fixed Spread trading accounts.

- No deposit or promotion bonus exist

- Lesser research and education tools compared to other brokers

- Assets other than forex pairs are limited compared to other brokers.

#7 AvaTrade – Forex Broker with Proprietary Trading Platform

AvaTrade is a top-tier regulated CFD broker with attractive pricing and multiple trading platforms

Regulations: AvaTrade is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa (45984), ASIC of Australia (406684), and CySec of the European Union (347/17).

Hence, AvaTrade can be considered less risky for trading in Nigeria. The Nigerian clients at AvaTrade are registered under the regulation of the B.V.I Financial Services Commission under entity name Ava Trade Markets Ltd.

Fees: There is no choice for account types at AvaTrade. The pricing structure and trading conditions are the same for all the clients in South Africa. The average spread for EUR/USD is 0.9 pips and no trading commission of any sort is incurred from the traders.

However, there is a high inactivity fee of $50 (monthly) if no trades are executed for 3 months. This can go up to $100 if no trades are executed for 12 consecutive months.

Trading conditions: AvaTrade offers multiple trading platforms including MT4, MT5, and their proprietary trading platform AvaTradeGo. Clients can trade with more than 700 instruments including 55 currency pairs, 25 commodities, and 20 cryptocurrencies.

Support: The customer support services at AvaTrade is excellent as the live chat, email, as well as local phone support in Nigeria is available 24/5. The support staff is resourceful and user-friendly.

Pros of Trading with Exness

- You can trade 700+ instruments at AvaTrade

- Local bank transfer available in Nigeria

- Local phone support is available 24/5 in Nigeria

- Multiple trading platforms available

- No commission for deposit/withdrawals

Cons of Trading with Exness

- Commission based trading accounts are not available

- No deposit or promotion bonus exist

- Lesser research and education tools compared to other brokers

- NGN cannot be chosen as base currency of the account

#8 IC Markets – Best ECN Forex Broker with Multiple Platforms

IC Markets us an Austraia based CFD broker that allows trading on multiple trading platforms at low cost

Regulation: IC Markets has better safety ratings than many other CFD brokers in Nigeria. IC Markets is regulated by ASIC in Australia, and CySEC in the European Union. However, Nigerian clients at IC Markets are registered under the regulation of the Financial Services Authority (FSA) of Seychelles.

Fees: IC Markets offers two types of accounts with different pricing structures. The Standard account involves spread as the only trading fee starting from 0.62 pips with no trading commission. The commission-based account incurs a commission of $3 and $3.5 with the cTrader and MetaTrader accounts respectively with spreads as low as 0.1 pips.

Trading Condition: IC Markets allow trading through MT4, MT5, and cTrader trading platforms. All three trading platforms can be used to trade on more than 2000 instruments including 61 currency pairs. The maximum leverage at IC Markets is 1:500 on forex pairs.

IC Markets offer excellent customer support services and accepts multiple methods for deposits and withdrawal without any commission.

IC Markets Pros

- IC Markets is regulated by top-tier ASIC of Australia

- MT4, MT5, as well as cTrader trading platform available

- Local phone support available in Nigeria

- Spreads at IC Markets are lower than average

- 2000+ CFD instruments available

IC Markets Cons

- High trading commission on commission based account

- NGN is not available as base currency

How to Choose the Best Forex Broker

1) Regulation: The CBN, so far, has left forex trading unregulated in Nigeria. This means that there are currently no forex brokers regulated by the CBN or the SEC.

Trading with an unregulated broker puts you at the risk of forex scams. That is why, at least one global tier 1 regulator such as ASIC, CySEC, FSCA, and FCA should regulate your broker. This should be your minimum consideration for the safety of your funds.

You can find your broker’s regulatory information at the bottom of their website. You will also find their registration number there.

For example, FXTM (ForexTime) is a multi-regulated forex broker that is licensed with FCA, CySEC & FSCA. They mention all their regulations on their website on the footer section of all the pages.

But it is important to note that traders/clients based in Nigeria are registered under their Offshore regulation which is Financial Services Commission (FSC) in Mauritius under the company name “Exinity Limited”. This is a practice followed by most of the regulated brokers including HotForex, FXTM, OctaFX, IC Markets, etc.

All these brokers register their Nigerian clients under offshore regulations. But since these brokers are well regulated in multiple jurisdictions, it is relatively low risk for traders as opposed to forex brokers that are no regulated with any Top-tier regulation, and are only regulated with Offshore regulations.

Since you cannot be too careful, we also recommend you to the website of regulators listed on your broker’s website. You can confirm their license number there.

Once you have found the license no. you should verify it from the regulator’s website to ensure that the license no. is valid.

2) Overall Fees: Trading forex is not about your profit and loss only. Different brokers have charges that you pay. You should find out these charges and calculate them before choosing your broker.

These fees usually include spreads, swaps, commissions, currency conversion charges, and deposit/withdrawal charges.

You have the option of either paying variable spreads or fixed spreads. Variable spreads means that the spread that you need to pay will be different each time you trade. The variable spread will depend on the timing of your trade, the instrument that you’re trading, and various market conditions such as liquidity and volume. Usually, forex traders prefer to pay a variable spread rather than a fixed spread. This is because, over time, fixed spreads cost more than variable spreads.

However, the advantage of a fixed spread is that you’re paying the same amount every time. So, you know exactly how much the cost of your trading efforts are going to be. There are some brokers which offer fixed spreads through certain account types. Most brokers prefer offering variable spreads.

If you want to trade major pairs like EUR/USD, then you should check the spread, commissions, and Swap Fees for this instrument. In general, all forex brokers transparently display their typical spread, commissions, and swap fees on their instrument specifications page.

As an example, you can see that the typical spread for EUR/USD at XM with a Standard account is 1.7 pips, and the Swap rates are also very high. There is no extra commission though.

You must also check if there are any other charges involved which could be related to inactivity, withdrawal fees etc.

3) Available Trading Platforms: MT4 and MT5 are the most popular trading platforms. Your ideal broker must have the two. These platforms must also be available across different devices and operating systems. They should work well on mobile phones, laptops, Mac, and Android.

In addition, your broker’s platform must be solid. Offering you different kinds of orders, speedy execution, and the economic calendar is very important. To put it simply, the platform must give you a comfortable trading experience.

4) Ease of Registration: You will be required to upload your ID and proof of address for registration. Uploading these documents should be easy. A good broker verifies these documents within 48 hours.

5) Support: Good brokers 24/5 support. A few of them have it 24/7. There should be an email address and live chat channels on their website. If there is a local number on their website, it is even better. A local number on their website will begin with +234.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

The following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. High leverage increases the amount of loss that the traders may face and involve high leverage increases the leverage risk.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on opened positions.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with them if it is fake. This risk can be mitigated by choosing an FCA-regulated broker in the UK. Clients registered under FCA are protected by up to GBP 85,000 in case of an unsettled dispute between broker and client.

Tips to Become a Successful Forex Trader

Educate: Learn the basics of forex trading.

Reliable Broker: Choose a regulated broker with good support.

Risk Management: Set stop-loss, take-profit, and manage risk.

Demo Account: Practice on a demo account before real trading.

Plan: Develop a clear trading plan and stick to it.

Major Pairs: Begin with major currency pairs.

Stay Informed: Follow global economic news.

Analysis: Use technical and fundamental analysis.

Emotions: Control emotions to avoid impulsive decisions.

Patience: Success takes time; avoid quick gains.

Consistency: Stick to a proven strategy.

Records: Maintain a trading journal.

Diversify: Consider diversifying beyond forex.

Common Mistakes To Avoid While Trading Forex

Inadequate Education: Trading without a good understanding of how forex works can lead to big losses.

Using Too Much Leverage: Being too ambitious with borrowed money can make losses much worse.

Neglecting Risk Management: Not protecting your investments with tools like stop-loss orders can be very risky.

Letting Emotions Control You: Making decisions based on fear or greed can lead to impulsive and bad choices.

No Trading Plan: Trading without a clear plan is like sailing without a map.

Skipping Analysis: Not analyzing the market properly can result in poor decisions.

Trading Too Often: Trading too much can increase costs and risk.

Ignoring News: Not keeping up with the news can lead to surprises in the market.

Revenge Trading: Trying to win back losses with impulsive trades can make things worse.

Choosing the Wrong Broker: Picking a bad broker can cause problems with executing trades and getting your money back.

Overconfidence: Overestimating your skills can lead to riskier decisions.

Lack of Patience: Expecting quick profits and not waiting for good opportunities can lead to losses.

FAQs on Forex Brokers in Nigeria

What is a forex broker?

A forex broker allows traders to trade CFDs on currencies & other trading instruments. To trade forex online, you need to open a trading account with a broker that offers forex trading. The forex broker will charge a fee for every trade that you enter.

Which Forex Broker has the lowest fees in Nigeria?

HotForex & Exness have the lowest overall fees as per our research. Their typical spreads with Premium & Standard accounts respectively are lower compared to the typical spreads with similar accounts at other forex brokers.

Who is the best broker in Forex?

HF Markets, Exness, IC Markets, AvaTrade and many other brokers can be considered best for trading forex in Nigeria. The suitability of each broker is different for each trader. Hence, traders must seek the best suited broker for themselves.

Which forex broker is best for beginners?

HF Markets, FXTM, IC Markets, and AvaTrade can be considered ideal for beginners. Newcomers in the forex market should look for brokers requiring less minimum deposit, low fees, a user-friendly platform, and top-tier regulation.

Which broker is the best in MT4?

HF Markets, Exness, IC Market, and FXTM is among the best brokers with MT4 trading platforms in Nigeria. The majority of the forex and CFD brokers in Nigeria offer to trade through the MetaTrader 4 trading platform.

How do I choose a forex broker?

Before choosing a forex broker in Nigeria, it is most important to check the regulatory authorities that have authorised the broker. After that, traders can compare the fees, trading platforms, available instruments, and customer support services to choose the best broker for themselves.

Which forex broker is best in Nigeria?

HF Markets, IC Market, Exness, and FXTM are among the best forex brokers in Nigeria. There are plenty of brokers in Nigeria that can be chosen to trade forex and CFD in Nigeria. Traders must choose the most suitable broker after comparing regulations, fees, trading platforms, available instruments, customer support and other aspects.

Who is the most trusted forex broker?

Forex trading is not yet regulated in Nigeria. All forex brokers accepting clients from Nigeria are offshore regulated. However, a broker that is regulated by top-tier authorities like FCA, FSCA, and ASIC can be considered more trustworthy.

Can I start forex with 5000 Naira?

Yes, Each broker has different requirement for minimum deposit amount to start forex trading. Their are forex brokers in Nigeria that allow trading with a deposit of even lesser than NGN 5000. Clients can start trading forex with as low as 1$ deposit amount.

Which forex brokers are regulated in Nigeria?

Currently there are no forex brokers regulated in Nigeria. All forex brokers that accept traders in Nigeria are foreign forex brokers. You must ensure that the broker that you are choosing is licensed with at least one Top-tier regulator like FCA, ASIC etc.