Forex Trading in Nigeria

Forex Trading is not regulated in Nigeria. If you are looking to trade forex then it is important to understand the risks & only trade via Tier-1 regulated brokers. We explain everything in this guide.

Forex trading is not regulated by any regulatory authority within the jurisdiction of Nigeria. Nigerian clients are registered under offshore regulations. However, you can trade forex via forex brokers that are licensed with multiple top-tier regulators such as the ASIC of Australia or the FCA of the UK.

6 Steps to Start Forex Trading in Nigeria

- Learn the basics of Forex Trading

- Understand how the Forex Market works

- Open an Account with licensed Forex Broker

- Understand Forex Trading with an Example

- Best Forex Trading Platforms for Nigerian Traders

- Understand the Risks of Forex Trading

- Pros and Cons of Forex Trading

- What are the Costs of Forex Trading?

Summary Table of Best Forex Brokers for Beginner traders in Nigeria in 2023

| Broker Name | Highlights | Trading Fees (Benchmark EUR/USD Standard Accounts) | Account Minimum | Max. Leverage | Learn More |

|---|---|---|---|---|---|

|

HotForex is a well regulated forex broker licensed with FCA, FSCA & CySEC. |

Commissions

Minimum spread of 0.1 pips

with Zero Account (plus $7 commission per lot) |

Account Minimum

$5

|

Max. Leverage

1:1000 for forex

|

Open Account

on HotForex |

|

|

FXTM is a well regulated forex broker licensed with FCA, FSCA & CySEC. |

Commissions

Minimum spread of 1.9 pips

with Standard Account |

Account Minimum

₦10,000

|

Max. Leverage

1:2000 for forex

|

Open Account

on FXTM |

|

|

XM Trading is regulated by CySEC and IFSC of Belize. |

Commissions

Minimum spread of 0.8 pips

with Standard Account |

Account Minimum

$5

|

Max. Leverage

1:888 for forex

|

Open Account

on XM |

|

|

OctaFX is regulated by CySEC and SVGFSA. |

Commissions

Minimum spread of 0.7 pips

with all Accounts |

Account Minimum

$25

|

Max. Leverage

1:500 for forex

|

Open Account

on OctaFX |

|

|

Exness is a well regulated forex broker licensed with FCA, FSCA & CySEC. |

Commissions

Minimum spread of 1 pip

with Standard Account |

Account Minimum

$10

|

Max. Leverage

1:2000 for forex

|

Open Account

on Exness |

|

|

AvaTrade is a well regulated forex broker licensed with ASIC, FSCA & CySEC. |

Commissions

Minimum spread of 0.9 pips

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:400 for forex

|

Open Account

on AvaTrade |

Forex trading is a global market where people trade different currencies. Imagine you have two kinds of money, let’s say dollars and euros. You want to exchange some of your dollars for euros because you think the euro might become more valuable.

So, you go to this big market, and you find someone who wants to trade their euros for your dollars. You agree on a price, make the trade, and now you have euros instead of dollars. If the euro’s value goes up, you can exchange it back for more dollars and make a profit.

But it’s a bit like a game because the values of currencies keep changing all the time. So, you need to be careful and think about when to trade to make money. Forex trading is like playing with money from different countries and trying to win by trading them at the right time.

There are two main advantage to trading forex. The first advantage is that forex brokers provide high levels of leverage. This means that you can trade a very quantity while only investing a fraction of the cost. The leverage can be as high as 1:3000. This means that you can trade $3000 while only using $1 of your own money.

The other advantage is the the forex market is the most liquid market in the world. This means that the trading costs are lower than other types of CFDs. So, you can trade the EUR/USD for a cheaper cost compared to trading gold or a cryptocurrency.

Forex trading, also known as currency trading, refers to the trading of global currencies. While forex trading, traders buy one currency and sell another. Forex trading is done for a variety of reasons such as hedging against currency risk, maintaining forex reserves, and speculating on the price movements for profit.

Forex trading has been gaining in popularity in Nigeria over the last decade. Retail investors are turning towards forex trading in greater numbers due to high liquidity and high leverage in the forex trading market.

Currently, forex trading is not regulated in Nigeria. This does not mean that it is illegal. Nigerian traders can trade forex through international forex brokers.

In this guide, we’ll talk about everything you need to know about forex trading before starting.

Chapter #1

What is Forex Trading?

Here is a brief overview of forex trading.

Understanding the Forex Market and its Participants

The foreign exchange market, or forex market, serves as a global platform for the exchange of currencies at prevailing rates. It facilitates international transactions by necessitating the exchange of different currencies. To ensure a fair trade, currencies are exchanged based on conversion rates, which vary for each currency pair and are influenced by a multitude of economic and geopolitical factors.

Traders engage in the forex market by analyzing these factors to predict the price movements of currency pairs. Leveraging their insights, they place buy or sell orders through margin trading. However, it’s crucial to recognize that forex trading carries a high level of risk, and many beginners face initial losses.

The forex market offers a diverse range of currency pairs, categorized as major, minor, and exotic. The EUR/USD pair is the most heavily traded globally, closely followed by GBP/USD. Trading in any currency pair signifies the exchange of one currency for another, underlining the intricate dynamics of this financial market.

The global forex trading market is open at all hours during weekdays. It is closed during the weekends. This 24/5 activity makes it convenient for traders from all around the world to trade with each other. A forex trader can choose his or her own hours of trading. The spreads generally get wider during the inactive hours but trading can still be done at any time of the day.

People from different time zones interact and make the market active for 24 hours a day. However, the forex market can be divided into four main time zones. These different time zones correspond with the Australian market, the United States market, the European market, and the Japanese market.

There are several participants that contribute to the forex market in different ways. Some of the most major players in the market include the banks (both central and commercial), worldwide governments, large multinational companies, retail investors and traders, investment management firms, brokers and dealers, money-transfer and money-exchange companies, and so on.

For example, as a retail trader, you can use a bank to convert your currency from NGN to USD. There can be different purposes for making the exchange including travel and business needs.

3 ways to trade forex

There are three main ways to trade in foreign exchange: spot, forward, and future.

Spot market

The spot market is also known as the ‘cash market,’ where currencies are bought and sold and delivered on the spot. The price of a currency in the spot market is determined by demand and supply. That means the more the demand for a currency higher the value of that currency.

However, it’s not that simple. Some countries intentionally keep the currency values low to make export cheaper or attract foreign investments. The currency value is calculated on many factors, such as interest rate, market sentiment, political change, and economic news.

The final deal between one party that sells an agreed-upon currency price and the other that buys that agreed-upon exchange rate is known as a ‘spot deal.’ Once you close the position, you receive the specified amount of that currency in cash. Although the spot deal is considered spontaneous, the cash settlement usually takes two days.

Forward market

A private agreement between the two parties to buy a currency at a future date and the pre-agreed price is a forward contract. Let’s take an example to understand how a forward contract works.

Assume that a UK car company wants to secure a contract for a future purchase of spare parts from X, which is located in the US. The UK company signs an agreement with the US company to buy the spare parts after six months.

Both agree for a future exchange rate of 1 GBP = 1.3700 USD, and at the time of the agreement, 1 GBP is equal to USD 1.3700. Now suppose, after six months, the value of one dollar drops to 1.3800. That means the importer will benefit by USD 0.01 per unit of the exchanged currency. Now reverse the situation, the price of one dollar increases to 1.36.

In this case, company X (exporter) will benefit from the forward contract to hedge their risk. The vital thing to note is that currency value can move in any direction, either up or down. Who benefits from a forward contract depends upon the value of one currency against the other after six months.

Future market

A future agreement is similar to a forward contract; the only difference is that latter is a standardized contract. The futures contract is a standard contract that specifies the quantity of a particular asset at a pre-determined price and delivery date.

For example, suppose Indian Oil signs a future contract to import 1 million barrels of oil with an oil producer based in Saudi Arabia. The oil producer promises to deliver the specified quantity in twelve months at a pre-agreed price of $75 per barrel.

So even when the price of one barrel falls to $70, the importer is obligated to pay the premium. The same is true when the price reaches $80; the oil producer will deliver the quantity despite the changes in the spot price.

How Are Currencies Traded and the Various Forex Instruments

Forex is traded in pairs. For example, a currency pair is NGN/USD. This currency pair allows you to buy or sell NGN in exchange for USD. There are numerous currency pairs operating in the global forex market.

However, forex traders should know that the USD is the most traded currency in the world. Most of the popular currency pairs in the world involve the USD. For example, EUR/USD is one of the most prominent currency pairs.

Currency pairs can be traded through a variety of financial instruments. A financial instrument denotes the type of contract through which you are making the trade. Different financial instruments include spot forex contracts, forward contracts, contracts for difference, and so on.

We have briefly covered each financial instrument here:

Spot forex contract – A spot forex contract is the most widely used instrument for forex trading. This is the traditional way in which forex trading is and was done. A spot forex contract allows currencies to be exchanged immediately and the delivery and settlement of the contract are done instantly.

Futures forex contract – This is a more complicated forex contract. A futures forex contract allows you to deliver and settle your trade at a later date. The prices are agreed upon beforehand. A futures forex contract allows you to take advantage of future price movements in the present.

Currency swaps – A currency swap allows traders to exchange their loan denominated in one currency for a loan denominated in another currency. This is why its called a “swap”. A swap allows you to repay the principal amount and interest amount in a different currency.

Currency Forward – A forward contract allows you to exchange one currency for another at a future date, however, the exchange rate is determined at the present. This allows for future exchanges while negating the effect of price movements in the forex market. This type of contract is most often used for international trades.

Options forex contracts – An option contract provides the buyer with the right, but not the obligation, to exchange currency at a later date at a predetermined exchange right. The buyer does not have to exchange the currency on the future date, but they can. For this right, the seller is paid a premium at the time of making the contract.

Non-deliverable forward (NDF) – A non-deliverable forward allows a buyer and a seller to settle a currency exchange without actually exchanging any currency. This is why the term “non-deliverable” is used. A Non-deliverable forward is the same as a forward contract, with the exception that the actual currency is never exchanged.

CFDs – A CFD, also known as a contract-for-difference, allows forex traders to trade currency. Under this type of contract, only the price difference between the opening of the contract and the closing of the contract needs to be paid.

What is Online Forex Trading and How Does it Work?

Online forex trading allows retail traders (also known as individual traders) to trade currencies and profit from price movements in the currency market. Online forex trading is gaining in popularity around the world since it provides traders with access to a highly liquid and volatile market.

Forex traders can trade online by taking advantage of the high leverage provided by global online forex brokers. Online forex trading can be done through a variety of financial instruments (as detailed above) but the most commonly used instrument is CFD. CFDs allow traders to only pay the difference in price and the actual currency does not need to be exchanged.

The barrier to entry in online forex trading is very low. You only need to make a small minimum deposit into an online brokerage account in order to get started. You can trade using margins, which means that your deposited amount only needs to cover the difference between the trades. Further, online brokers offer high leverage which means that profits (and loss) can be very high.

Online trading is done through trading platforms like MetaTrader 4. These trading platforms offer an easy way to keep track of price movements of different currencies and to execute trades. Online forex brokers offer a trading platform for free to their users.

There are several online forex brokers in the world these days. Over the last decade, the popularity of online forex trading has grown exponentially due to the services provided by these brokers.

For example, a Nigerian trader just needs to open an account with a reputable forex broker such as HotForex or FXTM. To open an account, they need to complete certain KYC formalities and provide a deposit amount. Once the account is registered, the trader can download the trading platform and start trading.

Chapter #2

Basic Forex Terminology

There are certain basic terms that a forex trader needs to understand.

Currency pair: A currency pair denotes the two currencies you will be trading. One currency will be bought or sold and the other currency will be exchanged in return. For example, NGN/USD is a currency pair that denotes the pair of Nigerian Naira and the American Dollar.

When trading the NGN/USD you will be exchanging the USD to buy and sell NGN. All forex trading is done via a currency pair.

In this currency pair, the NGN is known as the base currency and the USD is known as the quote currency. The exchange rate of NGN/USD denotes how much of the quote currency you will need in order to trade one unit of the base currency.

There are three types of currency pairs – major, minor, and exotic. Major pairs are the most traded pairs in the world. Exotic pairs are the least traded pairs. EUR/USD is the most traded currency pair in the world

You should always try to trade major currency pairs since these are more predictable, have tighter spreads, and have the highest trading volume.

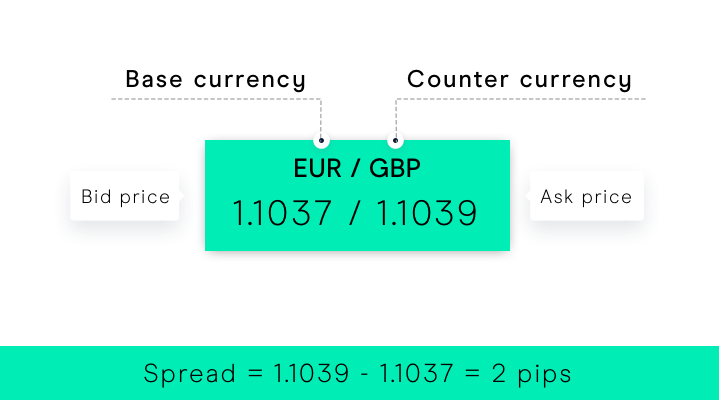

Pips: A pip is the smallest movement that the price of a currency can make. Pip is generally the fourth decimal movement of price in currency pairs. For USD-related currency pairs, the value of a pip is $0.0001. The spread that you will be charged for trading a currency pair is denoted in pips.

Leverage: Leverage is the ratio between the amount of money that you need to invest and the amount of exposure that you can gain in a trade. For example, the leverage offered by a forex broker can be 1:500.

A 1:500 leverage means that you need to provide $1 in order to trade $500 worth of currency. The higher the leverage, the larger the trade that you can make with a given amount of money.

Leverage increases the potential profit you can make through your trades since you only need a fraction of the money to be able to enter a sizeable trade. However, this also increases the amount of risk that you face with your trades. `

Bid Price: The bid price is the highest price that a purchaser is willing to pay for a security. In forex, the bid price refers to the amount of base currency needed to purchase the quote currency.

Ask Price: The ask price is the lowest amount that a seller is willing to pay to sell a security. In forex, the ask price refers to the amount of quote currency that you will need to sell in order to get one unit of base currency.

Spread: The spread is essentially a fee levied by a forex broker. It is denoted as the difference between the bid price and the ask price. The difference between the two is the fee that the broker is charging in order to provide brokerage services.

The spread is usually variable in nature. This means that the spread fluctuates in accordance with the liquidity and the timing of the trade.

The spread for trading each currency pair will be different. Usually, major currency pairs have tighter spreads than minor currency pairs. This means that trading major currency pairs is more affordable than trading other types of currency pairs.

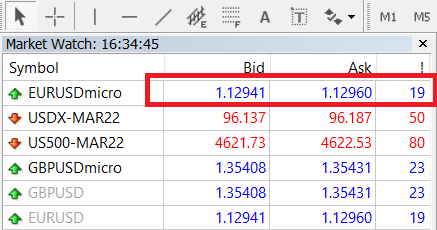

For example, this below screenshot shows the spread for EUR/USD at XM. Their spread with Micro Account is 1.9 pips on their MetaTrader platform.

Lot sizes: Lot size is the amount of currency that you will be trading. There are three different main lot sizes in the forex market.

The three sizes are Standard, Mini, and Micro.

A Standard lot is equivalent to 100,000 units of the base currency.

A Mini lot is equivalent to 10,000 units of the base currency.

A Micro lot is equivalent to 1,000 units of the base currency.

Different brokers offer different types of lot sizes, however, the terminology for the three main types of lots has largely remained the same.

Market Trading Terms

Some terminologies are based on market activities and traders must acknowledge these to understand price movements in the forex market.

1. Bull Market

Bullish trend or bullish market is a commonly used term in financial markets to denote appreciation in the price of the asset. For example, a continuous rise in prices of a commodity or stock for a prolonged period will be called a bullish trend.

In a forex pair, a bullish trend can be due to appreciation as well as the depreciation of one currency with respect to other. For example, a bullish trend in EUR/USD currency pair represents an appreciation of EUR and/or depreciation of USD.

2. Bear Market

A bearish trend or bearish market is exactly the opposite of a bullish trend. Continuous depreciation in the price of an asset is commonly denoted as a bearish trend.

In the forex market, appreciation of quote currency and/or depreciation of base currency can be called a bearish trend on a currency pair.

3. GDP

GDP or Gross Domestic Product is the total value of all the goods and services produced in a country in a particular time period. It is a popular indicator that represents the overall health of a nation’s economy.

Growth in GDP can be compared with other nations to predict the increase or decrease in the price of a currency pair. For example, in a hypothetical currency pair ABC/XYZ, the GDP of the country with ABC currency increases more than the GDP of XYZ nation. This means ABC is growing faster than XYZ and the price of ABC in terms of XYZ is very likely to increase.

4. Inflation

Inflation means a rise in prices in a nation over a time period. There are multiple factors in an economy that can increase or reduce inflation. Each country has different inflation rates at a particular time interval.

Inflation rates of two currencies involved in a currency pair can be compared to predict the price movement of a currency pair. The country with a higher rate of inflation will lose its value against the one that has a lower inflation rate.

5. Interest Rates

The interest rate of a country that is also known as the repo rate is the basic rate at which the central bank will provide loans in a particular nation to commercial banks. Interest rates also depict the rate at which investors can earn through fixed deposits in the country.

Interest rates are decided by the central bank or the monetary authority of a nation. Interest rates can be comprehended to predict the price movements in a currency pair.

Chapter #3

Understanding Forex Trading with an Example

Understanding forex trading can be complex for those who have never traded on any financial instrument online in the past. Those who have a slight experience of trading other capital markets like stocks, cryptocurrencies, or CFDs would be very comfortable with forex trading.

Let us understand the complete process and working methodology of forex market with the help of an example.

Online forex trading is done through trading platform which is a software that can be downloaded on electronic devices. The trading platform connects the traders to brokers, liquidity providers, and other forex traders.

Traders place buy or sell orders through trading platforms on their preferred trading instruments. The exposure and profit/loss depends on the volume traded and leverage involved.

A leverage of 1:10 will allow you to open a position worth $100 exposure with $10 in your trading account.

In this example, we will take the leverage of 1:10 on EUR/USD currency pair. The supposed market price for EUR/USD is 1.2100/1.2102. This means that the bid price is 1.2100 (the price that the dealer is willing to pay) and the ask price is 1.2102 (the price at which the dealer is willing to buy) and the spread is 2 pips (difference between the bid and ask price at 4th decimal).

First, we will place a buy order for 1 standard lot (100,000 units of the base currency). To place a buy order of 1 standard lot on EUR/USD, the following will be the calculation of the required account balance.

$1.2102 * 100,000 * 1/10 = $12,102

(ask price) * (units of base currency) * (leverage ratio) = (minimum account balance required to open the given position)

Now suppose the price of EUR/USD went up by 100 pips and reaches 1.2200/1.2202. By closing the buy position at this price, the following will be the profit.

(1.2200 * 100,000 * 1/10) – $12,102 = $12,200 – $12,102 = $98

(bid price * units of base currency * leverage ratio) – (exposure) = Profit/Loss

Now let us understand the same scenario with a short position on EUR/USD with 1 standard lot at the current market price of 1.2100/1.2102. Following will be the exposure amount in a short position.

$1.2100 * 100,000 * 1/10 = $12,100

(bid price) * (units of base currency) * (leverage ratio) = (minimum account balance required to open the given position)

Now suppose the price of EUR/USD went down by 150 pips and reaches 1.1950/1.1952. By closing the position at this position, the following will be the profit.

$12,100 – $(1.1952 * 100,000 * 1/10) = $12,100 – $11,952 = $148

exposure – (ask price * units of base currency * leverage ratio) = profit

It must be noted the exposure amount ($12,102 in the long position example and $12,100 in the short position example) will be at risk of capital markets. If the leverage is high, the profit/loss amount will move more with the change in the pip value of the underlying asset.

Chapter #4

How Can You Trade Forex in Nigeria?

Currency pairs can be traded online as CFDs or other derivative instruments. There are several brokers and banks that offer forex trading services. Such services can be either by acting as a market maker or by straight-through processing (STP). This depends on the business model of the forex broker or bank.

Most forex brokers online offer CFDs for forex trading.

What you need to Trade Forex in Nigeria

Here are the basic steps involved in forex trading and opening an account with a forex broker:

- Learn about Forex Trading: It is essential to first learn how to trade forex before you start your trading journey. Learn about how the Forex Market works and read about Technical & Fundamental analysis, and study charts & different currency pairs, how they have moved historically.

You must take 2-3 months & learn as much as possible about Forex Trading. A demo account can be used to trade with virtual currency before making actual trades. Beginners can gain experience, learn terminologies, understand volatility, check suitability, and test their strategies using demo accounts.

- Choose a Forex Broker: The next step is to find a forex broker that is both safe and reliable. Any Forex Broker that you choose must be licensed by at least one Tier-1 or Tier-2 financial regulatory authorities.

All the Forex brokers that are popular in Nigeria like FXTM, AvaTrade, HotForex, FBS, & OctaFX register their clients under offshore regulations like Belize, Mauritius, etc. So, you must make sure that the broker’s Group is at least regulated with FCA, CySEC, FSCA, or ASIC, even if the broker is registering your account under a different regulation.

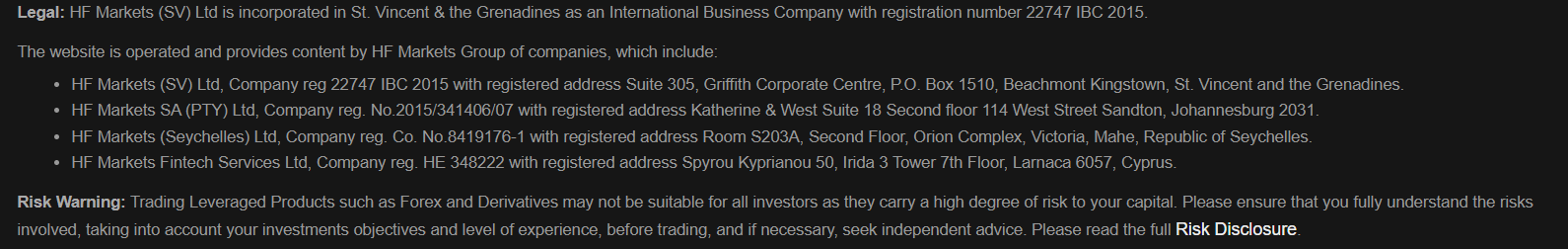

For example, HotForex registers the traders from Nigeria under HF Markets (SV) Ltd, which is in St. Vincent & the Grenadines. But HotForex Group is licensed with FCA, FSCA & CySEC. This makes HotForex Group a safe Forex broker for traders in Nigeria. Even though your account is not registered under Tier-1 regulation, but the fact that the broker that you are trading with is well regulated reduces the risk for safety of your deposited funds.

- Choose your Account Type: Generally, all Forex Brokers offer multiple Account Types, with varying fees & features. For example, the Zero Account at HotForex has a lower spread than Micro & Premium Accounts, but there is an extra fees of USD 6-8/lot (depending on the Forex pair).

You should also research the different types of accounts provided by the broker.

- Fill out an application form and complete KYC: You will need to register and open a trading account with the forex broker. This will also involve completing KYC norms, but this can be done completely online.

- Choose a username and password: Once your account is approved, you will receive a username and password or you can choose your own.

- Login to your account: Next, you can use your username and password to log in to your trading account through the broker’s website.

- Deposit money into your account: You will need to deposit some money into your account in order to start trading. Each broker has its own minimum initial deposit requirements.

- Practice trading: You can practice forex trading through a demo account. This is highly recommended for new traders.

- Stay informed: A key part of being a successful forex trader is staying informed on the latest developments and news.

What do you need for online forex trading?

There are certain things that you will need in order to trade forex online. Here are the basics:

- Device: You will need a personal computer, a laptop, or a smartphone in order to be able to access the markets. You will need to make sure that your device is compatible with the trading platform offered by your broker.

- Reliable internet connection: It is essential to have a reliable and fast internet connection. The internet connection will allow you to place your orders. You will also need the connection to be fast so that you can react quickly to changes in the market.

- Trading platform: Once you register with a forex broker, you will be able to download or install a trading platform on your device. The trading platform is the software that you will need to conduct your trading activity.

Forex Trading Strategies

Trading without strategy is like sailing without a compass. The sailor has no idea about the wind speed or the direction. That’s why the practice of forex analysis plays a vital role in currency trading. You look at the changes in the values of currency pairs and the forces that are influencing those price movements.

Traders use both fundamental and technical analysis for creating a profitable strategy. Many expert traders combine both techniques to take a hybrid approach. In short, the knowledge of technical analysis will tell you when (to buy or sell) and fundamental analysis tells you why (the price movements). Both are indispensable weapons for a successful forex trader. Remember that while most traders make a loss, the only way to profit from forex trading is to have a good strategy and manage your risk.

Let’s deconstruct both methods one by one.

Fundamental Analysis

What economic factors will impact the demand and supply of a currency? Welcome to Macroeconomics 101, the law of demand and supply. If the demand for a currency is increasing, the trader may assume the prices will rise. On the other hand, a demand reduction may be an indication of an eventual fall.

However, it’s not that simple! There are many factors such as economic health, political stability, global events, and others that influence the expansion and contraction of a particular currency. For instance, the US Sub-Prime Lending Crisis in 2008 caused a massive breakdown of financial systems worldwide.

The fundamental analysis generally involves the following economic indicators:

1. Economy:

In addition to global economic events, the localized changes in a national economy can also influence the currency prices of that country. For instance, the increased commodity prices globally can strengthen Australian dollars.

2. Political Changes:

Although government changes are not a frequent affair, currency prices can be affected during a transition period. Developed countries have relatively stable regimes in comparison to developing countries. Political instability is the main reason why the currencies of many African countries are so unpredictable.

3. Monetary and Fiscal Policy:

Central banks use monetary policy as an effective tool to control the demand and supply of a currency. They can reduce the interest rate in an economic slowdown and can increase to curb the inflation caused by economic growth. The fiscal policy entails taxation and government spending. Higher taxes can drive slower credit and economic development. Both government policies can have a significant impact on the national currency.

4. Activities of Major Participants:

Main participants such as banks, financial institutions, or hedge funds may buy or sell a specific currency to up or down the prices. You will be in much better positions if you have an idea about the main speculators of the forex market.

5. Economic data and reports:

Main participants such as banks, financial institutions, or hedge funds may buy or World governments publish statistical data and reports that reveal the economic health and performance over a period. Many financial reports like employment data, inflation rate, GDP, and foreign exchange reserve can indicate regional economic conditions, which can dramatically impact the local currency. A forex dealer can use an economic calendar to avoid unwanted surprises from the release of new data.

Technical Analysis

Charts and graphs are the primary tools of technical analysis. Charts help traders identify historical performance, ongoing trends, and price movements and calculate risk to maximize gains from currency trading.

Understanding different charting formats such as line, bar chart, and candlestick is essential to develop a solid trading strategy for beginners. The following are important terminologies associated with technical analysis.

1. Bar chart:

It is the most basic charting which helps users select a currency and its performance for a fixed period. The bar chart shows the highest and lowest currency price points and average performance over the period chosen.

2. Candlestick:

It also displays the same information: open, low, high, and close. However, the representation of data is very different from the bar chart. It becomes easier for users to see the highest and lowest peaks of the currency movements with thin vertical lines.

3. Price Trends:

Trend is a term used in technical analysis of capital markets that depicts the direction of the price. Generally, the price of the underlying instrument moves in a particular direction until a trend reversal is witnessed. The tops and bottoms of the charts can be analysed to identify the price trend at a given time.

Trendlines and trend reversal are very important components of technical analysis. A higher-high price action followed by a higher low represents an uptrend (bullish) while a lower low and lower high depict a downtrend in price movement.

4. Support and Resistance

Support and resistance are the prices at which the trends are likely to reverse or stop moving further in that direction. There can be multiple support and resistance levels for a single financial instrument.

Support is the lower limit at which the price trend is likely to reverse or stop moving further below. Resistance is the upper limit on the price trend. Whenever a resistance or support level is broken, the price moves significantly. These limits are created due to trend reversals and stagnancy of prices at the price that same particular level. A support or resistance level gets stronger every time it resists the price movement.

5. Moving Average

As the name suggests, the moving average is an important indicator that depicts the average price movement in a given time. A moving average indicator creates a series of averages of different subsets of the full data sets of prices in a particular time interval. Current prices below the moving average depict a buying opportunity while the prices above the moving average may benefit the sellers.

6. Fibonacci Retracement

Fibonacci retracement levels are based on the Fibonacci sequence and are used to identify potential support and resistance levels. Traders use these levels to determine potential price retracement areas during a trend.

7. Bollinger Bands

Bollinger Bands consist of a moving average (typically 20-day SMA) and two standard deviations above and below the moving average. They help traders identify periods of high or low volatility and potential price breakouts.

8. Candlestick Patterns

Candlestick charts display price data in a visual format using candlestick patterns. Traders analyze patterns such as doji, engulfing patterns, and hammers to identify potential trend reversals or continuation.

9. Volume Analysis

Volume analysis examines trading volume accompanying price movements. It helps traders understand the strength or weakness of a price trend and identify potential reversals or breakouts.

10. Chart Patterns

Chart patterns, such as head and shoulders, double tops, and triangles, are formed by price movements and can indicate potential trend reversals or continuations.

There are hundreds of strategies that are used in the technical analysis of financial instruments. Technical analysis works well on instruments with high liquidity like the forex market.

Experienced traders often use technical analysis in combination with fundamental analysis to understand why the value of a currency rises or falls for the selected period. For example, if the fundamentals indicate that the US Dollar will strengthen against the Euro due to policy divergence, and the technical analysis also indicates the same, then it is much more likely that your strategy may be successful as compared to incomplete research.

You can use simple mathematical tools such as moving averages, trend lines, and others for technical analysis. You can learn about more advanced concepts like Elliott Wave Theory, Fibonacci Studies, and Pivot Points as you progress.

Steps to Open a Forex Trading Account in Nigeria

The account opening process at every regulated broker is nearly similar. However, the process and time required to open the live account can vary from broker to broker. Following are the steps to open a live trading account in Nigeria.

Step 1: Select a Broker

Traders must check and compare every aspect of the broker and choose the most suitable broker with regulations, low fees, availability of desired instruments, helpful customer support service, convenient deposit and withdrawals, and a user-friendly trading platform.

Step 2: Visit their Website or Download the App

After choosing the broker, you need to visit their official website or download the application to open the account.

Step 3: Enter Basic Details

The first signup process involves providing basic details like name, phone number, email, and country of residence. Some brokers may ask for a few more details.

Step 4: Select Account Type

Most forex and CFD brokers offer more than one account type with different pricing structures, trading platforms, or trading conditions. Traders must choose the most suitable account type while opening their accounts.

Step 5: Document Verification

After configuring the account and answering a few basic questions related to forex trading, traders are required to verify their documents by uploading soft copies. Brokers will ask for name and address proof which can be done with a passport, national identification document, etc. Each broker can take different times to verify the document ranging from 2 hours to 24 hours on business days.

Step 6: Deposit Funds

Once the account has been verified, clients can deposit funds through the accepted methods from the website or application of the broker. It is important to check the associated fees and time required to process the transaction.

Step 7: Download the Trading Platform and Start Trading

Once the deposits are visible in the account equity, you can open trading positions on available instruments through the trading platform. The trading platform can be downloaded on mobile and desktop devices and can also be accessed through the web.

Chapter #5

Best Forex Trading Platforms for Nigerian Traders

Forex trading platforms have transformed the way people interact with financial markets. These platforms enable traders to gain exposure to hundreds of different markets around the world.

There are several trading platforms available in the market these days. This makes choosing a trading platform difficult.

Choosing the wrong platform can cause you to suffer from slow trade execution, no educational material, no technical indicators or analysis, and so on.

Since each forex broker offers a certain set of trading platforms, the trading platform offered by a forex broker is an important consideration while choosing a forex broker as well.

- Safety: The reputation of the forex broker is an important consideration. There are lots of fraudulent forex brokers operating online. Hence, you should only register with forex brokers that you can trust. The best way to gauge whether you can trust a forex broker is through the licenses by regulatory authorities that they possess. You should cross-reference their license numbers (available on their website) with the license number available on the regulator’s website.

- Fees: Each broker charges different fees for their services. These fees can vary wildly from broker to broker. Hence, you should choose a forex broker that charges reasonable fees. There are several components to the fees charged by a forex broker: minimum deposit, spread, commissions, overnight swap rates, deposit fees, withdrawal fees, and inactivity fees.

- Account Types, Currency Pairs, and Other Instruments Available: It is important to check which account types the broker offers. The account type will determine how much you are charged per trade, which instruments are available, whether you get DD or NDD services, and so on.

- Services Available: What are the features offered by your broker and your trading platform? Do they offer a news feed? Analysis? Custom leverage? Risk management tools?

- Deposit and Withdrawal Methods for NGN: As a Nigerian trader, you should check the deposit and withdrawal methods available for your currency. Also, make sure that you check the deposit and withdrawal fees.

- Ease of Use and Device Compatibility: Make sure that the trading platform offered by your broker is compatible with the devices that you use. For example, if you use a Windows computer, then make sure that the trading platform can be downloaded and installed on a Windows computer.

- Customer Service: The customer service and support offered by a forex broker is an important metric. It decides how problem-free your trading experience will be. Check reviews of different forex brokers to understand which ones provide good and helpful customer service.

Trading platforms are offered by forex brokers. A broker can offer a single trading platform or a variety of them. The most common trading platforms offered by brokers are MetaTrader 4, MetaTrader 5, or cTrader. Some brokers also offer their own proprietary trading platform.

As of date, there are no forex brokers licensed by the Nigerian government since the industry is still unregulated. Hence, before choosing a broker, you should check whether they are regulated by a tier-1 financial authority like the FCA of the UK or the ASIC of Australia.

There are a few top-tier brokers that have local offices in Nigeria and offer local deposit methods to Nigerian traders. These are OctaFX, Hotforex, and FBS.

You should make sure that the forex broker websites that you visit are genuine. Nigerian traders often end up visiting fake look-alike websites and get scammed. There are several scammers operating online that pose as regulated brokers. This makes it risky for retail traders.

Hence, it is important to only register your account on genuine websites. You should also check the licenses held by the broker and cross-check them with the financial regulator’s website.

Chapter #6

Risks of Online Forex Trading

Online forex trading is a highly risky activity. Here are some of the types of risks that you will face:

- Risk of Loss/Ruin: Forex trading is inherently risky since it is easy to make a loss from your trades. You can even lose all the money you have deposited in your account or even more. Make sure that you only trade with a broker that offers negative balance protection so that you do not lose more money than you have in your trading account.

- Risk of Using High Leverage: Forex brokers offer high leverage to make trading with them more profitable. As explained above, leverage increases your exposure to the market manifold. This increases the profit or loss you will face from trade by many times. Hence, new traders should only use low leverage while trading.

- Risk of High Volatility: Forex market is highly volatile. This means that the exchange rate between currencies change at a fast pace. Hence, it can be difficult to keep track of all the movements and you can quickly face a major loss.

- Unpredictable Market Movements: The financial markets are inherently unpredictable. It is impossible to reliably predict the price movement between currency pairs. This means that forex trading is a speculative activity and can lead to significant losses.

- Online Scams and Fraudulent Activity: You should be careful of fake brokers, fake signal sellers, ponzi schemes, and fake robots. Scam brokers offer attractive bonuses and promotions in order to lure traders. Then they take the deposit money and disappear. To protect yourself from scams, you should only trade through top-tier licensed brokers that can be verified from the FCA, CySEC, ASIC, or the FSCA.

There are multiple risk elements in the forex market. Choosing the right broker, taking informed decisions, technical and fundamental analysis, and other precautionary measures will reduce the risk factor. However, risk in the forex market can be mitigated but cannot be removed completely.

Leveraged forex trading involves significant financial risk. Forex trading is easily accessible for retail traders. More than 70% of forex traders face losses. It is always advisable to use the demo account and trade with virtual currencies before trading with real money. This will also allow traders to know whether forex trading is suitable for them or not.

To mitigate these risks, forex traders should:

- Educate themselves about the forex market and trading strategies.

- Use risk management techniques, such as setting stop-loss orders and position sizing.

- Avoid excessive leverage and only trade with capital that they can afford to lose.

- Stay updated on economic events and news that may impact the forex market.

- Remain disciplined and avoid making emotional decisions based on short-term market movements.

Risk management techniques in forex trading

Position Size: Determine trade size based on account balance and risk tolerance (1-2% per trade).

Stop-Loss: Set stop-loss orders to limit losses if the market moves against you.

Take-Profit: Use take-profit orders to secure gains at a predefined level.

Risk-Reward Ratio: Aim for favorable risk-reward ratios (1:2 or better).

Diversification: Spread risk by trading different assets, not all in one.

Control Leverage: Use leverage carefully to align with risk tolerance.

Trading Plan: Develop a clear plan with entry/exit rules and risk limits.

Emotions: Manage emotions to avoid impulsive decisions.

Stay Informed: Be aware of market events that could impact trades.

Monitor Trades: Adjust stop-loss and take-profit levels as needed.

Review Trades: Analyze trades to learn and improve strategies.

Avoid Revenge Trading: Don’t trade impulsively to recover losses.

Forex trading can be rewarding, but it is crucial to approach it with a clear understanding of the risks involved and to trade responsibly. Traders should consider seeking advice from financial professionals and only trade with money they can afford to lose.

Chapter #7

Pros and Cons of Forex Trading

There are some pros for traders trading in the forex market over other financial markets. But you must understand all the risks before making a decision whether to trade forex & CFDs or not..

Pros of Forex Trading

Following are the advantages of trading forex:

Largest Capital Market

You invest in the world’s largest financial market. With daily transactions crossing over USD 5 trillion, the sheer size of the forex market makes it truly a global marketplace with several profit opportunities.

24-Hour Market

The forex market operates around the clock so that you will find a trading opportunity any time of the day in at least one global time zone. As the forex market is a decentralized OTC market, its working hours are not subject to any centralized exchange system. For instance, trading hours begin at 5 PM EST in the USA on Sunday and rolls continuously with other markets until Friday at 5 PM. Note that even though currency trading is restricted for retail traders on weekends, the exchange rate keeps moving.

Low Capital Requirement and Lower Transaction cost

In addition to very low investment requirements, even the transaction cost of trading forex is relatively lower. For instance, you can start dealing in currencies with just USD 100 or even lower. The main earning of a broker comes from the bid-ask spread. Spread is measured in pips, the difference between the sell and buy price of a currency. However, some brokers do charge a commission or flat fees per transaction. You should factor in commission and spread while choosing a broker to lower your overall trading cost.

Availability of Leverage

The availability of high leverage is perhaps the main reason why forex trading appeals to so many people. It enables you to place a higher trading order with minimum capital.

Almost all the forex brokers offer leverage where you can borrow against deposited money in your trading account. It’s similar to taking a mortgage against your property; the only difference is that the margin requirement is very low. For instance, you can place a USD 100 order with just 3.33 US Dollar if your broker offers a 1:30 leverage ratio. However, leverage is a double-edged sword. It can amplify your losses, so heed caution when trading forex with leverage. You should avoid using high leverage.

Most Liquid Market

Forex market is also the world’s most liquid market. Liquidity refers to how quickly an asset can be sold or bought without affecting its value. Major currency pairs such as EUR/USD or USD/JPY are considered most liquid than exotic currency pairs.

Major pairs are more liquid hence the spread will be lower on major pairs. The spreads on less traded pairs are higher due to low liquidity.

Volatile

The same volatility, which makes it riskier for traders, can also present ample profit opportunities. Volatile market conditions cause rapid changes in the value of currency pairs, thus, increasing your chances of gains from the trade.

But this is also a big risk. If a currency pair changes in its value by a lot then it is considered volatile and can be a risk for investors as you can lose big if you are on the opposite side. For example, USD/TRY is considered a very volatile currency pair. You may lose quickly if you are in the wrong position, also you must consider the Swap Rates when trading such currency pairs.

Scalable

Scalable means you can trade in mini, micro, or standard lots, making it easier for traders to control investment size and capital exposure.

Affordable Technology

You don’t have to spend money on acquiring expensive hardware and software to start with forex trading. All you need is a computing device or a smartphone with a reliable internet connection. Your broker will provide charting and trading technologies at no cost once you subscribe.

Cons of Forex Trading

Following are the challenges or disadvantages of trading forex:

High Risk

Forex market is not ideal for many traders due to its high risk. The market risk in forex trading is much higher compared to other capital markets like stocks, commodities, etc. The involvement of leverage further increases the risk of losing a substantial amount within a few seconds.

The market is active 24 hours a day and any news event around the globe can affect the prices of currency pairs. Hence, at times it becomes impossible to correctly predict the price movement.

Lack of Transparency

There is no particular location from where the forex market is controlled or managed. Foreign currencies are exchanged in many ways mainly through central banks, private banks, large financial institutions, etc. The forex market is largely influenced by large-scale market makers, liquidity providers, and banks. Hence, there is no transparency about how the trade order is getting executed. The trading volume and market sentiment are also difficult to predict in the forex market.

Complex Valuation Method

The value of one currency in return for another keeps on changing due to multiple reasons at every minute. It is quite complex for retail traders to calculate the valuation of one currency in terms of another. The valuation depends on the economic and financial details of the involved currencies and their predictions. Compared to other capital markets, it is much more complex to do a valuation of the currencies.

Difficult to Learn

Stocks, commodities, and other markets are much easier to comprehend compared to the forex market. In the stock market, traders can get assistance from experts and portfolio managers. Comparatively, it is challenging to learn forex trading and understand the forex market. Traders have to learn most of the forex trading on their own.

The same volatility, which makes it riskier for traders, can also present ample profit opportunities. Volatile market conditions cause rapid changes in the value of currency pairs, thus, increasing your chances of gains from the trade.

But this is also a big risk. If a currency pair changes in its value by a lot then it is considered volatile and can be a risk for investors as you can lose big if you are on the opposite side. For example, USD/TRY is considered a very volatile currency pair. You may lose quickly if you are in the wrong position, also you must consider the Swap Rates when trading such currency pairs.

Scalable

Scalable means you can trade in mini, micro, or standard lots, making it easier for traders to control investment size and capital exposure.

Affordable Technology

You don’t have to spend money on acquiring expensive hardware and software to start with forex trading. All you need is a computing device or a smartphone with a reliable internet connection. Your broker will provide charting and trading technologies at no cost once you subscribe.

Cons of Forex Trading

Following are the challenges or disadvantages of trading forex:

High Risk

Forex market is not ideal for many traders due to its high risk. The market risk in forex trading is much higher compared to other capital markets like stocks, commodities, etc. The involvement of leverage further increases the risk of losing a substantial amount within a few seconds.

The market is active 24 hours a day and any news event around the globe can affect the prices of currency pairs. Hence, at times it becomes impossible to correctly predict the price movement.

Lack of Transparency

There is no particular location from where the forex market is controlled or managed. Foreign currencies are exchanged in many ways mainly through central banks, private banks, large financial institutions, etc. The forex market is largely influenced by large-scale market makers, liquidity providers, and banks. Hence, there is no transparency about how the trade order is getting executed. The trading volume and market sentiment are also difficult to predict in the forex market.

Complex Valuation Method

The value of one currency in return for another keeps on changing due to multiple reasons at every minute. It is quite complex for retail traders to calculate the valuation of one currency in terms of another. The valuation depends on the economic and financial details of the involved currencies and their predictions. Compared to other capital markets, it is much more complex to do a valuation of the currencies.

Difficult to Learn

Stocks, commodities, and other markets are much easier to comprehend compared to the forex market. In the stock market, traders can get assistance from experts and portfolio managers. Comparatively, it is challenging to learn forex trading and understand the forex market. Traders have to learn most of the forex trading on their own.

Chapter #8

What are the Costs of Forex Trading?

The cost that will be incurred by traders in forex trading will differ from broker to broker. Each broker charges different types of fees and the amount of fees can also be different.

Spreads and commissions are the major source of revenue for brokers and liquidity providers.

To be familiar with the fee structure, clients must check or inquire about the following components of fees before opening the account.

These are the common ways in which a forex broker will charge the traders in Nigeria for trading.

1) Spreads: Spreads are the major component of fees involved in forex trading. This is the difference between the bid and ask price or the buy and sell price.

Wider spreads mean lesser profit and lesser probability to make profits in a forex trade. Clients should seek brokers that offer narrower spreads. Depending on the currency pair, a spread of less than 1.5 pips is considered good.

2) Trading Commission: The commission that is incurred while executing trade orders is called a trading commission.

Some brokers offer commission-based trading on currency pairs with low spreads or zero spreads. Commission-based spread-free trading is considered ideal for large-volume traders and scalpers.

A commission on forex pairs can range from $2 to $10 for a Roundturn trade (both sides) of a Standard Lot. Details of commission (if charged) must be checked before opening the account.

3) Swap Fees: Swap fees are also called overnight charges. These are the charges that are incurred if a trading position is kept open overnight.

Orders that are opened and closed on the same day will incur no swap fees at all.

For every night the position is kept open, the swap fees will be added. Swap rates or overnight charges differ from broker to broker on every instrument.

4) Non-Trading Charges: These are the charges that will be incurred without executing trade orders. Non-trading charges can be of various types and can be tricky to identify as they are not clearly mentioned.

5) Inactivity Fee: An inactivity fee is a fee that gets deducted from the account balance if no trade orders are executed in a prolonged period of 3 months to 1 year.

6) Deposits & Withdrawals: Deposits and withdrawals can incur additional commission for some or all of the methods. Clients must check the commission or fees for deposits and withdrawals.

Other non-trading charges include account opening fees, conversion fees, internal transfer fees, etc. Subscription to additional services can also cost additionally.

Clients must enquire from the support executives about the non-trading charges separately.

Forex Trading in Nigeria FAQs

Is Forex Trading legal in Nigeria?

Forex trading is currently unregulated in Nigeria but it is not illegal to trade forex. Since there are no locally regulated forex brokers in Nigeria, so for the safety of your funds you must only trade via Tier-1 & Tier-2 licensed forex brokers.

Is Forex Trading profitable?

Is Forex Trading Good for Beginners?

How do I Start Trading Forex?

What is the first step to learn forex?

How long does it take to learn forex?

How much do you need to start trading forex in Nigeria?

How to trade Forex in Nigeria?