Best Forex Brokers Australia 2024

We've compared the regulated forex brokers in Australia. Our research is based on 16 factors including Broker's AFS License, Overall Trading Costs (Trading & Non-Trading Charges), Trading Conditions, Ease of withdrawals, platforms, support & more.

Online Forex Trading is legal in Australia and comes under regulatory compliance of the Australian Securities and Exchange Commission (ASIC). Despite the high risks, forex trading is quite popular among retail traders in Australia.

To offer forex and CFD trading services to Australian clients, a broker needs a regulatory license from ASIC. Clients should only choose an ASIC-regulated broker to trade forex and CFDs in Australia. Forex brokers without ASIC regulatory licenses are very likely to be fake and there is a very high third-party risk while trading with them.

It’s essential to understand that there is no universally “best” forex broker because each one caters to diverse types of traders. The suitability of a broker depends on an individual trader’s unique trading style, risk tolerance, and specific needs. Traders should carefully assess and choose a broker that aligns with their preferences and objectives to ensure a successful trading experience.

We have considered multiple aspects of the brokers to compare ASIC-regulated forex brokers in Australia. We compared their fees, safety, platforms, trading conditions, Risk management features, support & various other factors.

Our aim with this guide is to help Australian forex traders in choosing the most suitable and best broker for themselves after comparing every aspect while understanding the risks involved.

List of Best Forex Brokers Australia based on our Research for 2024

- eToro – Best Forex Broker in Australia with Proprietary Platform

- IC Markets – Best Australian Forex Broker for Low Costs

- Pepperstone – Best Low Spread Regulated Forex Broker

- FP Markets – Good Local Forex Broker with Low Minimum Deposit & AUD Accounts

- IG Markets – Best Most Trusted Forex Broker

- Plus500 – Forex Trading Platform with Risk Management tools

- FXCM – Regulated Forex Broker with MetaTrader platform

- CMC Markets – Reputed Forex Broker with wide Range of Instruments

There are various regulated as well as unregulated brokers in Australia that offers trading services on forex and CFDs.

Best Australian Forex Brokers

We have analysed several aspects of the brokers to list out the best ones in Australia.

#1 eToro – Best Forex Broker in Australia with Proprietary Platform

eToro is a well-regulated forex and CFD broker that offers low-cost trading in Australia. It is regulated by ASIC by the name of ‘ETORO AUS CAPITAL LIMITED’ under license number 491139 and ABN number 66 612 791 803. The license has a ‘current’ status and was acquired on 4/9/2017.

Apart from ASIC, eToro also holds licenses from FCA (583263) & CySEC (109/10). eToro is considered as a market maker broker which means it can take the other side of the trade to generate revenues.

eToro does not charge commission for deposits but will incur 5$ commission for every withdrawal regardless of the method. The minimum withdrawal amount is 30$. Bank transfer, credit cards, Neteller, Skrill, and PayPal are the available deposit and withdrawal methods for Australian clients.

eToro has USD as the only base currency of the account but accepts AUD for deposits and withdrawals. The minimum deposit amount for Australian clients is 50$. The conversion rate for AUD deposits is 50 pips for bank transfer and 100 pips for the credit card, Neteller, Skrill, and PayPal. The conversion rate on AUD withdrawal is 50 pips for every accepted method.

The spreads are low starting from 1 pip on currency pairs. The average typical spread for EUR/USD during peak trading hours is 1 pip. No trading commission is charged for any of the instruments. Non-trading commission involves withdrawal commission and a monthly inactivity fee of 10$ that is incurred every month after 12 consecutive months of inactivity.

49 currency pairs are available to trade with floating spreads. The maximum leverage for currency pairs is 1:30 for major pairs and 1:20 for minor pairs. 32 CFDs on commodities are available with max leverage of 1:20 on gold and 1:10 on others. 13 CFDs on indices with 1:20 leverage, 43 CFDs on Cryptocurrencies with 1:2 leverage, 264 CFDs on ETFs, and stock CFDs of US stock exchange can be traded on eToro in Australia with no commission.

MetaTrader trading platforms are not available at eToro. The trades are executed through its proprietary web and mobile trading platform. The customer support service is average as no phone numbers are available for customer support. The support representatives can be reached out via chat. Queries can also be solved by raising a ticket on the website, app, and trading platform.

eToro is ideal for beginners as there is a user-friendly social trading and copy trading account. Cryptocurrencies can also be bought and staked at eToro. There are various research, education, and analysis tools that are useful for new as well as experienced traders.

eToro Pros

- eToro is regulated by ASIC, FCA, CySEC and is considered safe in Australia

- The spreads are low starting from 1 pip

- No trading commission on any instrument

- Local bank transfers are available in Australia

- The minimum initial and additional deposit is $50 for traders based in Australia

eToro Cons

- MetaTrader trading platform is not available

- A commission of 5$ is charged on every withdrawal

- The additional conversion fee is charged for AUD deposits and withdrawals

- USD is the only available base account currency

#2 IC Markets – Best Australian Forex Broker for Low Costs

IC Markets is an ASIC-regulated forex broker in Australia. They are issuers of their products but don’t operate a dealing desk. But they offer low spread and commission-only based forex and CFD trading accounts. IC Markets also allow opening the account with AUD and 9 other currencies as the base currency.

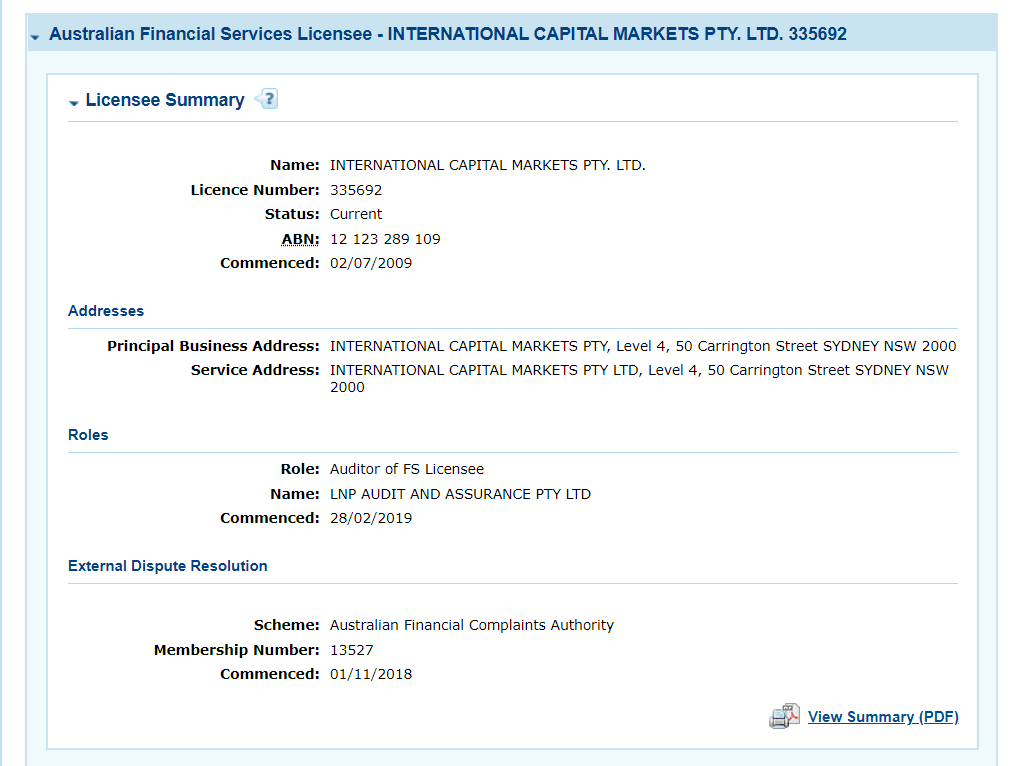

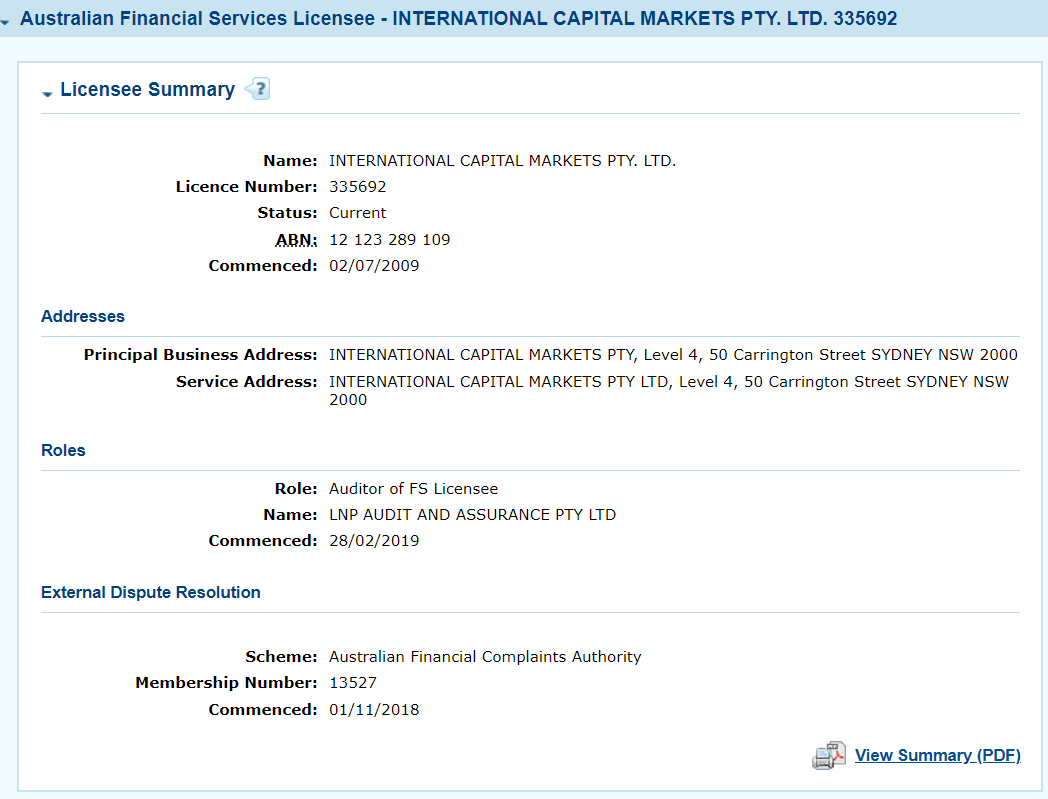

IC Market is regulated by the Australian Securities and Exchange Commission (ASIC) by the name of ‘International Capital Markets Pty Ltd’ under license number 335692. The license has a current status with the ABN number 12 123 289 109 and was acquired on 2/7/2009.

The license number and ABN number can be used to check the current status of the license from the ASIC website. AFSL license allows IC Markets to operate a financial services business in Australia under the regulatory compliance of ASIC.

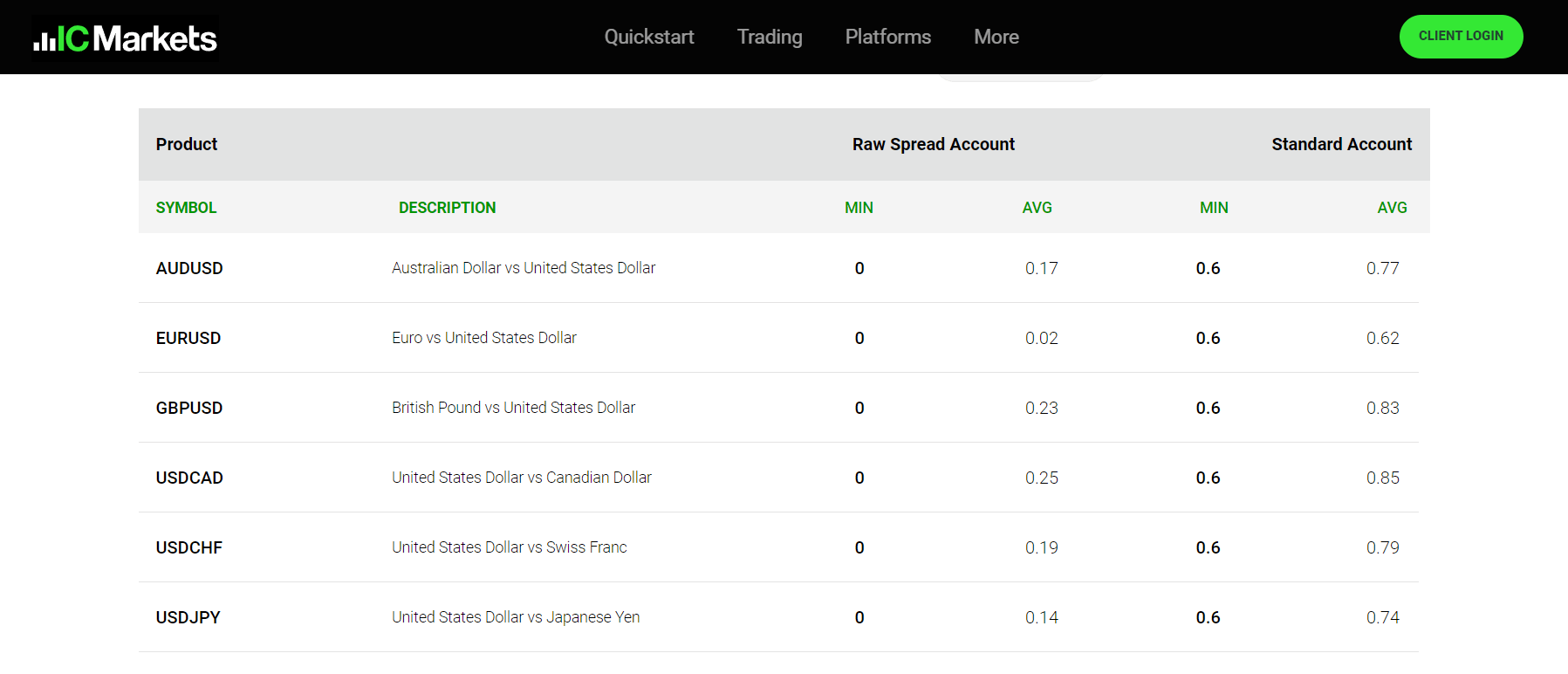

The spreads at IC Markets are among the lowest in Australia. Spreads with the Standard Account start from 0.6 pips on the standard account and are 0.62 pips for EUR/USD and 0.77 pips for AUD/USD on average.

The Commission-based Raw Spread trading account involves a very low spread with a commission of 3$ and 3.5$ for cTrader and MetaTrader platforms respectively for a single side trade of a standard lot. The average spread for EUR/USD is 0.02 pips and AUD/USD is 0.17 pips with the Raw Spread Account. This account is ideal for large-volume traders and scalpers.

IC Markets offers MT4, MT5, as well as cTrader trading platforms for trading CFDs. The Standard account is only available with MetaTrader trading platforms while the Raw Spread account can either be opened with MetaTrader or cTrader trading platforms.

The minimum deposit amount is 200$ which is equivalent to 270 AUD for both account types. The maximum leverage at IC Markets in Australia is different for CFDs on each asset class. The maximum leverage is 1:30 for forex, 1:20 for Indices and commodities, 1:5 for Stocks and Bonds, and 1:2 for cryptocurrencies.

IC Markets allows trading on 61 currency pairs, and CFDs on 25 indices, 22 commodities, 1600 stocks, 11 bonds, and 7 crypto assets. The number of trading instruments is higher than average among the regulated CFD brokers in Australia.

More than 15 deposit and withdrawal methods are accepted by IC Markets. The time for processing deposits and withdrawals can be different for each method. AUD deposits from Australia can be made through Credit/Debit cards, PayPal, Neteller, Skrill, Wire Transfer, Bpay, Broker to Broker, and POLI. Apart from the wire transfer, all the transactions are processed instantly or within a day.

The customer support service at IC Markets is good. Their support executives can be reached out via live chat, email, and local Australian phone numbers to clear any query. We tested their email support & Live Chat, and we found them to be responsive in answering our questions.

IC Markets Pros

- IC Markets is regulated by ASIC and is considered safe for Australian traders

- The spreads are among the lowest in Australia

- MetaTrader, as well as cTrader trading platforms, are available

- Wide range of trading instruments is available

- Multiple deposits and withdrawal methods are available

- AUD based accounts are available

- The local phone number for customer support is available

IC Markets Cons

- The minimum deposit is high (200$ or 270 A$)

- The commission of the Raw Spread account is slightly higher (7$ round trade)

#3 Pepperstone – Best Low Spread Regulated Forex Broker

Pepperstone is another low-cost forex broker that is regulated by ASIC and offers low-spread trading services in Australia. They support AUD-based base currency trading accounts with a minimum initial deposit of 200 AUD. Commission-based as well as spread-only trading accounts are available at Pepperstone.

Pepperstone is regulated by the Australian Securities and Exchange Commission (ASIC) with the name Pepperstone Group Limited. The ASIC license was acquired on 4/2/2013 with the ABN number 12 147 055 703. It has a ‘current’ status at the time of this review.

Apart from ASIC, Pepperstone Group also holds a Regulatory license from FCA in the UK (684312), CySEC in European Union (388/20), DFSA, BaFin, CMA, and SCB. It is a trustworthy brand among the global financial services providers operating since 2010. It can be considered safe for Australian clients as the third-party risk of choosing Pepperstone is very low.

It allows clients to choose between 2 account types namely Razor and Standard. The Standard account is the spread-only account in which no commission is involved. The spreads start from 0.6 pips with the Standard account and are 0.69 pips on average for EUR/USD. The Standard account is only available with the MetaTrader trading platform.

The Razor account can be opened with cTrader as well as MetaTrader trading platforms. The commission on the MetaTrader version for AUD-based accounts is AUD 7 for a round trade of a standard lot. The commission with the cTrader version of this account is USD 6 equivalent to a round trade of a standard lot. Spreads start from 0 pips and are 0.17 on average for EUR/USD with the Razor Account type.

Pepperstone also has a professional account type available with MT4, MT5, and cTrader platforms. It has max leverage of up to 1:500 on forex pairs and a dedicated relationship manager is assigned to every account. Traders need to fulfil certain criteria to unlock the benefits of professional accounts. The criterion includes completing a quiz, minimum assets worth AUD 2.5 million, gross income of AUD 250,000 for the last 2 years, or experience in the FX and CFD profession for more than a year.

For retail clients, the maximum available leverage is 1:30 on currency pairs for Australian clients according to the regulatory compliance of ASIC. A total of 63 forex pairs are available to trade at Pepperstone. Apart from this, 22 CFDs on cryptocurrency, 23 Indices, 32 commodities crosses, 3 currency indices, 100 ETFs, and stocks of Australia, US, the UK, and Germany can be traded via CFDs. The maximum leverage is capped at 1:20 for Indices and Gold, 1:10 for other commodities, and ETFs, 1:5 for stocks, and 1:2 for cryptocurrencies.

Australian clients can deposit and withdraw at Pepperstone through VISA/Mastercard debit and credit card, POLi, Bank Transfer, BPay, PayPal, Neteller, Skrill, and Union Pay. The minimum amount is 200 AUD.

Each method takes a different time to complete the transaction. Bank transfers and e-Wallet transactions are processed instantly. Withdrawals through Wire Transfer can take up to 5 working days to process. All transactions are free from the broker’s side except international bank transfer that incurs 20 AUD per transaction.

The customer support service is good with the live chat and email as queries can be resolved within 2-5 minutes. There is also a local phone support in Australia to contact the support executives directly.

Pepperstone has good offerings in the research and education section. There are plenty of learning materials available on the website and app that can be useful for beginners. We found Pepperstone to be a safe choice for new as well as experienced forex and CFD traders in Australia.

Pepperstone Pros

- Pepperstone is regulated by ASIC and 2 other Tier-1 & Tier-2 regulatory authorities i.e. FCA, CySEC.

- The spreads are low starting from 0.6 pips without commission

- AUD can be chosen as the base currency of the account

- Wide range of trading instruments available

- Metatrader, as well as cTrader trading platforms, are supported

- Multiple transaction methods supported including free local bank transfer

- Local phone support available in Australia

Pepperstone Cons

- Minimum Deposit is 200 AUD

- Commission on the Razor account is slightly high (7 AUD for round trade of 1 lot)

#4 FP Markets – Best AUD-Based Broker with Low Minimum Deposit

FP Markets or First Prudential Markets is an Australian forex and CFD broker that is regulated by ASIC. It offers AUD-based forex and shares trading accounts for different types of traders.

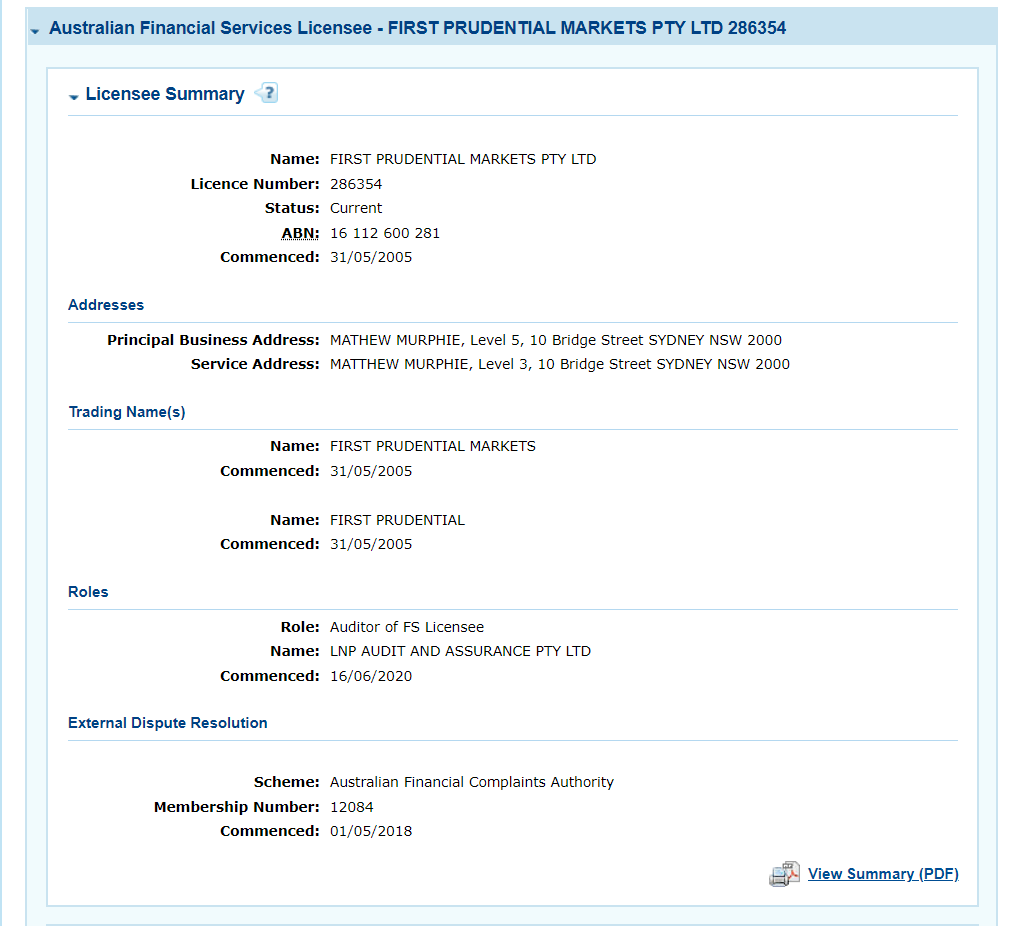

First Prudential Markets Pty Ltd is among the oldest forex and CFD brokers in Australia as it was founded in 2005. It acquired the Australian Securities and Exchange Commission (ASIC) license to operate as a financial services provider by the name of First Prudential Markets Ltd under license number 286354. The license has a current status with the ABN number 16 112 600 281 and was acquired on 31/5/2005.

FP Markets Group also holds the CySEC license (371/18). It can be considered safe for Australian clients due to strict regulatory compliance from ASIC.

Clients can choose between 2 types of forex trading accounts with MetaTrader 4 and 5 platforms. The forex trading account follows the ECN Pricing execution model, but they are the issuer of their products. They also offer 3 types of IRESS account types with the Direct Market Access (DMA) execution technique.

The two forex trading accounts namely Standard and Raw accounts can be opened with AUD as the base currency and a minimum initial deposit of 100 AUD. The Standard account is commission-free while the Raw account involves a commission of 6 AUD for a round trade of a standard lot. The spreads for EUR/USD is 1.2 pips and 0.1 pips on average with the Standard and Raw account types. No commission is applicable on commodities, indices, and cryptocurrencies with either account type.

Both account types allow trading on all the available instruments at FP Markets. There are 61 currency pairs, 5 metals, 13 indices, 7 commodities, and 11 cryptocurrencies available to trade. The max leverage in Australia is according to the regulatory compliance of ASIC.

Australian clients can deposit and withdraw in AUD through Credit/Debit cards, bank transfers, BPay, POLI, PayPal, Neteller, and Broker to Broker. No currency conversion rates will apply if the base account currency and deposit currency are AUD. All the transactions are processed in 1 business day. The withdrawal method needs to be the same as the deposit method.

FP markets have a local office in Sydney, Australia with local phone support to connect with the executives. Queries can also be raised through a live chat window and email.

FP Markets Pros

- FP Markets is regulated by ASIC and has low third-party risk

- AUD can be chosen as the base currency of the account

- Local phone support available in Australia

- The minimum initial deposit is 100 AUD

- Multiple free deposit and withdrawal methods are available

- IRESS trading platforms available apart from MT4 and MT5

FP Markets Cons

- Spreads are slightly higher than a few ASIC-regulated forex brokers in Australia

#5 IG Markets – Reputed FCA regulated Broker

IG Markets is a London based CFD broker that was incorporated in 1974 and is regulated by the ASIC in Australia.

IG Markets can be considered one of the safest choices for CFD brokers as it is regulated by the 3 top-tier regulatory authorities across the globe. It is also among the oldest FSPs that are currently offering CFD trading services in the Uk.

IG Markets Limited is the legal entity in Australia that is regulated by the Australian Securities and Investment Commission of Australia (099019851). It is also regulated by the FSCA of South Africa (41393), and FCA of the UK (195355). IG Markets is in the business of offering spread betting services since 1974 and has been offering CFD trading since 2003. It is also regulated in the US by the NFA and CFTC.

There are no choices of account types and the only account type is commission-free. The spread at IG Markets is 1 pip per lot for EUR/USD. The commission is only incurred on trading CFDs of Shares. There is an inactivity fee of $12 monthly but that will only be incurred if no trades are executed for more than 2 years.

AUD is available as the base currency of the account. clients can reach out for support services through live chat and local phone number in Australia. MT4 is the most chosen trading platform at IG Markets but they also support various advanced trading platforms like ProRealTime, L2 Dealer, etc.

There are more than 12,000 CFD instruments available to trade at IG Markets. This includes 90 currency pairs that can be traded with a maximum leverage of 1:30. 25 commodities, 10 cryptocurrencies, 70 indices, and nearly 12,000 shares can be traded via CFD at IG Markets.

Deposits and withdrawals can be done through local bank transfers, credit/debit cards, and several electronic payment gateways. No additional commission is incurred for deposits and withdrawals.

IG Markets Pros

- Multiple top-tier regulatory license

- Wide range of trading instruments

IG Markets Cons

- Higher trading fees

#6 Plus500 – Forex Trading Platform with Risk Management tools

Plus500 is a top-tier regulated CFD broker that was launched in 2008. It supports its own proprietary trading platform.

Plus500AU Pty Ltd is the legal entity of Plus500 that is regulated under ASIC of Australia with AFSL 417727. Apart from this, Plus500 also holds top-tier regulatory licenses from the FCA in the UK and FSCA in South Africa. Plus500 is also listed on the London Stock Exchange which further increases its safety ratings.

There are no choices for account types and the only available account type has spread as trading fees. The spreads are variable and start from 0.6 pips. For EUR/USD, we found the average spread to be 0.8 pips.

There is no deposit or withdrawal fee charged for any of the accepted methods. However, an inactivity fee of $10 is deducted from account equity each month if no trades are executed for 3 consecutive months.

Clients can trade with 71 currency pairs and more than 1000 CFDs on stocks, commodities, indices, and cryptocurrencies. The minimum deposit is $100 and the maximum leverage for the Australian clients is 1:30 for major pairs. MetaTrader or cTrader trading platforms are not available as it offers their proprietary trading platform.

Local phone support is not available but clients can connect with the support staff through live chat. The FAQ section can also clear a lot of common queries.

Plus500 Pros

- Multiple top-tier regulatory license

- It is listed on London Stock Exchanege

- Wide range of trading instruments

Plus500 Cons

- MetaTrader trading platform is not supported

- Local phone support is not available in Australia

- No choices of account types

#7 FXCM – ASIC Regulated Forex Broker with Multiple Trading Platforms

FXCM is an ASIC regulated forex broker that allows trading on multiple trading platforms including MT4.

FXCM Australia Pty. Limited is the legal entity of FXCM in Australia that is regulated by ASIC and registers Australian clients. The ASIC regulatory license number of FXCM is 309763. They also have a local office in Melbourne Australia.

FXCM has low third-party risk as it is also regulated by the top-tier regulatory authorities FSCA of South Africa and FCA of the UK. They incur variable spreads on each instrument. The Average typical spread on EUR/USD is 1.05 pips.

There are no choices for account types with different pricing structures. The trading fees are built into the spread. No deposit or withdrawal fees are charged from the broker for local bank transfers and several other methods in Australia.

By opening an account with FXCM, clients can trade on MetaTrader 4, NinjaTrader, TradingView, ZuluTrade, and capitaliseAI. They allow trading on more than 200 CFD instruments including 42 currency pairs.

FXCM Pros

- Multiple top-tier regulatory license

- Multiple trading platforms supported

- Low non-trading fees

FXCM Cons

- Only a single account type for all types of traders

- Local phone support is not available in Australia

- Lesser number of trading instruments available

#8 CMC Markets – Best Forex Broker with Highest Range of Markets

CMC Markets is an ASIC-regulated forex and CFD broker that allows trading on more than 12000 trading instruments through MT4 trading platform at low cost.

CMC Markets Asia Pacific Pty Ltd is the legal entity of CMC Markets that is regulated by the ASIC of Australia under license number 238054 and ABN Number 11 100 058 213. CMC Markets holds the ASIC regulation license since 2004.

They are also regulated by the FCA of the UK and are also a listed company on the London Stock Exchange. CMC Markets is a market maker but can be considered safe for trading forex and CFDs in Australia.

They only offer a single account type which trading fees built into spreads and swaps. Commission-based trading is only available to stocks. The average spread for EUR/USD currency pair at CMC Markets is 0.7 pips which is lower than many peers in Australia.

They do not charge any non-trading fees apart from the inactivity fees that is $10 per after 12 months of inactivity. They support the MT4 trading platform and the NextGEN trading platform for trading a wide range of instruments.

More than 12000 trading instruments are available including 338 currency pairs. No other forex broker in Australia allow trading on more number of forex pairs than CMC Markets.

The Maximum leverage is 1:30 as per the regulatory regimes of ASIC. AUD can be chosen as the base currency of account apart from USD and GBP. They do offer customer support services through local phone support in Australia through local number +61 (0) 2 8221 2100.

CMC Markets Pros

- Multiple top-tier regulatory license

- Highest range of trading instruments

- Low spreads starting from 0.6 pips

- Local phone support available in Australia

- CMC Markets is listed on London Stock Exchange

- CMC Markets does not have a minimum deposit limit

CMC Markets Cons

- MT5 or cTrader trading platform is not available

- CMC Markets is a market maker

How to Choose the Best Australian Forex Broker?

Forex trading in Australia is legal for a long time and there is a significant demand for online forex and CFD brokers in Australia. Most of the International Forex Brokers accept traders from Australia, but not all of them are licensed.

There are plenty of Financial Services Providers in Australia that operate without licenses. Some can be fake and can cause financial losses to the traders.

Each broker has different features and charges differently for their trading services. And it is important to consider that different broker can be ideal for different types of traders. Hence, it is very important to choose the most suitable forex broker in Australia for your trading style & risk appetite.

Also, you must note that trading Forex & CFDs is risky, and not for everyone. So, you must understand all the risks before you come to the process of a broker selection.

Once you have decided to trade, checking the following aspects in a broker is a must & it would assist you in choosing the right broker.

1) Verify that the Broker is Licensed by ASIC

Forex Trading in Australia is regulated by the Australian Securities and Exchange Commission (ASIC). ASIC was formed in 1998 after the Australian Securities Commission (ASC) was dissolved. Each financial services provider offering services within the jurisdiction of Australia needs to hold a ‘current’ regulatory license from ASIC.

Any broker or FSP that does not hold an ASIC license is very likely to be fake and is very risky for Australian traders. Traders must check every detail of the ASIC license before choosing a forex or CFD broker in Australia.

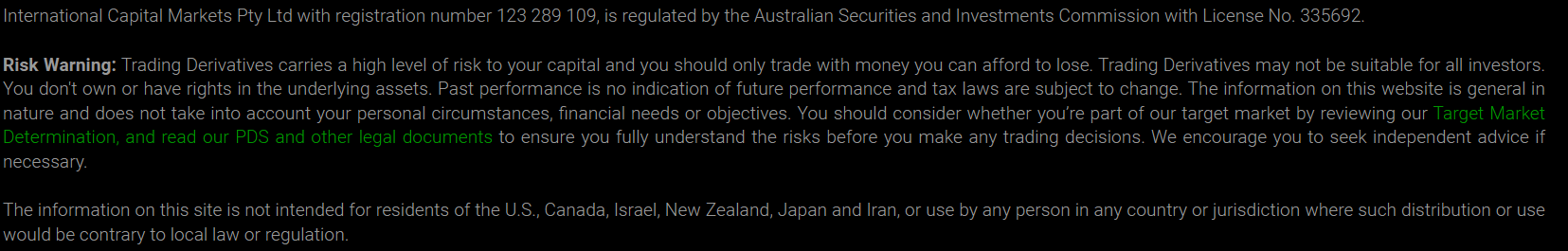

Most brokers mention their ASIC regulation details at the footnote of their website. The AFSL number or ABN number can be used to cross-check the license details from the ASIC website. Clients should verify the authenticity and current status of the license before choosing a broker.

Step 1: Find the Broker’s Regulatory Information:

For example, IC Markets forex broker (International Capital Markets Pty Ltd) is regulated by ASIC, and they mention their regulatory information along with the license no. on their website.

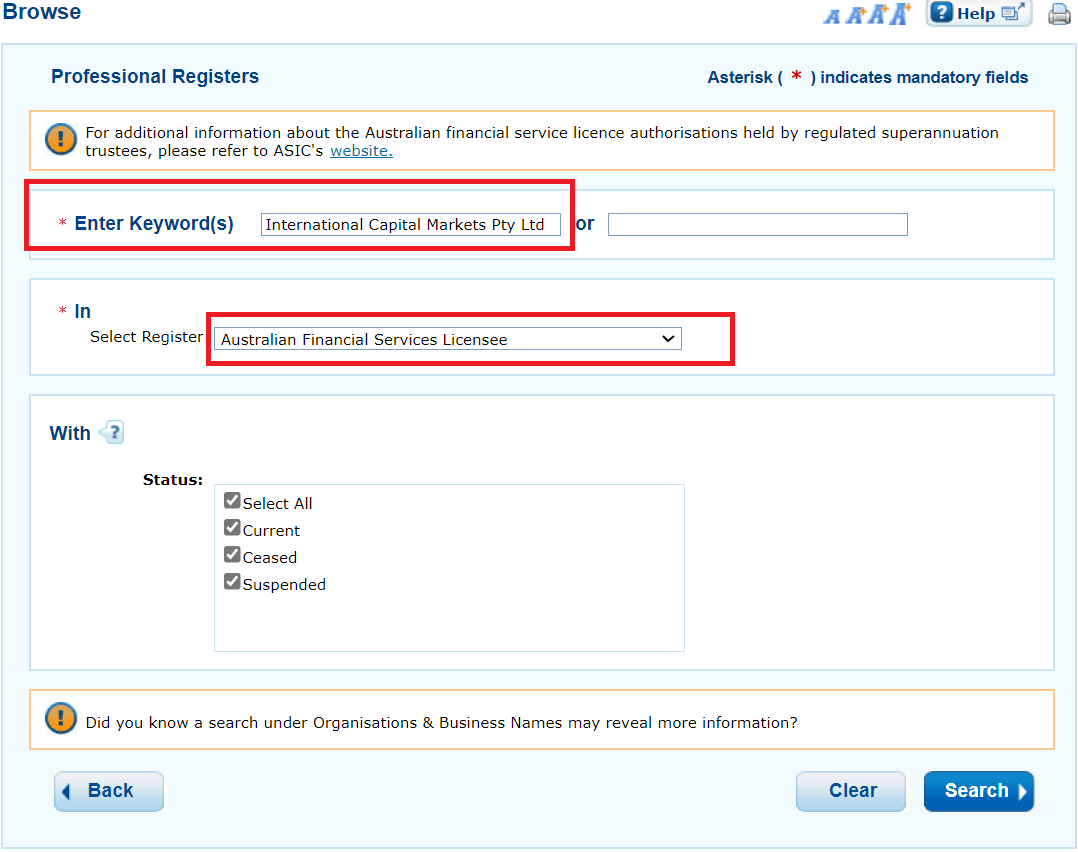

Step 2: Verify the License on ASIC Connect’s Public Register

Once you have the license no. of the broker’s company name, you should verify that on ASIC’s Professional Register which is available publicly under “Australian Financial Services License”.

Step 3: Check if the License is Valid

This step is straightforward. Once you have entered the License No., you will see the list of regulated AFS, and you will see the status, and other information which includes the year of licensing & validity.

2) Verify the Official Website of the Broker

Each authentic broker will have an official website where every detail about the broker can be accessed. If you find a broker offering lucrative features but does not have an official website, it is very likely to be fake.

The number of years in the business and reviews by professionals and existing clients should also be checked before choosing a broker. Some fake brokers may use the regulatory license and number of other brokers, hence it needs to be verified by the client.

Unlicensed or offshore-regulated brokers may try to attract traders with lower fees and higher leverage. Australian clients must not fall for this prey and stay informed while choosing the broker.

Australian clients must ensure that they are not registered under offshore regulations like FSC, BVI, FSA, CySEC, etc. Such regulatory authorities have much lenient regulatory compliance and may not be useful for Australian clients.

3) Cost of Trading

The cost of trading is the main basis of selection for many Australian clients. The cost of trading should be checked and compared but this should never be the only basis of selection as fake brokers often try to attract clients with lower fees.

There are various components of the overall cost that are incurred by forex and CFD traders. The following must be checked separately:

Trading Fees: Spreads are the major component of trading fees but brokers can also offer commission-based trading. The spreads in pips and commissions in AUD must be compared for preferred trading instruments. Higher spreads will decrease the gains and profit-making probability.

Apart from spreads and commission, swap rates are also needed to be checked before choosing a broker. This is the fee that is added to every opened position if kept open overnight. Some brokers can offer low spreads with high swap rates to compensate for lower spreads.

Non-Trading Fees: This includes the charges incurred without executing trade orders. Account opening is mostly free but deposits and withdrawals can involve additional commission for each transaction. Each accepted method can have a different commission. The currency conversion fee will also apply if the deposit currency is different from the base account currency.

Some brokers also charge inactivity fees if there is no trading activity for a prolonged period. The inactivity period can range from 3 months to 12 months while the monthly inactivity charges can vary from broker to broker.

Clients can check the details of all the associated costs of trading from the official websites. If not found, they can reach out to customer support executives to inquire about the same.

4) Available Account Types

Some brokers may offer multiple account types to serve the needs of different types of traders. Small-volume traders and beginners like to trade with the spread only while high-volume traders and scalpers would be more comfortable with commission-based spread-free pricing.

Brokers may or may not offer AUD or other preferred currency as the base currency of the account. The minimum deposit, leverage, available instruments, support trading platforms, maximum/minimum lot sizes, etc can be different for each account type. Clients should choose the best-suited account type according to their requirements and objective.

IC Markets and Pepperstone have multiple account types and allow traders to choose the most useful account type for themselves.

5) Number of Available Trading Instruments

If you wish to trade with multiple trading instruments from different asset classes, you must check the available trading instruments at the broker. Each broker allows trading on a different number of trading instruments. A higher number of instruments provides more opportunities to traders. However, some clients only trade with the market they are familiar with.

Clients must ensure whether their preferred trading instrument is available to trade or not. The details of available instruments can be checked under contract specifications on the broker’s website. The preferred trading instruments must also be available to trade with the chosen account type.

6) Is Your Preferred Trading Platform Available?

Each broker can support different trading platforms. Most of the forex and CFD brokers in Australia use MetaTrader 4, MetaTrader 5, or cTrader trading platforms but some can also have their proprietary trading platforms. Brokers like eToro and Plus 500 have their proprietary trading platforms while Pepperstone and FP markets use the MetaTrader trading platform.

The provided trading platforms should be supported by the device you wish to trade with. Some traders only trade with PC while others like to trade on the go with mobile and tablet trading platforms.

If you are familiar with a particular trading platform and only wish to trade with it, then you must ensure that the chosen broker offers it in the preferred device with the chosen account type.

7) How Good is Customer Support?

Customer support services can greatly affect the user experience with any of the brokers. The assistance of support executives can be needed at any point during the trade. The inability to connect with the staff of the broker may be bothersome for the clients.

You can raise random queries through email, live chat window, or call them to check the quality of the customer support service before opening an account.

For our tests, we talked to the Live Chat support with every broker. We tracked the average/typical time taken to connect with the chat, the time taken to answer questions & the quality, and the accuracy of responses in resolving our doubts.

Also, we tested the email support by sending emails to their support emails. We check the average time it took for the response, and the actual response itself.

8) You Must Clear All Your Queries

If you are unable to gather any information about the broker, it is better to ask them directly through the live chat window, email, or phone support.

You must not rely on the words of a friend or relative and should make an effort to find the best-suited forex and CFD broker for yourself.

The reviews by professionals and existing clients can be used to select and compare brokers but the final decision must be made on your research. You must also note to not fall for every review (good or bad), and try to verify if that review is actually accurate.

When in doubt, ask questions to the broker through customer support services.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

The following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. FCA-regulated brokers cannot offer more than 1:30 leverage however, leverage of 1:10 can be considered safe in the initial phase of forex trading.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on the opened positions.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with them if it is fake. This risk can be mitigated by choosing an FCA-regulated broker in the UK. Clients registered under FCA are protected by up to GBP 85,000 in case of an unsettled dispute between broker and client.

Interest Rate Risk

In Forex and CFD trading, Interest Rate Risk refers to the potential for changes in interest rates to impact currency values or the value of financial instruments. For example, if a country raises its interest rates, its currency might strengthen due to higher returns on investments in that currency, affecting Forex trades.

Liquidity Risk

Liquidity Risk is the risk that an asset cannot be bought or sold quickly enough in the market to prevent a loss or make the desired profit. In volatile market conditions, there might be fewer buyers or sellers, which can make it difficult to close positions at favorable prices.

Political and Economic Risks

Political and Economic Risks involve changes in political stability or economic policies which can cause market volatility. Events like elections, policy changes, or economic crises in a country can significantly affect currency values and financial markets, leading to unpredictable outcomes in Forex and CFD trading.

Tips to Become a Successful Forex Trader

Educate: Learn the basics of forex trading.

Reliable Broker: Choose a regulated broker with good support.

Risk Management: Set stop-loss, take-profit, and manage risk.

Demo Account: Practice on a demo account before real trading.

Plan: Develop a clear trading plan and stick to it.

Major Pairs: Begin with major currency pairs.

Stay Informed: Follow global economic news.

Analysis: Use technical and fundamental analysis.

Emotions: Control emotions to avoid impulsive decisions.

Patience: Success takes time; avoid quick gains.

Consistency: Stick to a proven strategy.

Records: Maintain a trading journal.

Diversify: Consider diversifying beyond forex.

Comparison of Best Forex Brokers Australia

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| Pepperstone |

0.77 pips

|

£0

|

1:30

|

Visit Broker |

| IC Markets |

1 pip

|

$200

|

1:30

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:30

|

Visit Broker |

| eToro |

1 pips

|

$200

|

1:30

|

Visit Broker |

| IG Markets |

1 pips

|

$300

|

1:30

|

Visit Broker |

| ETX Capital |

0.6 pips

|

$100

|

1:30

|

Visit Broker |

FAQs on Best Forex Brokers Australia

Which Australian Forex Brokers are Good?

There are some regulated low cost forex brokers like Pepperstone, IC Markets etc. Most of the forex brokers that are regulated are considered okay. But each broker has different regulations, fees, safety, support, accounts, and trading conditions. A broker ideal for one trader may not be ideal for another in the same country. You must compare each broker according to your trading style.

Are Forex Brokers Safe?

ASIC Regulated Forex Brokers are considered safe for trading forex. But Forex & CFD trading is a high-risk. Also, the involvement of leverage for retail & professional traders can increase gains but can also lead to losses more than the account balance.

The third-party risk can be mitigated by choosing an ASIC-regulated broker in Australia. Although, the market risk will always prevail in the forex market. It is important to note that a majority of the new traders lose money while trading forex.

Is Forex Trading Legal in Australia?

Yes forex trading is legal and is regulated by the Australian Securities and Investment Commission. Clients opening their account under ASIC-regulated brokers are registered and protected under ASIC regulatory compliance. The maximum leverage on forex pairs is 1:30 for the retail traders with ASIC-regulated brokers.

Which forex broker is best for beginners?

Beginners must ensure that the chosen broker is regulated by ASIC, offers low spread, low minimum deposit, and helpful customer support services. According to our analysis, Pepperstone, IC Markets, eToro, and FXCM are among the best brokers ideal for beginners.

Which is best forex broker?

Pepperstone, IC Markets, eToro, CMC Markets, FXCM, IG, and FP markets are the best forex brokers in Australia. Each broker is ideal for different types of traders. Each client must check and compare all the aspects of forex brokers before opening their account in Australia.

What is the most safest forex broker?

Forex trading in Australia is regulated by the Australian Securities and Exchange Commission (ASIC). All brokers that are regulated by the ASIC of Australia can be considered safe. Further, if the broker is also regulated in multiple jurisdiction or listed on a stock exchange, it is considered safe. Pepperstone, IC Market, eToro, CMC Markets, etc are among the safest brokers in Australia.

Is forex taxed in Australia?

Yes, forex trading in Australia is legal and the profits booked on trading forex is taxed as per the prevailing capital gain tax rates in Australia.

Who is the number 1 broker in Australia?

According to our analysis and comparison, Pepperstone can be considered as best forex broker in Australia. It offers low cost trading on multiple platforms and offers good customer support services. AUD is available as base currency and multiple methods are supported for deposit and withdrawal with no lower limit on minimum deposit.

Do you need $25,000 to day trade forex?

No, trading on forex pairs can be started with a minimum deposit of as low as $10. The minimum deposit amount for trading forex depends on broker chosen by the trader. Before opening the account, traders must check the minimum deposit requirement with the broker.

How do I withdraw money from forex?

Each ASIC-regulated forex and CFD brokers in Australia accept multiple methods for deposits and withdrawals. The time required to process the transaction and the commission incurred can be different for each accepted method for deposit and withdrawal. Most brokers describe the details of transaction methods on their official website. Traders can also inquire about this through customer support services.