Best CFD Trading Platforms Australia 2024

We have compared the regulated CFD Trading Platforms in Australia. Our analysis is based on multiple factors including ASIC regulation, trading fees, trading conditions, deposit & withdrawal options, trading platforms & more.

Contract for Difference or CFDs as they are known refers to an agreement between two parties (broker & the trader) that allows the trader to speculate on the price of a particular Instrument.

In a CFD trade, you don’t own the underlying assets, but you kind of engage in a bet on the value of that instrument. That is, CFD traders only speculate whether the instrument’s price will rise or fall.

For Retail Investors, Trading CFDs is highly risky hence it is advised that only experienced and professional traders should engage in it. This is true since it has been reported by ASIC that as high as 80% of Retail CFD traders lose.

Trading CFDs is legal in Australia. However, it is advised that traders must only register with brokers who are licensed by the ASIC (Australian Securities and Investment Commission). This advice is important to protect traders’ funds.

Here is a list of Best CFD Trading Platforms Australia for 2024

- Pepperstone – Overall Best CFD Trading Platform in Australia

- IC Markets – Best CFD Trading Platform with low fees

- FP Markets – Best CFD Broker with best trading conditions

- eToro AUS Capital LTD – Best CFD Trading platform with large instruments

- CMC Markets – Regulated CFD Broker with multiple instruments

- XM Trading – Best CFD Broker with no commission

Our criteria for judging include but are not limited to; AFSL License (Regulatory information and safety of funds with that broker), Overall Fees for major CFDs, Trading Conditions, Funding and withdrawal methods, time, and available customer service methods.

Best CFD Trading Platforms in Australia

Below are the Best CFD Trading platforms for traders based in Australia. For this guide, we researched & compared over 20 CFD trading platforms that accept traders based in Australia.

#1 Pepperstone – Overall Best CFD Trading Platform in Australia

Pepperstone Group Limited was established in 2010. This broker has been regulated by the Australian Securities and Investment Commission since 27th October 2010.

Pepperstone’s ACN with ASIC is 147055703 while its ABN is 12147055703. Pepperstone is the trading name of the ASIC-regulated legal entity Pepperstone Financial PTY LTD.

Trading Fees: Pepperstone offers the option to choose between Razor and Standard account types with different pricing structures. The Standard account type is spread only account with no commission while the razor account incurs a small spread at the expense of trading commission.

The average spread for EURUSD on the Razor account is 0.17 pips (plus $7 commission/lot) while that of the Standard account is 0.69 pips.

The average spread for AUDUSD is 0.17 and 0.77 for the razor and standard accounts respectively. For GBPUSD, the average spread is 0.28 and 0.88 for the Razor and Standard accounts respectively.

Swap fees on Pepperstone are decent and are calculated based on risk management analysis and market conditions. Their Swap Fees are not the lowest but it is not the highest also. Pepperstone swap rates can be found on their website.

Pepperstone only charges commission on its Razor account when trading CFDs on forex and shares. The charge per lot (1000 base currency) is 0.01. For USD it is 0.04, EUR is 0.03, and GBP is 0.02. This figure is doubled on the round-turn trade i.e. opening and closing the position.

Trading Conditions: The minimum deposit at Pepperstone is AUD 200. According to ASIC regulations, the maximum leverage for retail traders is 1:30 on major pairs. Professional traders can use the leverage of up to 1:400.

Pepperstone offers trading on 63 Currency pairs, and CFDs on 22 cryptos, 32 commodities, Indices, ETFs etc. all as CFDs.

The MT4, MT5, cTrader, and Social Trading platforms are trading platforms at Pepperstone and they are available on the web, PC, Android, and iOS. Pepperstone also has trading tools such as smart-trader, cTrader automates, Autochartist, Api Trading, etc.

Funding & Withdrawals: Pepperstone accepts Funding and Withdrawal of accounts via these methods; Card (Visa & Mastercard), POLi, Bank Transfer in Australia, Bpay, Neteller, Skrill, and Union Pay. This can be done by logging in to your secure client area. There are no deposit charges on Pepperstone.

Bank withdrawals usually take around 3 – 5 days to process.

Support: Pepperstone has three customer service options. You can reach them via email, call them or visit their Australia office in Melbourne. They also have a local Australian number to call.

Pepperstone Pros

- ASIC Regulated Forex broker

- No charges on deposits and withdrawals

- Low Spread with Standard Account

- AUD is available as base currency of the account

- Local phone support available in Australia

- The account can be configured in multiple ways

Pepperstone Cons

- Delay in processing bank withdrawals

- Charges high commission on Trading with Razor account

- No live chat on customer service on weekends

#2 IC Markets – Best CFD Trading Platform with low fees

IC Markets Group PTY LTD is registered by the Australian Securities and Investment Commission (ASIC) with registration number ACN 648 014 215.

Accounts & Fees: IC Markets offers two account types to traders. The Raw Spread and the Standard account. IC Markets offers an average spread of 0.17 pip and 0.77 pip for its Raw spread and Standard account for the AUDUSD pair.

For GBPUSD, its average spread is 0.23 and 0.83 pips for the raw spread and standard accounts. USDCAD had an average spread of 0.25 and 0.85 pips on the Raw spread and Standard accounts. However, the Raw Spread account has a commission of $3.5 per lot.

Trading Conditions: The minimum deposit at IC Markets is $200.

IC Markets offers CFD trading on 4 Futures, 18 Cryptocurrencies, 11 Bonds, 25 Indices, and 22 Commodities (which include metals).

Trading on IC Markets is carried out using MT4, MT5, and cTrader. These platforms are available on Android, web, PC, iOS, and Mac.

Funding & Withdrawals: The different account funding options available on the IC markets are; credit cards via visa and Master Card, PayPal, Neteller, Skrill, Union Pay, Wire transfer, Bpay, Fasapay, Broker to Broker, POLi, Radipay, etc. The time for processing these different options differs. While some take from minutes or hours to days before processing, others are instant. IC Markets does not charge any fee for deposits.

IC Markets does not charge any withdrawal fee for Australian payment methods, however, for international bank wire transfers outside Australia, a processing fee of 20 AUD is charged.

Customer Support: IC Market’s customer service is available 24/5 as per our tests. They have a live chat on their website along with Toll-Free Australian Phone numbers and emails for support.

Pros of Trading with IC Markets

- Zero Deposit & Withdrawal Fees

- Regulated by ASIC

- The spreads at IC Markets are low

- Multiple account types and trading platforms available

- AUD available as base currency

Cons of Trading with IC Markets

- Not offering negative balance protection

- Live Chat Support is very slow

#3 FP Markets – Best CFD Broker with best trading conditions

FP Markets is a regulated Forex & CFD broker. They are registered with the Australian Securities and Investment Commission (ASIC) with registration number 16 112 600 281. According to the ASIC website, its Australian office is in Sydney.

Accounts & Fees: FP Markets has two account types. These are the Standard and Raw accounts. The standard account has a minimum deposit of 100AUD, spread beginning from 1.0 pip and zero commission per lot.

The Raw account, on the other hand, has a minimum opening balance of 10AUD, spread beginning from 0.0 pip, and a 3 USD trading commission per side.

The EURUSD on the standard account has an average spread of 1.2 pip while that of the raw account is 0.1 pip. The average spread for AUDUSD is 1.3 and 0.2 pip for the standard and raw accounts respectively. For the GBPUSD the average spread is 1.4 and 0.3 for the standard and raw accounts respectively. The swap rate on FP Markets for EURUSD is -4.16 and 0.40, for AUDUSD, it is -20 and -20. GBPUSD is -1.94 and -2.24.

Trading Conditions: FP Markets offers around 63 forex pairs, over 350 CFD shares, 6 CFD metals, 5 commodities, 14 indices and 5 cryptocurrencies.

The FP Markets trading platforms are the MT4, MT5, WebTrader, and Mobile Trading apps.

Funding & Withdrawals: Funding your account can be done through a variety of payment methods. These methods include; debit and credit cards such as visa and master cards, bank transfer, Neteller, Skrill, Sticpay, dragon pay, and PerfectMoney. IF Money also accepts cryptocurrency deposits. However, this comes with blockchain charges. Funding your account on FP Markets is free and the processing time can range between seconds and days depending on the payment method.

Withdrawal of funds is also free of charge on FP Markets and uses the same payment methods as for funding the account.

Customer Support: Customers can reach out to FP Markets via live chat, phone, and email. They are available from Sundays to Fridays.

Pros of Trading with FP Markets

- Zero Deposit Fees

- Offering Demo Account to traders

Cons of Trading with FP Markets

- Not allowing US traders

- No negative balance protection

#4 eToro AUS Capital LTD – Best CFD Trading platform with large instruments

eToro is a popular Israel-based CFD platform with Social trading that was established in 2007. They are also registered with ASIC with registration number 66612791 803. eToro’s Australian head office is located in Sydney Australia.

Trading Conditions: eToro offers a variety of instruments such as 2714 stocks, CFDs on 45 cryptocurrencies, 49 currency pairs, 13 indices, 264 ETFs and 33 commodities.

Fees: The spread on eToro for the EURUSD pair is 1 pip, same with USDJPY. USDCAD is 1.5 pips, EURGBP is 1.5 pips and AUDUSD is 1 pip. This is for CFD trades. According to eToro, 68 per cent of retail CFD trades experience losses. This makes CFDs highly risky.

Funding & Withdrawals: eToro does not charge any fee for deposits to Australia-based traders. However, $5 is charged for withdrawals. There is also a conversion fee for deposits in other currencies. There is also a $10 per month inactivity fee after 12 months of inactivity.

eToro accepts the following payment systems; bank Transfer, Credit and Debit cards, PayPal, Neteller, Skrill, POLi, etc. The above-listed payment methods are processed instantly except for bank transfers which take between 4 to 7 days.

Customer Support: eToro customer service system is available 24 hrs every day. They have a live chat option, email, and phone number which one can use to lay complaints. However, there is no local Australian number.

Pros of Trading with eToro

- ASIC regulated broker

- A large number of instruments

- User friendly trading platform

- Free copy trading services

- Social trading and research tools are helpful

Cons of Trading with eToro

- Too high fees & other charges, including Inactivity and withdrawal charges

- High spread for many instruments

- AUD is not available as base currency of the account

- No other trading platforms like MT4, MT5, or cTrader available

#5 CMC Markets- Regulated CFD Broker with multiple instruments

CMC Markets is a London-based CFD broker that is also licensed with ASIC with registration number 69 081 002 851. According to the ASIC’s website, it has an office in Sydney, Australia.

CMC Markets is a publicly traded company in London & are regulated in Australia, so they are considered a low-risk broker for Australian traders.

Fees: The minimum spread for CFD forex pairs are; AUDUSD 0.70 pip, EURGBP 1.10 pip, EURUSD 0.70, and GBPUSD 0.90. USDCAD 1.30 pip. When trading CFDs, a commission is charged upon starting any trade. The minimum amount here is 7 AUD.

Trading Conditions: CMC Markets offers over 330 forex pairs, 82 indices, 19 cryptocurrencies, 55 treasuries etc. CMC Markets has a 100 per cent guarantee to stop loss. However, this comes with a fee.

CMC Markets has four trading platforms. The Next Generation trading platform, MetaTrader 4, Share trading standard platform and Share trading pro platform.

Funding & Withdrawals: CMC Markets accepts deposits on traders’ accounts via the following payment systems; credit and debit card, POLi, PayPal, and bank transfer. There are no deposit fees nor are there withdrawal fees. The same funding methods also apply to withdrawals.

Customer Support: Customer service on CMC Markets is structured into the following areas; instant live chat, phone number, leave a message, and email. CMC provided an Australian number for Australian clients to call in.

Pros of Trading with CMC Markets

- Well-regulated broker, also listed on LSE

- Good website interface

- Wide range of instruments available from multiple asset classes

- Good quality support services available

Cons of Trading with CMC Markets

- Trading charges are slightly high

- Limited number of funding and withdrawal methods

- No choices for account types

- MT4 is the only available trading platform

#6 XM Trading – CFD Broker with no commission

XM Trading (Trading Point of Financial Instruments Pty Limited) is regulated by the Australian Securities and Exchange Commission with license No. 443670.

Accounts & Fees: XM Trading provides three Account types for traders. We have the Micro account, Standard account, shares account and Ultra-low account.

The micro account has USD, AUD, and GBP (and a few others) as base currency options. There is no commission on trades and the minimum deposit at XM is $5.

But their spread is considered very high, especially with their Micro account which has an average spread of 1.6 pips for EURUSD, 1.8 pips for EURGBP, 2.9 pips for EURCAD, and 1.6 pips for AUDUSD as per their websites. The typical spread that we got when we tested was normally 0.1-0.2 pips higher than the typical spread that they mention.

The XM Standard Account has spread as low as 1 pip on Forex majors, no trading commission charged, base currency in AUD, a minimum deposit of $5 and provides negative balance protection. The XM Trader standard account spread for AUD/USD is 1.8 pips, for EURUSD is 1.7 pips, GBPUSD is 2.1 pips & USDCAD is 2.2 pips.

The Ultra-Low account has a bit lower spread, AUD as one of its base currencies, negative balance protection and allows hedging of funds. There is no trading commission with this account.

Trading Conditions: The XM trader shares account has a minimum deposit of $10000 and there are fees on trading.

XM Trader offers over 1000 CFD Instruments on commodities, energies, indices, metals, and stocks. All of these are offered as CFDs.

The trading platform on XM Trader is the MT4 and MT5 platforms. These are available on Android, Mac, iOS, and the web.

Customer Support: The customer support on XM Trader is effective with its live chat and quick email replies. It also has Australian phone lines to call.

Pros of Trading with XM Trading

- Low minimum deposit of $5

- Low Withdrawal Fees

- Varienty of Education Tools

Cons of Trading with XM Trading

- XM is not regulated by top-tier regulatory authorities

- Support is not availale for 24/7

- High spread on Standard and Micro Account

What is CFD Trading & How Does it Work?

In a CFD trade at a broker, the trader and the broker come to an agreement that the net difference between the open price of trade & the close price on any particular instrument will be settled in cash.

What this means is that the trader can speculate on the price of any Instrument. The trader can place Long Orders if they believe that the price of an asset will rise, or a Sell Order if they think that the asset’s price will drop in the future.

The prices of these instruments are the prices of underlying assets which could be cryptocurrencies, stocks, indices, commodities, and currencies.

Let’s understand it more.

1) Buying a CFD (Long Order)

If you believe the price of a particular asset like Gold will rise; then you can open a buy trade with your CFD broker.

If at the end of the trading period (or your order close), the instrument rises above the price at which you bought it; the broker pays your difference in the price, which would be your profit.

However, if the price moves below the price at which you bought it, then you would pay the broker the net difference, which would be your loss.

2) Selling a CFD (Short Order)

On the other hand, if the trader believes the price of the instrument will move below its current price, he can place a Sell Order. In the event that the moves according to his Sell speculation, the broker then pays him the difference at the end of the trading day or the price at the close of the order.

Let’s use an actual example.

For example, if a trader wants to place a Buy order on AUD/USD with an assumption that the AUD will rise in value against the USD.

The account balance is USD 500 at 1:10 leverage, betting that the AUD will rise against the USD. What will be the result after 100 pips move?

If you are using 1:10 leverage, you can place an order of USD 5000. This is 5 Micro Lots or 0.5 Mini Lots.

If the buying price of AUDUSD is 0.7000 and at the end of the market day, the exchange rate is 0.7100. This has yielded a profit of 100 pips.

The profit with this trade would be USD 50 or equivalent in AUD. But you could also lose this capital in your trade if the price goes against you by 100 pips.

The scenario above is an illustration of how with a small margin, a trader can trade a higher position using leverage. However, if the trade had gone against the trader & the USD had gained, the trader would have lost his capital.

Hence it is important to understand the risks when you are trading CFDs using Leverage.

Role of Spread in CFD Trading

The spread in CFD trading is the difference between the buying and selling prices of a contract. It represents the cost of trading and is how brokers make money. Spreads can vary based on market conditions, impacting your trading strategy and potential profitability.

Wider spreads mean higher costs for traders, so it’s important to choose a broker with competitive spreads. Additionally, in fast-moving markets, spreads can contribute to slippage, affecting the execution price of your trades. Understanding the spread is essential for managing your trading costs and strategy.

What is a CFD Trading Platform?

A trading platform is a software program that is used to place trade orders through any electronic device. The trading platform used for trading CFDs is called the CFD trading platform. Each forex and CFD broker uses one or more CFD trading platforms for online trading.

The task of each trading platform is to forward the orders placed by the traders to brokers. However, the interface, charts, patterns, indicators, processing time, slippage, etc may differ for each platform.

Types of CFD Trading Platforms in Australia

MetaTrader 4: The MetaTrader4 CFD trading platform was developed by MetaQuotes Software to allow fast and convenient online trading. MT4 was introduced in 2005 but is still used by a large proportion of CFD traders due to its simple design like Windows 98.

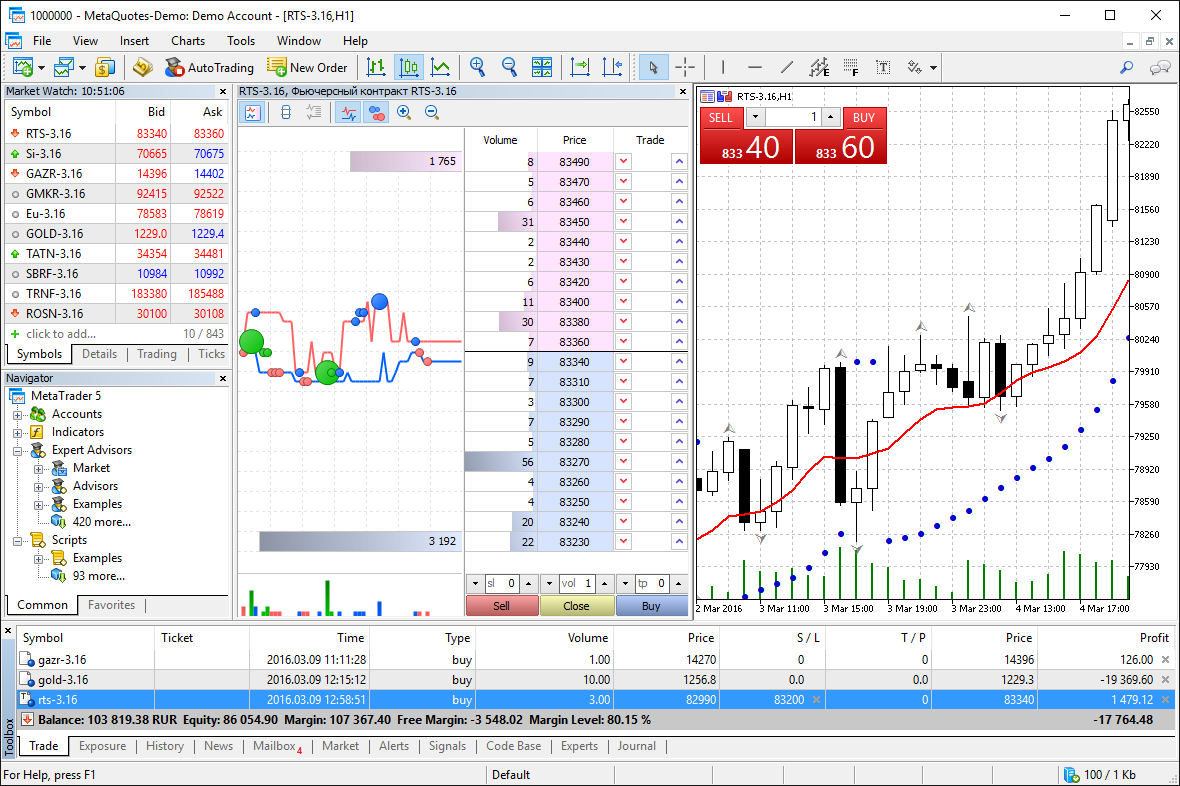

MetaTrader 5: The MT5 CFD trading platform is an upgraded versions of MT4 developed by the same company in 2010. It has more built-in trading tools and is generally preferred by experienced and algorithmic traders.

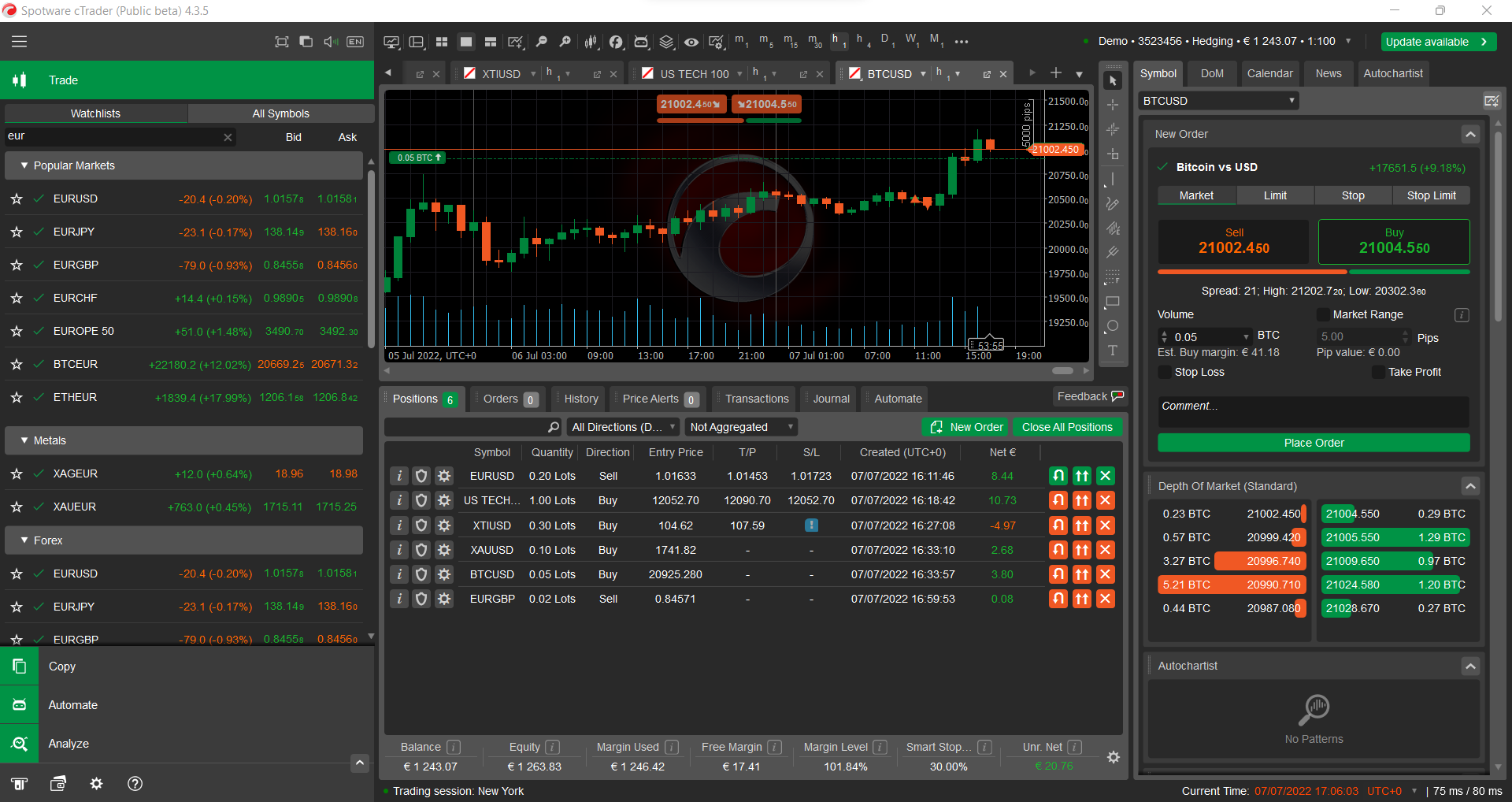

cTrader: The cTrader CFD trading platform was introduced in 2011 by Spotware Systems. cTrader offers a modern interface with more tabs and a detailed view. It is also among the three major trading platforms used globally for forex and CFD retail trading.

Proprietary Platforms: Many CFD brokers in Australia only support their own trading platforms designed by themselves for eg. eToro, Plus500, etc. Each of the proprietary trading platforms can provide a different trading environment for the traders.

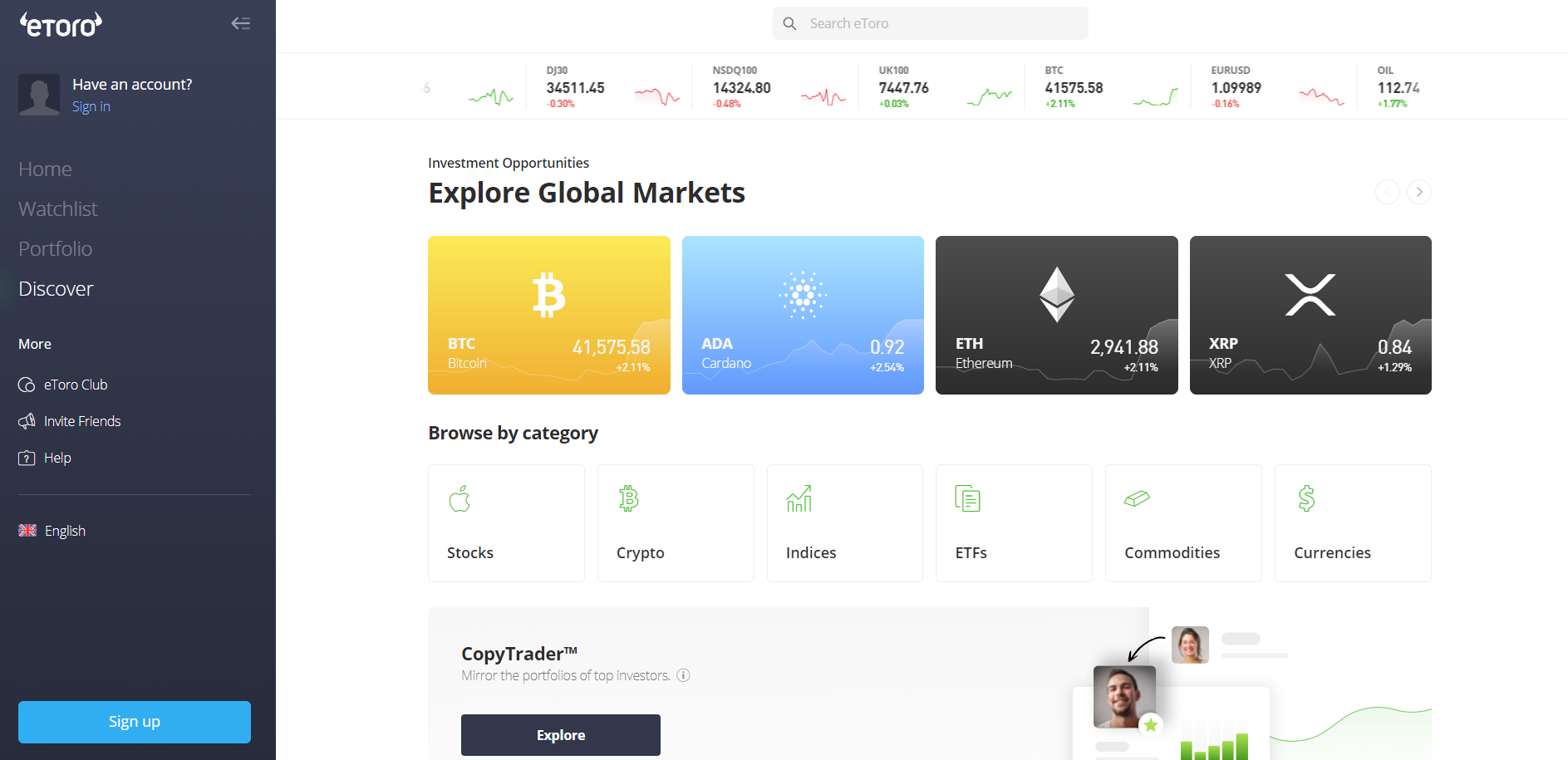

eToro: Among all other proprietary trading platforms, eToro is quite popular and unique. The eToro trading platform has a user-friendly interface which is ideal for beginners. eToro trading platform is very easy to use and the mobile application of the platform is also quite user-friendly.

Traders with no experience can trade easily through this platform. It allows traders to copy any trader without any additional cost. Social trading is also excellent which makes the traders feel connected with other traders and their opinion.

The suitability of each trading platform can differ from platform to platform. It is always advisable to check the platform by using a demo account for all the red flags that can arise while trading. However, the choice of the broker is more important as contract specification and trading conditions will be defined by the CFD broker and not the platform.

How to Start CFD Trading in Australia

CFD trading is legal in Australia and to participate in it, you have to register with a broker. The leverage at most brokers for Retail traders is 1:30 for Forex, 1:2 for Cryptos, and 1:20 for Indices and commodities.

First thing, to start trading CFDs, you must understand the risks involved.

Trading CFD is very risky especially when trading with leverage. Most retail CFD traders do make losses. In fact, around 70 to 80 per cent of retail CFD traders do experience loss.

This is because markets can be volatile and leverage can lead to a loss of trading capital. Hence, it is advised that only experienced and professional traders engage in CFD trade.

Step 1: Sign Up with a Regulated CFD Broker: To begin trading CFDs in Australia, you must first register with a licensed broker. The Australian Securities and Investment Commission (ASIC) is the government agency in charge of regulating the activities of financial service providers in Australia.

It is advised that you only register with an ASIC-regulated broker to protect your funds. You can search for all ASIC-regulated brokers on ASIC Connect Professional Register.

Step 2: Verify the CFD Broker’s License No.: You can verify the registration status of any broker in a few simple steps. In this guide, we will use Pepperstone.

Firstly, visit the ASIC registration platform on the link above.

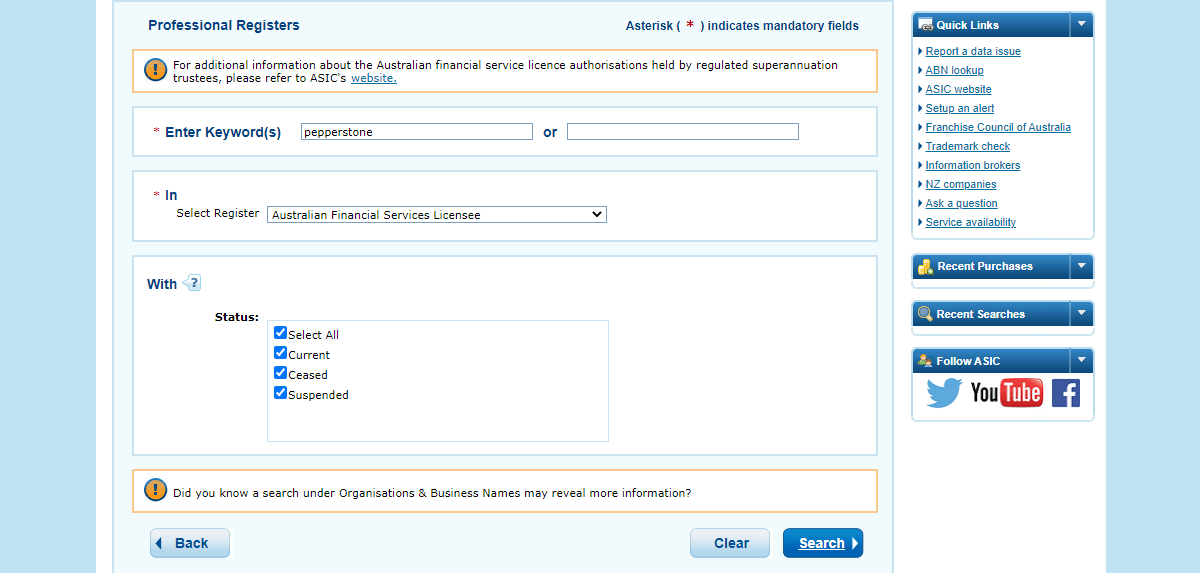

Secondly, click on the tab for the organization or family name. Here you will put the name of the broker you are trying to verify.

You can also choose to put the Australian Financial Service license number in the tab do number. In this review, we chose to use the name.

Thirdly, click on the tab to select register and choose Australian Financial Service licensee.

Finally, click on the search icon below and wait for the result.

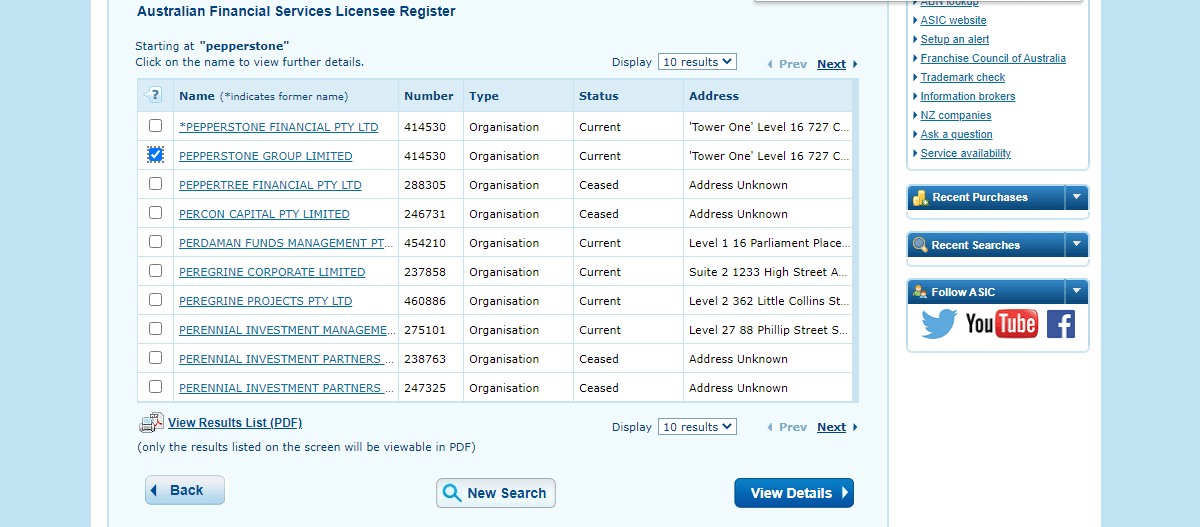

In this case, the result shows Pepperstone is a registered and licensed broker with ASIC. Similarly, several other forex and CFD brokers are also regulated by ASIC.

IC Market, Pepperstone, IF Markets, etc. are good examples of well-regulated Australian CFD brokers.

Step 3: Signup & Choose Account Type: To continue the process, open a trading account that suits you. Most CFD brokers have different account types with different trading conditions for different categories of traders. Choose the account type that’s best for you.

For example, Pepperstone has Standard Account & Razor Account. The Standard Account is a spread-only trading account, while Razor Account is an ECN Type account that has a lower spread plus extra commission per lot.

Step 4: Complete your KYC: Complete the Know Your Customer (KYC) form on the broker’s website to verify your registration. You would be required to submit your ID Proof, Address proof.

Step 5: Download the Platform from CFD Broker’s website: Download the trading platform that is best for you. Some brokers offer MT4, MT5, Web Trading, etc.

Lastly, fund your account and start trading.

Why Choose Broker According to Trading Style?

When choosing a CFD trading platform based on individual trading styles and needs, consider the following detailed guidance:

Trading Experience Level: Beginners should look for platforms with intuitive interfaces, educational resources, and strong customer support. Experienced traders might prefer platforms offering advanced charting tools, analytical capabilities, and a wider range of instruments.

Trading Style: Day traders need platforms with low latency, real-time data, and fast execution speeds. Swing traders or long-term investors might prioritize platforms with comprehensive research tools, historical data, and more advanced risk management features.

Asset Types and Markets: Choose a platform that offers the markets and asset types you’re interested in trading. Some platforms specialize in certain assets, like Forex or commodities, while others provide a broader range.

Fees and Costs: Consider the cost structure of the platform. This includes spreads, commissions, overnight financing charges, and any other account fees. Balance lower costs with the quality of service and features offered.

Regulatory Compliance: Ensure the platform is regulated by a reputable authority. This provides a level of security and trustworthiness.

Technology and Tools: Look for platforms with robust technology, including advanced charting tools, technical indicators, and automated trading options. Mobile trading capabilities are also important for traders on the go.

Leverage and Margin Requirements: Understand the leverage offered and the platform’s margin requirements. High leverage can amplify profits but also increase risks.

Risk Management Tools: Good platforms provide risk management tools like stop-loss orders, negative balance protection, and customizable leverage.

Demo Accounts: Utilize demo accounts to test the platform’s features and suitability for your trading style without risking real money.

By considering these aspects, traders can select a platform that aligns with their specific requirements, trading style, and experience level, leading to a more tailored and effective trading experience.

What Else to Consider?

Checking the authenticity of the ASIC license is the most important step when choosing any forex and CFD broker in Australia. However, considering some other factors can greatly enhance the trading experience and outcome.

Fees: Each broker can charge different trading and non-trading fees in Australia. Traders must make an effort to find out the details of all components of the fee and compare them with other brokers. You may not want to pay higher fees for similar features offered by ASIC-regulated brokers.

Trading Instrument: The number of trading instruments would be different at each CFD broker. Make sure the instruments that you wish to trade on are available at the given CFD trading platform.

Customer Support: The customer support services can ease the trading process as each query or issue faced can be resolved if good quality customer support services are offered by the CFD trading platform. A random query can be raised to check the quality of customer support services.

Base Currency: Some ASIC-regulated CFD brokers in Australia offer AUD-based accounts while others do not. Most Australian clients prefer to trade with AUD as the base currency. The deposit and withdrawal do not involve currency conversion if the account currency and deposit currency are the same. Hence, this needs to be checked before opening the account.

Deposit and Withdrawal Methods: You cannot trade with real money without deposits. Each broker allows deposits and withdrawals through different methods. Each trader might prefer to deposit through different methods. Traders must always check the accepted methods for deposit and withdrawal before opening an account. The processing time and commission (if applicable) should also be checked.

Risk in CFD Trading

CFD trading involves significant financial risk. Traders must comprehend each element of risk involved before beginning to trade CFDs in Australia.

Market Risk

Volatility or fluctuations in the prices of the underlying assets is the major risk in CFD trading. Unlike other markets, most CFD instruments can be traded throughout the day. If you have opened a position without stopping loss or taking profit limits, your invested capital will always be at risk of the market. Any event across the globe can trigger significant volatility at any time and you can lose your deposits within minutes.

Leverage Risk

Leverage is a debt taken from the broker or liquidity provider for trading. Traders can use leverage to increase profit amount significantly but high leverage can also be risky as it increases the possible losses. Leverage allows traders to book higher profits as well as losses. Beginners should use less leverage until they gain decent experience.

Counterparty Risk

When you open a trading account you need to make a deposit to start trading. Once you make a deposit, there is always a chance that your broker might run away with your deposits or don’t allow withdrawals. Choosing a fake broker or scammer for CFD trading is known as counterparty or third-party risk. Traders in Australia must only trade with ASIC-regulated brokers to mitigate counterparty risk.

Position Close-Out

If you open a large trading position and have left a much smaller balance in account equity, the position may close automatically if you face losses. When a leveraged position is opened, there should be a decent amount left in the account equity as if the prices move against the anticipation, the liquidity provider will take losses and will close your position automatically.

Emotional Risk

Trading CFDs can be emotionally challenging, especially during periods of high volatility or losses. Emotional decision-making can lead to impulsive actions that may not align with your trading strategy.

Complexity and Knowledge

CFD trading requires a good understanding of financial markets, technical and fundamental analysis, and risk management. Inexperienced traders who lack proper knowledge can face significant losses.

Unsuitability for Some Investors

CFD trading might not be suitable for all investors, especially those with low risk tolerance or limited trading experience.

To manage these risks, CFD traders should:

- Conduct thorough research and analysis before trading.

- Use risk management techniques, such as setting stop-loss orders and appropriate position sizes.

- Understand the potential impact of leverage and be cautious with high leverage ratios.

- Choose reputable and regulated brokers to minimize counterparty risks.

- Stay informed about market events and news that may affect CFD prices.

Comparison of Best CFD Trading Platforms in Australia

| CFD Trading Platform | Regulation | AUD/USD Spread | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|---|

| Pepperstone |

CySEC, ASIC, FCA

|

0.17 pips (plus $7 Commission/lot)

|

1:30

|

200 AUD

|

Visit Broker |

| IC Markets |

ASIC, CySEC

|

0.17 pips with Raw Account (plus $7 Commission/lot)

|

1:500

|

$200

|

Visit Broker |

| FP Markets |

ASIC, CySEC

|

1.3 pips

|

1:30

|

100 AUD

|

Visit Broker |

| eToro |

CySEC, FCA, ASIC

|

1 pips

|

1:30

|

$200

|

Visit Broker |

| CMC Markets |

FCA, ASIC

|

0.70 pips

|

1:30

|

0 AUD

|

Visit Broker |

| XM Trading |

CySEC, ASIC

|

1.6 pips

|

1:888

|

$5

|

Visit Broker |

FAQs on Best CFD Trading Platforms in Australia

Are CFDs legal in Australia?

Yes, CFD trading is legal in Australia. It is regulated by ASIC, and there are regulated brokers like Pepperstone, IC Markets, eToro etc.

How can you trade CFD in Australia?

You can trade CFDs in Australia by opening a trading account with a forex broker that is regulated by the ASIC. Verify that the broker that you are signing up with is regulated with a valid License No. which you must verify on ASIC Connect Professional Register.

Which broker is best for CFD trading?

Each CFD broker offers different trading conditions and is ideal for different traders. However, according to our analysis and comparison, Pepperstone and IC Markets are the best CFD brokers in Australia.

Is CFD good for trading?

CFDs or Contract for Deposit are derivative instruments in which there is no actual buying and selling of the underlying instruments. Only the price difference is speculated between opening and closing the position. CFD trading with leverage involves high risk and the majority of CFD traders face losses.

Is CFD trading Better than Stock Trading?

CFD trading is fast and convenient for traders as well as market makers. There is no actual buying and selling of the assets. While in conventional trading, the assets are physically bought and sold. CFD trading has higher liquidity hence the execution, as well as settlement of the trades, is much fast and more convenient.

Which platform is best for CFD trading?

MT4, MT5, and cTrader are the best third-party CFD trading platform. Many brokers only support their proprietary trading platforms. For any trading platform, the fees, trading conditions, safety of funds, etc will depend on the broker chosen by the trader.

Why do so many people lose money on CFD?

CFDs are high risk financial instruments that are highly volatile and the involvement of leverage makes it even more riskier. Clients trading CFDs can lose 100% of the deposited amount due to leverage. It is always advisable to gain experience through a demo account.

Are CFDs good for beginners?

CFDs are high risk financial instruments. If high leverage is used, it becomes riskier. Those who have no prior experience trading in capital markets might not find CFD trading ideal for themselves. It is always good to start with a demo account and gain experience before live trading with real currency.

Who is the world’s No 1 CFD provider?

Several CFD providers accept clients from different parts of the world and each one can be ideal for different types of traders. According to our analysis, Pepperstone, IC Markets, FP Markets, and eToro are among the best CFD providers in the world.

Is CFD tax free in Australia?

No, the profits booked on CFD trading is taxable in Australia under prevailing tax rates of capital gain tax.

Which broker has the most CFDs?

In Australia, IG allows CFD trading on more than 12,000 CFD instruments including 90 currency pairs. According to our analysis, IG Markets offers the highest number of CFD instruments in Australia.

What is the easiest CFD to trade?

Every trader can have different preferences for CFD instruments to trade on. EUR/USD is the most trader forex pair CFD hence the liquidity is high. The spread on EUR/USD is generally lower than other currency pairs hence it can be one of the easiest pairs to trade. Some traders also find XAU/USD as easiest CFD to trade.