What is a Pip in Forex Trading?

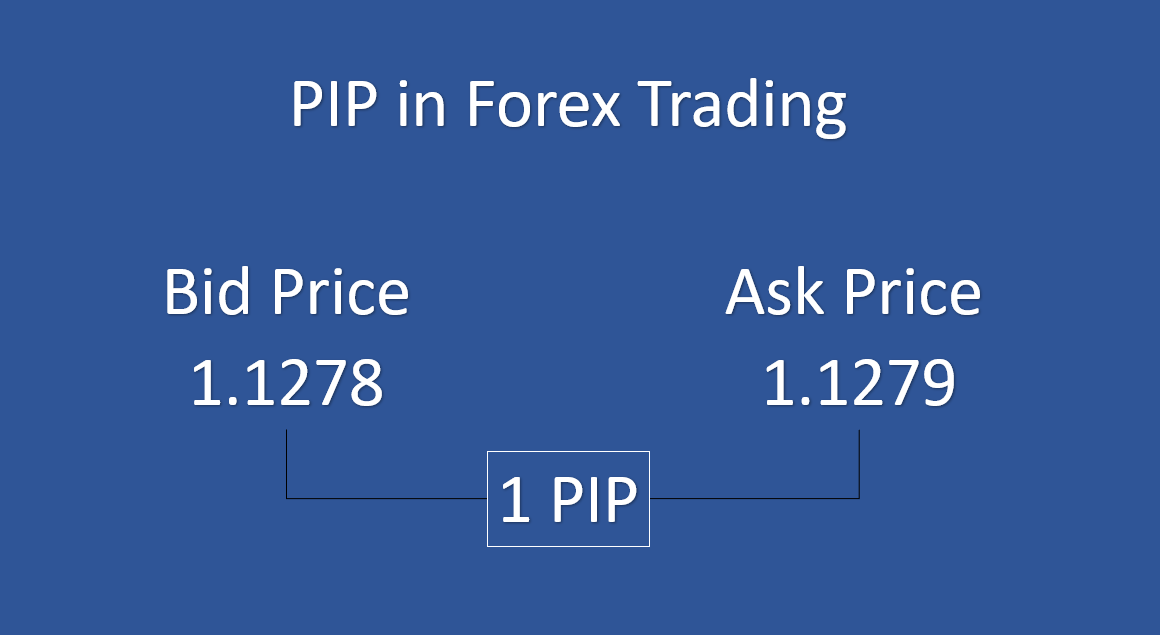

The percentage of points or pips refers to the smallest movement or change in the price of the currency pair. Under most circumstances, a pip is 1/100th of 1% or a unit change at the fourth decimal place (i.e. 0.0001).

For example, EUR/USD changed from 1.0517 to 1.0518, and the pip’s rise in value is 0.0001 USD, also referred to as the basis point. Also, most currency pairs have a maximum of four decimal places and the lowest pip value of one.

Understanding Pips

Pip is the most basic calculation tool to measure a movement in the exchange rate of a given currency pair. It is about 1/100th of a percentage point, which is the same as one basis point, or 0.01%. Forex traders primarily use pips to measure small price movements in currency rates.

A “pip” is a term used in currency trading to describe the smallest movement of a currency relative to another, i.e., a change in the EUR/USD rate would be considered in pips.

How is Pip Calculated?

Pip is one of the primary concepts of foreign exchange or forex. Forex traders use EUR/USD, EUR/CAD, or other pairs to buy up to the fourth decimal currency exchange. The fifth decimal is called a pipette. A pip is the smallest exchange rate movement, and the value is calculated after dividing 0.0001 or 1/10,000 by the exchange rate.

An exception to the pip rule is the Japanese Yen or JPY, which quotes up to two decimals. Therefore, the pip value of USD/JPY or EUR/JPY 1/100, is divided by the exchange rate.

, For example, , if the EUR/JPY rate is 133.62, the pip value is 1/100 of 133.62, i.e., 0.01.

Similarly, 1/10th of the pip is a fractional pip and remains at the end of the price as a superscript. So, for example, if the EUR/USD value changes from 1.10260 to 1.10360, the price is increased by ten pips. Likewise, the USD/JPY value changes from 106.500 to 105.400; the decrease is ten pips.

Profit and Loss in Pips

Forex trading involves two pairs, namely base and counter currencies. , For example, , EUR/USD would have USD as the quote and EUR as the base currency. The change in pip multiplied by the base currency is the pip value of profit.

Let us understand the effect of pip movement on profits and loss of traders with the example:

Example 1: Long on EUR/USD

Suppose EUR/USD currency pair is currently trading at 1.2150/1.2152. Here, 1.2150 is the bid price (sell) and 1.2152 is the ask price (buy). The spread here in this example is 2 pips which is the difference between the bid and ask price in pips.

Suppose you placed a buy order with 100,000 units (standard lot) of the EUR/USD pair with a leverage of 1:20. To place this order you will need a certain amount in your account equity.

100,000 X 1.2152 X 1/20 = $6076

Once you place this buy order, for each upward movement of 1 pip will generate a profit of $10. It must be noted that the profits will only be visible after 3 pip movement as 2 pip is the spread. After covering the spread each increment of 1 pip will generate $10 profit.

Every time you trade a standard lot i.e. 100,000 units, a movement of 1 pip will generate a profit of $10. 100 pip increment will generate a $1000 profit in this case.

Similarly, a drop of 1 pip will generate losses of $10 per 1 pip.

Example 2: Long on USD/JPY

To comprehend this example of long position on USD/JPY with 1 standard lot, it must be noted that JPY is the quote currency here, so the profits will be in JPY. We will need to convert JPY profits to USD to get a better estimation of the profit.

Suppose the USD/JPY currency pair is trading at 105.00/105.02, to open a position with the standard lot (100,000 units), traders will need the following amount in their account equity with leverage of 1:20.

100,000 X 105.02 X 1/20 = JPY 525,100

JPY 525,100 is nearly equal to $5000 at the conversion rate of 105. Hence, a trader needs a minimum of $5000 in the account equity to open this position. For a 1 pip increment, the profit will be 100,000 X 0.01 = 1000 JPY. for a 100 pip increment the profit will be 100,000 JPY which is nearly equal to $952.

It must be noted that 1 pip movement in USD/JPY is nearly $10 but not exactly $10 as it is calculated in JPY. Hence, it is fair to say that 1 pip movement in a standard lot of USD/JPY is equal to 1000 JPY.

Value of Pip in Different Asset Classes

The value of a pip in CFD (Contract for Difference) trading can greatly vary depending on factors such as the specific asset being traded, contract details, and the trading account’s currency. Here are some instances illustrating how pip values differ across various asset types:

Forex Pairs: In forex trading, the pip’s value hinges on the exchange rate and lot size. Major currency pairs often utilize a standard lot (100,000 units), with a pip roughly valued at $10 for standard accounts. Yet, this can fluctuate based on the currency pair and exchange rate.

Indices: Trading stock market indices, like the US30 (Dow Jones Industrial Average) CFD, computes pip value differently. Typically, it is denominated in the index’s currency. For instance, the US30 might have a pip value of $1 since the index is quoted in points rather than currency pairs.

Commodities: Pip value in commodities, such as gold, oil, or silver, is contingent upon contract size and the commodity itself. In a gold CFD, pip value could be $0.10 for a mini lot (10 ounces) or $1 for a standard lot (100 ounces).

Cryptocurrencies: Due to cryptocurrency volatility, pip value for crypto CFDs can significantly vary. Cryptocurrency pip values are usually in the cryptocurrency itself (e.g., Bitcoin or Ethereum), rather than traditional currency.

Stocks: CFD trading on individual stocks seldom employs pip value as in forex. Stock price movement is usually indicated in points or fractions of a point.

It’s crucial to recognize that the precise pip value for each CFD asset hinges on broker-provided contract specifics like contract size, tick size, and lot size. Traders should consult their broker’s specifications or trading platform to ascertain the accurate pip value for their chosen asset. Furthermore, given CFD trading’s leverage, potential gains or losses can amplify, emphasizing the need for effective risk management.

Calculate Forex Position Size using Pips

Pips can also calculate the forex position size. With the measure of pips in trading position, traders can identify the potential profit and loss amount. Therefore, it is necessary to trade in a realistic position. It involves three steps to calculate the forex position size.

For example, if the stop loss of a EUR/USD long position of 1.3660 is 1.3600, this means that the stop-loss would be 60 pips. If the given position is of 1 standard lot, then the trader has put a stop loss of $600.

The last step includes the trading size, i.e., standard, mini, or micro with 100,000, 10,000, and 1,000 units. The pip value also changes from $10 to $0.10 for each movement.

A trader that risks one per cent of $5,000 per trader for micro, i.e., $0.10 pip per movement, would have a forex position size often, dividing $50 by 50 pips multiplied by $0.10. Hence, the trader would have ten micro-lots positions.

Historical Examples

The trader’s base currency value affects different currency values. USD is a currency commonly paired with others.

A pair with USD as the exchange currency will have standard, mini, and micro lot pip values of $10, $1, and $0.10. The two primary reasons for changing pip value include the non-involvement of USD as a currency exchange rate or USD as the base currency.

Another reason could include the movement of USD in either direction by ten per cent.

For example, in November 1923, the exchange rate significantly diminished from 4.2 marks/dollar to 4.2 trillion marks/dollar in Germany’s Weimar Republic. Similarly, in 2001, the Turkish Lira made a significant change by removing six zeros from the exchange rate and reached 1.6 million/dollars. From January 2021 onwards, Lira’s average exchange rate stands at 7.3/dollar.

The economic conditions of the global market have a significant impact on currency movements and the pips.

Imagine a situation where the prices of products are moving beyond imagination or when the costs become too low. The former is called hyperinflation, and the second is a recession. Both these factors tend to make price movements ineffective in forex trading.

Hence, such factors can make trading unmanageable and pip invalid.

Hyperinflation has occurred in Argentina, Hungary, Germany, Russia, and China and is the state of an excessive price increase. Meanwhile, devaluation is the deliberated decrease in a country’s money value in China and Brazil. By and large, pips have significance, and their movement can create profits or losses for a trader.

How Does Forex Brokers Make Money?

Forex brokers make money by taking a small profit from the difference between the buying and selling prices of currency pairs, which is known as the spread. This spread is measured and represented in pips.

Some brokers may also charge commissions on trades. The tighter the spread, the more competitive the broker, but they may charge higher commissions. The wider the spread, the less competitive the broker, but they might not charge commissions.

Key Takeaways

- In forex trading, a pip or Percentage in Point is the smallest possible change in the prices of forex pairs.

- A pip is 1/100th of 1% or a unit change at the fourth decimal place i.e. 1 pip movement is equal to 0.0001 movements in forex.

- Japanese Yen is an exception in which 1 pip is equal to 0.01 rather than 0.0001.

- In a trade of a standard lot, 1 pip price movement will result in the $10 movement in the opened position.

- A pipette is equivalent to 1/10 or 0.1 of a pip. The movement of 1 pipette is 0.00001 movement in prices of forex pairs.

- It is important to understand pips to calculate the size of the opened position and predict the possible profits and losses.

FAQs on Pip in Forex Trading

How much is 50 pips worth?

The worth of pips in account currency depends on the lot size chosen by the trader. For a standard forex lot size of 1 lot, 1 pip is worth $10 hence a movement of 50 pip will lead to profit/loss of $500. For micro lot size of 0.1 pip, 50 pip would be worth $50.

How much is 1 pip in forex?

1 pip is 1/100 of 1% or the smallest possible unit change in the prices of the underlying instrument. For a forex pair like EUR/USD, movement of 1 pip will provide a profit or loss of $10 if the lot size is 1 standard lot.

How many pips are good in forex?

Most traders prefer a trading position with a profit of 40-50 pips keeping the stop loss of 20-25 pips. However, this depends on the trading volume, market conditions, risk appetite, etc. Large volume traders or scalpers can make decent profits with less than 10 pips movement while small volume traders may seek for 70-100 pips movement.

How is pip calculated in forex?

Pip means percentage in points which is 0.01%. A pip is the smallest possible change in the price of the underlying instrument. In forex trading, a movement of 1 pip means the movement of the price at the fourth decimal point. The price change from 1.2000 to 1.2001 is a change of 1 pip.

How much is $10 in pips?

In forex trading, a standard lot is of 1,00,000 units of the the quote currency. A pip in this case will be equal to $10 if the trader has opened a position of 1 standard lot. This means that with each pip movement, the profit and loss will increase and decrease by $10.

How do you calculate pips in GBP?

The value of pips is always calculated in terms of the base currency. To change the currency, it needs to be converted at the prevailing rates. For example, if a trader made 50 pips profit on a standard lot of GBP/USD, the profit will be $50 which will be nearly equal to £40. (according to prevailing exchange rates)

How do I calculate my pips in forex?

The profit and loss amount in forex is calculated using pips. The price difference between opening and closing of the position is calculated in pips which is the fourth decimal difference in the price of a currency pair. The pips can be converted to the base currency of the pair depending on the lot size.

How do you convert pips to cash?

Pips can be converted to cash depending on the trading volume. If a standard lot is traded, then a movement of 1 pip will be equal to $10 movement. Similarly 10 pip means $100. If the lot size is 0.01 lot then 1 pip will be equal to $0.1 or 10 cents.