Forex Trading New Zealand

Forex Trading is regulated and legal in New Zealand. If you are looking to trade forex then it is important to understand the risks & only trade via FMA regulated brokers. We explain everything in this guide.

You can trade forex via forex brokers that are licensed with FMA in New Zealand

6 Steps to Start Forex Trading for Beginners in New Zealand

Summary Table of Best Forex Brokers for Beginner traders in New Zealand in 2024

| Broker Name | Highlights | Trading Fees (EUR/USD Avg Spread) | Account Minimum | Max. Leverage | Learn More |

|---|---|---|---|---|---|

|

CMC Markets is regulated by the FMA in New Zealand with FSP number FSP41187 |

Fees

0.70 pips

with Standard Account |

Account Minimum

0

|

Max. Leverage

1:30 for Forex

|

Open Account

on CMC Markets |

|

|

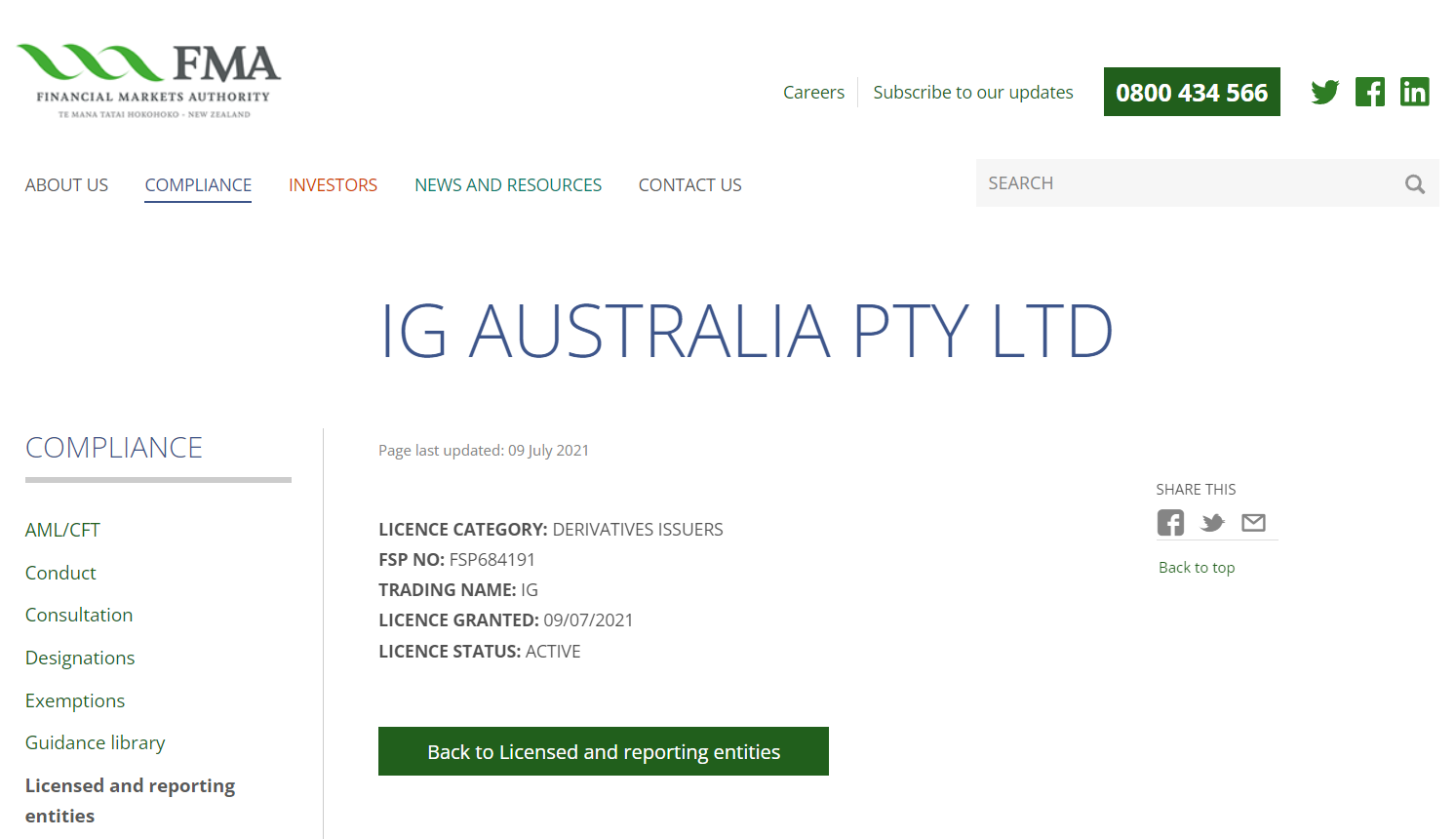

IG is regulated by FMA in New Zealand with FSP number FSP684191 |

Commissions

0.6 pips

with Standard Account |

Account Minimum

0

|

Max. Leverage

1:200 for Forex

|

Open Account

on IG |

|

|

Plus500 is regulated by FMA in New Zealand with FSP number FSP486026 |

Fees

0.8 pips

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:30 for Forex

|

Open Account

on Plus500 |

Chapter #1

What is Forex Market?

Forex trading is like a global market where people trade different currencies. Imagine you have two kinds of money, let’s say dollars and euros. You want to exchange some of your dollars for euros because you think the euro might become more valuable.

So, you go to this big market, and you find someone who wants to trade their euros for your dollars. You agree on a price, make the trade, and now you have euros instead of dollars. If the euro’s value goes up, you can exchange it back for more dollars and make a profit.

But it’s a bit like a game because the values of currencies keep changing all the time. So, you need to be careful and think about when to trade to make money. Forex trading is like playing with money from different countries and trying to win by trading them at the right time.

Foreign exchange market is a global marketplace where currencies are exchanged at different prevailing rates. International or offshore sales and purchases cannot be conducted without exchanging different currencies.

To get a fair value off the trade, the exchange of one currency in return for another is done according to a conversion rate. The conversion rate of each currency pair is different and can be affected by numerous economic, geo-political, and other factors.

By analyzing the markets, traders can predict the price movement of currency pairs and place buy or sell orders on them with leverage, called margin trading. Although, it is important to note that this is a high-risk market for Retail traders, and a majority of the beginners face losses in their initial phase of forex trading.

The Forex market involves various currency pairs that are divided into major, minor, and exotic pairs. EUR/USD is the most traded currency pair in the global forex market followed by GBP/USD. Any trading position on currency pair means the trader is buying or selling one currency in return for the other.

Let’s take an example, a buy order on NZD/USD means buying NZD in return for USD.

In simple terms, by opening a buy position on NZD/USD, the trader is buying AUD by paying USD in return. Similarly while selling NZD/USD, clients will be selling NZD to get USD in return.

In the long position or buy order, the trader will earn a profit if NZD gains in value against USD or USD loses its value in terms of NZD. If a position is closed, the NZD will be sold back at the prevailing conversion rate of NZD/USD and the trader will receive the converted USD in return.

Forex is the largest capital market in terms of the daily trading volume. Unlike stock markets, the forex market is active throughout the day. The liquidity of the traded currency pair depends on the time zone in the local jurisdiction of concerning currencies.

For example, when the liquidity on USD/CAD is high, it will not be the same on AUD/JPY due to different time zones.

Lower liquidity means a lesser trading activity on the concerned pair and the difference between buy and sell rates (spreads) will increase dramatically during this period.

Forex Trading can also be done by exchanging physical currencies. However, through derivatives like futures contracts and CFDs, forex trading has become more accessible for retail traders. But at the same point, it is risky for retail traders.

CFDs on Forex do not involve physical buying and selling of currencies but the price difference is paid out or debited from the traders.

In New Zealand, several financial services providers offer Forex Trading on leverage.

Leverage allows traders to open bigger positions with smaller deposits. The risk factor increases with the increase in leverage. The maximum leverage allowed by the FMA in New Zealand is 1:500 for forex.

Apart from market risk, there is also a counterparty risk or third-party risk of choosing a fake broker. To mitigate this risk, traders in New Zealand must always choose a broker that is licensed/authorized by the Financial Markets Authority (FMA), which can be verified from the official website of FMA.

Chapter #2

What is Forex Trading?

The foreign exchange market, or forex market, serves as a global platform for the exchange of currencies at prevailing rates. It facilitates international transactions by necessitating the exchange of different currencies. To ensure a fair trade, currencies are exchanged based on conversion rates, which vary for each currency pair and are influenced by a multitude of economic and geopolitical factors.

Traders engage in the forex market by analyzing these factors to predict the price movements of currency pairs. Leveraging their insights, they place buy or sell orders through margin trading. However, it’s crucial to recognize that forex trading carries a high level of risk, and many beginners face initial losses.

The forex market offers a diverse range of currency pairs, categorized as major, minor, and exotic. The EUR/USD pair is the most heavily traded globally, closely followed by GBP/USD. Trading in any currency pair signifies the exchange of one currency for another, underlining the intricate dynamics of this financial market.

There are several terminologies associated with forex trading. Acknowledging these terms is important to understand the working of forex trading.

1) Currency Pair: Forex trading is done on currency pairs in which two currencies are involved separated by ‘/’. The currency above or before the / is called base currency that is bought or sold in opening a position. The currency after or below the / is called quote currency that is used to buy and sell the base currency. For example, NZD/USD is a currency pair in which NZD is the base currency and USD is a quote currency.

2) Bid Price: Each time you see the price of a currency pair, there will be two prices. The price that the dealer is willing to pay if you sell the currency pair is called the bid price. The bid price is lower than the ask price and is generally mentioned before the ask price.

3) Ask Price: The ask price is the price that you will pay or the price dealer is willing to accept if you buy the base currency. The ask price or buy price is slightly higher than the bid price. For example, the price of NZD/USD will be denoted as 0.7287/ 0.7291. In this example 0.7287 is the bid price in USD at which the dealer is willing to sell 1 unit of NZD. 0.7291 is the ask price in USD at which the dealer will buy 1 unit of AUD.

4) Spread: In the above example, you can see the slight difference in the bid and ask price of the currency pair. This difference between the bid and ask price is called the spread. It is a type of fee that is paid to the dealer for creating and accommodating the market. Higher spreads mean more earnings for the dealer and lesser gains for the trader and vice versa. If the spread is 0, the bid and ask prices are equal. The spreads are generally denoted as the fourth decimal point in a currency pair. If AUD/USD is trading at 0.7287/ 0.7291, the spread is 0.0040 or 40 pips.

5) Pips: Pip or percentage in points is the smallest unit at which the prices of a currency pair can fluctuate. Most of the currency pairs fluctuate by four decimal places as the smallest change. If NZD/USD is trading at 0.7287/ 0.7291, then the smallest movement possible will be 0.0001 or 1 pip.

6) Lots: Forex trading is done in fixed lot sizes. A standard lot of a currency pair involves 1,00,000 units of the base currency. Generally, the minimum lot size that can be traded is 0.01 lot or 1000 units of the base currency. 1000 units of the base currency are also called a micro lot.

7) Leverage: Forex trading is commonly done with leverage. Since there is a very small price movement, leverage plays an important role to book higher profits with smaller deposits. Leverage is the fund borrowed from the dealer to open any position in forex trading. If a broker offers a leverage ratio of 1:100 on forex, it means that 99% of the amount in the opened position is leveraged or loaned from the broker. Bigger positions can be opened with leverage with a smaller deposit amount. Excessive leverage increases the risk factor as losses are to be covered by the trader.

8) Margin: It is the amount that the trader is required to pay to open a certain position in forex trading. Suppose if 1:100 is the leverage ratio then 1% of the overall cost of the position has to be paid by the trader initially. Any opened position in forex trading is worth margin amount + leverage amount.

9) Buy/Sell Order: Each currency pair can either be bought or sold. If a trader has placed a buy order, he would want the price of base currency to increase and quote currency to decrease. This is commonly called a long position in forex trading. In a short position, the trader has sold the base currency and will gain if the price of the base currency decreases. Going long as well as short is quite convenient in forex and CFD trading compared to other asset classes.

10) Stop Loss/Take Profit: These are the type of limit orders which can greatly assist in forex and CFD trading. The stop loss feature allows traders to limit the losses or protect their profits. The take-profit features allow traders to automatically take the profits if a target is achieved. If the set stops loss or take profit target price is triggered, the position is closed automatically. Stop loss and take profits can be set while placing the order and can also be placed or modified after opening the position.

Forex trading can best be learned with experience. It is a high-risk market and traders must use demo trading where they can gain experience with virtual currencies. It is a high-risk capital market and is not ideal for every type of trader. One must check the suitability, objective, and risk elements thoroughly before entering the forex market.

Forex Trading Strategies

Trading without strategy is like sailing without a compass. The sailor has no idea about the wind speed or the direction. That’s why the practice of forex analysis plays a vital role in currency trading. You look at the changes in the values of currency pairs and the forces that are influencing those price movements.

Traders use both fundamental and technical analysis for creating a profitable strategy. Many expert traders combine both techniques to take a hybrid approach. In short, the knowledge of technical analysis will tell you when (to buy or sell) and fundamental analysis tells you why (the price movements). Both are indispensable weapons for a successful forex trader.

Let’s deconstruct both methods one by one.

Fundamental Analysis

What economic factors will impact the demand and supply of a currency? Welcome to Macroeconomics 101, the law of demand and supply. If the demand for a currency is increasing, the trader may assume the prices will rise. On the other hand, a demand reduction may be an indication of an eventual fall.

However, it’s not that simple! There are many factors such as economic health, political stability, global events, and others that influence the expansion and contraction of a particular currency. For instance, the US Sub-Prime Lending Crisis in 2008 caused a massive breakdown of financial systems worldwide.

The fundamental analysis generally involves the following economic indicators:

1. Economy:

In addition to global economic events, the localized changes in a national economy can also influence the currency prices of that country. For instance, the increased commodity prices globally can strengthen Australian dollars.

2. Political Changes:

Although government changes are not a frequent affair, currency prices can be affected during a transition period. Developed countries have relatively stable regimes in comparison to developing countries. Political instability is the main reason why the currencies of many African countries are so unpredictable.

3. Monetary and Fiscal Policy:

Central banks use monetary policy as an effective tool to control the demand and supply of a currency. They can reduce the interest rate in an economic slowdown and can increase to curb the inflation caused by economic growth. The fiscal policy entails taxation and government spending. Higher taxes can drive slower credit and economic development. Both government policies can have a significant impact on the national currency.

4. Activities of Major Participants:

Main participants such as banks, financial institutions, or hedge funds may buy or sell a specific currency to up or down the prices. You will be in much better positions if you have an idea about the main speculators of the forex market.

5. Economic data and reports:

Main participants such as banks, financial institutions, or hedge funds may buy or World governments publish statistical data and reports that reveal the economic health and performance over a period. Many financial reports like employment data, inflation rate, GDP, and foreign exchange reserve can indicate regional economic conditions, which can dramatically impact the local currency. A forex dealer can use an economic calendar to avoid unwanted surprises from the release of new data.

Technical Analysis

Charts and graphs are the primary tools of technical analysis. Charts help traders identify historical performance, ongoing trends, and price movements and calculate risk to maximize gains from currency trading.

Understanding different charting formats such as line, bar chart, and candlestick is essential to develop a solid trading strategy for beginners. The following are important terminologies associated with technical analysis.

1. Bar chart:

It is the most basic charting which helps users select a currency and its performance for a fixed period. The bar chart shows the highest and lowest currency price points and average performance over the period chosen.

2. Candlestick:

It also displays the same information: open, low, high, and close. However, the representation of data is very different from the bar chart. It becomes easier for users to see the highest and lowest peaks of the currency movements with thin vertical lines.

3. Price Trends:

Trend is a term used in technical analysis of capital markets that depicts the direction of the price. Generally, the price of the underlying instrument moves in a particular direction until a trend reversal is witnessed. The tops and bottoms of the charts can be analysed to identify the price trend at a given time.

Trendlines and trend reversal are very important components of technical analysis. A higher-high price action followed by a higher low represents an uptrend (bullish) while a lower low and lower high depict a downtrend in price movement.

4. Support and Resistance

Support and resistance are the prices at which the trends are likely to reverse or stop moving further in that direction. There can be multiple support and resistance levels for a single financial instrument.

Support is the lower limit at which the price trend is likely to reverse or stop moving further below. Resistance is the upper limit on the price trend. Whenever a resistance or support level is broken, the price moves significantly. These limits are created due to trend reversals and stagnancy of prices at the price that same particular level. A support or resistance level gets stronger every time it resists the price movement.

5. Moving Average

As the name suggests, the moving average is an important indicator that depicts the average price movement in a given time. A moving average indicator creates a series of averages of different subsets of the full data sets of prices in a particular time interval. Current prices below the moving average depict a buying opportunity while the prices above the moving average may benefit the sellers.

6. Fibonacci Retracement

Fibonacci retracement levels are based on the Fibonacci sequence and are used to identify potential support and resistance levels. Traders use these levels to determine potential price retracement areas during a trend.

7. Bollinger Bands

Bollinger Bands consist of a moving average (typically 20-day SMA) and two standard deviations above and below the moving average. They help traders identify periods of high or low volatility and potential price breakouts.

8. Candlestick Patterns

Candlestick charts display price data in a visual format using candlestick patterns. Traders analyze patterns such as doji, engulfing patterns, and hammers to identify potential trend reversals or continuation.

9. Volume Analysis

Volume analysis examines trading volume accompanying price movements. It helps traders understand the strength or weakness of a price trend and identify potential reversals or breakouts.

10. Chart Patterns

Chart patterns, such as head and shoulders, double tops, and triangles, are formed by price movements and can indicate potential trend reversals or continuations.

There are hundreds of strategies that are used in the technical analysis of financial instruments. Technical analysis works well on instruments with high liquidity like the forex market.

Experienced traders often use technical analysis in combination with fundamental analysis to understand why the value of a currency rises or falls for the selected period. For example, if the fundamentals indicate that the US Dollar will strengthen against the Euro due to policy divergence, and the technical analysis also indicates the same, then it is much more likely that your strategy may be successful as compared to incomplete research.

You can use simple mathematical tools such as moving averages, trend lines, and others for technical analysis. You can learn about more advanced concepts like Elliott Wave Theory, Fibonacci Studies, and Pivot Points as you progress.

Chapter #3

Understanding Forex Trading with an Example

Forex trading in New Zealand is legal and in compliance with a strict regulatory framework. The Financial Markets Authority (FMA) is the regulatory authority that regulates forex trading in New Zealand.

There are a lot of Forex and CFD brokers in New Zealand that are regulated by FMA and offer leveraged trading on forex and other instruments. Trading with brokers that do not have a regulatory license from FMA is illegal in New Zealand.

The first and foremost thing to do as a trader is to choose an FMA-regulated forex broker in New Zealand. Brokers without FMA regulation in New Zealand have high third-party risk and must be avoided.

Most of the brokers display their regulation details on the footnote of their website. Some also have a separate page on their website. If not available, clients can also ask the customer support executives to provide the license or registration number of the FMA license.

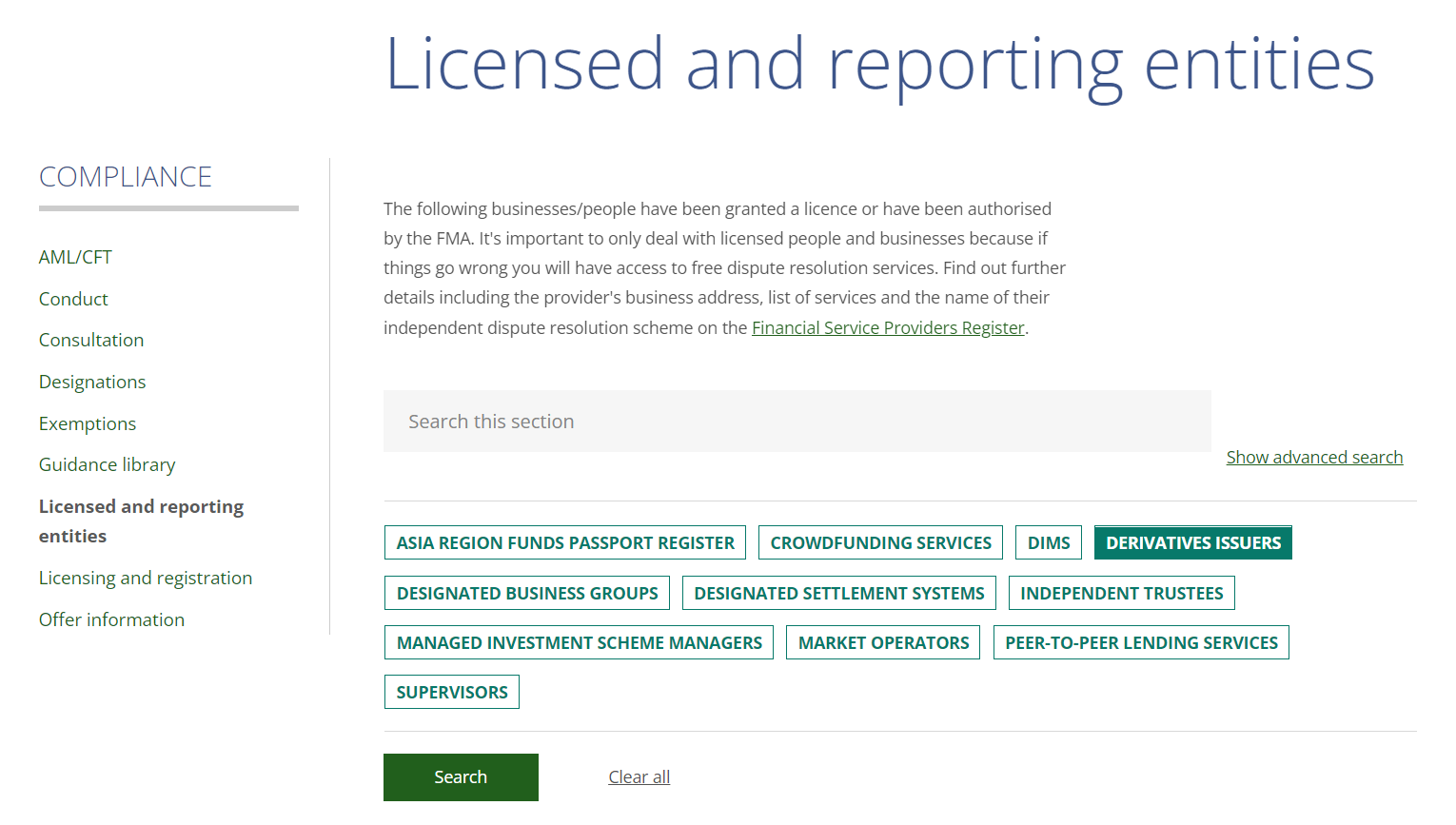

The FMA regulatory license can be cross-checked from the official website of FMA. There is a separate page to search for license details under ‘Compliance’ > ‘Licensed and reporting entities’. Clients can search for license details either with the name of the broker or the license number. This detail must be checked before choosing a forex broker in New Zealand.

After checking the license, potential traders should also check and compare the fees, available instruments, trading platforms, customer support, and other details of the broker. Online reviews by professionals and existing clients can also be read to get a glance at trading experience with particular brokers.

How to open trading account with broker in New Zealand

The next step to trade forex in New Zealand is to open a trading account with the selected broker. The account opening process is simple but each broker takes a different time to complete this process. Following are the details that the trader needs to provide to the broker to open an account.

1) Your Full Name: The name should be the same as that on Identity and address proofs and bank accounts. Any spelling mistake will not allow you to open the account.

2) Your Contact Details: This includes the mobile number and email id. The entered contact details will be cross-checked via OTP.

3) Current Address: You must have proof of the address where you are currently living.

4) Country of Residence

5) Documents: The proof of identity and address will be verified by the broker to complete the KYC process. This process can take 2 hours to 2 days depending on the service efficiency of the broker.

6) Deposit: You will receive a confirmation mail from the broker once the KYC process is completed. The trading can now be started after making an initial deposit. The minimum initial deposit amount requirement can differ from broker to broker and must be checked before opening the account. Time taken to process the transaction is also different for every deposit and withdrawal method.

For new clients, it is always advised to trade with a demo account and gain a decent amount of experience before risking real money. The demo account can also be used to check the success rates of trading strategies and suitability with different trading instruments.

Chapter #4

What are the Costs of Forex Trading?

The cost that will be incurred to traders in forex trading will differ from broker to broker. Each broker charges different types of fees and the amount of fees can also be different.

Spreads and commissions are the major source of revenue for the brokers and liquidity providers.

To be familiar with the fee structure, clients must check or inquire about the following components of fees before opening the account.

These are the common ways in which a forex broker will charge the traders in New Zealand for trading.

1) Spreads: Spreads are the major component of fees involved in forex trading. This is the difference between the bid and ask price or the buy and sell price.

Wider spreads mean lesser profit and lesser probability to make profits in a forex trade. Clients should seek brokers that offer narrower spreads.

2) Trading Commission: The commission that is incurred while executing trade orders is called a trading commission.

Some brokers offer commission-based trading on currency pairs with low spreads or zero spreads. Commission-based spread-free trading is considered ideal for large volume traders and scalpers.

A commission on forex pairs can range from $2 to $10 for a Roundturn trade (both sides) of a Standard Lot. Details of commission (if charged) must be checked before opening the account.

3) Swap Fees: Swap fees are also called overnight charges. These are the charges that are incurred if a trading position is kept open overnight.

Orders that are opened and closed on the same day will incur no swap fees at all.

For every night the position is kept open, the swap fees will be added. Swap rates or overnight charges differ from broker to broker on every instrument.

4) Non-Trading Charges: These are the charges that will be incurred without executing trade orders. Non-trading charges can be of various types and can be tricky to identify as they are not clearly mentioned.

5) Inactivity Fee: An inactivity fee is a fee that gets deducted from the account balance if no trades orders are executed in a prolonged period of 3 months to 1 year.

6) Deposits & Withdrawals: Deposits and withdrawals can incur additional commission for some or all of the methods. Clients must check the commission or fees for deposits and withdrawals.

Other non-trading charges include account opening fees, conversion fees, internal transfer fees, etc. Subscription to additional services can also cost additionally.

Clients must enquire from the support executives about the non-trading charges separately.

Chapter #5

What are the Risks of Trading Forex?

There are plenty of risk elements involved in forex trading. We have discussed some of the major components of the risk in trading forex in New Zealand.

1. Unregulated Broker risk:

Online forex trading has attracted thousands of retail investors in New Zealand. Trading with a trusted and well-regulated broker ensures your funds are in safe hands. If something goes wrong, there is a security mechanism that comes into play to protect your investments.

National, as well as major Tier-1 forex broker regulators, ensure that brokers offer fair and transparent trading environments. They set standard criteria and reporting requirements for a forex dealer before providing services to its clients. They also continue to monitor brokers’ trading practices and in case of wrongdoing, the financial regulator can cancel the broker’s license.

Before choosing, ensure that your broker is well regulated and trustworthy. Don’t get persuaded by Pyramid schemes or fake agents offering unbelievable and unrealistic returns. There are plenty of examples of when retail investors lost their money to fake brokers and Ponzi schemes.

The best way to avoid this risk is by selecting a broker having Tier I or Tier II licenses. Tier I indicates the highest level of trust, and Tier II has a low level of confidence. UK, European, American, Australian, and Canadian regulators score well on their trust level and are called Tier I regulators.

Traders based in New Zealand must only trade with forex brokers that are regulated with FMA. You must check the products for which the forex broker/firm has been Authorised, verify the Firm’s Reference No. and their website from FMA’s Register. Only this will ensure that you are trading with an authorized firm.

2) Market Risk

This is the risk of extraordinary price swings in currency pairs. Forex is a complicated market as the price movement depends on a countless number of factors. It is active throughout the day and any event across the globe can have an impact on the price movements. It is nearly impossible to correctly predict the price movements. Research and analysis can greatly enhance the success rates but the market risk will always prevail in the forex market. It may not always be possible to predict the price movement hence it essential to use proper risk management tools when entering your trades. We recommend using guaranteed stop loss orders instead of regular stop loss orders. We also recommend having a proven trading strategy in place rather than making ad-hoc bets.

3) Leverage Risk

The leverage allows traders to open bigger positions with smaller margin requirements. High leverage can help in booking higher profits in case of favorable outcomes. The extent of profits, as well as losses, depends on the size of the opened position. The bigger positions can provide dramatic losses and can also wipe out your account balance completely if a position is not closed.

Beginners should not involve too much leverage in trading forex in the initial phase. Leverage of more than 1:10 is considered risky. The FMA has restricted the maximum leverage that CFD brokers can offer to 1:500 for major forex pairs. The maximum leverage is lesser for CFDs on indices and commodities to protect the traders from high leverage risk. Brokers that are not regulated by FMA can offer even higher leverage but it is very risky.

4) Technical Glitches

Forex trading is mostly done online through trading platforms on mobile, tablets, and PC. A technical glitch can disrupt the trading experience. Traders can miss out on trading opportunities due to slow internet or processor issues.

The timing to open or close a position can vary due to technical problems. Accounts can be hacked. The account credentials and passwords must be protected. Public wi-fi networks must be avoided. Fingerprint or facial recognition to login into an account can enhance the safety of traders.

There are multiple risk elements in the forex market. Choosing the right broker, taking informed decisions, technical and fundamental analysis, and other precautionary measures will reduce the risk factor. However, risk in the forex market can be mitigated but cannot be removed completely.

Leveraged forex trading involves significant financial risk. Forex trading is easily accessible for retail traders. More than 70% of forex traders face losses. It is always advisable to use the demo account and trade with virtual currencies before trading with real money. This will also allow traders to know whether forex trading is suitable for them or not.

To mitigate these risks, forex traders should:

- Educate themselves about the forex market and trading strategies.

- Use risk management techniques, such as setting stop-loss orders and position sizing.

- Avoid excessive leverage and only trade with capital that they can afford to lose.

- Stay updated on economic events and news that may impact the forex market.

- Remain disciplined and avoid making emotional decisions based on short-term market movements.

Risk management techniques in forex trading

Position Size: Determine trade size based on account balance and risk tolerance (1-2% per trade).

Stop-Loss: Set stop-loss orders to limit losses if the market moves against you.

Take-Profit: Use take-profit orders to secure gains at a predefined level.

Risk-Reward Ratio: Aim for favorable risk-reward ratios (1:2 or better).

Diversification: Spread risk by trading different assets, not all in one.

Control Leverage: Use leverage carefully to align with risk tolerance.

Trading Plan: Develop a clear plan with entry/exit rules and risk limits.

Emotions: Manage emotions to avoid impulsive decisions.

Stay Informed: Be aware of market events that could impact trades.

Monitor Trades: Adjust stop-loss and take-profit levels as needed.

Review Trades: Analyze trades to learn and improve strategies.

Avoid Revenge Trading: Don’t trade impulsively to recover losses.

Forex trading can be rewarding, but it is crucial to approach it with a clear understanding of the risks involved and to trade responsibly. Traders should consider seeking advice from financial professionals and only trade with money they can afford to lose.

Chapter #7

Pros and Cons of Forex Trading

There are some pros for traders trading in the forex market over other financial markets. But you must understand all the risks before making a decision whether to trade forex & CFDs or not..

Pros of Forex Trading

Following are the advantages of trading forex:

Largest Capital Market

You invest in the world’s largest financial market. With daily transactions crossing over USD 5 trillion, the sheer size of the forex market makes it truly a global marketplace with several profit opportunities.

24-Hour Market

The forex market operates around the clock so that you will find a trading opportunity any time of the day in at least one global time zone. As the forex market is a decentralized OTC market, its working hours are not subject to any centralized exchange system. For instance, trading hours begin at 5 PM EST in the USA on Sunday and rolls continuously with other markets until Friday at 5 PM. Note that even though currency trading is restricted for retail traders on weekends, the exchange rate keeps moving.

Low Capital Requirement and Lower Transaction cost

In addition to very low investment requirements, even the transaction cost of trading forex is relatively lower. For instance, you can start dealing in currencies with just USD 100 or even lower. The main earning of a broker comes from the bid-ask spread. Spread is measured in pips, the difference between the sell and buy price of a currency. However, some brokers do charge a commission or flat fees per transaction. You should factor in commission and spread while choosing a broker to lower your overall trading cost.

Availability of Leverage

The availability of high leverage is perhaps the main reason why forex trading appeals to so many people. It enables you to place a higher trading order with minimum capital.

Almost all the forex brokers offer leverage where you can borrow against deposited money in your trading account. It’s similar to taking a mortgage against your property; the only difference is that the margin requirement is very low. For instance, you can place a USD 100 order with just 3.33 US Dollar if your broker offers a 1:30 leverage ratio. However, leverage is a double-edged sword. It can amplify your losses, so heed caution when trading forex with leverage. You should avoid using high leverage.

Most Liquid Market

Forex market is also the world’s most liquid market. Liquidity refers to how quickly an asset can be sold or bought without affecting its value. Major currency pairs such as EUR/USD or USD/JPY are considered most liquid than exotic currency pairs.

Major pairs are more liquid hence the spread will be lower on major pairs. The spreads on less traded pairs are higher due to low liquidity.

Volatile

The same volatility, which makes it riskier for traders, can also present ample profit opportunities. Volatile market conditions cause rapid changes in the value of currency pairs, thus, increasing your chances of gains from the trade.

But this is also a big risk. If a currency pair changes in its value by a lot then it is considered volatile and can be a risk for investors as you can lose big if you are on the opposite side. For example, USD/TRY is considered a very volatile currency pair. You may lose quickly if you are in the wrong position, also you must consider the Swap Rates when trading such currency pairs.

Scalable

Scalable means you can trade in mini, micro, or standard lots, making it easier for traders to control investment size and capital exposure.

Affordable Technology

You don’t have to spend money on acquiring expensive hardware and software to start with forex trading. All you need is a computing device or a smartphone with a reliable internet connection. Your broker will provide charting and trading technologies at no cost once you subscribe.

Cons of Forex Trading

Following are the challenges or disadvantages of trading forex:

High Risk

Forex market is not ideal for many traders due to its high risk. The market risk in forex trading is much higher compared to other capital markets like stocks, commodities, etc. The involvement of leverage further increases the risk of losing a substantial amount within a few seconds.

The market is active 24 hours a day and any news event around the globe can affect the prices of currency pairs. Hence, at times it becomes impossible to correctly predict the price movement.

Lack of Transparency

There is no particular location from where the forex market is controlled or managed. Foreign currencies are exchanged in many ways mainly through central banks, private banks, large financial institutions, etc. The forex market is largely influenced by large-scale market makers, liquidity providers, and banks. Hence, there is no transparency about how the trade order is getting executed. The trading volume and market sentiment are also difficult to predict in the forex market.

Complex Valuation Method

The value of one currency in return for another keeps on changing due to multiple reasons at every minute. It is quite complex for retail traders to calculate the valuation of one currency in terms of another. The valuation depends on the economic and financial details of the involved currencies and their predictions. Compared to other capital markets, it is much more complex to do a valuation of the currencies.

Difficult to Learn

Stocks, commodities, and other markets are much easier to comprehend compared to the forex market. In the stock market, traders can get assistance from experts and portfolio managers. Comparatively, it is challenging to learn forex trading and understand the forex market. Traders have to learn most of the forex trading on their own.

The same volatility, which makes it riskier for traders, can also present ample profit opportunities. Volatile market conditions cause rapid changes in the value of currency pairs, thus, increasing your chances of gains from the trade.

But this is also a big risk. If a currency pair changes in its value by a lot then it is considered volatile and can be a risk for investors as you can lose big if you are on the opposite side. For example, USD/TRY is considered a very volatile currency pair. You may lose quickly if you are in the wrong position, also you must consider the Swap Rates when trading such currency pairs.

Scalable

Scalable means you can trade in mini, micro, or standard lots, making it easier for traders to control investment size and capital exposure.

Affordable Technology

You don’t have to spend money on acquiring expensive hardware and software to start with forex trading. All you need is a computing device or a smartphone with a reliable internet connection. Your broker will provide charting and trading technologies at no cost once you subscribe.

Cons of Forex Trading

Following are the challenges or disadvantages of trading forex:

High Risk

Forex market is not ideal for many traders due to its high risk. The market risk in forex trading is much higher compared to other capital markets like stocks, commodities, etc. The involvement of leverage further increases the risk of losing a substantial amount within a few seconds.

The market is active 24 hours a day and any news event around the globe can affect the prices of currency pairs. Hence, at times it becomes impossible to correctly predict the price movement.

Lack of Transparency

There is no particular location from where the forex market is controlled or managed. Foreign currencies are exchanged in many ways mainly through central banks, private banks, large financial institutions, etc. The forex market is largely influenced by large-scale market makers, liquidity providers, and banks. Hence, there is no transparency about how the trade order is getting executed. The trading volume and market sentiment are also difficult to predict in the forex market.

Complex Valuation Method

The value of one currency in return for another keeps on changing due to multiple reasons at every minute. It is quite complex for retail traders to calculate the valuation of one currency in terms of another. The valuation depends on the economic and financial details of the involved currencies and their predictions. Compared to other capital markets, it is much more complex to do a valuation of the currencies.

Difficult to Learn

Stocks, commodities, and other markets are much easier to comprehend compared to the forex market. In the stock market, traders can get assistance from experts and portfolio managers. Comparatively, it is challenging to learn forex trading and understand the forex market. Traders have to learn most of the forex trading on their own.

Forex Trading FAQs

Is Forex Trading Allowed in New Zealand?

Yes, Forex trading is legal in New Zealand, and you must trade with FMA Regulated Forex Brokers. All forex trading activities & brokers must comply with the regulatory guidelines of FMA and the profits made are subject to tax implications.

How to Trade Forex in New Zealand?

Is forex good for beginners?

How long does it take to learn forex?

Is Forex Trading Profitable?