Best Forex Brokers New Zealand 2024

We researched 50+ forex brokers based on their regulations, fees & 10 more factors to list the best forex broker for traders residing in New Zealand.

The foreign exchange market is the largest capital market in the world in terms of the average daily trading volume. Forex trading involves financial risk but the number of retail traders is constantly increasing in New Zealand for the last few years.

It’s essential to understand that there is no universally “best” forex broker because each one caters to diverse types of traders. The suitability of a broker depends on an individual trader’s unique trading style, risk tolerance, and specific needs. Traders should carefully assess and choose a broker that aligns with their preferences and objectives to ensure a successful trading experience.

Forex trading in New Zealand is regulated by the Financial Markets Authority (FMA). The FMA was incorporated in 2011 but individuals in New Zealand have been trading forex long before that.

Forex brokers in New Zealand may or may not be regulated by the FMA in New Zealand. However, it is highly recommended for traders residing in New Zealand to trade only with brokers that are regulated by the FMA.

We have created a list of the best forex brokers in New Zealand to assist New Zealanders in choosing the best one for themselves. Several pros and cons have been discussed regarding the best forex brokers in New Zealand.

Here is a List of Best Forex Brokers in New Zealand for 2024 based on our Research

- CMC Markets – Overall Best Forex Broker in the New Zealand

- Plus500 – Best Forex Broker with User Friendly Platform

- IG Markets – Forex Broker with Highest Number of Instruments

Our list of best forex brokers in New Zealand includes the brokers that are regulated by the FMA and offer the best services in terms of several aspects. These brokers have been selected after a comprehensive analysis based on 12+ factors.

#1 CMC Markets – Overall Best Forex Broker in New Zealand

CMC Markets is a UK-based financial services provider that is also listed on the London Stock Exchange. It is the best choice for traders seeking a wide range of available instruments.

Regulation: CMC Markets can be considered safe for trading forex and various other CFD instruments. CMC Markets NZ Limited is the legal entity regulated by the FMA in New Zealand. Clients residing in New Zealand are registered and protected under regulatory regimes of FMA at CMC Markets.

CMC Markets can be considered trustworthy with less third-party risk as it is a publicly-traded company listed on London Stock Exchange. CMC Markets is also regulated by FCA in the UK, ASIC of Australia, BaFin of Germany, IIROC of Canada, MAS of Singapore, and DFSA of the United Arab Emirates.

Overall Fees: The spreads at CMC Markets on forex and other CFDs are lower compared to several other FMA-regulated brokers in New Zealand. The average typical spread for EUR/USD at CMC Markets is 0.7 pips. CMC markets do not offer commission-based trading with lower spreads.

The trading commission is only incurred while trading stock CFDs starting from a minimum of $10 per trade depending on the volume.

The inactivity fee is slightly higher ($10 per month) but is only incurred after 12 months of inactivity. The deposits and withdrawals are free of additional commission.

Trading Conditions: CMC Markets offer trading through MetaTrader 4 platform and their proprietary trading platform called as CFD Next Generation platform. The MT4 trading platform can only be chosen to trade CFDs of forex pairs, commodities, and Indices. The CMC Market NextGen platform allows trading on more than 10,000 instruments. 338 forex pairs can be traded on either platform.

CMC Markets has a local office in Auckland, New Zealand, and also offers customer support by phone but not on weekends. There is no lower limit on minimum deposit while the maximum leverage is 1:500 on forex pairs.

CMC Market Pros

- No commission to trade forex instruments

- Regulated with FMA in New Zealand

- Offer Negative Balance Protection

- Highly regulated and has a strong reputation with a long history

- No hidden fees such as deposit or withdrawal fees

- More than 10,000 instruments are available to trade

CMC Market Cons

- Customer support is not available through live chat

- Lesser variety of research and education tools

#2 Plus500 – Best Forex Broker with Proprietary Trading Platform

Plus500 is an FMA regulated CFD broker in New Zealand. It is a well-regulated broker that allows trading through its proprietary trading platform.

Regulation: Plus500AU Pty Ltd is the legal entity of Plus500 that is regulated by the Financial Market Authority (FMA) of New Zealand under FSP number FSP486026.

Plus500 is also regulated by multiple top-tier regulatory authorities like FCA in the UK, ASIC in Australia, FSCA of South Africa, CySEC in the EU, etc.

Plus500 is a publicly-traded company that is listed on the London Stock Exchange. They are transparent with their financials and ownership. Plus500 can be considered safe to trade forex and other CFDs in New Zealand due to very low third-party risk.

Overall Fees: Plus500 offers a single type of account with the same pricing structure to all clients. The trading fee is built into spreads as no commission is incurred for trading.

The average typical spread for EUR/USD at Plus500 is 0.8 pips. The inactivity fees are slightly high as $10 is incurred every month if no trades are executed for 3 consecutive months.

The deposits and withdrawals are free of additional commission and no other nontrading fee is incurred from the traders. Compared to other Forex and CFD brokers in New Zealand, the fees at Plus500 are average.

Trading Conditions: Clients can only trade with the Plus500 proprietary trading platform as no other platform is supported. The platform is user-friendly and simple to use with lots of features. It allows trading on more than 2000 instruments including 67 currency pairs.

Customer support services are not available through phone or live chat in New Zealand. Clients can resolve personal queries through email while most of the common queries can be resolved through FAQs.

The minimum deposit amount is $100. The research and education tools are limited compared to other FMA-regulated brokers in New Zealand.

Plus500 Pros

- No commission to trade forex instruments

- Plus500 is regulated by FMA in New Zealand

- No hidden fees such as deposit or withdrawal fees

- The trading platform at Plus500 is user friendly and ideal for the beginners

Plus500 Cons

- MT4, MT5 or any other trading platform is not available

- The minimum deposit amount is $100

#3 IG Markets – Best Forex Broker with Highest Number of Instruments

IG is a FMA regulated forex and CFD broker in New Zealand. Their parent company IG Group is listed on London Stock Exchange and is also included in the FTSE250 Index.

Regulation: IG is an FMA-regulated broker in New Zealand. IG AUSTRALIA PTY LTD is the legal entity that is regulated by FMA under FSP number FSP684191.

Apart from this IG is also regulated by the FCA of the UK, ASIC of Australia, CFTC of the USA, JFSA of Japan, MAS of Singapore, etc. IG is a subsidiary of IG group that is listed among the top 250 stocks on the London Stock Exchange.

IG was launched in 2003 and can be considered safe to trade forex and CFD in New Zealand with very low third-party risk.

Overall Fees: Trading fees at IG are only built into the spread and overnight charges. The average typical spread for EUR/USD at IG is 0.86 pips. This is average when compared with other FMA-regulated brokers in New Zealand.

The inactivity fee at IG is only incurred if no trades are executed for 24 consecutive months. 2 years is a comparatively longer inactivity period. $18 is incurred each month after 2 years of inactivity.

Deposits and withdrawals are free for all the available methods from the broker’s side.

Trading Conditions: IG offers the highest number of trading instruments among all the FMA-regulated brokers in New Zealand. More than 17000 financial instruments can be traded at IG. They allow clients to trade through MetaTrader 4 and their proprietary trading platform called as ProRealTime.

The minimum deposit amount at IG is $250. They offer excellent varieties of research and education tools to assist traders.

IG Pros

- No commission to trade forex instruments

- IG is regulated by FMA in New Zealand

- No hidden fees such as deposit or withdrawal fees

- More than 17000 instruments can be traded at IG

IG Cons

- The trading fee is slightly higher than some brokers

- The minimum deposit amount is slightly high

How To Select Best Forex Broker in New Zealand?

Due to a significant increase in demand in the last few years, a lot of national and international FSPs have started offering forex trading services in New Zealand. Many are authentic but some may be fake.

The best broker to trade forex and CFDs depend on the preferences of the traders. A broker ideal for one might not be suitable for the other. Clients must know how to choose the best forex broker for themselves.

Following are the major factors that must be considered while choosing the best forex broker in New Zealand.

1. Safety and Regulation

Whenever there is an element of financial risk, one must ensure the safety and regulation with the broker before making a deposit. The safety of a forex or CFD broker depends largely on the regulatory license held by them. The financial and ownership details must also be checked to ensure safety.

A broker can have regulatory licenses from different regulatory authorities in different jurisdictions. Financial Markets Authority (FMA) is the financial regulatory authority in New Zealand that overlooks the activities of various types of financial services providers.

The forex and other CFD brokers fall under the category of the derivative issuer at FMA. It is strongly recommended to clients residing in New Zealand to only trade with brokers that are regulated by the FMA.

Clients who choose to trade with brokers that are not regulated by FMA are registered under offshore regulations and are exposed to high third-party risk. In such cases, none of the government authorities can be reached out for help or held accountable in case of an unsettled dispute between brokers and clients.

Clients registered under FMA regulation can file their complaints through FMA official website against a regulated broker or FSP.

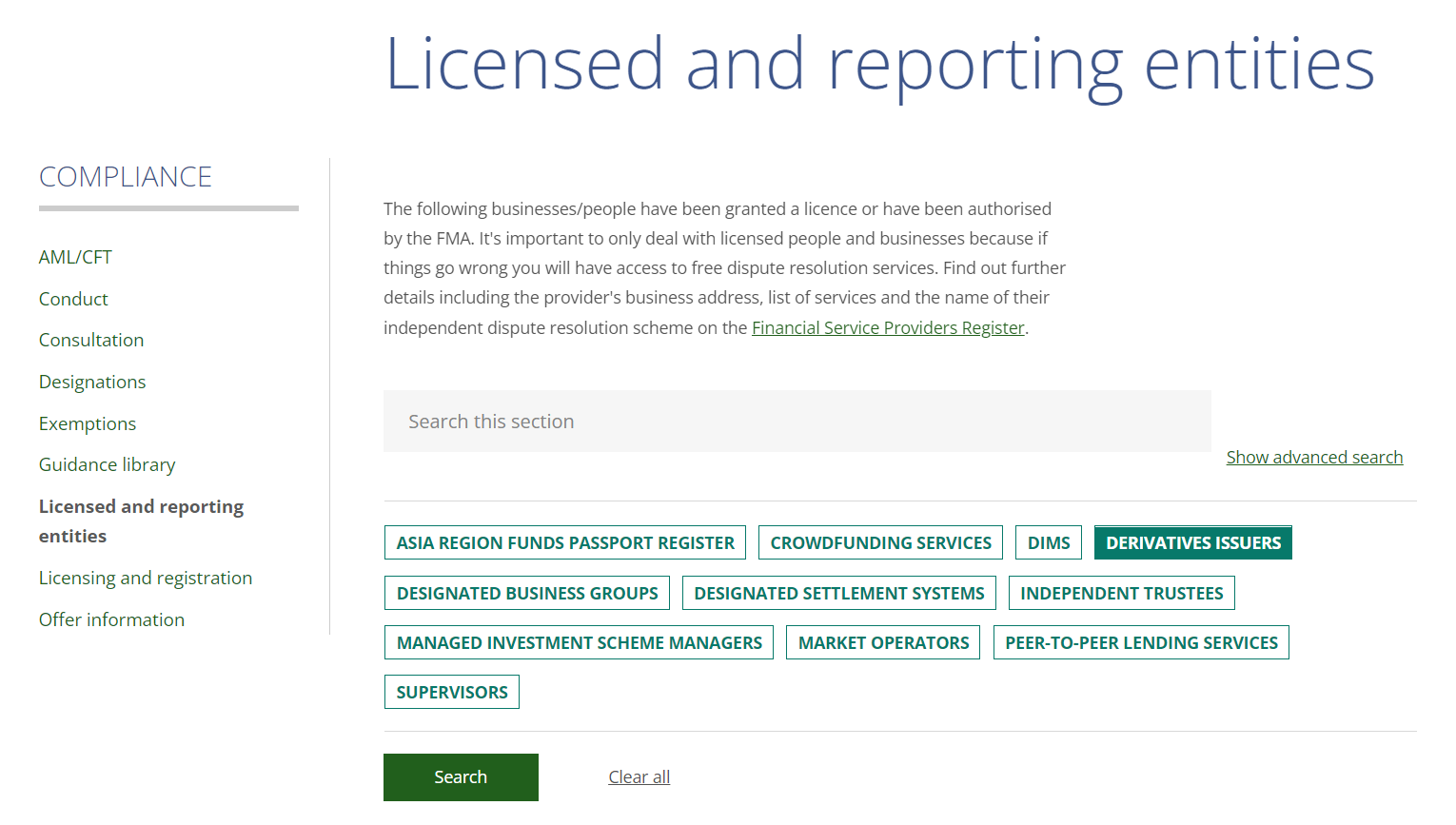

Most brokers mention their regulation details in the footnote of their website. If you cannot find it, you can also inquire about regulation through customer support services. The details and the FSP number can be cross-checked from the official FMA website.

The details of all the regulated brokers are available under the ‘Licensed and reporting entities’ section on the FMA website.

Apart from the regulation details, clients can also check the reviews by experts and existing clients for any reported scam against the broker. Some brokers are publicly traded on stock exchanges while others can be privately owned. All such details must be checked before you choose the best forex broker in New Zealand.

2. Fees

The fees are the most regarded and compared aspect for any broker. Fees can greatly affect the profits and losses clients are making on a trade. Although, some fake brokers may promise very little or negligible fees to get the deposits. Hence, fees are important but should never be the only basis of comparison.

The trading and non-trading fees associated with any broker must be checked separately before choosing. Spreads are the major component of trading fees with any CFD broker. Some brokers may incur a commission per trade with little or no spreads at all. Spread-based trading is ideal for beginners while most high-volume traders prefer commission-based trading.

Most brokers mention details of their fees on their websites. If you cannot find it, you can inquire through customer support services.

Spread is the difference between the bid and ask price of any financial instrument. Higher spreads mean lesser gains and higher revenues for the broker. Clients will be most benefitted by choosing the broker with the lowest spreads.

Clients must check or inquire about all other components of fees as lower spreads can be compensated with other fees by the brokers. The overnight rollover fees or swap fees are incurred for keeping a leveraged position open for more than a day. This should also be checked and compared if you wish to trade for longer tenures.

The commonly incurred non-trading fees include deposit, withdrawal, maintenance, account opening, currency conversion, and inactivity fees. For convenient and cost-efficient forex trading, clients must enquire and compare every component of the fee before choosing the best forex broker in New Zealand.

3. Trading Platform

Online trading can only be done through a trading platform. This platform connects you to the global market and the broker. The trading platform is the place where you will be spending most of your time after opening an account with any of the brokers. Hence, it is important to feel convenient with the trading platforms of the chosen broker.

MetaTrader 4, MetaTrader 5, and cTrader are the most chosen forex and CFD trading platforms in the world. Some brokers may offer their own trading platforms. It is important to get familiar with the trading platform before executing trades. A demo account can be used to familiarize the terminologies and features of the trading platform.

It is important to check whether the preferred trading platform is available with the chosen broker or not.

4. Available Instruments

The number of available instruments would be different for each forex and CFD broker. Clients must ensure that the instruments they wish to trade with are available with the chosen broker or not. Some brokers offer more than 10,000 financial instruments while some might offer less than 300 instruments.

The choice of broker based on available instruments depends entirely on the preferences of the trader. A higher number of instruments gives more opportunities to make better trades but it is better to only trade with markets that you are familiar with.

Different brokers may specialize in different types of instruments. Some brokers primarily focus on currency pairs while others may focus on cryptocurrencies, commodities, or stocks.

5. Customer Support

Clients feel more comfortable with brokers that offer good quality customer service. Brokers may offer customer support services through email, phone, live chat, or social media applications.

If the queries are resolved quickly, the trading experience is likely to be better. Clients can raise random queries through the available method to connect with customer support executives. This can be done before opening the live account to check the quality of support service at any broker.

6. Deposit and Withdrawals

All other services and features are irrelevant if the deposits and withdrawals are not fast and convenient. Clients must ensure that the broker they are about to choose accepts deposits and withdrawals through the preferred method of transaction.

Each method of transaction can take a different time for processing and can incur different fees for deposit or withdrawal. To avoid any inconvenience in the future, it is better to check or inquire about the accepted methods for deposits and withdrawals before opening an account.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

The following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. For example, if you are trading with leverage of 1:1000, then your losses will be amplified by 1000 times. That’s why its important to be careful when using leverage. Most reputed financial regulators limit the amount of leverage you can use to 1:30 or close to it.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on opened positions.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with them if it is fake. This risk can be mitigated by choosing regulated brokers.

Liquidity Risk Although forex markets are generally highly liquid, there may be instances of reduced liquidity during times of market turmoil or economic events. Low liquidity can make it difficult to execute trades at desired prices, leading to slippage or wider spreads.

Economic and Political Risks

Currency exchange rates are influenced by economic factors, political decisions, and geopolitical tensions. Unforeseen events or policy changes can cause significant volatility in currency markets, impacting trade positions. Staying informed about economic and political developments is crucial to manage these risks effectively.

Technical Risks

Technical issues related to trading platforms, internet connectivity, or broker systems can disrupt trading operations. System failures, outages, or delays can prevent timely order execution or lead to incorrect trade placements. It is important to use reliable platforms, maintain stable internet connections, and have contingency plans to minimize technical risks.

Psychological Factors

Forex trading can be psychologically demanding, and emotional decision-making can lead to impulsive or irrational trading choices. Fear, greed, or overconfidence can cloud judgment and result in poor decision-making. Developing disciplined trading strategies, managing risk effectively, and maintaining emotional control are essential to mitigate psychological risks.

Tips to Become a Successful Forex Trader

Educate: Learn the basics of forex trading.

Reliable Broker: Choose a regulated broker with good support.

Risk Management: Set stop-loss, take-profit, and manage risk.

Demo Account: Practice on a demo account before real trading.

Plan: Develop a clear trading plan and stick to it.

Major Pairs: Begin with major currency pairs.

Stay Informed: Follow global economic news.

Analysis: Use technical and fundamental analysis.

Emotions: Control emotions to avoid impulsive decisions.

Patience: Success takes time; avoid quick gains.

Consistency: Stick to a proven strategy.

Records: Maintain a trading journal.

Diversify: Consider diversifying beyond forex.

FAQs on Best Forex Brokers New Zealand

Which forex broker is best for beginners?

Beginners should seek for a broker that is safe, cost-efficient, and user friendly. According to our analysis and reviews by experts, CMC Markets, IG, and Plus500 are the best forex brokers for beginners in New Zealand.

Which is the most reliable forex broker?

All the brokers and financial services providers that are regulated by the Financial Markets Authority (FMA) in New Zealand can be considered safe and reliable to trade in New Zealand. If a broker is publically listed on a stock exchange and is also regulated by top-tier regulatory authorities, it is considered more reliable.

Which forex broker is the best?

According to our analysis and comparison, CMC Markets, Plus500, and IG are among the best brokers for forex trading in New Zealand. Traders must check and compare each feature and disadvantage of brokers before opening their account.

Is Forex Trading Legal in NZ?

Yes, forex trading is legal in New Zealand and is regulated by the Financial Markets Authority (FMA) of New Zealand. Traders residing in New Zealand must only trade with a broker that is regulated by FMA of New Zealand.

What is the best leverage for $20?

According to the FMA regulation in New Zealand, a regulated broker can offer a maximum leverage of 1:500 on forex and CFD trading. Traders in New Zealand can use up to 1:500 leverage with FMA-regulallted brokers. However, a leverage of 1:500 is considered risky for the beginners. It is advisable to use a safe leverage of 1:50 or less for the beginners.

Do forex traders pay tax NZ?

Yes, capital gains booked through forex and CFD trading in New Zealand are taxed according to the applicable prevailing tax rates. Currently, income on forex trading in New Zealand are taxed at following rates.

$0- $14,000 : 10.5% tax rate

$14,001- $48,000 : 17.5% tax rate

$48,001- $70,000 : 30% tax rate

70,001- $180,000 : 33% tax rate

More than $180,000 : 39% tax rate

What is the best time to trade forex in New Zealand?

If you are trading with the currency pairs involving NZD, the best time to trade forex is 11:00 AM to 7:00 PM. During this time, the New Zealand and Australian markets overlap with the Asian markets of Tokyo, Hong Kong, and Singapore. 7:00 PM to 3:00 AM is a good time to trade currency pairs involving USD and EUR in New Zealand.