Best Forex Brokers in South Africa 2024

We reviewed over 30 Forex brokers based on factors including safety (trust), overall fees, ease of withdrawals for SA traders & more factors to list these best forex brokers.

There are 30+ Forex Brokers that accept traders from South Africa. But how should you decide where you should trade & which forex trading platform is the best & safest to get started with?

These are many questions that come to mind when researching about forex trading brokers in South Africa. We will cover everything that you need to know to find licensed & trusted Forex brokers in SA.

Comparison of Best Forex Brokers South Africa

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage (Forex) | |

|---|---|---|---|---|

| HotForex |

1.3 pips

|

R70

|

1:1000

|

Visit Broker |

| Exness |

1 pip

|

$10

|

1:2000

|

Visit Broker |

| AvaTrade |

0.9 pips

|

$100

|

1:400

|

Visit Broker |

| XM |

1.6 pips

|

$5

|

1:888

|

Visit Broker |

| Tickmill |

1.6 pips

|

$5

|

1:500

|

Visit Broker |

| XTB |

1.3 pips

|

R1600

|

1:500

|

Visit Broker |

| IC Markets |

0.62 pips

|

$200

|

1:500

|

Visit Broker |

8 Best Forex Brokers in South Africa ranked based on our Research for 2024

- HotForex – Best Forex Broker in South Africa

- Exness – Regulated Forex Broker with Low Spread & Quick Withdrawals

- AvaTrade – Fixed Spread Forex Broker

- XM Forex – Forex Broker with Simple Interface

- Tickmill – Regulated South African Forex Broker

- FXTM – Good Forex Broker with ECN type Accounts

- XTB – FSCA Regulated Forex Broker

- IC Markets – Well Regulated Forex Broker with ECN Type Accounts

Our fact-based research is based on the comparison of brokers based on their regulatory licensed, fees, trust score, range of CFD asset classes, ease of local deposit & withdrawals, and 7 more factors.

Let’s get started!

Best South African Forex Brokers for 2024

Based on our research these are the best forex brokers for traders in SA.

Now each forex broker has its own features. The chronology of how we have listed them down does not signify the best to worse or otherwise. Therefore, to understand each aspect, thereby making the right decision, it is advised to go through all the broker descriptions.

1. HotForex – Best Forex Broker in South Africa

HF Markets SA Pty Ltd. is a FSCA authorized forex broker. Their FSP no. is 46632 & they are licensed since 2016. So they are considered a safe forex broker to trade with in SA.

Trading Conditions: HotForex has a minimum deposit of R70 ($5). Their trading fees are low compared to other forex brokers in South Africa. Their average spread for EUR/USD is 1.2 pips with their Premium account. Their spread is much lower with their Zero spread account, but there is an extra commission per lot.

There is no fee on deposits & withdrawals. Plus, you can deposit & withdraw via EFT in South Africa. Normally, the deposits & withdrawals are processed within a few hours.

HF Markets offer a max. leverage of 1:1000. You can trade 1200+ CFD instruments. In terms of currency pairs, HotForex offers 57 major and minor forex currencies, with a spread as low as 0.01. But crypto CFDs are not available on their platform.

In terms of Safety & Trust, HotForex is an authorized Financial Services provider in SA, registered and granted authorization by FSCA to provide forex trading services. The broker was registered in South Africa close to 5 years ago and has been maintaining its license since then.

HotForex (HF Markets Group) is not only regulated by FSCA, but also with FCA, CMA (Kenya), and CySEC, so it adds a cushion of the regulatory framework as a fraud in one country would mean fraud in other countries too. Since the HF Markets group is multi-regulated, we consider them a low-risk broker.

The broker has been around for a few years now, and they are well regulated which makes HotForex less of a regulatory non-compliant forex broker. So, we consider HF Markets to be a safe forex broker for SA traders.

Also, HotForex is a Metatrader-based forex & CFD broker. They offer the standard MT4 & MT5 trading platforms, which are available on all devices. This is considered good because you will have the availability of custom EAs.

HotForex has local phone support & office in South Africa. They offer support via Phone, Live Chat & Email. We tested their chat support and found that the wait time was under 15 seconds. The agents we were connected to with their chat support had technical knowledge of the problems we presented before them. So, we consider their support to be good.

HotForex Pros

- Low minimum deposit ($5)

- Multiple account types available

- HotForex is regulated by FSCA in South Africa

- ZAR available as base currency of the account

- Local phone support available in South Africa

HotForex Cons

- Spreads are higher than average

- support services not available on weekends

2. Exness – Regulated Forex Broker with Low Spread & Quick Withdrawals

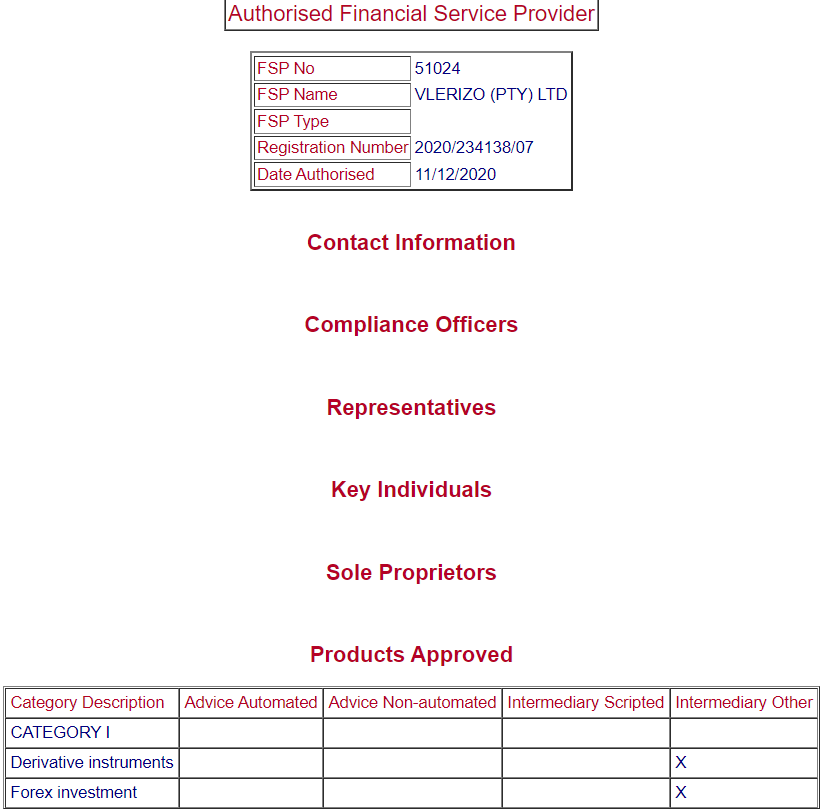

Exness ZA (PTY) Ltd is a FSCA authorized forex broker. Their FSP no. is 51024 and they are considered a safe forex broker to trade with in SA.

Exness is considered a safe and reliable CFD broker as they are regulated by FSCA in South Africa (51024). Apart from this, they are also regulated by FCA in the UK (730729), FSA of Seychelles, CBCS of Curacao and Sint Maarten, FSC of the British Virgin Islands, FSC of Mauritius, and the CySEC of Cyprus (EU).

There are 5 different account types to choose from. The Standard and cent version of the Standard account do not require a minimum deposit. The 3 professional accounts namely Raw Spread, Zero, and Pro account require a minimum deposit of $500.

The Raw Spread account involves a fixed commission of $7 per round-turn trade of a standard lot with very low spreads. Zero account also has very low spreads but the commission are variable. The Pro account does not involve any commission and the spreads are also lower than that with the Standard Account.

The Standard account is a commission-free account where the average typical spread for EUR/USD is 1 pip. Read our comprehensive review of Exness to know more about the different account types at Exness and the fees associated with each account type.

There is no non-trading fee of any type at Exness. The deposits and withdrawals are free for most of the available methods. And no inactivity fee is incurred.

Exness accepts deposits and withdrawals through local bank transfers in South Africa. Clients can also open a ZAR-based account and no currency conversion fee will be applicable if deposits are also made in ZAR. Additionally, clients can deposit and withdraw through Skrill, Neteller, Ozow, Mybux, and several other methods.

Exness offers excellent customer support service that is active 24*7. Clients can reach out to support executives through live chat, email, and phone support. Their FAQ section briefly covers most of the common queries raised by the clients.

Exness can be a great option to trade forex and CFDs in South Africa. They offer local phone support, local bank transfers, and ZAR-based accounts for South African traders. MT4, as well as MT5 trading platforms, can be used at Exness to trade on any device.

Exness Pros

- No lower limit on minimum deposit

- Multiple account types available

- Exness is regulated by FSCA in South Africa

- ZAR available as base currency of the account

- Local phone support available in South Africa

- Spreads at Exness are lower than average

- No non-trading fees exist

Exness Cons

- High trading commission on commission based accounts

- support services not available on weekends

3. AvaTrade – Fixed Spread Forex Broker

Ava Capital Markets Pty is a FSCA authorized forex broker. Their FSP no. is 45984 and they are considered a safe forex broker to trade with in SA.

Avatrade is a well-regulated market maker that has a local office in South Africa. It allows ZAR-based accounts and free ZAR deposits and withdrawals.

Avatrade Capital Markets Pty is the legal entity of Avatrade that is regulated under the FSCA of South Africa with FSP number 45984. They are also regulated by the ASIC of Australia (406684) and CySec of the European Union (347/17). This makes Avatrade fairly safe for the clients residing in South Africa.

There is no choice for account types at AvaTrade. The pricing structure and trading conditions are the same for all the clients in South Africa. The average spread for EUR/USD is 0.9 pips with no additional commission.

There is a high inactivity fee of $50 (monthly) at Avatrade if no trades are executed for more than 3 months. For inactivity of more than 12 months, the inactivity fees increase to $100 until the account balance reached 0.

AvaTrade offers multiple trading platforms for trading CFDs. It offers MT4, MT5, and a proprietary trading platform called AvaTradeGO. The social trading and copy trading features are also very convenient for suitable clients.

Clients residing in South Africa can deposit and withdraw through Ozow, Credit/Debit cards, and QR Pay. The minimum deposit amount is $100 or R1500 depending on the base currency of the account. Transactions can also be done through wire transfer but that may incur additional charges and the minimum deposit amount is $500.

More than 700 instruments can be traded at AvaTrade including 55 currency pairs, 25 commodities, and 20 cryptocurrencies.

The customer support service is good with the availability of local phone support and a live chat window. The support service is not available on the weekends.

AvaTrade Pros

- AvaTrade is regulated by FSCA in South Africa

- User friendly trading platform

- Local phone support available in South Africa

- Spreads at Avatrade are lower than average

- No non-trading fees exist

AvaTrade Cons

- High inactivity fees

- No choices for account types

- ZAR is not available as base currency

4. XM Forex – Forex Broker with Simple Interface

XM is an offshore regulated CFD broker that offers a wide range of research and analysis tools.

XM is not regulated by FSCA in South Africa or any other top-tier regulatory authority. South African clients at XM are registered under the Financial Services Commission (FSC) of Belize with license number 000261/158 under entity name XM Global Limited.

XM also holds a regulatory license from Cyprus Securities and Exchange Commission (CySEC) with license number 120/10. Although, only the clients residing in the European Union are registered under the CySEC regulation.

XM is a member of Trading Point Group which has multiple regulated businesses in the financial sector. The parent company of XM is also regulated by top-tier regulatory authorities but XM itself is an offshore regulated broker. The risk of choosing XM in South Africa is higher compared to all other CFD brokers that are regulated by FSCA or other top regulators.

XM claims to offer narrow spreads as low as 0.6 pips for currency pairs. However, the average typical spread for EUR/USD is 1.6 pips with the standard account which is slightly higher than some of the peers in South Africa. The spread for EUR/USD with the Ultra Low Account is 0.6 pips which is much narrower. No trading commission is charged with any of the account types at XM.

XM offers MT4 and MT5 trading platforms for all devices. They also grant access to multiple research and education tools that can greatly assist traders.

Each account type at XM can be opened with ZAR as the base currency. The Ultra Low Account has the least trading fees but it does not allow clients to avail themselves of any bonus.

Deposit and withdrawal at XM in South Africa can only be done via debit/credit card and Skrill wallet. The minimum deposit amount is R70 or $5.

More than 1400 financial instruments are available to trade including 57 currency pairs. The maximum leverage on forex pairs is 1:888 in South Africa. Maximum leverage will be reduced if the account equity is more than $20,000 equivalent.

XM is a good choice for beginners as there are a lot of educational tools that can assist beginners. The spreads are low with the Ultra-Low Account but the bonus cannot be grabbed with this account.

XM Pros

- The spreads at XM are very low

- User friendly trading platform

- Local phone support available in South Africa

- Low minimum deposit (R70)

- Low non-trading fees

XM Cons

- The parent company of XM is well regulated by XM is not regulated by FSCA

5. Tickmill – Regulated South African Forex Broker

Tickmill is a part of Tickmill Group of companies that is regulated in various jurisdictions including the top-tier FSCA of the South Africa.

Tickmill is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. The FSCA-regulated legal entity of Tickmill is Tickmill South Africa (Pty) Ltd with FSP number 49464. Apart from FSCA, Tickmill is also regulated by FCA in the UK (717270), CySEC in the European Union (278/15), and several other regulatory authorities around the globe.

Tickmill allows clients to choose from 3 different account types and the fee structure is different for each account type. The classic account type is a commission-free account type where the spread is the only trading fee. The spreads with the Classic account start from 1.6 pips and fluctuates based on market conditions.

The Pro and VIP account have commission-based fee structures with low spreads. The fixed commission with the Pro and VIP account is $4 and $2 for a round trade of a standard lot. clients need to have a minimum balance of $50,000 to enjoy the low commission on the VIP account. The spreads with the Pro and VIP account are as low as 0 pips.

The minimum deposit amount for the Classic and Pro Account is $100. Clients in South Africa can deposit and withdraw through local bank transfers, credit/debit cards, and e-wallets. ZAR cannot be chosen as the base currency of the account. Hence, deposits made in ZAR are automatically converted to the base account currency.

Tickmill allows trading on 62 currency pairs as CFD. Clients can also trade with CFD of stock indices, oil, stocks, commodities, and cryptocurrencies. They do not have local phone support in South Africa but clients can connect through the live chat window.

Tickmill Pros

- Tickmill is regulated by FSCA in South Africa

- Multiple account types available

- Local phone support available in South Africa

- Low non-trading fees

Tickmill Cons

- High minimum deposit ($100)

- ZAR is not available as base currency

6. FXTM – Good Forex Broker with ECN Type Accounts

FXTM (ForexTime) is a well-regulated forex broker that offers a range of features for traders in South Africa. FXTM is a good forex broker with ECN type accounts, making it an attractive choice for traders.

FXTM (ForexTime) is a well-regulated forex broker that offers a range of features for traders in South Africa. FXTM is a good forex broker with ECN type accounts, making it an attractive choice for traders who seek competitive spreads and execution speeds.

Regulation: FXTM is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, providing a level of security and trust for traders in the region. It’s important to note that FXTM also holds regulatory licenses in other jurisdictions, enhancing its credibility.

Account Types: FXTM offers various account types to cater to different trading styles. Traders can choose from Standard, Cent, Stock CFDs, ECN, and FXTM Pro accounts. Each account type comes with its own set of features and trading conditions.

Spreads: While FXTM offers competitive spreads, it’s crucial to note that spreads can vary depending on the chosen account type and market conditions. ECN accounts typically provide tighter spreads. The spreads at FXTM are slightly higher than the average of forex and CFD brokers in South Africa.

Minimum Deposit: 50$ is the minimum deposit required to open an account at FXTM . Although, the minimum deposit requirement varies depending on the chosen account type. FXTM offers a Cent account with a low minimum deposit, making it accessible to traders with smaller capital.

Trading Platforms: FXTM supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are known for their user-friendly interfaces and advanced charting tools. These platforms are available on various devices, ensuring flexibility for traders.

Customer Support: FXTM provides customer support through various channels, including email, live chat, and phone support. While their support is generally responsive, it’s important to note that support services may not be available 24/7.

Range of Instruments: FXTM offers a diverse range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. Traders have access to multiple markets to diversify their portfolios.

FXTM Pros

- FXTM is regulated by FSCA in South Africa

- Multiple account types available

- Multiple trading platforms supported

- Low non-trading fees

FXTM Cons

- Customer support not available on weekends

- Spreads are slightly high

7. XTB – Forex Broker with Proprietary Trading Platform

XTB is a Polish regulated broker in South Africa. XTB is not regulated by the FSCA in South Africa. They support proprietary trading platform for trading forex and CFDs.

XTB is not regulated by the FSCA in South Africa. They are regulated by the FCA of the UK but the South African clients are registered under Komisja Nadzoru Finansowego (KNF) regulation of Poland.

The third-party risk of choosing XTB in South Africa is higher compared to any other FSCA-regulated forex broker. However, it can still be chosen as it is regulated by the top-tier FCA in the UK.

The spreads are average when compared with other brokers. Overnight charges are incurred with the Standard account for keeping the positions open overnight. This can be avoided by choosing the swap-free account at the expense of slightly higher spreads.

The minimum spread at XTB is 0.5 pips but the average typical spread for EUR/USD at XTB is 1.3 pips. No trading commission is incurred for trading forex, indices, commodities, and cryptocurrencies.

XTB offers a proprietary trading platform called as xStation. MT4 or any other third-party platform is not available at XTB in South Africa. They allow trading of more than 2100 instruments as CFD. The maximum leverage is 1:500 on currency pairs.

USD is the only account currency available for South African clients at XTB. ZAR is not available as an account currency.

Deposits and withdrawals can be done through bank transfers, credit cards, and e-wallets. The currency conversion fees will be applicable for every ZAR deposit. Transactions through e-wallets will incur additional commission from the third party.

XTB Pros

- XTB is regulated by FSCA in South Africa

- User friendly trading platform

- Local phone support available in South Africa

- More than 2100 instruments available

XTB Cons

- XTB is not regulated by FSCA in South Africa

- MT4, MT5, or cTrader trading platform not available

- ZAR is not available as base currency

8. IC Markets – Best Low Spread Forex Broker in South Africa

IC Markets is an Australia based broker that is regulated by ASIC in Australia. It is not regulated by FSCA in South Africa.

IC Markets is a reputed broker in Australia and is regulated by the Australian Securities and Exchange Commission. They are not regulated by FSCA in South Africa. South African clients are registered under offshore regulation Financial Services Authority (FSA) in Seychelles.

The third-party risk of choosing IC Markets in South Africa is higher than FSCA regulated brokers. Apart from ASIC, IC Markets is also regulated by CySEC in the European Union.

The average typical spread for EUR/USD is 0.62 with the standard account. They also have a commission-based account in which the spreads for EUR/USD is is as low as 0.02 pips. The fixed commission-based account incurs a commission of $3 and $3.5 for cTrader and MetaTrader accounts.

IC Markets allows traders to trade with MT4, MT5, as well as cTrader trading platforms. The maximum leverage is 1:500 for the currency pairs. Nearly 2000 instruments are available to trade including 61 currency pairs.

IC Markets accepts multiple methods for deposits and withdrawals including credit/debit cards, e-wallets, and wire transfers. No additional commission is incurred for deposits and withdrawals from the broker’s side.

IC Markets Pros

- IC Markets is regulated by FSCA in South Africa

- MT4, MT5, as well as cTrader trading platform available

- Local phone support available in South Africa

- Spreads at IC Markets are lower than average

- 2000+ CFD instruments available

IC Markets Cons

- High trading commission on commission based account

- ZAR is not available as base currency

How we choose the Best Forex Brokers in South Africa?

Now that we have extensively discussed each top broker and its features, let us discuss what factors should be considered while choosing a forex broker!

We will list down 6 such factors, especially in the context of South Africa that is very important before considering choosing a forex broker either from the one we mentioned or the others in the market.

1. Is the broker Regulated in SA?

As stated in a few brokers’ features, not all of them are FSCA regulated or are Tier- 1 licensed brokers. Therefore, it is very necessary to check if they are compliant with FSCA at the least and if they are a multi-regulated forex broker.

A forex broker in South Africa must be licensed with FSCA for offering derivative instruments. You can check if a forex broker is regulated or not to accept traders in South Africa by finding their FSP No. and then verifying it from FSCA’s FSP search.

If the broker is licensed, then you will find their associated regulatory information on FSCA’s website. Below is an example of an Exness Broker which is licensed in South Africa with FSP No. 51024.

The regulatory information shows their license no., company information, status & the products for which Exness is licensed.

Similarly, you should ask your broker for their FSP No. & verify it on FSCA’s portal. Also, make sure to check if the FSP No. provided by the broker actually belongs to that broker.

Remember, beware of clones. Some fake brokers may create clone websites, and claim to be genuine, when they are actually fake, pretending to be regulated by using an actual regulated broker’s license no. as their own.

2. Reputation & User Reviews

Reputation is more than anything in terms of selecting a forex broker. What if a broker has a reputation for delaying withdrawals or denying them for some reason or the other? Or what if the broker is known to hunt the positions of traders by sudden widening?

Both these above points are signals of a broker that should not be trusted. And if there are multiple such complaints against a forex broker, then you should be more cautious before choosing such a broker.

Credibility assures the trader that a broker has not been involved in any fraudulent activity in the past. And it has a reputation for fair dealing with traders. Normally, you should trade with brokers that have zero conflict of interest with the traders. Market maker brokers may have an interest against you, so you must check the broker’s reviews before signing up.

Only secured and reputed brokers must be selected for trading.

3. Range of CFD Trading Instruments

Forex has many types of instruments, it is unnecessary to open multiple accounts for multiple instruments, therefore choose only the broker which has every tradable forex instrument under its umbrella of offerings.

As an example, HotForex SA has 53 currency pairs available on its platform. If you compare it with Exness, they have over 100 Forex pairs on their MT4 platform.

You should also check if the broker offers other CFD instruments that you want to trade. As an example, if you want to trade Gold CFD, then the broker that you want to choose should offer this CFD instrument. And if you want to trade CFDs on Indices like NASDAQ 100 then also it should be available on the broker’s platform.

You can check the list of all the Forex pairs & the CFD instruments available on the broker’s platform from their website.

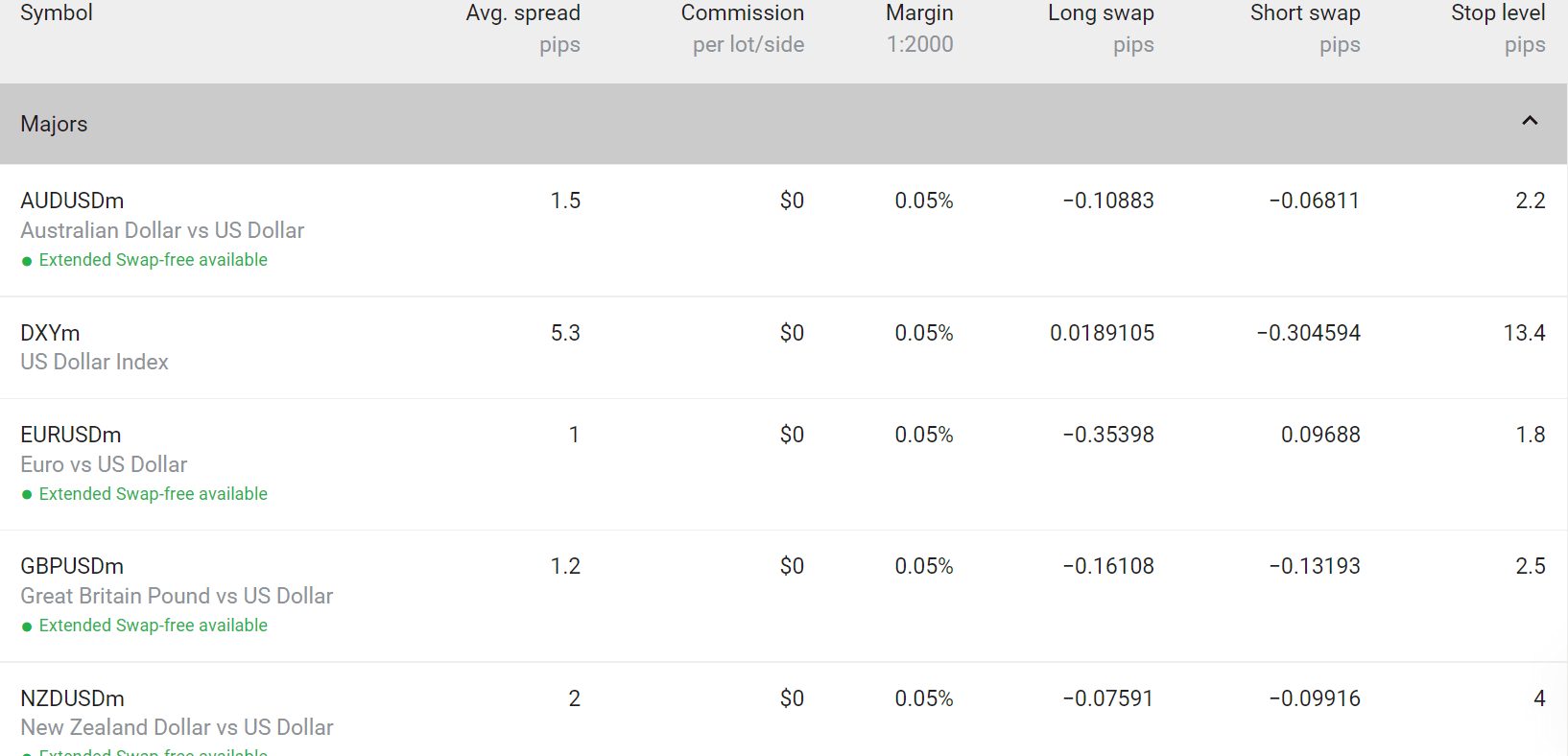

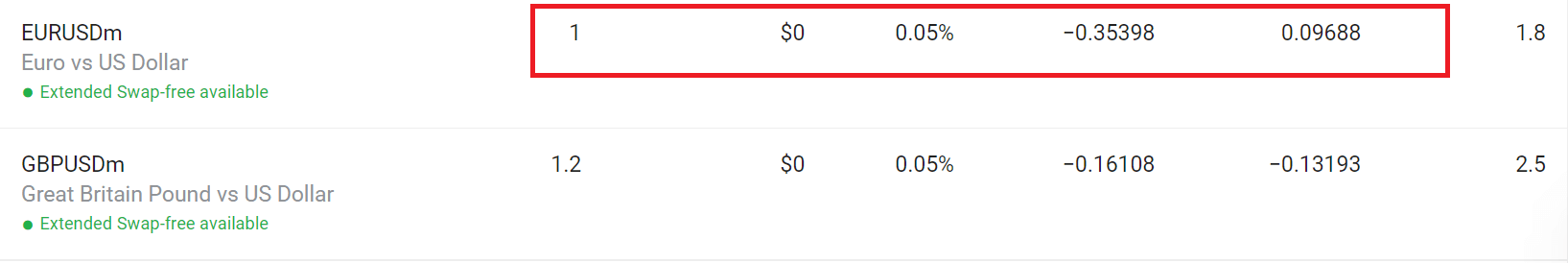

As an example, the below screenshot from Exness’s website is where they mention the no. of Forex Pairs available on their platforms and the typical trading contract conditions for each currency pair.

You will find a similar section of Contract Specifications for every Instrument on each broker’s website. Using this, you can see the available instruments with each account type.

4. Overall Fees & Transaction Charges

There are two types of costs that the forex broker would charge you: Trading Costs & Non-trading costs.

Trading Costs include the broker fees that are trade-specific. These are the fees that you are charged for each trade. This includes the spread, commission, and Swap Fees.

Let’s explain this with an example trade for EUR/USD Long of 1 Mini Lot at Exness with their Standard Account.

- Spread: The typical spread for EUR/USD with a Standard account is 1 pip. So, the basic fee would be $1 for 1 Mini Lot trade.

- Commission: Exness does not charge any extra commission per trade with a Standard account. But if you open a Raw Account, then there is an extra commission of $7/Standard lot, but the spread is much lower.

- Swap: If you decide to keep your position open overnight, then there will be a Swap Fee. You can earn this if the Swap is positive. Exness has a Long Swap for EUR/USD of USD −0.35398 per Standard Lot, and this will be charged every night. So, you will be charged USD 0.035398 for the Mini Lot order

Non-Trading Costs include other fees that a forex broker charges. This could include Inactivity fees or transaction charges for funding/withdrawals etc. Many forex brokers don’t charge anything for funding & withdrawals, but they still may charge for Inactivity.

Fees associated with deposits, withdrawals, and inactivity should be understood well before opening the account.

5. Choices of Account Types

There are sometimes choices of Account types across brokers, and each comes with different fees & features. Therefore, it is necessary to choose the account which gives the maximum benefit in terms of liquidity, commissions, or fees.

For example, if you want to trade a higher no. of lots, then it would definitely make sense to choose the account with the lowest fees.

Exness for example, a charge spread of 1 pip on average for EUR/USD with a Standard Account. But with their Pro Account (USD 500 Deposit), the same spread is 0.6 pips for EUR/USD.

So, if your trading volume is higher, it should make sense to open a Pro account as the typical fees that you pay would be lower than if you open Standard Account. You should also compare this fee across the brokers to check which one has the lower fees.

6. Trader Platforms and Education

Trading platforms and education provided by the broker come as an added advantage as it improves trading capabilities at zero cost for the retail trader. New Technical indicators or platform tools can come in very handy for someone looking to start forex trading in South Africa. Each broker offers different tools for research and education. A broker with ample education materials like blogs, videos, glossaries, economic calendars, etc would be more useful.

7) How Good is Customer Support?

Customer support services can greatly affect the user experience with any of the brokers. The assistance of support executives can be needed at any point during the trade. The inability to connect with the staff of the broker may be bothersome for the clients.

You can raise random queries through email, live chat window, or call them to check the quality of the customer support service before opening an account.

For our tests, we talked to the Live Chat support with every broker. We tracked the average/typical time taken to connect with the chat, the time taken to answer questions & the quality, and the accuracy of responses in resolving our doubts.

Also, we tested the email support by sending emails to their support emails. We check the average time it took for the response, and the actual response itself.

8) You Must Clear All Your Queries

If you are unable to gather any information about the broker, it is better to ask them directly through the live chat window, email, or phone support.

You must not rely on the words of a friend or relative and should make an effort to find the best-suited forex and CFD broker for yourself.

The reviews by professionals and existing clients can be used to select and compare brokers but the final decision must be made on your research. You must also note to not fall for every review (good or bad), and try to verify if that review is actually accurate.

When in doubt, ask questions to the broker through customer support services.

How to Open Live Forex Trading Account in South Africa

After checking and comparing each FSCA-regulated broker in South Africa, clients can open their account online through their official websites. The account opening process is simple and can be completed within 24 hours but depends on the broker.

Step 1: Choose the Broker

The broker must be chosen after extensive analysis and comparison. FSCA license is a must to trade safely in South Africa.

Step 2: Provide Basic Details

Visit the official website of the chosen broker and enter basic details like name and email to begin the account opening process. If the broker offers multiple account types and trading platforms, clients will also need to configure their accounts.

Step 3: Choose Password

Choose a unique password that will be used in the future to access the trading account.

Step 4: Document Verification

Traders need to submit a soft copy of their documents that will be cross-checked by the authorities at the broker. This is the most time-consuming step. Some brokers complete this process within 2 hours while some may also take up to 24 hours to verify documents.

Step 5: Make a Deposit

Once the account is verified, clients can make a deposit through any of the accepted methods and start trading through the trading platforms.

Before starting forex trading in the UK, it is important to understand the working of the forex market and the terminologies used while trading online. Traders must acknowledge each component of the risk involved in the forex market. It is always advisable to start with a demo account to learn the basics of trading and gain experience. More than 70% of forex traders lose money.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

The following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. FSCA-regulated brokers cannot offer more than 1:30 leverage however, leverage of 1:10 can be considered safe in the initial phase of forex trading.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on opened positions.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with it if it is fake. This risk can be mitigated by choosing an FSCA-regulated broker in South Africa.

FAQs on Forex Brokers in South Africa

Which is the Best Forex Broker in South Africa?

Which Forex Brokers offer ZAR Account?

There are only a few forex brokers that offer ZAR Base Currency Trading accounts. These include HotForex, Exness, Plus500 & a few other forex brokers.

Which Forex broker is best for beginners?

HotForex, Exness, and IC Markets are among the best forex brokers in South Africa. Beginners must practice with virtual currency through a demo account before trading on live accounts. Beginners should look out for brokers with low minimum deposit requirements and low fees. The chosen broker must be regulated by FSCA in South Africa.

How do I choose a forex broker?

While choosing a forex broker in South Africa, traders must ensure that the broker is regulated by FSCA. Additionally, the fees, trading conditions, platform, available instruments, and customer support services should also be checked before opening the account.

Can I trade forex without a broker?

Yes forex trading can be done through banks and currency exchanges without leverage. This will require substantial capital and is not feasible for retail traders. Retail traders can trade forex through FSCA-regulated forex brokers that allow CFD trading with leverage.

Which Forex broker is trustworthy?

In South Africa, any forex and CFD broker that is licensed and authorised by the Financial Sector Conduct Authority (FSCA) can be considered safe and trustworthy. HotForex, Exness, AvaTrade, Tickmill, etc are some of the best trustworthy brokers in South Africa.