XM South Africa Review 2024

XM is a market maker broker that offers trading on various instruments at decent spreads with Ultra Low Account. The South African clients at XM are regulated under IFSC Belize and the third party risk is high. Read to know whether you should open your trading account with XM or not.

XM is a market maker that offers low-cost trading services on various forex and CFD instruments. It is not regulated in South Africa. The South African clients are registered under the company name XM Global Limited that is regulated by International Financial Services Commission (IFSC) in Belize.

South African traders can open the forex and CFD trading accounts with ZAR as a base currency. Deposits and withdrawals can be done in Rand but there is a limited number of accepted methods. Clients can choose the most suitable account type for trading.

Table of Content

We have thoroughly reviewed every aspect of XM for South African clients. Read our review to know whether it is safe to trade with XM in South Africa or not, what are the trading costs that can be incurred at XM in South Africa? Which account type is best at XM? All such common queries have been considered in this review.

XM South Africa Summary

| Broker Name | XM Global Limited |

| Website | www.xmza.com |

| Regulation | IFSC & CySEC |

| Year of Establishment | 2009 |

| Minimum Deposit | R70 |

| Maximum Leverage | 1:888 |

| Trading Platforms | MT4 & MT5 |

| Trading Instruments | Forex, CFDs on Metals, Energy, Indices, Shares, Commodities. |

Is XM Safe?

XM Safety Pros

- The parent company of XM is regulated by top-tier regulatory authorities

- XM is regulated by CySEC and IFSC of Belize

XM Safety Cons

- XM is not regulated by FSCA of South Africa

- XM is not regulated by any top-tier regulatory authority

- XM is a market maker and can make revenues on the losses booked by traders

The safety of traders and their funds largely depends on the regulatory authority that has authorized the business in their jurisdiction. The Financial Sector Conduct Authority (FSCA) is the financial regulatory authority in South Africa that authorizes and regulates the financial services providers in South Africa. However, XM is not regulated under FSCA or any other local regulatory authority in South Africa.

Following are the details of the regulatory license of XM.

- IFSC of Belize

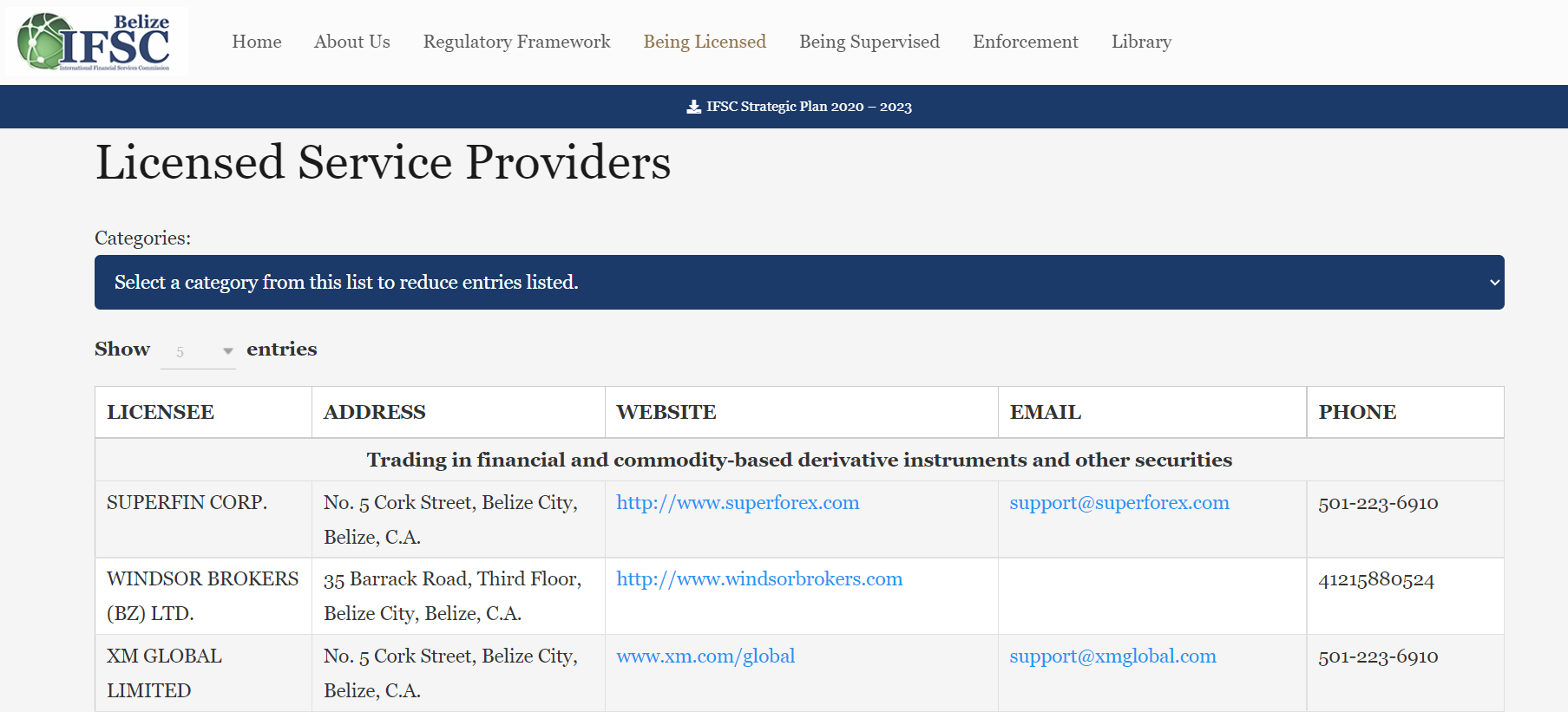

XM is operating in South Africa under the regulation of the International Financial Services Commission (IFSC). The license is registered by the name of XM Global Limited under license number 000261/158 with a registered company address at No. 5 Cork Street, Belize City, Belize, CA.

The IFSC regulation has more lenient compliance conditions than the FSCA of South Africa. Due to this, the risk of choosing XM in South Africa is slightly higher compared to all the market makers and brokers regulated under FSCA in South Africa.

- CySEC of European Union

The Cyprus Securities and Exchange Commission (CySEC) of Cyprus is a renowned financial regulator based in European Union. XM holds the CySEC license by the name of Trading Point of Financial Instruments Limited as it is a member of Trading Point Group. The CySEC regulatory license is held by XM under license number 120/10.

CySEC is a tier 2 regulatory authority that grants the Financial Service Providers (FSPs) the permission to operate their business in the European Union. South African clients are not registered under CySEC regulation.

Apart from IFSC and CySEC, XM does not hold a regulatory license from any other local or offshore regulatory authority.

XM has been in the forex and CFD trading business since 2009. It is a member of Trading Point Group which is a group of financial services providers and holds multiple regulatory licenses. XM is a subsidiary of Trading Point Holdings Limited.

Trading Point Holdings Limited is regulated by FCA of UK (705428) under the name Trading Point of Financial Instruments UK Limited. It also holds a regulatory license from ASIC of Australia (443670) under the name Trading Point of Financial Instruments. The parent company of XM is regulated by top-tier offshore regulatory authorities but not by the FSCA of South Africa.

The clients at XM are not registered under the regulatory license held by Trading Point Holdings Limited. However, complaints against XM can be registered at regulatory authorities that regulate Trading Point Holdings Limited in their local jurisdiction. South African clients are registered under the IFSC Belize regulation and can only file a complaint at IFSC.

The third-party risk of choosing XM in South Africa is high as it is a market maker and is not regulated by FSCA or any other local regulatory authority in South Africa. Although, it can still be considered safe and can be chosen to trade forex and CFD instruments in South Africa. According to our review, the risk is slightly higher compared to all the forex and CFD brokers and market makers that are regulated by FSCA.

XM Trading Fees

XM Fees Pros

- The spreads with Ultra Low Account are low

- Trading commission only exists on shares CFD trading

- No commission for deposit and withdrawal

XM Fees Cons

- XM is not regulated by FSCA of South Africa

- Average spread with the Standard account is high

- XM deducts inactivity fees if no trades are placed for 90 days

XM charges a tight spread on various trading instruments and offers cost-efficient trading on Forex and CFDs. We have separately reviewed every component of the fee structure that is incurred to South African traders.

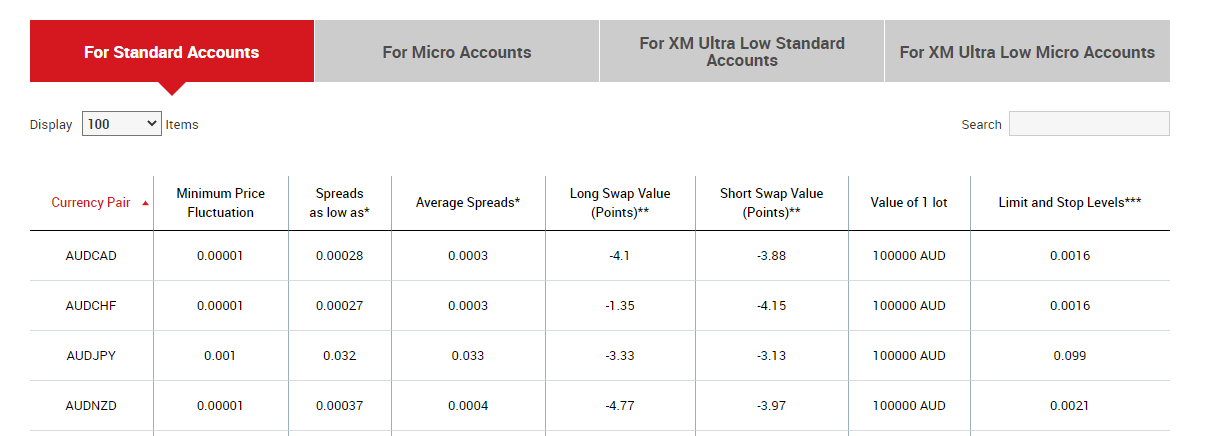

- Spread: The spreads at XM are variable and depend on liquidity and market conditions. The spreads also differ based on the account type chosen by the trader. XM offers 3 live trading account types for trading forex and CFDs while 1 account is exclusively structured for trading stocks.

The spreads with the Micro and Standard account type are similar as they only differ based on lot size. The Ultra-Low account type at XM offers the best spreads on all instruments starting from 0.6 pips. The table below describes the average typical spreads associated with all the account types at XM in South Africa.

- Swap Fees: This is the fee that is incurred to the trader if a position is kept open overnight. Swap fees are also called overnight charges. Each trading instrument has different swap fees for long and short positions. The choice of account type does not affect the swap fees at XM as all the accounts have the same swap fees for every instrument.

- Trading Commission: XM does not charge a trading commission on any of the live trading accounts for forex and CFD instruments. Trading commissions are only incurred on shares account. The commission on trading shares of the US, UK, and Germany without CFD involves a commission.

The commission for US shares is 0.04$ per share, UK shares is 0.10% per transaction, Germany shares is 0.10% per transaction. The minimum commission per transaction for shares of the USA is 5 USD, the UK is 9 USD, Germany is 5 USD.

- Other Charges: XM does not charge any additional commission for deposit and withdrawal. The account opening is free and no hidden commission is involved. The only non-trading fee at XM is the inactivity charges.

Inactivity fees of 5$ or equivalent are charged each month after 90 days of inactivity. The inactivity period at XM is defined as 90 consecutive days with no order execution, deposit, withdrawal, or internal transfer. This fee of 5$ is charged each month until the account balance reaches 0. No charge is imposed if the account balance reaches zero.

| Trading Instrument | Average Spread with Standard Account (pips) | Average Spread with Ultra Low Account (pips) |

|---|---|---|

| EUR/USD | 1.7 | 0.8 |

| GBP/USD | 2.1 | 1 |

| Gold/USD | 3.5 | 2.5 |

| US Crude Oil | 3 | 3 |

| US Tech 100 | 1 | 1 |

We have compared the average spreads incurred at XM with the spreads incurred by various brokers in South Africa. It must be noted that the spreads mentioned in the following table are with the Standard accounts with no commission involved.

| Trading Instrument | XM | FXTM | eToro | Exness | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 1.7 | 1.9 | 1.1 | 1 | 0.77 |

| GBP/USD | 2.1 | 2 | 2.3 | 1.2 | 1.19 |

| EUR/GBP | 2 | 2.4 | 2.8 | 1.60 | 1.40 |

| USD/JPY | 1.6 | 2.2 | 1.2 | 1.1 | 0.86 |

| USD/CAD | 2.2 | 2.5 | 1.7 | 2.1 | 1.07 |

According to our review, the spreads at XM are slightly above average with the Standard and Micro account types. The spreads with the Ultra-Low account are much lesser without any added commission or higher deposit requirement.

Hence, if you are choosing the Ultra-Low account type while opening the account, XM is among the most affordable forex and CFD brokers in South Africa. If you choose the Standard or Micro account at XM, you might be paying higher than average spreads on forex and CFD instruments in South Africa.

There is no trading commission involved in trading forex and CFDs. The swap fees are slightly higher than average in South Africa. Inactivity fees are the only non-trading fees that can be incurred by traders.

XM Account Types

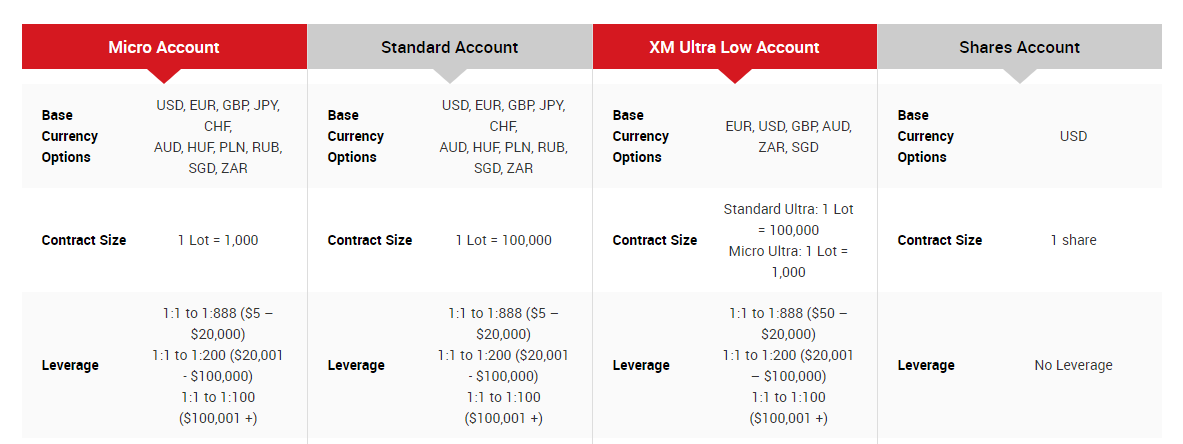

XM allows traders to choose between 4 different account types. 3 of them offer forex and CFD trading and can be opened with ZAR as the base currency. The shares account can only be used to trade available shares and must be opened only with USD as a base currency. Our detailed review of each account type can assist you in choosing the most suitable account type for yourself with consequences.

- Standard Account: This is the basic account type at XM that can be opened with ZAR and 11 other currencies as the base currency of the account. It allows trading on standard lots of all the available trading instruments at XM. One standard lot in the forex pair has 1,00,000 units of the quote currency. All the available bonuses offered to South African clients can be grabbed with this account type. The spreads are higher than that with Ultra-Low Account.

- Micro Account: The only difference between the Standard account and the Micro account is the lot size. The Micro account allows trading on all the available trading instruments with micro-lots. The micro lot denotes 1000 units of the quote currency. The bonus is also available with this account.

- Ultra-Low Account: This is the most suitable account type at XM for a majority of the traders in South Africa. The spreads are very low without any trading commission. Traders who choose to open an XM Ultra Low account will not be eligible for any of the bonus offerings in South Africa. All the other features are the same as the Standard account.

All the 3 account types described above can be opened with ZAR as the base currency and allow access to all the available trading instruments on MT4 and MT5 trading platforms. The MT4 trading platform does not support CFD trading on stocks.

The minimum deposit with each of these accounts is 5$ for USD-based accounts and R70 for ZAR-based accounts. The maximum leverage is 1:888 if the account balance is 5$-20,000$ equivalent, 1:200 for 20,000$ to 100,000$, and 1:100 for more than that. The leverage structure is the same with all three account types.

XM has a separate shares trading account that can only be opened with USD as the base currency and a minimum deposit of 10,000$. This account is structured to trade shares on a commission basis.

Overall, there are 3 choices of trading accounts for CFDs and currency pairs. However, there is only a slight difference between them. The Ultra Low Account at XM is the best account type as it offers trading at tight spreads. It does not allow to claim any bonus. The availability of each account type with ZAR as the base currency and R70 minimum deposit is a major advantage for South African traders.

How to Open an Account at XM

The account opening process at XM is simple and fast. Clients can start trading the same day they open their accounts after completing the whole process. To open the account at XM you will need an address and identity proof to be submitted for verification.

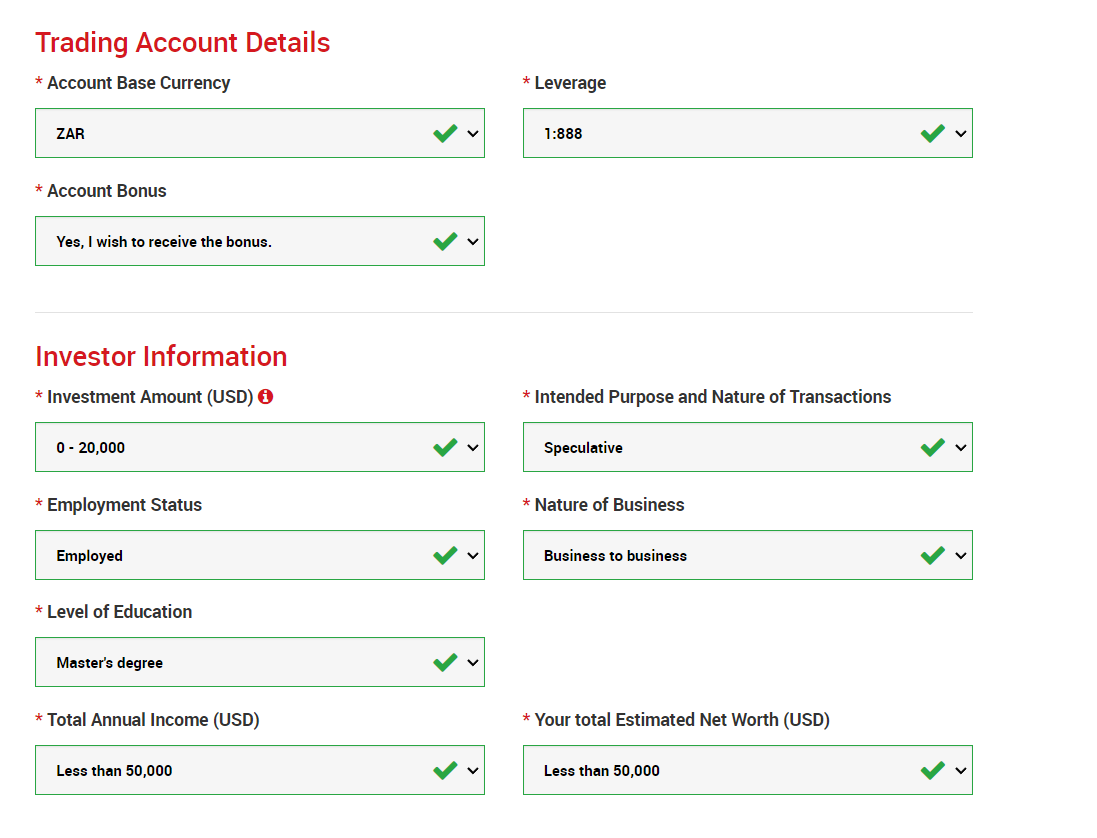

The first step is to enter the basic details like name address, email, phone number, etc. A verification link is sent to the email after this. Upon following the link, clients will land on another form where other details are to be entered. The account type, base currency, and trading platform are selected by the client. XM also requires clients to enter basic employment and financial background.

After this, the account needs to be validated by submitting the address and identity proof. In general, it takes less than a day for executives at XM to verify the documents and allow clients to start trading. After verification, a confirmation mail is sent to the client. Trading can be started after making a deposit through any of the available methods.

XM Demo Account Review

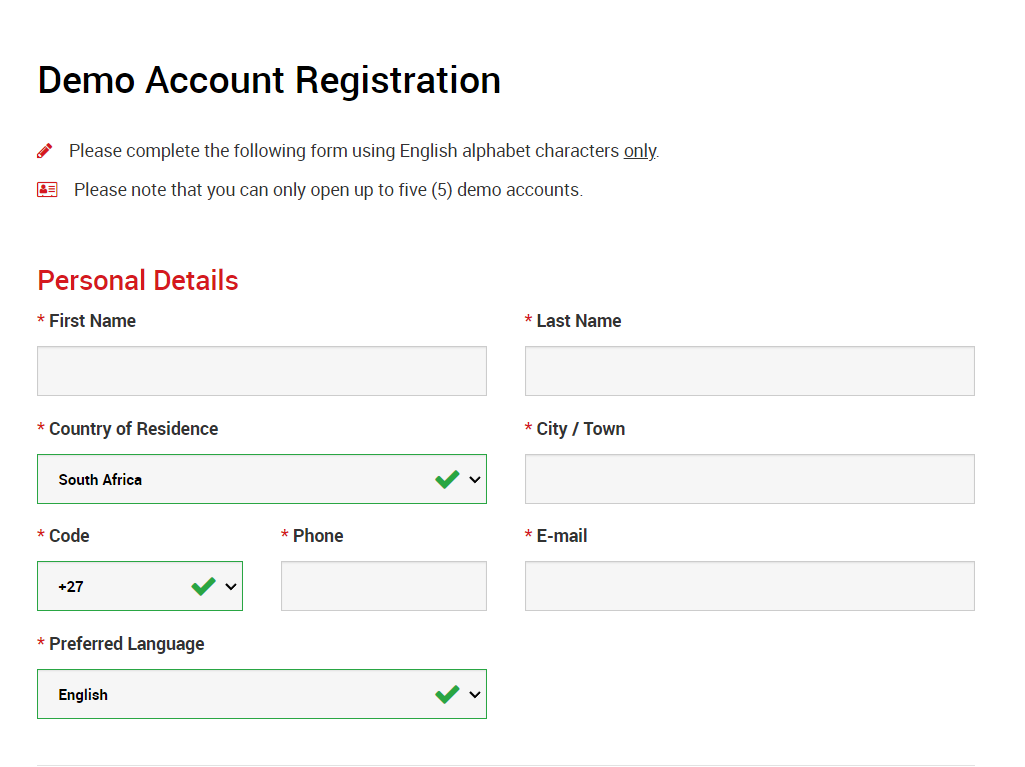

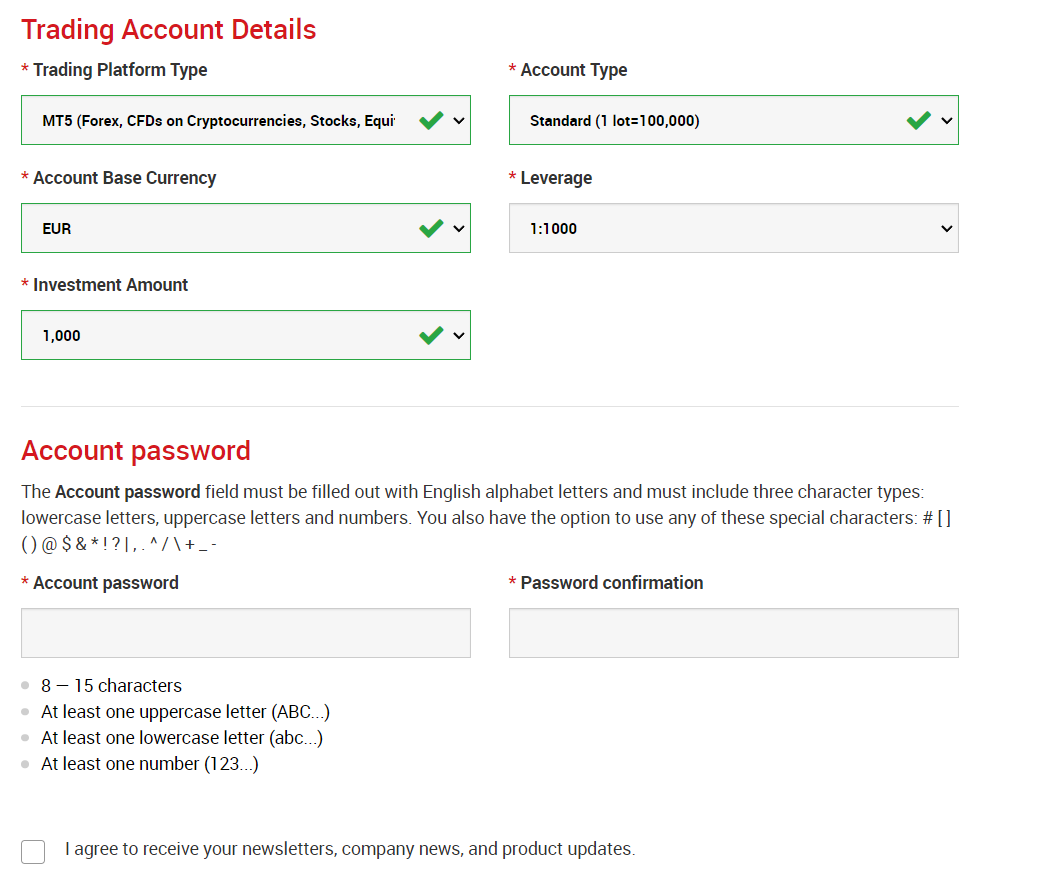

To open a demo account at XM, traders need to visit the official website of XM and click on “Open a demo account”. Clients need to enter their basic details like first name, last name, country of residence, city, phone number, and email address. XM also allows traders to choose between 22 languages for the demo account.

Each client can open up to 5 demo accounts. The demo account at XM is very useful for beginners as well as experienced traders as each demo account can be configured according to the requirements of the clients.

Clients can choose between MT4 and MT5 as trading platforms for the demo account. The pricing structure can also be chosen between Standard and XM Ultra Low Standard account types. 10 currencies can be chosen as the base currency of the account including USD, EUR, GBP, ZAR, AUD, etc.

The maximum leverage of the demo account can be chosen from 1:1 to 1:1000 for major forex pairs. The investment amount can be chosen from 1000 to 5,000,000 units of the base currency. For the best use of the demo account, traders must choose the amount that will be deposited by them in future. Traders must also choose the account password that will be used to login into the demo account.

Once the demo account is configured, the login details of the demo account will be available in the personal area. This detail can be used to log in on the chosen trading platforms on the web, desktop, and mobile.

According to our analysis, the demo account at XM is very useful as it can be configured in multiple ways according to the suitability of the traders.

XM Deposits and Withdrawals

XM Deposit/Withdrwal Pros

- Multiple Withdrawal Options: XM allows withdrawals via bank transfer, credit/debit cards, and electronic wallets like Skrill and Neteller, providing flexibility for users.

- Low Minimum Deposit: The minimum deposit at XM is just $5, making it accessible for traders with limited capital.

- No Deposit Fee: XM does not charge a deposit fee, which means the full amount of your deposit can be used for trading.

- No Withdrawal Fee for Most Transactions: Basic withdrawals at XM are generally free of charge, except for some specific conditions like bank wire transfers below $200.

- Fast Account Opening: XM is known for its user-friendly and fast account opening process.

XM Deposit/Withdrawal Cons

- Fee for Small Bank Wire Withdrawals: There’s a fee for bank wire withdrawals less than $200, which might be a downside for small-scale traders.

- Inactivity Fee: XM charges an inactivity fee, which could be a drawback for traders who do not trade regularly.

- Deposit Complexity: Although XM does not charge for deposits, the process might not be as straightforward compared to similar brokers, which could be a minor inconvenience for some users.

The deposit and withdrawal methods depend on the country from which you are trading with XM. For clients residing in South Africa, there are 2 methods to fund the account and withdraw. The withdrawal method has to be the same as the deposit method at XM.

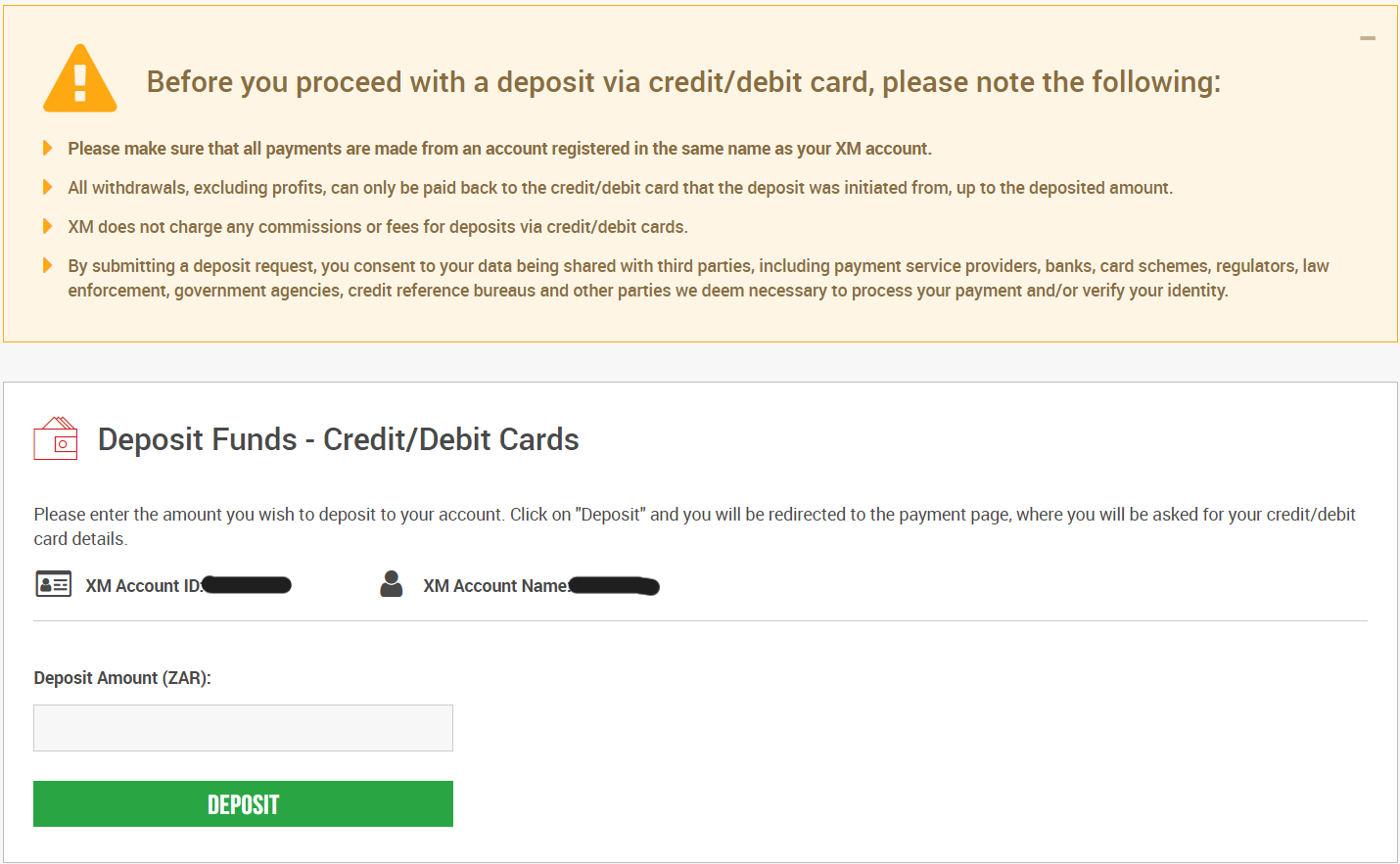

- Debit/Credit Card: The debit and credit cards of VISA and Mastercard are accepted as funding and withdrawal methods at XM. The deposit can be made in ZAR with no added commission. The card must be registered with the same name as that of the account. The minimum deposit amount through this method is R70 while the maximum amount per transaction is R35,000 for ZAR based account. The deposits are processed instantly while the withdrawals can take up to 3 business days to reflect in the bank account.

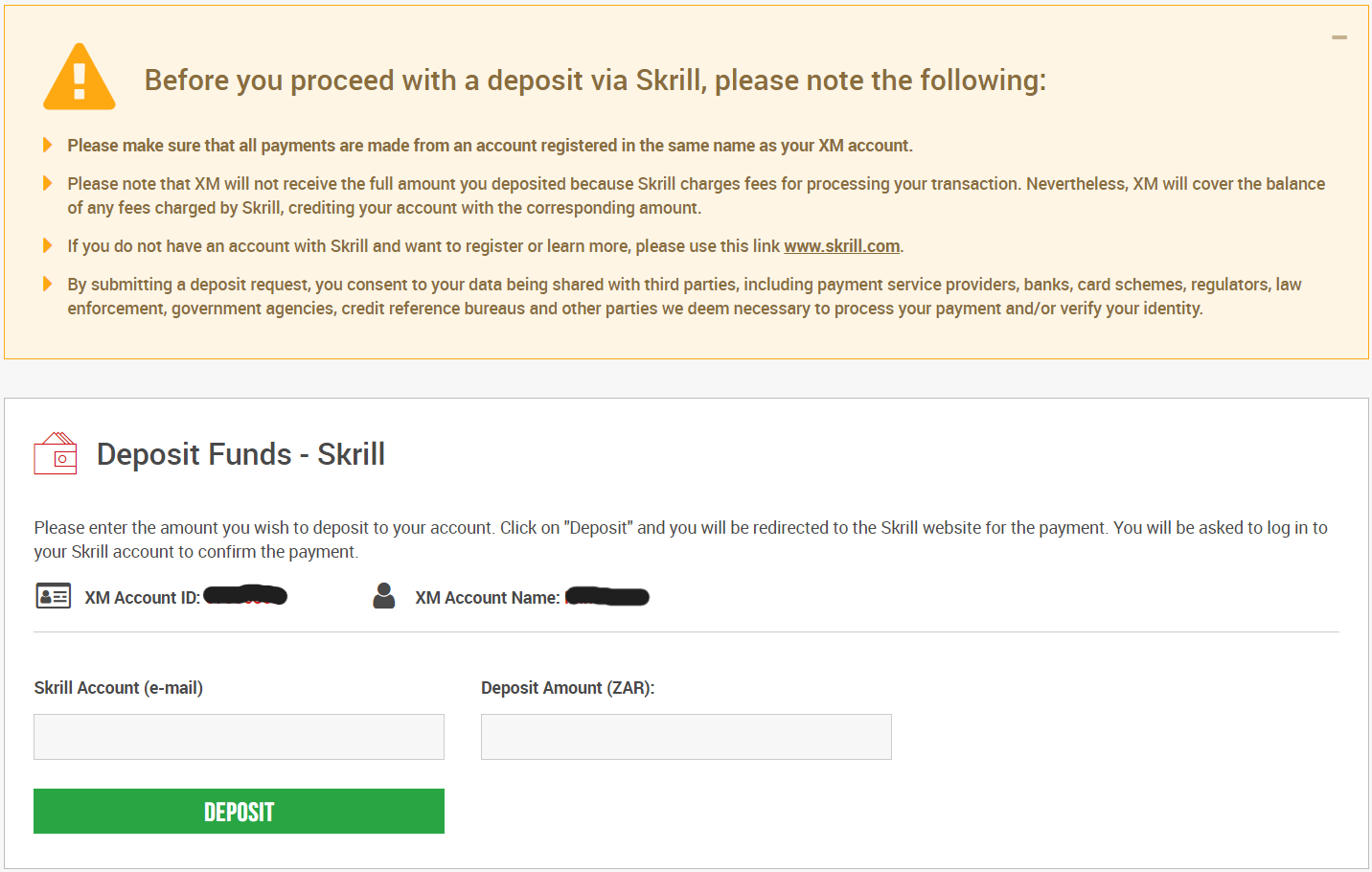

- Skrill: Skrill is the only e-wallet transaction method that is currently accepted at XM by South African traders. Skrill incurs third-party transaction fees but that is covered by XM as all the charges are added back to the account balance. The Skrill account should be registered with the same name as the account at XM. The deposits, as well as withdrawals, are reflected instantly via Skrill. The minimum and maximum amounts that can be deposited are R70 and R35,000.

XM Available Instruments

XM allows trading on currency pairs and CFDs of stocks, indices, commodities, and energies. Following are the details of each asset class that can be traded by opening an account with XM.

- 57 currency pairs: All the 3 forex trading accounts give access to trade on 57 currency pairs including USD/ZAR and EUR/ZAR. Each pair has a different variable spread and different swap values. The number of currency pairs is higher than a few regulated brokers but many of the peers offer more currency pairs than XM. The forex pairs are available on MT4 as well as the MT5 trading platform.

- 1286 Stock CFDs: XM allows trading stocks through CFDs but they are only available with the MT5 trading platforms and not on MT4 platforms. Major stocks on the exchanges of the USA, UK, France, Germany, Netherlands, Spain, Switzerland, Belgium, Italy, Greece, Portugal, Sweden, Finland, Norway, Austria, Russia, Brazil, and Canada can be traded at XM. The minimum and maximum trade sizes (number of shares) that can be traded in a single position are different for each stock.

- 8 Commodities CFD: 8 CFDs on commodities can be traded with the maximum leverage of 1:50. CFDs of cocoa, coffee, corn, cotton, copper, soybeans, sugar, and wheat are available to trade.

- 14 Stock Indices CFDs: Trading on stock indices can be done at XM as CFDs. The maximum leverage is 1:100 for indices.

- 4 Precious Metal: Gold and Silver can be traded at XM via CFDs with a maximum leverage ratio of 1:400. Palladium and Platinum are available to trade as futures CFDs with a margin of 4.5%.

- 5 Energy CFDs: Brent Crude Oil, London Gas Oil, Natural Gas, WTI Oil, and WTI Oil Mini can be traded at XM through CFDs with a maximum margin of 1.5%.

- 100 Shares: Shares of the USA, UK, and Germany can also be traded at XM directly without CFDs. There is a fixed commission involved in trading each share. Holding these shares will also generate dividends after the deduction of Tax.

XM does not offer trading on cryptocurrencies. The number of instruments available to trade is higher than many of the regulated forex and CFD brokers in South Africa.

XM Trading Platforms

All the trading positions are opened, closed, and modified through the trading platforms. Hence, the trading platform is one of the most important aspects of a forex broker. XM offers multiple trading platforms for different devices. We have separately reviewed the available trading platforms at XM in South Africa for desktop, mobile, and web.

Web Trading Platform

MT4 WebTrader and MT5 WebTrader are two options as web trading platforms at XM. These platforms can be used through any web browser from desktop, mobile, and tablets. MT4 and MT5 webtrader have single-step login and are available in more than 40 languages.

The web trader at XM is highly customisable and can be linked with online trading tools and plugins. The research and analysis tools are limited when compared with MT4 and MT5 for desktop devices.

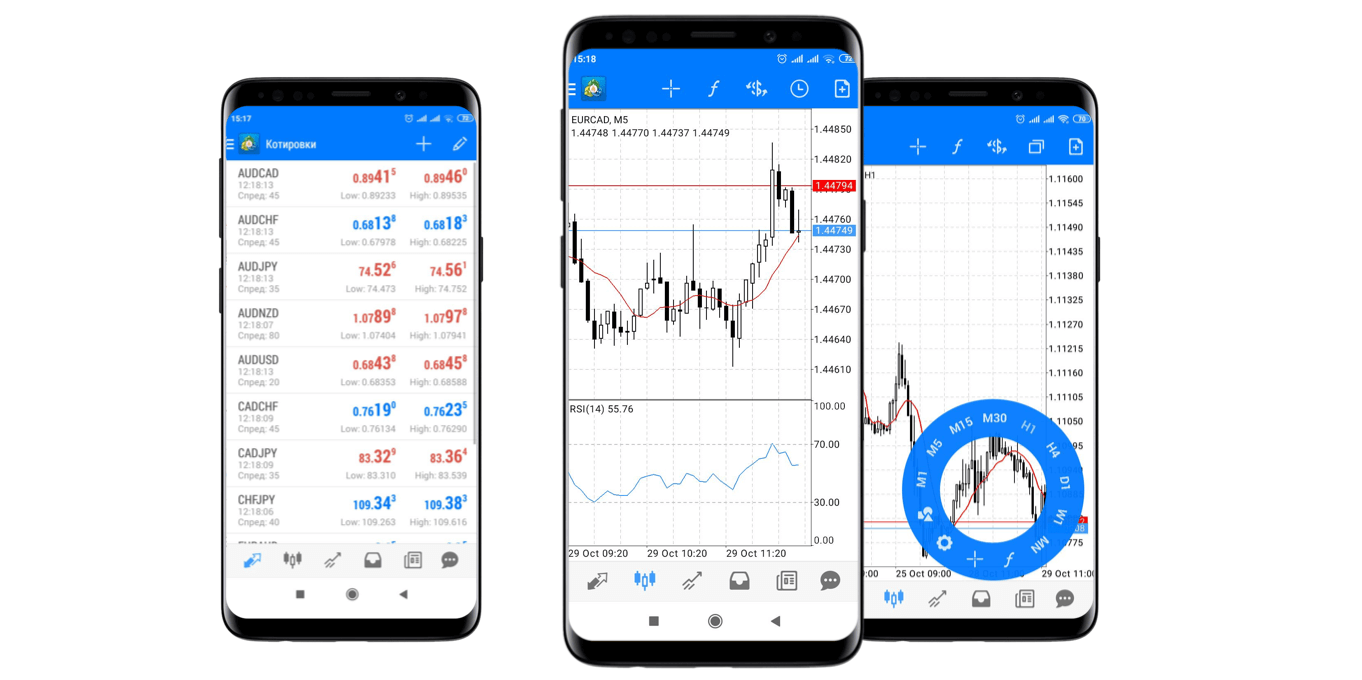

Mobile Trading Platform

Traders who prefer to trade on the go through mobile and tablet devices have 3 options to choose from for trading platforms. XM offers MT4, MT5, and a proprietary trading application called XM App. All these mobile trading platforms are available for Android and iOS devices.

MT4 and MT5 mobile trading apps are quite common among forex traders. These apps can be downloaded and linked with an XM account to trade through mobile and tablets. Both these trading platforms are very simple to use. They are fast and all the features are easily accessible. Alerts and notifications can also be set so traders do not miss out on trading opportunities.

The XM Trader App is a proprietary trading platform of XM designed only for mobile and tablet devices for Android and iOS devices. Apart from trading, the XM app can also be used for account management and accessing the latest news. The trading area is similar to MT5 but looks better. 90 indicators are available with the XM app.

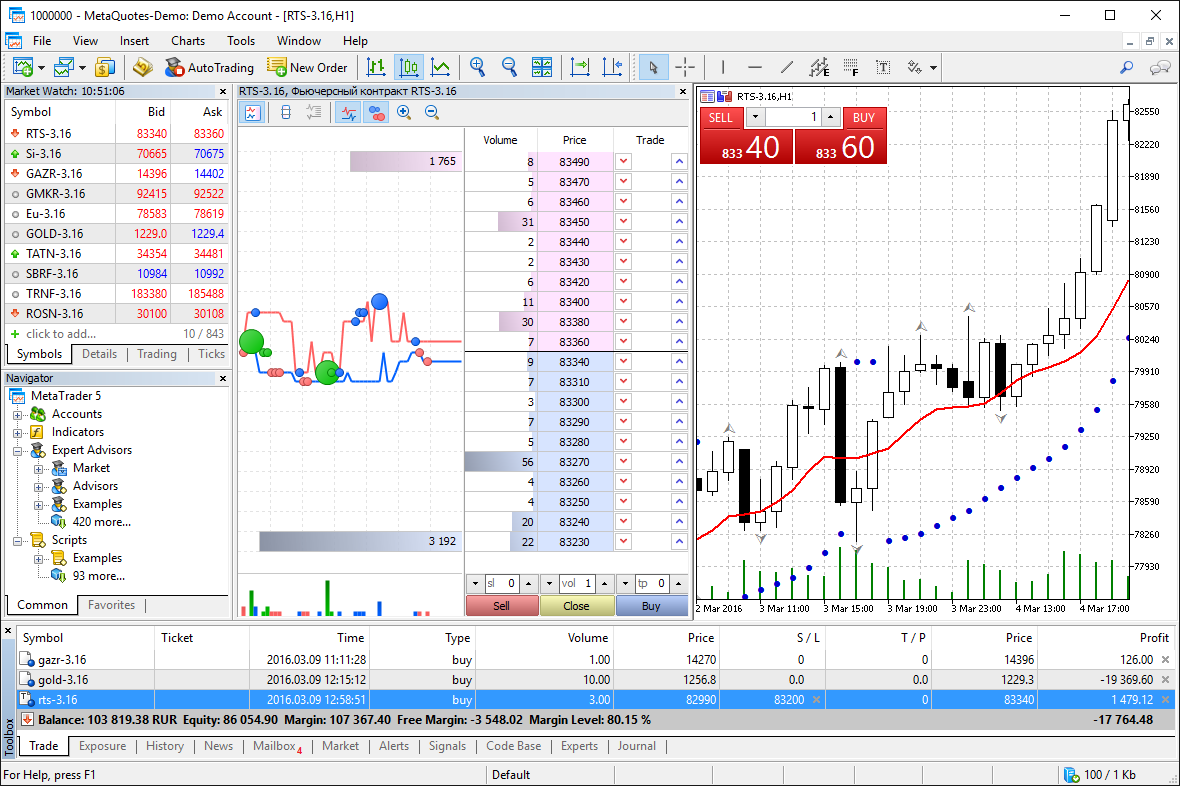

Desktop Trading Platform

For desktop devices, XM offers the two most widely used trading platforms for forex and CFD trading. MT4 and MT5 trading platforms can be downloaded on desktop devices and linked with an XM account to trade online.

MetaTrader 4 or MT4 is the most basic trading platform designed in 2005 with a very simple interface and basic features. The look and feel of the interface are similar to Windows 98. It is considered an ideal platform for beginners and is the most chosen trading platform globally.

MT5 is an upgraded version of MT4 with more indicators, time frames, and patterns. MT5 has a modern-looking window with better features for automated trading. MT5 is preferred by experienced traders but is ideal for all types of traders.

Apart from MT4 and MT5, no other trading is available at XM. Both platforms are available with all account types.

XM Trade Execution Method

Each forex and CFD broker can use different trade execution methods. Following are the details of trade execution methods followed by XM.

No Dealing Desk (NDD) Model: XM operates primarily as a No Dealing Desk (NDD) broker. This means that it does not take the opposite side of clients’ trades, reducing potential conflicts of interest. Instead, XM aggregates liquidity from various liquidity providers, including banks and financial institutions, and passes clients’ orders directly to these liquidity providers.

Straight Through Processing (STP): XM’s STP execution model involves electronically transmitting clients’ orders to liquidity providers without any manual intervention. This helps to ensure quick and accurate execution of trades, as well as minimizing the possibility of requotes.

Market Execution: For most account types, XM offers market execution, where orders are executed at the best available market price. When you place a trade, the order is executed at the prevailing market price without any price manipulation. This execution method aims to provide traders with transparent and fair pricing.

Brokers with no dealing desk (NDD) and Straight Through Processing (STP) of trade orders are considered safer compared to market makers. XM broker does not take part in the trade orders placed by the clients.

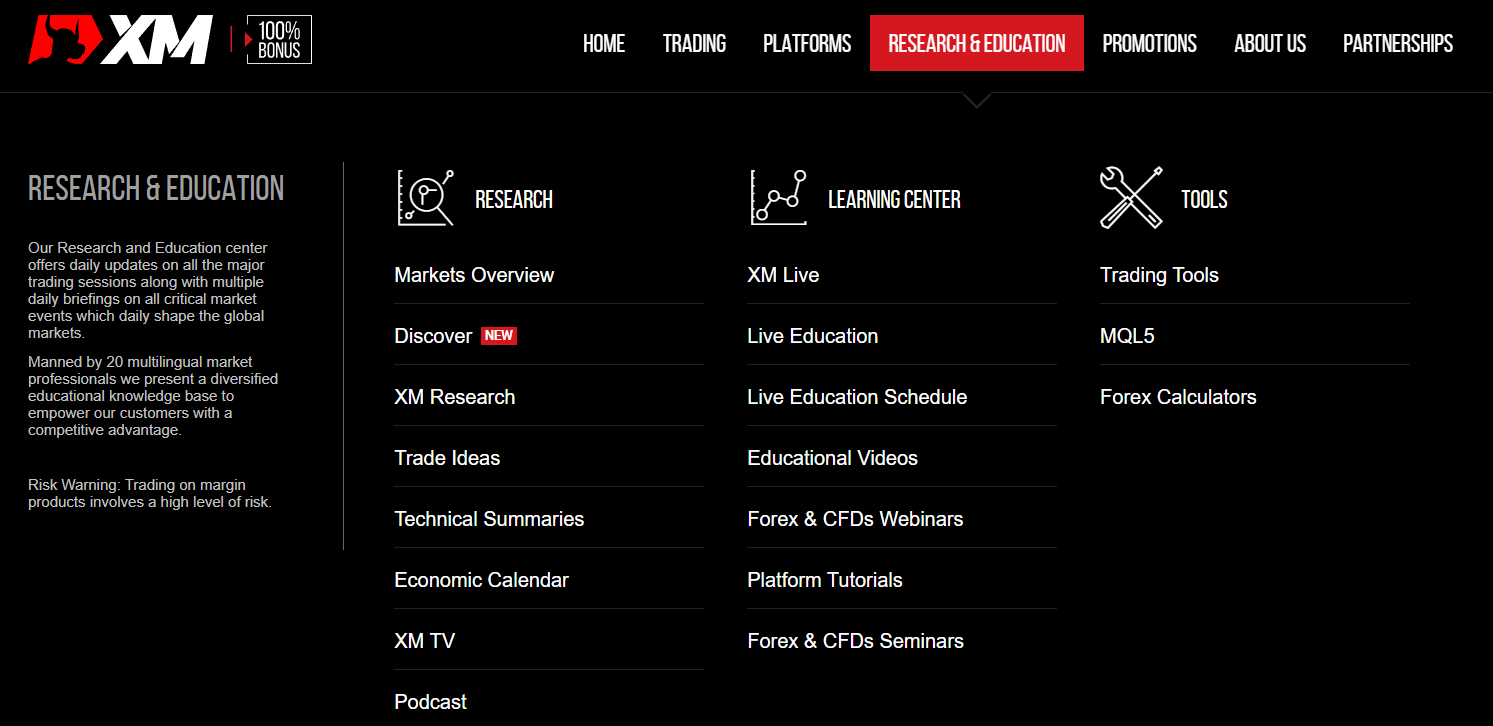

XM Research and Education Tools

XM Broker offers a comprehensive suite of research and educational tools aimed at empowering traders with the knowledge and insights necessary to make informed trading decisions. Here are the research and education resources provided by XM:

- Webinars: XM conducts frequent webinars led by seasoned traders and industry experts. These interactive sessions cover a wide range of topics, such as technical analysis, fundamental analysis, risk management, and trading strategies. Traders have the opportunity to engage with the presenters, ask questions, and gain valuable insights.

- Seminars: In addition to webinars, XM organizes in-person seminars in various locations globally. These seminars provide traders with in-depth knowledge on different aspects of trading. By attending these seminars, traders can learn from professionals, expand their network, and acquire practical trading tips.

- Video Tutorials: XM Broker offers an extensive library of video tutorials that cater to traders of all skill levels. These tutorials cover a diverse range of topics, including platform tutorials, trading strategies, technical analysis indicators, and more. The videos are designed to be educational, accessible, and easy to comprehend.

- Market Analysis: XM provides daily market analysis reports encompassing technical analysis, fundamental analysis, and market news. These reports cover major financial markets, including forex, stocks, commodities, and indices. Traders can stay up-to-date with the latest market trends, news events, and potential trading opportunities.

- Economic Calendar: XM features an economic calendar that displays upcoming economic events, news releases, and significant indicators. This calendar allows traders to stay informed about scheduled economic data releases that may impact the financial markets. By utilizing the economic calendar, traders can effectively plan their trades and manage their risk.

- Trading Tools: XM Broker offers a variety of trading tools to enhance the trading experience. These tools include real-time market charts, technical analysis indicators, trading calculators, and risk management tools. By utilizing these tools, traders can analyze price movements, identify trends, and manage their trades more efficiently.

Please note that the availability of specific research and education tools may vary depending on the trader’s account type and geographical location. Traders can access these resources through the XM Broker website or the trading platforms provided by the broker.

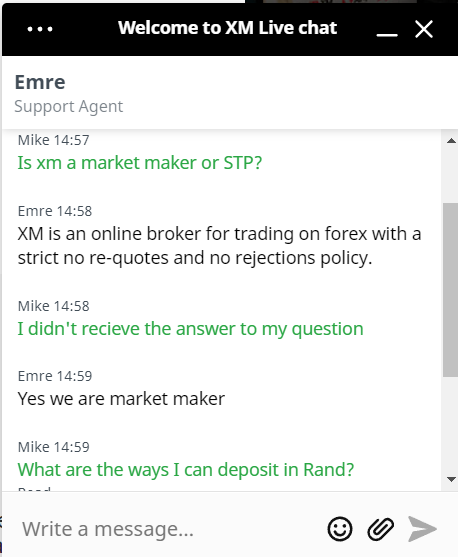

XM Customer Support & Contact

The customer support service at XM is available via the live chat window and email. We tried to raise several queries at different times of the day to provide an honest review for the South African clients.

- Live Chat: The live chat support at XM is very useful and user-friendly. We tried to connect multiple times and got connected with the executives within 1-2 minutes. Most of our queries were resolved with direct answers. This is the best method to connect with support executives at XM in South Africa.

- E-mail Support: South African clients can also raise their queries through e-mail at [email protected]. We mailed them multiple times with different queries but the reply was late (2-3 hours on average) and less relevant.

XM does not have local phone support for South African clients. They do have an international helpline number but that will incur additional international calling charges from South Africa.

The support services are available 24 hours on 5 days a week. Compared with other forex and CFD brokers in South Africa, the customer support service is below average. Many regulated forex and CFD brokers in South Africa offer local phone support.

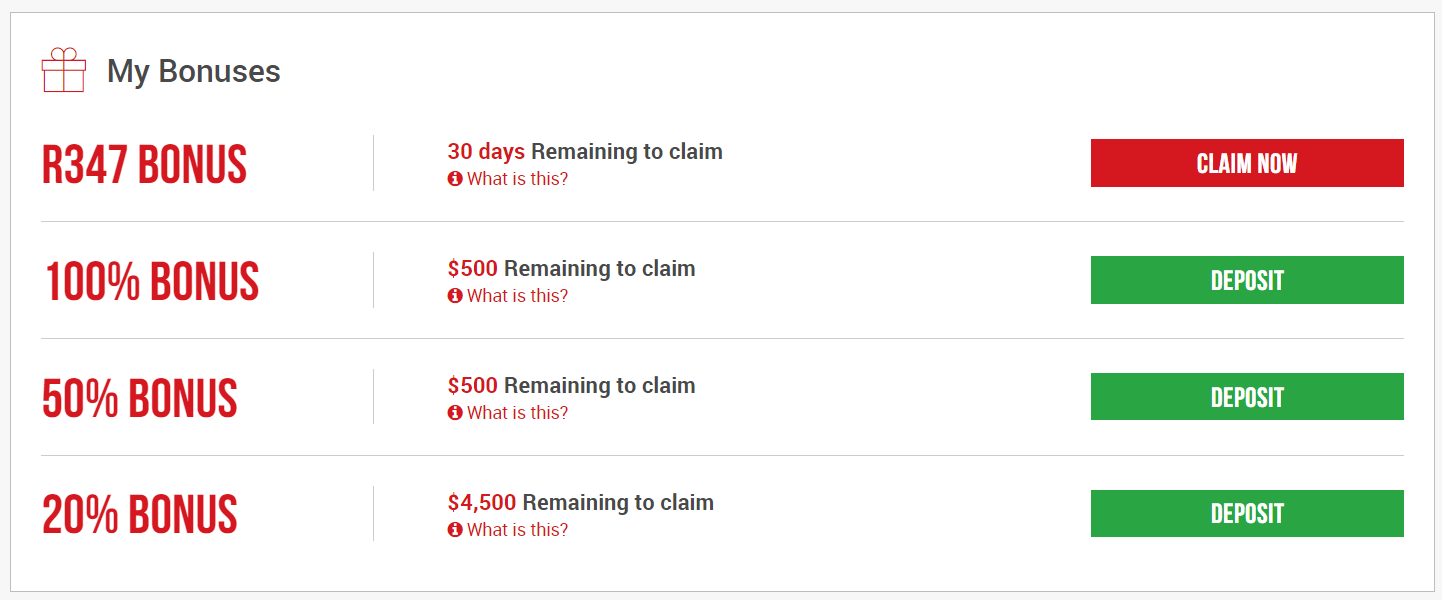

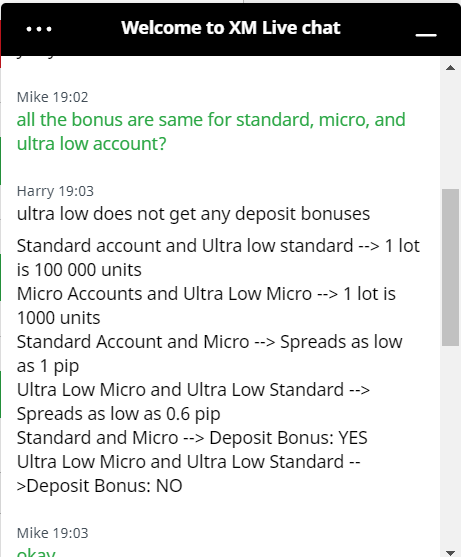

XM Trading Bonus

XM has attractive bonus offerings for South African clients for account opening and deposit. It is not mentioned on their website and App but upon inquiring from support executives, we found that the deposit bonus is not available with the Ultra Low Account. Following are the bonus offering available to South African clients at the time of this review.

- R347 Welcome Bonus: A bonus of R347 is available for everyone who opens any type of account at XM and completes the verification. No deposit is required for this bonus but only the profits earned from the bonus amount can be withdrawn.

- 100% Deposit Bonus: A deposit bonus of 100% is exclusively available for clients in the African region. Any deposit made can be increased by 100% up to 500$ equivalent. This is a limited period offer and is not applicable with the Ultra Low Account type.

- 50% + 20% Deposit Bonus: This is a deposit bonus at XM available with Standard and Micro account types. The deposit bonus of 50% is applicable up to a total deposit bonus of 500$ or R7800. Once this bonus is claimed completely, the 20% deposit bonus can be grabbed up to a total bonus amount of $4500. None of the bonus amounts can be withdrawn as only the profits made with the bonus amount is available for withdrawal.

- Refer a Friend: XM rewards its clients for referrals as part of their promotional activity. A withdrawable bonus of 35$ is rewarded for each referred client upon successful registration and deposit.

Compared with other forex and CFD brokers in South Africa, the bonus offerings at XM are better than the majority.

However, all the deposit bonuses can only be grabbed with the Standard and Micro account type that have higher spreads. The low spread account type namely the Ultra Low account does not qualify for any of the deposit bonuses. Hence, South African clients at XM need to choose between high spread with a bonus or a low spread with no bonus.

XM South Africa FAQs

Does XM have the Volatility 75 Index?

No. XM offers trading on 14 cash indices CFDs and 10 Futures CFDs but the Volatility 75 Index is not available to trade at XM.

Is XM a Good Broker?

XM is a market maker and can take the other side of the trade to generate revenue. It is not regulated by FSCA or any other top-tier regulatory authority so the risk is high. South African clients are registered at XM under IFSC Belize regulation. XM offers trading on various instruments without any commission at decent spreads and can be chosen to trade forex and CFD in South Africa.

Can XM be trusted?

Yes, the parent company of XM is a well regulated entity however XM is not regulated by FSCA of South Africa. The third party risk of choosing XM is higher than any broker that is regulated by FSCA in South Africa.

Does XM have NASDAQ?

Yes. XM offers trading on US100, US30, and US500 indices of NASDAQ with cash CFDs as well as Futures CFDs.

Is XM a South African broker?

No, XM has its headquarters in Limassol, Cyprus. It has offices in various countries but does not have a local office in South Africa. XM is not a South African broker but accepts clients from South Africa.

What is the minimum deposit on XM in rands?

$5. The minimum deposit at XM is R70 or $5 through debit/credit cards and e-wallets. XM does not incur any fee for deposit and withdrawal through any of the available methods.

Which country owns XM?

XM is a privately owned firm which has its headquarters in the island nation of Cyprus. Apart from this, XM has its offices in various cities of the world.

How does XM make money?

XM is a market maker which means it primarily matches clients who have placed matching orders but it can also take the opposite side of the trade orders placed by the clients.

How Long Does XM Withdrawal Take?

South African clients can withdraw through 2 methods at XM. The withdrawal through the e-wallet Skrill is processed instantly and is reflected in the bank account within an hour. The withdrawals through debit and credit cards can take up to 3 business days to reflect in the bank account.