Best NAS100 Brokers in South Africa

We've listed the licensed South African forex brokers that offer NAS100 CFD instrument at lowest fees. We compare the fees, platforms, safety & more.

NASDAQ is one of the most popular indices in the world. South African traders can trade NASDAQ as a CFD instrument.

CFD trading allows traders to speculate on the price movements in financial markets without owning any assets. Several CFD brokers have been approved by the FSCA of South Africa to provide such services in South Africa.

CFD brokers offer a range of instruments, including CFD on the NASDAQ index. It is normally available as NAS100 on the broker’s platform.

The NAS100 or the Nasdaq-100 (or the US Tech 100) tracks the performance of 102 non-financial equity securities listed on the US-based NASDAQ stock exchange.

Comparison of Best NAS100 Brokers South Africa

| Spread Betting Platform | Typical NAS100 Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| Exness |

52.5 pip

|

$10

|

1:500

|

Visit Broker |

| HF Markets |

2.03 pips

|

R70

|

1:1000

|

Visit Broker |

| AvaTrade |

1 pip

|

$100

|

1:500

|

Visit Broker |

| XM |

3 pips

|

$5

|

1:888

|

Visit Broker |

| Plus500 |

1.9 pips

|

$100

|

1:500

|

Visit Broker |

| Tickmill |

0.8 pips

|

$100

|

1:100

|

Visit Broker |

6 Best NAS100 Brokers for South African Traders

If you’re a CFD trader that wants to speculate on the price movement of US equity securities, then the NAS100 is a good place to start. It is a holistic index that covers several of the top companies based in the United States. The NAS100 should not be confused with the NASDAQ Composite index, which tracks the performance of every company listed on the NASDAQ stock exchange.

We’ll be covering the regulated CFD brokers that offer the NAS100 to South African traders. We will also be discussing the NAS100 in detail along with how to trade it from South Africa.

Best South African brokers with NAS100

#1 Exness – Best NAS100 Broker in South Africa

Exness was founded in 2008 and is a retail broker that offers a comfortable but effective trading environment.

Safety: Exness is considered to be a very safe broker for traders in South Africa. Exness is regulated by the FSCA as Vlerizo (Pty) Ltd under FSP number 51024. In addition, it is also regulated by the global tier-1 financial regulator FCA of the UK.

It is also regulated by the FSA of Seychelles, CBCS of Curacao and Sint Maarten, FSC of the British Virgin Islands, FSC of Mauritius, and the CySEC of Cyprus.

Fees: The average spread offered by Exness to trade the NAS100 (or the US Tech 100 as it is listed on Exness’ website) is 48.6 pips when trading through the Standard account and no commission.

Exness also offers three types of Professional accounts which are the Raw Spread, Zero, and Pro accounts.

When trading NAS100 through the Raw Spread account, you may be charged a commission of up to USD 3.5 per lot per side. With the Zero account, you will be charged a minimum commission of USD 3.5 per lot per side. Additionally, if you choose to trade through the Pro account, then there will be no commission.

Customer Support: For South African traders, customer support is available in English 24*7. Exness support professionals can be reached through a live chat window on their website, through email, or through a global toll-free phone number.

Exness does not have a local phone number for South African traders.

Trading Platform: Exness offers the popular MetaTrader 4 and MetaTrader 5 trading platforms to its traders. Both these trading platforms are highly intuitive and full of rich features. They also provide several technical indicators which traders can use to make informed trading decisions.

These platforms are available for Windows, macOS, iOS, and Android.

Exness Pros

- Exness is regulated by FSCA and FCA

- Multiple account types available

- ZAR available as base currency of the account

- support services available 24*7

Exness Cons

- Spread on NAS100 CFD is high

- Local phone support not available in South Africa

#2 HF Markets – Low fees NASDAQ CFD Broker in South Africa

HF Markets, previously known as HotForex, has been in operation since 2010 and is one of the leading global forex and CFD brokers.

Safety: HF Markets is regulated by the FSCA as HF Markets SA (PTY) and holds license number 46632. In addition, it is regulated by the tier-1 financial authority FCA of the UK.

It also holds licenses from other financial regulators such as the DFSA of the United Arab Emirates.

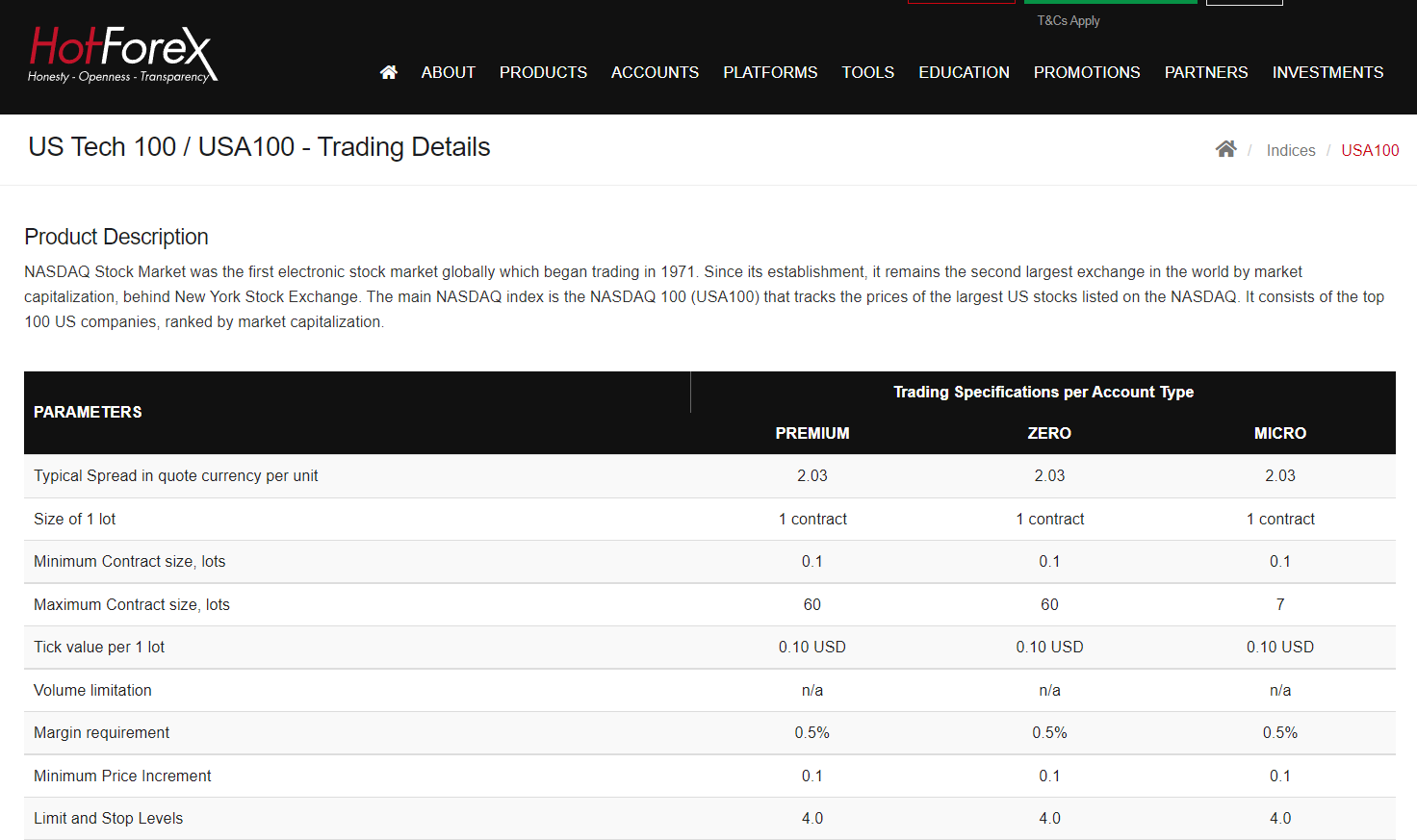

Fees: HF Markets offers the NAS100 with a typical spread of 2.03 pips with all trading accounts. HF Markets offers a variety of accounts to trade through, such as the Micro, Premium, HFCopy, Auto, PAMM, and Zero Spread accounts. The exact fees will vary depending on which account you are trading through.

Customer Support: HF Markets is known for providing quick and helpful customer support. The best way to reach them is through a live chat window that is available on their website. Other ways to connect with their support executives are through email or phone calls.

HF Markets customer support is available at all times on weekdays. The support services are not available on weekends.

Trading Platform: HF Markets offers the popular MetaTrader 4 trading platform to its users. The platform is known for being easy to use and it has most of the features that a serious CFD trader might need. The MetaTrader 4 supports Windows, Android, macOS, and iOS.

In addition, HF Markets also offers the more advanced MetaTrader 5. The MetaTrader 5 has more sophisticated technical indicators and functionality as compared to the MetaTrader 4.

Both these trading platforms can also be accessed directly through a web browser. HF Markets does not have a proprietary trading platform.

HF Markets Pros

- HF Markets is regulated by FSCA and FCA

- Spread on NAS100 and other CFD is low

- Multiple account types available

- ZAR available as base currency of the account

- Low minimum deposit requirement of R70

- Local phone support available in South Africa

HF Markets Cons

- Support services are not available on weekends

#3 Avatrade – NAS100 CFD broker with Proprietary Trading Platform

Avatrade is a regulated broker that was incorporated in 2006. The broker is best known for the variety of trading platforms that it offers & fixed spread.

Safety: Avatrade is regulated by the FSCA as Ava Capital Markets Pty and holds license number 45984. It is also regulated by the tier-1 financial authority ASIC of Australia.

Further, it is regulated by the CBI of Ireland, the FSC of the British Virgin Islands, the FSA of Japan, the FRSA of Abu Dhabi, the CySEC of Cyprus, and the ISA of Isreal.

Further, Avatrade also offers negative balance protection to its traders. Overall, we consider Avatrade to be safe for South African traders.

Fees: Avatrade offers a spread of over 1 pip to those trading the NAS100 index.

Customer Support: Avatrade has an exhaustive help centre that can be used to answer easy questions. In addition, Avatrade has an email ID that can be used for more difficult questions.

Avatrade also has a live chat option that is available on their website, however, your questions will be answered by a chatbot rather than a real person. This may lead to a waste of time.

Trading Platforms: Avatrade offers several trading platforms to its users. Each of these has its own pros and cons. The most popular trading platforms offered by Avatrade are the WebTrader and MT4 platforms. You also have AvaOptions which is specifically meant for options trading.

AvaTrade Pros

- AvaTrade is regulated by FSCA and ASIC

- Spread on NAS100 and other CFD is very low

- Multiple trading platforms supported

AvaTrade Cons

- No choices of account types

- Minimum deposit amount is high

- ZAR is not available as base currency of the account

- Local phone support not available in South Africa

#4 XM Broker – NASDAQ CFD Broker with Low Spreads

XM was founded in 2009 and has a strong track record.

Safety: XM is not regulated in South Africa by the FSCA but its parent company Trading Point of Financial Instruments Pty Ltd holds regulatory licenses from various top-tier regulatory authorities including FCA and ASIC.

For global and South African users, XM is licensed by the IFSC of Belize as XM Global Limited.

XM is also regulated by the CySEC of Cyprus, along with other reputable financial authorities.

XM does not hold FSCA regulatory license but can be considered safe due to IFSC regulation and its parent company’s regulatory licenses. The third-party risk of choosing XM is comparatively higher than other top-tier regulated NAS100 brokers in South Africa.

Fees: XM offers the NAS100 with spreads that can be as low as 1 pip. XM offers four different account types, and the exact fees that will be charged depend on the type of account held by the user.

Customer Support: Users can reach XM customer support through live chat, phone call, or email. Their support services are available at all times on weekdays (GMT). They offer their customer support in English for South African traders. They also have a local office in South Africa. Overall, their customer support is known for being prompt.

Trading Platforms: XM offers the MT4 and MT5 trading platforms to its users. As mentioned earlier, both these platforms are highly popular with CFD traders. They support almost any device and can be accessed directly through a web browser as well.

XM Pros

- Spread on NAS100 and other CFD is very low

- Multiple trading platforms supported

- Local phone support available in South Africa

- Minimum deposit amount is low

XM Cons

- XM is not regulated by FSCA in South Africa

- ZAR is not available as base currency of the account

#5 Plus 500 – Proprietary Trading Platform with NAS100 CFD

Plus500 is a well regulated broker that allows trading on NAS100 CFD through its proprietary trading platform.

Safety: The south African clients at Plus500 are registered under FSCA regulation. Plus500 is regulated by the Financial Sector Conduct Authority FSCA of South Africa under license number 47546.

Plus500 globally holds regulatory licenses in various jurisdictions. It is regulated by FCA in the UK, ASIC in Australia, CySEC in the European Union, FMA in New Zealand, MAS in Singapore, etc.

Multiple top-tier regulations make Plus500 considerably safer than most other NAS100 CFD brokers in South Africa. Plus 500 is transparent with its earnings and financials as it is a publically traded company listed on the London Stock Exchange.

Plus500 is one of the safest CFD brokers that offers trading services on the NAS100 index. The third-party risk of choosing Plus500 is very low.

Fees: Plus500 allows trading on US Tech 100 CFD with a minimum spread of 1.9 pips. This is lower compared to many other regulated CFD brokers in South Africa. Plus500 allows trading on the NAS100 index with a maximum leverage of 1:20.

Customer Support: The Customer support services at Plus500 are available 24*7 through chat and email. No local phone support service is available in South Africa. This means clients cannot connect directly with the support executives but can reach out through email and WhatsApp anytime. The FAQ section can also assist in resolving some of the common queries.

Trading Platforms: Plus500 allows trading only on its proprietary trading platform. It does not support MetaTrader 4, MT5, cTrader, or any other third-party trading platform. The trading platform is user-friendly and is good for beginners.

Plus500 Pros

- Plus500 is regulated by FSCA, FCA, and ASIC

- Spread on NAS100 and other CFD is low

- Customer support service is available 24*7

Plus500 Cons

- Plus500 does not support MT4, MT5, or cTrader platform

- ZAR is not available as base currency of the account

- Local phone support is not available in South Africa

- Minimum deposit amount is high

#6 Tickmill – NAS100 CFD broker in South Africa with Low Spread

Tickmill is a low cost CFD broker that is regulated by multiple top tier regulatory authorities and can be considered safe.

Safety: Tickmill is regulated in multiple jurisdictions globally under the most reputed regulatory authorities. The South African clients at Tickmill are registered under the FSCA regulation.

Tickmill South Africa (Pty) Ltd is the legal entity that is regulated by the FSCA of South Africa under FSP number 49464. Apart from this, Tickmill is also regulated by the FCA of the UK, ASIC of Australia, and CySEC of the European Union.

Tickmill is not listed on any stock exchange for public trading. It is a privately owned firm that was incorporated in 2015. Hence, it is comparatively newer than its other counterparts.

Fees: Tickmill incurs lower spreads compared to many other regulated CFD brokers in South Africa. The average spread for the CFD of NAS100 is 1.93 pips which can go as low as 0.8. Tickmill allows trading on NAS100 with a maximum leverage of 1:100.

Customer Support: Tickmill has a registered office in South Africa but they do not offer local phone support. clients can only connect with the support staff at Tickmill by filling up the contact form on their website.

Trading Platforms: Tickmill supports the two most widely used trading platforms called MetaTrader 4 and MetaTrader 5. The MT4 is ideal for beginners while the MT5 is can be more useful for experienced traders. Stocks can only be traded with the MT5 platform but NAS100 Index CFD can be traded with any of the trading platforms.

Tickmill Pros

- Tickmill is regulated by FSCA, FCA, and ASIC

- Spread on NAS100 and other CFD is very low

- Customer support service is available through live chat

- High leverage of 1:100 is available on NAS100 CFD

Tickmill Cons

- ZAR is not available as base currency of the account

- Local phone support is not available in South Africa

- Minimum deposit amount is high

Index CFD Trading

Index CFD (Contract for Difference) trading involves speculating on the price movements of stock market indices without owning the underlying assets. Traders can bet on an index’s price rising (going long) or falling (going short). They use leverage to control larger positions, which amplifies both profits and losses.

No actual ownership of the index occurs. Traders use trading platforms to execute trades, analyze markets, and employ risk management tools. Costs include spreads and overnight financing charges. Successful trading requires analyzing market data, managing risk, and adhering to regulations.

What is NAS100?

The NAS100 is an index that tracks the performance of 102 equity securities issued by 100 companies in the United States. This index was originally founded by the NASD but it is now run as a publicly-traded entity. The NAS100 was first launched in 1985. The index has recorded a CAGR of around 13.5% per year without including dividends.

The NAS100 does not list any financial services equities in its index (financial stocks are tracked in a different index known as the Nasdaq Financial 100). The list is known to be a good indicator of the performance of technology stocks in the United States. The index gives around 56% weightage to the technology sector.

The NAS100 includes the largest and most actively traded equity securities in the United States. Some of the sectors that it tracks include technology, biotechnology, retail, healthcare, and more. The index only lists companies that are traded on the NASDAQ exchange.

Following are the stocks that are currently included in the NAS100 stock index.

Activision Blizzard

Adobe

Align Technology

Alphabet A

Alphabet C

Amazon

AMD

American Electric Power

Amgen

Analog Devices

ANSYS

Apple

Applied Materials

ASML

Autodesk

Automatic Data Processing

Baidu.com

Biogen

Booking Holdings

Broadcom

Cadence Design Systems

Charte a

Cintas

Cisco

Cognizant

Comcast

Copart

Costco Wholesale

CrowdStrike

CSX

DexCom

DocuSign

Dollar Tree

eBay

Electronic Arts

Exelon

Fastenal

Fiserv

Gilead Sciences

Honeywell

IDEXX Laboratories

Illumina

Intel

Intuit

Intuitive Surgical

JD.com

Keurig Dr Pepper

KLA-Tencor

Lam Research

Lululemon Athletica

Marriott

Marvell Technology

Match Group

MercadoLibre

Meta Platforms

Microchip Technology

Micron Technology

Microsoft

Moderna

Mondelez

Monster Beverage

Netease

Netflix

NVIDIA

NXP Semiconductors

O Reilly Automotive

Okta

Old Dominion Freight Line

Paccar

Paychex

PayPal

PepsiCo

Pinduoduo

QUALCOMM

Regeneron Pharmaceuticals

Ross Stores

Seagen

Sirius XM

Skyworks Solutions

Splunk

Starbucks

Synopsys

Tesla

Texas Instruments

The Kraft Heinz Company

T-Mobile US

VeriSign

Verisk Analytic a

Vertex Pharmaceuticals

Walgreens Boots Alliance

Workda a

Xcel Energy

Indices Similar to NAS100

Following are the other indices apart from NAS 100 that popular among the traders.

- S&P 500: A broader index representing 500 large-cap U.S. companies across various sectors.

- Dow Jones Industrial Average (DJIA): Composed of 30 large, publicly-owned companies based in the United States.

- FTSE 100: The top 100 companies listed on the London Stock Exchange, representing a variety of sectors.

- DAX: A German stock market index representing 30 of the largest and most liquid German companies trading on the Frankfurt Exchange.

- Nikkei 225: Reflects the performance of 225 large, publicly-owned companies in Japan.

- Hang Seng Index: Tracks the performance of the largest companies listed on the Hong Kong Stock Exchange.

- Shanghai Composite Index: A market index of all stocks (A shares and B shares) that trade on the Shanghai Stock Exchange.

- CAC 40: A benchmark French stock market index, representing the 40 most significant stocks among the 100 highest market caps on the Euronext Paris.

Each of these indices provides a different geographic and sectoral exposure and can be considered based on investment preferences and goals.

Tips and Tricks for Trading on NAS100

Trading the NAS 100 index can be a lucrative endeavor, but it necessitates careful analysis and prudent risk management. Here are some valuable pointers to consider when engaging in NAS 100 trading:

Comprehend NAS 100 Dynamics: Develop a strong understanding of the NAS 100 index’s composition, comprising the top 100 non-financial firms listed on NASDAQ. This insight aids in tracking the performance of influential tech and growth-oriented companies.

Stay Abreast of Information: Keep a watchful eye on financial news, earnings releases, and macroeconomic indicators that could impact the constituent companies within NAS 100. The tech and innovation sectors are particularly responsive to market developments.

Harness Technical Analysis: Employ technical analysis tools to identify critical support and resistance levels, trends, and chart patterns on NAS 100 price charts. These insights shape your entry and exit strategies.

Manage Volatility: NAS 100 can experience substantial volatility, especially during earnings seasons or major market events. Adapt your position sizes and leverage to effectively manage potential volatility-related risks.

Mind Trading Hours: Familiarize yourself with NAS 100’s trading hours, typically coinciding with U.S. market operational hours. This awareness influences your trading strategy, considering your geographical location.

Prioritize Risk Management: Enforce rigorous risk management practices, including setting well-defined stop-loss and take-profit levels. Establish a predetermined percentage of your trading capital for risk on any single trade.

Embrace Diversification: While NAS 100 spotlights tech and growth stocks, consider diversifying your trading portfolio across various asset classes and indices to mitigate risk exposure.

Conduct Correlation Analysis: Delve into the correlation between NAS 100 and other major indices or assets. A comprehensive understanding of correlations aids in anticipating potential market movements.

Economic Indicator Insights: Stay attuned to economic indicators that hold sway over technology firms, such as interest rates, inflation figures, and consumer spending data.

Earnings Reports Impact: Vigilantly monitor earnings reports of significant index constituents. Unforeseen positive or negative outcomes can trigger noteworthy price shifts.

Harness Technical Indicators: Employ technical indicators like moving averages, relative strength index (RSI), and stochastic oscillators to refine your trade entry and exit strategies.

Test with Demo Trading: Before committing real capital, hone your trading strategies through simulated trading using a demo account. This practice cultivates confidence and fine-tunes your approach.

Guard Against Overtrading: The NAS 100’s inherent volatility may tempt traders into excessive trading. Adhere to your well-crafted trading plan and sidestep impulsive decisions.

Survey Long-Term Trends: Extend your analysis to encompass longer-term trends, identifying potential trading opportunities. While scalping and day trading are commonplace, swing and position trading can be effective as well.

Commit to Ongoing Learning: Stay current with market developments, emerging trends, and novel trading methodologies. Sustained learning is pivotal for maintaining a competitive edge in the ever-evolving trading landscape.

How to Trade the NAS100 from South Africa?

The NAS100 is an index based in the United States. Since it is highly popular and well-known, there are several ways to gain exposure to the index. However, it is difficult to invest in the NAS100 from South Africa unless you are registered with a US securities broker.

However, there is a much easier way to gain exposure to US stocks and trade the NAS100 from South Africa. Several FSCA-regulated brokers (like the ones listed above) offer the NAS100 as a CFD instrument that can be traded.

CFDs do not allow you to own any asset. Instead, they allow you to profit from the price movements of the underlying security. CFDs are traded with leverage which increases the amount of profit or loss that you can face from a single trade.

For example, suppose you are making use of a 1:5 leverage to trade a CFD. This means that you can hold a position worth $100 while only using $20 of your own money. This allows you to make much larger trades with relatively less money.

Trading with leverage is highly risky and is meant for experienced traders. If you’re new to trading, then start with a demo account so that you do not risk real money.

The NAS100 is an exciting index that gains in value almost every year. The index has a storied history and is a great way to gain exposure to the US financial markets. If you’re knowledgeable about the US equity market, then trading the NAS100 through a licensed broker may be a good option.

How to Choose a Broker to Trade the NAS100 in South Africa?

There are several CFD brokers in South Africa that offer trading services on NAS100 Index. However, each broker has different features and trading conditions. Clients residing in South Africa must be able to identify and select the brokers that are best suited for them.

Safety: The safety of your funds and your private data is most important while trading online. There are a lot of fake brokers who have a high third-party risk. Only an FSCA-regulated CFD broker can be considered safe for trading NAS100 in South Africa.

Clients must check and verify the authenticity of the FSCA license as scammers can also use fake FSCA regulatory licenses. This can be done by checking the FSP number and name of the brokers’ entity on the FSCA register online. The types of instruments offered under regulation can also be checked through the register.

Fees: There are various costs associated with trading CFDs. NAS100 can be traded in South Africa as Index CFD. The CFD instruments generally incur spreads, commissions, and overnight charges among trading fees. Inactivity, deposit/withdrawal, and currency conversion fees are considered non-trading fees.

Most FSCA-regulated CFD brokers are transparent with the charges they incur and mention it on their website. However, clients can also inquire about the trading as well as non-trading fees.

Choosing a broker with low fees is always advantageous for the traders but some fake brokers use low fees to lure retail traders into high risk. Hence, fees must not be the only reason to select a broker.

Trading platform: A trading platform is an electronic software where trading positions are opened, closed, and modified. It is where traders spend most of their time trading NAS100 as a CFD. The look and feel of each trading platform will be different. MT4, MT5, and cTrader are the most commonly chosen trading platforms in South Africa. However, many brokers only support their own proprietary trading platforms. Before choosing a broker, it is important to check the supported trading platforms and their features.

New traders must use a demo account to get familiar with the tabs and terminologies on an electronic trading platform.

Customer Support: Traders may face issues and queries at any instance while trading CFDs online. The overall trading experience can be much better with the broker with good customer support services. Most CFD brokers offer live chat and email support but only a few offer support services through local phone numbers. Traders are likely to get the most relevant and useful answers to their queries through local phone support.

Deposit/Withdrawal Methods: Each broker supports different methods for the deposit and withdrawal of funds from a bank account to the trading account and vice versa. The fees charged for deposit and withdrawal can be different for each method. The time taken to process the transaction is also different. Traders must ensure that the broker they are choosing allows convenient deposits and withdrawals through their preferred method in South Africa. Local bank transfer is the most preferred method among CFD traders in South Africa.

Research and Education Tools: CFD brokers provide various tools to traders for research and analysis. Various educational material is also provided by the brokers. Such tools can be very helpful for traders in making informed trading decisions. Traders must ensure that the chosen broker offers enough tools for research and education.

Risk of Trading Indices CFD

Trading Indices CFDs carries certain risks. Here are key risks to consider:

- Market Risk: Index prices can be volatile due to economic data, geopolitical events, and market sentiment, resulting in potential gains or losses.

- Leverage Risk: CFDs allow larger positions with smaller investments, but this amplifies both profits and losses, with potential for losses exceeding the initial investment.

- Counterparty Risk: Choosing a reputable and regulated broker is crucial to mitigate the risk of the counterparty not meeting their obligations.

- Liquidity Risk: Less popular indices may have lower liquidity, making it difficult to enter or exit positions at desired prices, with wider bid-ask spreads.

- Overnight Financing Costs: Holding CFD positions overnight can result in financing costs, which should be considered in trade planning.

- Political and Regulatory Risk: Government policy changes, regulations, tax laws, and geopolitical events can impact Indices CFDs.

To manage these risks, conduct research, develop a trading strategy, employ risk management techniques, and seek professional advice.

FAQs on Best NAS100 Brokers in South Africa

Which Broker is Best for NAS100?

We consider HF Markets, Exness, AvaTrade & few other forex brokers as best suited to trade CFD on NAS100. The best choice for each trader depends on safety, fees, leverage, trading platforms, transaction methods, etc.

How Much Money do you Need to Trade on Nas100?

Each CFD broker in South Africa have different minimum initial deposit requirement. The lowest minimum deposit to trade on NAS100 is $1 on Exness and ZAR 70 on HF Markets and XM. The leverage offered by these brokers allow traders to open much bigger position with small deposits but it is risky.

Which Forex Brokers is Best for NASDAQ?

Nasdaq indices as well as its stocks can be traded as CFD in South Africa. There are many forex and CFD brokers in SA that offer CFD on NASDAQ. HF Markets SA, Tickmill, Exness offer trading on NASDAQ 100 as a CFD instrument.

How much ZAR do you need to trade NAS100?

South African traders can start trading on CFD of NAS100 with a minimum deposit of R70 or $5. XM, HF Markets, and Exness allow trading on NAS100 with least minimum deposit.

Can I trade NASDAQ on MT4?

Yes, NAS100 or US Tech 100 can be traded as CFD through MetaTrader 4 (MT4) trading platform. Exness, HF Markets, XM, Tickmill and several other brokers in South Africa offer MT4 trading platforms for trading CFD on NASDAQ indices.

What is the best time to trade NAS100?

4:30 PM to 11:00 PM on weekdays in South Africa is the best time to trade on NAS100. This is because at this time the stock markets in the US namely NYSE and NASDAQ are active. Hence, there are best trading opportunities and high liquidity during this time.

Which broker has NAS100 in South Africa?

Several forex and CFD brokers including HotForex, FXTM, XM, Exness, etc offer CFD trading with leverage on NAS100 index. Traders can open their account with an FSCA-regulated CFD broker to trade online on NAS100 CFD.

How to trade NASDAQ in South Africa?

NASDAQ Index and its stocks can be traded easily in South Africa as a CFD. Several FSCA-regulated brokers in Soutg Africa allow CFD trading with leverage on indices and stocks in NASDAQ.

Which platform is best for trading NASDAQ?

MT4 and MT5 are the most widely used trading platform for CFD trading NASDAQ. However, traders can also use proprietary platforms like eToro, Plus500, etc to trade on NASDAQ as a CFD. It is important to check the trading platform through a demo account before opening live account.

Is US 100 same as NAS 100 or US Tech 100?

Yes, NAS100 or US100 or US Tech 100 is an index that includes the stocks of the top 102 businesses that are listed on the NASDAQ. It is one of the largest traded stock index that can also be traded via CFDs.