Best Forex Brokers Canada 2024

Forex trading is a growing trend all over the world. The number of retail traders in forex trading has been on a constant surge for the last few years. With an increase in the number of traders, several brokers or dealers offering leveraged forex trading to retail clients have emerged in the market.

Forex trading in Canada is regulated by the Investment Industry Regulatory Organization of Canada (IIROC). Forex and CFD brokers must become a member of IIROC before they can accept clients from Canada. Some provincial regions in Canada can have different regulations on financial services providers.

Out of several brokers that accept Canadian clients, we have segregated some of the best forex brokers in Canada. These brokers have been selected based on more than 15 factors like Safety, regulation, fees, trading conditions, deposits, withdrawals, etc.

Best Forex Brokers in Canada based on our Research for 2024

- Forex.com – Best Forex Broker with Spread and Commission Account

- AvaTrade – Best Low Cost Forex Broker

- FXCM – Best Commission Based Forex Broker

- CMC Markets – Best Forex Broker with Highest number of Instruments

- Oanda – Best Regulated Forex Broker

We have also highlighted the basic details and features of each broker in our list of best forex brokers in Canada. Clients must choose the broker that is best suited for them after checking and comparing all the best forex brokers in Canada.

List of Best Forex Brokers in Canada for 2024

The following brokers are selected after a comprehensive analysis of various parameters. We have also described each broker, in short, to assist in choosing. Multiple pros and cons have been discussed in this list of best forex brokers in Canada.

1. Forex.com – Best Forex Broker with Spread and Commission Account

Forex.com offers spread as well as commission-based trading on various financial instruments. They allow clients in Canada to open accounts with CAD and USD as the base currency.

Regulation

GAIN Capital – FOREX.com Canada Limited is the legal entity of Forex.com in Canada under IIROC regulation. The Gain Capital Group LLC is a wholly-owned subsidiary of StoneX Group Inc which is also a member of IIROC and is listed on the New York Stock Exchange.

Apart from IIROC, Forex.com is also regulated by top-tier regulatory authorities like FCA of the UK, CFTC of the US, and JFSA of Japan. The parent company Stonex Capital Inc separately holds several regulatory licenses from top-tier authorities.

Forex.com can be considered safe for trading forex and CFD in Canada due to multiple top-tier regulations.

Trading and Non-Trading Fees

The trading fees at Forex.com are built into spreads as well as commissions. The Standard account type is a spread-only account with spreads as low as 0.9 pips. The average typical spread for EUR/USD and USD/CAD with the Standard account type at Forex.com are 1.3 pips and 2.9 pips respectively.

The average typical spread with the Commission Account for EUR/USD is 0.3 pips. The commission for trading forex pairs is $5 for a round-turn trade of a standard lot.

Among the non-trading fees, the inactivity fee is the major component. Forex.com incurs an inactivity fee of 15 CAD or USD (depending on the base currency of the account). This fee is only incurred if no trade orders are executed for more than 12 months.

Trading Platform

Forex.com offers a proprietary trading platform that is available on the web and can also be downloaded on devices. The proprietary trading platform includes several features like 10+ indicators, 14 timeframes, and 60+ technical indicators.

Apart from this, MT4 and MT5 trading platforms can also be chosen to trade CFDs. All trading platforms at Forex.com grant access to trade on 82 forex pairs. 15 indices, 10 commodities, and more than 4500 stocks. All the available instruments can only be traded as CFDs.

Customer Support

The customer support services at Forex.com are available 24/5. Clients can connect with the support executives through the live chat window, email, and local, and international phone numbers. The availability of local phone support is a major advantage for Canadian clients.

Forex.com Pros

- Forex.com is regulated by IIROC in Canada

- The parent company Stonex is listed on NYSE

- Spread as well as commission based trading available

- CAD can be chosen as base currency of the account

- Multiple trading platforms supported

- Local phone support available in Canada

Forex.com Cons

- Minimum deposit amount is high ($100)

- High inactivity fees of CAD 15 per month

- Spreads are slightly higher compared to other IIROC-regulated brokers

2. AvaTrade – Best Low Cost Forex Broker

AvaTrade is an Ireland-based CFD broker that has offices and regulatory licenses in various jurisdictions across the globe. It allows opening an account with CAD as the base currency.

Regulation

The accounts for Canadian clients at AvaTrade are opened via Friedberg Mercantile Group Ltd. The trade orders are processed by the AvaTrade Group. The Friedberg Mercantile Group Ltd is a registered member of IIROC. However, AvaTrade is not a subsidiary or has any holding in the Friedberg Mercantile Group Ltd.

Hence, the accounts at AvaTrade are registered with a member of Friedberg Mercantile Group Ltd. but AvaTrade is not regulated by IIROC. AvaTrade Group is a privately owned FSP and is not listed on any stock exchange.

AvaTrade Group holds a regulatory license from Multiple top-tier regulatory authorities globally. It is regulated by ASIC in Australia and FCA in the UK among the top-tier regulatory authorities.

AvaTrade can be considered safe for Canadian traders as Canadian clients are registered under IIROC regulation. AvaTrade Group holds multiple top-tier regulatory licenses but is not a member of IIROC.

Fees

There are no choices for account types at AvaTrade. The trading fees with the only available account type are built into spreads. Hence, no trading commission is incurred at AvaTrade. The average typical spreads for EUR/USD and USD/CAD are 0.7 pips and 1.5 pips respectively.

The non-trading commission at AvaTrade is high. The withdrawal commission depends on the method chosen by the trader. The inactivity fee is 50 CAD or USD depending on the base currency of the account. It will be deducted for every 3 months or 90 days of inactivity.

Trading Platform

AvaTrade offers a complete suite of MetaTrader 4 and MetaTrader 5 trading platforms for the web and all devices. They offer their proprietary trading platform in other countries but in Canada, only MT4 and MT5 trading platforms are available at AvaTrade.

More than 250 financial instruments can be traded at Avatrade with both trading platforms. This includes a total of 62 currency pairs.

Customer Support

The customer support service at AvaTrade is available 24/5. Clients can connect with the support staff through a live chat window on the website and app. AvaTrade also offers customer support through WhatsApp and email.

AvaTrade offers local phone support for Canadian clients available throughout the week.

AvaTrade Pros

- AvaTrade is regulated by IIROC in Canada

- Spreads are lower than many other IIROC regulated brokers

- CAD can be chosen as base currency of the account

- Multiple trading platforms supported

- Local phone support available in Canada

AvaTrade Cons

- Minimum deposit amount is high ($100)

- High inactivity fees of CAD 50 per 3 months

- No choices for account types with different fee structure

3. FXCM – Best Commission Based Forex Broker

FXCM is trustworthy forex and CFD broker as it is regulated by several top-tier regulatory authorities globally.

Regulation

FXCM has partnered with Friedberg Direct to offer forex and CFD trading services to Canadian clients. The accounts of Canadian clients at FXCM are opened with Friedburg Direct which is a member of IIROC and is regulated by IIROC.

These accounts are serviced by FXCM. Account maintenance, order execution, customer service, and all other services are provided by FXCM. However, the accounts are opened with Friedberg Direct and Canadian clients are protected under IIROC and Canadian Investor Protection Fund.

FXCM is trustworthy forex and CFD broker as it is regulated by several top-tier regulatory authorities globally. FXCM is regulated by the FCA of the UK, ASIC of Australia, FSCA of South Africa, and CySEC of EU.

Fees

There is a single account type that grants access to all the instruments and features at FXCM. The trading fees at FXCM are built into spreads and commissions. Every client needs to pay a spread as well as a commission for trading all the available instruments.

The commission for a round turn trade of a standard lot of a major pair is $14. For the minor forex pairs, the same is $18. No commission is charged for other CFD instruments.

Additional to the commission, the trading fees also involve a variable commission at FXCM. The average typical spread for EUR/USD and USD/CAD is 0.2 pips and 0.5 pips respectively.

Trading Platform

FXCM offers 2 trading platforms for Canadian clients. The MT4 is the most widely used trading platform for CFD trading globally. Apart from MT4, FXCM has a proprietary trading platform called Trading Station. This platform has several additional tools and features compared to MT4.

The number of available trading instruments is lesser than many other CFD brokers in Canada. FXCM offers a total of 43 CFDs on currency pairs and 19 CFDs on indices and commodities.

Customer Support

The customer support services at FXCM are very good as clients can reach out to the support staff through multiple methods. The live chat window on the website and WhatsApp are the most convenient methods to resolve any query.

Canadian clients at FXCM can connect with the support staff through email, local phone numbers, live chat, and WhatsApp. Clients can also physically visit the local office of Friedberg Direct in Toronto.

FXCM Pros

- FXCM is regulated by IIROC in Canada

- Spreads are very low

- Multiple trading platforms supported

- Local phone support available in Canada

FXCM Cons

- Trading commission will be incured on each trade

- Combination of spread and commission makes it very expensive

- No choices for account types with different fee structure

4. CMC Markets – Best Forex Broker with Highest number of Instruments

Canadian clients at CMC Markets are registered under IIROC and are protected under CIPF.

Regulation and Safety

CMC Markets Canada Inc. is a member of the IIROC and Canadian Investor Protection Fund (CIPF). It is a UK-based CFD broker that is also regulated by FCA in the UK.

CMC Markets is a publicly-traded company listed on London Stock Exchange (LSE) with the ticker symbol CMCX. CMC Markets can be considered safe to trade forex and other CFDs in Canada.

Trading and Non-Trading Fees

Forex pairs and all other CFD instruments except shares do not include any commission at CMC Markets. There is a single account type for retail clients in which spread is the only trading fee.

The average spread for EUR/USD and USD/CAD is 0.7 pips and 1.3 pips respectively.

Among the non-trading fees, inactivity fees are charged if no trades are executed for 12 months. The monthly inactivity fee of 15 CAD or USD will be deducted each month after 12 months of inactivity until the account balance reaches 0.

Deposits and withdrawals through wire transfer will incur a commission of $15 and $10 respectively. For all other methods, no commission is incurred at CMC Markets in Canada.

Trading Platforms

CMC Markets offers two different trading platforms to choose from. The MetaTrader 4 is a popular CFD trading platform that is offered by a large number of CFD brokers.

CFD Next Generation Platform is a proprietary trading platform of CMC Markets. Web trading through browsers can only be done with the proprietary platform. Both platforms can be downloaded on smartphones, tablets, and PC.

Both platforms offer a total of 329 forex pairs, 95 Indices, and 111 commodities. The number of available forex pairs at CMC Markets is higher than other IIROC-regulated CFD brokers in Canada. CMC Markets also offers CFDs on 9451 shares and 46 treasuries but these can only be traded with the proprietary trading platform.

Customer Support

The customer support services at CMC Markets are available through live chat, email, and local phone numbers. They also have a local office in Toronto. The support executives are user-friendly.

CMC Markets Pros

- CMC Markets is regulated by IIROC in Canada

- CMC Markets is listed on London Stock Exchange

- Spreads are lower than many other IIROC regulated brokers with no commission

- CAD can be chosen as base currency of the account

- Multiple trading platforms supported

- Local phone support available in Canada

- No lower limit on minimum deposit

- 329 forex pairs and 10,000+ CFDs can be traded

CMC Markets Cons

- High inactivity fees of CAD 15 per months

- No choices for account types with different fee structure

5. Oanda – Best Regulated Forex Broker

Clients at Oanda are registered under IIROC regulation and are protected under the CIPF.

Regulation and Safety

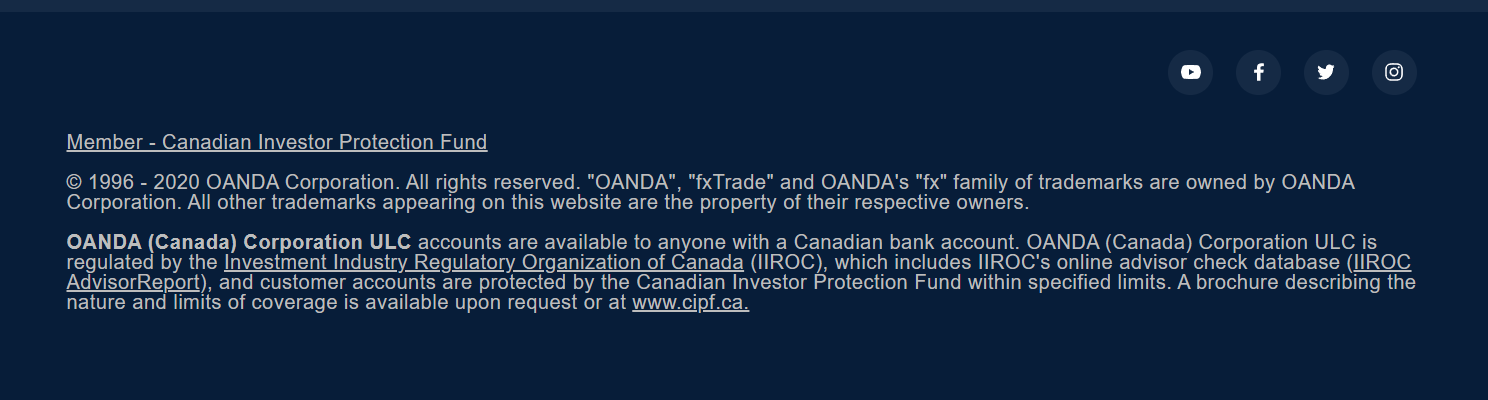

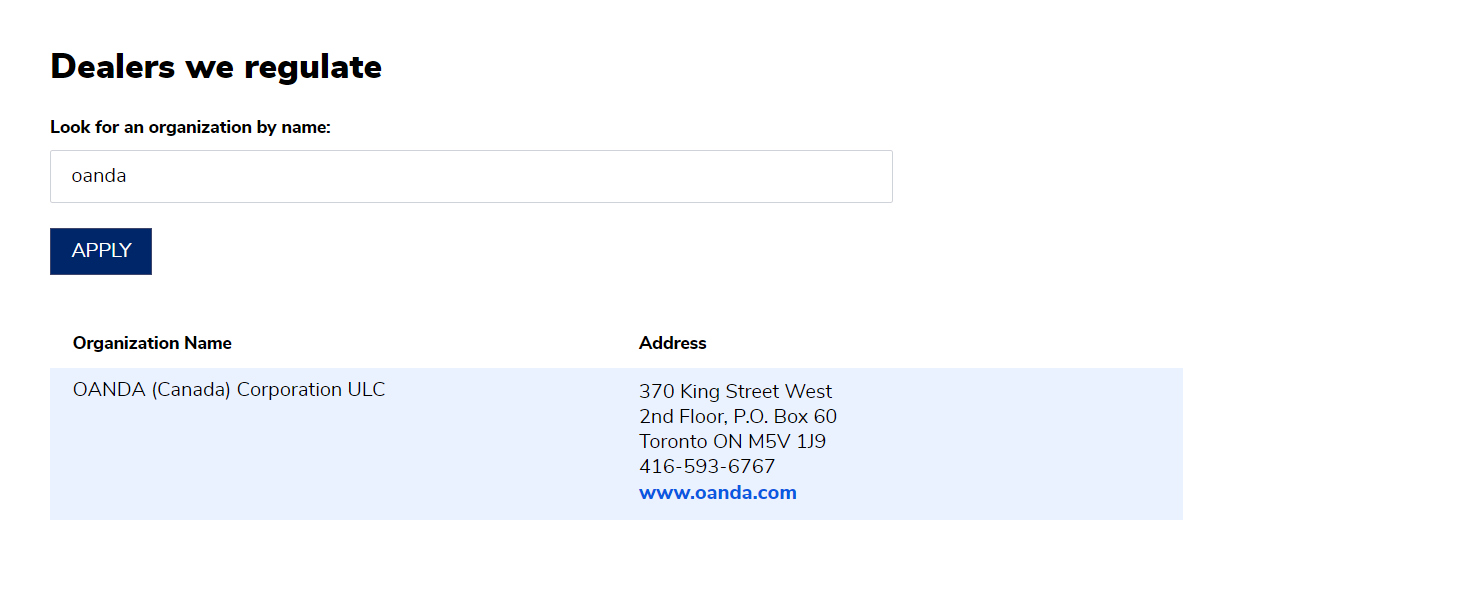

OANDA (Canada) Corporation ULC is the legal entity of Oanda that is a member of IIROC.

Oanda holds multiple regulatory licenses apart from IIROC. It is regulated by CFTC in the US and FCA in the UK. Oanda is not publicly traded on any stock exchange and is a privately held firm. Although, it is safe to trade with Oanda in Canada.

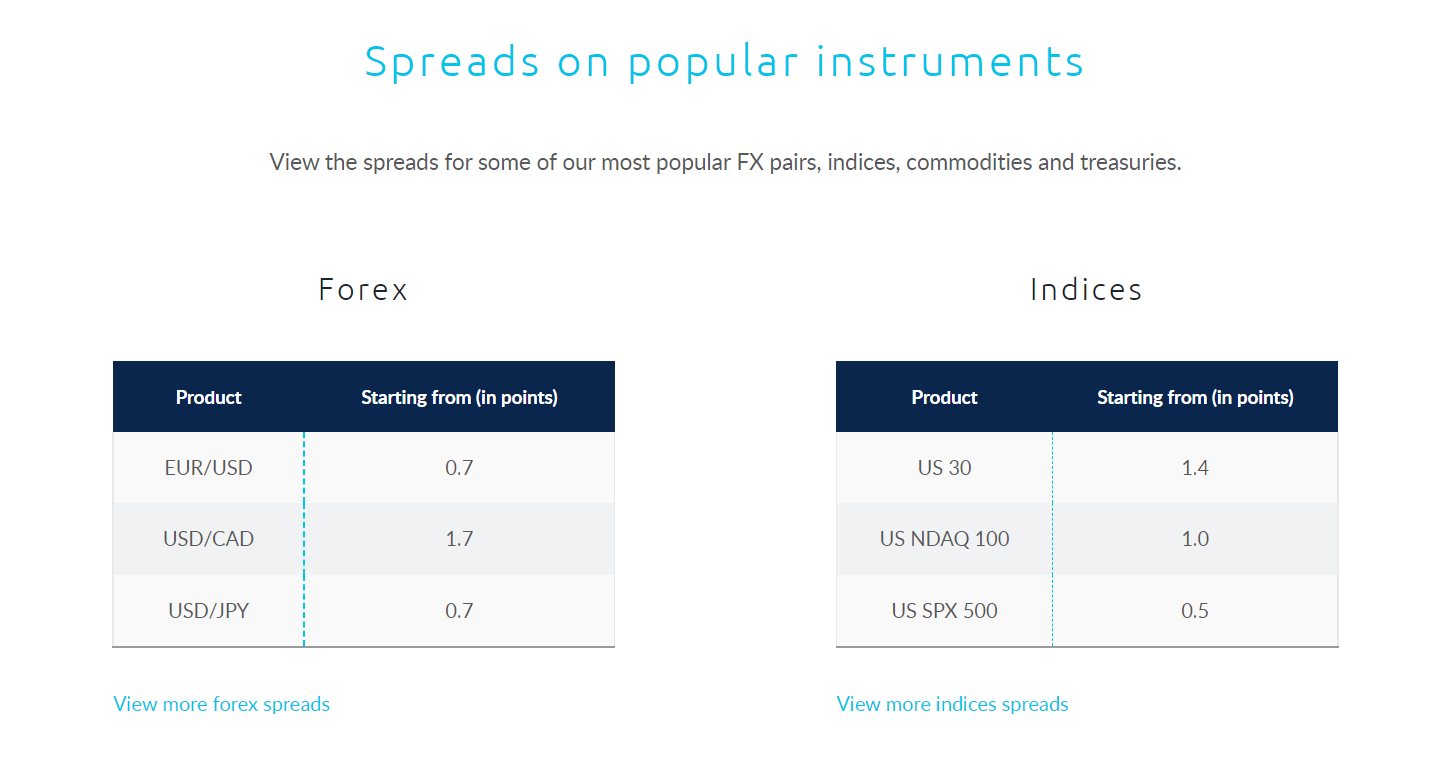

Trading and Non-Trading Fees

The trading fees at Oanda are built into spreads with the Standard as well as the Premium account types. The trading commission is only incurred stocks CFDs.

The average typical spread for EUR/USD and USD/CAD at Oanda is 1.3 pips and 1.8 pips respectively.

Oanda incurs commission on withdrawal on select methods. Deposits are free for all the available methods from the broker’s side. An inactivity fee of $15 is charged each month after a period of inactivity of 12 months.

CAD-based accounts are available at Oanda. Hence, no currency conversion fee will be applicable if deposits are also made in CAD. Otherwise, a currency conversion fee will be applicable on each transaction requiring currency conversion.

Trading Platforms

Oanda offers MetaTrader 4 trading platform which is the most widely used platform for CFD trading. Apart from this, they also have their proprietary trading platform called Oanda Trade Web. This platform has several additional tools and features compared to MT4.

A total of 70 forex pairs can be traded at Oanda as CFD. Apart from this, 120 financial instruments like indices and commodities are also available to trade as CFD.

Customer Support

The customer support service at Oanda is only available through the live chat window. Email or local phone support is not available in Canada.

Oanda Pros

- Oanda is regulated by IIROC in Canada

- CAD can be chosen as base currency of the account

- Multiple trading platforms supported

- No lower limit on minimum deposit

Oanda Cons

- High inactivity fees of CAD 15 per months

- Deposits and withdrawals will incur commission

- Local phone support is not available in Canada

- Less than 130 instruments available

How to Choose Forex Brokers in Canada?

Choosing a broker for trading forex and CFDs is the most important step. Due to the increase in demand, there are a lot of financial services providers in Canada that offer leveraged trading on financial instruments. Traders must choose a safe, reliable, and suitable broker for trading CFDs in Canada.

The following are the major aspects that must be considered while choosing the best forex broker in Canada.

Regulation

The regulations of a broker under which clients are getting registered are the most important factor out of all. The Investment Industry Regulatory Organization of Canada (IIROC) is the financial regulator in Canada that overlooks the activities of FSPs and Safeguards the registered clients.

Clients registered under IIROC regulation are protected under the Canadian Investor Protection Fund (CIPF) with a cover of up to $1 million per client.

Brokers that are not members of IIROC must not be chosen in Canada. Trading with non-IIROC members in Canada is illegal as clients are exposed to high third-party risk when registered under offshore regulation.

Some fake or unlicensed brokers may use fake licenses to attract clients. Canadian traders must stay away from such brokers. Attractive bonuses, very few fees, and promises of unrealistic gains are the common methods used by fake brokers to get deposits from retail clients.

The authenticity of the IIROC membership must be cross-checked before opening an account with any of the brokers. Most authentic brokers will mention the regulation details at the footnote of their website while some may have a separate page for this.

IIROC maintains a register of member firms which can be freely accessed through the official website of IIROC. The website also mentions the members or brokers that are banned or suspended from conducting business in Canada.

The forex broker that you are choosing to trade in Canada must be present in the database of the Canadian Securities Administration on the IIROC website. Clients should look out for spelling mistakes or any suspicious red flags.

If you cannot find the trading name or entity name of your broker on the IIROC website, it is very likely to be fake and must be avoided in Canada. IIROC does not provide unique license numbers to regulated entities like most other regulatory authorities.

For Example, Oanda has mentioned its IIROC-regulated entity as OANDA (Canada) Corporation ULC. This is mentioned in the footnote on the page ‘legal documents’. If you cannot find the regulation details on the website, you can always raise a query through the customer support services of the broker.

To cross-check this detail, clients can visit www.iiroc.ca and search for the keyword ‘Oanda’ under the ‘dealers we regulate’ page. The name of the registered entity must be the same as that mentioned on the website.

Canadian clients opening an account with forex brokers must be registered under IIROC regulation. However, brokers that are also regulated in other jurisdictions with top-tier regulatory authorities can increase the trust factor. The most reputed regulatory authorities include the FCA of the UK, ASIC of Australia, CFTC of the USA, FSCA of South Africa, etc.

Fees and Commission

Choosing a broker with lower fees and commissions can have a major impact on profits and losses. However, Fake brokers often try to attract retail clients with very low fees. Hence, this should not be the only factor to consider a broker for trading in Canada.

Each component of the fees and commission must be checked thoroughly before choosing a broker. Opening an account without checking fees may lead to inconvenience in the future.

Spreads are the major component of trading fees with CFD brokers. This is a difference between bid and ask price. If the spreads are wider, the price will need to move a bit more to book profits. Lower spreads are more beneficial for scalpers or high-volume traders.

Some brokers may incur a fixed or variable commission on each trade order depending on the volume of the trade. In general, there is a separate account for a commission-based pricing structure in which the spreads are very low or narrow.

Swap fee or overnight rollover charges is the fee that is incurred when a trading position is kept open overnight. Each instrument has a different swap fee for each instrument for the long and short positions. If you wish to trade for a longer duration, make sure to check and compare the swap fees incurred with the chosen broker.

Among the non-trading fees, deposits and withdrawal fees are the most important. Each method for deposit and withdrawal can have a different commission associated with them. The commission for transactions through the preferred method must be checked before choosing a broker.

Inactivity fees can be monthly or periodic charges that are incurred if no trades are executed for a prolonged period. It will not be incurred if trade orders are executed regularly.

Clients must enquire through the customer support service regarding the trading as well as non-trading fees before opening their accounts.

Trading Platform

The trading platform is where most of the time is spent while forex and CFD trading. Clients must ensure that the chosen trading platform is user-friendly. They must acknowledge the features and terminologies associated to make better use of the platform.

MT4 is the most chosen forex CFD trading platform in the world. It is older than MT5 but is still chosen by a lot of beginners as it is quite easy to use. Most forex and CFD brokers offer MT4 and MT5 trading platforms while some can also have their proprietary trading platforms.

Available Markets

Each IIROC-regulated CFD broker offers a different number of trading instruments. The instruments that you are planning to trade may or may not be available with certain brokers.

Clients must check all the available instruments along with the trading conditions of the instruments. Each instrument has different spreads and swap rates. However, clients should only trade in the markets they are familiar with.

Customer Support

The customer support services can come in handy whenever you face a query or issues regarding any step in forex trading. Easily available and user-friendly support services are likely to enhance the trading experience in forex.

Most brokers offer support services through live chat, email, phone, and social media applications. Clients can check the quality of the support services by raising random queries through available methods to check the quality and the time taken to revert with a helpful answer.

How to Open Forex Trading Account in Canada?

Before opening an account, make sure the broker is regulated by IIROC in Canada. After this traders can check and compare brokers on the basis of fees, trading conditions, customer support, trading platforms etc. Once the broker is finalised, the following are the steps to open a live trading account in Canada.

Step 1: Visit the Official Website

Make sure the website where you are opening the account is an official website of the IIROC-regulated forex broker. Many fake brokers or clones of the IIROC-regulated firms use fake licenses to lure retail traders in Canada. The official website can be checked through the IIROC website.

Step 2: Enter Basic Details

To begin the account opening process, traders need to provide their basic details like name, address, and contact details. Traders will also need to provide their financial details and trading experience. Each broker may ask for different details to open a live trading account in Canada.

Step 3: Choose a Password

The password needs to be unique and discrete. This will be used to access your trading account in the future.

Step 4: Document Verification

The details provided by the traders need to be cross-checked through document verification by the KYC process. Traders need to provide soft copies of identity and address proof which will be verified by the broker. Generally, documents are verified within 24 hours but depends on the broker chosen.

Step 5: Make a Deposit

The last step is to make a deposit before traders can open trading positions through the trading platforms. The minimum deposit amount is different for each broker. In the initial phase, traders should make smaller deposits as the whole account balance will be exposed to financial risk in leveraged trading. Traders should also ensure their preferred method for deposits and withdrawals is available at the chosen broker.

Once the deposits are reflected in the account equity, traders can open trading positions on the available trading instruments. The trading platform can be downloaded on mobile, tablet, and desktop devices and can also be accessed through web.

Few More Important Steps Before Trading

Familiarize Yourself with the Platform: Explore the app’s interface to understand where to find key features like the market watch, charts, and order placement.

Set Up Charts: Configure charts for the currency pairs you’re interested in. Adjust timeframes and add any indicators or tools you plan to use for analysis.

Conduct Market Analysis: Analyze currency pairs using technical, fundamental, or sentiment analysis to make informed trading decisions.

Place Your First Trade: Choose a currency pair, determine your position size, and set any stop-loss or take-profit orders. Then, execute your trade.

Monitor and Manage Your Trade: Keep track of your open positions and adjust them if necessary based on market movements or your trading strategy.

Practice Risk Management: Always consider the risk involved in each trade and manage your capital responsibly.

The account opening process for online forex trading is simple. Choosing the broker is the most important step in the account opening process. Beginners are advised to trade with virtual currency on a demo account before trading with real currency on a live account. This will provide experience and test the suitability of traders with forex trading.

Forex Trading Laws in Canada

Forex trading in Canada is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Securities Administrators (CSA). There are certain laws regarding forex trading in Canada that the trader must acknowledge before starting to trade forex in Canada.

- All brokers providing trading services to Canadian clients must hold the license of an investment dealer, a restricted dealer, or a foreign dealer issued by IIROC.

- All regulated brokers must disclose the risk associated with leveraged forex and CFD trading to their clients before they open trading positions.

- As per the IIROC regulation, a regulated broker cannot offer leverage of more than 1:50 to retail clients for trading on currency pairs. The leverage can be increased if the trader qualifies to be a professional trader.

- IIROC-regulated forex brokers must maintain keep their funds and clients’ funds in a segregated bank account.

- According to Anti Money Laundering (AML) regulations, withdrawals can only be made through the method used for depositing the funds.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

The following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. IIROC-regulated brokers cannot offer more than 1:50 leverage however, leverage of 1:10 can be considered safe in the initial phase of forex trading.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on opened positions.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with them if it is fake. This risk can be mitigated by choosing an IIROC-regulated broker in Canada.

Liquidity Risk

Although forex markets are generally highly liquid, there may be instances of reduced liquidity during times of market turmoil or economic events. Low liquidity can make it difficult to execute trades at desired prices, leading to slippage or wider spreads.

Economic and Political Risks

Currency exchange rates are influenced by economic factors, political decisions, and geopolitical tensions. Unforeseen events or policy changes can cause significant volatility in currency markets, impacting trade positions. Staying informed about economic and political developments is crucial to manage these risks effectively.

Technical Risks

Technical issues related to trading platforms, internet connectivity, or broker systems can disrupt trading operations. System failures, outages, or delays can prevent timely order execution or lead to incorrect trade placements. It is important to use reliable platforms, maintain stable internet connections, and have contingency plans to minimize technical risks.

Psychological Factors

Forex trading can be psychologically demanding, and emotional decision-making can lead to impulsive or irrational trading choices. Fear, greed, or overconfidence can cloud judgment and result in poor decision-making. Developing disciplined trading strategies, managing risk effectively, and maintaining emotional control are essential to mitigate psychological risks.

Tips to Become a Successful Forex Trader

Educate: Learn the basics of forex trading.

Reliable Broker: Choose a regulated broker with good support.

Risk Management: Set stop-loss, take-profit, and manage risk.

Demo Account: Practice on a demo account before real trading.

Plan: Develop a clear trading plan and stick to it.

Major Pairs: Begin with major currency pairs.

Stay Informed: Follow global economic news.

Analysis: Use technical and fundamental analysis.

Emotions: Control emotions to avoid impulsive decisions.

Patience: Success takes time; avoid quick gains.

Consistency: Stick to a proven strategy.

Records: Maintain a trading journal.

Diversify: Consider diversifying beyond forex.

Comparison of Best Forex Brokers Canada

| Spread Betting Platform | Typical USD/CAD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| Forex.com |

2.8 pips

|

$100

|

1:50

|

Visit Broker |

| AvaTrade |

1.5 pip

|

$100

|

1:50

|

Visit Broker |

| FXCM |

0.5 pips

|

$50

|

1:50

|

Visit Broker |

| CMC Markets |

1.3 pips

|

0

|

1:50

|

Visit Broker |

| Oanda |

1.8 pips

|

0

|

1:50

|

Visit Broker |

FAQs on Best Forex Brokers in Canada

Is Forex Trading Legal in Canada?

Yes, forex trading is legal in Canada and is regulated by IIROC. Each broker needs to be a member of IIROC before they can accept clients from Canada. Canadian clients are registered under IIROC regulation and are protected by CIPF.