Forex Trading Canada

Forex Trading is regulated in Canada by IIROC, and retail traders can trade legally via regulated dealing members that offer forex trading & CFD trading.

You can trade forex via forex brokers that are licensed with multiple Top-tier regulators

6 Steps to Start Forex Trading in Canada

Forex trading, also known as currency trading, refers to the trading of global currencies. Currencies are traded in pairs, forex traders buy one currency and sell another. Forex trading is done for a variety of reasons such as hedging against currency risk, maintaining forex reserves, and speculating on the price movements for profit.

Forex trading has been gaining in popularity in Canada over the last decade. Retail investors are turning towards online forex trading in greater numbers due to high liquidity and high leverage in the forex trading market.

Is Forex Trading Legal in Canada?

Yes, forex and CFD trading is legal in Canada and is regulated by Investment Industry Regulatory Organisation of Canada (IIROC). IIROC is a national self-regulatory authority of Canada that has legalized leveraged forex trading via CFD. Their aim is to make the financial markets safe and reliable for traders and investors while protecting the integrity of capital markets.

In Canada, provincial regions can have their own regulations over capital markets apart from IIROC. A broker that is licensed and regulated under IIROC can accept clients from anywhere in Canada. However, if a broker does not hold a regulatory license from IIROC, the local provincial regulators can decide whether a broker can operate in that region or not.

Trading forex and CFDs through the brokers that are not regulated by IIROC is banned in most regions. It is advisable for clients residing in Canada to only trade with brokers regulated by IIROC. Clients can check the authenticity of the brokers’ license through the license register at the official website of IIROC.

As per the regulatory regimes of IIROC, the maximum leverage that the brokers can offer to Canadian clients is 1:50. The IIROC offers protection of up to $1 million per client with the regulated forex and CFD derivative brokers. In case if a broker goes bankrupt, IIROC can cover up to $1 million per client.

In this guide, we’ll talk about everything you need to know about forex trading in Canada.

Summary Table of IIROC Regulated Forex Brokers in Canada 2024

| Broker Name | Highlights | Trading Fees (Benchmark USD/CAD Standard Accounts) | Account Minimum | Max. Leverage | Learn More |

|---|---|---|---|---|---|

|

GAIN Capital – FOREX.com Canada Limited is authorized by IIROC |

Commissions

Typical spread of 2.8 pips

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:50 for forex

|

Open Account

on Forex.com |

|

|

CMC Markets Canada Inc. is authorized by IIROC |

Commissions

Typical spread of 1.3 pips

with Standard Account |

Account Minimum

$0

|

Max. Leverage

1:50 for forex

|

Open Account

on CMC Market |

|

|

Friedberg Mercantile Group Ltd is authorized by IIROC. |

Commissions

Typical spread of 1.5 pips

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:50 for forex

|

Open Account

on AvaTrade |

|

|

Friedberg Direct is authorized by IIROC. |

Commissions

Typical spread of 0.5 pips

with Standard Account |

Account Minimum

$50

|

Max. Leverage

1:50 for forex

|

Open Account

on FXCM |

Chapter #1

What is Forex Trading?

Here is a brief overview of forex trading.

Understanding the Forex Market and its Participants

The forex market is the largest financial market in the world. The forex market has an average daily turnover of more than $6.6 trillion according to a BIS report in 2019. The same report also stated that the daily trading volume of forex in Canada is nearly $110 million USD. The size of the global forex market has only been increasing every year.

The Canadian Dollar (CAD) is a largely traded currency in forex market globally. The USD/CAD is a major currency pair that is among the most traded currency pairs in the world.

Similar to other financial markets, the exchange rate between different currencies depends on demand and supply, amongst other factors. The price of a currency moves upwards if there are more people buying the currency than those selling the currency.

The forex market is an example of a decentralized market. This means that there is no central control over the market. The decentralized nature of the market makes it possible for traders and investors to deal directly with each other rather than rely on a central exchange.

The global forex trading market is open at all hours during weekdays. It is closed during the weekends. This 24/5 system makes it convenient for traders from all around the world to trade with each other. However, the liquidity for particular currency pairs is different at different times of the day. In hours of low liquidity, the spreads can become wider.

People from different time zones interact and make the market run for 24 hours a day. However, the forex market can be divided into four main time zones. These different time zones correspond with the Australian market, the United States market, the European market, and the Japanese market.

There are several participants that contribute to the forex market in different ways. Some of the major players in the market include the banks (both central and commercial), worldwide governments, large multinational companies, retail investors and traders, investment management firms, brokers and dealers, money-transfer and money-exchange companies, and so on.

For example, as a retail trader, you can use a bank to convert your currency from CAD to USD. There can be different purposes for making the exchange including travel and business needs.

3 ways to trade forex

There are three main ways to trade in foreign exchange: spot, forward, and future.

Spot market

The spot market is also known as the ‘cash market,’ where currencies are bought and sold and delivered on the spot. The price of a currency in the spot market is determined by demand and supply. That means the more the demand for a currency higher the value of that currency.

However, it’s not that simple. Some countries intentionally keep the currency values low to make export cheaper or attract foreign investments. The currency value is calculated on many factors, such as interest rate, market sentiment, political change, and economic news.

The final deal between one party that sells an agreed-upon currency price and the other that buys that agreed-upon exchange rate is known as a ‘spot deal.’ Once you close the position, you receive the specified amount of that currency in cash. Although the spot deal is considered spontaneous, the cash settlement usually takes two days.

Forward market

A private agreement between the two parties to buy a currency at a future date and the pre-agreed price is a forward contract. Let’s take an example to understand how a forward contract works.

Assume that a UK car company wants to secure a contract for a future purchase of spare parts from X, which is located in the US. The UK company signs an agreement with the US company to buy the spare parts after six months.

Both agree for a future exchange rate of 1 GBP = 1.3700 USD, and at the time of the agreement, 1 GBP is equal to USD 1.3700. Now suppose, after six months, the value of one dollar drops to 1.3800. That means the importer will benefit by USD 0.01 per unit of the exchanged currency. Now reverse the situation, the price of one dollar increases to 1.36.

In this case, company X (exporter) will benefit from the forward contract to hedge their risk. The vital thing to note is that currency value can move in any direction, either up or down. Who benefits from a forward contract depends upon the value of one currency against the other after six months.

Future market

A future agreement is similar to a forward contract; the only difference is that latter is a standardized contract. The futures contract is a standard contract that specifies the quantity of a particular asset at a pre-determined price and delivery date.

For example, suppose Indian Oil signs a future contract to import 1 million barrels of oil with an oil producer based in Saudi Arabia. The oil producer promises to deliver the specified quantity in twelve months at a pre-agreed price of $75 per barrel.

So even when the price of one barrel falls to $70, the importer is obligated to pay the premium. The same is true when the price reaches $80; the oil producer will deliver the quantity despite the changes in the spot price.

How Are Currencies Traded?

Forex is traded in pairs. For example, a currency pair is CAD/USD. This currency pair allows you to buy or sell CAD in exchange for USD. There are numerous currency pairs operating in the global forex market.

However, forex traders should know that the USD is the most traded currency in the world. Most of the popular currency pairs in the world involve the USD. For example, EUR/USD is the largest traded currency pair.

Currency pairs can be traded through a variety of financial instruments. A financial instrument denotes the type of contract through which you are making the trade. Different financial instruments include spot forex contracts, forward contracts, contracts for difference, and so on.

We have briefly covered each financial instrument here:

Spot forex contract – A spot forex contract is the most widely used instrument for forex trading. This is the traditional way in which forex trading is and was done. A spot forex contract allows currencies to be exchanged immediately. The delivery and settlement of the contract are done instantly.

Futures forex contract – This is a more complicated derivative contract. A futures forex contract allows you to deliver and settle your trade at a later date. The prices are agreed upon beforehand. A futures forex contract allows you to take advantage of future price movements in the present.

Currency swaps – A currency swap allows traders to exchange their loan denominated in one currency for a loan denominated in another currency. This is why it is called a “swap”. A swap allows you to repay the principal amount and interest amount in a different currency. Any one of the two parties involved in a currency swap will earn profits.

Currency Forward – A forward contract allows you to exchange one currency for another at a future date, however, the exchange rate is determined at the present. This allows for future exchanges while negating the effect of price movements in the forex market. This type of contract is most often used for international trades.

Options forex contracts – An option contract provides the buyer with the right, but not the obligation, to exchange currency at a later date at a predetermined exchange right. The buyer does not have to exchange the currency on the future date, but they can. For this right, the seller is paid a premium at the time of making the contract.

Non-deliverable forward (NDF) – A non-deliverable forward allows a buyer and a seller to settle a currency exchange without actually exchanging any currency. This is why the term “non-deliverable” is used. A Non-deliverable forward is the same as a forward contract, with the exception that the actual currency is never exchanged.

CFDs – A CFD, also known as a contract-for-difference, allows forex traders to trade on price movements of the currency. Under this type of contract, only the price difference between the opening and the closing of the contract needs to be paid. There is no physical exchange of one currency in return for another.

What is Online Forex Trading and How Does it Work?

Online forex trading allows retail traders (also known as individual traders) to trade currencies and profit from price movements in the currency market. These brokers offer trading on forex pairs as a CFD. Online forex trading is gaining in popularity around the world since it provides traders with access to a highly liquid and volatile market.

Forex traders can trade online by taking advantage of the high leverage provided by global online forex brokers. Online forex trading can be done through a variety of financial instruments (as detailed above) but the most commonly used instrument is CFD. CFDs allow traders to only pay the difference in price and the actual currency does not need to be exchanged.

Online forex trading via CFDs is the least complicated. The easy availability of leverage makes it much more lucrative. You only need to make a small minimum deposit into an online brokerage account in order to get started. You can trade using margins, which means that your deposited amount only needs to cover the difference between the trades. High leverage can assist in booking bigger profits with smaller deposits. However, leverage also increases the risk factor as clients can lose the whole amount kept in the trading account.

Online CFD trading is done through trading platforms like MetaTrader 4. These trading platforms offer an easy way to keep track of price movements of different currencies and to execute trades. Online forex brokers offer a trading platform for free to their users.

There are several online forex brokers in the world these days. Over the last decade, the popularity of online forex trading has grown exponentially. The demand for forex brokers is increasing due to the ease of accessibility in CFD trading.

For example, a trader in Canada just needs to open an account with an IIROC-regulated forex broker such as CMC Markets or City Index. To open an account, they need to complete certain KYC formalities and provide a deposit amount. Once the account is registered, the trader can download the trading platform and start trading.

Chapter #2

Basic Forex Terminology

There are several terminologies associated with forex trading. Acknowledging these terms is important to understand the working of forex trading.

1) Currency Pair: Forex trading is done on currency pairs in which two currencies are involved separated by ‘/’. The currency above or before the / is called base currency that is bought or sold in opening a position. The currency after or below the / is called quote currency which is used to buy and sell the base currency. For example, AUD/USD is a currency pair in which AUD is the base currency and USD is a quote currency.

2) Bid Price: Each time you see the price of a currency pair, there will be two prices. The price that the dealer is willing to pay if you sell the currency pair is called the bid price. The bid price is lower than the ask price and is generally mentioned before the ask price.

3) Ask Price: The ask price is the price that you will pay or the price dealer is willing to accept if you buy the base currency. The ask price or buy price is slightly higher than the bid price. For example, the price of AUD/USD will be denoted as 0.7287/ 0.7291. In this example 0.7287 is the bid price in USD at which the dealer is willing to sell 1 unit of AUD. 0.7291 is the ask price in USD at which the dealer will buy 1 unit of AUD.

4) Spread: In the above example, you can see the slight difference in the bid and ask price of the currency pair. This difference between the bid and ask price is called the spread. It is a type of fee that is paid to the dealer for creating and accommodating the market. Higher spreads mean more earnings for the dealer and lesser gains for the trader and vice versa. If the spread is 0, the bid and ask prices are equal. The spreads are generally denoted as the fourth decimal point in a currency pair. If AUD/USD is trading at 0.7287/ 0.7291, the spread is 0.0040 or 40 pips.

5) Pips: Pip or percentage in points is the smallest unit at which the prices of a currency pair can fluctuate. Most of the currency pairs fluctuate by four decimal places as the smallest change. If AUD/USD is trading at 0.7287/ 0.7291, then the smallest movement possible will be 0.0001 or 1 pip.

6) Lots: Forex trading is done in fixed lot sizes. A standard lot of a currency pair involves 1,00,000 units of the base currency. Generally, the minimum lot size that can be traded is 0.01 lot or 1000 units of the base currency. 1000 units of the base currency are also called a micro lot.

7) Leverage: Forex trading is commonly done with leverage. Since there is a very small price movement, leverage plays an important role to book higher profits with smaller deposits. Leverage is the fund borrowed from the dealer to open any position in forex trading. If a broker offers a leverage ratio of 1:100 on forex, it means that 99% of the amount in the opened position is leveraged or loaned from the broker. Bigger positions can be opened with leverage with a smaller deposit amount. Excessive leverage increases the risk factor as losses are to be covered by the trader.

8) Margin: It is the amount that the trader is required to pay to open a certain position in forex trading. Suppose if 1:100 is the leverage ratio then 1% of the overall cost of the position has to be paid by the trader initially. Any opened position in forex trading is worth margin amount + leverage amount.

9) Buy/Sell Order: Each currency pair can either be bought or sold. If a trader has placed a buy order, he would want the price of base currency to increase and the quote currency to decrease. This is commonly called a long position in forex trading. In a short position, the trader has sold the base currency and will gain if the price of the base currency decreases. Going long as well as short is quite convenient in forex and CFD trading compared to other asset classes.

10) Stop Loss/Take Profit: These are the type of limit orders which can greatly assist in forex and CFD trading. The stop loss feature allows traders to limit losses or protect their profits. The take-profit features allow traders to automatically take the profits if a target is achieved. If the set stops loss or take profit target price is triggered, the position is closed automatically. Stop loss and take profits can be set while placing the order and can also be placed or modified after opening the position.

11) Support and Resistance: Support and resistance are quite popular indicators in technical analysis. The support and resistance are the specific prices of a financial instrument that are likely to reverse the course of price trends. Support is the lower point or bottom while resistance is the upper level or ceiling. Falling prices are likely to halt or increase after reaching the support level. Rising pricing will stop moving upward after reaching the resistance.

Forex trading can best be learned with experience. It is a high-risk market and traders must use demo trading where they can gain experience with virtual currencies. It is a high-risk capital market and is not ideal for every type of trader. One must check the suitability, objective, and risk elements thoroughly before entering the forex market.

Forex Trading Examples

Let us understand the complete process and working methodology of the forex market with the help of an example.

Online forex trading is done through a trading platform which is software that can be downloaded on electronic devices. The trading platform connects traders to brokers, liquidity providers, and other forex traders.

Traders place buy or sell orders through trading platforms on their preferred trading instruments. The exposure and profit/loss depend on the volume traded and the leverage involved.

A leverage of 1:10 will allow you to open a position worth $100 exposure with $10 in your trading account.

In this example, we will take the leverage of 1:10 on EUR/USD currency pair. The supposed market price for EUR/USD is 1.2100/1.2102. This means that the bid price is 1.2100 (the price that the dealer is willing to pay) and the ask price is 1.2102 (the price at which the dealer is willing to buy) and the spread is 2 pips (difference between the bid and ask price at 4th decimal).

First, we will place a buy order for 1 standard lot (100,000 units of the base currency). To place a buy order of 1 standard lot in EUR/USD, the following will be the calculation of the required account balance.

$1.2102 * 100,000 * 1/10 = $12,102

(ask price) * (units of the base currency) * (leverage ratio) = (minimum account balance required to open the given position)

Now suppose the price of EUR/USD went up by 100 pips and reaches 1.2200/1.2202. By closing the buy position at this price, the following will be the profit.

(1.2200 * 100,000 * 1/10) – $12,102 = $12,200 – $12,102 = $98

(bid price * units of base currency * leverage ratio) – (exposure) = Profit/Loss

Now let us understand the same scenario with a short position on EUR/USD with 1 standard lot at the current market price of 1.2100/1.2102. Following will be the exposure amount in a short position.

$1.2100 * 100,000 * 1/10 = $12,100

(bid price) * (units of the base currency) * (leverage ratio) = (minimum account balance required to open the given position)

Now suppose the price of EUR/USD went down by 150 pips and reaches 1.1950/1.1952. By closing the position at this position, the following will be the profit.

$12,100 – $(1.1952 * 100,000 * 1/10) = $12,100 – $11,952 = $148

exposure – (ask price * units of base currency * leverage ratio) = profit

It must be noted the exposure amount ($12,102 in the long position example and $12,100 in the short position example) will be at risk of capital markets. If the leverage is high, the profit/loss amount will move more with the change in the pip value of the underlying asset.

Latest Development and Technological advancement in Forex Trading

The latest developments and technological trends in Forex trading with the use of AI as of 2024 are quite groundbreaking. Here’s an overview of the key advancements:

Automated Trading Systems and AI Traders: AI-driven automated trading systems have become more prevalent, accounting for a significant portion of forex transactions. These systems are capable of analyzing large datasets rapidly, identifying market trends and executing trades with remarkable speed and efficiency. This has led to the emergence of autonomous AI traders, which can react to market changes and news events almost instantaneously, providing an edge over traditional human traders.

AI-Driven Market Sentiment Analysis: The use of Natural Language Processing (NLP) and machine learning algorithms in sentiment analysis has become a critical tool. By analyzing news articles, social media, and online content, AI can gauge public sentiment towards different currencies, offering traders valuable insights for making more informed decisions.

Virtual and Augmented Reality in Trading: The integration of AI with Virtual Reality (VR) and Augmented Reality (AR) technologies is reshaping the trading experience. This includes immersive environments with interactive forex data visualizations, AI-generated alerts in AR overlays, realistic forex training simulations, and collaboration in virtual spaces.

Real-Time Big Data Processing: The ability to process and analyze large datasets in real-time has become crucial. Big Data technologies enable traders to stay updated with the latest market movements and news, allowing them to make quicker and more informed decisions.

Hyper-Accurate Forex Analysis and Predictive Analytics: Advanced machine learning techniques are transforming forex analysis, making it possible to predict price movements with higher accuracy. Predictive analytics using historical data and statistical algorithms are providing traders the ability to anticipate market trends and currency fluctuations more accurately.

Democratized Access for Retail Traders: AI and Big Data are leveling the playing field for retail traders by providing access to advanced analytics and trading signals. Online forex brokers are offering AI tools that can analyze charts, market news, and identify trading opportunities.

Automated Risk Management: AI systems are capable of conducting rapid automated risk analyses, including real-time evaluation of risk exposures and volatility modeling. This enhances safer trading practices.

Increased Transparency and Regulation: With the rise of AI and automation, forex markets are facing stricter regulations for transparency and control over autonomous systems.

Personalized Trading Experience: AI algorithms are enabling a more personalized trading experience by learning from each trader’s behavior and preferences, offering tailored trading advice and strategies.

Growth of Social Copy Trading: Social trading platforms are being enhanced by AI, enabling smarter trader selection, dynamic copy trading, and predictive analytics for better trade filtering.

Always-Learning Algorithms: Self-improving AI algorithms are on the horizon, which will continually adapt and optimize trading strategies, making real-time adjustments to market changes.

These advancements are transforming the Forex trading landscape, making it more efficient, accurate, and accessible. The integration of AI in Forex trading is not just enhancing existing methodologies but also creating new opportunities and paradigms for traders at all levels.

Chapter #3

How Can You Trade Forex in Canada?

Currency pairs can be traded online as CFDs or other derivative instruments. There are several brokers and banks that offer forex trading services. Such services can be either by acting as a market maker or by straight-through processing (STP). This depends on the business model of the forex broker or bank.

Most forex brokers online offer CFDs for forex trading.

What do you need to Trade Forex in Canada?

Here are the basic steps involved in forex trading and opening an account with a forex broker in Canada:

- Learn about Forex Trading: It is essential to first learn how to trade forex before you start your trading journey. Learn about how the Forex Market works, Technical & Fundamental analysis, study charts & different currency pairs, and how they have moved historically.

You must take 2-3 months & learn as much as possible about Forex Trading.

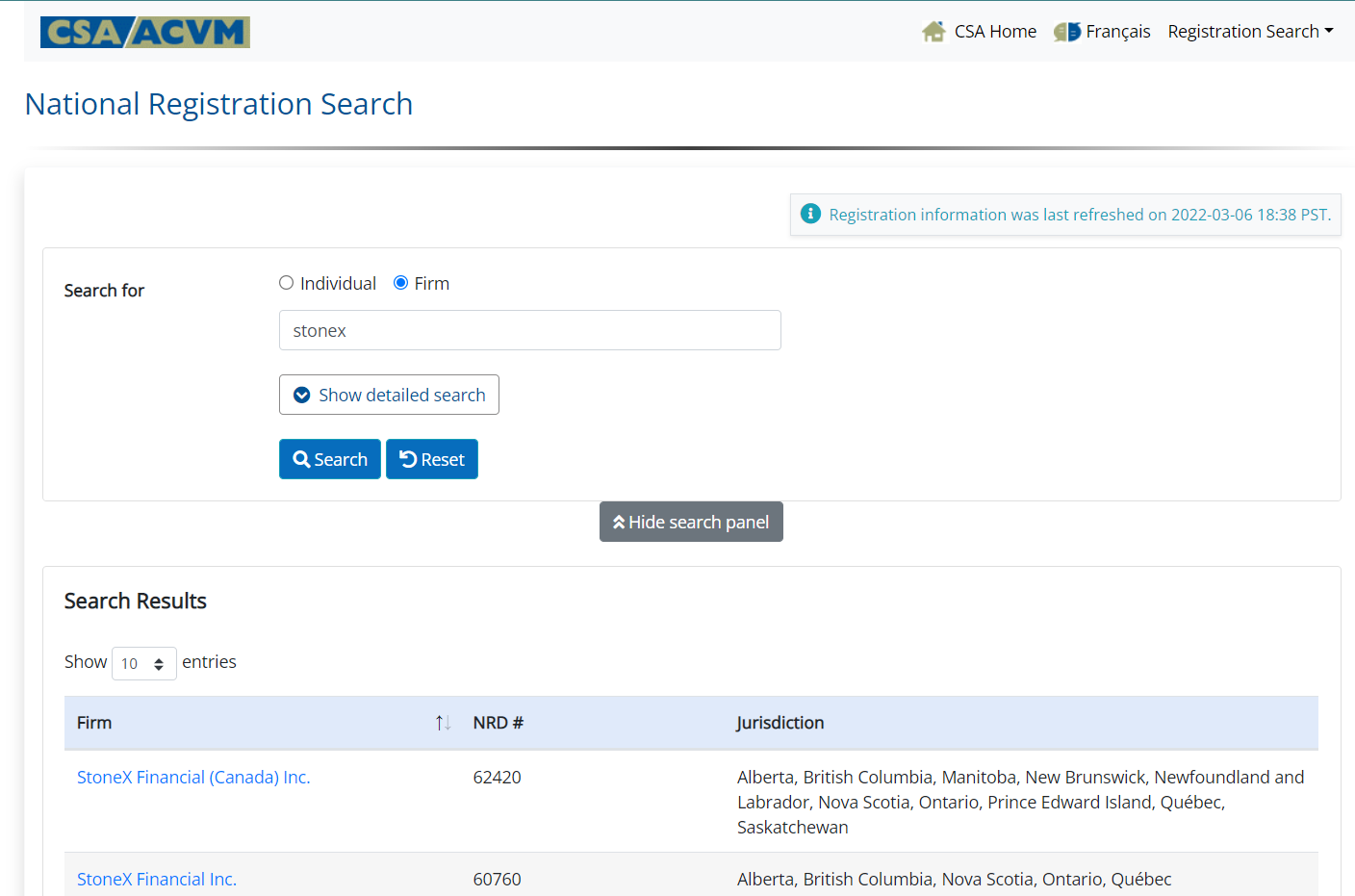

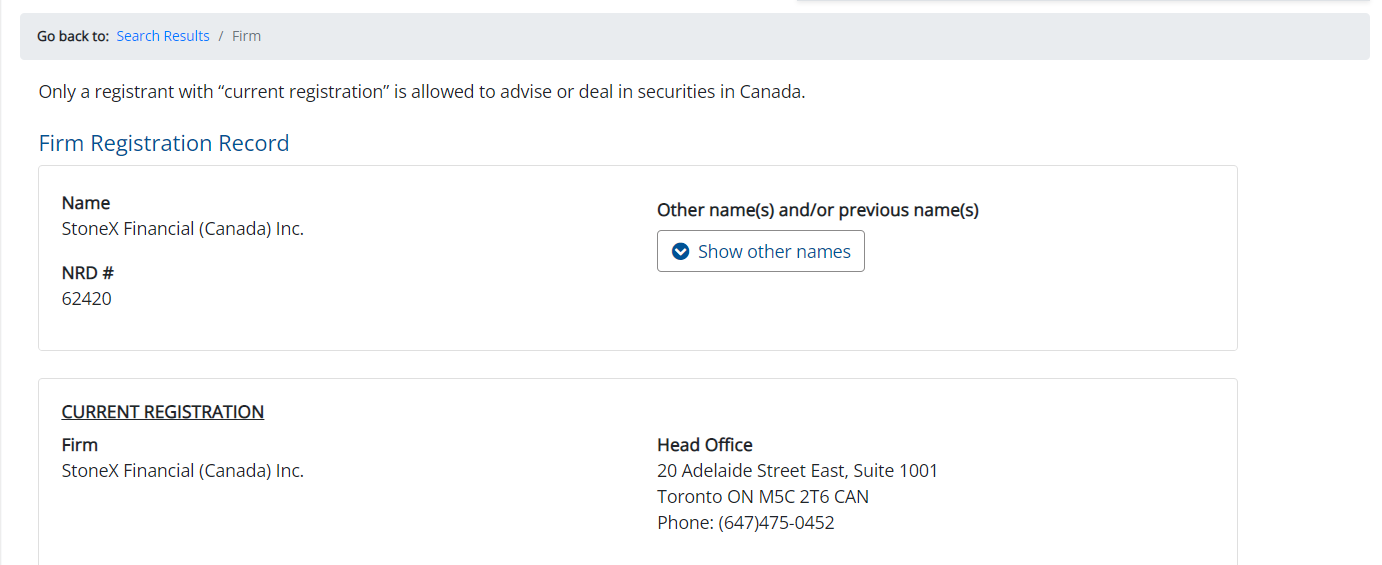

- Choose a Forex Broker: Choosing a broker is the most important step in online forex trading. Forex brokers require a regulatory license from IIROC to accept clients from Canada. However, fake brokers or conmen can use fake license to convince the traders to open an account with them.

It is very important to check the CMS license details of the broker before opening an account. Some fake brokers, salesman, or agents can use fake or cloned licenses to lure clients. The license number and name must be cross-checked for errors from the official website of IIROC.

With the IIROC-regulated brokers, clients in all regions of Canada are registered under IIROC regulation. If the chosen broker is not regulated by IIROC, clients will be registered under offshore regulations like Belize, Mauritius, etc. Such brokers are riskier than IIROC-regulated brokers and cannot be chosen to trade forex in Canada. Each region in Canada can also have additional regulations.

The safety ratings and trust factor can be further enhanced if the broker’s Group or its entity is regulated with global top-tier regulatory authorities like FCA, FSCA, or ASIC.

Even though your account is not registered under Tier-1 regulation, but the fact that the broker that you are trading with is well regulated globally makes it less risky for the safety of your deposited funds. Clients must check the regulatory license and check their authenticity from the regulator’s website.

- Choose your Account Type: Generally, all Forex Brokers offer multiple Account Types, with varying fees & features. For example, the Zero Account at HotForex has a lower spread than Micro & Premium Accounts, but there is an extra fees of USD 6-8/lot (depending on the Forex pair).

You should also research the different types of accounts provided by the broker. Each account type is ideal for different types of traders. Make sure to choose a suitable account type.

- Fill out an application form and complete KYC: You will need to register and open a trading account with the forex broker. This will also involve completing KYC norms, but this can be done completely online.

- Choose a username and password: Once your account is approved, you will receive a username and password or you can choose your own.

- Login to your account: Next, you can use your username and password to log in to your trading account through the broker’s website.

- Deposit money into your account: You will need to deposit some money into your account in order to start trading. Each broker has its own minimum initial deposit requirements.

- Practice trading: You can practice forex trading through a demo account. This is highly recommended for new traders.

- Stay informed: A key part of being a successful forex trader is staying informed on the latest developments and news.

ttygfhjk,jyhtgrfedwqs

What do you need for online forex trading?

There are certain things that you will need in order to trade forex online. Here are the basics:

- Device: You will need a personal computer, a laptop, or a smartphone in order to be able to access the markets online. You will need to make sure that your device is compatible with the trading platform offered by your broker.

- Reliable internet connection: It is essential to have a reliable and fast internet connection. The internet connection will allow you to place your orders. You will also need the connection to be fast and reliable so that you can react quickly to changes in the market.

- Trading platform: Once you register with a forex broker, you will be able to download or install a trading platform on your device. The trading platform is the software that you will need to conduct your trading activity.

Chapter #4

Forex Trading Strategies

Trading without strategy is like sailing without a compass. The sailor has no idea about the wind speed or the direction. That’s why the practice of forex analysis plays a vital role in currency trading. You look at the changes in the values of currency pairs and the forces that are influencing those price movements.

Traders use both fundamental and technical analysis for creating a profitable strategy. Many expert traders combine both techniques to take a hybrid approach. In short, the knowledge of technical analysis will tell you when (to buy or sell) and fundamental analysis tells you why (the price movements). Both are indispensable weapons for a successful forex trader.

Let’s deconstruct both methods one by one.

Fundamental Analysis

What economic factors will impact the demand and supply of a currency? Welcome to Macroeconomics 101, the law of demand and supply. If the demand for a currency is increasing, the trader may assume the prices will rise. On the other hand, a demand reduction may be an indication of an eventual fall.

However, it’s not that simple! There are many factors such as economic health, political stability, global events, and others that influence the expansion and contraction of a particular currency. For instance, the US Sub-Prime Lending Crisis in 2008 caused a massive breakdown of financial systems worldwide.

The fundamental analysis generally involves the following economic indicators:

1. Economy:

In addition to global economic events, the localized changes in a national economy can also influence the currency prices of that country. For instance, the increased commodity prices globally can strengthen Canadian dollars.

2. Political Changes:

Although government changes are not a frequent affair, currency prices can be affected during a transition period. Developed countries have relatively stable regimes in comparison to developing countries. Political instability is the main reason why the currencies of many African countries are so unpredictable.

3. Monetary and Fiscal Policy:

Central banks use monetary policy as an effective tool to control the demand and supply of a currency. They can reduce the interest rate in an economic slowdown and can increase to curb the inflation caused by economic growth. The fiscal policy entails taxation and government spending. Higher taxes can drive slower credit and economic development. Both government policies can have a significant impact on the national currency.

4. Activities of Major Participants:

Main participants such as banks, financial institutions, or hedge funds may buy or sell a specific currency to up or down the prices. You will be in much better positions if you have an idea about the main speculators of the forex market.

5. Economic data and reports:

Main participants such as banks, financial institutions, or hedge funds may buy or World governments publish statistical data and reports that reveal the economic health and performance over a period. Many financial reports like employment data, inflation rate, GDP, and foreign exchange reserve can indicate regional economic conditions, which can dramatically impact the local currency. A forex dealer can use an economic calendar to avoid unwanted surprises from the release of new data.

Technical Analysis

Charts and graphs are the primary tools of technical analysis. Charts help traders identify historical performance, ongoing trends, and price movements and calculate risk to maximize gains from currency trading.

Understanding different charting formats such as line, bar chart, and candlestick is essential to develop a solid trading strategy for beginners. The following are important terminologies associated with technical analysis.

1. Bar chart:

It is the most basic charting which helps users select a currency and its performance for a fixed period. The bar chart shows the highest and lowest currency price points and average performance over the period chosen.

2. Candlestick:

It also displays the same information: open, low, high, and close. However, the representation of data is very different from the bar chart. It becomes easier for users to see the highest and lowest peaks of the currency movements with thin vertical lines.

3. Price Trends:

Trend is a term used in technical analysis of capital markets that depicts the direction of the price. Generally, the price of the underlying instrument moves in a particular direction until a trend reversal is witnessed. The tops and bottoms of the charts can be analysed to identify the price trend at a given time.

Trendlines and trend reversal are very important components of technical analysis. A higher-high price action followed by a higher low represents an uptrend (bullish) while a lower low and lower high depict a downtrend in price movement.

4. Support and Resistance

Support and resistance are the prices at which the trends are likely to reverse or stop moving further in that direction. There can be multiple support and resistance levels for a single financial instrument.

Support is the lower limit at which the price trend is likely to reverse or stop moving further below. Resistance is the upper limit on the price trend. Whenever a resistance or support level is broken, the price moves significantly. These limits are created due to trend reversals and the stagnancy of prices at the price at that same particular level. A support or resistance level gets stronger every time it resists the price movement.

5. Moving Average

As the name suggests, the moving average is an important indicator that depicts the average price movement in a given time. A moving average indicator creates a series of averages of different subsets of the full data sets of prices in a particular time interval. Current prices below the moving average depict a buying opportunity while the prices above the moving average may benefit the sellers.

There are hundreds of strategies that are used in the technical analysis of financial instruments. Technical analysis works well on instruments with high liquidity like the forex market.

Experienced traders often use technical analysis in combination with fundamental analysis to understand why the value of a currency rises or falls for the selected period. For example, if the fundamentals indicate that the US Dollar will strengthen against the Euro due to policy divergence, and the technical analysis also indicates the same, then it is much more likely that your strategy may be successful as compared to incomplete research.

You can use simple mathematical tools such as moving averages, trend lines, and others for technical analysis. You can learn about more advanced concepts like Elliott Wave Theory, Fibonacci Studies, and Pivot Points as you progress.