IC Markets UK Review 2024

IC Markets is a low-cost CFD broker that allows tading on more than 1700 instruments. Clients in UK are registered under CySEC. Check pros and cons before opening your account.

IC Markets is a CFD broker that was launched in 2007. IC Markets is not regulated by the Financial Conduct Authority in the UK. However, they have temporary permissions to operate their business in the UK as they are regulated in EEA country (Cyprus).

IC Markets stands out as an online forex and CFD broker recognized for its competitive pricing and rapid trade execution. Traders appreciate the broad range of financial instruments accessible through IC Markets, encompassing forex, commodities, indices, and cryptocurrencies. The platform is favored for its low spreads and consistent trading conditions.

One notable feature of IC Markets is its flexibility in trading options. Traders have the choice between commission-based and spread-only trading for CFDs across various financial instruments. The broker supports multiple trading platforms, providing users with diverse options to suit their preferences. Additionally, IC Markets facilitates convenient methods for both deposits and withdrawals, contributing to a user-friendly trading experience.

We have comprehensively covered every aspect of IC Markets to assist the traders in making an informed decision. This review of IC Markets (EU) Ltd is specifically done for clients in the UK.

IC Markets UK Pros

- IC Markets is regulated by CySEC

- Spreads are as low as 0.6 pips with the Standard account

- Local phone support is available in UK

- Support services are available 24/7

- Clients can choose between USD/EUR/ GBP as the account currency

- 1700+ trading instruments available

- MT4, MT5, and cTrader trading platforms supported

IC Markets UK Cons

- IC Markets is not regulated by FCA in the UK

- Local bank transfer is not available in the UK

Table of Content

- IC Markets Summery

- Regulation & Safety of Funds

- IC Markets Trading Fees

- IC Markets Account Types

- IC Markets Account Opening

- IC Markets Deposits and Withdrawals

- IC Markets Trading Platform

- IC Markets Research and Education

- IC Markets Available Instruments

- IC Markets Customer Support & Contact

- IC Markets FAQs

IC Markets UK Summary

| Broker Name | IC Markets (EU) Ltd |

| Website | www.icmarkets.eu |

| Regulation | CySEC, ASIC, FSA |

| Year of Establishment | 2007 |

| Minimum Deposit | $200 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4, MT5, cTrader |

| Trading Instruments | 1700+ CFDs on forex pairs, commodities, indices, shares, ETFs, cryptocurrencies |

Safety and Regulation

IC Market Safety Pros

- Regulated by CySEC in the UK

- Regulated by ASIC

IC Market Safety Cons

- IC Markets is not regulated by FCA of the UK

- Third-party risk at IC Market is high

- IC Markets is not listed on any stock exchange

Before choosing a broker to trade CFDs, it is of utmost importance to check the regulatory license and regimes that govern the broker. In the jurisdiction of the United Kingdom, the Financial Conduct Authority (FCA) is the top-tier regulatory authority.

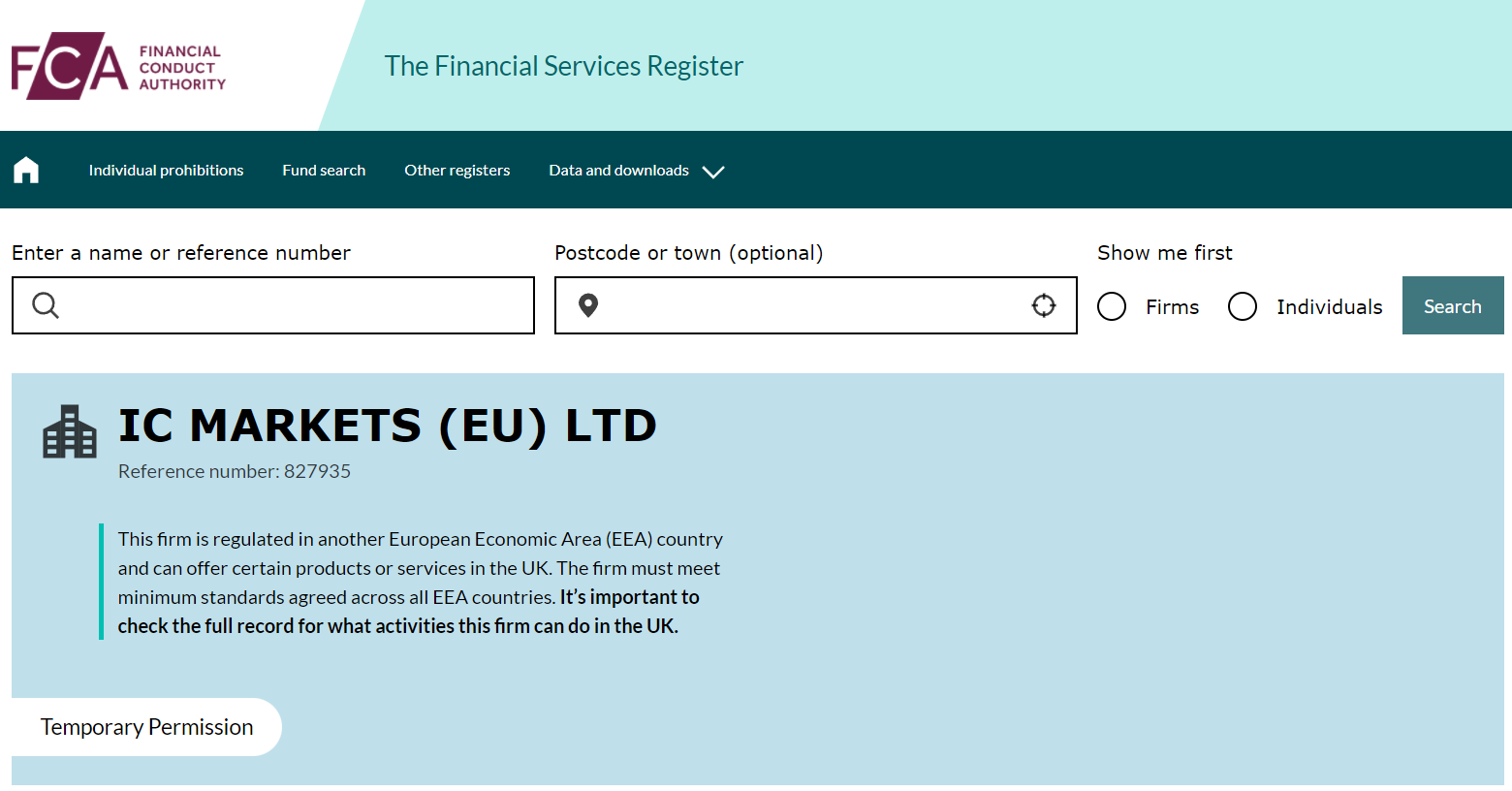

IC Markets is not regulated by FCA but they are authorized by FCA in the UK. They have permission to carry out business activities in the UK with new as well as existing customers. The current status of IC Markets (EU) Ltd can be checked at the online FCA register with reference number 827935.

Any firm that is regulated in any country of the European Economic Area (EEA) can offer certain products or services in the UK. Although, it must meet the minimum standards and compliance across all EEA countries. Following are the details of regulated entities of IC Markets:

- IC Markets (EU) Ltd – CySEC

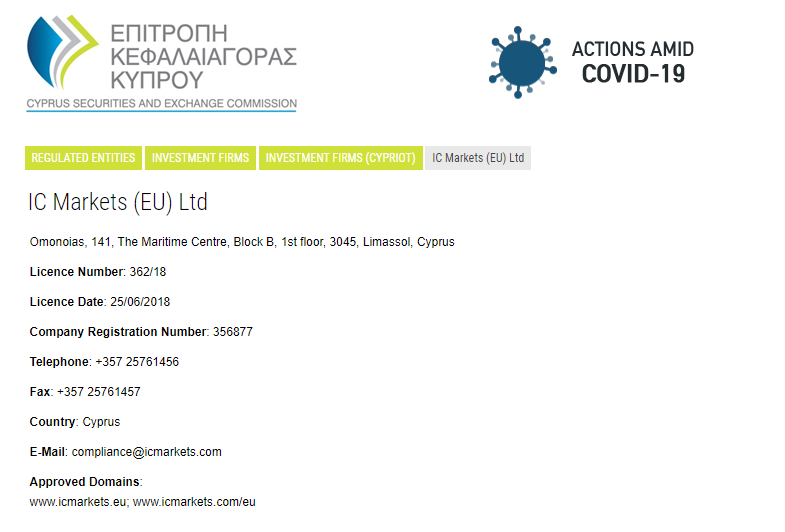

The clients in the UK are registered under Cyprus Securities and Exchange Commission (CySEC) regulations. IC Markets holds the CySEC license by the name IC Markets (EU) Ltd under license number 362/18 and company number HE 356877.

IC Markets (EU) Ltd has its registered address at 141 Omonoias Avenue, The Maritime Centre, Block B, 1st floor, 3045 Limassol, Cyprus. The broker does not have a local office in the UK.

IC Markets is authorised in the UK with temporary permissions because they holds a CySEC license. Clients registered with IC Markets (EU) Ltd are protected by the ‘Investor Compensation Fund’ of Cyprus. IC Markets (EU) Ltd is a member of the Investor Compensation Fund as they are regulated by CySEC.

- Raw Trading Ltd – FSA (Seychelles)

Clients in the UK can also choose to register with Raw Trading Ltd which is an offshore regulated entity of IC Markets. Raw Trading Ltd is regulated by the Financial Services Authority of Seychelles. The FSA license is held under registration number 8419879-2 and license number SD018. Clients registering with IC Markets Global or Raw Trading Ltd are protected by IC Market’s insurance coverage of up to $1 million per client. - International Capital Markets Pty Ltd – ASIC

IC Markets is regulated by the Australian Securities and Exchange Commission (ASIC) as International Capital Markets Pty Ltd. Its ASIC license has been registered with ABN number 12 123 289 109 and license number 335692 with 2/7/2009 as the commencement date.

The ASIC license increases the safety ratings of IC Markets as it is a top-tier regulatory authority in the jurisdiction of Australia. Clients in the UK are not registered under ASIC regulation.

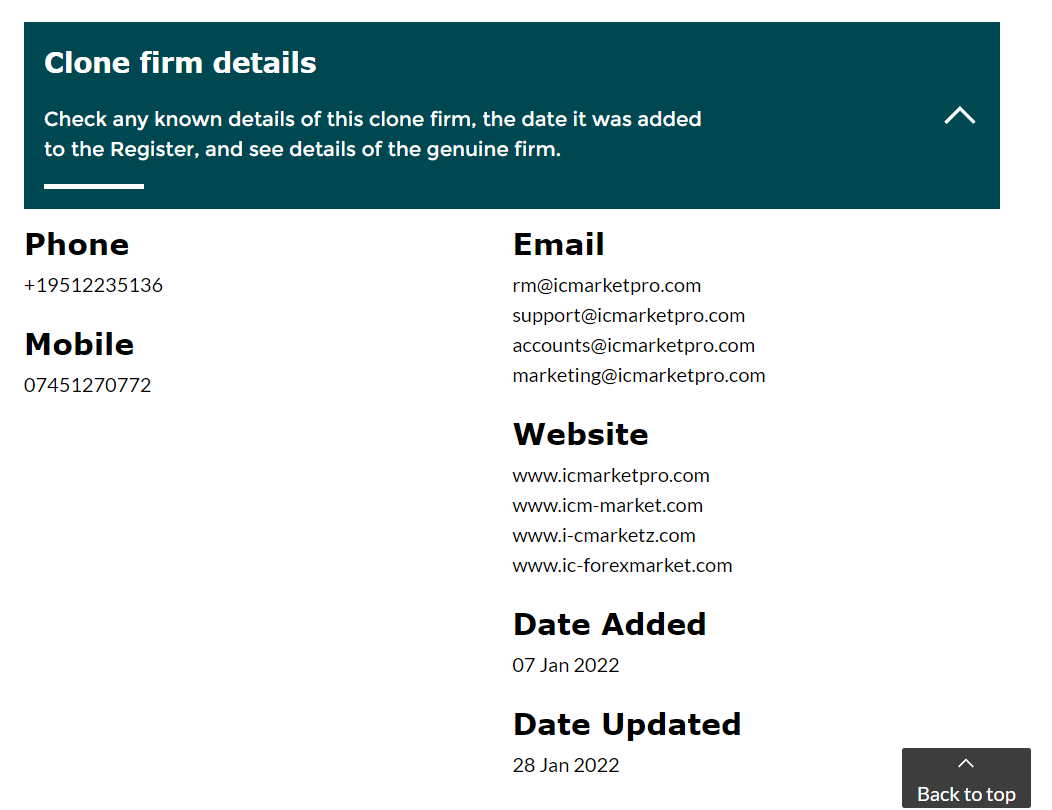

IC Markets has been in the CFD trading business since 2007 and is a considerably old broker. Clients must not confuse legitimate and regulated IC Markets entities with fake ones. There are a few clones of IC Markets that are using their name and regulation to scam clients in the UK.

According to our review, IC Markets can be considered safe for trading in the UK. CySEC-regulated IC Markets (EU) Ltd is a safer choice in the UK compared to the offshore regulated entity. The third-party risk of choosing IC Markets in the UK is average but higher when compared with brokers regulated by FCA.

IC Markets Fees

IC Market Fees Pros

- Two different fee structures

- Commission-based trading available with very low spread

- Overall trading cost is comparatively low

- No inactivity fee or any non-trading fees

IC Market Fees Cons

- Swap fee is slightly high

Fees are an important section that must be looked out for before opening a live account. For easier understanding and comparison, we have reviewed this section in 4 parts. All CFD brokers have these 4 components of fees:

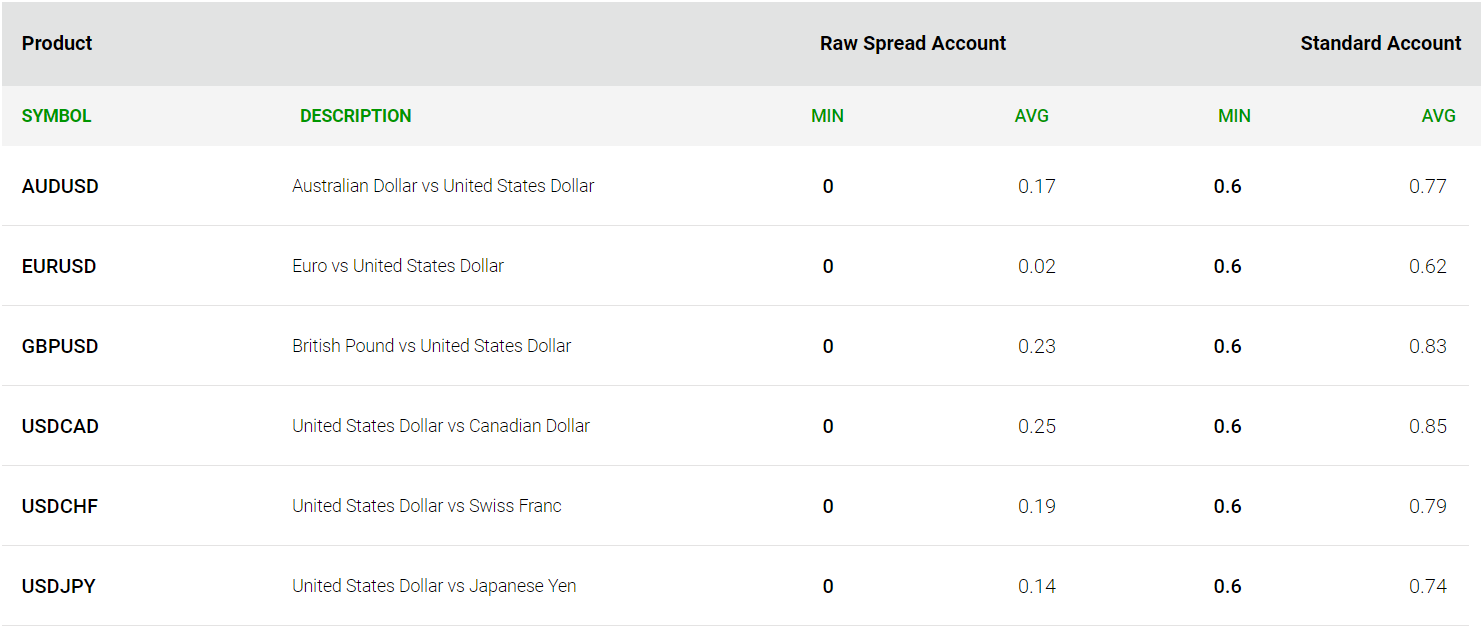

- Spread: It is the difference between the bid and asks the price of a CFD instrument. The average typical spreads for forex majors are among the best in the UK. For EUR/USD as a benchmark, the average spread is 0.62 with the Standard Account and 0.02 with the commission-based Raw Spread Account.

The following table includes the details of spreads incurred with the Standard and Raw Spread Account at IC Markets.

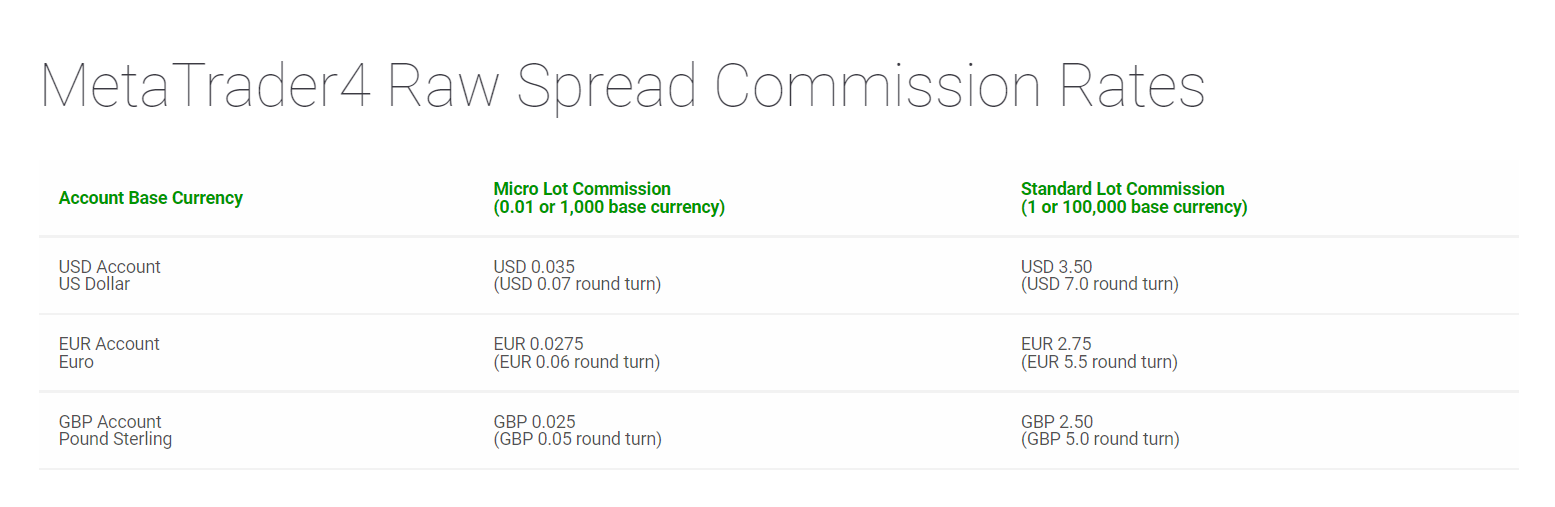

Trading Instrument Standard Account Raw Spread Account Account EUR/USD 0.62 0.02 GBP/USD 0.83 0.23 EUR/GBP 1.27 0.27 Gold/USD 2.083 1.083 Crude Oil 0.028 0.028 US Tech 100 Index 1.807 1.807 UK 100 2.133 2.133 - Trading Commission: It is the commission charged while executing trade orders. At IC Markets, the commission is only charged with the Raw Spread Account. MetaTrader and cTrader versions of this account type have a difference in trading commission.

For the MetaTrader trading platforms, the commission is GBP 5/ EUR 5.5/USD 7 for a round-turn trade of a standard lot. It will be incurred proportionately to the lot size of the trade.

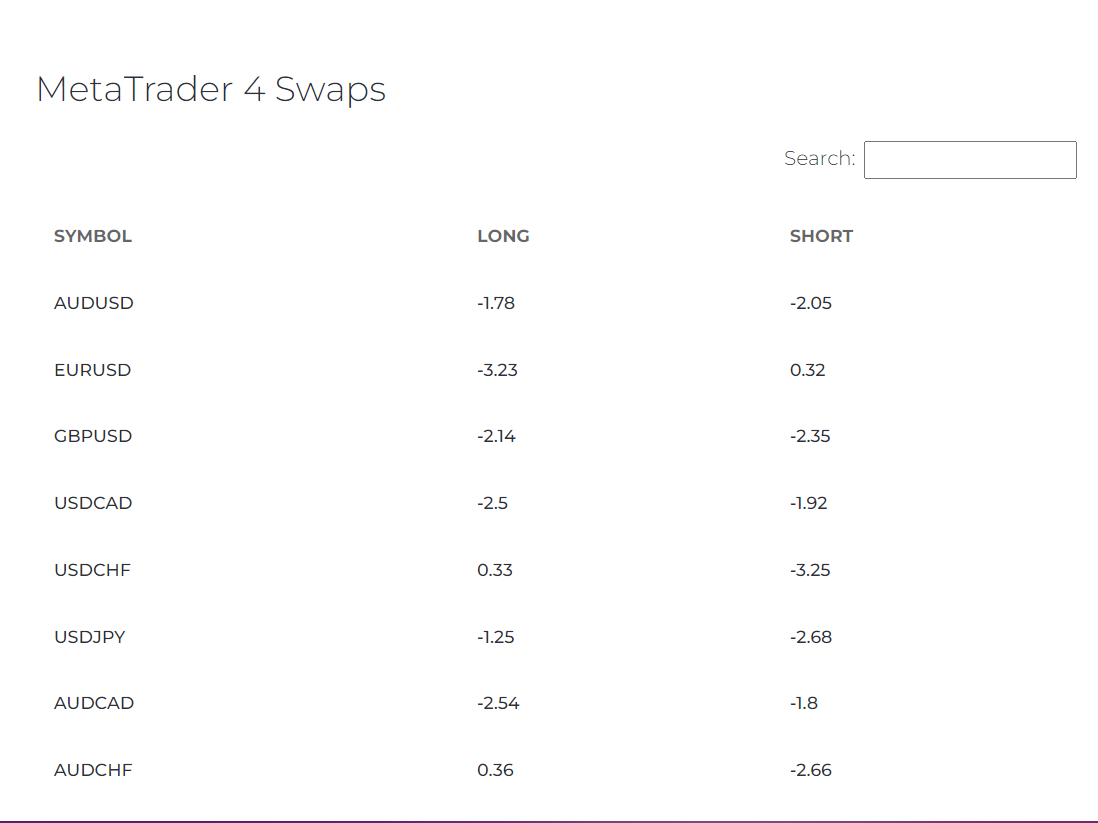

For the cTrader trading platform, the commission is $3 for a single side or $6 for a round-turn trade of a standard lot. For the accounts with EUR or GBP as the base currency, the commission amount will be converted to the base account currency at prevailing conversion rates. - Swap Fees: The swap fee is also known as rollover rate or overnight charges as it is the interest that is incurred if a leveraged position is kept open overnight. For positions opened and closed on the same day, no swap fee will be applicable. The long and short swap fee is different for each CFD instrument.

IC Markets has lower swap rates than the majority of forex and CFD brokers in the UK. For EUR/USD, the long and short swap rates in pips are -3.23 and +0.32 respectively. - Non-Trading Commission: This includes all the charges that are incurred without executing trade orders. At IC Markets, there is no commission for inactivity, account opening, deposit, withdrawal, maintenance, etc. Apart from wire transfers, deposits and withdrawals are free for all the accepted methods.

Overall, the spreads at IC Markets are low compared to the majority of other brokers in the UK. The commission is average while the swaps are also low. No non-trading charges are a major plus point in the fee segment.

The Standard account at IC Markets has only spread as trading fees. The Raw spread account involves a very low spread but also incurs a fixed commission on each trade.

We have compared the spreads on major currency pairs for several other brokers in the UK. The following table compares the spreads incurred on the Standard account with no commission involved.

| Trading Instrument | IC Markets | FXTM | eToro | CMC Markets | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 0.62 | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 0.83 | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 1.27 | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 0.74 | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 0.85 | 2.5 | 1.7 | 1.3 | 1.07 |

IC Markets Account Types

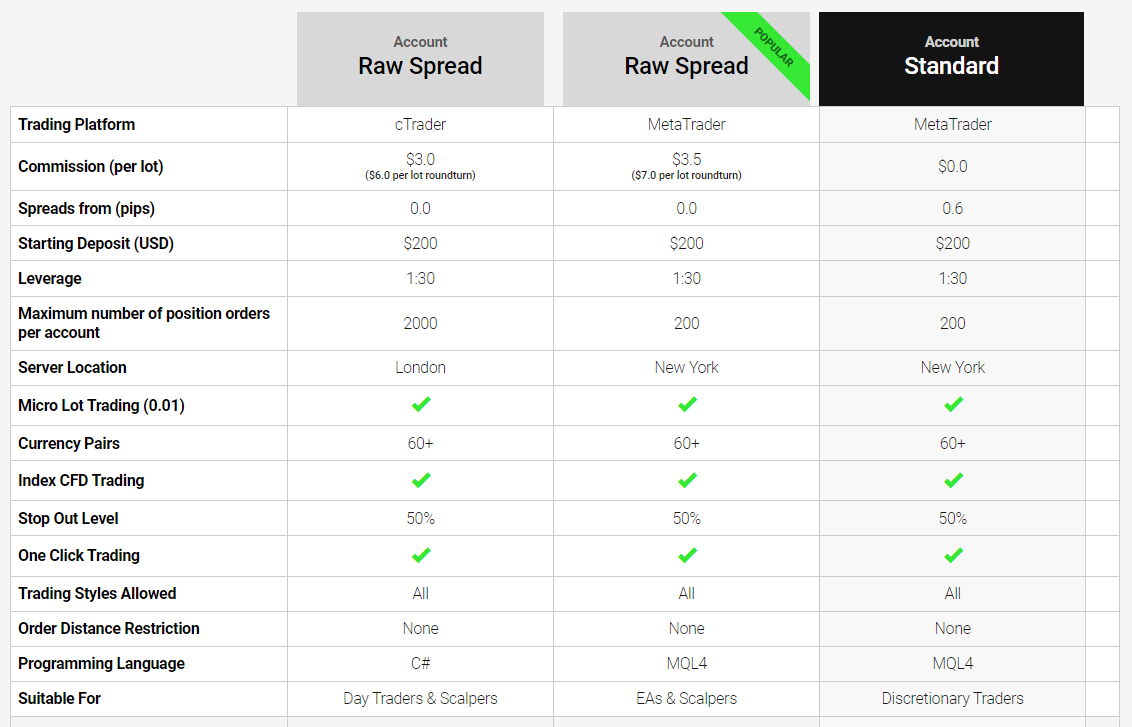

IC Markets mainly offers 2 account types with different pricing structures. All the other features are nearly the same for both account types.

- Standard Account: This account type is ideal for all types of traders including beginners. Spread is the only fee incurred with this account.

- Raw Spread Account: This account is ideal for scalpers and high-volume forex traders. The fixed commission is charged on currency pairs with a very low spread. The Raw Spread Account can be chosen either with cTrader or MetaTrader trading platform.

The commission-based trading is only available with CFDs of forex pairs and metals. For all the other instruments, only spread is incurred as trading fees for both the account types.

Each live account at IC Markets can be opened either with GBP, EUR, and USD as a base currency in the UK. The minimum deposit amount is $/€/£ 200. For any base currency of the account, the minimum deposit amount is 200 units.

According to our review, the minimum deposit amount is slightly higher compared to other brokers. The client has the ability to trade with all the instruments with multiple trading platforms and different pricing structures. This can suffice the trading suitability of different types of traders.

How to Open an Account at IC Markets?

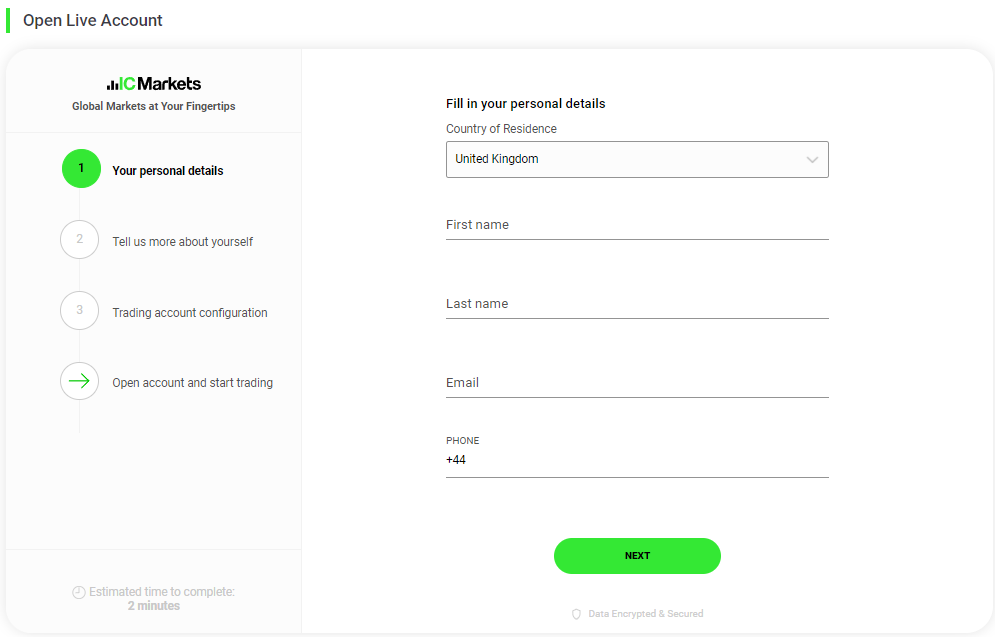

The account opening process at IC Markets is easy and can be completed within minutes. The approval of the account can take up to 1-3 business days before clients can start trading. Following are the steps involved in opening a live trading account at IC Markets:

Step 1: Personal Details

Clients can start the account opening process through the website and official app of IC Markets. Live trading account can also be opened with an offshore entity i.e. IC Markets Global instead of IC Markets (EU) Ltd. Clients need to select the Raw Trading Ltd under regulated entities for this.

The first step to open an account at IC Markets is entering basic details like name, email, and phone number. The details should match exactly with that on the personal ID.

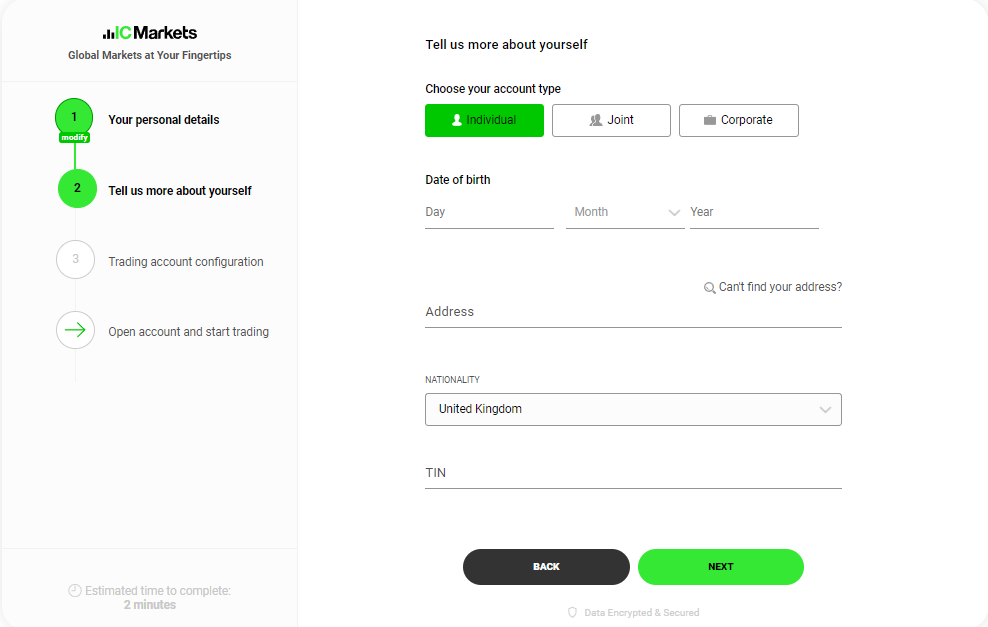

Step 2: Address

The next step in the account opening process is to enter the date of birth and address. In the same step, clients also need to enter their Taxpayer Identification Number (TIN). The account cannot be opened without a valid TIN number.

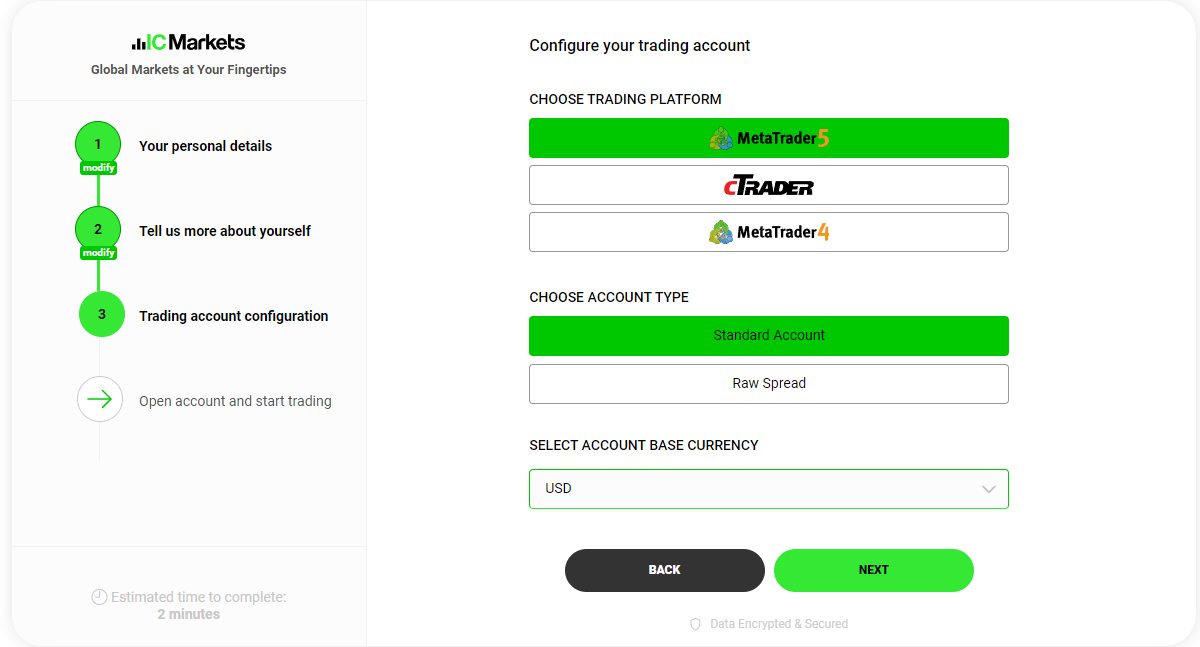

Step 3: Account Configuration

The trading account has to be configured with preferred trading platforms, account types, and base currency. Clients must research or inquire about all the selections before making any. Once chosen, the account configuration cannot be changed.

Step 4: Document Verification

Once the account is configured, you will be redirected to the personal area. Demo trading can be started after step 3. Clients need to submit address and identity proof before they can start live trading. Once the documents have been verified by the executives at IC Markets, a confirmation mail will be sent to your registered email address with credentials for trading platforms.

Step 5: Deposit

Before you start trading, you need to make an initial deposit. The minimum initial deposit amount is $/€/£ 200. Any of the accepted methods can be chosen for this according to convenience and preference.

Once the deposit amount is reflected in your account balance, trading positions can be opened on any available instrument.

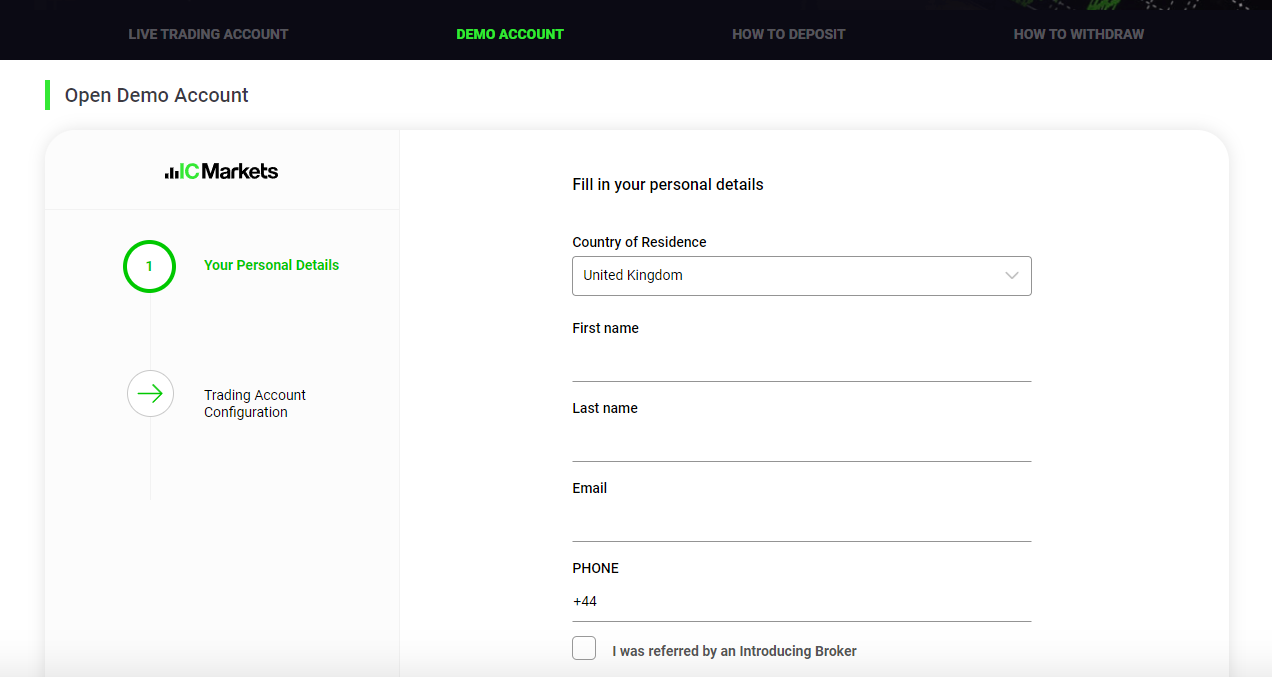

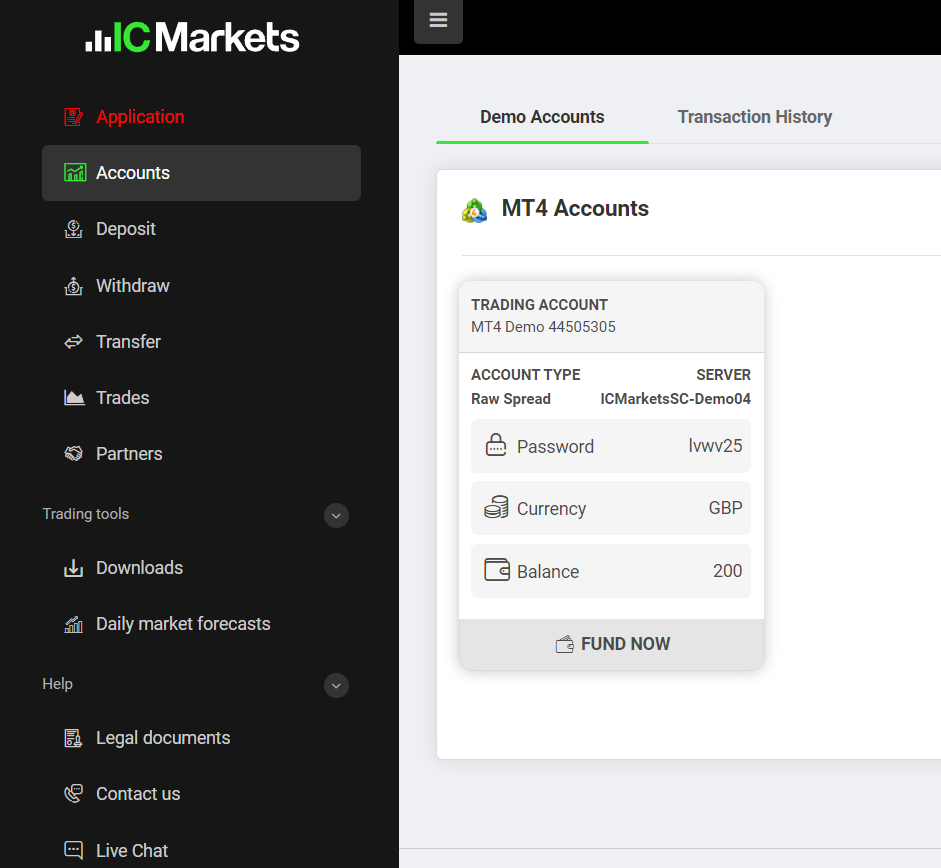

IC Markets Demo Account Review

IC Markets offers a very useful demo trading account which can be opened by any individual through their website. To open a demo account at IC Markets, clients need to click on ‘open a demo account’ on the login screen. Clients need to enter basic details like name, email, phone number, and address.

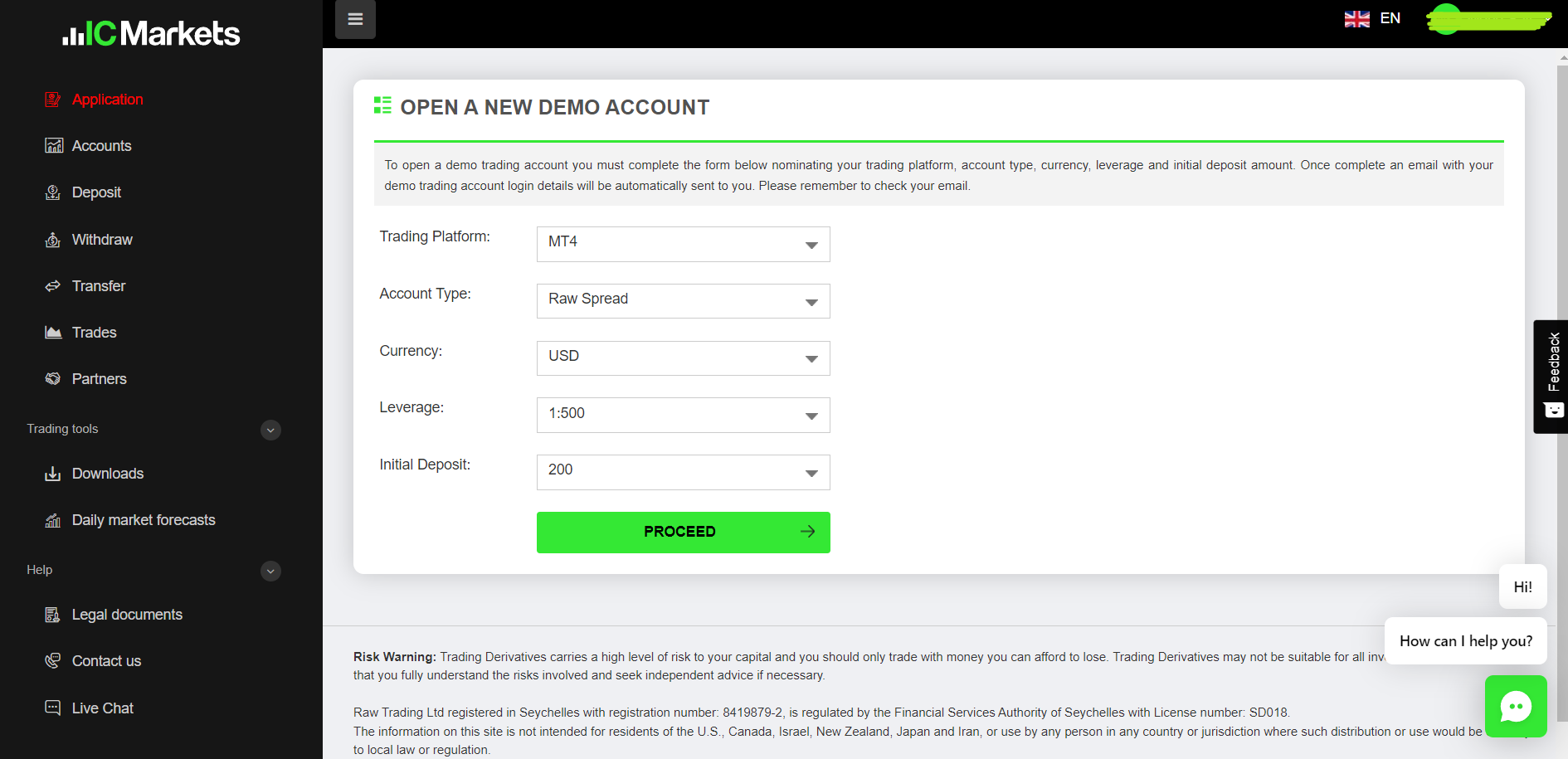

The demo account at IC Markets can be configured according to the requirements and desires of the clients. Clients can choose the trading platform of the demo account between MT4, MT5, and cTrader.

The fee structure for the demo account can also be chosen between the Standard and Raw Spread accounts. The Standard account has spread only fee pattern while the Raw Spread account involves commission with low spreads.

The base currency of the demo account can be chosen between USD, AUD, EUR, CHF, NZD, JPY, SGD, CAD, and HKD.

Clients can also select the leverage they wish to use with the demo account. The maximum leverage can be selected from 1:1 to 1:500. However, the maximum leverage on the demo account will be different for each asset class.

Clients can also select the initial deposit of virtual currency in the demo account the minimum amount is 200 while the maximum amount is 5,000,000 units of the base currency.

Once the demo account is configured, the login details of the demo account can be viewed under accounts section on the dashboard. The trading platform chosen while configuring the demo account can be downloaded from the dashboard. The login ID and password can be used to log in and trade virtual currencies on the demo account.

According to our analysis and comparison, IC Markets offers best demo accounts among FCA regulated brokers in the UK. The ability to configure the account as per the desires of the traders is a major advantage at IC Markets. Every type of trader can configure a suitable demo account for themselves.

IC Markets Deposits and Withdrawals

IC Market Deposit/Withdrawal Pros

- Diverse Payment Options: Offers a wide range of deposit and withdrawal methods.

- No Deposit Fees: Deposits are free, making it cost-effective to fund accounts.

- Quick Fund Access: Withdrawals are processed within 2 days, ensuring timely access to funds.

- Flexible Currency Options: Supports multiple base currencies, reducing conversion fees.

- No Minimum Withdrawal: Allows withdrawing any amount, providing flexibility.

IC Market Deposit/Withdrawal Cons

- Conversion Fees: Potential fees for currency conversion if account and bank currencies differ.

- International Withdrawal Fee: Charges for international bank transfers, which can add to the cost.

- No Crypto Transactions: Lacks cryptocurrency support for deposits and withdrawals.

- Minimum Deposit Required: $200 minimum deposit may deter beginners or small-volume traders.

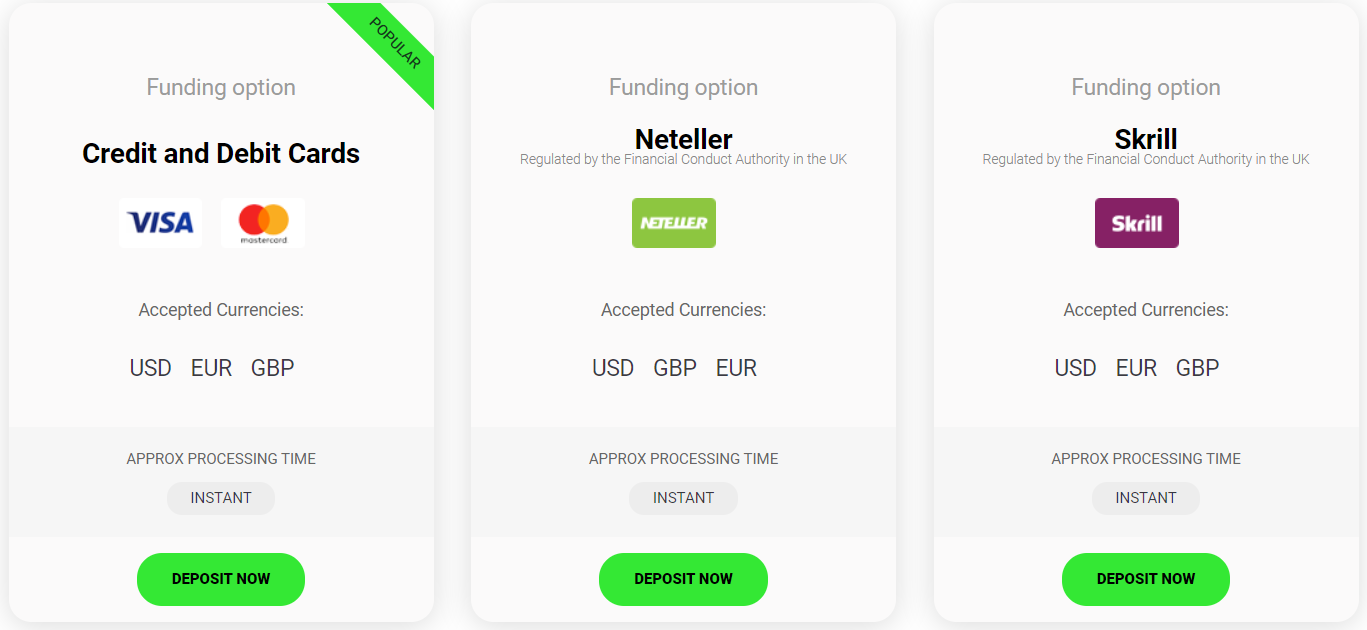

IC Markets accept 4 methods for deposits and withdrawals from clients in the UK. Each method takes a different time to process. All these methods can be used to deposit in USD, EUR, or GBP. Deposits made in an account with a different base currency than deposit currency are automatically converted to account currency.

- Credit/Debit Cards: Visa and Mastercard cards can be used to deposit and withdraw at IC Markets at no additional commission. The deposits are processed instantly with no processing time. Withdrawals can take 2 to 5 hours.

- E-Wallet: Neteller and Skrill can be used for deposit and withdrawal at IC Markets. The processing time for deposit as well as withdrawal is instant with this method.

- Wire Transfer: Clients also deposit and withdraw through Wire Transfer. It may incur additional commission that has to be paid by the clients. The deposits and withdrawals through wire transfer can take 2 to 5 business days to process.

Cryptocurrencies or local bank transfers are not available at IC Markets in the UK. Credit/Debit cards, Neteller, Skrill, and Wire Transfer are the only accepted methods for deposits and withdrawals.

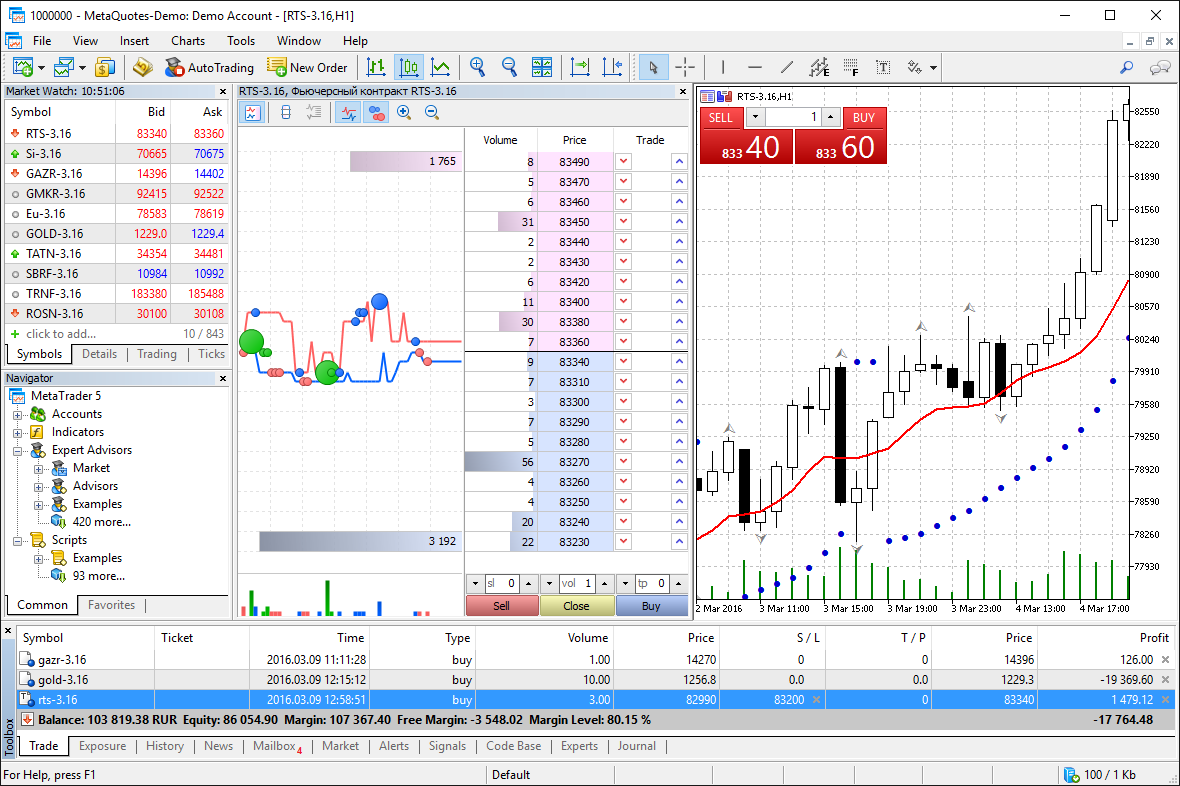

IC Markets Trading Platforms

All trade orders and modifications are executed through trading platforms. IC Markets does not have its proprietary trading platform. MT4, MT5, and cTrader are the most chosen forex and CFD trading platform globally. IC Markets offer all three of these platforms for web, mobile, and desktop devices.

Web Trading Platform

The web trading platform at IC Markets is provided by MetaTrader and cTrader. Both these web trading platforms are third-party platforms. These are available in multiple languages and can be customised according to the client’s needs.

The cTrader platform has a modern-looking interface compared to the MetaTrader web trading platform. Traders cannot set price alerts and notifications on both the IC Markets web trading platform.

Mobile Trading Platform

The mobile trading platform at IC Markets is also provided by MetaTrader and cTrader trading platforms. The MT4, as well as the MT5 trading platforms, can be downloaded separately.

The cTrader mobile trading platform is also available in multiple languages. It has a one-step login with no fingerprint or facial recognition.

Desktop Trading Platform

IC Markets offer 3 desktop trading platforms namely MetaTrader 4, MetaTrader 5, and cTrader. All these platforms can be downloaded on desktop devices and can be customized according to the requirement of the traders.

MT4 has a simple interface that looks similar to Windows 98. It is compatible with desktop devices with any configuration. MT4 is the most chosen forex and CFD trading platform globally. It was introduced by MetaQuotes Software in 2005 and is still used by a large number of traders.

MT5 is an upgraded version of MT4 launched in 2011. This platform allows easier access to algorithmic trading through the MQL5 language. The look and feel of MT5 are also better than MT4 with better visuals and features.

The cTrader was introduced in 2010 by Spotware Systems. As the name suggests, this platform uses the #c language for programming algorithmic trading. The interface is user-friendly with limited customisation.

IC Markets Research and Education

IC Markets offer multiple tools to educate every type of trader in the UK. The research tools are however limited when compared with other forex and CFD brokers in the UK.

The research tools include a market analysis blog and an economic calendar. They publish blogs on price prediction, market sentiments, and trends to assist the traders. No specific research tools are available for specific capital markets and instruments.

We found a rich variety of education tools at IC Markets. They offer a beginner’s course to understand the basics of forex and CFD markets that includes 10 lessons. Other offerings like podcasts, webinars, video tutorials, WebTV, etc can assist all types of traders to enhance their trading skills.

Market Analysis: IC Markets often provides daily market analysis and insights, including technical and fundamental analysis, covering a variety of financial instruments such as forex pairs, indices, commodities, and more.

Economic Calendar: An economic calendar is a tool that displays important economic events, announcements, and indicators with potential impacts on the financial markets. IC Markets may provide an economic calendar to help traders stay informed about upcoming events.

Trading Central: IC Markets might offer access to Trading Central, a third-party research provider that offers technical analysis, trade ideas, and research reports on various financial instruments.

Webinars and Seminars: IC Markets could host webinars and seminars on trading-related topics. These live sessions may cover trading strategies, market trends, and more, often conducted by industry experts.

Multiple articles are available at IC Markets describing the advantages and analysis techniques that can be helpful for traders in the UK.

Compared with other ASIC-regulated forex and CFD brokers in the UK, IC Markets offer sufficient tools for educating the traders. However, the number of tools to support the traders in the research is much lesser.

Available Instruments

All the available financial instruments at IC markets are traded via CFDs. Contract for Deposit (CFD) is a derivative instrument in which there is no buying or selling of physical assets. Only the price differences are speculated by the traders to book profit in short and long positions.

The leverage allows traders to open a much bigger position with smaller deposits. Although, involving high leverage is risky as bigger positions can wipe out the whole amount held in the trading account.

Following are details of available trading instruments at IC Markets:

- 61 Currency Pair: Forex pairs can be traded as CFDs with a maximum leverage of 1:30 in the UK. Currencies are always traded in pairs. 6 out of them are major currency pairs. The first currency in a pair is the base currency that is to be bought or sold in return for the quote currency.

- 22 Commodities: Precious metals, Energies, and Soft Commodities can be traded via CFD at IC Markets. Futures, as well as spot prices of commodities, can be speculated via CFDs. The maximum leverage for CFD on gold is 1:20. For all the other commodities crosses, the maximum leverage is 1:10.

- 25 Indices: CFDs on Indices can be traded at IC Markets with a maximum leverage of 1:20. Major stock indices from American, European, Asian, and Australian stock exchanges can be traded as CFD. ICE Dollar and VIX index are the future CFDs of Indices while all the other indices are traded in spot.

- 11 Bonds: The changes in the interest rates of government bonds can be speculated via CFD at IC Markets. The maximum leverage for Bonds CFD is 1:5. Bonds cannot be traded on the cTrader trading platform.

- 18 Cryptocurrencies: Cryptocurrency CFD crosses with the base account currency can be traded with leverage of 1:2. Crypto CFD trading is available 7 days a week as the crypto market is active and liquid all the time.

- 1600+ Stocks: More than 1600 stocks from American and European markets can be traded via CFDs at IC Markets. Stock CFDs can only be traded through the MetaTrader 5 trading platforms. Clients will also earn dividends if declared.

There is a great variety of trading instruments that can be traded by opening an account with IC Markets in the UK. The number of available instruments is higher than many regulated CFD brokers in the UK.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 61 | 1:30 |

| Indices | 25 | 1:20 |

| Commodities | 32 | 1:20 for Gold, 1:10 for others |

| Shares | 1600+ | 1:5 |

| Bonds | 11 | 1:5 |

| Cryptocurrencies | 18 | 1:2 |

IC Markets Trade Execution Method

IC Markets employs a Straight Through Processing (STP) and Electronic Communication Network (ECN) execution model for its trading accounts. STP involves sending client orders directly to liquidity providers, such as banks and financial institutions, without any interference from the broker. With IC Markets, your trade order is forwarded to their partnered liquidity provider.

On the other hand, ECN is a technology that enables direct interaction between traders and liquidity providers in a transparent marketplace. Traders can access real-time price quotes and execute trades at the best available bid and ask prices from multiple liquidity providers.

IC Markets is well-known for its fast trade execution speed, made possible by their STP/ECN execution model. The implementation of ECN technology ensures swift and efficient trade execution with minimal slippage. This is particularly advantageous for high-frequency traders and those who require precise order execution.

It is important to acknowledge that trade execution speed may vary due to factors like market liquidity, account type (Standard or Raw Spread), chosen trading platform (e.g., MetaTrader 4, MetaTrader 5, cTrader), and internet connection speed. The broker’s infrastructure and proximity of servers to liquidity providers can also impact execution speed.

IC Markets Customer Support

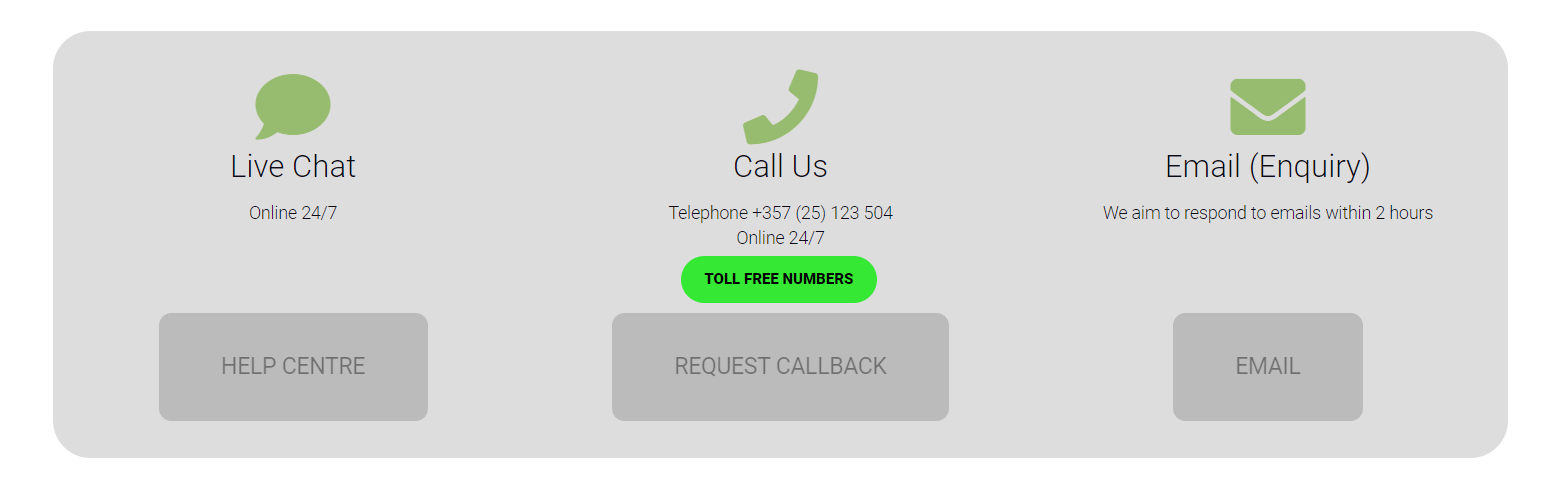

The customer support service at IC Markets is impressive. Clients can connect with the customer support staff via 3 means. We have separately reviewed our experience with the support staff with all three:

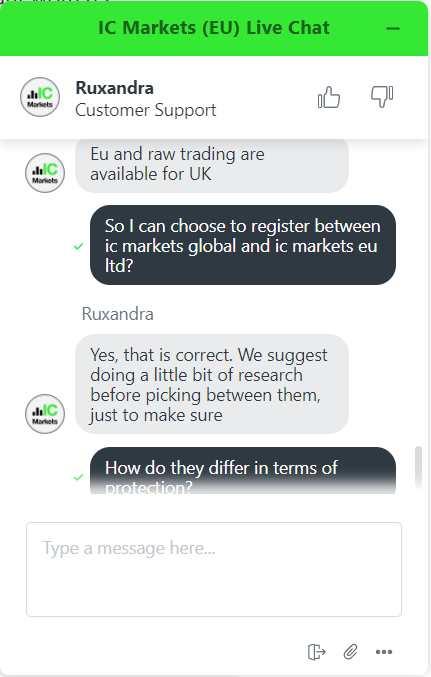

- Live Chat: The live chat support at IC Markets is available 24/7. This means that live chat support is always available in the UK. The live chat window is first connected with a chatbot that matches the keywords in the queries with the FAQs. Some of the most common queries can be resolved through the chatbot.

Clients can request to connect with a support executive through the chatbot. The connectivity time is less than a minute and sometimes can take up to 5 minutes. We tried to connect with an agent at different times in the UK. All of our queries were resolved and we found the executive to be very helpful and honest. - E-mail: Clients can also resolve their queries through e-mail at [email protected]. The response time is 2 hours in general. It is a time-consuming method to connect with the support staff. Although, it is useful when you need written proof or a document supporting your query.

- Phone Support: A telephone support service is the best method to connect with the support staff at IC Markets. IC Markets offer local phone support for clients in the UK at +357 (25) 123 504. Phone support is also available 24/7.

Overall, the customer support service for UK clients is very good at IC Markets. Clients in the UK can reach out for support through multiple methods at any time on any day.

Do We Recommend IC Markets?

Yes. IC Markets can be chosen to trade CFDs in the UK but clients must know that they are riskier than all the brokers that are regulated by the FCA. They are regulated in an EEA country, hence can be chosen to trade CFDs in the UK.

The spreads and other trading costs are very low while no non-trading charges exist at IC Markets. Multiple instruments can be traded with different trading platforms and suitable account types. The customer support service is excellent in the UK.

Yes, IC Markets offer commission free trading with low spreads. They also offer research and education tools to assist the traders. It is ideal for beginners but majority of the beginners lose money while trading forex.