AxiTrader UK Review 2024

AxiTrader is an FCA regulated forex broker that allows trading on CFD instruments through MT4 trading platform. Check all the pros and cons of Axi in the UK before opening your account at Axi.

AxiTrader is an Australia-based forex and CFD broker that accepts clients from multiple countries. It allows trading on forex and other CFD instruments through MetaTrader 4 trading platform.

AxiTrader is regulated by 2 top-tier regulatory authorities and could be a good choice to trade online in the UK. We have reviewed AxiTrader comprehensively and honestly to assist the clients in choosing a suitable broker in the UK.

AxiTrader UK Pros

- AxiTrader is regulated and authorized by FCA in the UK

- The minimum deposit is $1 as no lower limit exists

- Free deposits and withdrawals through multiple methods

- Professional account available with $25,000 deposit

- Local phone number available for customer support

- GBP can be Chosen as the base currency of the account

- Multiple account types available

AxiTrader UK Cons

- The number of available instruments is low

- MT5 or cTrader trading platform are not available

- Inactivity fees ($10/month) are charged after 12 months of inactivity

This review has been specifically done for Axi Financial Services (UK) Limited which is the FCA-regulated legal entity in the UK. Multiple pros and cons have been discussed with comparison from other FCA-regulated forex brokers in the UK.

Table of Content

AxiTrader UK Summary

| Broker Name | Axi Financial Services (UK) Ltd |

| Website | www.axi.com/uk |

| Regulation | FCA, ASIC, FSA |

| Year of Establishment | 2007 |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4 |

| Trading Instruments | 140+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

AxiTrader Safety and Regulation

The safety of clients and their deposits at a financial service provider majorly depends on the regulatory authority that regulates the firm. This authority that regulates a broker is responsible for the safety and welfare of the traders and investors. Following are the regulatory authorities that regulate AxiTrader.

- The Financial Conduct Authority (FCA)

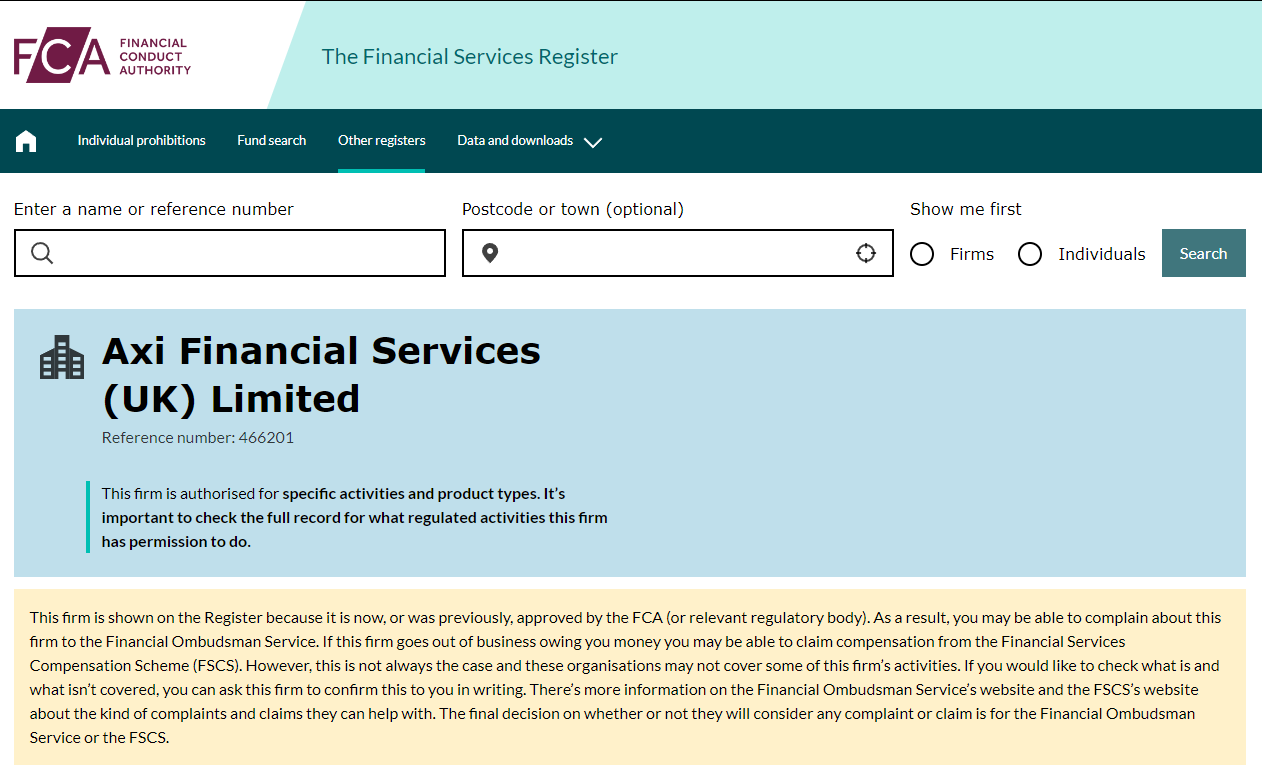

The Financial Conduct Authority (FCA) is the financial regulatory authority in the jurisdiction of the United Kingdom. All FSPs require a regulatory license from FCA to operate their business in the UK.AxiTrader or Axi is the trading name of the legal entity Axi Financial Services (UK) Ltd which is registered at FCA with reference number 466201. AxiTrader acquired the FCA license in 2007 to offer leveraged CFD products as per the FCA guidelines.

Clients residing in the UK are registered under FCA regulation and are protected by FCA regulatory compliance. Axi cannot offer leverage of more than 1:30 in the UK. Clients are protected by up to GBP 85,000 in case of an unsettled dispute between the broker and clients.

- Australian Securities and Investments Commission (ASIC)

The Australian Securities and Exchange Commission (ASIC) is a top-tier financial regulatory authority in the jurisdiction of Australia. They overlook registered brokers and their activities to safeguard the interest of traders and investors in Australian financial markets.

Axi or AxiTrader is registered at ASIC by the legal entity AxiCorp Financial Services Pty Ltd with AFSL number 318232 and ABN number 85 127 606 348. Axi acquired this ASIC license in 2007 and currently has a registered status with no registered dispute. Australian and New Zealand clients are registered under ASIC regulatory compliance.

- The Financial Services Authority (FSA)

The Financial Services Authority (FSA) is a financial regulatory authority in St Vincent and the Grenadines. It allows registered firms to operate their business internationally. However, the compliance requirements are less strict as it is an offshore regulation.AxiTrader Limited is the legal entity of AxiTrader that is registered in St Vincent and Grenadines under license number 25417 BC 2019 at the Financial Services Authority.

Clients in the UK, Australia, and New Zealand are not registered under FSA regulations. Most international clients at Axi are registered under FSA regulations.

The FCA regulatory license makes AxiTrader safe for traders in the UK. Additionally, the ASIC license further increases the trust factor. AxiTrader was launched in 2007 and keeps the clients’ funds in a segregated bank account.

AxiTrader is a privately held company and is not listed on any stock exchange but we found them fairly transparent with their financials, disclosures, and agreements.

Axitrader is a market maker and can take the other side of the trading position opened by the clients. AxiTrader can be considered safe to trade forex and CFDs in the UK.

AxiTrader Fees

There are two different fee structures at AxiTrader that depend on the account type chosen by the trader. The Standard account is a spread-only account with no trading commission while the Pro and Elite account offers low-spread trading at the expense of a trading commission.

For a detailed review of fees charged at AxiTrader, we have separately described each component of trading and non-trading fees.

Trading Fees

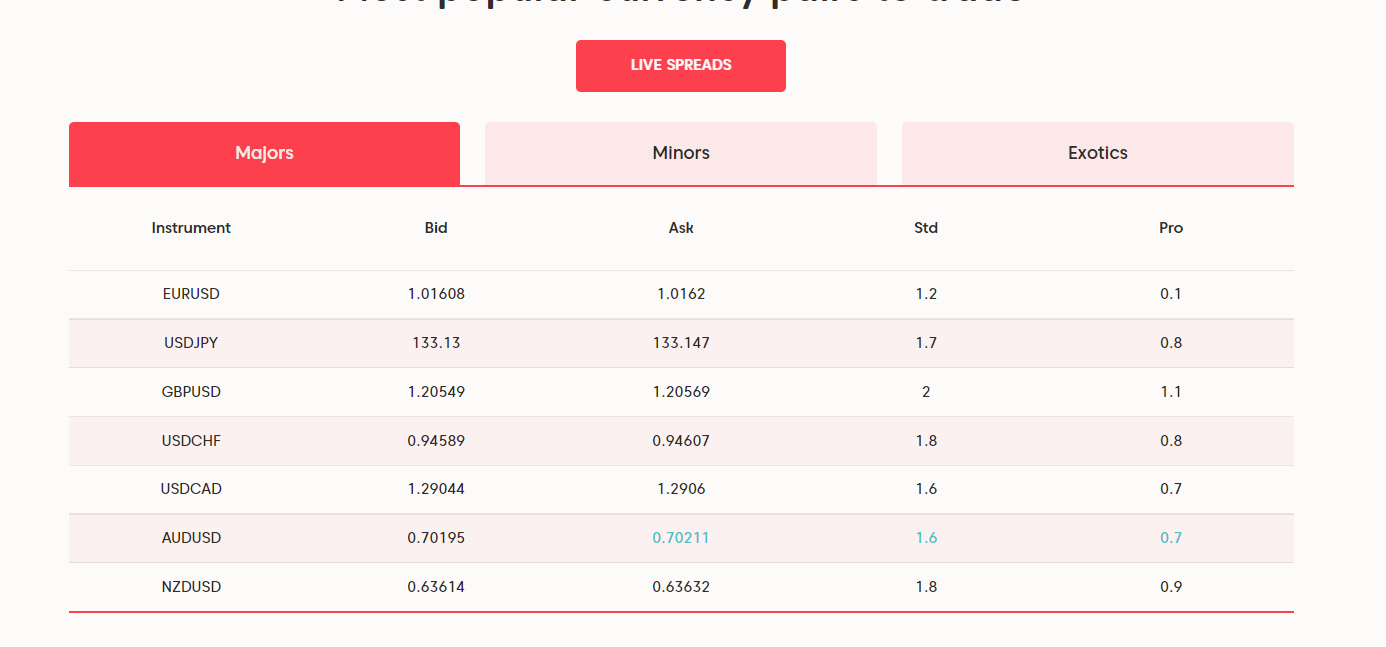

- Spread: Spread is the difference between the bid and ask price of the trading instrument and is also the major source of revenue for brokers and liquidity providers. The spreads at AxiTrader are floating and are different for each available instrument.

The spreads with the Standard account start from 0.4 pips while the Pro account offers as low as 0 pips spread. We checked the average spread for EUR/USD and found it to be 1.1 pips with the Standard account and 0 pip with the Pro account. The spreads with the elite account (Professional) are similar to the Pro account.

The following table describes the spread at Axitrader in the UK.

Trading Instrument Average Spread with Standard Account Average Spread with Pro Account EUR/USD 1.2 0.2 GBP/USD 1.5 0.6 Gold/USD 23 16 US Crude Oil 5.2 NA US Tech 100 125 NA BTC/USD 2500 GER40 330 NA UK100 220 NA USA30 200 NA USA500 50 NA For better analysis and comparison of spreads, we have compared the average typical spread charged by various CFD brokers in the UK. The spreads mentioned in the table below are with the standard account that does not involve any trading commission.

Trading Instrument AxiTrader FXTM eToro CMC Markets Pepperstone EUR/USD 1.2 1.9 1.1 0.70 0.77 GBP/USD 1.5 2 2.3 0.9 1.19 EUR/GBP 1.2 2.4 2.8 1.10 1.40 USD/JPY 1.3 2.2 1.2 0.7 0.86 USD/CAD 1.5 2.5 1.7 1.3 1.07 - Trading Commission: The trading commission is only incurred with the Pro and Elite account types. For the Pro account, the commission is $7 for a round-turn trade of a standard lot. For the Elite account, the commission is $3.5 for a round-turn trade of a standard lot.

| Broker Name | Commission for Single Side Trade | Commission for a Round Trade |

|---|---|---|

| AxiTrader | $3.5 | $7 |

| HFM | $3 | $6 |

| IG Markets | $3.5 | $7 |

| Tickmill | $2 | $4 |

| FXTM | $2 | $4 |

| FBS | $10 | $20 |

| IC Market | $3.5 | $7 |

| Pepperstone | $3.5 | $7 |

Non-Trading Fees

AxiTrader does not incur any non-trading fee for active traders as deposits and withdrawals are free. No account maintenance fee is charged. As GBP is available as the base currency no currency conversion fee will be charged for GBP deposits.

The only non-trading fee at AxiTrader is the inactivity fee which is a monthly charge incurred from inactive accounts. If no trades are executed for 12 consecutive months, AxiTrader will incur a monthly inactivity fee of 10 units of the base account currency. This will be charged until the account balance reaches zero.

The following table compares the inactivity fees for popular forex and CFD brokers in the UK. The inactivity fees are incurred each month after the inactivity period.

| Broker Name | Inactivity Period | Monthly Inactivity Fees |

|---|---|---|

| AxiTrader | 12 Months | $10 |

| HFM | 6 Months | $5 |

| FXTM | 6 Months | $5 |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | 3 Months | $10 |

| IG Market | 2 Years | $10 |

Following table compares the deposit and withdrawal fees at AxiTrader in the UK

| Broker Name | Deposit Fees | Withdrwal Fees |

|---|---|---|

| AxiTrader | NA | NA |

| FXTM | NA | $1 For Local Bank Withdrawal |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | NA | NA |

| IG Market | NA | NA |

Overall, we found AxiTrader to be cost-effective compared with several other FCA-regulated forex and CFD brokers in the UK. The spreads are the major component of revenue for AxiTrader. The commission with the Pro account is slightly high but the professional account offers the best pricing.

AxiTrader Account Types

For retail traders in the UK, Axi offers 2 account types namely Standard and Pro. The third account type is specifically configured for professional traders named Elite account. Following is the description of each account type at AxiTrader.

- Standard Account

This is the basic account type at AxiTrader with the spread only a pricing structure. The Standard account type is ideal for all types of traders as there are no lower limits on minimum deposits.

- Pro Account

This account type involves a commission-based pricing structure with very low spreads. It is ideal for experienced traders and scalpers. No minimum deposit requirement with max leverage of 1:30.

- Elite Account

This is the professional account type at AxiTrader that can only be opened with a minimum deposit of $25,000. Apart from lower fees, the Elite account offers maximum leverage of 1:400. It is only ideal for professional traders as the minimum deposit requirement are very high.

All the available account types at AxiTrader can be opened with GBP as the base currency along with USD, EUR, and AUD. The standard and Pro accounts can be opened with 10 different base currencies.

As per the regulatory compliance of FCA, the maximum leverage for retail traders is capped to 1:30. Each instrument type has different maximum leverage limits. Only professional traders with deposits of more than $25,000 can trade with leverage as high as 1:400.

The number of available instruments is the same across all account types. The trading platforms and additional tools are also available for all account types with the same offerings.

Axitrader Demo Account Review

AxiTrader’s demo account offers a risk-free environment for traders to practice and learn with real market conditions and access to educational resources. However, it has a limited duration, and there can be emotional differences when trading with real money.

The demo account at Axitrader is free and traders only need to provide some basic information like name, email, and phone number to open the demo account. It allows trading on all the available instruments with virtual currency that can be chosen by the trader.

The execution speed may not fully mimic live trading, and some account features might be limited. It’s a valuable tool for practice, but traders should be aware of the distinctions between demo and live trading.

How to Open Account at AxiTrader

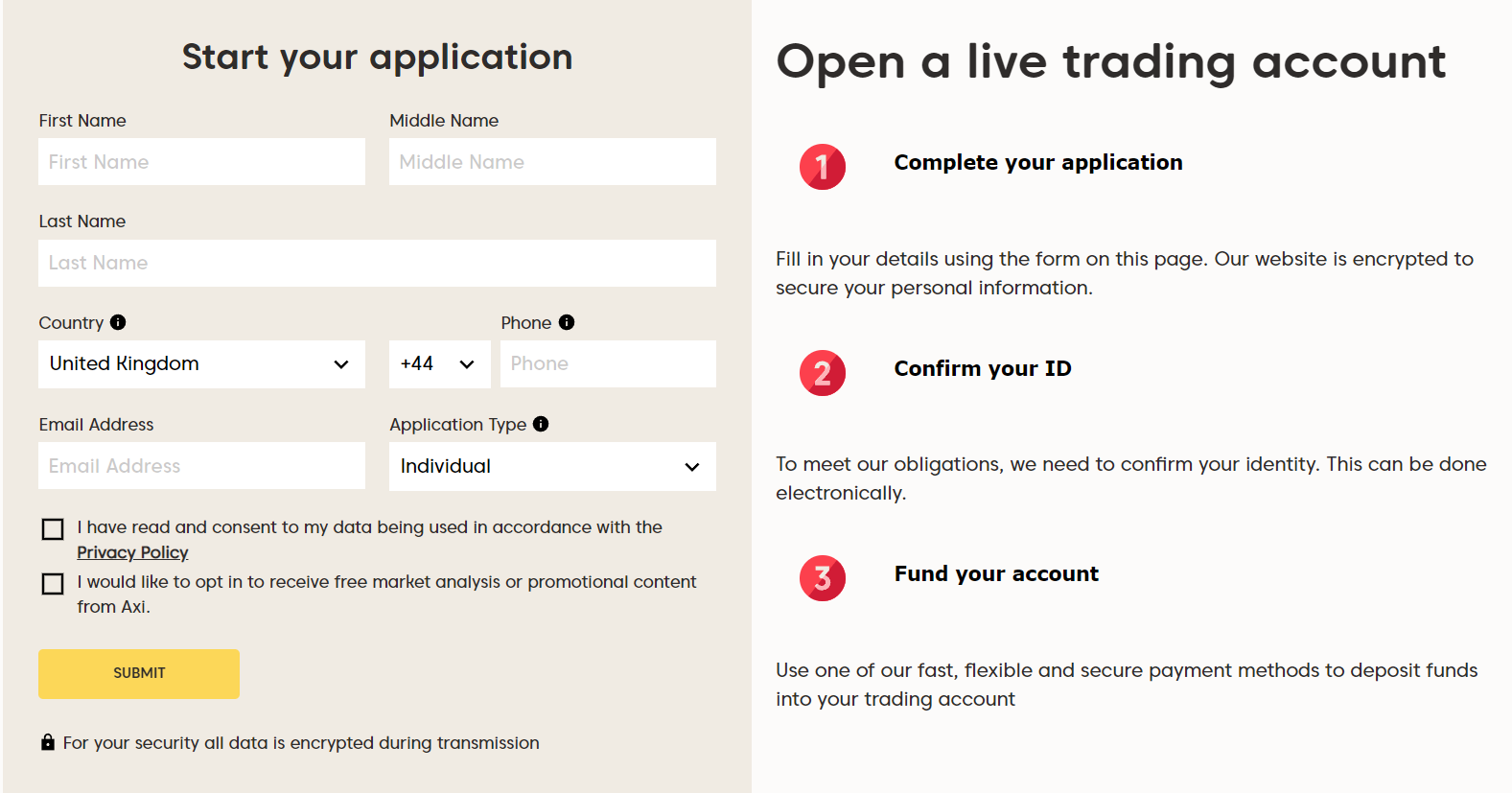

The account opening process at AxiTrader is simple and can be completed within a few hours on a business day. Following are the steps that need to be followed to open a live trading account at AxiTrader in the UK.

Step 1: Basic Details

To start the account opening process at AxiTrader, traders need to visit the official AxiTrader website and visit the account opening page. The first step is the provide the basic details like name, phone number, and email address.

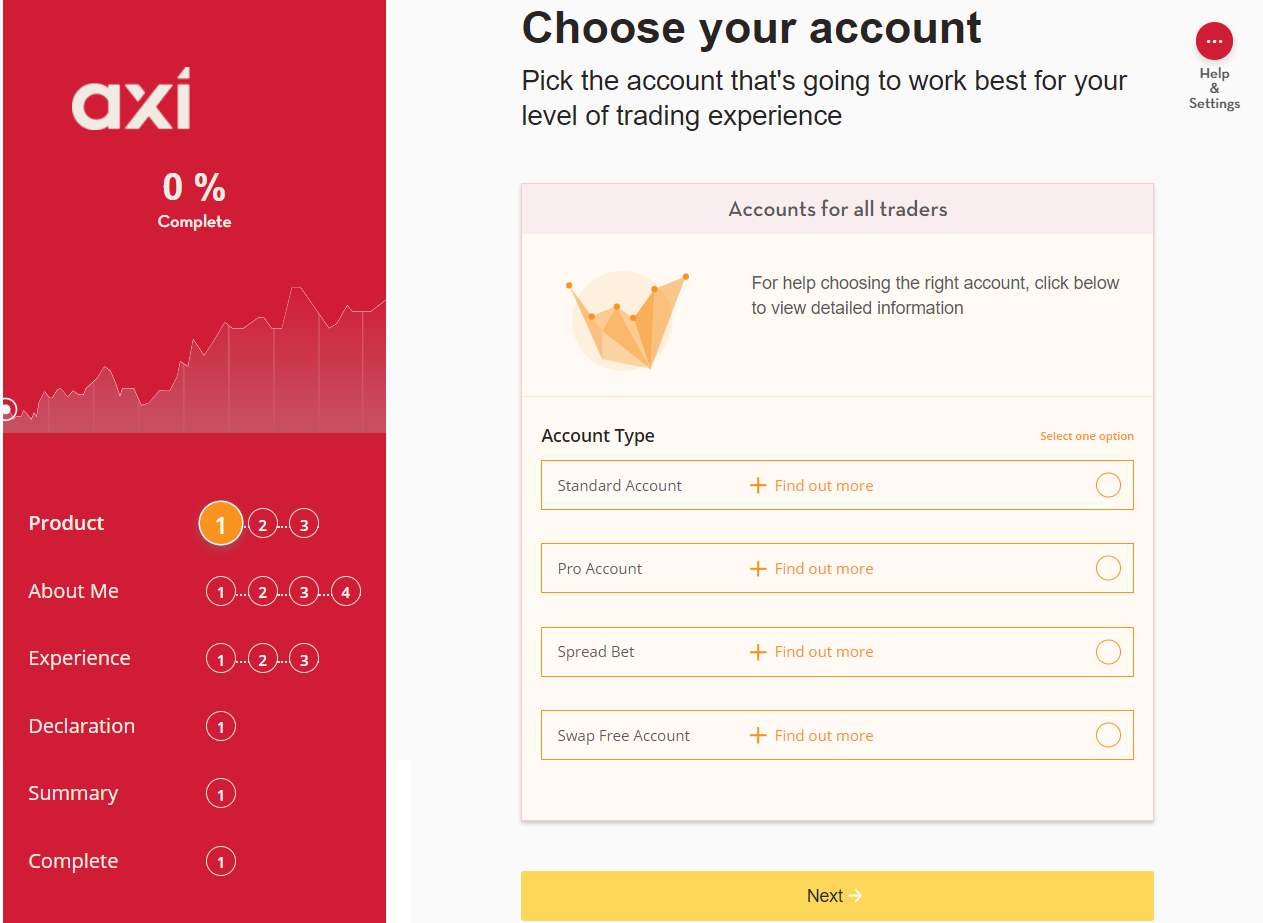

Step 2: Choose Password and Account Type

After providing basic details, clients need to choose a strong password which will be used to access the live account AxiTrader and the trading platform as well. After choosing the password, traders need to choose the account type. Traders in the UK have four options namely Standard account, Pro account, Spread betting account, and Swap-free account.

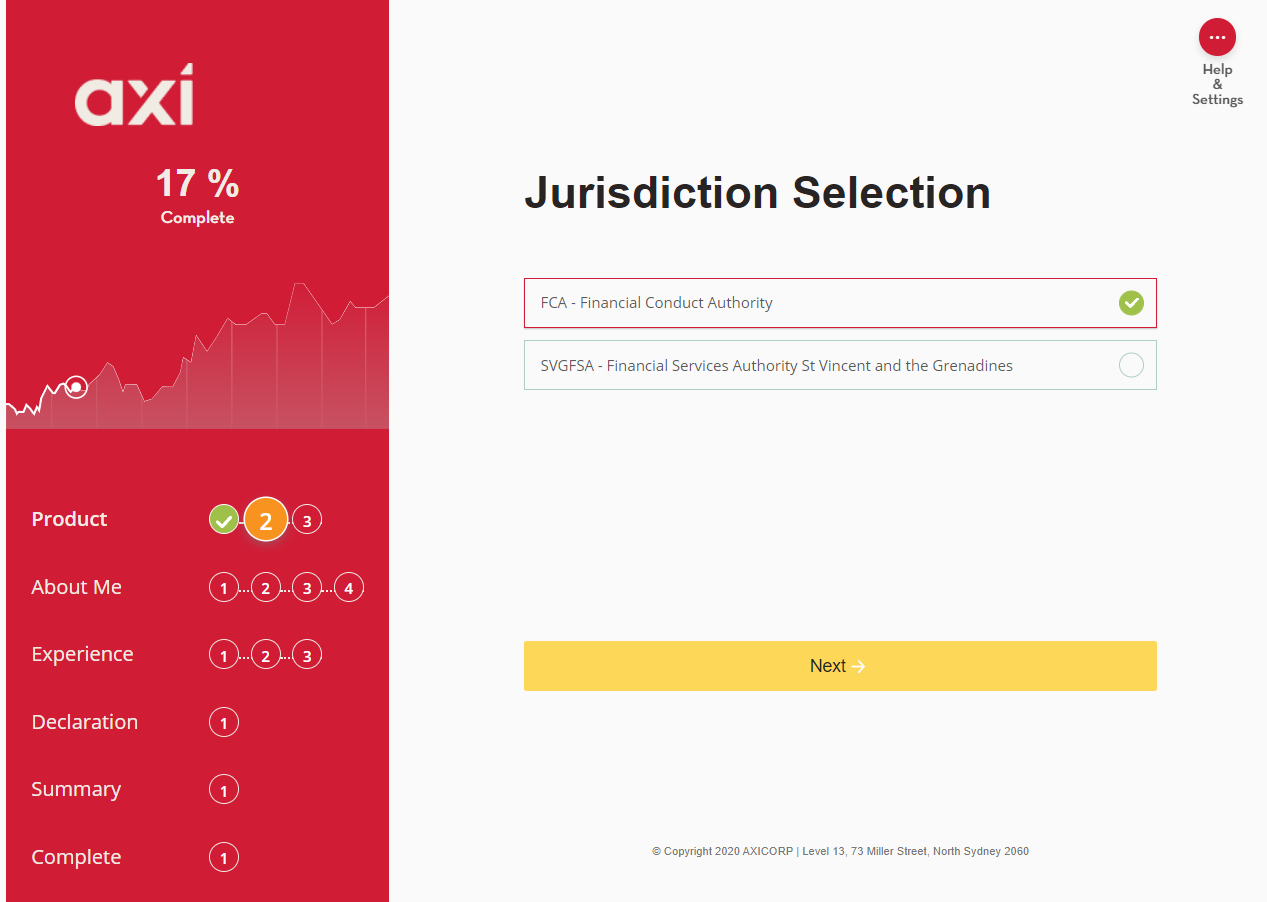

Step 3: Choose Regulatory Authority and Base Currency

Clients residing in the UK can choose to open an account and get registered under 2 regulatory authorities. In this step, traders can choose between FCA and SVGFSA. Traders must always choose FCA as this will grant them protection under FCA regulation.

However, those who wish to trade with high leverage with no protection can choose SVGFSA but this is very risky. Traders can also choose the account currency in this step between GBP, CHF, EUR, PLN, and USD.

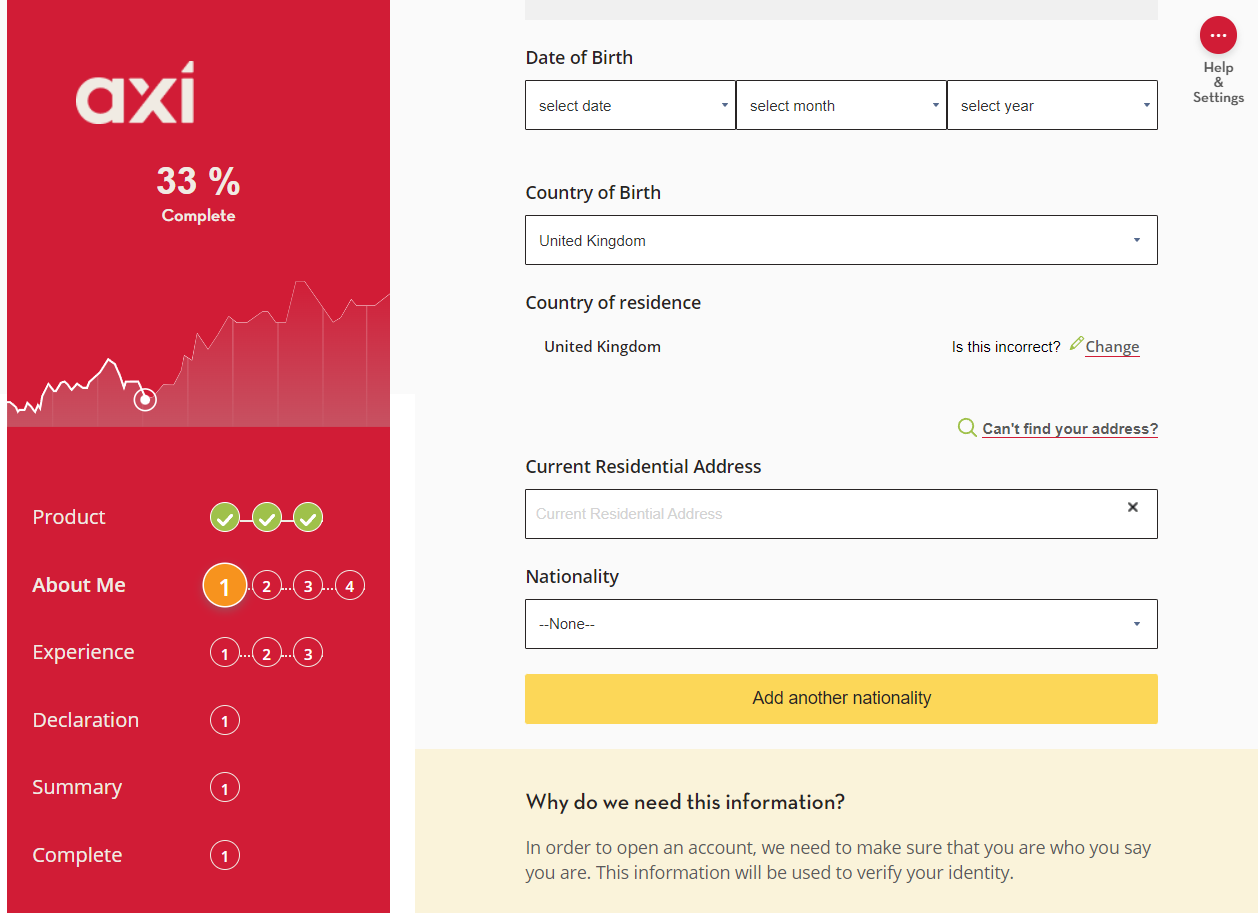

Step 4: DOB and Address

In the next step, traders need to provide further details of their name, date of birth, and address. These details will be verified by submitting a soft copy of the documents. Hence, the entered details should be the same as that on the documents.

Executives at AxiTrader will verify your details with the document before you can start trading. On a business day, this process can take a few hours to a day. Once the account is verified, the account opening process is almost complete.

Step 5: Trading Experience

AxiTrader requires the details of your trading experience before account opening. Traders need to answer a few basic questions like experience in the forex market and a few other questions.

Step 6: Fund Your Acount

After signing the declaration, the last step is to fund the account to begin trading at AxiTrader. There is no lower limit on minimum deposit as traders can deposit as low as $1 through their preferred method of investment.

AxiTrader Deposits and Withdrawals

AxiTrader Deposit/Withdrwal Pros

- No Deposit or Withdrawal Fees: Axi does not charge any fees for deposits or withdrawals, which can help reduce overall trading costs.

- Multiple Deposit Methods: Axi supports a variety of deposit methods, including bank wires, credit and debit cards, and e-wallets like Skrill and Neteller, providing flexibility for traders.

- Multi-Currency Accounts: Axi offers accounts in multiple base currencies, which can help avoid conversion fees and is beneficial for international traders.

AxiTrader Deposit/Withdrawal Cons

- Withdrawal Method Limitations: While Axi offers various withdrawal methods, it’s noted that funds deposited via credit/debit card cannot be withdrawn back to the card and must be withdrawn via bank transfer, which may be less convenient for some users.

- Variation in Account Features by Jurisdiction: The features and proposals for accounts may vary depending on the trader’s jurisdiction, which could affect the availability of certain benefits or trading conditions.

The deposits as well as withdrawals are free of any additional commission and do not have any lower limits. Clients residing in the UK can deposit and withdraw at AxiTrader through Debit/credit cards, e-wallets, bank transfers, and cryptocurrencies.

The withdrawals can only be made through the method used for deposits. The source of payment needs to be registered with the name of the account holder. Third-party transactions are not supported at AxiTrader.

The deposits through bank transfer and e-wallets are reflected within an hour while the withdrawals can take up to 5 business days to reflect in the accounts.

AxiTrader Trading Platforms

MT4 is the only available trading platform at AxiTrader. MetaTrader 4 is the most widely used trading platform developed by MetaQuotes Software in 2005. It has a simple interface, fast processing, and good compatibility with all types of electronic devices.

The MT4 trading platform can be downloaded on android, iOS, Windows, and macOS and linked with the AxiTrader trading account.

AxiTrader also offers a separate copy trading app and MyFxbook. The copy trading app can be downloaded on Android and iOS devices to copy any trader at Axi. The MyFXbook is an AutoTrade service that needs to be connected with the main account with a minimum deposit of $1000.

The unavailability of MT5, cTrader, or any other trading platform apart from MT4 is a disadvantage for those who do not prefer to trade with MT4.

AxiTrader Research and Education Tools

AxiTrader is a well-established online trading broker that offers a range of research and educational tools to support traders in making informed decisions. Let’s explore the research and education resources provided by AxiTrader:

Market Analysis: AxiTrader provides comprehensive market analysis, including daily market updates, economic news, and expert commentary across various financial markets. Traders can access these reports to stay up-to-date with the latest market developments and identify potential trading opportunities.

Trading Central: AxiTrader partners with Trading Central, a reputable third-party research provider. Through this collaboration, traders gain access to technical analysis reports, trading signals, and market insights for different asset classes. These resources can assist traders in generating trading ideas and enhancing their decision-making process.

Economic Calendar: AxiTrader offers an economic calendar that displays upcoming economic events, such as central bank meetings, economic data releases, and geopolitical developments. This tool enables traders to anticipate potential market volatility associated with these events and adjust their strategies accordingly.

Webinars and Educational Materials: AxiTrader conducts webinars and provides educational materials covering a wide range of trading topics. These resources cater to traders of all levels, offering valuable insights into technical analysis techniques, risk management strategies, and trading psychology. Traders can leverage these educational materials to enhance their trading knowledge and skills.

It’s worth noting that the availability and extent of research and educational tools may vary based on the trader’s account type and jurisdiction. Traders should consult with AxiTrader or refer to their website to confirm the specific research and educational resources accessible to them.

AxiTrader Trade Execution Method

AxiTrader operates with a Straight Through Processing (STP) trade execution model. Here’s an overview of how their trade execution method generally works:

STP Execution: AxiTrader employs an STP model, directly forwarding clients’ trade orders to liquidity providers like banks, without using a dealing desk.

Direct Market Access: Through STP, AxiTrader aims to offer traders direct access to the interbank forex market, potentially leading to quicker execution and tighter spreads.

No Dealing Desk: AxiTrader emphasizes the absence of a dealing desk, ensuring trades are processed transparently without broker interference.

Variable Spreads: Typically, AxiTrader provides variable spreads that adjust based on market conditions, generally tightening during high liquidity periods.

Market Depth: STP may grant traders insight into market depth, revealing bid and ask prices beyond the surface level.

Price Aggregation: AxiTrader likely combines prices from multiple sources to present competitive rates to traders.

No Requotes: Under the STP model, traders are less likely to face requotes. Orders are executed based on prevailing market prices.

ECN Accounts: AxiTrader might extend ECN accounts, offering direct liquidity access and potentially narrower spreads.

Swift Execution: STP execution is designed for speedy and seamless order execution, minimizing delays.

AxiTrader Customer Support

The customer support services at AxiTrader are excellent in the UK. They also have a local office in London and offer toll-free local phone numbers for customer support. The following support services are available at AxiTrader from Monday to Friday 24*7.

- Live Chat: The live chat services are available through their website and app. Additionally, registered clients can also resolve their queries through WhatsApp. They take less than 2 minutes to revert to the live chat window with a helpful reply.

- Email: Clients can also raise their queries through email. This is a slower method to reach out to the support executives as it can take more than an hour to get back.

- Local Phone Support: Clients residing in the UK can reach out to the support executives directly by calling on +44 203 544 9646. It is a toll-free number in the UK and is available 24*7 from Monday to Friday.

There are no issues with the customer support services at AxiTrader in the UK. The help centre at the official website of AxiTrader can resolve most of your queries through FAQs.

Available Instruments

At the time of this review, the total number of available instruments at AxiTrader is less than 150. Compared to other FCA-regulated brokers in the UK, Axi offers fewer instruments to trade. Following are the details of available instruments.

- 39 Forex Pairs: Only 39 forex pairs can be traded at AxiTrader in the UK. This includes 7 major pairs with max leverage of 1:30, 13 minor pairs, and 19 exotic pairs each with a maximum leverage of 1:20.

- 15 Commodities CFDs: Gold, Silver, Platinum, Copper, Crude, Brent, and other commodities can be traded in a spot as well as future CFDs. The maximum leverage is 1:20 for Gold and 1:10 for all other metals.

- 50 Stock CFDs: CFDs of 50 stocks can be traded at Axi from the US, UK, and European exchanges with a maximum leverage of 1:5.

- 36 Cryptocurrency CFDs: Crosses of 36 cryptocurrencies are available to trade as CFDs at AxiTrader with a maximum leverage of 1:2.

- 13 Index CFDs: Indices from major stock exchanges can be traded as CFD with maximum leverage of 1:20. Indices can be traded as spot CFD as well as future CFD.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 39 | 1:30 for majors, 1:20 for Minors |

| Indices | 13 | 1:20 |

| Commodities | 15 | 1:20 for Gold, 1:10 for others |

| Shares | 50 | 1:5 |

| Cryptocurrencies | 36 | 1:2 |

Although there is a wide range of markets available for trading on MT4 still the number is lesser when compared with other FCA-regulated brokers in the UK.

It must be noted that all the available instruments at AxiTrader can only be traded as CFD. This means that there is no actual buying or selling of the instruments but only the price difference is speculated and cash-settled to book profits or losses.

Do We Recommend AxiTrader?

Yes, AxiTrader is an FCA-regulated forex and CFD broker that uses the market maker trade execution techniques. They can take another side of the trade but are well-regulated and transparent and can be considered safe.

AxiTrader offers local phone support in the UK with GBP as the base account currency. No commission or currency conversion fee will be applicable to UK clients at AxiTrader.

MT4 is the only trading platform that allows trading on less than 150 instruments. Hence, AxiTrader might not be ideal for traders who do not want to trade with MT4.

AxiTrader UK FAQs

Is Axi regulated in UK?

Yes, AxiTrader is an FCA-regulated forex and CFD broker. It is registered at FCA with legal entity Axi Financial Services (UK) Ltd under license number 466201.

How much is minimum deposit to Axi?

There is no lower limit on the deposit and withdrawal amount at AxiTrader in the UK. The minimum deposit amount for retail traders is 1 unit of the base account currency. To trade with the elite account, professional traders need to deposit a minimum of $25,000.

Is Axi trustworthy?

Yes, AxiTrader is regulated by top-tier regulatory authorities like FCA and ASIC. It is a market maker but can be trusted to trade forex and CFDs in the UK. In case of an unsettled dispute between the broker and clients, clients are protected by up to GBP 85,000.

How do I withdraw money from Axi?

Clients residing in the UK can deposit and withdraw at AxiTrader through credit/debit cards, e-wallets, bank transfers, and cryptocurrencies. The withdrawal method needs to be the same as the deposit method.

Is AxiTrader a good broker?

Yes, AxiTrader is an FCA-regulated broker with GBP as the base currency. They offer local phone support in the UK and allow free deposits and withdrawals through local bank transfers.

Is Axi a market maker?

Yes, AxiTrader is an FCA and ASIC-regulated forex broker that uses a ‘market maker’ execution technique. They have clearly mentioned this in their execution policy. Being a market maker, Axi can take the opposite side of the trading position opened by clients.