4 Best Forex Trading Platform UK 2024

There are multipe forex trading platforms available in the UK. If you cannot decide which trading platform to choose for forex and CFD trading, this guide might be helpful.

The daily trading volume in the forex market has been on a constant rise since it became available on electronic trading platforms. Any individual can trade forex pairs through any of the devices from anywhere in the world. However, you will require a trading platform that not only connects you to the forex market but can also enhance your trading experience through distinct features.

Online forex trading in the UK is regulated under the Financial Conduct Authority (FCA) of the UK. All forex brokers are required to hold a regulatory license from the FCA to accept clients residing in the UK. There are several FCA-regulated forex and CFD brokers in the UK. Each broker may offer multiple trading platforms for trading forex pairs online.

In this guide, we have mentioned and described the pros and cons of the best forex trading platforms in the UK. These platforms are offered by the FCA-regulated forex and CFD brokers in the UK.

List of Best Forex Trading Platform UK

- MetaTrader 4 – City Index, Pepperstone, CMC Markets, ETX Capital

- MetaTrader 5 – Pepperstone, Forex.com, FXTM, ActivTrades

- cTrader – Pepperstone, FxPro

- eToro – eToro’s trading platform

Following are the best forex trading platforms in the UK that are offered by several FCA-regulated forex brokers in the UK. Some proprietary trading platforms are only available with one broker while many third-party platforms can be chosen via multiple forex brokers.

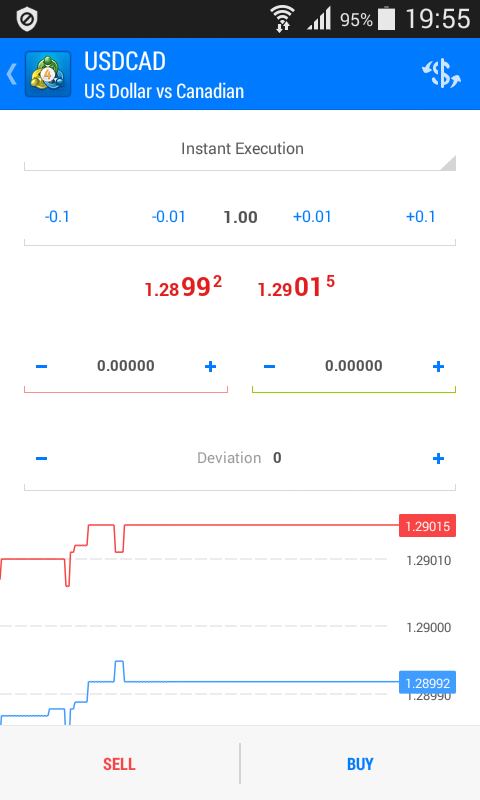

#1 MetaTrader 4 – City Index, Pepperstone, CMC Markets, ETX Capital

The MT4 or MetaTrader 4 is the most popular forex trading platform around the globe. It was developed by MetaQuotes Software in 2004 and has been widely chosen as a trading platform by thousands of traders worldwide.

MetaTrader 4 was the first forex trading platform that was chosen by a large number of retail traders. It is also responsible for the increased participation by retail traders in the forex market.

Since its inception in 2004, the MT4 trading platform has been revamped several times. Currently, the platform has several features for algorithmic and advanced traders as well. MT4 uses the MQL4 language for algorithmic trading.

Apart from market execution, the types of orders supported by the MT4 forex trading platform are buy stop, buy limit, sell stop, and sell limit orders.

The MetaTrader 4 trading platform is provided by City Index, Pepperstone, CMC Markets, ETX Capital and several other FCA regulated CFD brokers in the UK. The number of available instruments depends on the broker selected by the client.

Several stock exchanges are not available on the MT4 platform. The number of available instruments, timeframes, indicators, and tools for market analysis is lesser than MT5 which is a major disadvantage for advanced traders.

However, MT4 has a user-friendly interface and easy access to forex pairs CFD and several other CFD instruments. Despite being one of the oldest trading platforms, MT4 is still used by a large number of traders. It is still considered a good choice for beginners due to its simplicity and ease of use.

MetaTrader 4 Pros

- MT4 is ideal for beginners

- Most chosen forex trading platform in the world

- User-friendly interface

- Supported by a large number of brokers

- 9 timeframes available

- 4 types of pending orders supported

MetaTrader 4 Cons

- Limited number of instruments can be traded

- Several stocks cannot be traded on MT4

- The economic calendar is not available

- Complex user interface looks like Windows 98

Best Brokers in UK with MT4 Trading Platform

1) City Index

City Index is regulated by the FCA under license number 446717. City Index is the trading name of the legal entity Stonex Financial Limited. The firm is publically listed on NASDAQ and is also regulated by the ASIC of Australia.

The average spread for EUR/USD at City Index is 0.8 pips. They do not charge a commission for trading forex. Clients can trade on more than 4000 instruments with GBP as the base currency.

2) Pepperstone

Pepperstone UK is regulated by the FCA under license number 684312. They are also regulated in Germany, Cyprus, Australia, the United Arab Emirates, the Bahamas, and Kenya. Hence can be considered safe with low third party risk.

Pepperstone offers two account types. The standard account is based on spread only while the Razor account involves a very low spread with the trading commission. The average typical spread for EUR/USD with the Standard and Razor account are 0.7 and 0.1 respectively. The Razor account additionally incurs a commission of GBP 4.50 per round trade of a standard lot.

Pepperstone is among the few forex brokers in the UK that offer MT4, MT5, as well as cTrader trading platforms. GBP can be chosen as the base currency of the account with any of the trading platforms. Pepperstone allows trading on more than 1200 financial instruments including 60+ currency pairs.

3) CMC Markets

CMC Markets is among the oldest forex brokers in the UK and is regulated by the FCA under license number 173730. CMC Markets is also regulated in Germany, Canada, Australia, New Zealand, Singapore, and the United Arab Emirates. They are also publically listed on the London Stock Exchange.

The trading fees at CMC markets are built into spreads. The average typical spread for EUR/USD is 0.7 pips with no commission. CMC Markets also offer a separate spread betting account.

Apart from MT4, CMC Markets also offer a proprietary trading platform called Next Generation. However, it is also based on MT4. They offer more than 11,500 trading instruments including 336 currency pairs.

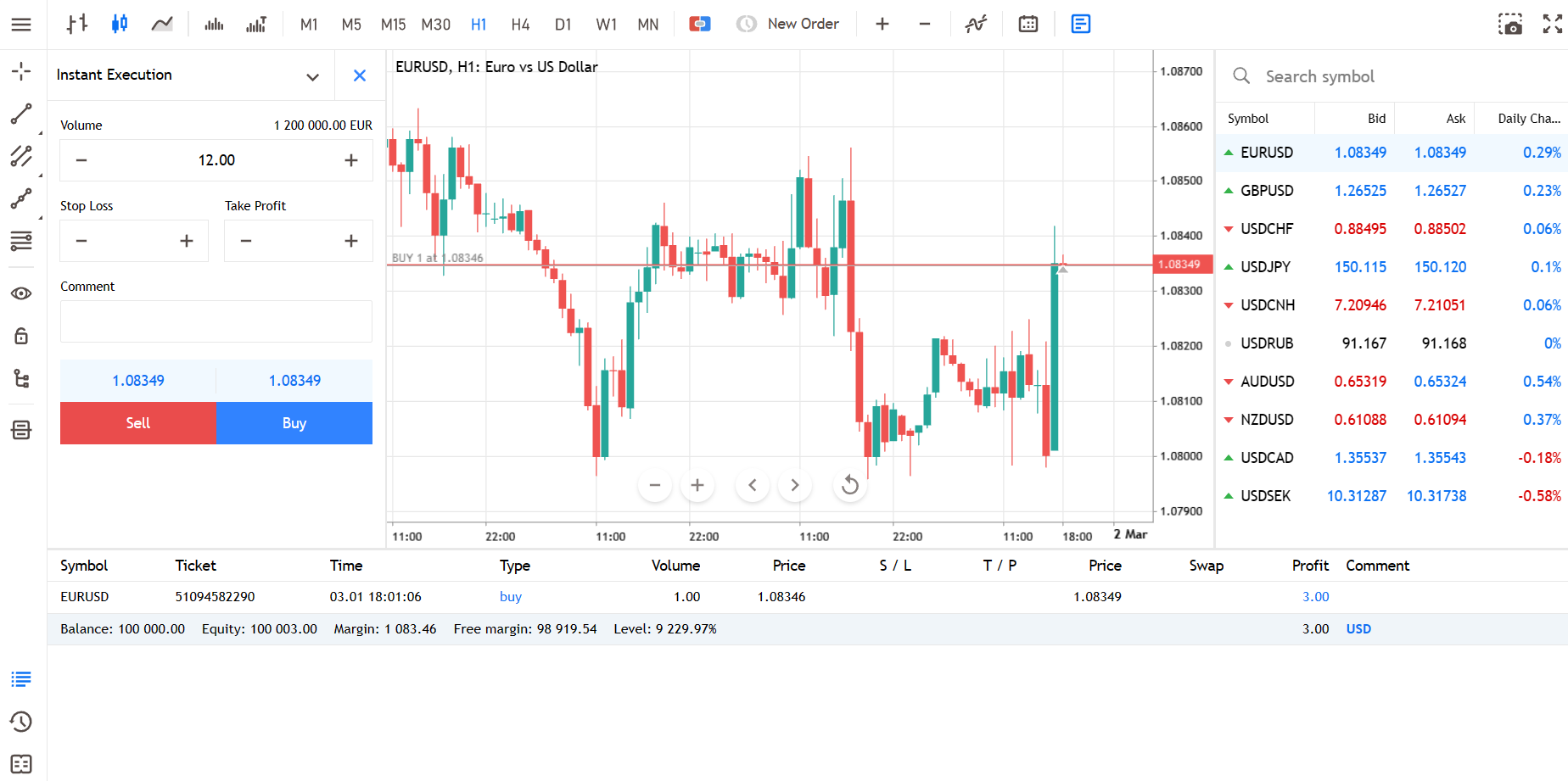

#2 MetaTrader 5 – Pepperstone, Forex.com, FXTM, ActivTrades

MT5 or MetaTrader 5 is an advanced version of MT4 launched in 2009 by MetaQuotes Software. MT5 may sound like an upgraded version of MT4 but it is created for a different type of trader by the same developer company.

MT5 is ideal for advanced traders who use multiple tools and algorithms for trading. Stocks can also be traded on MT5. However, the number of available instruments depends on the broker that you choose to trade with. The use of the MT5 trading platform has been increasing exponentially in recent years.

MT5 trading platform is offered by Pepperstone, Forex.com, FXTM, ActivTrades, and several other FCA-regulated CFD brokers in the UK.

Apart from market execution, the types of orders supported by the MT4 forex trading platform are buy stop, buy limit, sell stop, sell limit, buy stop-limit, and sell stop-limit orders.

The MT5 trading platform is ideal for advanced traders as it uses the MQL5 programming language for algorithmic trading. MQL5 is an Object-Oriented Programming (OOP) language based on C++ that allows traders to provide advanced commands to their algorithms.

Compared to MT4, the MetaTrader 5 trading platform has a higher number of indicators, timeframes, and tools for analysis. It is also much faster than MT4 in processing complex algorithms and testing.

MT5 is among the best forex trading platforms in the world that also allow clients to trade with stocks and futures. Those forex traders who also wish to trade with other financial instruments may find MT5 ideal for themselves. However, MT5 may not be ideal for beginners as it is designed for advanced traders.

MetaTrader 5 Pros

- MT5 allows trading on stocks and several other assets

- It allows advanced algorithmic trading based on MQL5

- 21 timeframes are supported in MT5

- Highest number of Indicators and charts

- 6 types of pending orders supported

- The economic calendar is available

MetaTrader 5 Cons

- MT5 is not ideal for beginners

- Complex user interface looks like Windows 98

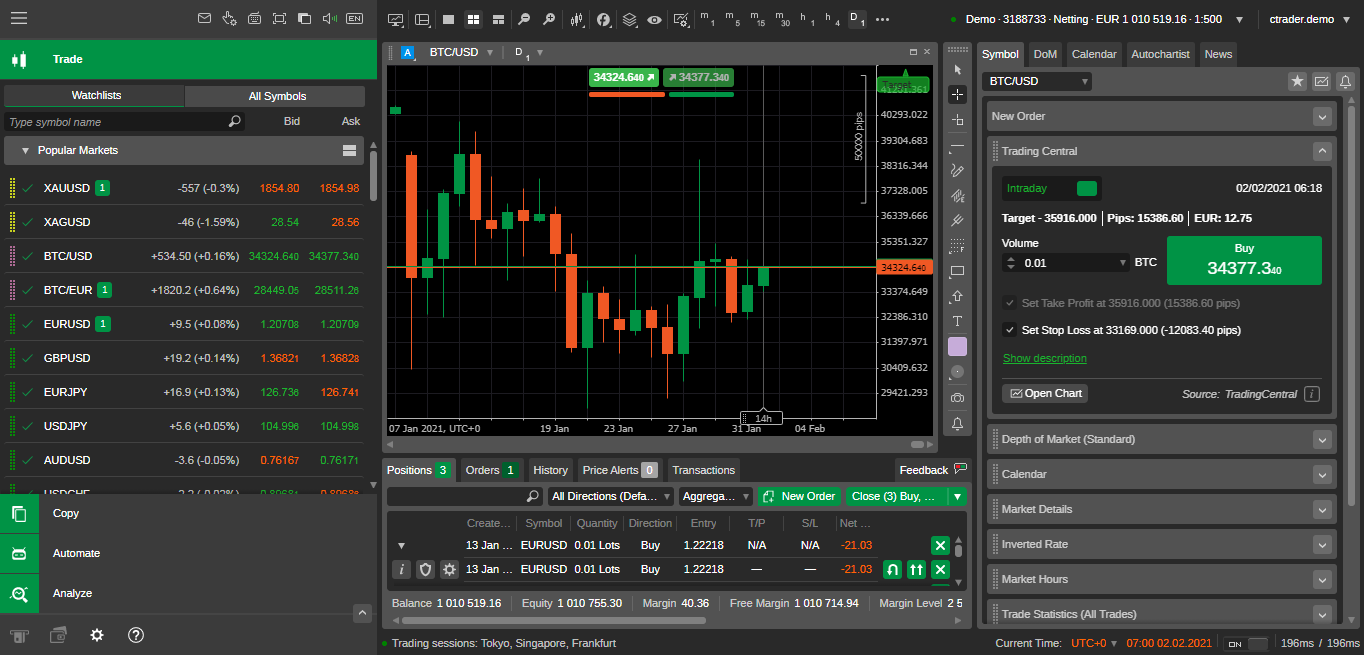

#3 cTrader – Pepperstone, FxPro

cTrader is a forex trading platform that was incorporated in 2011 by Spotware System Ltd. It is also a third-party trading platform that is supported by a lot of CFD brokers worldwide.

cTrader has a modern-looking interface with simple access to analysis and charting tools. It uses the C programming language for algorithmic trading. The C programming language is much simpler to encode and compile compared to MQL4 and MQL5. cTrader makes it easier for basic traders to try algorithms in their trading strategies.

It offers a wide variety of indicators, charts, and tools for analysis. Multiple financial instruments apart from forex pairs can be traded with cTrader. The calculation of risk and reward is also easier with cTrader compared to MT4 and MT5.

Details like days low/high spreads, trading volume, depth of market, etc for each available instrument are mentioned in the list. The types of pending orders supported include buy stop, buy limit, sell stop, sell limit, buy stop-limit, and sell stop-limit orders. cTrader is a highly customizable trading platform where the themes and background colour patterns can also be changed.

The cTrader is offered by a comparatively lesser number of brokers than MetaTrader. Currently, the cTrader is supported by Pepperstone, FxPro, and a few more FCA-regulated forex brokers in the UK.

Traders who wish to trade with a simple and modern-looking interface with a separate toolbox for each chart and several other features can trade with the cTrader forex trading platform. Copy trading is much simple to do with cTrader as it is the key feature of choosing cTrader over MT4 and MT5. Compared to MetaTrader 4 and 5, the number of users is much lesser with the cTrader trading platform.

cTrader Pros

- cTrader is ideal for all types of traders

- The look and feel of the cTrader Platform are modern and customizable

- Algorithmic trading can be done with C# language

- Separate toolbox for each chart

- 70 Indicators available

- Easy to switch between multiple accounts

- Simple copy trading feature

cTrader Cons

- cTrader is only available with a limited number of brokers in the UK

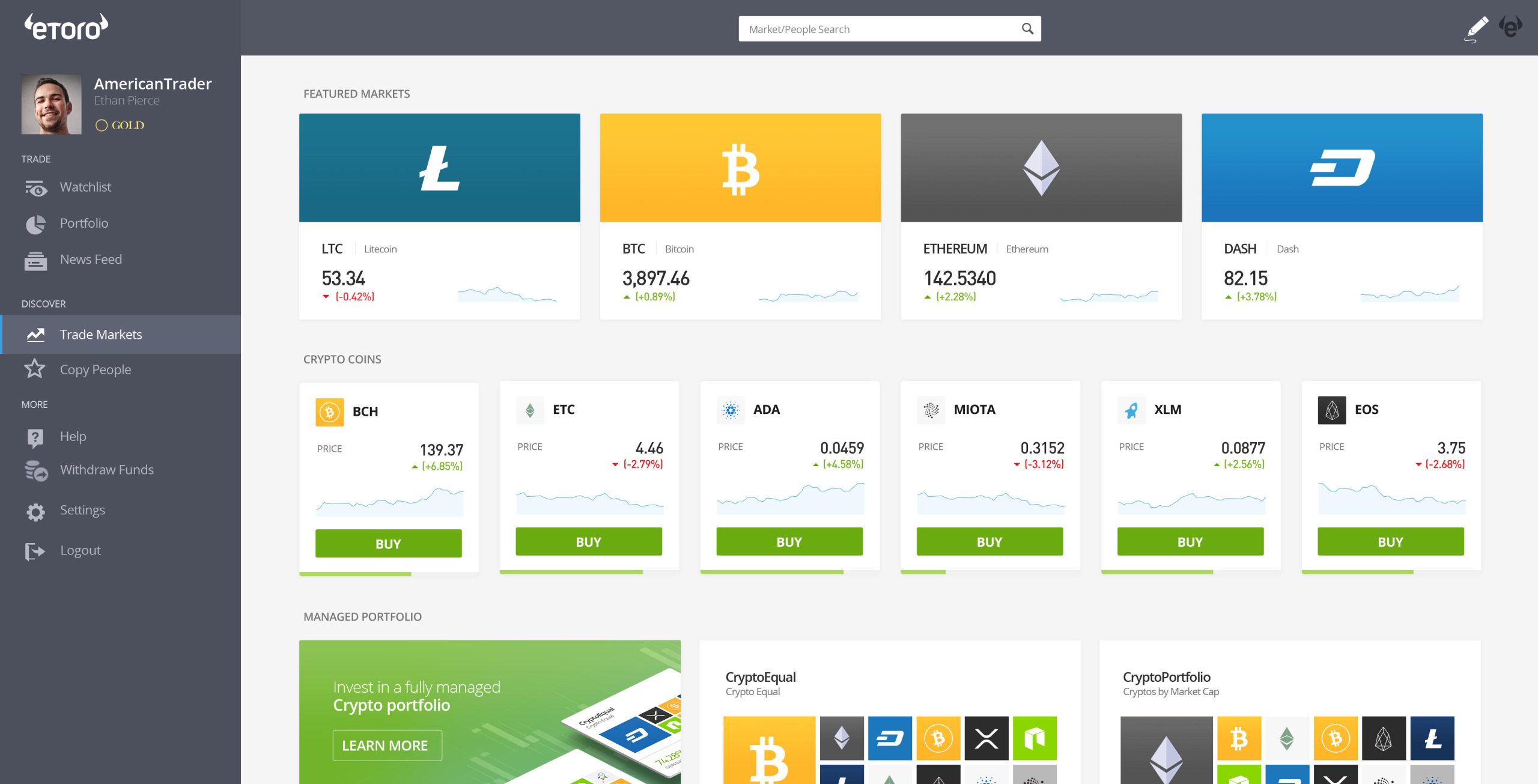

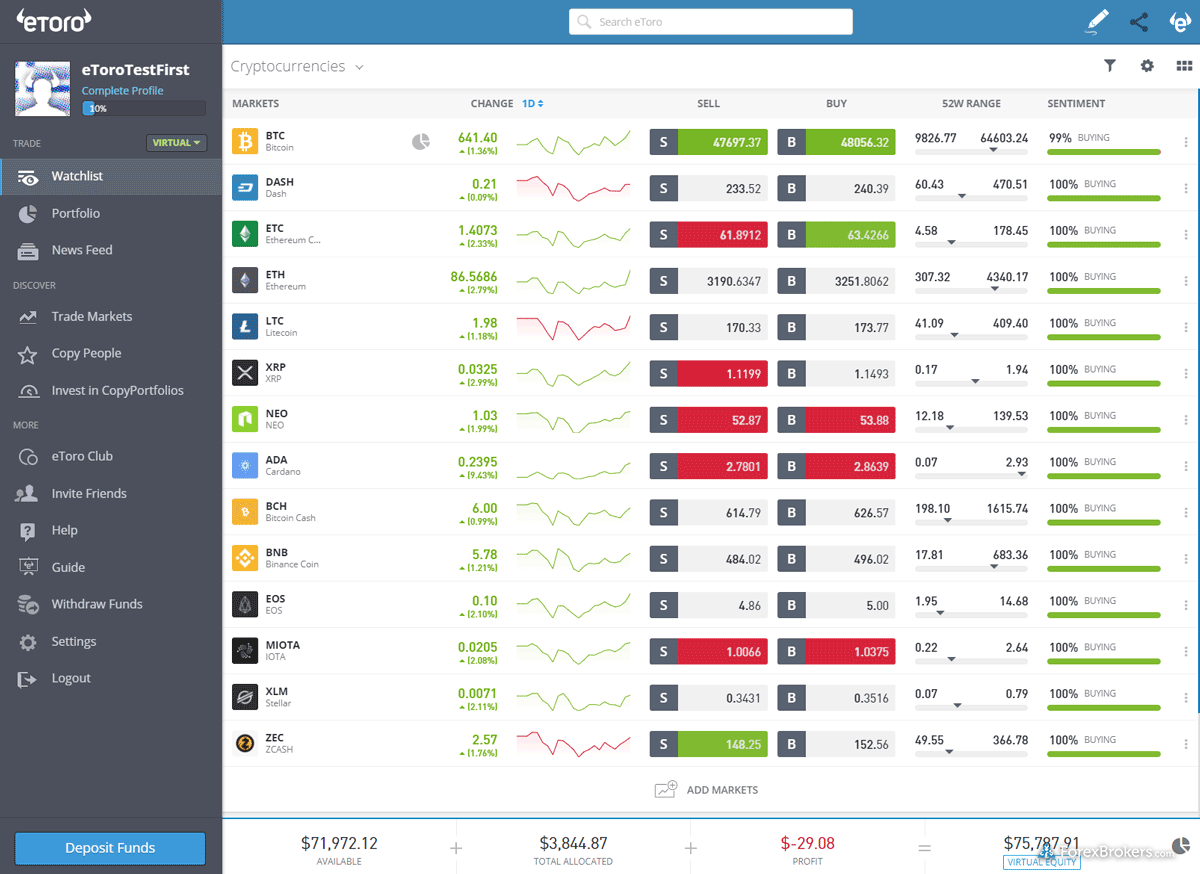

#4 eToro – eToro’s trading platform

eToro is a proprietary trading platform designed by eToro (UK) Ltd. This means that this platform can only be used if you have opened an account with eToro.

The platform has a very simple user interface when compared with MetaTrader or cTrader platforms.

The eToro trading platform is the most ideal for beginners. However, advanced traders may not find eToro useful as it lacks a lot of advanced features when compared to MT5 and cTrader.

The eToro trading platform cannot be automated. This means that algorithmic trading cannot be done. However, the social trading feature is quite useful. Each instrument has a separate social media feed on the platform where traders can share their opinion and connect with other traders.

There is also a separate news feed for each instrument. The stats window on each instrument covers every important detail of the instrument that traders must know.

eToro has a unique copy trading feature in which any trader with a public profile at eToro can be copied by any other trader without any additional commission. The performance of each trader is visible along with the portfolio and trading history. The traders that are followed by multiple traders and have sizeable assets under copy (AUC) are rewarded by eToro.

A total of 3000 assets can be traded with the eToro trading platform. The charts are interactive but only have limited features. 9 timeframes 50 indicators can be used for analysis.

eToro Pros

- eToro has a very simple user-interface

- It is ideal for beginners in forex trading

- The copy trading feature is easier to use compared to other platforms

- Each instrument has a separate social media feed and news segment

eToro Cons

- No algorithmic or automated trading can be done apart from copy trading

- Only available with eToro broker

- Lesser number of timeframes, indicators, and tools.

How to Select the Best Forex Trading Platforms?

Apart from the ones mentioned above, there are many more forex trading platforms available with FCA-regulated CFD brokers in the UK. Some brokers offer only one platform while many allow traders to choose the best platform for themselves. The following are factors to consider while choosing a forex trading platform in the UK.

1) Choose According to Your Needs

Each forex and CFD trading platform will have distinct features. Some will have a higher number of indicators while others will have a unique copy trading feature. You cannot identify the best-suited platform for yourself if you are not certain about your requirements.

If you are new to forex and CFD trading through platforms, you may seek a user-friendly platform with basic features. If you wish to trade with automation and advanced strategies, you will definitely want the platform to support algorithmic trading. It is important to choose a trading platform according to the requirements of the traders.

2) Don’t Follow the Trend

When MetaTrader 5 came into the market in 2010, a lot of forex traders switched from MT4 to MT5 as was new and fast. However, soon many traders found it complex and turned back to MT4. It is important to understand that MT4 and MT5 are designed for different types of audiences. This is the reason that many traders still prefer MT4 even after a decade since MT5 was incorporated.

Traders might miss out on opportunities by going after the trend while choosing a trading platform.

3) Do Your Own Research

There are hundreds of articles and write-ups on the internet regarding the best forex trading platforms. However, no single platform can be considered best as each platform has different pros and cons.

Clients must try each platform with demo accounts to test the suitability and comfort of the chosen trading platform. Clients must check all the available features and do their own research instead of following an influencer, magazine, or website. Clients must keep their distance from unsolicited advisories

and recommendations.

4) Trade with the One you are Comfortable With

All the features, indicators, time frames, and tools are of no use if you are never going to use them. Many traders choose the platform with the highest number of tools and indicators that are of no use to them.

The sole purpose of choosing the best forex trading platform is that your trading experience should be good and you must be comfortable with the platform. Choosing complex platforms with a plethora of tools will not make you a better trader. You should always trade with the platform that feels most comfortable with.

Common Mistakes While Trading Forex

When trading on Forex platforms, traders often make certain mistakes that can have a negative impact on their trading performance. It is crucial to be aware of these common mistakes and take measures to avoid them. Here are some pitfalls to watch out for:

- Absence of a Trading Plan: Failing to create a well-defined trading plan is a common mistake. Traders should outline their trading goals, strategies, risk tolerance, and money management rules in a comprehensive plan. Without a plan, traders may make impulsive decisions driven by emotions or market noise.

- Emotional Decision-Making: Allowing emotions, such as fear, greed, or impatience, to influence trading decisions can lead to poor outcomes. Emotional trading often results in chasing trades, holding onto losing positions for too long, or exiting profitable trades prematurely. Traders should strive to maintain discipline and adhere to their trading plan.

- Overtrading: Engaging in excessive trading without a valid reason or exceeding one’s risk tolerance is known as overtrading. This mistake can increase transaction costs, overexpose traders to the market, and raise the likelihood of making errors. Quality trades should take precedence over quantity.

- Ignoring Risk Management: Neglecting proper risk management is a significant mistake. Traders should determine appropriate position sizes, set stop-loss orders to limit potential losses, and consider risk-reward ratios before entering trades. Without sound risk management, traders may face significant losses that can impact their trading capital.

- Lack of Patience and Discipline: Successful Forex trading requires patience and discipline. Impatient traders may enter trades prematurely or exit too soon, missing out on potential profits. It is essential to exercise patience, wait for suitable trade setups, and adhere to the trading plan consistently.

- Failure to Adapt to Market Conditions: Markets are dynamic, and traders need to adapt their strategies accordingly. Failing to adjust trading approaches based on changing market conditions can lead to poor performance. Traders should stay updated on market developments and be flexible in their trading strategies.

- Neglecting Fundamental Analysis: While technical analysis is commonly used in Forex trading, disregarding fundamental analysis can be a mistake. Fundamental factors, such as economic indicators and central bank policies, can significantly impact currency prices. Traders should consider both technical and fundamental analysis to make informed trading decisions.

- Insufficient Education and Research: Inadequate knowledge about Forex markets and trading strategies is a prevalent mistake. Traders should continuously educate themselves, stay updated with market news and analysis, and conduct thorough research before making trading decisions.

Avoiding these common mistakes requires discipline, ongoing learning, and adherence to a well-defined trading plan. Forex trading should be approached as a long-term endeavor, focusing on building consistent and sustainable trading strategies.

Latest Development in Trading Platforms with AI and Machine Learning

Market Prediction: AI algorithms analyze historical and real-time market data to predict future trends.

Automated Trading: Machine learning helps in developing sophisticated trading bots that execute trades based on predefined criteria.

Risk Management: AI tools assess risk levels in trading strategies, helping to minimize potential losses.

Personalized Insights: Providing tailored trading recommendations based on individual trading patterns and preferences.

Sentiment Analysis: Analyzing social media and news to gauge market sentiment, which can influence trading decisions.

Fraud Detection: AI-driven systems to detect and prevent fraudulent activities in trading accounts.

Customer Service: Chatbots and virtual assistants powered by AI to provide instant customer support and guidance.

Portfolio Management: AI tools offering optimized portfolio management solutions based on market conditions and individual risk profiles.

Other Popular Trading Platforms

NinjaTrader

Overview: NinjaTrader stands out as a versatile platform, particularly favored by day traders. It excels in offering advanced charting capabilities, robust customization options, and seamless support for automated trading strategies.

Key Features: Notable features include advanced charting tools, extensive customization options, automation capabilities, market replay for practice, and a variety of order types.

User Base: NinjaTrader predominantly attracts day traders looking for a dynamic and customizable platform.

Cost: The platform offers a free version with basic features, while advanced features require a subscription or a one-time purchase.

Thinkorswim

Overview: Thinkorswim, now under the Charles Schwab umbrella, is a comprehensive trading platform well-regarded for its sophisticated charting, an array of technical analysis tools, and access to a wide spectrum of financial markets.

Key Features: Highlights include advanced charting functionality, a rich toolkit for technical analysis, diverse market access (including stocks, options, futures, and forex), a paper trading mode for risk-free practice, and a wealth of educational resources.

User Base: Thinkorswim caters to a diverse community of traders, from investors to day traders and options traders.

Cost: The platform is free for TD Ameritrade account holders, although it’s important to note that associated fees may apply.

TradingView

Overview: TradingView is a web-based platform valued for its user-friendly interface and powerful charting features. Although not a full trading platform, it is widely embraced for chart analysis and collaborative idea sharing.

Key Features: It offers interactive and customizable charts with a broad selection of technical indicators and drawing tools. Additionally, it provides a social networking component for idea sharing, broker integration for direct order execution, and the ability to set alerts for price and indicator triggers.

User Base: TradingView is particularly popular among technical analysts, chart enthusiasts, and traders seeking a flexible charting solution.

Cost: A free version with basic features is available, and paid subscriptions unlock enhanced functionality and real-time data.

Comparison of Best Trading Platforms in UK

| Trading Platform | Parent Company | Launch Year | No. Of Indicators | Supported Brokers | |

|---|---|---|---|---|---|

| MetaTrader 4 |

MetaQuotes SoftWare

|

2005

|

60+

|

AvaTrade, Forex.com, FXCM, CMC Market, etc | Visit Broker |

| MetaTrader 5 |

MetaQuotes SoftWare

|

2010

|

38+

|

AvaTrade, Forex.com, etc | Visit Broker |

| CMC Next Gen |

CMC Market

|

2010

|

115+

|

CMC Markets | Visit Broker |

| Interactive Workstation |

Interactive Broker

|

2009

|

62+

|

Interactive Broker | Visit Broker |

| FXCM Trading Station |

FXCM

|

2010

|

20+

|

FXCM | Visit Broker |

Comparison of Best Forex Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Trading Platform Supported | |

|---|---|---|---|---|

| eToro |

1.1 pips

|

$10

|

eToro Platform

|

Visit Broker |

| Pepperstone |

0.77 pips

|

$0

|

MT4, MT5, cTrader

|

Visit Broker |

| FxPro |

1.3 pips

|

$100

|

MT4, MT5, cTrader

|

Visit Broker |

| City Index |

0.8 pips

|

£100

|

MT4

|

Visit Broker |

| CMC Markets |

0.6 pips

|

$0

|

MT4

|

Visit Broker |

| FXTM |

1.8 pips

|

$5

|

MT4, MT5

|

Visit Broker |

FAQs on Best Forex Trading Platforms UK

Which forex trading platform is best?

MT4, MT5, and cTrader are the most chosen forex trading platforms in the world. Some of the proprietary trading platforms like eToro, ETXCapital, etc are also chosen largely.

The best forex trading platform can be different for each trader as each platform has different suitability for traders.

Which is the best forex trading platform in the UK for beginners?

MT4 and eToro can be considered the best trading platforms for beginners. eToro has a much simpler and modern-looking interface. MT4 has all the basic features and advanced tools that are required by traders in the initial phase of forex trading.

Can I trade Forex without a broker?

No, forex cannot be traded as CFD without a broker. Large-volume traders can trade currencies through banks but that is not feasible for retail traders. Forex traders need to open an account with an FCA-regulated forex broker to trade on currency pairs in the UK.

What is the safest forex broker?

Any broker in the UK that is regulated by the FCA can be considered safe for clients residing in the UK. Traders registered under FCA regulation are covered with up to GBP 85,000 in case of an unsettled dispute between broker and client. For additional safety, traders can choose brokers with multiple top-tier regulations like ASIC and FSCA.

What is the cheapest forex trading platform?

Pepperstone is one of the cheapest forex brokers in the UK. It must be noted that the fees are decided by the broker and not the trading platform. Hence, trading and non-trading fees depend entirely on the broker and not the platform. The same platform may incur different trading charges for different brokers.

What is the most successful forex strategy?

There are hundreds of forex trading strategies that are suitable for different traders. Each trader can use his own strategy to make successful trades in forex and CFD trading. Trend trading, scalping, and range trading are among the most successful forex trading strategies.

What app do most forex traders use?

MT4 or MetaTrader 4 is the most used forex trading application and trading platform globally. It is simple and easy to comprehend with the basic user interface. MT4 is followed by MT5 and cTrader in terms of a number of users.

Which forex broker is best for beginners?

Pepperstone and eToro can be considered as best forex brokers for beginners in the UK. eToro has a very simple interface that allows any individual to trade without much understanding of terminologies. For MT4, MT5, and cTrader trading platforms, Pepperstone can be an ideal choice for beginners as it has a low fee and low minimum deposit requirement.

Is forex a gamble?

No, Forex trading cannot be considered gambling if a trader has done research and analysis on price movement. In gambling, the outcome is random and uncertain. However, a trader can analyse market trends, use economic data, and study historic price movements to predict the price movement in future. Forex trading involves high financial risk but it is different from gambling.

What is the easiest forex trading platform?

According to our analysis eToro offers the easiest trading platform that is ideal for beginners. The proprietary trading platform offered by eToro is user-friendly and good social media interface.

What is the difference between a forex broker and a forex trading platform?

Forex trading platforms are electronic trading software that is installed on devices or can be used through the web. Forex trading platforms are provided and maintained by forex brokers. Forex brokers are the firms that connect traders to the forex market via the trading platform.