Best Day Trading Platforms UK 2024

The trend of day trading is increasing dramatically due to substantial demand. Before you begin to day trade in the UK, check out basic details of best day trading platfoms in the UK.

If you have made up your mind to start day trading, you are not the only one. Each day thousands of new retail traders begin their journey to make a daily side income through trading.

Day trading involves financial risk. If you end up choosing a wrong or fake trading platform, the risk is further increased. Hence, before going any further, the first step is to choose a safe and suitable day trading platform in the UK.

In this guide, we have covered everything you need to know about day trading. We have also listed the best trading platforms currently available in the UK along with their short description to assist the traders in choosing the best.

List of Best Day Trading Platforms in UK

- eToro – Best Day Trading Platform for Beginners

- IG Markets – Best Regulated Day Trading Platform

- City Index – Best Overall Day Trading Platform

- CMC Markets – Low Cost Day Trading Platform

- Pepperstone – Best Day Trading Broker with Multiple Trading Platforms

What is Day Trading?

As the name suggests, day trading involves buying and selling financial assets on the same day to book profits or losses. Day trading can be done on numerous financial instruments. However, stocks are traditionally the most common financial asset that is used for day trading.

In recent times, forex, commodities, indices, ETFs, cryptocurrencies, and several other assets are also used for day trading. Any financial instrument whose value changes multiple times during the day is best suited for day trading.

Even the smallest movements in price can be used to book profits due to the availability of leverage. Contract for Deposits (CFD) is gaining tremendous popularity among day traders. CFDs allow traders to speculate on the price movements of underlying assets without physically buying and selling the assets.

There is a significant demand for day trading platforms in the UK. There are more than 30 brokers and financial services providers that offer day trading services. It is very important for traders to be able to identify the best ones.

Best Day Trading Platforms in UK

The best day trading platform depends on the suitability of the trader. Although, we have taken 12 factors into consideration to listing out the best day trading platforms in the UK in 2024.

#1 eToro – Best Day Trading Platform for Beginners

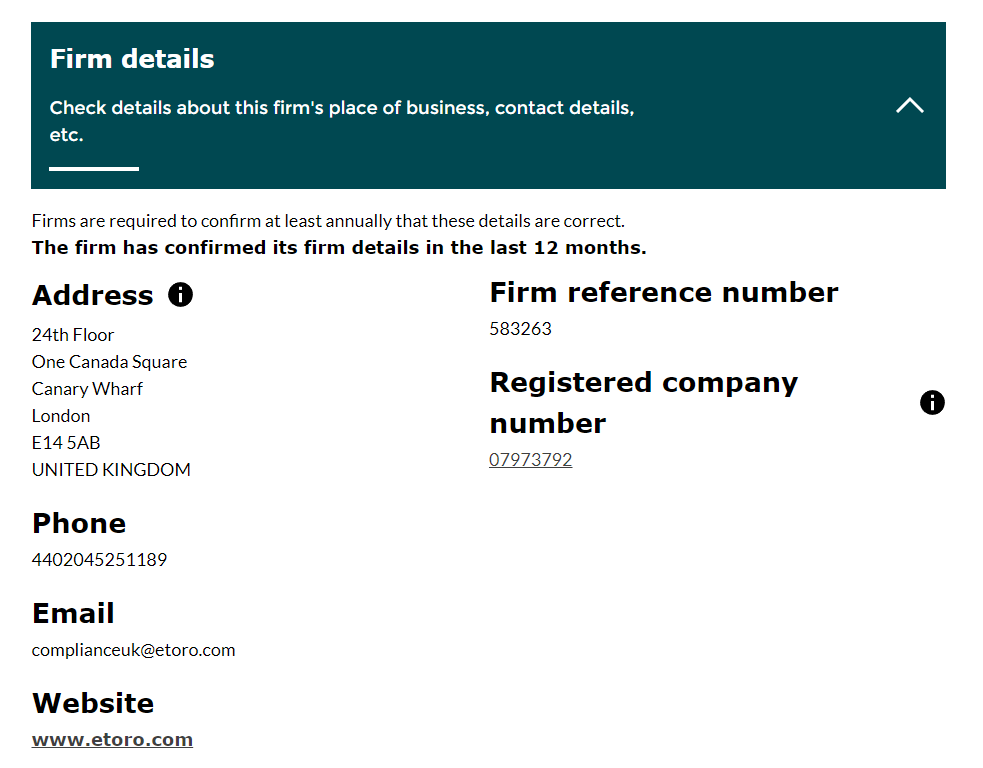

eToro is an FCA-regulated CFD broker that allows trading on its proprietary trading platform.

Regulation: eToro (UK) Ltd is regulated by the Financial Conduct Authority of the UK under license number 583263. They are also regulated by the ASIC of Australia and CySEC of the European Union.

Fees: eToro incurs spread as the only day trading fees in the UK for stocks, ETFs, currencies, commodities, and indices. Cryptocurrencies trading will incur a commission of 1% of the trading amount.

Compared with other FCA-regulated brokers in the UK, the trading fees at eToro are average.

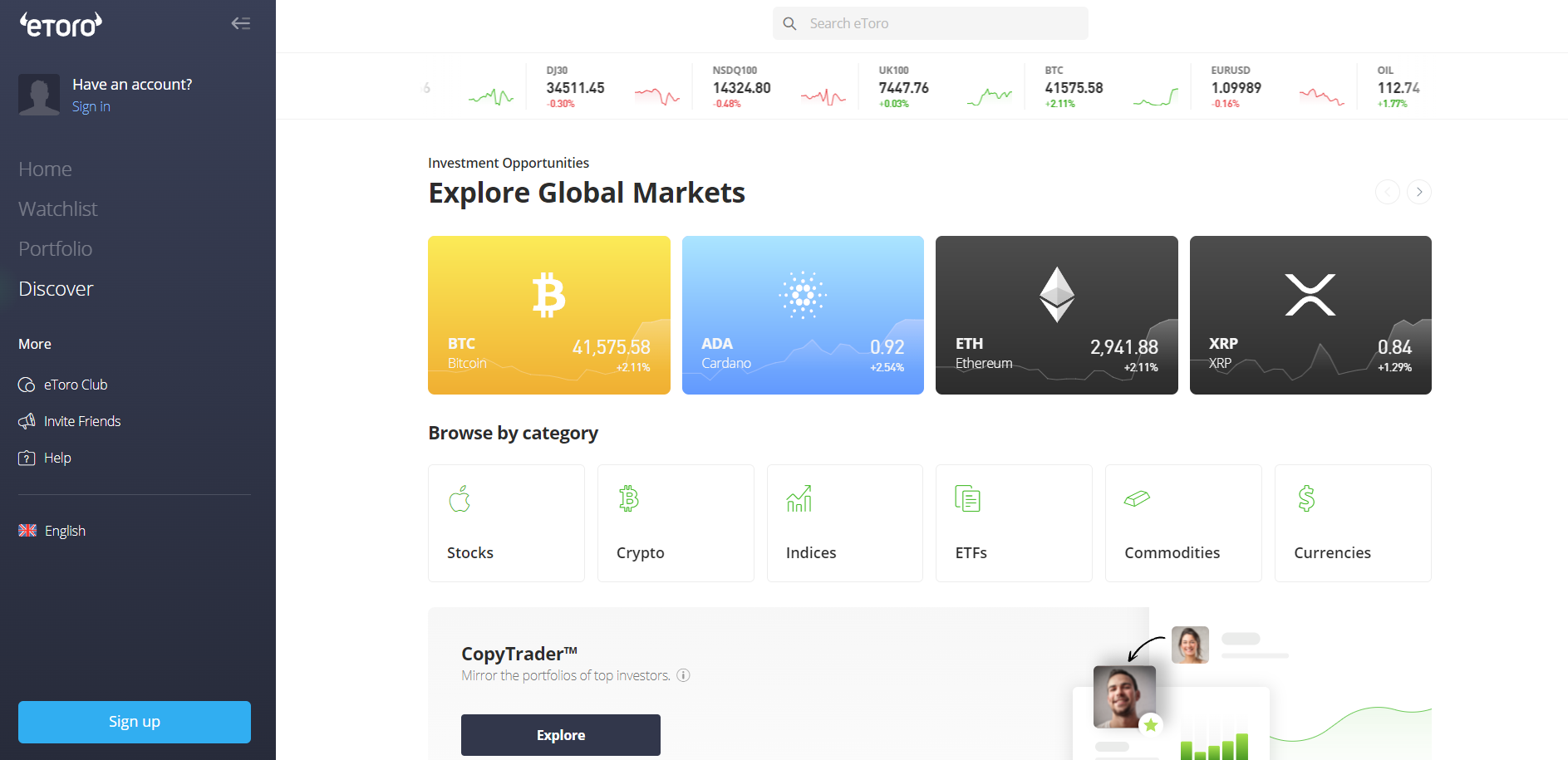

Trading Condition: Day traders at eToro can only trade with the eToro trading platform. It is a user-friendly platform with a simple interface. This makes it ideal and less complex for beginners. The copy trading services on eToro are free of additional commission.

GBP cannot be chosen as the base currency of the account as USD is the only accepted currency. GBP or any other currency deposits are subject to currency conversion fees. More than 3200 financial instruments are available to trade at eToro.

#2 IG Markets – Best Regulated Day Trading Platform

IG Markets is a CFD trading platform that has been offering financial services since 1974.

Regulation: IG Markets is regulated by the FCA in the UK under license number 195355. They are also regulated by top-tier regulatory authorities like FSCA of South Africa, ASIC of Australia, and NFA, CFTC of the USA.

Fees: The trading fees at IG Markets are built into the spread with no commission except stock CFDs. Stock CFDs of different regions have different trading commissions at IG Markets. The commission on US stocks is 2 cents per share with a minimum commission per trade of $15.

Trading Condition: IG Markets allow traders to choose from multiple trading platforms including MT4, ProRealTime, L2 Trader, etc. MT4 is the most ideal platform for beginners. They allow trading on more than 12000 instruments with GBP as the base currency of the account.

#3 City Index – Best Overall Day Trading Platform

City Index is an FCA-regulated CFD broker that allows day trading with several research tools on MT4 platform.

Regulation: City Index acquired the FCA license in 2003 to offer CFD trading in the UK. Stonex Financial is the legal entity of City Index registered at FCA with license number 446717. The Stonex Group is a publicly listed company on NASDAQ. They are also regulated by ASIC of Australia and MAS of Singapore.

Fees: CFD day trading at City Index involves spread as the only trading fee. For trading stocks, City Index charges a commission of $10 per trade. No other fee like deposit, withdrawal, account maintenance, etc is charged at City Index in the UK.

Trading Conditions: MT4 is the only trading platform at City Index where clients can trade more than 4000 instruments as CFD. They do not have a lower cap on deposit amount and GBP can be chosen as the base currency of the account.

#4 CMC Markets – Low Cost Day Trading Platform

CMC Markets is an FCA-regulated financial service and is ideal for day trading in the UK.

Regulation: CMC Markets separately holds two regulatory licenses from the FCA for CFD trading and spread betting. CMC Markets UK PLC holds license number 173730 and CMC Spreadbet LLC holds license number 170627 for FCA regulation.

CMC Markets is a publicly listed company on the London Stock Exchange and is also regulated by several financial regulatory authorities globally.

Fees: The spreads at CMC Markets are lower than the average among the day trading platforms in the UK. The trading commission is only incurred while trading stocks as CFDs. For all other instruments, the spread is the only trading fee incurred for day trading in the UK.

Apart from the inactivity fee, they do not charge any other non-trading fees as deposits and withdrawals are free.

Trading Conditions: CMC Markets allow day trading through the MT4 trading platform on more than 12000 financial instruments. GBP can be chosen as the base currency with free deposits and withdrawals through bank transfers.

#5 Pepperstone – Best Day Trading Broker with Multiple Trading Platforms

Pepperstone is an FCA-regulated CFD broker that allows trading at low cost on multiple trading platforms

Regulation: Pepperstone is regulated by the Financial Conduct Authority (FCA) of the UK with the legal entity Pepperstone Limited under license number 684312. They are also regulated by the ASIC of Australia, CySEC of the EU, BaFIN of Germany, CMA of Kenya, etc. Pepperstone can be considered safe for day trading in the UK with low third-party risk.

Fees: Pepperstone offers two account types with different pricing structures. The Standard account is a commission-free account with spreads starting from 0.69 pips. The average spread for EUR/USD with the Standard account at Pepperstone is 1.12. The same with the commission-based account is as low as 0.09 pips. However, a trading commission of $7 is incurred on a round-turn trade of a Standard lot.

Pepperstone does not incur any non-trading charges like inactivity fees, deposit/withdrawal fees, or account maintenance fees.

Trading Conditions: At Pepperstone, different types of traders will find a suitable account type. They support MT4, MT5, as well as cTrader trading platforms with both account types. GBP can be chosen as the base currency of the account along with USD, EUR, and AUD. There are no lower limits on minimum deposits.

Comparison of Best Day Trading Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| eToro |

3 pips

|

$200

|

1:30

|

Visit Broker |

| IG Markets |

1.1 pips

|

$300

|

1:30

|

Visit Broker |

| Pepperstone |

1.12 pips

|

£0

|

1:500

|

Visit Broker |

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

$0

|

1:30

|

Visit Broker |

How to Start Day Trading in the UK?

Following are the steps that one must follow to make the most out of day trading in the UK.

Step 1) Learn about day trading:

To begin day trading in the UK, the first and foremost thing is to do some research and acknowledge the risk involved. Each financial asset that is used for day trading carries different risk elements as its price movement depends on different factors.

It is important to understand why the prices of the underlying assets are moving. Trading without the knowledge of capital markets is similar to gambling.

Clients can use educational websites, magazines, and videos to learn about capital markets. A demo trading account can be used to get familiar with the process and terminologies of day trading.

Step 2) Find a Trading Platform:

Choosing your trading partner is an important step as the trading experience will be different with each financial services provider. There are a lot of factors that need to consider while choosing a day trading platform.

Since it is important, we have comprehensively described the factors that are most necessary to consider while choosing a day trading platform in the UK.

Step 3) Open Account and Make a Deposit:

The account opening process at any FCA-regulated day trading platform can take 2-24 hours. Clients need to enter basic details like name, address, personal info, etc. This information will be verified through KYC.

After opening the account, clients need to make a deposit. Each broker has different requirements for an initial and subsequent minimum deposit. For beginners, it is recommended to deposit a small amount before they gain decent experience in day trading.

Step 4) Trade with Suitable Instruments:

There are hundreds of financial instruments that can be day traded. Clients must only deal in the markets they are familiar with and can speculate on the prices. The analysis must be done before placing any trade order.

Step 5: Set Stop Loss and Take Profit Limit

After placing the buy or sell order, it is important to set limits on profits and losses. This will also allow traders to acknowledge the risk-to-reward ratio for each trade order.

How to Choose the Best Day Trading Platform in the UK?

There are several factors that need to be considered while choosing a broker. The following are the most important factors that must be checked and compared before opening an account with a day trading platform.

Regulation: Financial Conduct Authority (FCA) is the financial regulator in the UK that overlooks the activities of registered financial services providers. Any firm with financial business in the UK including brokers, market makers, etc.

Checking FCA regulation and its authenticity is the primary step for choosing any day trading platform in the UK. Clients can check for registered and regulated entities at the official website of FCA.

Most FSPs mention the details of their FCA regulation in the footnote of the website. Clients must look out for the registered license number of the FSP. This number can be verified from the FCA website. If you cannot find the FCA regulation details on the broker’s website, you can inquire through customer support services.

Fees: Everyday trading app will incur different charges. The services offered may or may not be the same but trading fees are very likely to be different with each broker. Going for a broker with low fees is beneficial for the traders’ but fake brokers may use low fees as a lure to grab the deposits.

Trading fees in CFDs include spread, commission, and overnight charges. If you open and close the position on the same day, no overnight charges will be incurred. Spread is the difference between the bid and the ask price on an instrument.

Day trading platforms with low spreads can increase the profit probability and amount. Apart from this, clients must check or inquire about the non-trading charges like deposit, withdrawal, inactivity, account opening, maintenance, etc.

Trading Platform: To get the most out of day trading, you need to have a proper understanding of the trading platform. The platform where you will place buy or sell orders must be user-friendly, fast, and suitable for traders. Some traders prefer more complex platforms like MT5 while others prefer a simpler interface like eToro, Plus500, etc.

Customer Service: A day trading platform with good quality customer support services would be a better choice for beginners. More queries and issues tend to arise in the initial phase of trading. Hence, you must choose a day trading platform with good quality live chat and phone support.

Clients can test the support services’ quality before opening the account by raising random queries through available methods.

Day Trading Strategies

Day trading involves buying and selling financial instruments for a short period of time. However, there are multiple-day trading strategies that are used by experienced day traders.

Scalping

Scalping is a trading strategy in which traders aim to make profits through small price movements. The trading volume is generally high in scalping while the tenure of keeping the position open is small. Scalpers need to have a strict exit strategy or stop loss as one large loss can take away profits earned in multiple trades.

Momentum Trading

Prices of financial instruments generally tend to move in a trend. The trends can be predicted through trendlines unless there is a change in a trend. Day traders can predict an upward or downward trend and enter when a trend is picking up momentum. The trading strategy to capitalise on the momentum of a trend is called momentum trading.

Range Trading

Certain day traders aim to predict the range in which the prices of the financial instrument will fluctuate in a short time period. The prices tend to move in a range and a trading position can be opened at the extreme ends of the range.

News Based Trading

News events play a major role in influencing the price movements of financial instruments. News events have an immediate impact on the prices and many day traders tend to trade solely on the basis of such events. It is important to understand the impact of each news event to correctly predict its impact on the prices.

High-Frequency Trading

High-frequency trading (HFT) is a day trading strategy in which computer programs are developed and implemented to automatically enter and exit trading positions. This strategy is ideal for experienced traders who can convert their trading strategy into programs to book profit in a short duration.

Swing Trading on Intraday Data

Although swing trading is typically associated with holding positions for more than a day, some traders use this strategy on shorter time frames within a single trading day, capitalizing on the “swing” or volatility within the day.

Market Making

A strategy more commonly used by professionals, market making involves continuously buying and selling securities to provide liquidity to the markets, profiting from the spread between the buy and sell prices.

Arbitrage

This involves buying a security in one market and simultaneously selling it in another market at a higher price, thereby profiting from the temporary price difference.

Risk Involved in Day Trading

Market Volatility: Day traders are exposed to price swings within a single day, which can lead to potential losses if market movements go against their positions.

Leverage Dangers: Many day traders use leverage to amplify potential gains, but it also increases potential losses. A trade moving in the wrong direction can result in significant losses.

Lack of Diversification: Day traders typically focus on a limited number of positions during the day. The absence of diversification means that a single losing trade can have a substantial impact on their overall portfolio.

Psychological Pressure: The fast-paced nature of day trading can be emotionally and psychologically challenging. The need for quick decisions and risk management in a high-pressure environment can lead to stress, anxiety, and emotional trading, often resulting in losses.

Transaction Costs: Frequent trading leads to high transaction expenses, including commissions and spreads, which can erode profits or increase losses.

Overtrading Temptation: Day traders might be tempted to overtrade, taking impulsive positions. Overtrading can result in losses due to hasty decision-making.

Inadequate Knowledge: A lack of market knowledge, trading strategies, and risk management can lead to poor decision-making and losses.

Market Manipulation: In certain instances, day traders may encounter market manipulation or “pump-and-dump” schemes in less regulated markets, potentially causing sudden and substantial losses.

Technical Glitches: Technical issues or internet connectivity problems can prevent traders from executing trades or managing positions effectively, leading to losses.

Time Commitment: Day trading demands significant time and attention throughout the trading day, which may not be feasible for individuals with other responsibilities or full-time jobs.

Regulatory Considerations: Depending on your location, day trading may be subject to specific regulations and tax implications. Violating regulatory rules can result in penalties or account closures.

Unrealistic Expectations: Maintaining realistic profit expectations is crucial. Unrealistic ambitions can lead to reckless trading behavior. It’s important to understand that day trading doesn’t guarantee rapid wealth and involves substantial risk.

Common Mistakes That Most Day Traders Make

Following are the common mistakes among beginners in day trading. A day trader must avoid making the following mistakes:

- Trading Without Limit Orders

Day traders must always use limits on orders to avoid facing significant losses. A stop loss limit restricts the loss on an open position while the take profit limit closes the position when the price reaches the trigger. - OverTrading

While day trading, the trader must wait for the right time to open a position after due research. Trading too much on any given instrument leads to overtrading which can increase the trading cost and also increase the risk. - Lack of a Trading Plan: Failing to have a well-defined trading plan is a common mistake. Traders should establish clear goals, risk tolerance, and a strategy for entries, exits, and position sizing. A trading plan helps traders stay focused and disciplined.

- Neglecting Proper Research and Analysis: Successful day trading requires thorough research and analysis. Failing to conduct due diligence on market conditions, news events, and technical indicators can lead to poor trade decisions. Traders should dedicate time to research and develop a sound trading strategy.

- Emotional Trading: Allowing emotions, such as fear or greed, to drive trading decisions can lead to poor outcomes. Emotional trading often results in impulsive trades, chasing trades based on FOMO (fear of missing out), or holding onto losing positions for too long.

- Trade Without Research

Day traders often tend to open trading positions without research or analysis which leads to severe losses. Trading without analysis and research is similar to gambling.

FAQs on Best Day Trading Platforms UK

Which platform is best for day trading?

According to our review, eToro, IG Markets, City Index, and CMC Markets are the best day trading platforms in the UK. Each broker offers different features and service quality and charges different fees for the same. Clients must check and compare day trading platforms to choose the most suitable platform.

Which trading platform is most profitable?

Profits on day trading does not directly depend on the trading platform. You can gain slightly higher profits by choosing a platform with low fees. However, profits in day trading depend largely on analysis, discipline, and experience.

Is day trading Still Profitable?

Profits or loss on day trading depends on the experience and skill set of the trader. Disciplined day trading done with adequate research and analysis can be highly profitable. Limiting the orders with stop loss and take profit can reduce the risk but their will always be financial risk involved in day trading.

Why do you need 25k to day trade?

It is not necessary to start trading with $25,000.

Beginners in day trading should trade with a lower amount and maintain a lower margin or account equity. With the involvement of leverage, there can be significant risk. Beginners should always start with a demo account to gain experience. The deposits in the initial days should be kept low.

Is day trading Legal in the UK?

Yes, day trading is legal and traders can day trade on multiple types of financial instruments in UK. Forex and CFD trading in UK is regulated by FCA of the UK.

Can you make $500 a day day trading?

Yes but traders should not aim to make unrealistic gains on regular basis. Traders should take limited risk by maintaining the stop loss and take profit limits. Most traders make 1-2% of their invested amount per day but some high risk traders may also aim for 4-5% per day. For $500 profit per day, traders may need to deposit $50,000.

What app do most day traders use?

Most forex and CFD traders use MetaTrader 4 trading application and trading platform on mobile tablets, and desktop devices. This is due to its simple interface and compatibility with other trading software. MT5 and cTrader are also chosen by a large number of traders.

Do day traders pay tax UK?

Yes, the profits booked on day trading is liable for Capital Gains Tax (CGT) according to prevailing tax rates. As per the 2023/2024 tax regimes, profits of more than GBP 6000 per year is liable for capital gain tax.

Can you get rich quickly by day trading?

No, day trading involves high financial risk. The profits or losses majorly depend on the research and analysis of the trader but the financial risk will still exist. Day trading can mean having passive income or regular income. It is not a get-rich-quick scheme. Traders need the discipline to excel in the day trading markets.