Best Forex Brokers Malaysia 2024

For this list, we reviewed over 20 forex brokers that accept traders based in Malaysia. We checked the brokers based on their Tier-1 & Tier-2 regulations, Overall Fees, trading conditions, ease of funding & withdrawals, support & 8 more factors.

If you are interested in trading Forex or CFDs as a retail trader you will have to look for an offshore broker because Securities Commission Malaysia (SCM) has banned retail foreign currency exchange (Forex) and Contract For Differences (CFDs) brokers from operating in Malaysia.

It’s essential to understand that there is no universally “best” forex broker because each one caters to diverse types of traders. The suitability of a broker depends on an individual trader’s unique trading style, risk tolerance, and specific needs. Traders should carefully assess and choose a broker that aligns with their preferences and objectives to ensure a successful trading experience.

As of today, it is not legal to trade Forex in Malaysia and all popular foreign Forex brokers in Malaysia are unlicensed by the SCM. People trading Forex with these unlicensed brokers are doing so at their own risk as it is grey area.

It is recommended that you do not trade forex or CFDs until there are retail forex brokers regulated by SCM.

Here is a list of Best Forex Brokers Malaysia 2024 based on our Research

- HF Markets – Well-Regulated Forex Broker in Malaysia

- OctaFX – Low Fess Forex Broker

- XM – Best Forex Broker with low withdrawal fees

- Tickmill – Best Forex Broker with no deposit & withdrawal fees

- FXTM – Best Forex Broker that offer demo account

- Pepperstone – Best Forex Broker that offer negative balance protection

Nevertheless, if you still decide to trader forex or CFDs in Malaysia, choose a broker that is regulated by Top-Tier regulators. Unregulated brokers can be risky because they don’t offer any protection for your deposited funds.

Choosing a Tier-1 regulated forex broker will offer you some safety in the fact that the broker is reputed & not a scam.

Best Forex brokers Malaysia

Since forex trading is not regulated in Malaysia, we have researched the best foreign regulated forex brokers that accept traders based in Malaysia.

More information about these online forex brokers can be found below.

#1 HF Markets – Well Regulated Forex Broker in Malaysia

HF Markets, previously known as HotForex is a well regulated foreign forex broker that offers Forex and CFDs trading to traders. HF Markets is considered a safe Forex broker for depositing funds and has low risks because it is licensed in many jurisdictions.

Safety/Regulation: HF Markets is an offshore company incorporated in St. Vincent & the Grenadine as HF Markets (SV) Ltd, traders in Malaysia are under this regulation because HF Markets is not regulated by SCM in Malaysia. Their parent company ‘HF Markets Group’ is regulated in the United Kingdom (UK) as ‘HF Markets (UK) Ltd’ by the Financial Conduct Authority (FCA).

The parent company of HF Markets is also licensed by the Dubai Financial Services Authority (DFSA) as HF Markets (DIFC) Ltd, the Financial Services Authority (Seychelles) as HF Markets (Seychelles) Ltd and the Financial Sector Conduct Authority (FSCA) in South Africa as HF Markets SA (PTY) Ltd.

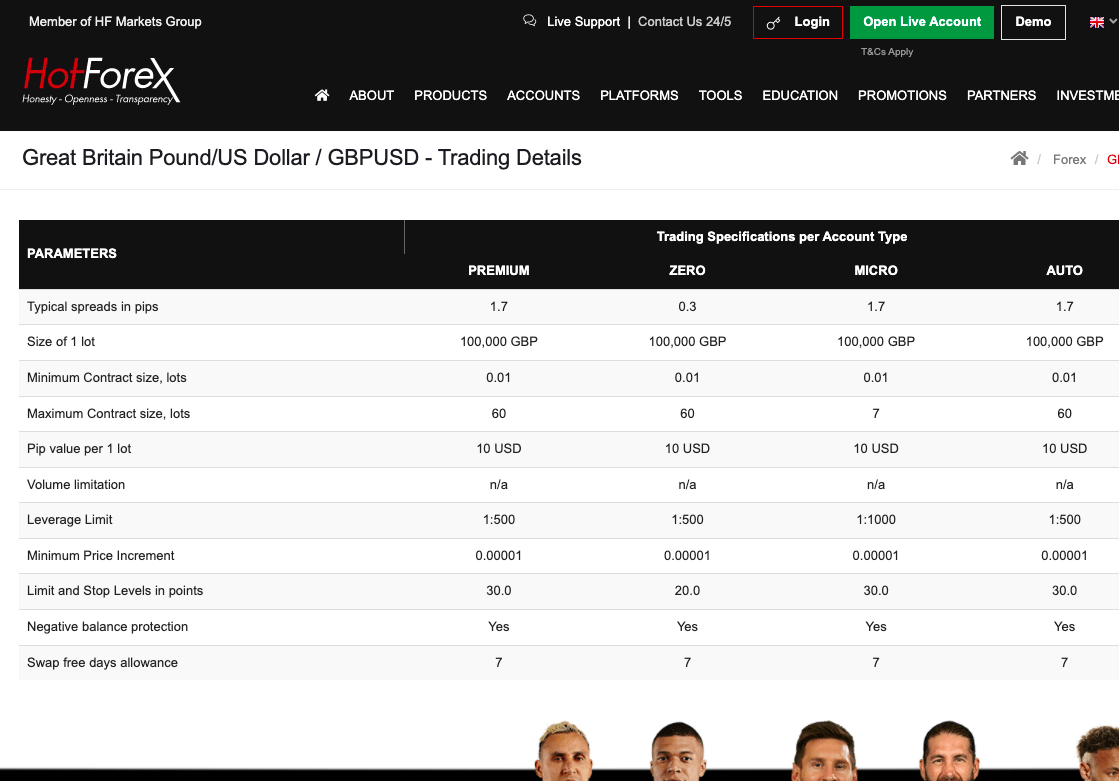

Overall Fees: The fees on HF Markets depends on the account type held by the trader.

Trading Fees: HF Markets operates a variable spreads system for all account types, spreads start from 1 pip for Micro, Premium, Auto, PAMM, and HFCopy accounts while the Zero Spread Account has a minimum spread of 0.0 pips. Typical spreads for major currency pairs are shown on the table below:

| Pairs | Micro Account | Premium Account | Zero Account | Auto Account |

|---|---|---|---|---|

| EUR/USD | 1.3 pips | 1.3 pips | 0.1 pips | 1.3 pips |

| GBP/USD | 1.7 pips | 1.7 pips | 0.3 pips | 1.7 pips |

| EUR/GBP | 1.5 pips | 1.5 pips | 0.2 pips | 1.5 pips |

The HF Markets Zero Spread Account charge a commission of $3 per lot traded for majors and $4 for minors. Other account types are commission-free. HF Markets also offers a 7 days allowance of swap-free trading allowance for new traders.

You will also need to pay a 1% fee on cryptocurrency withdrawals made through Bitpay. HF Markets will charge a dormant account fee of $5 if you do not make any trades for six months.

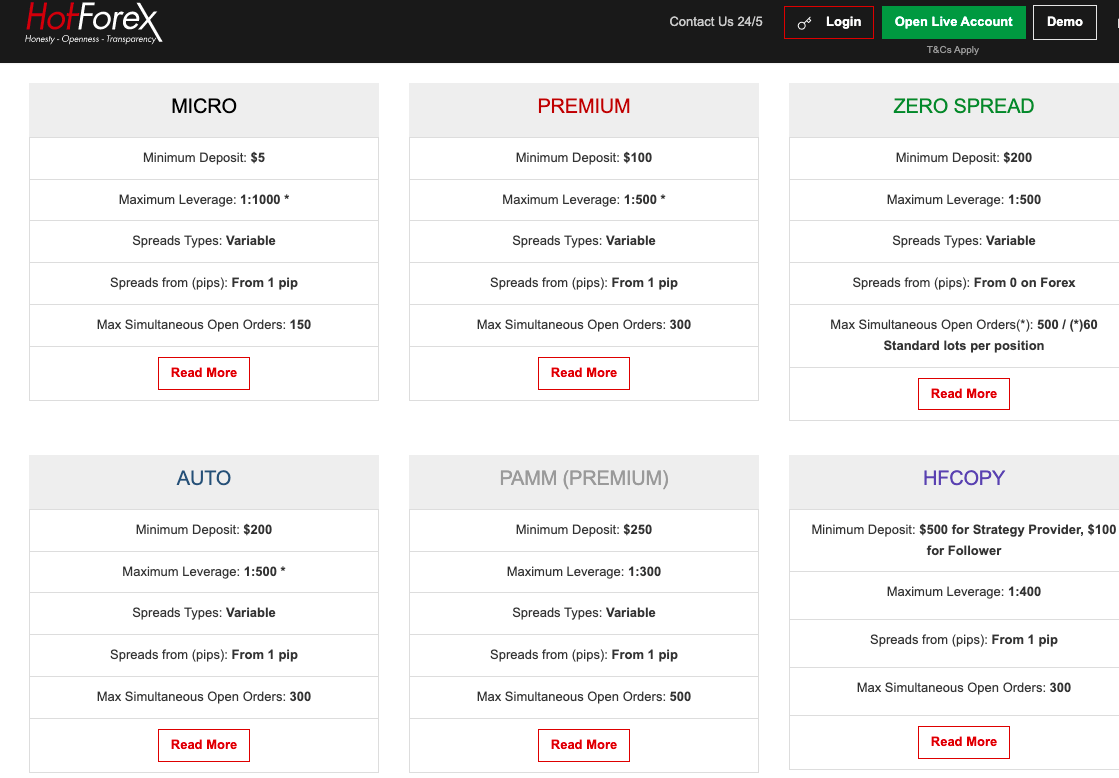

Account types: HF Markets offers 6 account types from which traders can choose, including an Islamic account features option that charges no swap fees or interests in line with Shariah.

Negative balance protection: HF Markets offers negative balance protection for traders on its platform, which means that when a trade order is unsuccessful and a trading account loses money and moves to a negative balance, the platform will revert the account balance to zero.

Supported platforms: HF Markets supports MT4 and MT5 trading applications available on desktop (Windows and macOS), mobile devices (Android, iPadOS, & iOS) and web terminals.

Number of instruments: HF Markets offers over 1,200 trading instruments including Forex & CFD trading on 53 currency pairs (majors & minors), 56 shares, 7 crypto assets, commodities, indices, energies, DMA stocks, bonds, metals, and ETFs.

Order execution: HF Markets has no dealing desk and uses Market Execution to process trade orders on its platform.

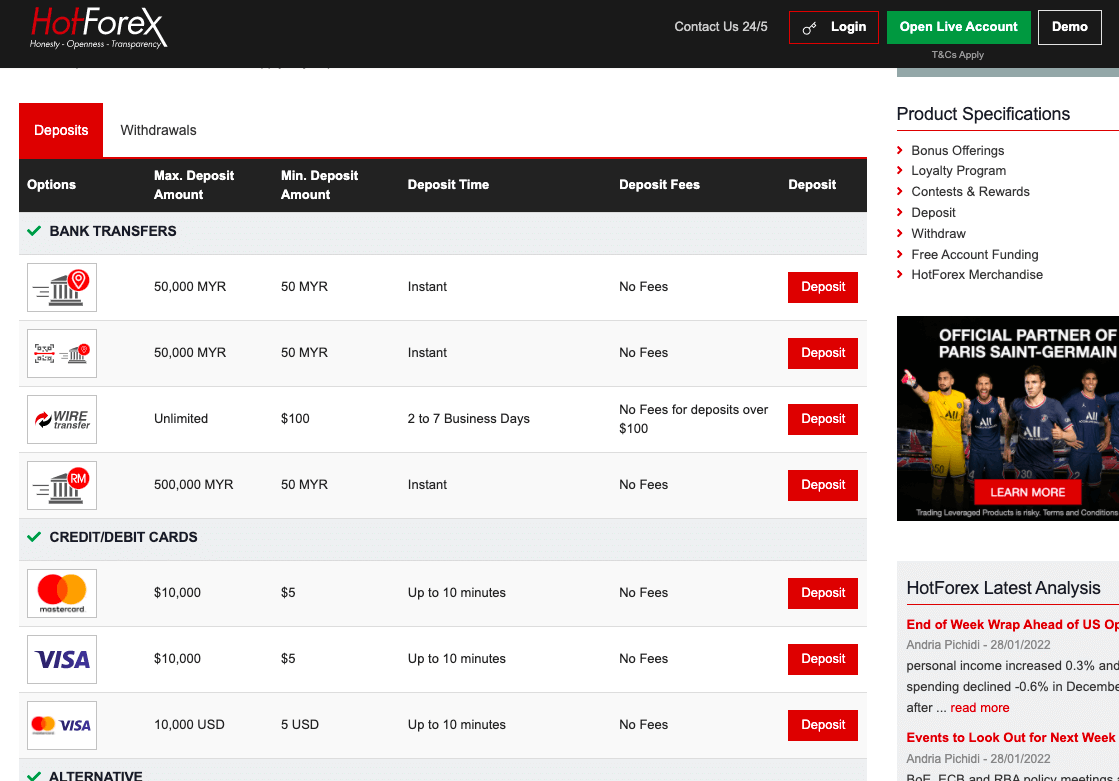

Deposit/Withdrawals: HF Markets supports deposits/withdrawals through different payment methods. The minimum deposit of HF Markets is $5, different account types and payment methods also have different required minimum amounts.

The minimum deposit in Malaysian Ringgit is 50 MYR with a maximum of 500,000 MYR per transaction. The maximum deposit in US Dollars is $10,000 per transaction. Deposits via Malaysian banks are credited instantly, while deposits through cards and e-wallets are credited within 10 minutes.

The minimum withdrawal amount to Malaysian bank account is $15 and processed within 2 business days. Card withdrawals and wire transfers take 2-10 business days, with a minimum amount of $5 and $100 respectively. E-wallet withdrawals require a minimum amount of $5 processed instantly and cryptocurrency withdrawals are processed in 2 business days.

HF Markets Pros

- Regulated by Tier-1 and 2 regulators

- Allow low minimum deposit

- Offers negative balance protection

- 24 hours fast customer support on business days

- Accepts deposits/withdrawals to Malaysian bank accounts

- Supports multiple trading platforms

- Offers deposit bonuses for traders that they can withdraw

HF Markets Cons

- Their support is not available 24/7

- No MYR as base account currency

- Charges account inactivity fee

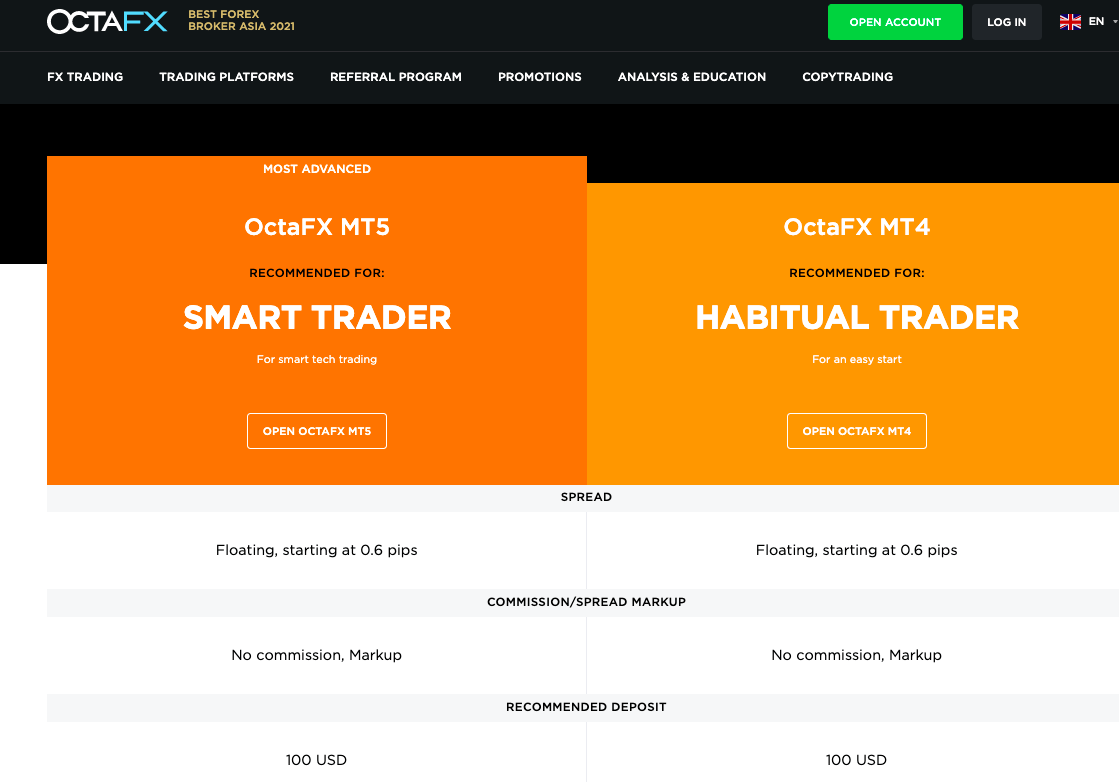

#2 OctaFX – Low Fess Forex Broker

OctaFX is a Forex broker that launched in 2012. They offer brokerage for trading in Forex and CFDs. OctaFX is considered high risk because they are regulated by only one Tier-2 regulator.

Safety/Regulation: OctaFX is licensed and regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines, an offshore-based regulator, as Octa Markets Inc., traders in Malaysia are under this regulation as OctaFX is not regulated by SCM.

The broker is also licensed by the Cyprus Securities and Exchange Commission (CySEC) as Octa Markets Cyprus Ltd, through which it serves European clients.

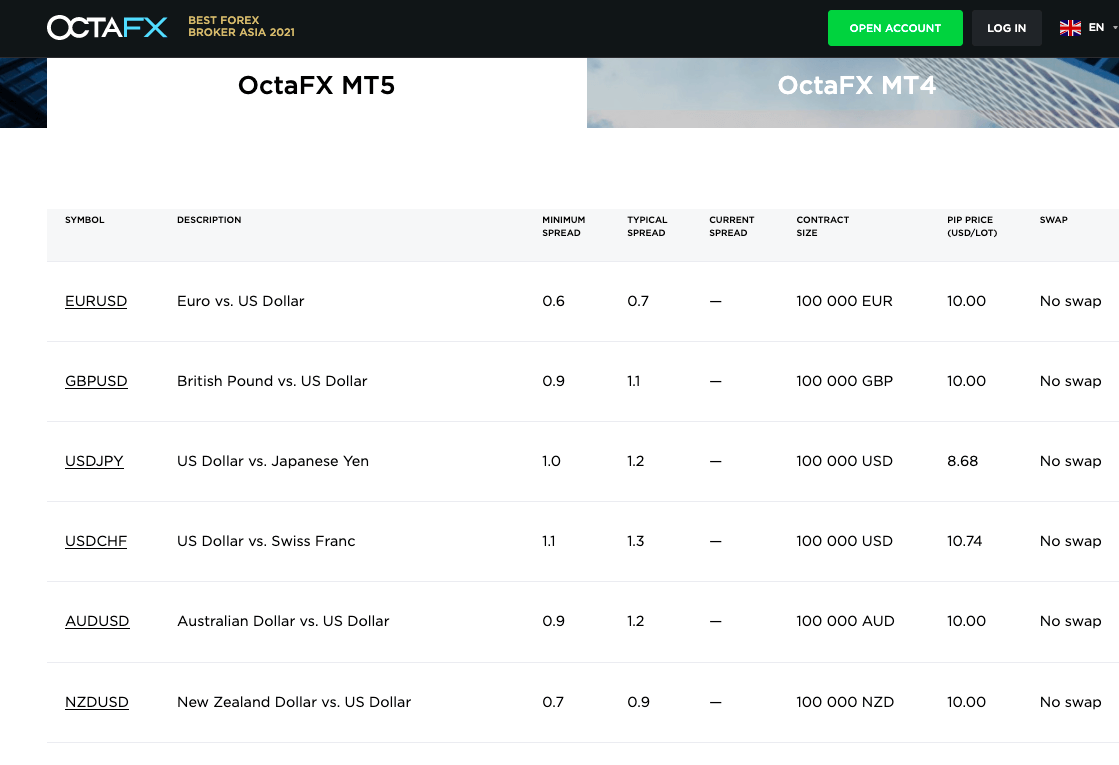

Overall Fees: The summary of OctaFX fees are:

Trading Fees: The trading fees on OctaFX depends on the account type. While both accounts have commission-free trading, OctaFX operates a floating spread system, with spreads starting from 0.6 pips for all accounts. Typical spreads for major currency pairs are shown on the table below.

| Pairs | OctaFX MT4 Account | OctaFX MT5 Account |

|---|---|---|

| EUR/USD | 0.7 pips | 0.7 pips |

| GBP/USD | 1.1 pips | 1.1 pips |

| EUR/GBP | 1.5 pips | 2.1 pips |

The fees do not interest and are calculated based on the direction of the trade position (buy or sell). The fee calculator is available on the Islamic account section of the website.

Non-Trading Fees: OctaFX does not charge any deposit fees or withdrawal fees for any payment methods used, which applies to all account types. Dormant account fees are not charged on OctaFX.

Account types: OctaFX offers two types of trading accounts – MT4 and MT5. They also offer a swap-free MT4 Islamic account for Muslim traders.

Negative balance protection: OctaFX offers negative balance protection for traders’ accounts and resets the trading account balance to zero if a trader loses more than the money in their account, which means that the trader will not owe any money.

Supported platforms: OctaFX supports MetaTrader 4 and MetaTrader 5 trading platforms, available on the web, Windows, macOS, Android, and iOS devices.

The number of instruments: Trading instruments offered OctaFX are Forex on 35 currency pairs, CFDs on 10 indices, 5 cryptos, 4 metals, and 3 energies.

Order execution: OctaFX offers Market Execution for trade orders on its platform.

Deposit/Withdrawals: Traders in Malaysia can deposit to OctaFX via many payment methods. The minimum deposit with Malaysian local banks and Billplz is 100 MYR, which is processed within 1-3 hours.

Deposits with cards and e-wallets like Skrill are credited instantly or within 5 minutes, with a required minimum deposit of $25 and $50. OctaFX also accepts deposits in cryptocurrencies (Bitcoin, Litecoin, etc.) which are processed within 30 minutes.

OctaFX Minimum withdrawal with local banks is 20 RM with a maximum of 50 000 RM, which take 1-3 days for funds to reflect in your bank account.

E-Wallets (Neteller and Skrill) minimum withdrawal is 5 USD, received in 5 minutes and 20 USD for Visa cards, received in an hour after processing.

Processing takes 1-3 hours for all withdrawal methods and is done during office hours. Cryptocurrency withdrawals are received 30 minutes after processing.

Support: OctaFX provides 24/7 live chat and email support. Their email address and live chat are available on their website.

OctaFX Pros

- Offers deposit bonus

- Has negative balance protection

- Has 24/7 live chat support that is responsive

- No swaps fees are charged

- Supports deposits and withdrawals via Malaysian bank accounts

- Supports copy trading

- Supports auto trading with robots (EAs, cBot)

- Has an office in Malaysia

- Does not charge account inactivity fees

OctaFX Cons

- No phone support offered

- Offers fewer trading instruments

- Has few regulations

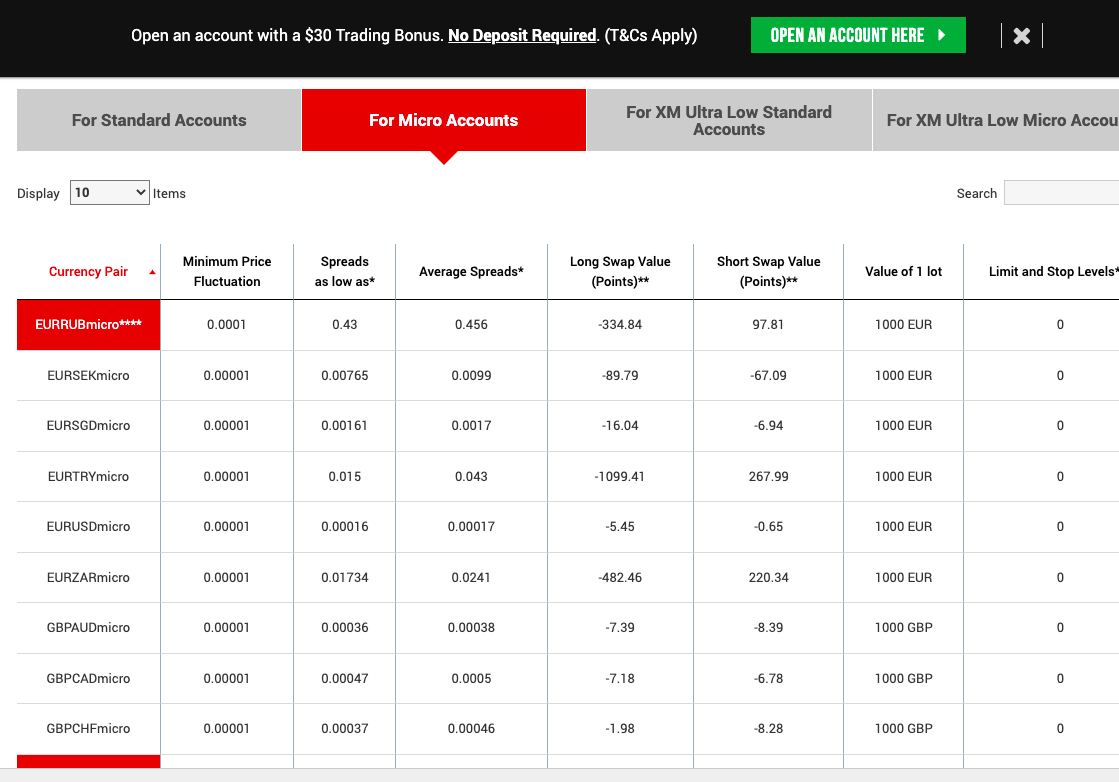

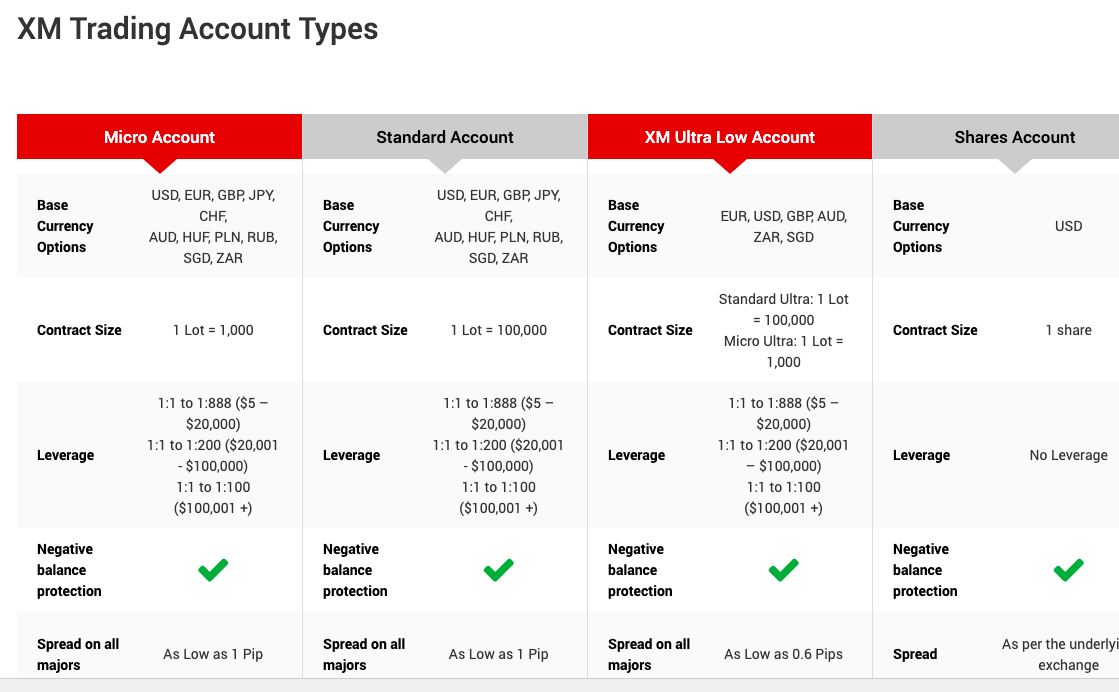

#3 XM – Best Forex Broker with low withdrawal fees

XM is a licensed Forex broker that gives users the ability to trade Forex and CFDs on all devices. Because it is regulated by top Forex regulators, it is considered safe for trading, although XM is not licensed by SCM in Malaysia.

Safety/Regulation: XM is the Trading name of XM Global Limited, registered in Belize, and regulated by the Belize International Financial Services Commission (IFSC). Traders based in Malaysia are under this regulation.

XM Group (Trading Point) is licensed by the Australian Securities and Investments Commission (ASIC), a Tier-1 regulator, the Dubai Financial Services Authority (DFSA), and Cyprus Securities and Exchange Commission (CySEC).

Trading Fees: All account types on XM are commission-free except the Shares account. Swap fees are charged on all account types except the Islamic account. A variable spreads system is used on XM, and Micro & Standard accounts spreads are much higher than other brokers, although Ultra Low account has lower spreads. The average spreads for majors are shown on the table below:

| Pairs | Micro Account | Standard Account | XM Ultra-Low Account |

|---|---|---|---|

| EUR/USD | 1.7 pips | 1.7 pips | 0.8 pips |

| GBP/USD | 2.1 pips | 2.1 pips | 1 pips |

| EUR/GBP | 2 pips | 2 pips | 1.1 pips |

Account types: XM offers four trading account types: a Micro Account, Standard Account, XM Ultra Low Account, and Shares Account. They also feature a zero-swap Islamic account option.

Negative balance protection: XM offers protection against negative balance, which means you will never lose more money than you have in your XM account.

Supported platforms: XM supports MT4, MT5, and XM WebTrader, all of which can be accessed on desktop, mobile devices, and tablets.

Number of instruments: XM clients can trade more than 1,000 instruments including Forex (57 currency pairs), CFDs on stocks, stock indices, commodities, energies, indices, and metals.

Order execution: XM offers its users real-time market executions, which means that your trade orders are executed as you place them.

Deposit/Withdrawals (methods, minimum, time): Traders can make direct wire transfers to their trading accounts and have them credited within a few days. Cards and e-wallets (like Skrill, and Webmoney) deposits are credited instantly or within a few hours.

The minimum deposit to start trading on XM is $5 for Standard, Micro, and XM Ultra Low accounts. While the Shares Account requires a minimum deposit of $10,000. XM has no maximum deposits limits.

Withdrawals made via wire transfers to bank accounts and cards are received within 2-5 business days while e-wallets withdrawals are received within 24 hours. The minimum withdrawal amount on XM is $15.

XM supports deposits/withdrawals to local banks in Malaysia. CIMB, Hong Leong, Maybank, Public Bank, and RHB Bank are the local Malaysian banks used by XM.

Support: XM has 24/5 customer support via live chat, email and international phone calls.

XM Pros

- Offers deposit and trading bonuses to traders

- Have a lot of tradable instruments

- Support local banks for deposits/withdrawals

- Licensed by Tier-1 regulator

- Relatively low trading fees

Customer support is not available 24/7

Charges account inactivity fee

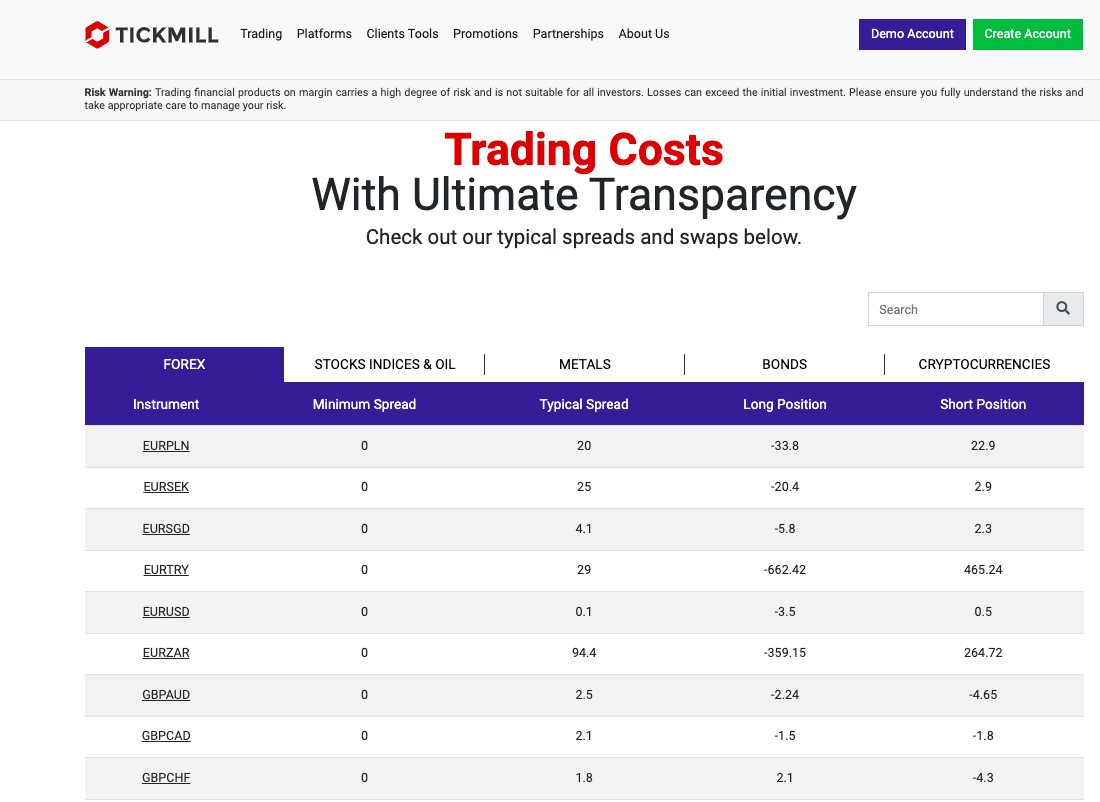

#4 Tickmill – Best Forex Broker with no deposit & withdrawal fees

Tickmill is a licensed Forex broker that has been recognized as low-risk because it is regulated in several jurisdictions.

Safety/Regulation: Tickmill is regulated by an offshore regulation in Seychelles Financial Services Authority (FSA) as Tickmill Ltd Seychelles, traders in Malaysia are under this regulation.

The Tickmill Group is regulated with 3 Tier-1 & Tier-2 regulations, FCA, Financial Sector Conduct Authority (FSCA) in South Africa, CySEC, and Financial Services Authority of Labuan Malaysia. They are not regulated with SCM in Malaysia.

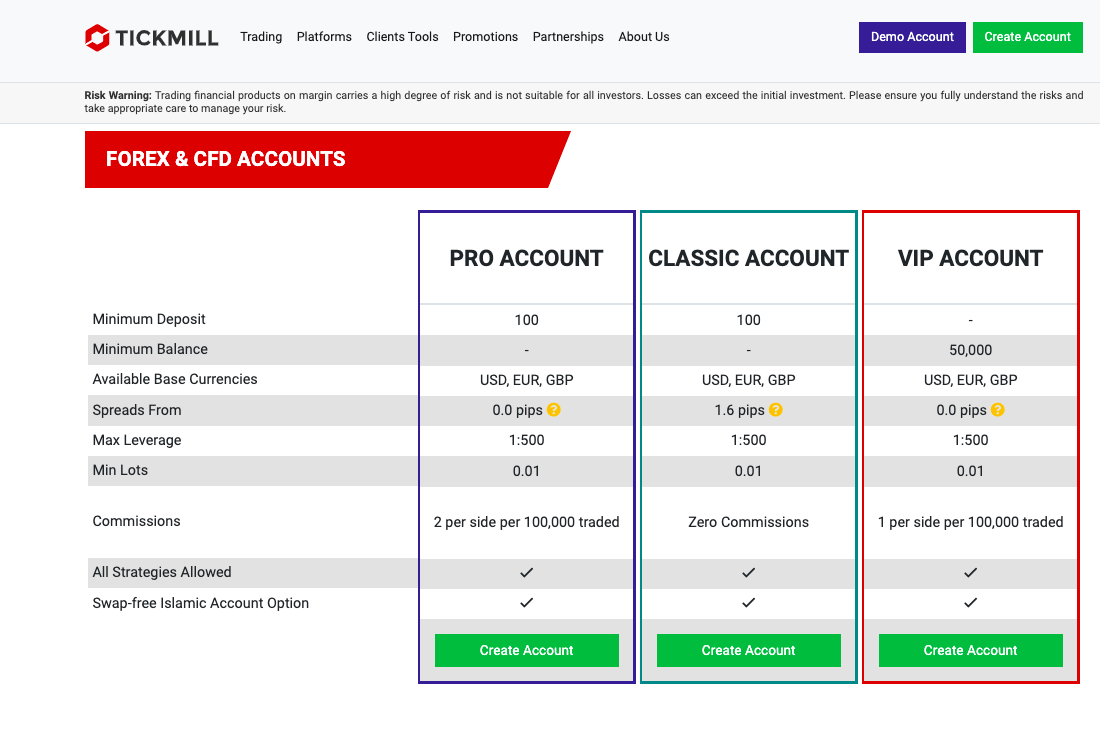

Trading Fees: Different account types have varying trading fees on Tickmill. Spreads start from 0.0 pips for the Pro and VIP Account with commission fees of €2 per side and €1 per side respectively, while Classic Account spreads start from 1.6 pips and it has no commission charges. All accounts are charged swap fees, although swap-free Islamic account features are available for all account types. Typical spreads for major currency pairs on Tickmill are:

| Pairs | Spreads (pips) |

|---|---|

| EUR/USD | 0.1 |

| GBP/USD | 0.3 |

| EUR/GBP | 0.4 |

Account types: Tickmill has 3 basic account types, Classic Account, Pro Account, and VIP Account. They also have Islamic account features for all account types.

Negative balance protection: Tickmill supports negative balance protection for all traders.

Supported platforms: Supported trading platforms for Tickmill are MetaTrader 5, MetaTrader 4, MetaTrader WebTrader available on all devices.

Number of instruments: 62 currency pairs, CFDs on stocks indices, metals, oil, bonds, and cryptocurrencies.

Order execution: Tickmill combines market-making and straight-through processing (STP) to quickly execute trade orders at a speed of 0.20 seconds.

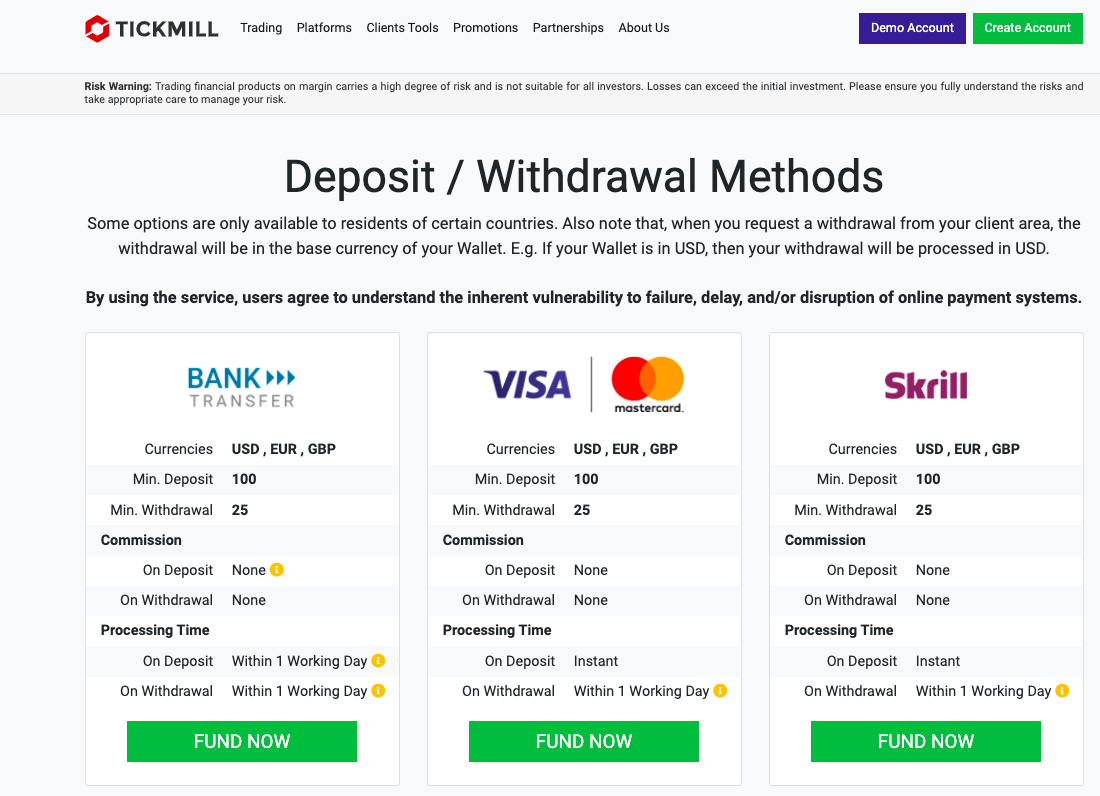

Deposit/Withdrawals: Tickmill accepts many payment methods for deposits and withdrawals. The minimum deposit amount on Tickmill is $100, deposits via bank transfers are credited within 1 working day, while deposits via cards (Visa & MasterCard) e-wallets (Skrill, Neteller, etc.), and WebMoney are credited instantly.

The minimum withdrawal amount for Tickmill is $25 and is processed within 1 working day for all payment methods.

Tickmill Pros

- Offers a $30 welcome bonus to new traders

- Has local phone support in Malaysia

- Has an office in Malaysia

- Has negative balance protection

- Fast order execution

- Has live chat support in ‘Bahasa Malay’

Tickmill Cons

- Does not have 24/7 support

#5 FXTM – Best Forex Broker that offer demo account

FXTM is a well-regulated forex broker and CFD trading service provider that is considered safe for trading.

Safety/Regulation: FXTM is registered in Mauritius as Exinity Limited and regulated by Financial Services Commission (FSC) Mauritius, which is a foreign regulator. FXTM is not regulated by SCM in Malaysia, and Malaysian traders are under Mauritius regulation.

The FXTM Group is also licensed by the FCA as Exinity UK Ltd and CySEC as ForexTime Limited.

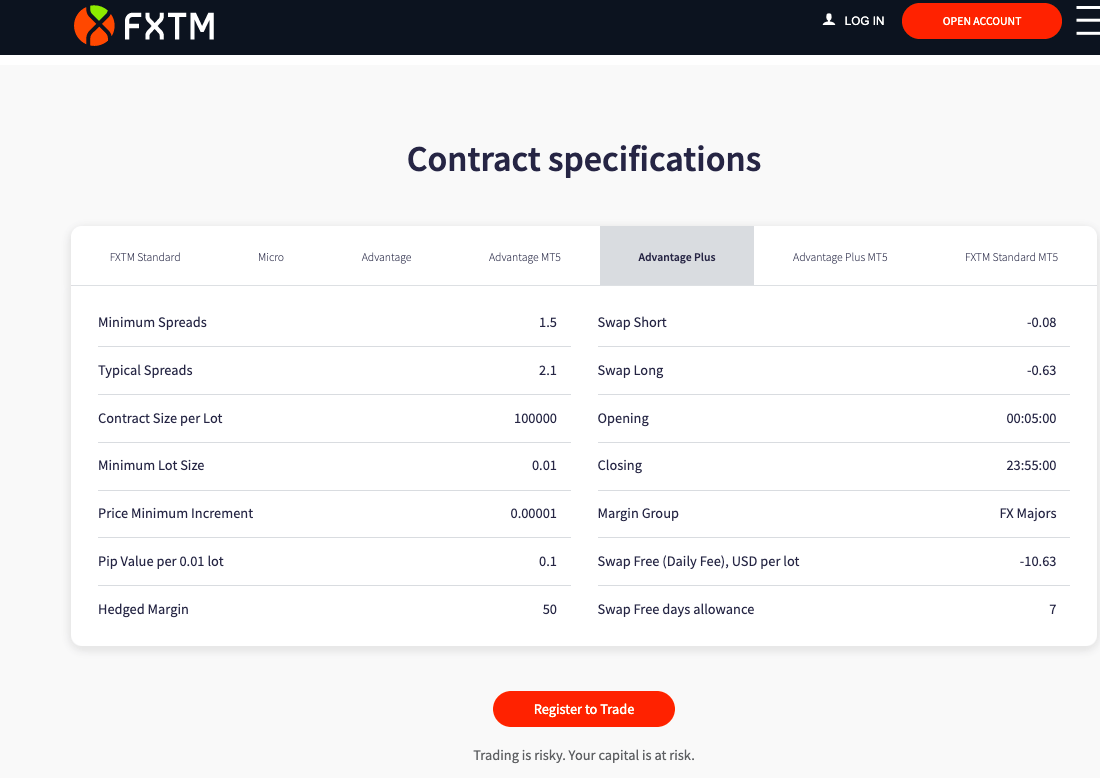

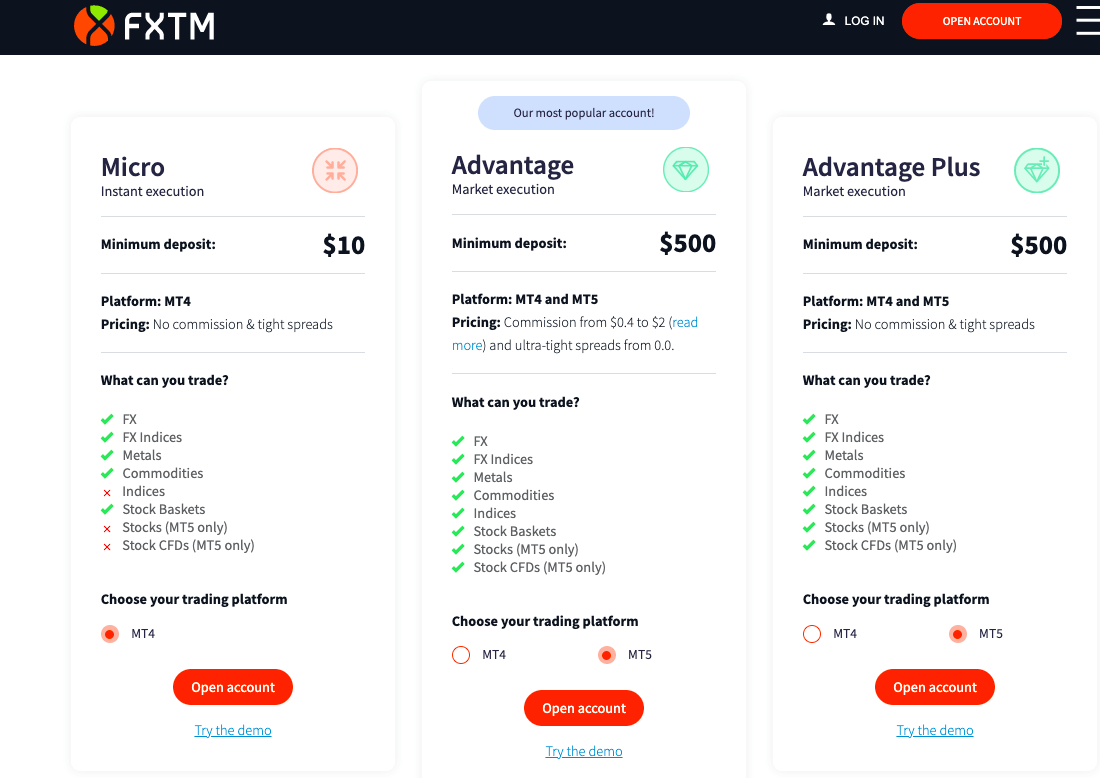

Trading Fees: The trading fees on FXTM depends on the account type, while the Micro and Advantage Plus Account are commission-free with tight spreads, the Advantage Account charges commissions of $2 per lot side trade with spreads starting from 0.0 pips. Typical spreads for majors are shown below:

| Pairs | Micro Account | Advantage Account | Advantage Plus Account |

|---|---|---|---|

| EUR/USD | 1.9 pips | 0.0 pips | 2.1 pips |

| GBP/USD | 2 pips | 0.2 pips | 2.5 pips |

| EUR/GBP | 2.4 pips | 0.6 pips | 2.7 pips |

FXTM offers a 7-day swap-free option on all accounts except for FX Exotic pairs.

Account types: Three account types available on FXTM are Micro Account, Advantage Account and Advantage Plus Account. FXTM offers a swap-free option that makes the trading account Islamic for Muslim clients to comply fully with the no-riba tenets of Sharia law.

Negative balance protection: FXTM corrects negative balance on a trading account after a trade to zero so that the trader does not owe the broker.

Supported platforms: FXTM trading platforms are MT4 & MT5 which are available on the web, desktop and can be downloaded on the Google Play Store and Apple App Store. They also have the FXTM Trader available for mobile devices only.

Number of instruments: FXTM offers trading Forex on more than 50 currency pairs and CFDs on stocks, commodities, indices, metals, and FX indices.

Order execution: FXTM offers both instant and market order execution. While the Advantage and Advantage Plus accounts operate with the Market Execution, your orders are placed directly to the market. Micro Accounts operate the Instant Execution where your orders are placed against other market participants.

Deposit/Withdrawals: FXTM minimum deposit is 10 MYR for traders in Malaysia, which is processed instantly and the deposit is 10,000 MYR to 50,000 MYR per transaction, depending on the local bank. Deposits via cards and e-wallets require a minimum deposit of $5 and are processed instantly.

Minimum withdrawal to a Malaysian bank account is from MYR 50 with a maximum of MYR 50,000 per transaction, which is processed within 24 hours. The minimum withdrawal amount to cards and e-wallets is $17 and is processed within 1 business day. It has a maximum withdrawal limit of $12,000 per transaction and $25,000 per day.

FXTM supported banks in Malaysia are Hong Leong Bank, Maybank, CIMB Bank, Public Bank, and RHB bank.

Support: Customer support for FXTM is available 24/5 via live chat and email, which can be found on their website.

FXTM Pros

- Regulated by Tier-1 & 2 regulators

- Easy to navigate website

- Accepts deposits from Malaysian local banks

- Allows withdrawals to Malaysian local banks

- Fast processing of deposits and withdrawals

- Offers referral bonus

FXTM Cons

- Charges withdrawal fees

- Charges account inactivity fees

- No local phone support in Malaysia

#6 Pepperstone – Best Forex Broker that offer negative balance protection

Pepperstone is an offshore forex broker, that is multi-regulated by Tier-1 & 2 regulators and is considered safe for Forex trading and low risk for Malaysian traders.

Safety/Regulation: Pepperstone is licensed by an offshore regulator in the Bahamas, the Securities Commission Bahamas (SCB), as Pepperstone Markets Limited. Malaysian traders are under this regulation.

Pepperstone Gropu is regulated by ASIC, CMA (Capital Market Authority) in Kenya, CySEC, FCA, and DFSA. Pepperstone is not regulated in Malaysia by SCM

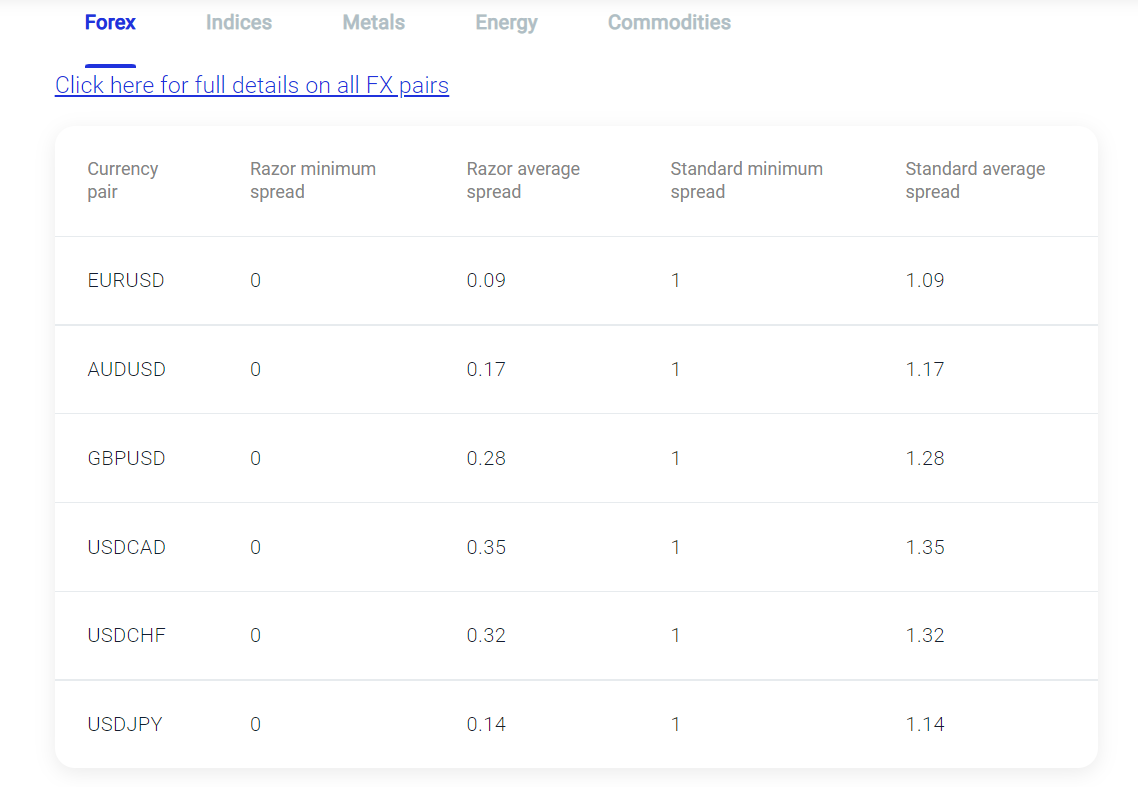

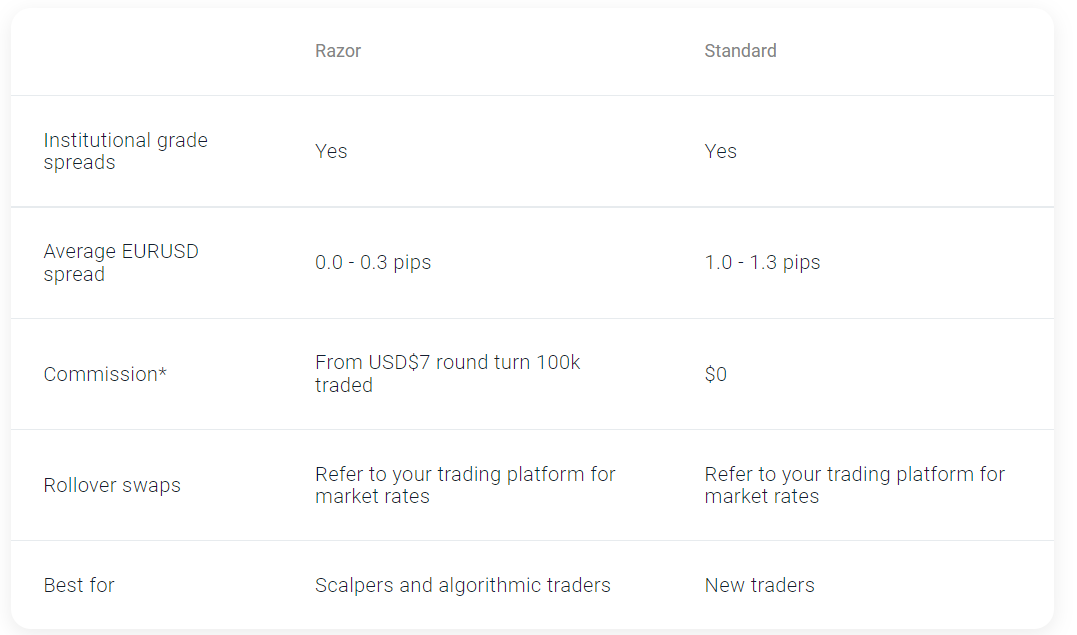

Trading Fees: Pepperstone trading fees for Razor Account on MT4/MT5 is $0.04 per lot side and $6 for a round turn trade on the cTrader platform. Standard Accounts on Pepperstone are commission-free.

Average spreads for currency pair majors on Pepperstone are shown on the table below:

| Pairs | Razor Account | Standard Account |

|---|---|---|

| EUR/USD | 0.17 pips | 0.77 pips |

| GBP/USD | 0.59 pips | 1.19 pips |

| EUR/GBP | 0.40 pips | 1.40 pips |

Account types: The account types offered by Pepperstone are Razor Account and Standard Account. They also feature Islamic Accounts for Muslims and Pro Account for experienced traders.

Negative balance protection: There is negative balance protection for retail clients on Pepperstone trading platform.

Supported platforms: Pepperstone supports trading through MetaTrader 4, MetaTrader 5, and cTrader, available on the web, desktop, and mobile devices (Android & iOS).

Number of instruments: About 1,200+ instruments can be traded on Pepperstone including Forex and CFDs on shares, cryptocurrencies, commodities, ETFs, currency indices and index CFDs.

Order execution: Pepperstone operates market execution for trade orders.

Deposit/Withdrawals: The minimum deposit amount on Pepperstone is $10. Traders can make deposits via PayPal, cards, e-wallets and bank wire transfers in Malaysia. Bank transfers take 2-7 days to be credited, while other methods are credited instantly.

Minimum withdrawal on Pepperstone is $80 for bank wire transfers, while cards have no minimum withdrawal amount. Withdrawals made to bank accounts are processed within 3-5 days, while other methods are processed in 24 hours.

Support: Pepperstone offers email, live chat and WhatsApp support to traders as well as international phone support in the Bahamas.

Pepperstone Pros

- Accepts deposits/withdrawals to Malaysian banks like May Bank, CIMB, and others

- Has 24/7 support on live chat and WhatsApp

- No account inactivity fees

- Supports copy trading

Pepperstone Cons

- Charges withdrawal fees for some payment methods

- Support is relatively slow

- No phone support in Malaysia

- Charges currency conversion fees

How to Open Account with Forex Broker in Malaysia?

To open a Forex account and start trading in Malaysia, follow the steps below:

Step 1) Choose a Tier-1 Regulated Broker:

Since Forex trading is not regulated in Malaysia, the brokers register Malaysian traders under Offshore regulations, which means that your funds are not held in a Malaysian bank account, and disputes cannot be handled locally by the regulators in Malaysia.

It is best to trade with a broker that has multiple regulations and recommended that you choose a broker that is regulated by at least one Tier-1 regulator like FCA of the UK and ASIC of Australia.

Tier-1 regulators usually have more rules to ensure the protection of funds by the broker. Other factors to consider when choosing a broker is their trading fees and how easy it is to make deposits and withdrawals. Traders can cross-check whether a broker is regulated by these regulators by going to their website and entering the name of the corporate entity running the brokerage.

It is important to note that Forex CFDs and brokers are not yet allowed by SCM, and only 2 brokers are allowed by SCM to offer non-forex CFDs, they are Phillip Futures Sdn Bhd and CGS-CIMB.

SCM’s CFD regulations require brokers to register under these non-forex CFD regulations and report their transactions. Only authorized brokers can offer CFDs on commodities, indices, and equities.

Many Offshore Brokers and leading names in the Forex & CFD industry like OctaFX, FXTM, XM, Tickmill, and HF Markets are operating in Malaysia without Authorization and the SC has put them on the blacklist/investor alert list.

Warnings and investor alerts issued by SC is a sign that these brokers are considered risky. So the only safety that you have if you decide to trade is to ensure you choose brokers that are regulated with Tier-1 & Tier-2 regulations.

Despite the SCM rules, many people in Malaysia are still trading forex & CFDs offered by foreign forex brokers. This is because there is some misinformation and wide advertising by these brokers and the lack of local platforms offering all the instruments to retail traders.

All the brokers on this post are foreign brokers that are not regulated locally in Malaysia. They are regulated by one of the major regulators like CySEC (Europe), ASIC (Australia) or the FCA (UK). You are trading at your own risk when trading with foreign-regulated brokers, and there is a high chance of scams if a broker is totally unregulated.

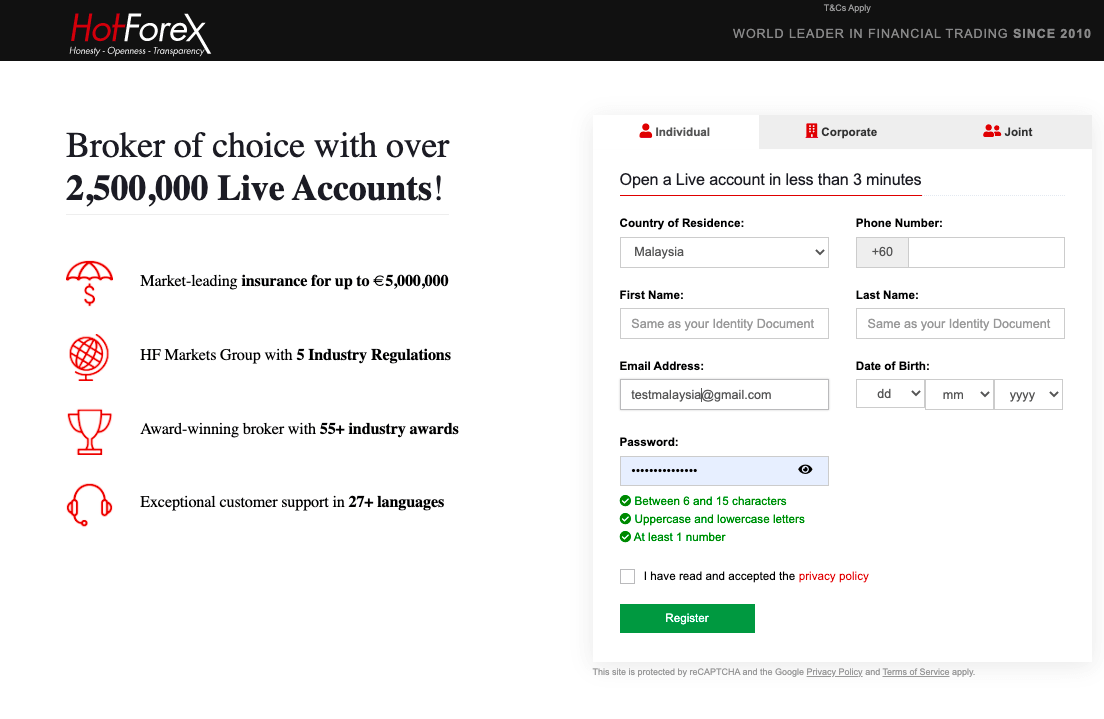

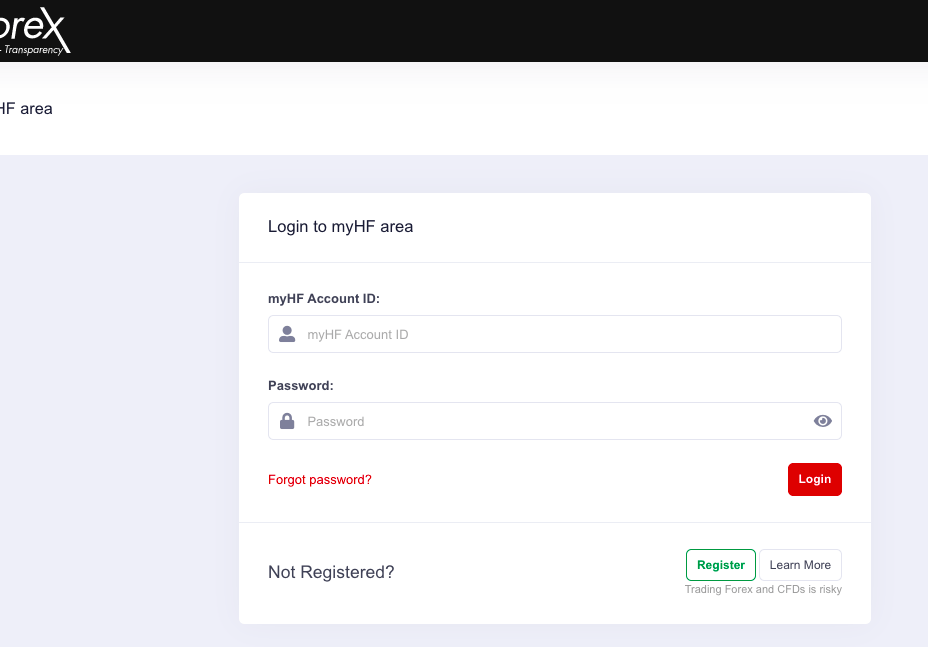

After choosing a regulated broker, proceed to the next step of opening a trading account. In this post, we will use HF Markets as an example in this post.

Step 2) Open Trading Account:

-

- Go to the HF Markets website at www.hfm.com

- Click on the ‘Open Live Account’ button, highlighted in green colour, at the top right side of the page.

- Select the client type, either as an individual, corporate or joint, then fill in your information, create a password, select Nigeria as country of residence, select NGN as account base currency, check the terms and conditions box after reading, and click on register.

-

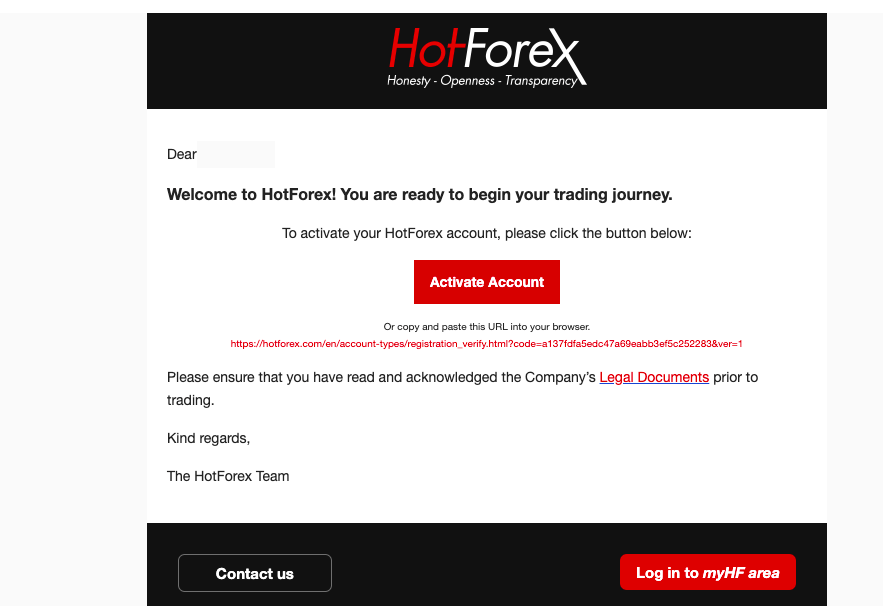

- A verification link will be sent to your email address. Go to your email inbox and click the ‘Activate Account’ link to continue with your registration.

-

- After clicking the link, you will get a confirmation email with your ‘myHF account ID’ after the account is activated.

-

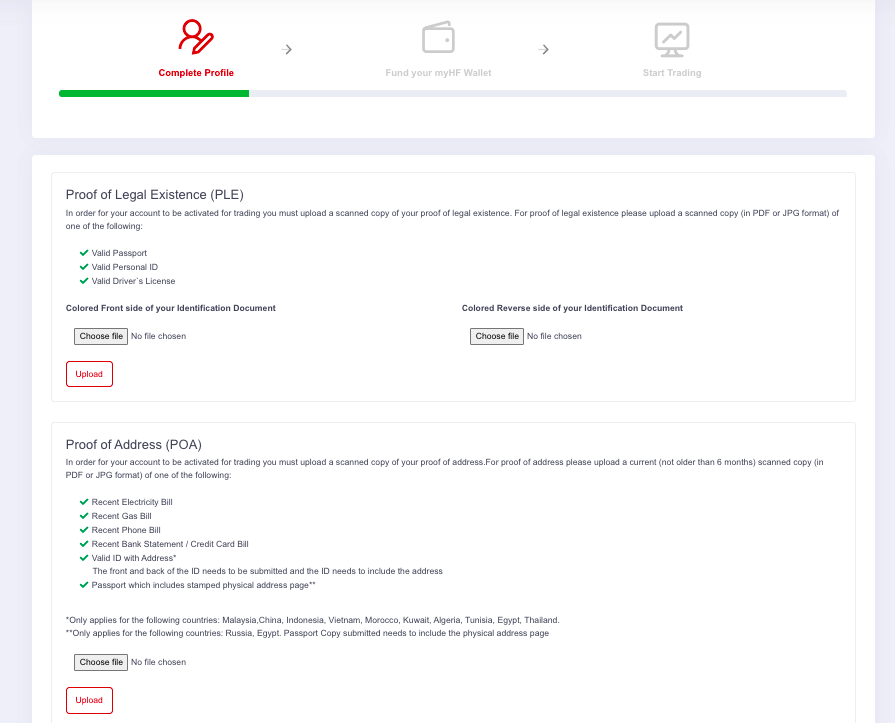

- Now you can proceed to login, and on your dashboard, you will be required to complete registration/profile by supplying some personal and economic information, including your experience level with Forex trading.

-

- Next, you will be required to upload a valid ID to verify your identity and a proof of address to verify your address. Then wait for the approval.

- After your account is approved, you can make deposits, start trading, make transfers and withdrawals.

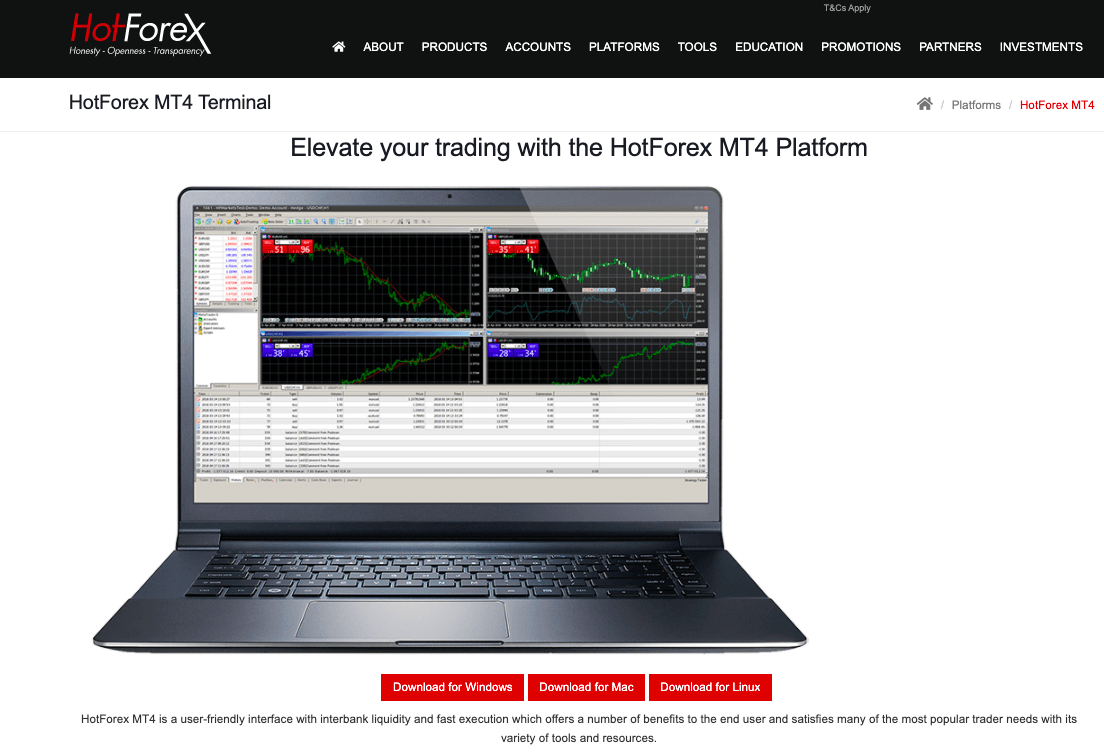

Step 3) Download the Platform:

After your account is approved, you can go ahead and download the HF Markets website to download an MT4 or MT5 trading platform for any device.

Now that you have downloaded a trading platform, you can log in make deposits, trade, and withdraw funds.

Traders in Malaysia can deposit funds to their online trading accounts through multiple payment options accepted by most brokers in Malaysia.

The most common options include debit/credit cards and local bank transfers via a Malaysian bank account. Normally these forex brokers accept local payments via online payment processors in Malaysia or e-wallets like Skrill.

Local bank transfers via a Malaysian bank account to a broker can normally take 1-2 days on average to process and might attract some charges (some brokers offer free funding). Other deposit methods are usually free and processed instantly or in a few hours.

Because retail Forex & CFD trading brokers are unregulated in Malaysia, if you are depositing and withdrawing funds through foreign Forex brokers, then it can be tricky.

If you are funding & withdrawing via bank transfers, then it can be risky; as Malaysian banks are not authorized to deal with unlicensed Forex brokers & dealers. Some of them might refuse to process your payment or report an account if they realize the parties involved are offshore retail forex brokers.

How To Choose Best Forex Brokers in Malaysia

Selection of the best-suited forex broker is the most important step in starting forex trading. If you are a beginner in forex trading, the following are the factors that need to be considered before opening your live trading account.

Regulation: Forex and CFD trading is not yet regulated in Malaysia. Hence traders need to ensure that the brokers they are choosing are safe. This can be done by going through the background of the company and checking their regulation in different parts of the world.

A broker that is regulated by one or more tier 1 regulatory authority like FCA, ASIC, or FSCA have less third-party risk and are considered safer than those who are not. Apart from regulations, traders must also enquire about the broker’s history, ownership, and reviews by existing clients and experts. Also, check reviews by reputed websites such as this website to see if a broker is legitimate and has a good reputation in the market.

Fees: The fees incurred from traders is the source of revenue for the brokers. Each broker incurs different fees with different structures. In forex, narrow spreads are highly beneficial for traders. Apart from spreads and commission traders must also enquire about other charges like account management fees, inactivity fees, deposit/withdrawal fees, currency conversion fees, etc.

Trading Platform: The trade orders will be placed and closed through the trading platform. Hence, the interface of the trading platform should be user-friendly. MT4 and MT5 are the most chosen trading platforms globally but some brokers also offer much simpler platforms. It is important to check the available trading platforms at the broker and check suitability with the platform.

Customer Support: Traders might face queries while trading online at any instance. With actively available customer support services through live chat and phone, traders can get quality services from the broker. Traders can check the quality and availability of support services by raising random queries before opening their accounts.

Available Instruments: Each forex and CFD broker in Malaysia allows trading on a different number of available instruments. Before opening a live trading account, traders must check the available instruments and ensure that their preferred instrument is available at the broker or not. Traders must also check the contract specification for their preferred instrument before opening account.

Risk Involved in Forex Trading

The forex market is a high-risk financial market and forex traders are exposed to a high risk of financial losses. The risk involved in forex trading can be mitigated to lower levels by taking precautionary measures and informed decisions. However, the risk in forex trading cannot be eliminated completely.

Following are the major component of Risk in Forex Trading

Market Risk

Forex markets are active 24*5, unlike conventional capital markets. The prices of each currency pair can fluctuate due to multiple reasons at any time of the day. At times these sudden movements are hard to predict. Research, analysis, and news feeds can mitigate the market risk but forex traders can always face losses due to market risk.

Leverage Risk

Leverage allows traders to open bigger positions with smaller deposits. Leverage allows traders to book more profit but it is a double-edged sword that can also increase the losses exponentially. FCA-regulated brokers cannot offer more than 1:30 leverage however, leverage of 1:10 can be considered safe in the initial phase of forex trading.

Position Close Out

If a large position is opened with a small amount remaining in the account equity, the position will close out automatically when the price moves against the anticipation. The auto closure of the position without the wishes of the trader may lead to significant losses. Traders must always open positions according to their account balance and keep a stop loss on an opened position.

Third-Party Risk

The risk of opening an account with a fake broker or scammer is called third-party risk. The broker holds all your deposits and might run away with them if it is fake. This risk can be mitigated by choosing a broker that is well-regulated by top-tier authorities like FCA, FSCA, and ASIC.

Lack of Knowledge and Experience

Insufficient knowledge and experience in Forex trading can increase the risk of making poor trading decisions. It’s essential to educate yourself about fundamental and technical analysis, risk management, and trading strategies before engaging in live trading. Starting with a demo account can help you practice and gain confidence before trading with real money.

Emotional and Psychological Risks

Forex trading can be emotionally challenging, as traders may experience fear, greed, or impatience. Emotional decision-making can lead to impulsive trades and poor risk management. Developing discipline, patience, and emotional control is crucial for successful trading.

Tips to Become a Successful Forex Trader

Educate: Learn the basics of forex trading.

Reliable Broker: Choose a regulated broker with good support.

Risk Management: Set stop-loss, take-profit, and manage risk.

Demo Account: Practice on a demo account before real trading.

Plan: Develop a clear trading plan and stick to it.

Major Pairs: Begin with major currency pairs.

Stay Informed: Follow global economic news.

Analysis: Use technical and fundamental analysis.

Emotions: Control emotions to avoid impulsive decisions.

Patience: Success takes time; avoid quick gains.

Consistency: Stick to a proven strategy.

Records: Maintain a trading journal.

Diversify: Consider diversifying beyond forex.

Comparison of Best Forex Brokers Malaysia

| Broker Name | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| HF Markets |

1.2 pips

|

$5

|

1:1000

|

Visit Broker |

| OctaFX |

0.5 pips

|

100 MYR

|

1:500

|

Visit Broker |

| XM |

1.6 pips

|

$5

|

1:888

|

Visit Broker |

| Tickmill |

0.3 pips

|

$100

|

1:30

|

Visit Broker |

| FXTM |

1.5 pips

|

$200

|

1:200

|

Visit Broker |

| Pepperstone |

0.2 pips

|

$200

|

1:30

|

Visit Broker |

FAQs on Best Forex Brokers Malaysia

Is Forex Trading Legal in Malaysia?

Forex trading in Malaysia is not legalized yet but is neither illegal. Retail forex brokers offering trading services in Malaysia operate in a legal grey area. International forex brokers are allowed to accept clients residing in Malaysia.

Which Forex Brokers have Islamic Accounts?

Many Forex Brokers support Islamic Accounts for Muslim traders, this includes HF Markets, Tickmill, FXTM, OctaFX, and others. Such brokers do not incur swap fees on their Islamic or swap-free accounts. In return, they might incur a higher spread or trading commission.

How do I choose a good forex broker?

To choose a good forex broker in Malaysia, you need to ensure safety through regulatory licenses held by the broker. Compare the fees, available instruments, trading platforms, customer support services, etc.

Which brokers are most trusted?

Forex brokers that hold regulatory licenses from top-tier financial regulatory authorities of the world can be trusted and considered safe. Forex trading is not yet regulated in Malaysia, traders need to be vigilant while opening the account and avoid fake brokers.

Can I trade forex without a broker?

No, retail traders cannot trade forex without opening their account with a broker. Traders need to open an account with a well-regulated forex broker that accepts clients residing in Malayisa to trade forex and CFDs.

Who controls the forex market?

Forex market or the prices of currency pairs cannot be controlled by one single authority. It is highly influenced by the government, central banks, commercial banks, or international financial institutions.

What is the safest forex broker?

A broker that is regulated by one or more financial regulatory authorities of top-tier can be considered safe for trading. FCA of the UK, ASIC of Australia, FSCA of South Africa, etc are considered as top-tier regulatory authorities. If a broker or its parent company is listed on an Stock Exchange, it increases the trust factor.HF Markets, FXTM, Pepperstone, etc are among the safest forex brokers in Malaysia.

Which broker is the best in Malaysia?

According to our analysis and comparison, HF Markets, FXTM, Pepperstone, and Tickmill are the best forex brokers in Malaysia. These brokers have been selected on the basis of regulation, fees, trading conditions, trading platform, deposit and withdrawal and several other factors.

Which Forex Broker is Best For Beginners?

Based on our research, HF Markets is best for beginners because it offers negative balance protection, has low fees, offers bonuses, and is regulated by a Tier-1 regulator.