Best cTrader Forex Brokers UK 2024

cTrader is the third most chosen electronic trading platform in the world. It has various advantages over MT4 and MT5 and is ideal for several types of traders.

cTrader is a trading platform used by people to buy and sell currencies, stocks, and other financial assets. It’s easy to use and has tools to help traders analyze prices. It’s known for being fast and allows automated trading. Traders can also see how many people want to buy or sell at different prices, which can be useful. It’s available on computers, the web, and mobile devices, making it convenient.

cTrader is an advanced trading platform that is ideal for all types of traders due to its simple interface and professional trading capabilities. cTrader is an electronic trading platform that was developed by Spotware Systems in 2010 in the island nation of Cyprus.

List of Best cTrader Forex Brokers in the UK

- Pepperstone – Regulated CFD Broker with Fast Trade Execution

- IC Markets – Best for Automated Trading

- FxPro – Best Broker for Educational Resources

cTrader is preferred by a lot of traders worldwide for forex and CFD trading. The trading conditions and contract specifications like spreads, leverage, swaps, available instruments, etc depend on the broker chosen by the trader. Hence, it is important to check the features, trading conditions, and safety of the brokers that you are choosing with the cTrader platform.

We have analyzed multiple forex and CFD brokers in the UK that allow trading through cTrader as a trading platform on multiple devices. To assist the traders in choosing the best-suited cTrader forex broker, we have also described their important features and conditions.

#1 Pepperstone – Regulated CFD Broker with Fast Trade Execution

Pepperstone is an FCA-regulated forex and CFD broker that allows trading on various financial instruments through different trading platforms including cTrader.

Regulation: Pepperstone UK Ltd is the legal entity registered with Financial Conduct Authority (FCA) under license number 684312. Pepperstone is regulated by several other financial regulatory authorities including ASIC of Australia, BaFIN of Germany, CySEC of EU, etc.

Pepperstone has its headquarters in London and was launched in 2010. It has a very low third-party risk and can be considered safe for traders in the UK.

Fees: Pepperstone offers two types of accounts namely Razor and Standard with different trading fees. The spreads with the Razor account start from 0.1 pips. The Razor account also incurs a trading commission of $3.5 per side for a standard lot.

The spreads with the Standard account start from 0.6 pips with no commission. The average typical spread for EUR/USD is 0.7 pips with the Standard account and 0.1 with the Razor account. Both accounts can be chosen with the cTrader trading platform.

No other fees are incurred at Pepperstone. Deposits and withdrawals are free and there is no inactivity fee.

Trading Condition: Traders can choose between MT4, MT5, and cTrader as trading platform. Traders can also select the leverage with a maximum being 1:30 for major pairs as per FCA regulatory compliance.

There is no minimum deposit amount for trading. However, to start copy trading, traders will need to make a minimum deposit of $2000.

GBP can be chosen as the base currency of the account. Deposits and withdrawals can be made through local bank transfers, credit/debit cards, and several e-wallets.

Overall, Pepperstone can be an ideal choice for all types of traders due to the availability of multiple trading platforms with different pricing structures.

#2 IC Markets – Best for Automated Trading

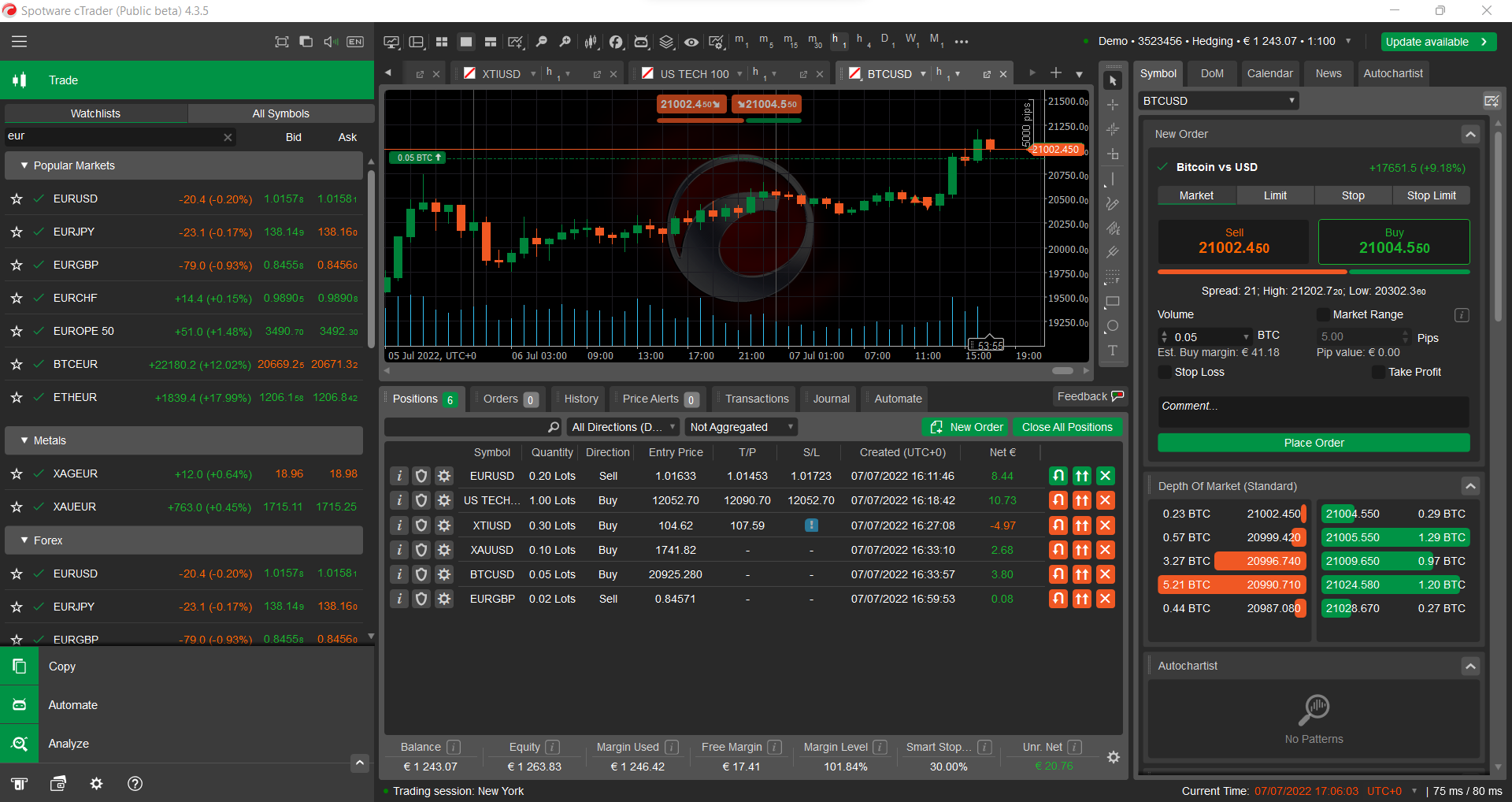

IC Markets is an Australian forex and CFD broker that has been offering trading services since 2007. It allows trading through cTrader along with MT4 and MT5 trading platforms.

Regulation: Traders residing in the jurisdiction of the UK are registered at IC Markets under FCA regulation. IC Markets is regulated by FCA under license number 827935.

IC Markets is also regulated by the ASIC in Australia and CySEC in the European Union. They were incorporated in 2007 and can be considered safe for traders residing in the UK.

Fees: IC Markets offer 3 different types of trading accounts but only one can be chosen with the cTrader trading platform. The cTrader Raw Spread account at IC Markets incurs a fixed commission of $3 for a single side trade of a standard lot.

The commission with the MetaTrader account is $3.5 per side per standard lot. Hence, the cTrader account involves slightly lower fees compared to MetaTrader.

Traders cannot trade without commission through cTrader at IC Markets. The spreads with the cTrader Raw Spread account are as low as 0 pips. For EUR/USD, the average typical spread is 0.1 pips with this account type.

The cTrader account at IC Markets might not be ideal for traders who wish to trade with the spread only. The commission-free account at IC Markets is only available with the MetaTrader trading platform with spreads starting from 0.6 pips.

IC Markets does not involve any deposit/withdrawal fees or inactivity fees.

Trading Condition: IC Markets allow trading on more than 1600 instruments including 61 currency pairs, 25 indices, 20 commodities, bonds, ETFs, and 10 cryptocurrencies. The minimum deposit amount at IC Markets is $200.

#3 FxPro – Best Broker for Educational Resources

FxPro is an FCA-regulated forex and CFD broker that allows trading through multiple trading platforms including cTrader. However, clients can only trade with a commission-based pricing structure at FxPro through the cTrader trading platform.

Regulation: FxPro FxPro UK Limited is authorized and regulated by the Financial Conduct Authority under license number 509956. They are also regulated by the CySEC of the EU and FSCA of South Africa.

FxPro was incorporated in 2006 and has partnered with various sporting clubs including McLaren Formula 1 Team. FxPro can be considered safe for trading forex and CFDs in the UK.

Fees: The fee structure at FxPro depends on the account type chosen by the trader. The cTrader account involves a trading commission of $4.5 per standard lot apart from the spreads that are very low (starting from 0.1 pips).

The trading accounts with MT4 and MT5 trading platforms incur spread as the only trading fees which are much higher than that with the cTrader account. The cTrader account might not be ideal for small-volume traders at FxPro as the trading commission will be incurred.

Trading Conditions: The cTrader account at FxPro allows trading on forex pairs, metals, indices, and energies. Futures and shares cannot be traded with the cTrader account but are available with the MT4 and MT5 accounts at FxPro.

Features of cTrader Trading Platform

User-Friendly Interface:

cTrader is known for its clean, intuitive interface that caters to both novice and experienced traders. The platform offers a customizable layout, allowing users to adjust the interface according to their preferences.

Advanced Charting Tools:

The platform provides advanced charting capabilities, including multiple chart types, time frames, and technical indicators. Traders can easily analyze market trends and patterns with these comprehensive charting tools.

Level II Pricing:

cTrader offers Level II pricing, which displays the full range of executable prices directly from liquidity providers. This feature provides deeper insight into market depth, helping traders make more informed decisions.

One-Click Trading:

To facilitate fast execution, cTrader supports one-click trading directly from the chart or quote panel. This allows traders to quickly open and close positions without navigating through multiple screens.

Detachable Charts and Windows:

Traders can detach charts and other parts of the platform interface to set up a more flexible trading environment. This is particularly useful for those with multiple monitors, enabling them to monitor different instruments or time frames simultaneously.

cTrader Automate:

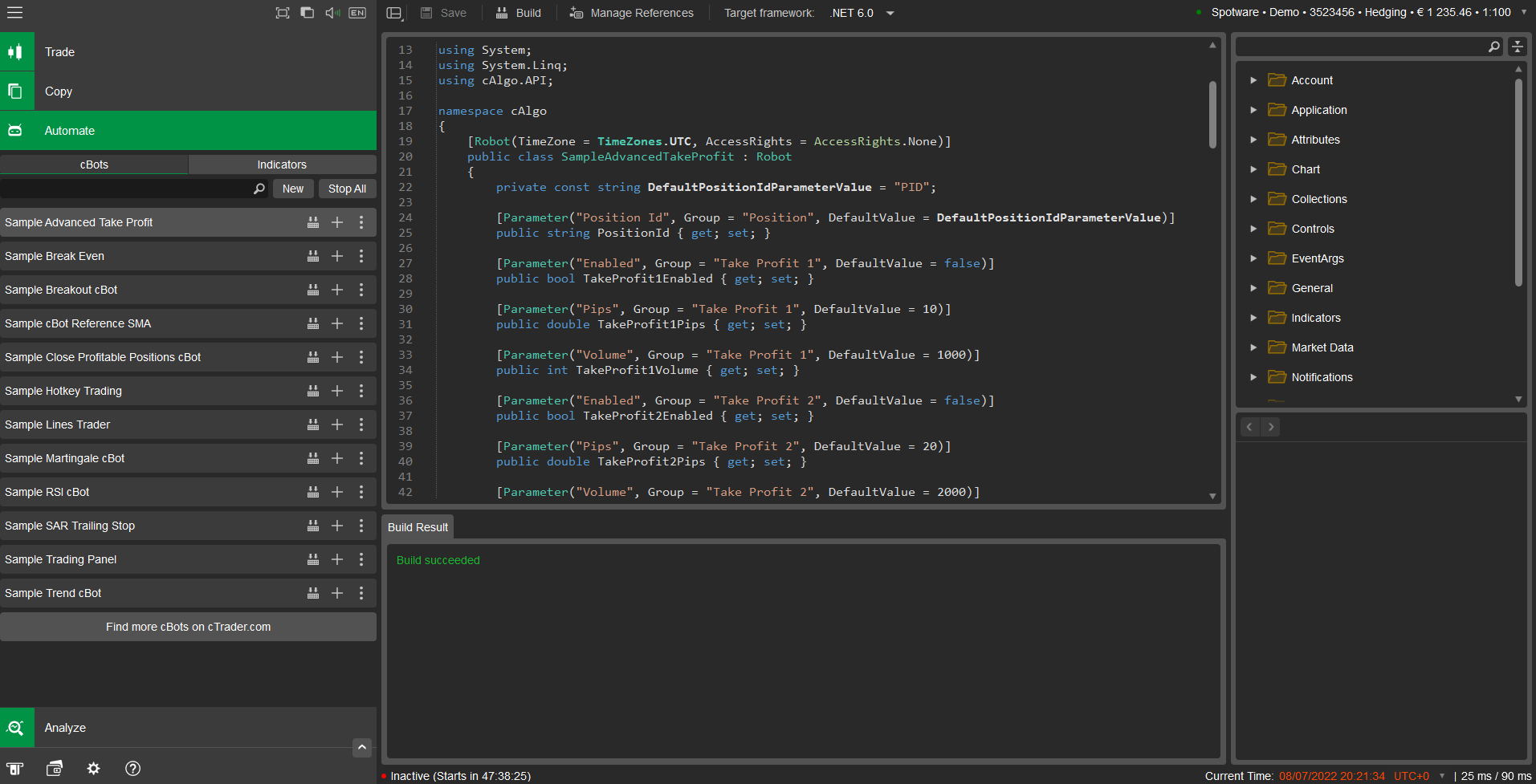

Formerly known as cAlgo, cTrader Automate is a feature that allows traders to develop and run algorithmic trading robots and custom technical indicators using the C# programming language. This caters to traders interested in automating their trading strategies.

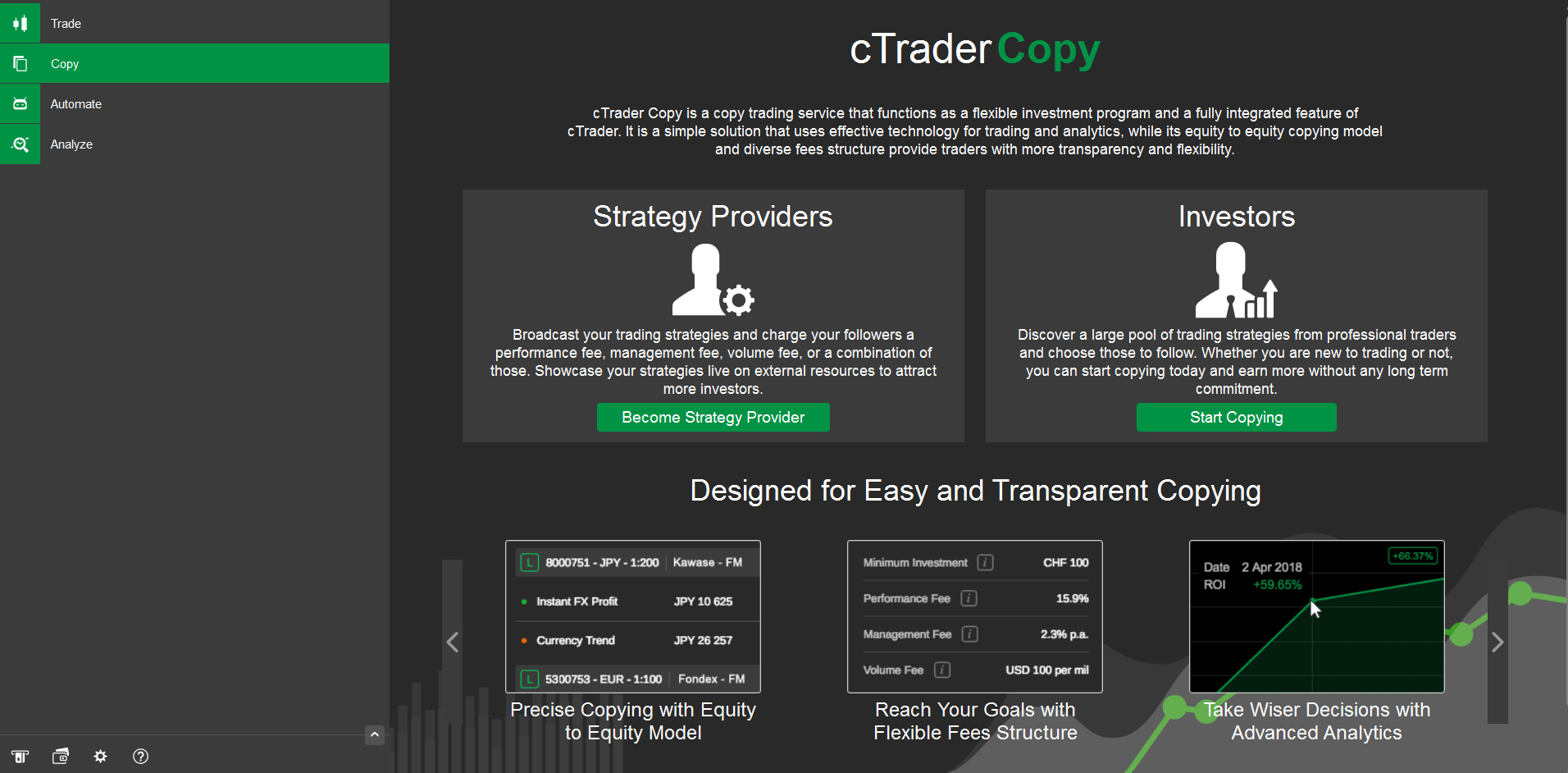

cTrader Copy:

This is cTrader’s copy trading feature, allowing users to copy the strategies of other traders or provide their strategies for others to follow. It offers flexible risk management and customization options for followers and strategy providers.

Cloud Integration:

cTrader supports cloud integration, enabling traders to save their accounts, templates, and chart setups in the cloud. This feature allows for seamless access and transition between different devices.

Advanced Order Types:

The platform supports advanced order types such as Market Orders, Limit Orders, Stop Orders, and a range of conditional orders like Stop-Limit Orders, providing traders with sophisticated trade management options.

Comprehensive Market Analysis Tools:

cTrader includes various analysis tools, such as economic calendars, market sentiment indicators, and detailed trade statistics, helping traders stay informed and make data-driven decisions.

Mobile Trading:

cTrader offers mobile applications for both Android and iOS devices, ensuring traders can manage their accounts and trade from anywhere, at any time.

Web Platform:

The cTrader Web platform provides access to trading accounts without the need for software installation, offering flexibility for traders to access their accounts from different devices.

Pros and Cons of Choosing cTrader

Thousands of traders use the cTrader trading platform on various devices to trade forex and CFDs. However, the number of traders who use MT4 and MT5 is higher than cTrader. The trading conditions, instruments availability, etc, depend on the broker chosen with the cTrader platform.

There are several pros and cons of choosing cTrader over other trading platforms in the UK.

Pros of Trading With cTrader

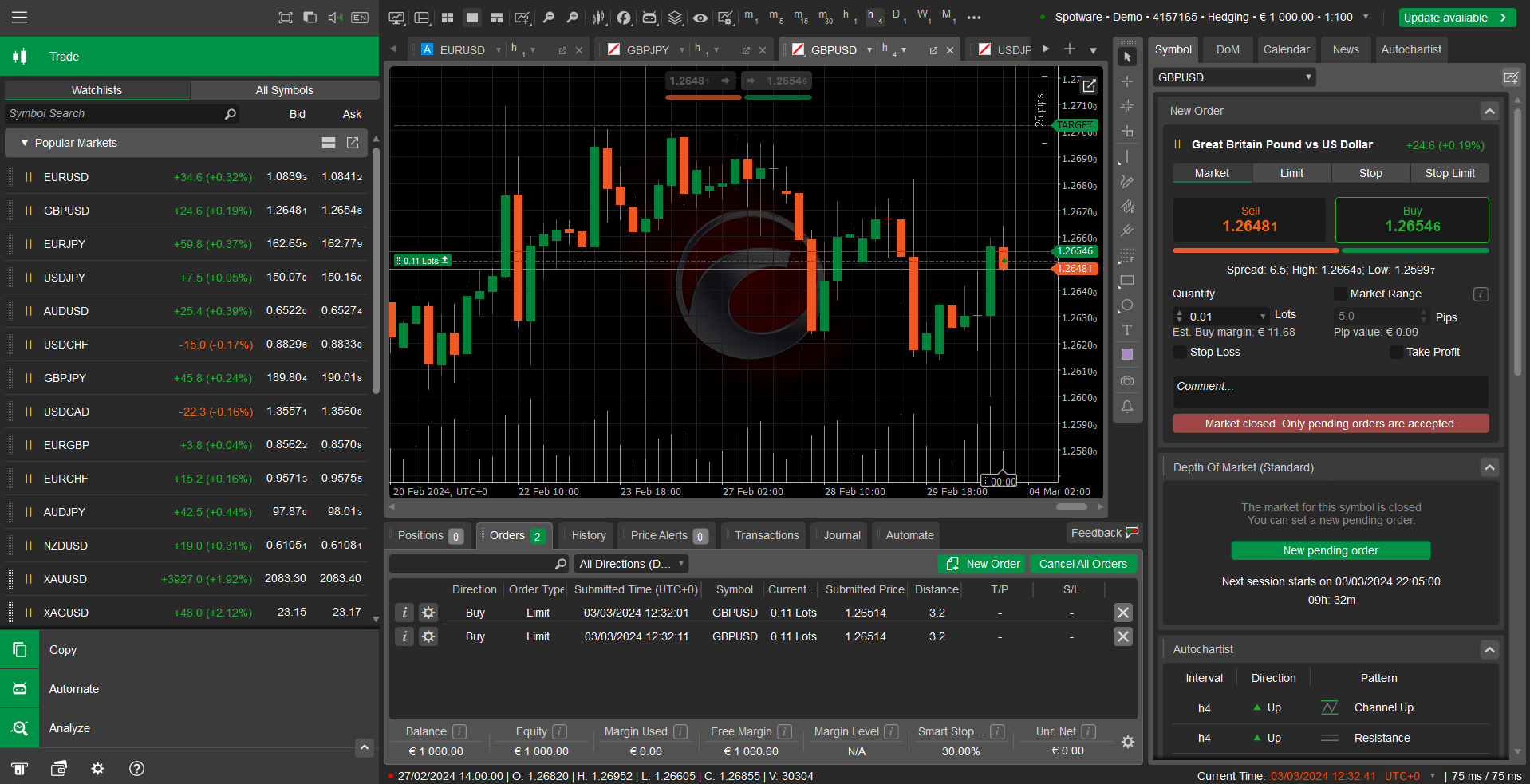

1) Simple Interface: Compared to MT4 and MT5, the user interface of the cTrader trading platform is much simpler. All the available features are easily accessible from the main trading window at cTrader. The available instruments are listed on the left side, and the right toolbar specifies contract details and allows the placing of trades on the chosen instruments.

It is very easier to track, modify, or close position on cTrader. The platform is designed in such a manner that it is suitable for beginners as well as experienced traders.

2) Detailed Charts: The detailed candlestick charts of the selected financial instrument are visible whenever an instrument is selected. The default chart opens on a small window in the middle of the platform window which can be maximized to access several other features. Multiple time frames, ticks, Renko, and ranges can be selected on the detailed chart.

3) Copy Trading: The copy trading feature is easily accessible through the cTrader trading platform. Traders can easily copy other traders or become strategy providers through which other traders can copy your trades.

The conditions and fees for copy trading depend on the broker chosen by the trader.

4) Automated Trading: Algorithmic trading is a major reason why many traders prefer cTrader over MT4 and MT5 trading platforms. cTrader allows traders to program their trading strategy in C# language which is much simple to work with.

Automated trading with MT4 and MT5 trading platforms is done with MQL4 and MQL5 programming languages. These languages are slightly difficult to work with compared to the C# language. There are several preset c programs that can be modified or used to implement automated trading strategies.

If you are new to automated trading and programming, starting with the C# language at cTrader will be much simpler compared to MQL4 and MQL5 languages.

Cons of Trading With cTrader

1) Limited Indicators: The number of charting tools and indicators at the cTrader trading platform is lesser than MT4 and MT5 trading platforms. However, the tools are still higher than many other proprietary trading platforms.

There are a limited number of preset patterns and indicators which limits the technical analysis that can be done on any instrument at cTrader. This is a major reason why most traders do not use cTrader for analysis or use a third-party tool for technical analysis.

2) Complexity: The navigation through all the available tools and features is convenient at cTrader as a lot of tabs are present on the home window. However, this increases the complexity of the platform and some traders might not be able to focus on useful tools.

On the contrary, MT4, MT5, eToro, etc have lesser tabs that allow traders to focus more on the charts’ opened positions.

cTrader Mobile Trading Platform

cTrader can also be used from mobile and tablet devices apart from desktop and web traders. The android and iOS version of cTrader is an ideal mobile trading application for beginners.

The cTrader mobile application is available in 22 languages and has a very simple interface. It offers interactive charts for research and analysis. The app has 26 timeframes and more than 50 indicators to assist traders. Compared to other mobile trading platforms, cTrader can be considered among the best mobile trading application in the UK.

cTrader vs MT4 vs MT5

| cTrader | MT4 | MT5 |

|---|---|---|

| cTrader is developed by Spotware Systems | MT4 is developed by MetaQuotes Software | MT5 is developed by MetaQuotes Software |

| cTrader was developed in 2011 | MT4 was developed in 2005 | MT5 was developed in 2010 |

| cTrader has 26 timeframes | MT4 has 9 timeframes | MT5 has 21 timeframes |

| cTrader uses #C language for automated trading | MT4 uses MQL4 language for automated trading | MT5 uses MQL5 language for automated trading |

| cTrader has a modern-looking interface but less customisation | MT4 has basic interface like windows 98 but highly customisable | MT5 has similar interface like MT4 but more features |

How to Choose a cTrader Forex Broker?

If you wish to trade with the cTrader electronic trading platform, you will need to open an account with a broker that supports the cTrader platform. To have a better trading experience, traders need to consider certain aspects before opening their accounts.

Following are the major considerations that traders should look out for while choosing a cTrader forex broker for themselves.

1) Regulation

The Financial Conduct Authority (FCA) is the financial regulator that safeguards the interest of traders and looks over the activities of regulated entities. Forex brokers or financial service providers may or may not be regulated by FCA in the UK.

FCA regulation is the most important factor that traders should look out for while choosing a forex or CFD broker. This can be checked by accessing the register of regulated entities at the official website of FCA.

Most brokers mention the details of FCA regulation in the footnote of their website including the FCA license number. This number can be entered at the FCA register to cross-check the details of FCA regulations. Clients registered under FCA are protected by up to GBP 85,000.

2) Fees

The trading fees for trading any particular instrument can be different for each broker. Most brokers have multiple pricing structures differentiated by the account types. For example, the spread is the only trading fee at FxPro with MT4 and MT5 platforms while the cTrader account involves a trading commission.

Lower spreads are highly advantageous for traders as it increases the profit, reduce the loss amount as well as increase the probability of making profits. However, some fake brokers or scammers may use lower fees to lure deposits from new traders.

3) Trading Instruments

Each forex and CFD broker that allows trading through the cTrader trading platform in the UK offer a different number of instruments. If you choose a broker without checking available instruments, you might not find your preferred trading instruments on the cTrader trading platform.

Apart from the availability of instruments, traders must also check the contract specifications and trading conditions like leverage, spreads, swap, etc.

4) Customer Support

A good customer support service can have a major impact on the trading experience. The availability of support services is most important for the beginner. Traders tend to face multiple queries in their initial phase.

Most forex and CFD brokers offer support services through live chat and email. However, some brokers may also offer local phone numbers for customer support. Traders must be able to connect effortlessly with the broker to resolve queries.

Traders must only compare the fees after checking the regulation details and ensuring the safety of the broker.

Key Features of cTrader Trading Platform

Following are the key features of the cTrader trading platform:

- User-Friendly Interface: cTrader offers an intuitive and customizable interface, making it easy for traders to navigate and access tools efficiently.

- Advanced Charting: The platform provides sophisticated charting tools with multiple timeframes, technical indicators, drawing tools, and object-based charting for in-depth market analysis.

- Level II Pricing: cTrader includes Level II pricing, showing real-time liquidity and order book depth, aiding traders in making informed decisions.

- One-Click Trading: Traders can execute trades quickly with one-click trading, allowing swift entry and exit from positions.

- Algorithmic Trading: cTrader supports algorithmic trading through its cAlgo platform, where traders can create and backtest custom trading algorithms using C# programming.

- Order Types: The platform supports various order types, such as market, limit, stop, and trailing stop orders, catering to diverse trading strategies.

- Direct Market Access (DMA): With DMA, traders can connect directly to liquidity providers, ensuring transparent and low-latency trading.

- Cloud-Based Trading: cTrader’s cloud-based infrastructure enables traders to access their accounts and trade from any device with an internet connection.

- Risk Management Tools: The platform provides essential risk management tools, like Stop Loss and Take Profit orders, to help traders protect their positions.

- Copy Trading Integration: cTrader supports copy trading, allowing users to follow and replicate trades of successful traders on the platform.

- Multi-Account Management: Traders can manage and trade multiple accounts simultaneously using cTrader’s multi-account management feature.

cTrader’s feature-rich environment makes it suitable for both beginners and experienced traders, offering a comprehensive suite of tools to enhance the overall trading experience.

Limitations of cTrader Platform

Broker Availability: While cTrader’s popularity has grown, it might not be as universally offered by brokers in comparison to more prevalent platforms like MetaTrader 4 or MetaTrader 5. This can constrain the options available to traders seeking cTrader compatibility.

Relative Popularity: Despite its feature set, cTrader might have garnered less attention and adoption among traders and developers compared to some other trading platforms. Consequently, this could result in a smaller selection of third-party indicators, expert advisors (EAs), and a narrower community support base.

Custom Indicator Availability: The variety of custom indicators accessible for cTrader might be more limited than what’s accessible on other platforms. This could be a concern for traders who heavily rely on tailored technical indicators.

Algorithmic Trading Complexity: While cTrader supports algorithmic trading through cAlgo, the process of crafting and implementing automated trading strategies might be more intricate compared to platforms utilizing more established programming languages, such as MetaTrader’s MQL4 or MQL5.

Comparison of Best cTrader Forex Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| Pepperstone |

0.09 pips

|

£0

|

1:500

|

Visit Broker |

| IC Markets |

1 pip

|

$200

|

1:500

|

Visit Broker |

| Fxpro |

1.3 pips

|

$100

|

1:30

|

Visit Broker |

FAQs on Best cTrader Forex Brokers UK

Is cTrader better than MetaTrader?

Each trading platforms have its pros and cons. cTrader is a modern-looking platform with multiple tabs and easy accessibility. MetaTrader trading platforms have a much simpler interface and compatibility. More traders prefer MT4 and MT5 over the cTrader forex trading platforms.

Which company owns cTrader?

Spotware Systems is a fintech company based in Limassol Cyprus that developed the cTrader forex and CFD trading platform. The cTrader was incorporated for retail traders in 2010.

What Brokers Can you use with cTrader?

Pepperstone, IC Markets, and FxPro. Many forex and CFD brokers in the UK offer cTrader trading platforms and accept clients from the UK. However, only 3 of them are currently regulated by the FCA and can be considered safe for trading on the cTrader trading platform.

Is cTrader safe?

Yes, cTrader is a safe and reliable electronic trading platform that was introduced in 2010. However, the safety of clients depend on the broker they have chosen with the cTrader trading platform.

Does cTrader have an app?

Yes the cTrader mobile trading application can be downloaded on Android and iOS devices to trade from mobile and tablet devices. The cTrader mobile trading app needs to be linked with a live trading account at a regulated broker that supports cTrader platforms.

Is cTrader better than MT4?

cTrader offers more indicators and supports more time frames for analysis. It also has a modern-looking interface compared to the MT4 interface which looks like windows 98. However, more traders prefer MT4 over cTrader due to its simplicity, fast execution, customisation, and adaptability with different software. Each trader has different suitability of trading platforms.

What is the minimum deposit for cTrader?

The minimum amount required to start trading with cTrader depends on the broker chosen by the trader. cTrader is an electronic trading platform. It needs to be paired with a broker that supports the cTrader platform. The minimum deposit, fees, contract specification, regulation, and trading conditions depend on the broker chosen by the trader.

Is cTrader good for scalping?

Yes, scalping can be done on the cTrader trading platform and many scalpers prefer cTrader for scalping. cTrader offers fast execution with a simple interface and easy automation with c language, making it ideal for scalping in forex and CFDs.

Can you copy trades from cTrader to MT4?

No, the trade orders from cTrader cannot be directly copied to MT4 but it can be done using third-party applications. Copy trading on the cTrader platform can only be done through the cTrader trading platform.

Which broker is best for cTrader?

Yes, scalping can be done conveniently through the cTrader trading platform. Scalpers trade for a very short tenure that involves rapid opening and closing of trading positions. cTrader allows fast execution of trades with no slippage that is convenient for scalping.

Is cTrader better than Tradingview?

cTrader is a trading platform while TradingView is a web-based social network for traders that allow basic to advanced level analysis and research on charts. TradingView can also be paired with a supported broker for trading but cTrader can only be used for trading. Trading view offers many more features compared to cTrader.