Best Automated Trading Platforms UK 2024

We've compared the some of automated trading platforms for UK traders. You can check advantages & disadvantages and also compare them. In this guide you can also learn how to choose the best automated trading forex broker for your trading and how to open account with a broker.

Automated trading has slowly become the norm in forex and CFD trading. Most of the trading in forex markets is automated.

Automated trading refers to trading with the help of scripts, algorithms, or automated trading software (called EAs or Expert Advisors). The algorithm will automatically place long or short orders for you, based on pre-determined entry and exit point conditions in your script.

Most forex and CFD brokers operating in the UK support automated trading. They have trading platforms that can be integrated with automated trading software to allow you to trade without manually making the trades.

For example, MetaTrader 5 is one of the most popular trading platforms with support for EAs (Expert Advisors).

You can build or write your own algorithms for automated trading, or you can install third-party scripts and customize it according to your requirements.

Remember that you should only trade through brokers that are licensed by the Financial Conduct Authority (FCA) in the UK to ensure the safety and protection of your funds.

Here is a List of the Best Automated Trading Platforms in the UK for 2024 based on our Research

- eToro – Best Automated Trading Broker UK

- Pepperstone – Award-Winning Broker

- AvaTrade – Best Trading Platforms for Automated Trading

- CMC Markets – Highly Reputed Broker

- FXCM – Best in Class for Algorithmic and Social Trading

Key Takeaways

- The programming languages of computers can be used in financial markets to take the advantage of price action and trading opportunities.

- With automated trading, traders can trade without bringing their emotions.

- The decision to open or close a trade depends on an algorithm programmed in computer language.

- MQL4, MQL5, and cTrader are the most common programming language used in trading.

- Automated trading can be risky at times when a fundamental event triggers prices significantly.

In this article, we’ll cover five of the best-automated trading brokers that operate in the UK. We’ll also discuss how to open such an account and some frequently asked questions.

List of the Best Automated Trading Brokers UK

#1 eToro – Best Automated Trading Broker UK

eToro is a forex and CFD broker that has been operating since 2007. The broker is most widely known for its social and copy trading services.

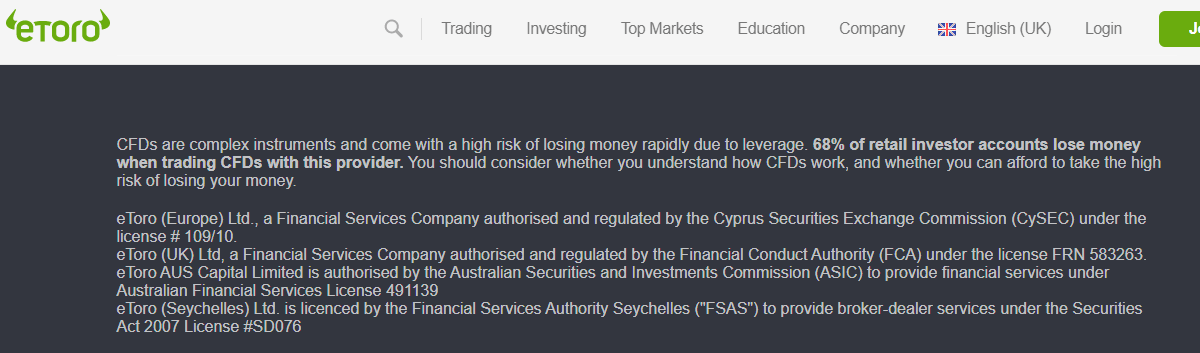

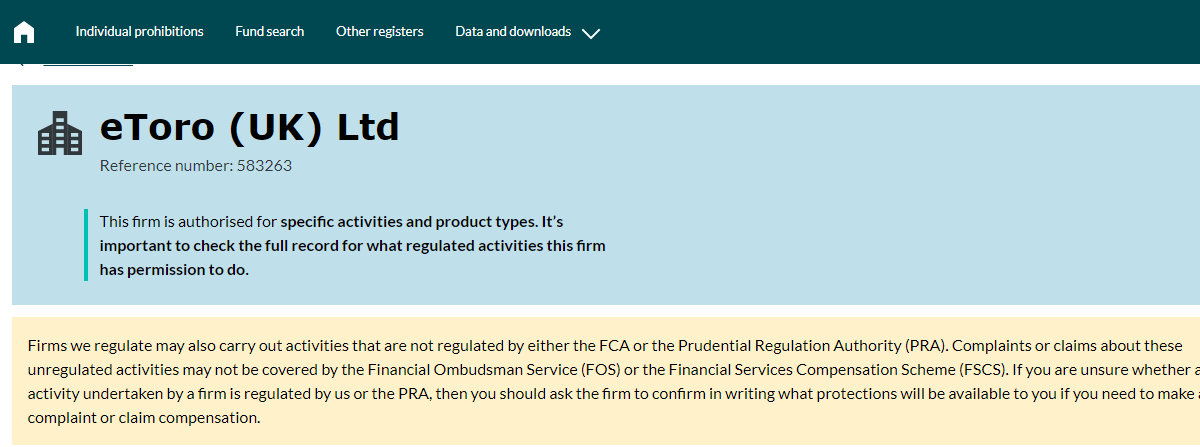

Regulation: eToro is regulated by the Financial Conduct Authority (FCA) under the name eToro (UK) Limited. The company holds license number 583263. eToro is also regulated in other jurisdictions such as Australia (by the ASIC), Cyprus (by the CySEC), and Seychelles (by the FSAS).

eToro also implements safety practices such as negative balance protection and segregation of funds.

Overall, we believe that eToro is a safe broker to trade through for residents of the UK.

Overall Fees: eToro charges a minimum spread of 1 pip for trading the benchmark EURUSD currency pair. The spread is quite high even though eToro does not charge a commission.

In addition to the spread, eToro also charges an “overnight fee” if you hold an open position overnight.

eToro also charges a few “hidden fees” such as a withdrawal fee of $5 and an inactivity fee of $10 per month if you’re inactive for a period of more than 12 months.

eToro does not charge deposit fees or account maintenance fees.

Trading Conditions: eToro requires a minimum deposit of $10 from traders residing in the UK.

The broker offers just two types of accounts called “live” and “demo”. The live account allows you to trade using real money while the demo account is meant for just practising and paper trading.

The maximum leverage that traders from the UK can employ is 1:30 (for forex instruments), in accordance with FCA rules.

With eToro, you have the availability of trading 49 currencies, 33 commodities, 13 indices, more than 2000 stocks, and 264 ETFs. The overall number of instruments is quite low, especially for traders from the UK who cannot trade cryptocurrency CFDs.

eToro only allows USD as a base currency. This means that traders from the UK will have to convert their GBP into USD before they can trade, hence they’ll have to bear the conversion cost.

You can deposit money into your account in a variety of ways including credit cards, bank transfers, or payment wallets such as Skrill and Neteller. Remember that if you use a bank transfer, then you need to transfer a minimum of $500.

Customer Support: eToro does not offer customer support through phone calls or email. The live chat option is also available only to Club members.

The only way to reach their customer support team is through a ticketing system available on their website. This process can be quite slow, hence, the customer support provided by eToro is quite poor when compared to other brokers.

Traders can also find answers to common questions themselves by looking through the Help Center section on the website.

eToro Pros

- It provides social and copy trading services

- eToro does not charge a commission

- Intuitive and easy-to-learn trading platform

eToro Cons

- eToro charges hidden fees in the form of a withdrawal fee and inactivity fee

- The selection of trading instruments is low

#2 Pepperstone – Award-Winning Broker

Pepperstone has been operating since 2010 as an Australian broker. The broker has expanded to the UK and other regions of the world in a short period of time.

Regulation: Pepperstone is licensed to operate by the FCA under the name Pepperstone Limited. In addition, Pepperstone is licensed by the ASIC of Australia, SCB of the Bahamas, CMA of Kenya, CySEC of Cyprus, BaFIN of Germany, and the DFSA of the United Arab Emirates.

Pepperstone also executes safety policies such as negative balance protection and segregation of funds.

Pepperstone is considered to be safe for traders from the UK thanks to its FCA license and strong reputation and global presence.

Overall Fees: As a benchmark, the minimum spread for trading major EURUSD forex pair via the Standard account is 0.6 pips. This is quite high considering Pepperstone also charges a commission.

The commission for trading through the Standard account is $6 for a round turn per lot.

In our opinion, the trading fees charged by Pepperstone are quite high when compared to other similar brokers. However, Pepperstone also provides a rebate on high-volume trades exceeding 100 lots.

Pepperstone does not charge extra non-trading fees such as deposit fees, withdrawal fees, account opening fees, or inactivity fees.

Trading Conditions: Pepperstone does not require a minimum deposit at the time of opening a trading account.

They offer two types of trading accounts which are called Razer and Standard. The accounts differ in terms of the trading platform available and the fee structure. The Razer account is meant for high-volume traders while the Standard account is meant for beginners and low-volume traders.

Pepperstone offers a decent range of trading instruments including 60+ currency pairs, 100 UK-based stocks, 100+ ETFs, 20+ indices, and 20+ commodities.

The maximum leverage offered by Pepperstone to its UK-based traders is 1:30 for trading forex.

Deposits can be made by UK residents using bank transfer, debit cards, credit cards, and PayPal. Pepperstone also offers the GBP as a base currency, which means that traders from the UK do not have to convert their currency (and pay conversion fees) when they deposit money into their trading accounts.

Customer Support: Pepperstone offers customer support in English through live chat, phone call, and email.

We found their customer support team to be highly responsive and we got a response within 5 minutes. The response was also helpful. Note that responses through email may take longer.

The customer support team is available only during weekdays.

Pepperstone Pros

- They have a regional website for traders from the UK

- Highly safe broker licensed by the FCA

- They provide good customer support

Pepperstone Cons

- Limited range of trading instruments

- The overall fees are quite high

#3 AvaTrade – Best Trading Platforms for Automated Trading

AvaTrade was founded in 2006 and has a global presence.

Regulation: Even though Avatrade has a dedicated website for traders from the UK, the company is not yet regulated by the FCA.

Instead, they are regulated in several other jurisdictions such as Ireland by the Central Bank of Ireland, the British Virgin Islands Financial Services Commission, the ASIC of Australia, the FSCA of South Africa, the FSA of Japan, and the ADGM-FSRA of Abu Dhabi.

Avatrade also implements safety practices such as segregation of funds and negative balance protection.

Even though Avatrade is not regulated by the FCA, we consider them to be safe for UK traders. This is because they are regulated by tier 1 regulators such as the ASIC of Australia as well as in several reputed jurisdictions including in the EU.

Overall Fees: The typical spread for trading EURUSD pair is 0.9 pips. They do not charge a commission.

They also charge an overnight fee if you keep trades open overnight.

Avatrade does not charge deposit fee, withdrawal fee, or account maintenance fee.

However, Avatrade does charge an inactivity fee if your account is dormant for a period of more than three months. In such cases, they charge a quarterly fee.

Trading Conditions: Avatrade allows you to open two types of accounts for retail forex and CFD trading. These accounts are called Standard and Professional.

The two accounts differ in terms of the leverage that can be used. Professional accounts offer higher leverage, however, you need to meet certain stringent conditions in order to open a Professional account with Avatrade.

Avatrade offers a maximum leverage of up to 1:400 for those using the Standard account. This is even true in the UK since Avatrade is not regulated by the FCA yet.

Avatrade offers a very wide range of trading platforms for traders to choose from. These platforms are WebTrader, AvaTradeGo, AvaOptions, Metatrader 4, MetaTrader 5, DupliTrade (for automated trading), ZuluTrade (for automated trading), and mobile and Mac trading.

The trading instruments that Avatrade offers are forex pairs, indices, commodities, and stocks.

Traders from the UK can deposit funds into their trading account through credit cards and wire transfers.

Customer Support: Avatrade offers customer support to traders from the UK through phone calls, live chat, and email. They do not provide customer support on weekends.

We tested the live chat option available on Avatrade’s UK website and found the responses to be insightful and quick.

Avatrade also has a FAQs section on its website, however, the organization is haphazard and it is hard to find information.

AvaTrade Pros

- They offer a wide range of trading platforms to choose from including dedicated automated trading platforms (such as Duplitrade and Zulutrade)

- They provide good customer support

AvaTrade Cons

- Their UK website does not provide a lot of information

- They are not regulated by the FCA of the UK

#4 CMC Markets – Highly Reputed Broker

CMC Markets was founded in 1989 and is a UK-based financial services company.

Regulation: CMC Markets is regulated by the FCA under the name CMC Markets UK PLC. The broker holds license number 173730. The broker is also regulated by the ASIC of Australia, the BaFin of Germany, the MAS of Singapore, the DFSA of Dubai, the FMA of New Zealand, and the IIROC of Canada.

They implement a number of safety regulations such as insurance, segregation of funds, and negative balance protection.

Overall, CMC Markets is a highly reputed and highly regulated broker. They are considered safe for traders from the UK.

Overall Fees: CMC Markets a minimum spread of 0.7 pips for trading the benchmark EURUSD currency pair. The spread is quite thin when compared to other similar brokers.

They do not charge a commission for trading any instrument apart from stock CFDs. For trading UK-based stock CFDs, they charge a minimum commission of GBP 9.

CMC Markets does not charge a deposit or withdrawal fee, but they do charge an inactivity fee.

Overall, their fees are quite low considering how reputed they are and the wide range of services that they offer.

Trading Conditions: CMC Markets offers a single type of account for retail traders who want to trade CFDs. This account is called the CFD account (other accounts for spread betting and corporate trading also exist.)

The minimum deposit is 0 pounds, so you can open an account for free.

CMC Markets offers a leverage of up to 1:30 for traders from the UK. This is in accordance with FCA regulations.

You can gain exposure to a very wide variety of trading instruments (more than 11000 in total) including 330+ currency pairs, 110+ indices, 100+ commodities, 9000 shares, more than 1000 ETFs, and more than 50 government bonds. The range of trading instruments for UK traders is one of the widest that we’ve ever seen.

Traders from the UK can deposit money into their trading accounts through credit cards, debit cards, online bank transfers, and PayPal.

Customer Support: CMC Markets offers customer support in English at all times during weekdays.

They offer customer support through phone call, live chat, and email.

They also have an extensive FAQs section which is highly organized. It is quite easy to find relevant information from their website.

CMC Markets Pros

- They have been in the business since 1989

- Extremely wide range of trading instruments to choose from

- They have a local website for traders from the UK

- The overall fees charged is quite low

CMC Markets Cons

- They charge an inactivity fee

#5 FXCM – Best in Class for Algorithmic and Social Trading

FXCM was founded in 1999 and is based in the United States.

Regulation: FXCM is regulated by the FCA under the name Forex Capital Markets Limited. The broker holds license number 217689.

In addition, FXCM is licensed by the ASIC of Australia, the FSCA of South Africa, and the CySEC of Cyprus.

FXCM is regulated by the best regulators in the world which are the FCA, ASIC, and the CySEC.

They have also put in place segregation of funds and negative balance protection.

Overall, we consider FXCM to be highly safe for traders from the UK.

Overall Fees: The minimum spread for EURUSD can be as low as 0.1 pips when trading with the Standard account. The Active Trader account charges even tighter spreads.

When using the Active Trader account you do need to pay a commission if you’re from the UK.

Overall, the fees are quite low when compared to other similar brokers.

FXCM does not charge a deposit or withdrawal fee. However, they do charge an inactivity fee.

Trading Conditions: Traders from the UK can start trading forex for as low as GBP 300. The minimum deposit for opening an Active Trader is much higher.

FXCM offers two types of accounts: Standard and Active Trader. The Active Trader account is meant for high-volume traders.

FXCM has a decent range of trading instruments including currency pairs, commodities, indices, and shares.

The maximum leverage available to residents of the UK is 1:30.

You can deposit money into your account through debit cards, credit cards, online bank transfer, or certain payment wallets.

Customer Support: FXCM offers customer support through live chat, email, and phone call. They only offer customer support on weekdays, but at all times.

We contacted their customer support team through live chat and got a response within 5 minutes.

FXCM Pros

- FXCM is regulated by all three major financial regulators for retail CFD and forex trading

- They charge low fees

- They have a dedicated website that is targeted for the traders from the UK

FXCM Cons

- They do not offer customer support on weekends

How to Choose a Broker for Automated Trading?

The first and most important step is to choose a broker that is regulated by the FCA. Being regulated by the FCA means that the broker is held accountable by the Regulators in the UK. The broker needs to follow several rules laid down by the FCA when offering their services to residents of the UK.

Some of the main safety practices that they need to implement is segregation of funds, negative balance protection, and insurance. For example, if you’re trading with Pepperstone and the broker goes into liquidation, then you’re still protected for an amount up to GBP 85,000 under the FSCS scheme run by the UK government.

These practices ensure the safety of the funds deposited by the trader to their trading account.

You can check whether a broker is regulated by the FCA by cross-checking the broker’s website with the FCA’s website.

Let’s take the example of eToro.

As you can see on their website, they have stated that they are regulated by the FCA (information is provided on the footer section of the website) and hold license number 583263.

The next step is to check the overall fees which include trading and non-trading fees.

For example, you can check the fees charged by eToro on their website. They charge a spread that depends on the timing of the trade and the instrument being traded.

You should check the lowest or average spread for trading the EURUSD currency pairs. This provides you with a way to compare the fees that they charge with that of other brokers.

You should also check the trading conditions, customer support, any promotional bonuses, and the reviews of the broker.

You should try to trade with brokers that offer competitive rates and they offer the trading instruments that you want to trade.

If you’re a new trader, then you should check the educational material and research offered by brokers to their traders. You should also check whether you can open a demo account and practice trading in real conditions without using any real money.

When looking for the best-automated trading broker, you should check which trading platforms they offer. Some of the best trading platforms for automated trading are MetaTrader 4 and MetaTrader 5.

Fees

Each broker incurs a different overall fee with a different structure. In automated trading, trades are automatically opened and closed as per algorithms. Automated traders do not prefer brokers with high spreads as they may also face losses due to spread.

Traders must check and compare the fee structure before opening their accounts. This will increase profits, reduce losses, and increase the success rates of algorithms in automated trading.

Trading Platform

The choice of the trading platform will play an important role in automated trading. Each trading platform supports a different language. For example, MT4 supports MQL4 language, MT5 supports MQL5 language, and cTrader supports #C language.

Apart from language, the backtesting facility will also differ for each platform. The assistance provided for developing the algorithms will be different. Automated traders must know which trading platform is ideal for them and ensure that it is available with the broker they are opening their accounts with.

Available Instruments

The availability of multiple trading instruments will offer more opportunities to the automated trader. Automated traders can include multiple instruments in their algorithms. The entry and exit criteria in the algorithm can be met on multiple instruments.

Hence, it is always better to choose a broker that offers more financial instruments. It is important to check whether the preferred instruments by the automated trader are available with the chosen broker or not.

Deposits and Withdrawal

traders must ensure that the chosen broker allows convenient deposits and withdrawals through preferred methods. Traders must check the time taken and the fees associated with each transaction. Automated trading requires a higher initial deposit but traders can check the services of deposit and withdrawal with a small amount before depositing a large amount.

Customer Support

Beginners in automated trading may face several queries while implementing algorithms in automated trading. A user-friendly customer support service can be very helpful for automated trading in its initial phase.

Customer service through a local phone number can be very helpful while some brokers may offer quality services through live chat. To check the quality of services, traders can raise random queries regarding automated trading through the available methods before opening their accounts.

Pros and Cons of Automated Trading

Automated trading allows traders to establish specific rules for the entry and exit of a chosen financial instrument. The rules need to be programmed in a language that is accepted by the trading platform from a computer.

Before you start automated trading with any of the brokers in the UK, you must acknowledge the pros and cons of automated trading. Following are the major pros and cons of automated trading in the UK.

Pros of Automated Trading

- Never Miss an Opportunity

For those who trade on any particular price swings on financial instruments through technical analysis, automated trading can be very beneficial. Traders only need to program their entry and exit rules and they will never miss a similar price swing even when they are away from their trading platform. - Emotions are Minimised

Even the most disciplined and experienced traders battle their own emotions while placing trade orders. Manual traders will always be doubtful about placing orders, stopping loss, trading volume, taking profit, etc. Eventually, most of the trading decisions will depend on emotions in some way or another. Automated trading does not involve emotions in any manner and will only work upon the data fed to the algorithm by the trader. - Easy Backtesting

Whatever algorithm is built for automated trading can be tested on plenty of price movements in the past. Each automated trading strategy can be backtested for any particular time frame at any moment in the past. This allows traders to enhance their algorithms and reach out for better outcomes. - Discipline with Speed

By the time, a disciplined manual trader decides whether to enter or not, the trading opportunity can be missed. This is not the case in Automated trading. With automated trading, the speed of placing and closing trade orders is much faster allowing traders to reach better outcomes in a more disciplined manner.

Cons of Automated Trading

- Mechanical and Technical Failures

Automated traders have to rely on their algorithm that works on computers. There is always a risk of mechanical failures, software glitches, algorithm language errors, internet connectivity issues, and other failures that can be hazardous in automated trading. The trade orders may fail to execute or multiple false orders can be placed due to a technical glitch in automated trading. - Over-Optimization

Algorithms that work very well on backtesting may or may not have the same output in the live market. Overfitting the automation to reach near perfection may not work in a live market. This leads to placing trade orders with negligible profits at high risk. - Fundamental News Event can be Missed

Most dramatic and unexpected price movements in the market occur due to fundamental news event that triggers the price. This cannot be predicted by any algorithm as traders have to respond to it manually. At times when such news events fluctuate the prices, most automated strategies are very likely to fail and generate losses for the traders.

How to Start Automated Trading for Beginners?

To begin with automated trading in the UK, traders need an understanding of how algorithmic trading works. You need to build an algorithm that will automatically take entry and exit positions on capital markets.

For this, you will need a proper understanding of the financial markets you are dealing with. Additionally, you need to define scenarios for entry and exit with conditions. These conditions are fed to the trading platform through a programming language. MQL4, MQL5, C, C++, and Python are the most commonly used language in Algorithmic trading.

Open range, stop loss, take profit, the risk-to-reward ratio, and several other conditions are fed to the automated trading platforms.

Automated trading through algorithms is ideal for experienced traders only. Automated traders need to identify a pattern that will generate profits without the involvement of emotions. The success rates of the same algorithm can be different during different market trends. The algorithm can be tested multiple times on different market trends of the past.

Hence, beginners need expertise in technical and fundamental analysis of the capital markets and an understanding of programming language to begin automated trading.

It is always advisable to learn about automated trading through books, videos, blogs, courses, and experienced traders before starting. Following are the points that a beginner must consider before starting automated trading:

- Learn Trading Basics: Understand trading concepts.

- Grasp Automation: Learn about automated trading and tools.

- Pick a Platform: Choose a platform supporting automation.

- Learn Programming: Gain basic coding skills.

- Study Algorithmic Trading: Understand coding for strategies.

- Develop a Strategy: Create a simple trading plan.

- Backtest: Test strategy using historical data.

- Manage Risk: Integrate risk management rules.

- Code Your Strategy: Translate your strategy into code.

- Test in Simulation: Simulate strategy performance.

- Optimize and Refine: Improve based on simulation results.

- Monitor and Learn: Deploy live, monitor, and adapt.

- Stay Informed: Keep up with trading trends.

- Mind Risks: Recognize risks despite automation.

- Regulations: Understand any trading regulations.

- Start Small: Begin live trading with a small amount.

- Seek Advice: Consult experienced traders if needed.

Automated trading demands learning, practice, and risk management. Start with basic strategies and gradually refine your approach as you grow more confident.

How to Optimize Your Algorithm in Algo Trading?

The following measures can help you in improving the code written in MQL4,MQL5, or any other languages used in algo trading.

Code Optimization: Reduce redundancy by extracting common code blocks into functions. This makes the code easier to maintain and read.

Error Handling: Enhance error handling by adding more descriptive error messages and handling specific error cases.

Dynamic Lot Size: Instead of a fixed lot size, consider implementing a dynamic lot sizing strategy based on account balance or risk management principles.

Commenting: Improve comments to explain the logic and functionality more clearly, especially for complex parts of the code.

Functionality Enhancements: Introduce additional features like trailing stops, dynamic adjustment of take profit/stop loss levels based on market conditions, or integration with other indicators for more robust entry/exit signals.

Risk of Trading with Automated Trading Platform

Automated trading, also referred to as algorithmic trading or black-box trading, offers several advantages but also comes with inherent risks. Let’s explore these risks associated with automated trading:

- Technical Failures: Automated trading heavily relies on technology and can be susceptible to technical glitches, system failures, or connectivity issues. Network outages, software bugs, or power disruptions can disrupt trading operations, leading to missed trades, incorrect order executions, or other malfunctions.

- Programming Errors: The accuracy and reliability of automated trading systems depend on their programming quality. Coding errors or bugs can result in unintended consequences, such as placing incorrect trades or executing orders at inappropriate prices. Conducting thorough testing and code review is essential to minimize the risk of programming errors.

- Market Volatility: While automated trading algorithms are designed to respond to market conditions, rapid and unpredictable market movements, especially during periods of high volatility or major news events, can cause algorithms to generate excessive trades or execute orders at unfavorable prices.

- Over-optimization: Developing and fine-tuning automated trading strategies involves optimizing parameters based on historical data. However, there is a risk of over-optimization, where strategies perform well in backtesting due to fitting the historical data too closely, but fail to produce desired results in live trading. Over-optimized strategies may lack adaptability to changing market conditions.

- Model Risks: Automated trading systems rely on specific models and assumptions about market behavior. If the underlying models are flawed or fail to accurately capture market dynamics, the trading strategies based on them may generate poor results. Unexpected market conditions or anomalies may not be adequately addressed by an automated system.

- Lack of Human Judgment: Automated trading removes the human element from decision-making, which can be advantageous but also risky. Algorithms operate based on predefined rules and cannot account for unexpected events or exercise subjective judgment. Unforeseen market conditions or anomalies may not be adequately handled by an automated system.

- Regulatory and Legal Risks: Automated trading is subject to regulatory oversight and compliance requirements. Changes in regulations or failure to comply with applicable rules can result in legal consequences, financial penalties, or trading restrictions. It is crucial to understand and adhere to the relevant legal and regulatory frameworks.

To mitigate these risks, it is essential to implement robust risk management techniques. This includes conducting rigorous testing and monitoring of automated trading systems, setting predefined risk limits, and regularly reviewing and updating strategies. Additionally, having contingency plans for technical failures or market disruptions can help minimize potential losses.

Mistakes to Avoid While Doing Automated Trading

- Lack of a clear strategy.

- Over-optimizing for past data.

- Neglecting risk management.

- Ignoring changing market conditions.

- Overtrading and high costs.

- Limited backtesting.

- Failing to monitor system behavior.

- Lack of diversification.

- Ignoring emotional factors.

- Neglecting news and events.

- Overdependence on automation.

- Inadequate system testing.

Comparison of Best Automated Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| eToro |

1.1 pips

|

$200

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| Pepperstone |

0.69 pips

|

£0

|

1:30

|

Visit Broker |

| AvaTrade |

1.3 pip

|

$100

|

1:30

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:30

|

Visit Broker |

FAQs on Best Automated Brokers UK

Is automated day trading profitable?

There is never a guarantee that you will make money from trading. In fact, most traders lose money. Automated trading offers you a way to make your trades without emotions creeping in solely backed by a trading strategy. It also allows you to make trades much faster than you would be able to otherwise.

Which is the best automated trading platform?

The most popular platform for automated trading is the MetaTrader 5. It is a highly versatile software that is offered by most forex and CFD brokers. However, most traders also use MetaTrader 4 and cTrader for automated trading. There are also other specialized automated trading tools such as Duplitrade and Zulutrade.

How can I automate my trading?

To automate a trading strategy, traders need to design a trading strategy and convert the strategy into algorithm. The algorithms need to be coded into a programming language like MQL4, MQL5, #C, etc. depending on the language supported by the trading platform.

Is automated trading successful?

Automated trading keeps out the emotions in online trading. The algorithms define entry and exit conditions on the selected capital market. Automated trading is ideal for experienced traders who can build their own trading strategy in a programming language. Automated trading involves risk and traders can face substantial losses due to glitches in the code or major news events.

Can a trading robot make you rich?

No, trading through algorithms or trading bots may or may not deliver profit every time. Traders need to build their strategies and improvise them to improve the success rates of the algorithm. Automated trading through a trading robot involves financial risk and is not a get-rich-quick scheme.

How do I start automated trading?

To start automated trading, traders need to open their accounts with a broker that supports automated trading. Traders need to build their strategy and convert it into algorithms through a programming language supported by the trading platform. Beginners in automated trading must backtest their algorithms on historical price charts and demo trading accounts.

Which broker is best for robot trading?

According to our analysis, Pepperstone, CMC Markets, and FXCM are among the best forex and CFD brokers for automated or robot trading in the UK. An ideal broker for Automated trading must offer low spread and allow convenient programming of trading algorithms in the trading platform.

Do automated trading platforms work?

Yes, automated trading allows traders to enter and exit trading positions based on algorithms written in a programming language by the trader. This allows traders to book profits automatically when certain conditions are met keeping aside emotions. However, automated trading is risky and the whole account equity can be wiped due to a small error in the algorithm.

Does eToro do automated trading?

The automated trading on eToro does not work like other trading platforms. Traders at eToro can copy trade orders from other traders or put certain equity into autopilot mode but the trading strategy cannot be coded into a programing language like MQL4, MQL5, or #C language.

Is automated trading legal in the UK?

Yes, automated trading is legal in the UK as long as you’re trading through a broker that is licensed by the FCA. Client5s registered under FCA regulation are protected with up to GBP 85,000 per client in case of an unsettled dispute between broker and client.