IG Markets South Africa Review 2024

IG Markets is an FSCA-regulated broker in South Africa that offers CFD trading and spread betting services globally. It is one of the oldest CFD brokers in South Africa. Read our honest review of IG Market before opening your account.

IG Markets is a popular CFD broker and spread betting platform incorporated in 1974 by British political activist Stuart Wheeler. IG Markets was initially started as a spread betting firm named IG Index. Later on, it also started offering CFD trading services.

IG Markets is among the largest CFD brokers and spread betting platforms globally. It offers trading services on more than 18,000 instruments to more than 300,000 clients worldwide. It is a reputed entity that is regulated by several top-tier regulatory authorities globally and is listed on London Stock Exchange.

We have comprehensively reviewed each component of IG markets for traders residing in South Africa. Our aim is to provide honest opinions on the broker along with pros and cons to assist the traders in making a better choice.

Table of Content

IG Markets South Africa Pros

- IG Markets is regulated and authorized by FSCA in South Africa

- No non-trading charges exist

- Free deposits and withdrawals through local bank transfer

- Low trading spread

- 24*7 customer support through live chat

- Multiple top-tier regulation

- Listed on London Stock Exchange

- More than 18000 instruments available

IG Markets South Africa Cons

- No choices for account types

- Local phone support is not available

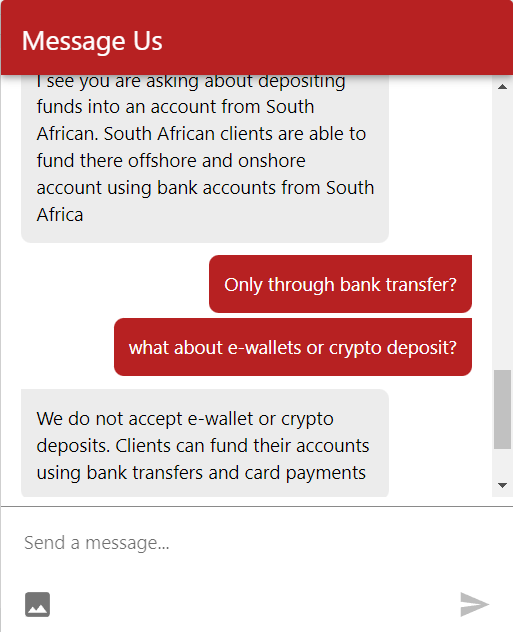

- e-wallets and cryptocurrency deposit not supported

IG Markets South Africa Summary

| Broker Name | IG MARKETS SOUTH AFRICA LIMITED |

| Website | https://www.ig.com/za |

| Regulation | FCA, FSCA, ASIC, NFA |

| Year of Establishment | 1974 |

| Minimum Deposit | R4000 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4, ProRealTime |

| Trading Instruments | 18,000+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

IG Markets Safety and Regulation

The safety of funds deposited and gained by the trader largely depends on the regulation of the broker. Apart from regulation, customer reviews, years of service, transparency of financials, etc. may also affect safety ratings.

IG Markets is regulated by multiple top-tier regulators. Following are the details of regulatory licenses held by IG markets.

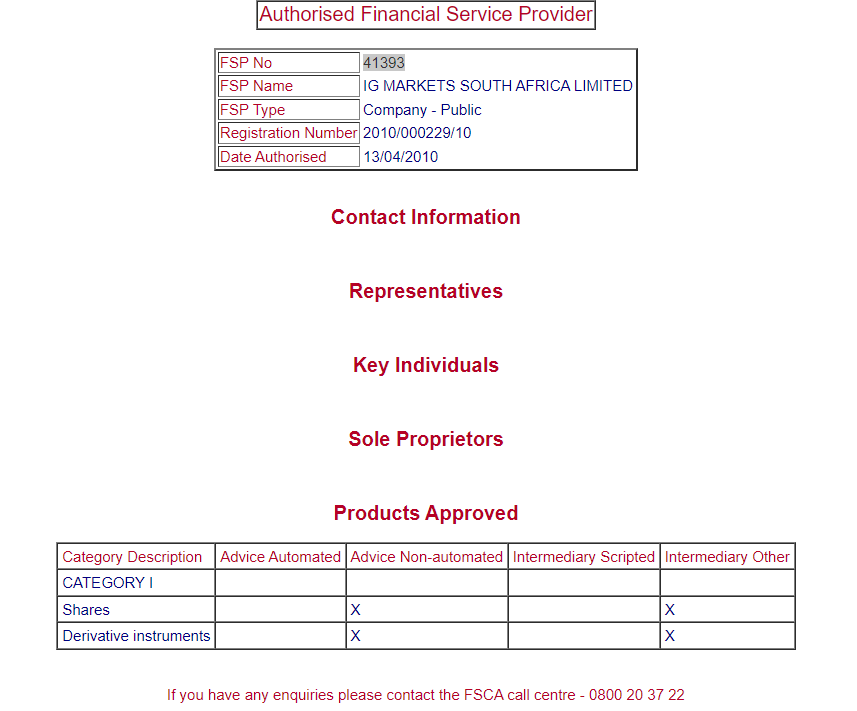

- FSCA of South Africa: IG Markets is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under FSP number 41393 as a legal entity IG Markets South Africa Limited. Clients residing in South Africa are registered under FSCA regulation at IG Markets. The FSCA license was acquired by IG Markets in 2010.

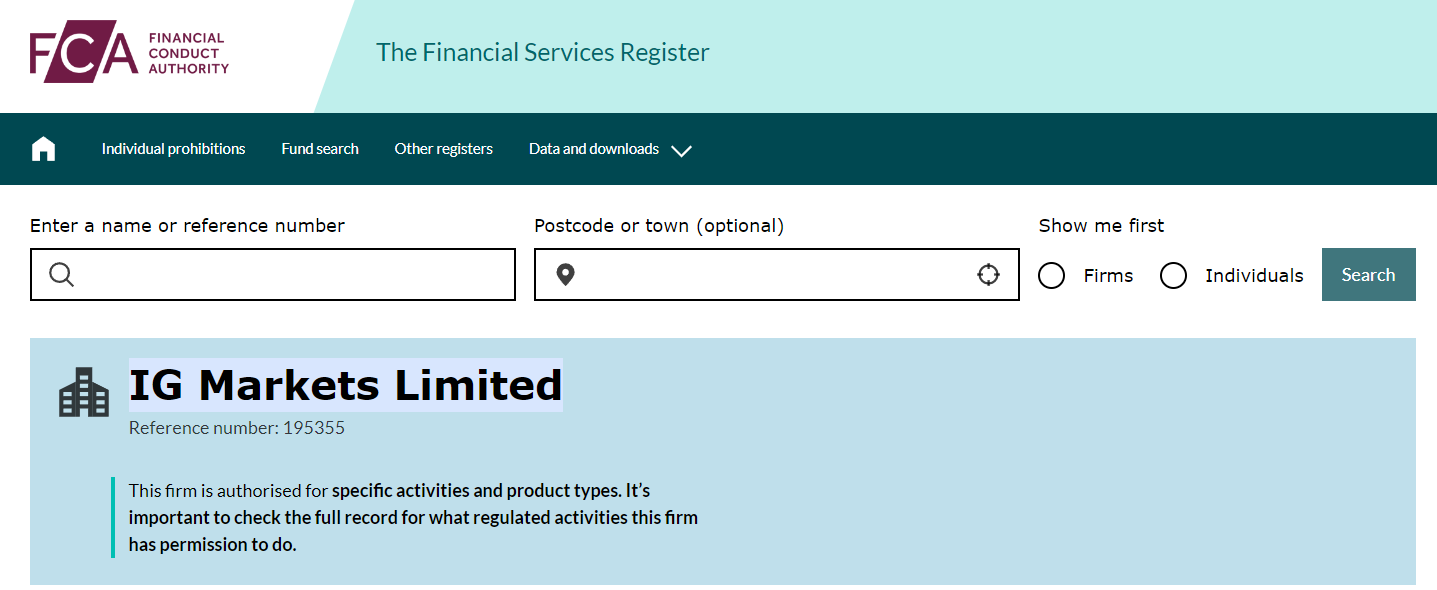

- FCA of the UK: IG Markets is regulated by The Financial Conduct Authority of the UK under license number 195355 as a legal entity IG Markets Limited. The license was acquired by IG Markets in 2001. IG Markets is among the oldest brokers to get FCA licenses that are still active.

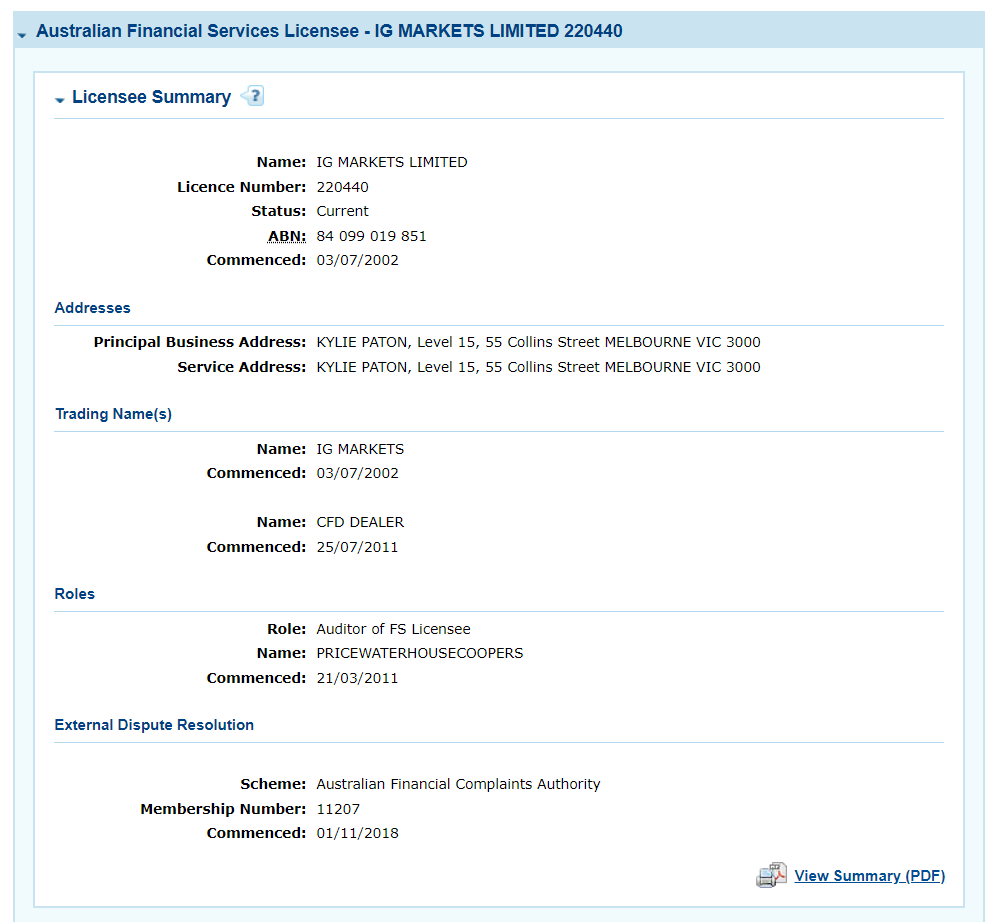

- ASIC of Australia: IG Markets is regulated by the Australian Securities and Exchange Commission since 2002. IG Markets Limite is the legal entity of IG Markets under license number 220440 and ABN number 84 099 019 851.

Apart from these, IG Markets is also regulated by MAS of Singapore, CFTC & NFA of USA, FMA of New Zealand, JFSA of Japan, etc. Due to multiple top-tier regulatory licenses including FSCA of South Africa, IG markets can be considered safe with low third-party risk.

IG Markets was incorporated in 1974 and is one of the oldest CFD brokers that is still active. It is also listed on London Stock Exchange with the ticker symbol IGG. Due to public listing, the firm is bound to publically disclose its financial details.

According to our analysis and comparison, IG Markets is among the safest CFD brokers and spread betting platforms for clients residing in South Africa. The third-party risk of choosing IG Markets in South Africa is very low.

IG Markets Fees

The majority of trading fees at IG Markets are built into spreads. However, we have covered every aspect through which the broker can charge traders. Following are the methods in which CFD brokers generally charge their clients.

- Spread: The difference between the bid and ask price is the major source of revenue for CFD brokers and Spread betting platforms. At IG Markets the spreads are lower than the majority of FSCA-regulated brokers.The average typical spread for EUR/USD at IG Markets is 0.74 while the minimum spread for the same is 0.6 pips. IG Markets does not offer multiple account types with different fee structures. The trading fees are built into spreads. The following table compares the average spread on some of the popular CFD instruments.

- Trading Commission: IG Markets do not charge trading commissions for any CFD instrument except shares. The commission is only applicable on shares CFD.The trading commission on CFDs of South African shares is ZAR 50 or 0.2% of the trading amount, whichever is higher. The commission is different for UK, US and European shares.

- Swap Fees: overnight funding or swap fees are incurred only when a leveraged position is kept open overnight. The swap fee at the IG market is calculated using a predefined formula. The swap fee is neither too high nor lower than other FSCA-regulated brokers in South Africa

- Non-Trading Charges: IG Markets do not incur deposit/withdrawal fees and account opening/maintenance fees. An inactivity fee of R150 is incurred when no trades are executed for 2 years. Apart from this currency conversion charge of 0.5% is incurred when a foreign currency is converted to base account currency.

- Live Chat: Live chat support is available 24*7 even on the weekends. We tried to connect with the support staff through live chat multiple times. Clients are first connected to a chatbot and later transferred to a live agent. Our queries were resolved within minutes. We received helpful and quick replies to our queries through live chat.

- Email Support: Clients can also raise their queries through email [email protected]. Email support is useful when clients require written proof from the broker or exchange documents. They generally revert back within 24 hours to email queries.

- Phone Support: IG Markets does not offer local phone support in South Africa but clients can reach out to the support executives through an international helpline number 010 344 0051. Phone support is available from 9 am Saturday to 11 pm Friday.

- 79 Currency Pairs: A total of 79 currency pairs are available to be traded as CFD at IG Markets including major, minor, and exotic pairs. The maximum leverage on forex pairs is 1:30.

- 17 Indices CFD: IG Markets allow trading on CFDs of 17 indices of American and European markets. Clients can also trade on South Africa 40 Index as CFD. The maximum leverage on Indices CFD is 1:20.

- 17 Commodities CFD: Clients can trade on CFDs of energies, metals, and soft commodities with a maximum leverage of 1:20.

- 13 Cryptocurrency: South African clients can also trade on cryptocurrencies as CFD with a maximum leverage of 1:2.

- 17000+ Shares: Shares of South African, American, European, African, and Asian markets can be traded as a CFD with a maximum leverage of 1:5.

| Trading Instrument | Average Spread |

|---|---|

| EUR/USD | 0.74 |

| GBP/USD | 1.17 |

| Gold/USD | 0.25 |

| US Crude Oil | 0.09 |

| US Tech 100 | 2.03 |

| BTC/USD | 36 |

| GER40 | 1.2 |

| UK100 | 1 |

| USA30 | 2.1 |

| USA500 | 1.31 |

Following table compares the trading commissions incurred at popular forex and CFD brokers in South Africa.

| Broker Name | Commission for Single Side Trade | Commission for a Round Trade |

|---|---|---|

| HFM | $3 | $6 |

| IG Markets | $3.5 | $7 |

| Tickmill | $2 | $4 |

| FXTM | $2 | $4 |

| FBS | $10 | $20 |

| IC Market | $3.5 | $7 |

| Pepperstone | $3.5 | $7 |

Following table compares the inactivity fees incurred at popular forex and CFD brokers in South Africa

| Broker Name | Inactivity Period | Monthly Inactivity Fees |

|---|---|---|

| HFM | 6 Months | $5 |

| FXTM | 6 Months | $5 |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | 3 Months | $10 |

| IG Market | 2 Years | $10 |

Overall, IG Markets can be considered a cost-efficient broker. The trading, as well as non-trading charges at IG Markets, are comparatively lower than the majority of FSCA-regulated brokers in South Africa.

IG Markets Account Types

IG Markets does not offer multiple account types. All clients at IG Markets trade with the same account type that involves spread as the only trading fee.

Clients can choose to trade with USD, EUR, GBP, and ZAR as the base currency of the account. However, if the currency paired with the base currency of a different currency is traded then the profit and loss amount will be liable for currency conversion charges.

The maximum leverage for forex pairs is 1:30 at IG Markets.

IG Markets Deposits and Withdrawals

IG Markets supports cards and bank transfers for deposits and withdrawals in South Africa. They do not incur any charges or commissions for deposits and withdrawals in South Africa.

Credit/Debit Cards: Clients in South Africa can deposit and withdraw through Credit/Debit cards of any South African bank without any commission. The deposits can take up to 24 hours to reflect in the trading account while withdrawals can take up to 3-5 business days to process. The minimum deposit amount through this method is R4000.

Local Bank Transfer: South African clients can also deposit through bank transfer which is processed within 1-3 business days. The withdrawal may take up to 5 business days to reflect in the bank account.

Apart from cards and bank transfers, IG does not support any other methods for deposit and withdrawal in South Africa. E-wallets and cryptocurrencies can be used for deposit and withdrawal into IG CFD trading accounts.

IG Markets Customer Support

The customer support services are excellent at IG Markets in South Africa. Following are the methods through which clients can connect with the support staff at IG Markets in South Africa.

Overall, the support services at IG Markets in South Africa are resourceful. The availability of live chat 24*7 is a major advantage.

IG Markets Research and Education

IG Markets offers a comprehensive range of research and educational tools suitable for traders in South Africa. Their platform provides extensive market analysis, including daily updates and insights from in-house analysts and third-party providers.

For education, IG offers a wide array of resources, from detailed articles and tutorials to webinars covering various trading topics, ideal for both beginners and experienced traders. These tools are designed to enhance trading knowledge and market understanding.

Available Instruments

IG offers a wide range of trading instruments totalling to more than 18000 CFD instruments. The number of available instruments is the highest among all FSCA-regulated brokers in South Africa.

It must be noted that all the available instruments are CFD instruments. CFDs are derivative instruments in which no actual buying and selling is done. Only the price difference between the opening and closing positions is settled with cash. At IG Markets can clients can also do spread betting on the available instruments.

Following are the details of available trading instruments in South Africa.

The maximum leverage on the available instruments can be increased up to 1:222 on forex, indices, and commodities by opening a professional account.

Do We Recommend IG Markets?

Yes, IG Markets is an FSCA-regulated CFD broker and spread betting platform in South Africa. It is a reputed financial services provider incorporated in 1974. The trading fees at IG Markets are low while more than 18000 instruments are available to be traded. The customer support service is excellent with 24*7 availability through live chat.

IG Markets South Africa FAQs

Is IG Markets legit?

Yes, IG Markets is an FSCA-regulated broker in South Africa that is also regulated by various top-tier regulatory authorities like FCA of the UK, ASIC of Australia, etc. IG Markets is a listed company on London Stock Exchange (LSE) with the ticker symbol IGG.

Is my money safe with IG markets?

Yes, IG Markets is a well-regulated broker with multiple top-tier regulations including FSCA of South Africa. The broker is transparent with their financials as it is a listed company on London Stock Exchange.

What is IG Markets minimum deposit?

There is no lower limit on minimum deposits at IG Markets in South Africa with local bank transfers. However, if a credit/debit card is used for a deposit, the minimum amount is R4000.