CMC Markets South Africa Review 2024

CMC Markets is a highly reputed broker offering forex trading services in South Africa

CMC Markets is a spread betting and CFD broker that was established in 1989, is listed on the London Stock Exchange, and makes up the FTSE 250 index.

CMC Markets is not regulated by the Financial Sector Conduct Authority (FSCA), and may pose a higher risk to South Africans compared to FSCA regulated brokers, however, they have Tier 1 regulation from the FCA and ASIC.

For educational purposes, we have rendered an unbiased review of the key offerings of CMC Markets, like their platforms, minimum deposit, account types, fees, and deposit and withdrawal methods and conditions.

CMC Markets South Africa Pros

- Multiple Tier regulations

- Wide range of instruments; 12000+

- Website and trading platforms focus on education

- Low trading fees for Forex

- Advanced research tools

- Ease to use app

CMC Markets South Africa Cons

- No FSCA regulation

- No ZAR account

- Customer service is not available 24/7

- High fees on Stock CFDs

- No MT5

CMC Markets South Africa Summary

| Broker Name | CMC Markets Singapore Pte. Ltd |

| Website | cmcmarkets.com |

| Regulation | MAS, FCA, IIROC, ASIC, FMA, BaFIN |

| Year of Establishment | 2008 |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:500 (for professional traders) |

| Trading Platforms | Next Generation (mobile and web) MetaTrader4 (mobile and web) |

| Trading Instruments | Forex, Indices, Cryptocurrencies, Shares, Commodities, and Treasuries |

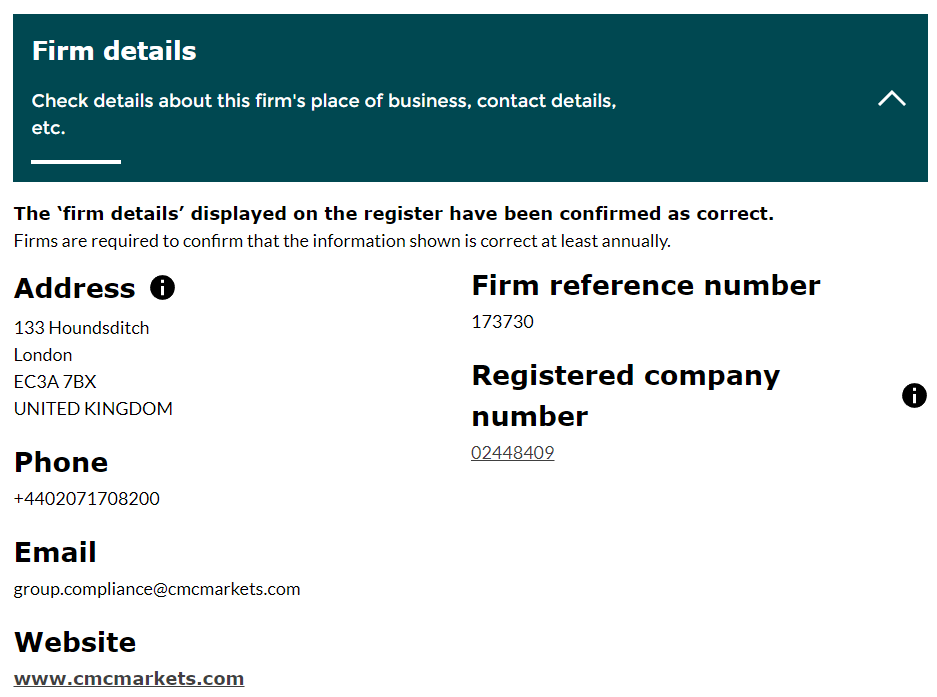

CMC Markets Safety and Regulation

CMC Markets is not regulated by the South African Financial Sector Conduct Authority (FSCA), and may be a high-risk broker because it’s not under the FSCA watch.

However, CMC Markets is regulated by Tier 1 brokers such as the UK’s Financial Conduct Authority (FCA), Australia’s Securities and Investment Commission (ASIC), Canada’s Investment Industry Regulatory Organization (IIROC), and New Zealand’s Financial Market Authority (FMA).

As a South African resident, when you open an account with CMC Markets your account will be registered under the Monetary Authority of Singapore (MAS).

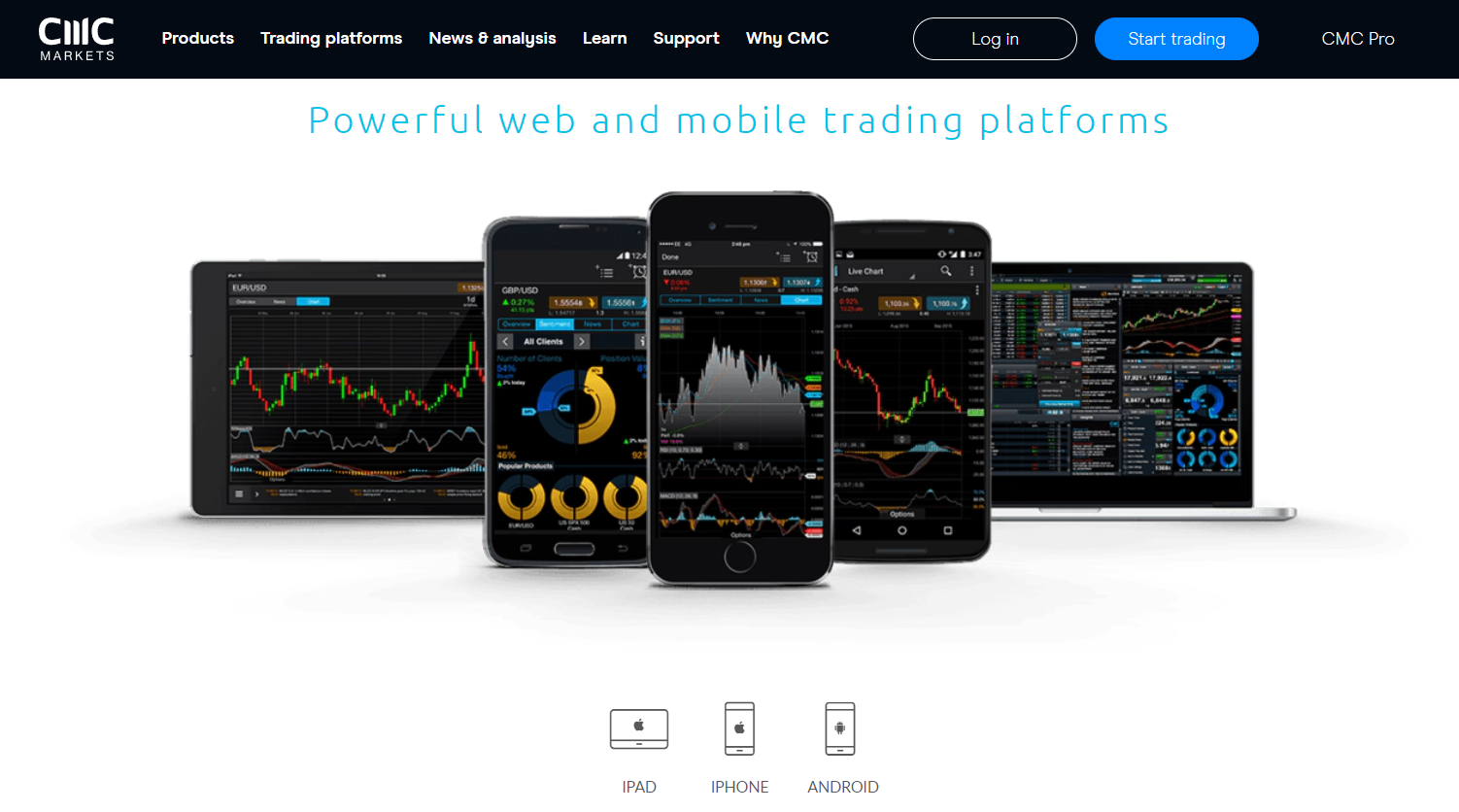

CMC Markets Trading Platforms

MetaTrader 4 and Next Generation are the trading platforms you can trade on as a CMC Markets client. Here are some of the unique features of the platforms that you should know.

Next Generation

Next Generation is CMC Markets’ homegrown trading platform available on Android, iOS, and the web.

You can carry out the technical analysis on Next Generation using over 115 technical indicators, and drawing tools, 12 chart types, and a pattern recognition scanner that scans over 120 products every 15 minutes to detect both completed and surfacing patterns.

News, market insights, tweets, market calendar, and clients’ sentiments are also available for fundamental analysis.

Next Generation also supports order types like trailing order, guarantee stop loss order, and boundary order to help you manage risk more efficiently.

The mobile and web platforms feature the same functionalities and also have platform tour videos and other educational videos for learning to trade. Both platforms offer the same financial instruments and have built-in customer support to help in times of difficulty.

MetaTrader4

MetaTrader 4 is one of the most popular trading platforms in the world of Forex, shared by several brokers.

MT4 allows you to customize your trading interface, by providing free add-on and plugins. On its MT4 you can automate your trades using trading robots, and switch from one broker to another within the same platform.

CMC Markets clients who use MT4 can only trade Forex, Indices, and Commodities.

CMC Tradable Instruments

With CMC Markets, you can trade over 12,000 instruments on the following financial products:

Forex: CMC Markets offers over 330 Forex pairs, including majors, exotics, minors, and Forex indices. The minimum leverage for Forex Pairs is 1:30 and professional traders may be allowed to use leverage up to 1:500

Indices: You can trade 80+ indices on CMC Markets, including FTSE 100 and US 30. The maximum leverage for indices is 1:20

Cryptocurrencies: CMC Markets supports the trade of 18 cryptocurrencies, including majors and alt coins. CMC Markets’ average leverage for cryptocurrencies begins at 2:1.

Commodities: You can trade 100+ commodities on CMC Markets, including Gold and silver.

Shares: CMC Markets offers 10,000+ shares. This includes shares from giant companies like Amazon and Apple.

Treasuries: Get exposure to 50+ government bonds and rates.

ETF: You can trade 1000+ ETFs on Next Generation.

CMC Market Fees

CMC Markets fees can be divided into Trading Fees and Non Trading fees.

Trading Fees

1) Spread: The spread is the difference in the price at which a broker is willing to sell and buy a financial product. Spread on major Forex pairs like EURUSD starts from 0.5. The minimum spread for Gold is 0.2 points.

The following table compares the trading fees at CMC Markets for different trading instruments:

| Trading Instrument | Minimum Spread |

|---|---|

| EUR/USD | 0.50 |

| GBP/USD | 0.90 |

| Gold/USD | 0.24 |

| US Crude Oil | 2.5 |

| US Tech 100 | 1 |

| BTC/USD | 75 |

| GER40 | 1.2 |

| UK100 | 1 |

| USA30 | 2.2 |

| USA500 | 0.5 |

2) Commission: A commission is a fee charged by a broker for providing a trading platform and an account for you to trade. Trading Share CFDs on CMC Markets attracts commission.

The Commission varies depending on the country the shares originate from. However, here is an example with a US share to help you understand how the CMC Markets commission works.

The commission for any US share is $0.02 per share, and the minimum commission you can pay is $10

If, after cumulating the commission on all the share units you buy, it’s not up to $10, you will be charged the minimum commission of $10

Let’s say you buy 700 units of a US share. You will have to pay a commission of (700 (units) × $0.02) $14.

However, if you buy just 400 units, the actual commission will be $8, Since this is less than the minimum commission, you will have to pay a commission of $10.

3) Holding Cost: A swap or holding cost is a fee brokers charge or pay when you leave a position open after trading hours.

Forex: The holding cost depends on the tomorrow to next day (tom-next) rate of the currency pair in question.

Commodities and Treasuries: The holding cost for these products depends on the inferred holding cost built into the underlying futures contracts, from which the price of the underlying treasury and cash commodity is derived.

Share basket, commodity Indices, and Forex indices: Weighted sum of constituents’ holding cost rate plus/minus CMC’s fee on buy/sell positions

Non Trading Fees

1) Inactivity Fee: If your trading account stays dormant for up to 12 months and there are available funds in your account, you will be charged an inactivity fee of £10 per month until your account balance is zero.

Inactivity fees can be avoided by ensuring your trading account is empty if you plan to take a break from using it.

Note that if you decide to reactivate your account, inactivity of up to three months will be refunded to your account (i.e in a situation where it has already been deducted).

Following Table Compares the inactivity fees at various brokers in South Africa.

| Broker Name | Inactivity Period | Monthly Inactivity Fees |

|---|---|---|

| CMC Markets | 12 Months | $10 |

| FXTM | 6 Months | $5 |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | 3 Months | $10 |

| IG Market | 2 Years | $10 |

2) Market Data Fee: To view price data for some instruments, you have to pay a monthly subscription fee that depends on the data classification and your trading account.

3) Grantee Stop Loss Order (GSLO): To use GSLO, you will have to pay a premium that is calculated with the formula ‘premium rate x trade size (units)’. In a situation where GSLO is not triggered, you will receive a refund of the premium.

4) Currency Conversion Fees: +/- 0.5% rate on any losses or gains you realize and when you subscribe for plans that are not domiciled in your account’s currency.

CMC Markets Account Types

CMC Markets offers a demo account for learning how to trade with £10,000 worth of virtual funds.

For live trading, you can choose from any of CMC Markets’ three live trading accounts.

1) CFD Trading Account: GBP, EUR, SGD, USD, SEK, AUS, PLN, NOK, and NZD are the account Currencies available in the CFD Trading Account.

CFDs in Forex, Indices, commodities, cryptocurrencies, shares, and treasuries, are available on this account.

The CFD Trading account supports account netting, order boundaries, hedging, and a price depth ladder.

2) FX Active Account: The FX Active account is available on Next Generation and MT4 and is ideal for Forex traders who want to spend less on fees seeing that you get to enjoy a 25% spread discount on all 330+ FX pairs.

The account base currencies available on the FX active account include GBP, EUR, USD, SGD, CAD, AUS, SEK, NOK, PLN, and NSD.

The FX Active account supports hedging.

CMC Markets Deposit and Withdrawal

Here are some basics to know about CMC Markets Deposit and withdrawal:

Deposit

You can fund your CMC Markets trading accounts using credit/debit cards, bank transfers, and PayPal.

These funding methods are accepted on both mobile and web Platforms. CMC Markets does not honor third party funding.

Minimum starting deposit is zero but CMC Markets recommends 100 GBP or ZAR equivalent to make room for margin & fees that will be levied as you trade

Withdrawal

CMC Markets accepts withdrawals via bank transfer, card, and PayPal.

It is worthy of note to add that withdrawal requests made before 11 a.m. will be processed the same day.

If you withdraw with a credit/debit card, you can withdraw up to $40,000, and for PayPal, the maximum daily withdrawal is £10,000.

Withdrawal with PayPal and domestic banks takes about 1-2 working days; for International banks, withdrawal can take up to 3-5 working days, while card withdrawal usually takes an hour or may take up to 5 business days.

CMC Markets Customer Service

CMC Markets in South Africa provides customer service via email and phone throughout the week, which is convenient for traders who need help during trading times. The support is offered in many languages because of CMC Markets’ worldwide presence, making it more user-friendly for a diverse group of traders. However, the lack of a live chat option might deter some traders from seeking immediate help, particularly for those wary of making international calls.

While the customer service at CMC Markets is generally regarded as effective, there is potential for enhancement, especially in terms of the response time for chat support. Despite occasional short waits in the chat queue, the delays aren’t typically lengthy. The phone support responds quickly, and emails are usually answered within a day. The support staff is equipped to handle a variety of inquiries, ensuring thorough and timely answers.

CMC Markets Educational Materials and Resources

CMC Markets also focuses on education and research, as they have provided a good number of tools for this purpose. Here are some things to note:

Demo Account: CMC Markets offers a free demo account that helps you practice how to trade in a real-life market environment but with virtual cash. Demo trading is risk-free and although it is built to mimic live trading, experts argue that it is not the same, seeing that you can lose actual money in live trading.

Economic Calendar: It keeps you aware of all upcoming events around the globe that are likely to have an impact on the market.

Market Insights: On the insight section of the trading platform, market analysts share commentaries daily to help you make more informed trading decisions.

Next Generation also features news from Morningstar, Reuter News tweets, and CMC TV (a YouTube channel).

Educational Materials: The CMC Markets website has free educational resources that cut across spread betting, fundamental analysis, technical analysis, Forex trading, risk management, and a general trading guide.

Platform Tour Videos: Next Generation trading platform has platform tour videos that may be useful to new users of the app to help them navigate through the trading platform with ease.

Webinars: From time to time, CMC Markets holds webinars and seminars where they host trading experts who share some strategies to help traders at different levels stay on top of the game.

Tools for Technical Analysis: CMC Markets’ next generation provides charts, indicators, pattern scanners, alerts, etc. to help you carry out the technical analysis.

Market Sentiments: CMC Markets gives you almost real-time Information on the number of traders who are buying and selling a particular product and also allows you to see how market sentiment has changed as days go by and the price moves.

Frequently Asked Questions

Can I Trust CMC Markets?

CMC Markets is unregulated in South Africa so they pose a high risk. Accounts you open are domiciled under foreign laws and conflict resolution will be difficult. Although CMC hold foreign licenses, trading with them is at your own risk.

Is It Easy To Withdraw Money On CMC Markets?

Yes, withdrawing funds from CMC Markets is easy. You have to go to the withdrawal tab on the trading platform, select a destination, and follow the prompts to request a withdrawal.

Does CMC Markets Have a ZAR Account?

No, CMC Markets does not have a ZAR account. As a result of this, you may have to deal with currency conversion fees that usually range between 3-8%.

What Is The Minimum Withdrawal On CMC Markets?

There is no fixed minimum withdrawal however, the maximum withdrawal amount varies depending on the withdrawal method.